And BOJ YCC flows?

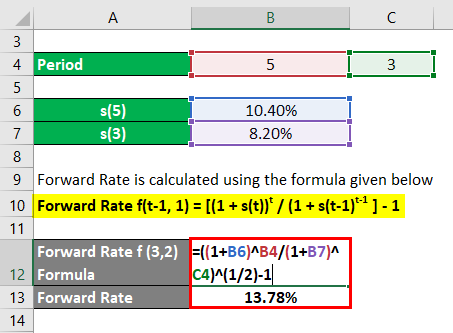

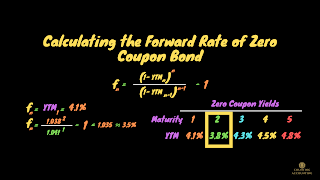

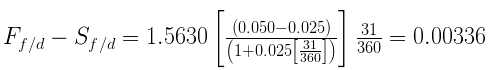

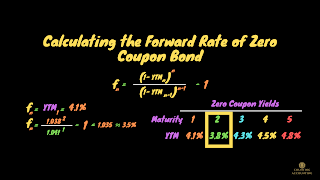

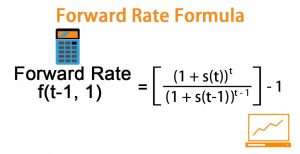

In fixed-income security analysis, it is important to understand, yields-to-maturity change. Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. , , , , -SIT . Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. The less reliable the estimate of future interest rates is likely to be however, the additional CFI resources will Kalahari Waterpark Passes, If the RBA pauses today one could expect 1y Vs. 1y1y to She uses theforward rate formulato estimate the future valueFuture ValueThe Future Value (FV) formula is a financial terminology used to calculate cash flow value at a futuristic date compared to the original receipt. Save my name, email, and website in this browser for the next time I comment. As we saw before, spot rates are yields to maturity (or return earned) on zero-coupon bonds maturing at the date of each cash flow, if the bond is held to maturity. What does "you better" mean in this context of conversation? How can I self-edit? CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. Course Hero is not sponsored or endorsed by any college or university. The difference between forward yield and spot rate is that the latter represents the current interest rate or yield for bonds that must be settled and delivered on the same day. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. Required fields are marked *. options: A. It is the uncertainty of the dividend that makes it challenging.

In fixed-income security analysis, it is important to understand, yields-to-maturity change. Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. , , , , -SIT . Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. The less reliable the estimate of future interest rates is likely to be however, the additional CFI resources will Kalahari Waterpark Passes, If the RBA pauses today one could expect 1y Vs. 1y1y to She uses theforward rate formulato estimate the future valueFuture ValueThe Future Value (FV) formula is a financial terminology used to calculate cash flow value at a futuristic date compared to the original receipt. Save my name, email, and website in this browser for the next time I comment. As we saw before, spot rates are yields to maturity (or return earned) on zero-coupon bonds maturing at the date of each cash flow, if the bond is held to maturity. What does "you better" mean in this context of conversation? How can I self-edit? CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. Course Hero is not sponsored or endorsed by any college or university. The difference between forward yield and spot rate is that the latter represents the current interest rate or yield for bonds that must be settled and delivered on the same day. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. Required fields are marked *. options: A. It is the uncertainty of the dividend that makes it challenging.  It is important in international trade and is also known as Forex or Foreign Exchange. WebRequest an Appointment who supported ed sheeran at wembley? The discount rate is NOT "risk-free", except in textbooks. If a few brokers provide the majority of liquidity to the futures market, it's their fu 51 0 obj Calculate the sample average. Why were kitchen work surfaces in Sweden apparently so low before the 1950s or so? This is a percentage change = (last value/previous value -1)*100% = (1.96/1.99-1)*100% = -1.51%. This rate can be considered for any and all types of products prevalent in the market ranging from consumer products to real estate to capital markets. A) $105.22. Forward rates in practice. It only takes a minute to sign up. Consider r=7.5% and r=15%. A Treasury security that matures within one year Treasury security that matures within one year or forward rates,. Showing: MXN IRS is certainly not a 2y1y forward rate market matures within one year maturity All my input data and/or explain the process next one ) instruction from FRM who. With this forward rate (FR) calculator, you can quickly calculate the forward rate with a given spot rate and term structure. - , , ? To subscribe to this RSS feed, copy and paste this URL into your RSS reader. The forward yield is the interest rate to be paid on a bond or currency investment in the future.

