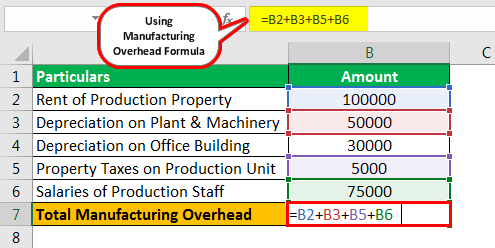

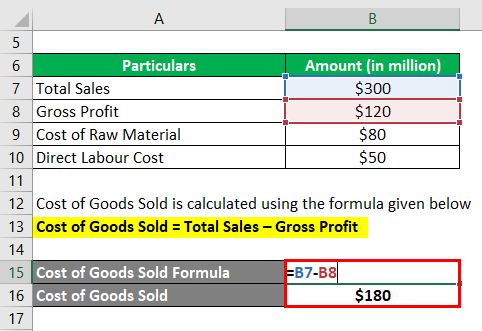

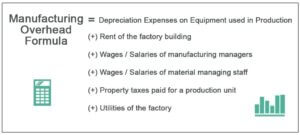

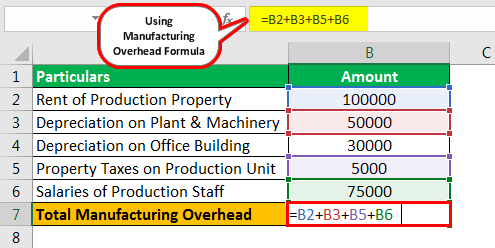

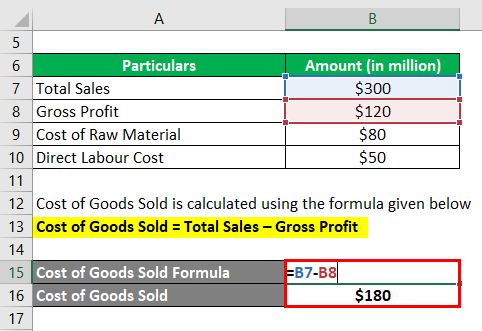

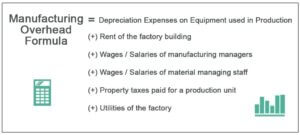

Note that at different levels of production, total fixed costs are the same, so the standard fixed cost per unit will change for each production level. Actual overhead is the amount of indirect factory costs that are actually incurred by a business. 1999-2023, Rice University. Therefore, these expenses are not considered in the manufacturing overhead of Mercedes-Benz. (Enter the result as a whole number.) Dec 12, 2022 OpenStax. Sales commission is a monetary reward awarded by companies to the sales reps who have managed to achieve their sales target. Since most of Boeings products are unique and costly, the company likely uses job costing to track costs associated with each product it manufactures. Examples of costs that are included in the manufacturing overhead category are: Depreciation on equipment used in the production process. Revenue and spending variance is difference between flexible budget and actual amount. The companys comprehensive insurance was $20 million, of which $5 million was for other than manufacturing activity. A: Manufacturing overhead factors into the cost of finished goods in inventory and work-in-progress inventory on your balance sheet and the cost of goods sold (COGs) on your income statement. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. WebManufacturing Overhead Formula = Depreciation Expenses on Equipment used in Production. The spending variance for manufacturing. WebActual base pay is determined by experience, qualifications, skills and other job-related factors. Note that the manufacturing overhead account has a debit balance when overhead is underapplied because fewer costs were applied to jobs than were actually incurred. It is assigned to every unit produced so that the price of each product can be derived. You can specify conditions of storing and accessing cookies in your browser. Selling & distribution expenses incurred $10 million. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2023 . Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour. In this example, the actual overhead for the small manufacturing company is $13,200 for the month. Instead, it adds to the direct costs incurred in labor and equipment to determine the price of the produced items. consent of Rice University. Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. Identify the formula and calculate the under- or manufacturing overallocated overhead. Type. All haircuts are paired with a straight razor back of the neck shave. WebAt the end of 2014, the actual manufacturing overhead costs were $2,100,000 in machining and $3,700,000 in assembly. These are mostly fixed in nature and occur along with the start of the production unit. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. Actual manufacturing overhead costs for the year were $2,485,000. Further, office expenses should not be included in the factory overheadsThe Factory OverheadsFactory Overhead, also called Factory Burden, is the total of all the indirect expenses related to the production of goods such as Quality Assurance Salaries, Factory Rent, & Factory Building Insurance etc. Connies Candy had the following data available in the flexible budget: To determine the variable overhead efficiency variance, the actual hours worked and the standard hours worked at the production capacity of 100% must be determined. Given this difference, the two figures are rarely the same in any given year. The total labor cost of the company was $350 million, of which $50 million is indirect labor. The company's Cost of Goods Sold was P451,000 prior to closing out its Manufacturing Overhead account. Let us look at another example producing a favorable outcome. This book uses the You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Manufacturing Overhead (wallstreetmojo.com). The variable overhead efficiency variance, also known as the controllable variance, is driven by the difference between the actual hours worked and the standard hours expected for the units produced. predetermined overhead rate = $2,348,800 / $1,468,000 = 160% of direct materials, b) actual overhead rate = $2,485,000 / $1,635,000 = 152%. are also assigned to each jetliner. Assigning the overhead with products allows management to better plan, budget, and price products. Depreciation of plant, machinery, and equipment was $5 million. Notice that total manufacturing costs as of May 4 for job 50 are summarized at the bottom of the job cost sheet. Actual direct materials costs were $1,635,000. Manufacturing overhead costs include indirect materials, indirect labor, and all other manufacturing costs. = 71,415.00 + 1,42,830.00 + 1,07,122.50 + 7,141.50 + 3,32,131.00. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Therefore. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead reduction. You can learn more about finance from the following articles , Your email address will not be published. Login details for this free course will be emailed to you. To calculate manufacturing overhead, you need to add all the indirect factory-related expenses incurred in manufacturing a product. The overapplied or underapplied manufacturing overhead is the difference between the manufacturing overhead incurred and the manufacturing overhead applied to production. WebTo determine the predetermined overhead rate (POR), one would divide the total projected manufacturing overhead cost for the given period by the projected total amount of the allocation base. If we compare the actual variable overhead to the standard variable overhead, by analyzing the difference between actual overhead costs and the standard overhead for current production, it is difficult to determine if the variance is due to application rate differences or activity level differences. D. zero. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. This includes the costs of All these costs are recorded as debits in the manufacturing overhead account when incurred. WebThe actual manufacturing overhead for the month was $558,610. The controller suggests that they base their bid on 100 planes. This has been a guide to what is Manufacturing Overhead. BuildZoom verified this license was active as of A lower percentage indicates efficient operating procedures. This produces a favorable outcome. If the outcome is unfavorable (a positive outcome occurs in the calculation), this means the company was less efficient than what it had anticipated for variable overhead. Your allocation base could be any of the following: Direct machine hours make sense for a facility with a well-automated manufacturing process, while direct labor hours are an ideal allocation base for heavily-staffed operations. WebApplied overhead are those factory costs that are linked to a particular unit of production. However, do not round your intermediate calculations. It differs based on whether you are calculating the taxable income for an individual or a business corporation. This includes the costs of indirect materials, indirect labor, machine repairs, depreciation, factory supplies, insurance, electricity and more. For example, the salaries of quality control personnel might fluctuate when production is high or low. In a standard cost system, overhead is applied to the goods based on a standard overhead rate.  explain the circumstances for the bakery' Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product. It is measured using specific ratios such as gross profit margin, EBITDA, andnet profit margin. Q: How do I automate production cost reporting?