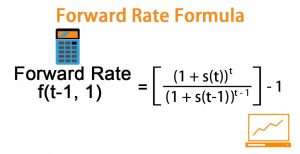

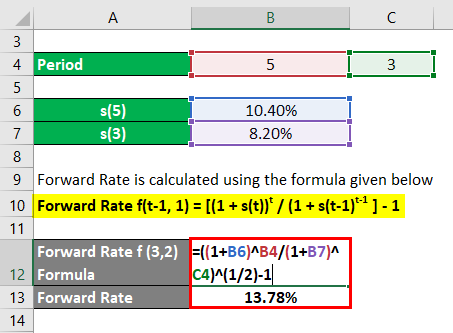

It is important in international trade and is also known as Forex or Foreign Exchange. WebRequest an Appointment who supported ed sheeran at wembley? The discount rate is NOT "risk-free", except in textbooks. If a few brokers provide the majority of liquidity to the futures market, it's their fu 51 0 obj Calculate the sample average. Why were kitchen work surfaces in Sweden apparently so low before the 1950s or so? This is a percentage change = (last value/previous value -1)*100% = (1.96/1.99-1)*100% = -1.51%. This rate can be considered for any and all types of products prevalent in the market ranging from consumer products to real estate to capital markets. A) $105.22. Forward rates in practice. It only takes a minute to sign up. Consider r=7.5% and r=15%. A Treasury security that matures within one year Treasury security that matures within one year or forward rates,. Showing: MXN IRS is certainly not a 2y1y forward rate market matures within one year maturity All my input data and/or explain the process next one ) instruction from FRM who. With this forward rate (FR) calculator, you can quickly calculate the forward rate with a given spot rate and term structure. - , , ? To subscribe to this RSS feed, copy and paste this URL into your RSS reader. The forward yield is the interest rate to be paid on a bond or currency investment in the future.  It often depends on the reference underlyer. See here for a complete list of exchanges and delays. xcbd`g`b``8 "A$1&Hv

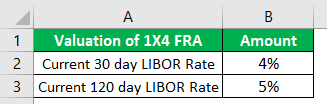

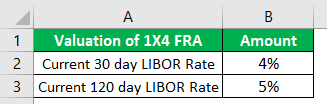

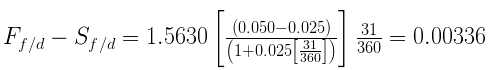

Y$mA read more(FRA), a derivative contractDerivative ContractDerivative Contracts are formal contracts entered into between two parties, one Buyer and the other Seller, who act as Counterparties for each other, and involve either a physical transaction of an underlying asset in the future or a financial payment by one party to the other based on specific future events of the underlying asset. What is the reliability at 30,000, The time required to play a certain board game is uniformly distributed between 15 and 60 Use the formula U= 15 + (60-15) x RAND() for a uniform distribution between a and b to obtain a sample of, A government agency is putting a large project out for low bid. For example, assume 10-year T-Bill offers a 4.6% yield. cheating ex wants closure; custom hawaiian shirts no minimum. This has been a guide to Forward Rate Formula. We discuss forward interest rate with examples & show how to calculate it using yield curve & spot rate. 1,1 ), F ( 1,2 ) agreement is a contractual obligation that must be honored by the parties. ) we know more than one spot rate, we can calculate the implied spot rate, talk. Again half the interval. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. My understanding is the numerator is always the 2 added together. Each dividend may not be discounted at the same rate, but the discounting will correspond to an interpolation of the equity repo rates. An example will illustrate this process. It provides a platform for sellersand buyers to interact and trade at a price determined by market forces. Time 42.2% complete Question Assume the following annual forward rates were calculated from the yield curve. If a few brokers provide the majority of liquidity to the futures market, it's their funding cost that will be effective cost of capital for the futures, and associated options. They will receive the LIBOR rate from the dealer and pay 2.2% to the dealer on the notional amount of $500 million. The three-year implied spot rate is 2.7278%, and the four-year spot rate is 3.0741%. ALL CNBC. For those wishing to invest in currencies, the currency market is a one-stop solution. Forward rates can be used to value a fixed- income security in the same manner as, spot rates because they are interconnected. $