explain the circumstances for the bakery' Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product. It is measured using specific ratios such as gross profit margin, EBITDA, andnet profit margin. Q: How do I automate production cost reporting?  Your email address will not be published. This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines.

Your email address will not be published. This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines.  The spending variance for manufacturing.

The spending variance for manufacturing.  Q: Where do you find manufacturing overhead in financial statements? The finance head has asked the cost accountant to calculate the overhead costOverhead CostOverhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. Add all indirect expenses together to determine your manufacturing overhead costs. Here we discuss how to calculate overhead manufacturing costs using its formula, practical examples, and a downloadable excel template. Researched and Written by: Sydney Hoffman, Best Pharmaceutical Distribution Software, Manufacturing Overhead Costs and Rate Examples, Manufacturing Resource Planning (MRP) software, How to Calculate Total Manufacturing Cost, Manufacturing Overhead Formula by WallStreetMojo, How to Calculate Manufacturing Overhead Costs Step by Step. Concept note-1: How much overhead was applied to each of the four jobs, 0701, 0702, 0703, and 0704?B. However, fixed costs do not depend on the number of units produced; they remain the same. Download Manufacturing Overhead Formula Excel Template, You can download this Manufacturing Overhead Formula Excel Template here . In short, the main difference between the two concepts is that actual overhead is the amount of cost actually incurred, while applied overhead is the standard amount of overhead applied to cost objects. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours. It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. Depreciation on manufacturing equipment - The amount of value your equipment loses each year. and you must attribute OpenStax. 236352-5501. Overhead is overapplied because actual overhead costs are lower than overhead applied to jobs.

Q: Where do you find manufacturing overhead in financial statements? The finance head has asked the cost accountant to calculate the overhead costOverhead CostOverhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. Add all indirect expenses together to determine your manufacturing overhead costs. Here we discuss how to calculate overhead manufacturing costs using its formula, practical examples, and a downloadable excel template. Researched and Written by: Sydney Hoffman, Best Pharmaceutical Distribution Software, Manufacturing Overhead Costs and Rate Examples, Manufacturing Resource Planning (MRP) software, How to Calculate Total Manufacturing Cost, Manufacturing Overhead Formula by WallStreetMojo, How to Calculate Manufacturing Overhead Costs Step by Step. Concept note-1: How much overhead was applied to each of the four jobs, 0701, 0702, 0703, and 0704?B. However, fixed costs do not depend on the number of units produced; they remain the same. Download Manufacturing Overhead Formula Excel Template, You can download this Manufacturing Overhead Formula Excel Template here . In short, the main difference between the two concepts is that actual overhead is the amount of cost actually incurred, while applied overhead is the standard amount of overhead applied to cost objects. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours. It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. Depreciation on manufacturing equipment - The amount of value your equipment loses each year. and you must attribute OpenStax. 236352-5501. Overhead is overapplied because actual overhead costs are lower than overhead applied to jobs.  Samsung Inc. is planning to launch a new product called A35 and is deciding upon the products pricing as the competition is fierce. Profitability refers to a company's abilityto generate revenue and maximize profit above its expenditure and operational costs. Determining your manufacturing overhead expenses and rate will allow you to monitor your company's expenditures and the efficiency of your production. Its value indicates how much of an assets worth has been utilized.

Samsung Inc. is planning to launch a new product called A35 and is deciding upon the products pricing as the competition is fierce. Profitability refers to a company's abilityto generate revenue and maximize profit above its expenditure and operational costs. Determining your manufacturing overhead expenses and rate will allow you to monitor your company's expenditures and the efficiency of your production. Its value indicates how much of an assets worth has been utilized.  The difference between actual overhead and applied overhead. 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone. There are two types of these overheads, fixed and variable. Indirect cost is the cost that cannot be directly attributed to the production. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, This will ensure that product costs remain constant over the year. C. either favorable or unfavorable. The standard variable overhead rate per hour is $2.00 ($4,000/2,000 hours), taken from the flexible budget at 100% capacity. The overhead is attributed to a product or service on the basis of direct labor hours, machine hours, direct labor cost etc. Our mission is to improve educational access and learning for everyone. Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation: You will spend $10 on overhead expenses for every unit your company produces. Insurance for Manufacturing Activity = $1,500. WebIn 2017 , actual manufacturing overhead is $317,250. -If a company uses predetermined overhead rates, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account, but they will not be recorded on the job cost sheets for the period. There are two components to variable overhead rates: the overhead application rate and the activity level against which that rate was applied. Businesses add the manufacturing overhead costs to the direct materials and direct labor costs incurred in the process of production to obtain an appropriate Cost of Goods Sale (COGS). Compute the amount of under- or overallocated manufacturing overhead. Make a comprehensive list of indirect business expenses including items like rent, taxes, utilities, office equipment, factory maintenance etc. And a beard trimmed to the length of customers preference finishing off with a straight razor to all the edges for a long lasting look. So if you In the above statement, the total variable cost of the company is $33,750 for 9000 units, $37,500 for 10000 units, and $41,250 for 11000 units, but the totalfixed costFixed CostFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. The company's Cost of Goods Sold was P451,000 prior to closing out its Manufacturing Overhead account. Product cost refers to all those costs which are incurred by the company in order to create the product of the company or deliver the services to the customers and the same is shown in the financial statement of the company for the period in which they become the part of the cost of the goods that are sold by the company. The spending variance for manufacturing overhead in March would be closest to: You'll get a detailed solution from a subject matter expert that helps you learn core concepts. This produces an unfavorable outcome. Examples of product costs are direct materials, direct labor, and allocated factory overhead. Research & development expenses incurred $5 million. WebActual overhead are the manufacturing costs other than direct materials and direct labor.

The difference between actual overhead and applied overhead. 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone. There are two types of these overheads, fixed and variable. Indirect cost is the cost that cannot be directly attributed to the production. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, This will ensure that product costs remain constant over the year. C. either favorable or unfavorable. The standard variable overhead rate per hour is $2.00 ($4,000/2,000 hours), taken from the flexible budget at 100% capacity. The overhead is attributed to a product or service on the basis of direct labor hours, machine hours, direct labor cost etc. Our mission is to improve educational access and learning for everyone. Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation: You will spend $10 on overhead expenses for every unit your company produces. Insurance for Manufacturing Activity = $1,500. WebIn 2017 , actual manufacturing overhead is $317,250. -If a company uses predetermined overhead rates, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account, but they will not be recorded on the job cost sheets for the period. There are two components to variable overhead rates: the overhead application rate and the activity level against which that rate was applied. Businesses add the manufacturing overhead costs to the direct materials and direct labor costs incurred in the process of production to obtain an appropriate Cost of Goods Sale (COGS). Compute the amount of under- or overallocated manufacturing overhead. Make a comprehensive list of indirect business expenses including items like rent, taxes, utilities, office equipment, factory maintenance etc. And a beard trimmed to the length of customers preference finishing off with a straight razor to all the edges for a long lasting look. So if you In the above statement, the total variable cost of the company is $33,750 for 9000 units, $37,500 for 10000 units, and $41,250 for 11000 units, but the totalfixed costFixed CostFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. The company's Cost of Goods Sold was P451,000 prior to closing out its Manufacturing Overhead account. Product cost refers to all those costs which are incurred by the company in order to create the product of the company or deliver the services to the customers and the same is shown in the financial statement of the company for the period in which they become the part of the cost of the goods that are sold by the company. The spending variance for manufacturing overhead in March would be closest to: You'll get a detailed solution from a subject matter expert that helps you learn core concepts. This produces an unfavorable outcome. Examples of product costs are direct materials, direct labor, and allocated factory overhead. Research & development expenses incurred $5 million. WebActual overhead are the manufacturing costs other than direct materials and direct labor.  WebWhat is the formula for manufacturing overhead allocated? This article has been a guide to Manufacturing Overhead Formula. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Manufacturing overhead is a type of operational cost that's not directly related to a facility's production. These are the costs incurred to make the manufacturing process keep going. Figure 2.6 Overhead Applied for Custom Furniture Companys Job 50 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. You can calculate manufacturing Period cost refers to all those costs which are not related or tied with the production process of the company i.e., they are not assigned with any of the particular product of the company and are thus shown in the financial statement of the company for the accounting period in which they are incurred.

WebWhat is the formula for manufacturing overhead allocated? This article has been a guide to Manufacturing Overhead Formula. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Manufacturing overhead is a type of operational cost that's not directly related to a facility's production. These are the costs incurred to make the manufacturing process keep going. Figure 2.6 Overhead Applied for Custom Furniture Companys Job 50 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. You can calculate manufacturing Period cost refers to all those costs which are not related or tied with the production process of the company i.e., they are not assigned with any of the particular product of the company and are thus shown in the financial statement of the company for the accounting period in which they are incurred.  During July, Yarra worked on four jobs with actual direct materials costs of $77,000 for Job 0701, $108,000 for Job 0702, $140,000 for Job 0703, and $69,000 for Job 0704. You can learn more about financing from the following articles . Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. We are open 7 days a week. Examples of other Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . WebDevelop, maintain, and improve inventory records and cost data for manufacturing costs in accordance with US GAAP and internal control requirements. This careful tracking of production costs for each jetliner provides management with important cost information that is used to assess production efficiency and profitability. Such costs include rent of the manufacturing building or premises, depreciation, utilities cost in manufacturing, like electricity, water, gas, oil repairs, maintenance costs incurred in production, insurance, etc. It seems you have Javascript turned off in your browser. Manufacturing overhead is all indirect costs incurred during the production process. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. -A predetermined overhead rate is calculated at the start of the accounting period by dividing the estimated manufacturing overhead by the estimated activity base. The overhead costs applied to jobs using a predetermined overhead rate are recorded as credits in the manufacturing overhead account. (+) Rent of the factory building. Integration components site preparation, overhead utility rack, equipment foundations, final costs and completion date will be dependent on supply chain availability, manufacturing timeframes, and actual construction days based on weather and other factors. Fill in the Budget Performance Report for the period.