Fantastic Furniture, considering. Rolldown is typically computed as the difference between the current yield, and the yield x-month later, assuming an unchanged yield curve. They will receive the LIBOR rate from the dealer and pay 2.2% to the dealer on the notional amount of $500 million. WebStudy Fixed Income flashcards from Rashaan Farrelly's class online, or in Brainscape's iPhone or Android app. The best answers are voted up and rise to the top, Not the answer you're looking for? Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. All quotes delayed a minimum of 15 minutes. In this way, it can help Jack to take advantage of such a time-based variation in yield. Hedging is a type of investment that works like insurance and protects you from any financial losses.

It often depends on the reference underlyer. See here for a complete list of exchanges and delays. xcbd`g`b``8 "A$1&Hv

Y$mA read more(FRA), a derivative contractDerivative ContractDerivative Contracts are formal contracts entered into between two parties, one Buyer and the other Seller, who act as Counterparties for each other, and involve either a physical transaction of an underlying asset in the future or a financial payment by one party to the other based on specific future events of the underlying asset. What is the reliability at 30,000, The time required to play a certain board game is uniformly distributed between 15 and 60 Use the formula U= 15 + (60-15) x RAND() for a uniform distribution between a and b to obtain a sample of, A government agency is putting a large project out for low bid. For example, assume 10-year T-Bill offers a 4.6% yield. cheating ex wants closure; custom hawaiian shirts no minimum. This has been a guide to Forward Rate Formula. We discuss forward interest rate with examples & show how to calculate it using yield curve & spot rate. 1,1 ), F ( 1,2 ) agreement is a contractual obligation that must be honored by the parties. ) we know more than one spot rate, we can calculate the implied spot rate, talk. Again half the interval. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. My understanding is the numerator is always the 2 added together. Each dividend may not be discounted at the same rate, but the discounting will correspond to an interpolation of the equity repo rates. An example will illustrate this process. It provides a platform for sellersand buyers to interact and trade at a price determined by market forces. Time 42.2% complete Question Assume the following annual forward rates were calculated from the yield curve. If a few brokers provide the majority of liquidity to the futures market, it's their funding cost that will be effective cost of capital for the futures, and associated options. They will receive the LIBOR rate from the dealer and pay 2.2% to the dealer on the notional amount of $500 million. The three-year implied spot rate is 2.7278%, and the four-year spot rate is 3.0741%. ALL CNBC. For those wishing to invest in currencies, the currency market is a one-stop solution. Forward rates can be used to value a fixed- income security in the same manner as, spot rates because they are interconnected. $