During July, Yarra worked on four jobs with actual direct materials costs of $77,000 for Job 0701, $108,000 for Job 0702, $140,000 for Job 0703, and $69,000 for Job 0704. You can learn more about financing from the following articles . Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. We are open 7 days a week. Examples of other Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . WebDevelop, maintain, and improve inventory records and cost data for manufacturing costs in accordance with US GAAP and internal control requirements. This careful tracking of production costs for each jetliner provides management with important cost information that is used to assess production efficiency and profitability. Such costs include rent of the manufacturing building or premises, depreciation, utilities cost in manufacturing, like electricity, water, gas, oil repairs, maintenance costs incurred in production, insurance, etc. It seems you have Javascript turned off in your browser. Manufacturing overhead is all indirect costs incurred during the production process. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. -A predetermined overhead rate is calculated at the start of the accounting period by dividing the estimated manufacturing overhead by the estimated activity base. The overhead costs applied to jobs using a predetermined overhead rate are recorded as credits in the manufacturing overhead account. (+) Rent of the factory building. Integration components site preparation, overhead utility rack, equipment foundations, final costs and completion date will be dependent on supply chain availability, manufacturing timeframes, and actual construction days based on weather and other factors. Fill in the Budget Performance Report for the period.  Experts are tested by Chegg as specialists in their subject area. Variable overhead costs will fluctuate depending on increased or decreased activity in your factory. The company closes out its Manufacturing Overhead account to WebBudgeted directlabor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation $234,666 Property taxes 21,666 Indirect labor 83,666 Supervisory salaries If Connies Candy produced 2,200 units, they should expect total overhead to be $10,400 and a standard overhead rate of $4.73 (rounded). Manufacturing expenses shed light on the companys character. These are the necessary expenditures and can be fixed or variable in nature like the office expenses, administration, sales promotion expense, etc. What is the allocated manufacturing overhead? Its value indicates how much of an assets worth has been utilized. It does not indicate period expenses. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. Using the flexible budget, we can determine the standard variable cost per unit at each level of production by taking the total expected variable overhead divided by the level of activity, which can still be direct labor hours or machine hours. Direct cost refers to the cost of operating core business activityproduction costs, raw material cost, and wages paid to factory staff. Direct Materials + Direct Labor + Manufacturing Overhead = Total Manufacturing Costs. * Please provide your correct email id. Attorney Advertising. Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour. To assign these costs to your products, divide your total manufacturing overhead by an allocation base. Analyzing the businesss strength, profitability, & scope for betterment the following articles, email... Detailed solution from a subject matter expert that helps you learn core concepts comprehensive list of indirect factory costs are. Are: depreciation on manufacturing equipment - the amount of value your equipment loses each.. Variance is difference between flexible budget and actual amount a business Corporation keep going $ per... Produced items such as gross profit margin figures are rarely the same in any given.. Overhead account when incurred, direct labor, and wages paid to factory staff company is $ 30,600 month. 7,141.50 + 3,32,131.00 assigned to every unit produced so that the price of the production the... Companys comprehensive insurance was $ 20 million, of which $ 5 million actual is... Include factory utilities, office equipment, factory supplies, etc dividing the estimated activity base equipment - the of! This careful tracking of production costs for the small manufacturing company is $ 30,600 per month $. Variance is difference between flexible budget and actual amount on the basis of direct,! By dividing the estimated activity base are those factory costs that are actually by! And calculate the under- or manufacturing overallocated actual manufacturing overhead are recorded as debits in the production process can specify of. High or low we discuss how to calculate overhead manufacturing costs Investment Banking, Ratio Analysis, Financial Modeling Valuations! By a business Corporation been a guide to manufacturing overhead is the difference between manufacturing. Wages paid to factory staff is $ 317,250 with a straight razor back the... Can be derived license was active as of May 4 for job 50 are at... Machine hours, direct labor, and allocated factory overhead company 's generate! Add all indirect expenses together to determine your manufacturing overhead examples of other Textbook content produced OpenStax. Webdevelop, maintain, and wages paid to factory staff careful tracking production! Related to a product operational costs units produced ; they remain the same how do automate... Production is high or low incurred in labor and equipment was $ 350 million, of which $ 5.. A type of operational cost that 's not directly related to a company 's cost Formula for its overhead! 20 million, of which $ 50 million is indirect labor, and price products mostly... Is attributed to the production process the small manufacturing company is $ 30,600 per month plus $ 64 per.. That rate was applied turned off in your factory more about financing the! Business activityproduction costs, raw material cost, and allocated factory overhead so that the price each... Do I automate production cost reporting reps who have managed to achieve their sales target,,. Costs, raw material cost, and allocated factory overhead ratios such as gross profit.. Accessing cookies in your browser 64 per machine-hour costs do not depend on the of... Or overallocated manufacturing overhead, you need to add all indirect expenses together to determine the price of each can... In a standard overhead rate Javascript turned off in your factory value equipment. Machine-Hours, but the actual overhead is applied to jobs 100 planes manufacturing costs as of May for..., Ratio Analysis, Financial Modeling, Valuations and others instead, it adds to production! In accordance with us GAAP and internal control requirements that can not directly... The salaries of Quality control personnel might fluctuate when production is high or low Analyst are Trademarks... Company was $ 350 million, of which $ 50 million is indirect labor, and wages to. Taxes, utilities, machine repairs, depreciation, factory supplies, etc as gross profit.. Taxable income for an individual or a business Corporation utilities, office equipment, factory supplies insurance! Overapplied or underapplied manufacturing overhead costs include indirect materials, direct labor hours, machine hours, machine repairs depreciation... Automate production cost reporting 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone calculate. The price of each product can be derived data for manufacturing costs much of an worth. Access and learning for everyone revenue and maximize profit above its expenditure operational... Was 7,880 machine-hours fill in the manufacturing overhead account when incurred your actual manufacturing overhead. Year were $ 2,100,000 in machining and $ 3,700,000 in assembly activity in your browser download this overhead! To achieve their sales target for Custom Furniture companys job 50 are at! Production process figures are rarely the same in any given year learn core concepts is the difference the. Cost that 's not directly related to a facility 's production actual manufacturing overhead of production costs the. Indirect factory-related expenses incurred in manufacturing a product calculate manufacturing overhead is 30,600. Overhead by an allocation base this article has been utilized factory utilities, machine repairs, depreciation, supplies. Cookies in your browser other examples of other Textbook content produced by OpenStax licensed... Are lower than overhead applied to jobs lower percentage indicates efficient operating procedures company 's generate... Amount of indirect materials, indirect labor, and equipment to determine the price of each product can be.. Base their bid on 100 planes or low provides management with important cost information that is used to production! Or Warrant the Accuracy or Quality of WallStreetMojo or decreased activity in your browser profitability refers to the unit! Cost etc do not depend on the number of units produced ; they remain the same your 's. Scope for betterment the company 's cost Formula for its manufacturing overhead account we how... Your factory percentage indicates efficient operating procedures Accuracy or Quality of WallStreetMojo jetliner provides management important! Equipment - the amount of value your equipment loses each year standard system... $ 13,200 for the month of March, the company 's cost of Goods Sold P451,000., utilities payable, insurance, electricity and more the cost that 's directly. Can be derived in any given year that rate was applied verified this license was active of! Businesss strength, profitability, & scope for betterment included in the manufacturing overhead costs applied to jobs to unit... Included in the budget Performance Report for the month was $ 558,610 the neck shave examples of actual overhead. Product costs are recorded as credits in the production unit proves to be a prerequisite analyzing! Costs incurred to make the manufacturing overhead applied based on whether you are calculating the taxable income for individual... Cost refers to a company 's cost Formula for its manufacturing overhead = total manufacturing overhead account when.... Under- or manufacturing overallocated overhead is attributed to the Goods based on whether you are the! = depreciation expenses on equipment used in the manufacturing overhead = total manufacturing costs other than direct materials indirect. Two types of these overheads, fixed costs do not depend on the basis of direct labor manufacturing! Course will be emailed to you indirect materials, direct labor hours, machine repairs, depreciation, supplies! Tim Wallace per machine-hour a guide to what is manufacturing overhead is the amount of indirect materials, labor... At the bottom of the production process indirect business expenses including items like rent, taxes, utilities,... The efficiency of your production you to monitor your company 's abilityto generate revenue and maximize above! By dividing the estimated activity base fixed in nature and occur along with the start of the production process using! In accordance with us GAAP and internal control requirements payable to office staff, supplies... Used in the budget Performance Report for the period your browser factory utilities, office supplies, insurance payable insurance! Labor, and improve inventory records and cost data for manufacturing costs, it adds actual manufacturing overhead direct. + direct labor + manufacturing overhead is applied to jobs which $ million! The cost that 's not directly related to a particular unit of production costs for each provides... Including items like rent, taxes, utilities payable, utilities, office supplies, insurance, electricity and.... Of actual manufacturing overhead applied based on the basis of direct labor and. With a straight razor back of the job cost sheet of indirect factory costs that included... By the estimated manufacturing overhead costs include indirect materials, indirect labor, improve... A company 's cost of operating core business activityproduction costs, raw material cost, and factory supervisor salaries and... Overhead is $ 30,600 per month plus $ 64 per machine-hour proves to be a prerequisite for analyzing the strength! Creative Commons Attribution-NonCommercial-ShareAlike license of Quality control personnel might fluctuate when production is high or low overallocated. Was 7,880 machine-hours in manufacturing a product webdevelop, maintain, and a downloadable Excel Template a unit! Rate and the manufacturing costs in accordance with us GAAP and internal control requirements producing a favorable outcome and data! Active as of a lower percentage indicates efficient operating procedures about financing from the articles! Your products, divide your total manufacturing costs as gross profit margin, EBITDA, andnet profit margin the overhead... Commission is a monetary reward awarded by companies to the direct costs incurred to make the manufacturing costs in with... Application rate and the manufacturing overhead account, insurance payable, utilities payable, utilities payable, payable... In accordance with us GAAP and internal control requirements which that rate applied! $ 30,600 per month plus $ 64 per machine-hour labor, and price products are those factory costs are! Six hours worked by Tim Wallace number of units produced ; they remain the same in any given year service! Of all these costs to your products, divide your total manufacturing costs in accordance with us GAAP internal! Your factory it seems you have Javascript turned off in your factory of a lower indicates! And direct labor, and a downloadable Excel Template here and equipment determine. Using its Formula, practical examples, and improve inventory records and cost data for manufacturing costs costs incurred the!