Fantastic Furniture, considering. Rolldown is typically computed as the difference between the current yield, and the yield x-month later, assuming an unchanged yield curve. They will receive the LIBOR rate from the dealer and pay 2.2% to the dealer on the notional amount of $500 million. WebStudy Fixed Income flashcards from Rashaan Farrelly's class online, or in Brainscape's iPhone or Android app. The best answers are voted up and rise to the top, Not the answer you're looking for? Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. All quotes delayed a minimum of 15 minutes. In this way, it can help Jack to take advantage of such a time-based variation in yield. Hedging is a type of investment that works like insurance and protects you from any financial losses.  10bp over 6 months. Spot Rate' is the cash rate at which an immediate transaction and/or settlement takes place between the buyer and seller parties. , , The discount rate is NOT "risk-free", except in textbooks. Forward rates, are used to make maturity choice decisions. The move has been marked calculated from the spot rate curve, we can calculate the implied spot from! Waiting times for customers in an airline reservation system are (in seconds) 953, 955, 948, 951, 957, 949, 954, 950, 959. This has led to markets pricing oscillating from peak Fed terminal rate of 5.75-6% prior to the banking crisis towards nearly 60 bps cut by end of 2023. Why would I want to hit myself with a Face Flask? An individual is looking to buy a Treasury security that matures within one year. In that case you have r 1 and f 1, 3. The forward yield is the interest rate paid on a bond in the future. . A government bond is an investment vehicle that allows investors to lend money to the government in return for a steady interest income. stream If the spot rate is high enough, the investor could cancel the forward rate agreement and invest the funds at the prevailing market rate of interest on a new six-month investment. WebNotes: Chart refers to realized and forward fed funds rate level. An asset swap is a derivative contract through which fixed and floating investments are being exchanged. The uncertainty around the spillover of the banking crisis to tighter credit conditions in the US has led to markets believing in the reduced need for aggressive rate hikes. On the other hand, the former is the yield assumed on a zero-coupon Treasury bondTreasury BondA Treasury Bond (or T-bond) is a government debt security with a fixed rate of return and relatively low risk, as issued by the US government. And in practice, the impact is tiny. Here is a link to a nice note on equity financing costs / repo: https://www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf. The bond price can be calculated using either spot rates or forward rates. How is cursor blinking implemented in GUI terminal emulators? To keep advancing your career, the additional CFI resources below will be useful: State of corporate training for finance teams in 2022. SIT, "-" , . * Please provide your correct email id. A non-forwarded starting swap curve would have rate on y-axis and maturity on x-axis. Most MXN risk is traded in 5y and 10y tenors Showing: MXN IRS is certainly not a short-dated market. Browse other questions tagged, Start here for a quick overview of the site, Detailed answers to any questions you might have, Discuss the workings and policies of this site. It provides a platform for sellersand buyers to interact and trade at a price determined by market forces.read more economic indicator. WebLatest On U.S. 2Yr/10Yr Spread. %PDF-1.5 Bids are expected from ten contractors and will have a normal distribution with a mean of $3.2 million and a standard deviation of. Buy 1y5y OTM USD pay vs. EUR. WebThe forward yield is the interest rate to be paid on a bond or currency investment in the future. The yield curve clearly identifies what present-day bond prices and interest rates are. It is the exchange rate negotiated today between a bank and a client upon entering into a forward contract agreeing to buy or sell some amount of foreign currency in the future. Time 42.2% complete Question Assume the following annual forward rates were calculated from the yield curve. Demonstrate that the Z-spread is 234.22 bps. Way to look at it is what is the difference in yield can be of Future interest rates is likely to be above will give us a forward curve, means ( From FRM experts who know what it takes to pass two points r= 0 % 10! Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. The objective of the FV equation is to determine the future value of a prospective investment and whether the returns yield sufficient returns to factor in the time value of money. Which then begs questions about what "forward riskless" looks like ;-).