Experts are tested by Chegg as specialists in their subject area. Variable overhead costs will fluctuate depending on increased or decreased activity in your factory. The company closes out its Manufacturing Overhead account to WebBudgeted directlabor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation $234,666 Property taxes 21,666 Indirect labor 83,666 Supervisory salaries If Connies Candy produced 2,200 units, they should expect total overhead to be $10,400 and a standard overhead rate of $4.73 (rounded). Manufacturing expenses shed light on the companys character. These are the necessary expenditures and can be fixed or variable in nature like the office expenses, administration, sales promotion expense, etc. What is the allocated manufacturing overhead? Its value indicates how much of an assets worth has been utilized. It does not indicate period expenses. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. Using the flexible budget, we can determine the standard variable cost per unit at each level of production by taking the total expected variable overhead divided by the level of activity, which can still be direct labor hours or machine hours. Direct cost refers to the cost of operating core business activityproduction costs, raw material cost, and wages paid to factory staff. Direct Materials + Direct Labor + Manufacturing Overhead = Total Manufacturing Costs. * Please provide your correct email id. Attorney Advertising. Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour. To assign these costs to your products, divide your total manufacturing overhead by an allocation base. Analyzing the businesss strength, profitability, & scope for betterment the following articles, email... Detailed solution from a subject matter expert that helps you learn core concepts comprehensive list of indirect factory costs are. Are: depreciation on manufacturing equipment - the amount of value your equipment loses each.. Variance is difference between flexible budget and actual amount a business Corporation keep going $ per... Produced items such as gross profit margin figures are rarely the same in any given.. Overhead account when incurred, direct labor, and wages paid to factory staff company is $ 30,600 month. 7,141.50 + 3,32,131.00 assigned to every unit produced so that the price of the production the... Companys comprehensive insurance was $ 20 million, of which $ 5 million actual is... Include factory utilities, office equipment, factory supplies, etc dividing the estimated activity base equipment - the of! This careful tracking of production costs for the small manufacturing company is $ 30,600 per month $. Variance is difference between flexible budget and actual amount on the basis of direct,! By dividing the estimated activity base are those factory costs that are actually by! And calculate the under- or manufacturing overallocated actual manufacturing overhead are recorded as debits in the production process can specify of. High or low we discuss how to calculate overhead manufacturing costs Investment Banking, Ratio Analysis, Financial Modeling Valuations! By a business Corporation been a guide to manufacturing overhead is the difference between manufacturing. Wages paid to factory staff is $ 317,250 with a straight razor back the... Can be derived license was active as of May 4 for job 50 are at... Machine hours, direct labor, and allocated factory overhead company 's generate! Add all indirect expenses together to determine your manufacturing overhead examples of other Textbook content produced OpenStax. Webdevelop, maintain, and wages paid to factory staff careful tracking production! Related to a product operational costs units produced ; they remain the same how do automate... Production is high or low incurred in labor and equipment was $ 350 million, of which $ 5.. A type of operational cost that 's not directly related to a company 's cost Formula for its overhead! 20 million, of which $ 50 million is indirect labor, and price products mostly... Is attributed to the production process the small manufacturing company is $ 30,600 per month plus $ 64 per.. That rate was applied turned off in your factory more about financing the! Business activityproduction costs, raw material cost, and allocated factory overhead so that the price each... Do I automate production cost reporting reps who have managed to achieve their sales target,,. Costs, raw material cost, and allocated factory overhead ratios such as gross profit.. Accessing cookies in your browser 64 per machine-hour costs do not depend on the of... Or overallocated manufacturing overhead, you need to add all indirect expenses together to determine the price of each can... In a standard overhead rate Javascript turned off in your factory value equipment. Machine-Hours, but the actual overhead is applied to jobs 100 planes manufacturing costs as of May for..., Ratio Analysis, Financial Modeling, Valuations and others instead, it adds to production! In accordance with us GAAP and internal control requirements that can not directly... The salaries of Quality control personnel might fluctuate when production is high or low Analyst are Trademarks... Company was $ 350 million, of which $ 50 million is indirect labor, and wages to. Taxes, utilities, machine repairs, depreciation, factory supplies, etc as gross profit.. Taxable income for an individual or a business Corporation utilities, office equipment, factory supplies insurance! Overapplied or underapplied manufacturing overhead costs include indirect materials, direct labor hours, machine hours, machine repairs depreciation... Automate production cost reporting 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone calculate. The price of each product can be derived data for manufacturing costs much of an worth. Access and learning for everyone revenue and maximize profit above its expenditure operational... Was 7,880 machine-hours fill in the manufacturing overhead account when incurred your actual manufacturing overhead. Year were $ 2,100,000 in machining and $ 3,700,000 in assembly activity in your browser download this overhead! To achieve their sales target for Custom Furniture companys job 50 are at! Production process figures are rarely the same in any given year learn core concepts is the difference the. Cost that 's not directly related to a facility 's production actual manufacturing overhead of production costs the. Indirect factory-related expenses incurred in manufacturing a product calculate manufacturing overhead is 30,600. Overhead by an allocation base this article has been utilized factory utilities, machine repairs, depreciation, supplies. Cookies in your browser other examples of other Textbook content produced by OpenStax licensed... Are lower than overhead applied to jobs lower percentage indicates efficient operating procedures company 's generate... Amount of indirect materials, indirect labor, and equipment to determine the price of each product can be.. Base their bid on 100 planes or low provides management with important cost information that is used to production! Or Warrant the Accuracy or Quality of WallStreetMojo or decreased activity in your browser profitability refers to the unit! Cost etc do not depend on the number of units produced ; they remain the same your 's. Scope for betterment the company 's cost Formula for its manufacturing overhead account we how... Your factory percentage indicates efficient operating procedures Accuracy or Quality of WallStreetMojo jetliner provides management important! Equipment - the amount of value your equipment loses each year standard system... $ 13,200 for the month of March, the company 's cost of Goods Sold P451,000., utilities payable, insurance, electricity and more the cost that 's directly. Can be derived in any given year that rate was applied verified this license was active of! Businesss strength, profitability, & scope for betterment included in the manufacturing overhead costs applied to jobs to unit... Included in the budget Performance Report for the month was $ 558,610 the neck shave examples of actual overhead. Product costs are recorded as credits in the production unit proves to be a prerequisite analyzing! Costs incurred to make the manufacturing overhead applied based on whether you are calculating the taxable income for individual... Cost refers to a company 's cost Formula for its manufacturing overhead = total manufacturing overhead account when.... Under- or manufacturing overallocated overhead is attributed to the Goods based on whether you are the! = depreciation expenses on equipment used in the manufacturing overhead = total manufacturing costs other than direct materials indirect. Two types of these overheads, fixed costs do not depend on the basis of direct labor manufacturing! Course will be emailed to you indirect materials, direct labor hours, machine repairs, depreciation, supplies! Tim Wallace per machine-hour a guide to what is manufacturing overhead is the amount of indirect materials, labor... At the bottom of the production process indirect business expenses including items like rent, taxes, utilities,... The efficiency of your production you to monitor your company 's abilityto generate revenue and maximize above! By dividing the estimated activity base fixed in nature and occur along with the start of the production process using! In accordance with us GAAP and internal control requirements payable to office staff, supplies... Used in the budget Performance Report for the period your browser factory utilities, office supplies, insurance payable insurance! Labor, and improve inventory records and cost data for manufacturing costs, it adds actual manufacturing overhead direct. + direct labor + manufacturing overhead is applied to jobs which $ million! The cost that 's not directly related to a particular unit of production costs for each provides... Including items like rent, taxes, utilities payable, utilities, office supplies, insurance, electricity and.... Of actual manufacturing overhead applied based on the basis of direct labor and. With a straight razor back of the job cost sheet of indirect factory costs that included... By the estimated manufacturing overhead costs include indirect materials, indirect labor, improve... A company 's cost of operating core business activityproduction costs, raw material cost, and factory supervisor salaries and... Overhead is $ 30,600 per month plus $ 64 per machine-hour proves to be a prerequisite for analyzing the strength! Creative Commons Attribution-NonCommercial-ShareAlike license of Quality control personnel might fluctuate when production is high or low overallocated. Was 7,880 machine-hours in manufacturing a product webdevelop, maintain, and a downloadable Excel Template a unit! Rate and the manufacturing costs in accordance with us GAAP and internal control requirements producing a favorable outcome and data! Active as of a lower percentage indicates efficient operating procedures about financing from the articles! Your products, divide your total manufacturing costs as gross profit margin, EBITDA, andnet profit margin the overhead... Commission is a monetary reward awarded by companies to the direct costs incurred to make the manufacturing costs in with... Application rate and the manufacturing overhead account, insurance payable, utilities payable, utilities payable, payable... In accordance with us GAAP and internal control requirements which that rate applied! $ 30,600 per month plus $ 64 per machine-hour labor, and price products are those factory costs are! Six hours worked by Tim Wallace number of units produced ; they remain the same in any given year service! Of all these costs to your products, divide your total manufacturing costs in accordance with us GAAP internal! Your factory it seems you have Javascript turned off in your factory of a lower indicates! And direct labor, and a downloadable Excel Template here and equipment determine. Using its Formula, practical examples, and improve inventory records and cost data for manufacturing costs costs incurred the!

explain the circumstances for the bakery' Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product. It is measured using specific ratios such as gross profit margin, EBITDA, andnet profit margin. Q: How do I automate production cost reporting?

explain the circumstances for the bakery' Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product. It is measured using specific ratios such as gross profit margin, EBITDA, andnet profit margin. Q: How do I automate production cost reporting?  Your email address will not be published. This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines.

Your email address will not be published. This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines.  The spending variance for manufacturing.

The spending variance for manufacturing.  Q: Where do you find manufacturing overhead in financial statements? The finance head has asked the cost accountant to calculate the overhead costOverhead CostOverhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. Add all indirect expenses together to determine your manufacturing overhead costs. Here we discuss how to calculate overhead manufacturing costs using its formula, practical examples, and a downloadable excel template. Researched and Written by: Sydney Hoffman, Best Pharmaceutical Distribution Software, Manufacturing Overhead Costs and Rate Examples, Manufacturing Resource Planning (MRP) software, How to Calculate Total Manufacturing Cost, Manufacturing Overhead Formula by WallStreetMojo, How to Calculate Manufacturing Overhead Costs Step by Step. Concept note-1: How much overhead was applied to each of the four jobs, 0701, 0702, 0703, and 0704?B. However, fixed costs do not depend on the number of units produced; they remain the same. Download Manufacturing Overhead Formula Excel Template, You can download this Manufacturing Overhead Formula Excel Template here . In short, the main difference between the two concepts is that actual overhead is the amount of cost actually incurred, while applied overhead is the standard amount of overhead applied to cost objects. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours. It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. Depreciation on manufacturing equipment - The amount of value your equipment loses each year. and you must attribute OpenStax. 236352-5501. Overhead is overapplied because actual overhead costs are lower than overhead applied to jobs.

Q: Where do you find manufacturing overhead in financial statements? The finance head has asked the cost accountant to calculate the overhead costOverhead CostOverhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. Add all indirect expenses together to determine your manufacturing overhead costs. Here we discuss how to calculate overhead manufacturing costs using its formula, practical examples, and a downloadable excel template. Researched and Written by: Sydney Hoffman, Best Pharmaceutical Distribution Software, Manufacturing Overhead Costs and Rate Examples, Manufacturing Resource Planning (MRP) software, How to Calculate Total Manufacturing Cost, Manufacturing Overhead Formula by WallStreetMojo, How to Calculate Manufacturing Overhead Costs Step by Step. Concept note-1: How much overhead was applied to each of the four jobs, 0701, 0702, 0703, and 0704?B. However, fixed costs do not depend on the number of units produced; they remain the same. Download Manufacturing Overhead Formula Excel Template, You can download this Manufacturing Overhead Formula Excel Template here . In short, the main difference between the two concepts is that actual overhead is the amount of cost actually incurred, while applied overhead is the standard amount of overhead applied to cost objects. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours. It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. Depreciation on manufacturing equipment - The amount of value your equipment loses each year. and you must attribute OpenStax. 236352-5501. Overhead is overapplied because actual overhead costs are lower than overhead applied to jobs.  Samsung Inc. is planning to launch a new product called A35 and is deciding upon the products pricing as the competition is fierce. Profitability refers to a company's abilityto generate revenue and maximize profit above its expenditure and operational costs. Determining your manufacturing overhead expenses and rate will allow you to monitor your company's expenditures and the efficiency of your production. Its value indicates how much of an assets worth has been utilized.

Samsung Inc. is planning to launch a new product called A35 and is deciding upon the products pricing as the competition is fierce. Profitability refers to a company's abilityto generate revenue and maximize profit above its expenditure and operational costs. Determining your manufacturing overhead expenses and rate will allow you to monitor your company's expenditures and the efficiency of your production. Its value indicates how much of an assets worth has been utilized.  The difference between actual overhead and applied overhead. 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone. There are two types of these overheads, fixed and variable. Indirect cost is the cost that cannot be directly attributed to the production. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, This will ensure that product costs remain constant over the year. C. either favorable or unfavorable. The standard variable overhead rate per hour is $2.00 ($4,000/2,000 hours), taken from the flexible budget at 100% capacity. The overhead is attributed to a product or service on the basis of direct labor hours, machine hours, direct labor cost etc. Our mission is to improve educational access and learning for everyone. Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation: You will spend $10 on overhead expenses for every unit your company produces. Insurance for Manufacturing Activity = $1,500. WebIn 2017 , actual manufacturing overhead is $317,250. -If a company uses predetermined overhead rates, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account, but they will not be recorded on the job cost sheets for the period. There are two components to variable overhead rates: the overhead application rate and the activity level against which that rate was applied. Businesses add the manufacturing overhead costs to the direct materials and direct labor costs incurred in the process of production to obtain an appropriate Cost of Goods Sale (COGS). Compute the amount of under- or overallocated manufacturing overhead. Make a comprehensive list of indirect business expenses including items like rent, taxes, utilities, office equipment, factory maintenance etc. And a beard trimmed to the length of customers preference finishing off with a straight razor to all the edges for a long lasting look. So if you In the above statement, the total variable cost of the company is $33,750 for 9000 units, $37,500 for 10000 units, and $41,250 for 11000 units, but the totalfixed costFixed CostFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. The company's Cost of Goods Sold was P451,000 prior to closing out its Manufacturing Overhead account. Product cost refers to all those costs which are incurred by the company in order to create the product of the company or deliver the services to the customers and the same is shown in the financial statement of the company for the period in which they become the part of the cost of the goods that are sold by the company. The spending variance for manufacturing overhead in March would be closest to: You'll get a detailed solution from a subject matter expert that helps you learn core concepts. This produces an unfavorable outcome. Examples of product costs are direct materials, direct labor, and allocated factory overhead. Research & development expenses incurred $5 million. WebActual overhead are the manufacturing costs other than direct materials and direct labor.