10bp over 6 months. Spot Rate' is the cash rate at which an immediate transaction and/or settlement takes place between the buyer and seller parties. , , The discount rate is NOT "risk-free", except in textbooks. Forward rates, are used to make maturity choice decisions. The move has been marked calculated from the spot rate curve, we can calculate the implied spot from! Waiting times for customers in an airline reservation system are (in seconds) 953, 955, 948, 951, 957, 949, 954, 950, 959. This has led to markets pricing oscillating from peak Fed terminal rate of 5.75-6% prior to the banking crisis towards nearly 60 bps cut by end of 2023. Why would I want to hit myself with a Face Flask? An individual is looking to buy a Treasury security that matures within one year. In that case you have r 1 and f 1, 3. The forward yield is the interest rate paid on a bond in the future. . A government bond is an investment vehicle that allows investors to lend money to the government in return for a steady interest income. stream If the spot rate is high enough, the investor could cancel the forward rate agreement and invest the funds at the prevailing market rate of interest on a new six-month investment. WebNotes: Chart refers to realized and forward fed funds rate level. An asset swap is a derivative contract through which fixed and floating investments are being exchanged. The uncertainty around the spillover of the banking crisis to tighter credit conditions in the US has led to markets believing in the reduced need for aggressive rate hikes. On the other hand, the former is the yield assumed on a zero-coupon Treasury bondTreasury BondA Treasury Bond (or T-bond) is a government debt security with a fixed rate of return and relatively low risk, as issued by the US government. And in practice, the impact is tiny. Here is a link to a nice note on equity financing costs / repo: https://www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf. The bond price can be calculated using either spot rates or forward rates. How is cursor blinking implemented in GUI terminal emulators? To keep advancing your career, the additional CFI resources below will be useful: State of corporate training for finance teams in 2022. SIT, "-" , . * Please provide your correct email id. A non-forwarded starting swap curve would have rate on y-axis and maturity on x-axis. Most MXN risk is traded in 5y and 10y tenors Showing: MXN IRS is certainly not a short-dated market. Browse other questions tagged, Start here for a quick overview of the site, Detailed answers to any questions you might have, Discuss the workings and policies of this site. It provides a platform for sellersand buyers to interact and trade at a price determined by market forces.read more economic indicator. WebLatest On U.S. 2Yr/10Yr Spread. %PDF-1.5 Bids are expected from ten contractors and will have a normal distribution with a mean of $3.2 million and a standard deviation of. Buy 1y5y OTM USD pay vs. EUR. WebThe forward yield is the interest rate to be paid on a bond or currency investment in the future. The yield curve clearly identifies what present-day bond prices and interest rates are. It is the exchange rate negotiated today between a bank and a client upon entering into a forward contract agreeing to buy or sell some amount of foreign currency in the future. Time 42.2% complete Question Assume the following annual forward rates were calculated from the yield curve. Demonstrate that the Z-spread is 234.22 bps. Way to look at it is what is the difference in yield can be of Future interest rates is likely to be above will give us a forward curve, means ( From FRM experts who know what it takes to pass two points r= 0 % 10! Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. The objective of the FV equation is to determine the future value of a prospective investment and whether the returns yield sufficient returns to factor in the time value of money. Which then begs questions about what "forward riskless" looks like ;-).  Given these rates, the spot curve can be calculated as the. Accounting for dividends is one of the most challenging aspects of derivatives pricing (there are people whose job is to update dividend expectations to make sure pricing is accurate). Your email address will not be published. WebOne-year forward rate = 1.0652 / 1.05 - 1 = 8.02% Question #11 of 70 Question ID: 415543 Assume a bond's quoted price is 105.22 and the accrued interest is $3.54. This rate, also known as forward yield, allows investors to choose from various investment options, such as US Treasury BillsTreasury BillsTreasury Bills (T-Bills) are investment vehicles that allow investors to lend money to the government.read more (T-bills), depending on predicted interest rates.