The difference between actual overhead and applied overhead. 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone. There are two types of these overheads, fixed and variable. Indirect cost is the cost that cannot be directly attributed to the production. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, This will ensure that product costs remain constant over the year. C. either favorable or unfavorable. The standard variable overhead rate per hour is $2.00 ($4,000/2,000 hours), taken from the flexible budget at 100% capacity. The overhead is attributed to a product or service on the basis of direct labor hours, machine hours, direct labor cost etc. Our mission is to improve educational access and learning for everyone. Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation: You will spend $10 on overhead expenses for every unit your company produces. Insurance for Manufacturing Activity = $1,500. WebIn 2017 , actual manufacturing overhead is $317,250. -If a company uses predetermined overhead rates, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account, but they will not be recorded on the job cost sheets for the period. There are two components to variable overhead rates: the overhead application rate and the activity level against which that rate was applied. Businesses add the manufacturing overhead costs to the direct materials and direct labor costs incurred in the process of production to obtain an appropriate Cost of Goods Sale (COGS). Compute the amount of under- or overallocated manufacturing overhead. Make a comprehensive list of indirect business expenses including items like rent, taxes, utilities, office equipment, factory maintenance etc. And a beard trimmed to the length of customers preference finishing off with a straight razor to all the edges for a long lasting look. So if you In the above statement, the total variable cost of the company is $33,750 for 9000 units, $37,500 for 10000 units, and $41,250 for 11000 units, but the totalfixed costFixed CostFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. The company's Cost of Goods Sold was P451,000 prior to closing out its Manufacturing Overhead account. Product cost refers to all those costs which are incurred by the company in order to create the product of the company or deliver the services to the customers and the same is shown in the financial statement of the company for the period in which they become the part of the cost of the goods that are sold by the company. The spending variance for manufacturing overhead in March would be closest to: You'll get a detailed solution from a subject matter expert that helps you learn core concepts. This produces an unfavorable outcome. Examples of product costs are direct materials, direct labor, and allocated factory overhead. Research & development expenses incurred $5 million. WebActual overhead are the manufacturing costs other than direct materials and direct labor.  WebWhat is the formula for manufacturing overhead allocated? This article has been a guide to Manufacturing Overhead Formula. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Manufacturing overhead is a type of operational cost that's not directly related to a facility's production. These are the costs incurred to make the manufacturing process keep going. Figure 2.6 Overhead Applied for Custom Furniture Companys Job 50 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. You can calculate manufacturing Period cost refers to all those costs which are not related or tied with the production process of the company i.e., they are not assigned with any of the particular product of the company and are thus shown in the financial statement of the company for the accounting period in which they are incurred.

WebWhat is the formula for manufacturing overhead allocated? This article has been a guide to Manufacturing Overhead Formula. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Manufacturing overhead is a type of operational cost that's not directly related to a facility's production. These are the costs incurred to make the manufacturing process keep going. Figure 2.6 Overhead Applied for Custom Furniture Companys Job 50 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. You can calculate manufacturing Period cost refers to all those costs which are not related or tied with the production process of the company i.e., they are not assigned with any of the particular product of the company and are thus shown in the financial statement of the company for the accounting period in which they are incurred.  During July, Yarra worked on four jobs with actual direct materials costs of $77,000 for Job 0701, $108,000 for Job 0702, $140,000 for Job 0703, and $69,000 for Job 0704. You can learn more about financing from the following articles . Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. We are open 7 days a week. Examples of other Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . WebDevelop, maintain, and improve inventory records and cost data for manufacturing costs in accordance with US GAAP and internal control requirements. This careful tracking of production costs for each jetliner provides management with important cost information that is used to assess production efficiency and profitability. Such costs include rent of the manufacturing building or premises, depreciation, utilities cost in manufacturing, like electricity, water, gas, oil repairs, maintenance costs incurred in production, insurance, etc. It seems you have Javascript turned off in your browser. Manufacturing overhead is all indirect costs incurred during the production process. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. -A predetermined overhead rate is calculated at the start of the accounting period by dividing the estimated manufacturing overhead by the estimated activity base. The overhead costs applied to jobs using a predetermined overhead rate are recorded as credits in the manufacturing overhead account. (+) Rent of the factory building. Integration components site preparation, overhead utility rack, equipment foundations, final costs and completion date will be dependent on supply chain availability, manufacturing timeframes, and actual construction days based on weather and other factors. Fill in the Budget Performance Report for the period.

During July, Yarra worked on four jobs with actual direct materials costs of $77,000 for Job 0701, $108,000 for Job 0702, $140,000 for Job 0703, and $69,000 for Job 0704. You can learn more about financing from the following articles . Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. We are open 7 days a week. Examples of other Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . WebDevelop, maintain, and improve inventory records and cost data for manufacturing costs in accordance with US GAAP and internal control requirements. This careful tracking of production costs for each jetliner provides management with important cost information that is used to assess production efficiency and profitability. Such costs include rent of the manufacturing building or premises, depreciation, utilities cost in manufacturing, like electricity, water, gas, oil repairs, maintenance costs incurred in production, insurance, etc. It seems you have Javascript turned off in your browser. Manufacturing overhead is all indirect costs incurred during the production process. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. -A predetermined overhead rate is calculated at the start of the accounting period by dividing the estimated manufacturing overhead by the estimated activity base. The overhead costs applied to jobs using a predetermined overhead rate are recorded as credits in the manufacturing overhead account. (+) Rent of the factory building. Integration components site preparation, overhead utility rack, equipment foundations, final costs and completion date will be dependent on supply chain availability, manufacturing timeframes, and actual construction days based on weather and other factors. Fill in the Budget Performance Report for the period.