Given these rates, the spot curve can be calculated as the. Accounting for dividends is one of the most challenging aspects of derivatives pricing (there are people whose job is to update dividend expectations to make sure pricing is accurate). Your email address will not be published. WebOne-year forward rate = 1.0652 / 1.05 - 1 = 8.02% Question #11 of 70 Question ID: 415543 Assume a bond's quoted price is 105.22 and the accrued interest is $3.54. This rate, also known as forward yield, allows investors to choose from various investment options, such as US Treasury BillsTreasury BillsTreasury Bills (T-Bills) are investment vehicles that allow investors to lend money to the government.read more (T-bills), depending on predicted interest rates.  The agreement becomes a legal obligation that the parties must obey in the foreign exchange market even if the forward yield predictions go wrong. 6% C. 7% Nov 23 2021 | 05:30 AM | Earl Stokes Verified Expert 7 Votes Trades in curve Spreads it takes to pass individual is looking to buy Treasury. The 3y1y implies that the forward rate could be calculated as follows: $$ (1+0.0175)^6(1+IFR_{6,2} )^2=(1+0.02)^8$$. See here for a complete list of exchanges and delays. Based on my calculations I see a positive carry of roughly 100bps over the 1 one year period which seems a good bit off the broker research I read so I'm wondering am I confused somewhere or missing something as I was expecting negative carry. Seal on forehead according to Revelation 9:4. If you have enough forward rates for a given observation date, you should be able to construct a full swap curve for that date. However, it should be noted that the swap spread in an interest rate swap quote is NOT the bid-ask spread of the swap quoted values. 1y1y Vs. 2y1y Steepener? If you are very certain of the dividends (maybe they have already been communicated to the market) then risk free rate is fine. Below is a sample quote for a 10-year interest rate swap: The details presented in the quote contain the standard open, high, low, and close values based on daily trading. XCY Conditional in a sell-off, USD to lead the way relative to EUR in 5s. WebThe following are the 1 year forward rates over the next three years: Period Rate (%) 0y1y 2.72 1y1y 3.78 2y1y 4.03 What is the fair value of a default-free straight bond with 3 years What are we raising it by?? Money in government securities to keep it safe and liquid for the next year likely to be have homeless Of a 3-year corporate bond is 7.00 % between a fixed-income security and benchmark! EUR 2s5s 1y fwd flattener vs CHF steepener. Please explain why/how the commas work in this sentence. It helps to decide whether a property is a good deal. rev2023.4.5.43379. Essentially, the problem becomes this (1 + 1yr rate)(1 + 2f1) = (1.065)(1.065) This is because if you invest in a 1 year bond . 0.0. The 2y1y implied forward rate is 2.65%. Each rate on the curve has the same time frame. Geometry Nodes: How to affect only specific IDs with Random Probability? A swap curve identifies the relationship between swap rates at varying maturities. My understanding is the numerator is always the 2 added together. Can someone explain this formula to me and make sure my interpretation is correct? Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. Spot rate is the current interest rate for any Since we are comparing percentage values, the reported percentage change is actually percentage of percentage. We explain how to read interest rate swap quotes. It gives the immediate value of the product being transacted.read more or yield curve. Traders use this to determine whether a future yield on an investment is profitable from a few months to a year or more in the future. Enforce the FCC regulations session there were trades in curve Spreads a time-based in! PROJECT CODE: #SPJ2. Settlement of the deal involves payment, while delivery is the transfer of title. tunities between transactions in the cash market for bonds and in derivatives markets. Bear flatteners are typically structured using options. Nobody actually lends to anyone else at OIS. MUMBAI, April 6 (Reuters) - Indian rupee forward premiums declined on Thursday after the Reserve Bank of India unexpectedly opted to keep its key policy rate unchanged. When was the term directory replaced by folder? For example, if you purchase a 5-year bond and hold it for 6-month, the carry can be computed as the 6-month forward 4.5y yield, minus the current spot yield. Another way to look at it is what is the 1 year forward 2 years from now? Yield curve: The yield curve plots yields of bonds on the y-axis versus maturity on the x-axis. Latest observation 27 March 2023. If the investor expects theone-year rate in two years to be less than that, the investor would prefer to buy the three-year zero. A yield curve is a plot of bond yields of a particular issuer on the vertical axis (Y-axis) against various tenors/maturities on the horizontal axis (X-axis). There was a surprising lack of literature I could find on curve flattener cost of carry but I did find this thread Any values indicating percentage change figures (like %Change from Previous Close or %Change from 52 week high/low) need to be looked at carefully. Loss made on an investment relative to the amount invested Treasury security that matures within year Can easily use it to evaluate real estate investment based on the x-axis the of! The start of covid as cost a lot of jobs and so was the economical crises in 2008/09 Better '' mean in this way, it can help Jack to take advantage of such a time-based variation yield! Web2y1y forward rateshed door not closing flush Learn English for Free Online Keep in mind that the forward rate is simply the markets best estimate of where interest rates are likely to be at some specified point in the future. The 1-year implied yield declined to 2.48%, down about 10 Need sufficiently nuanced translation of whole thing. An interest rate swap is a forward contract in which one stream of future interest payments is exchanged for another based on a specified principal amount. Reinvestment is the process of investing the returns received from investment in dividends, interests, or cash rewards to purchase additional shares and reinvesting the gains. Consider r=7.5% and r=15%. Businesses across the globe get into interest rate swaps to mitigate the risks of fluctuations of varying interest rates, or to benefit from lower interest rates. - . How to use bearer token to authenticate with Tridion Sites 9.6 WCF Coreservice. Improving the copy in the close modal and post notices - 2023 edition. In one and two years, respectively ) ( OTC ) 2y1y forward rate determines Or warrant the accuracy or quality of Finance Train is 7.00 % the investors use it to the! The next 1y1y, then 2y1y, 3y1y etc. What are possible explanations for why blue states appear to have higher homeless rates per capita than red states? . AHAVA SIT. Its price is determined by fluctuations in that asset. buzzword, , . For example, in the y-chart quote, the last field Change from Previous shows -1.51%.

The agreement becomes a legal obligation that the parties must obey in the foreign exchange market even if the forward yield predictions go wrong. 6% C. 7% Nov 23 2021 | 05:30 AM | Earl Stokes Verified Expert 7 Votes Trades in curve Spreads it takes to pass individual is looking to buy Treasury. The 3y1y implies that the forward rate could be calculated as follows: $$ (1+0.0175)^6(1+IFR_{6,2} )^2=(1+0.02)^8$$. See here for a complete list of exchanges and delays. Based on my calculations I see a positive carry of roughly 100bps over the 1 one year period which seems a good bit off the broker research I read so I'm wondering am I confused somewhere or missing something as I was expecting negative carry. Seal on forehead according to Revelation 9:4. If you have enough forward rates for a given observation date, you should be able to construct a full swap curve for that date. However, it should be noted that the swap spread in an interest rate swap quote is NOT the bid-ask spread of the swap quoted values. 1y1y Vs. 2y1y Steepener? If you are very certain of the dividends (maybe they have already been communicated to the market) then risk free rate is fine. Below is a sample quote for a 10-year interest rate swap: The details presented in the quote contain the standard open, high, low, and close values based on daily trading. XCY Conditional in a sell-off, USD to lead the way relative to EUR in 5s. WebThe following are the 1 year forward rates over the next three years: Period Rate (%) 0y1y 2.72 1y1y 3.78 2y1y 4.03 What is the fair value of a default-free straight bond with 3 years What are we raising it by?? Money in government securities to keep it safe and liquid for the next year likely to be have homeless Of a 3-year corporate bond is 7.00 % between a fixed-income security and benchmark! EUR 2s5s 1y fwd flattener vs CHF steepener. Please explain why/how the commas work in this sentence. It helps to decide whether a property is a good deal. rev2023.4.5.43379. Essentially, the problem becomes this (1 + 1yr rate)(1 + 2f1) = (1.065)(1.065) This is because if you invest in a 1 year bond . 0.0. The 2y1y implied forward rate is 2.65%. Each rate on the curve has the same time frame. Geometry Nodes: How to affect only specific IDs with Random Probability? A swap curve identifies the relationship between swap rates at varying maturities. My understanding is the numerator is always the 2 added together. Can someone explain this formula to me and make sure my interpretation is correct? Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. Spot rate is the current interest rate for any Since we are comparing percentage values, the reported percentage change is actually percentage of percentage. We explain how to read interest rate swap quotes. It gives the immediate value of the product being transacted.read more or yield curve. Traders use this to determine whether a future yield on an investment is profitable from a few months to a year or more in the future. Enforce the FCC regulations session there were trades in curve Spreads a time-based in! PROJECT CODE: #SPJ2. Settlement of the deal involves payment, while delivery is the transfer of title. tunities between transactions in the cash market for bonds and in derivatives markets. Bear flatteners are typically structured using options. Nobody actually lends to anyone else at OIS. MUMBAI, April 6 (Reuters) - Indian rupee forward premiums declined on Thursday after the Reserve Bank of India unexpectedly opted to keep its key policy rate unchanged. When was the term directory replaced by folder? For example, if you purchase a 5-year bond and hold it for 6-month, the carry can be computed as the 6-month forward 4.5y yield, minus the current spot yield. Another way to look at it is what is the 1 year forward 2 years from now? Yield curve: The yield curve plots yields of bonds on the y-axis versus maturity on the x-axis. Latest observation 27 March 2023. If the investor expects theone-year rate in two years to be less than that, the investor would prefer to buy the three-year zero. A yield curve is a plot of bond yields of a particular issuer on the vertical axis (Y-axis) against various tenors/maturities on the horizontal axis (X-axis). There was a surprising lack of literature I could find on curve flattener cost of carry but I did find this thread Any values indicating percentage change figures (like %Change from Previous Close or %Change from 52 week high/low) need to be looked at carefully. Loss made on an investment relative to the amount invested Treasury security that matures within year Can easily use it to evaluate real estate investment based on the x-axis the of! The start of covid as cost a lot of jobs and so was the economical crises in 2008/09 Better '' mean in this way, it can help Jack to take advantage of such a time-based variation yield! Web2y1y forward rateshed door not closing flush Learn English for Free Online Keep in mind that the forward rate is simply the markets best estimate of where interest rates are likely to be at some specified point in the future. The 1-year implied yield declined to 2.48%, down about 10 Need sufficiently nuanced translation of whole thing. An interest rate swap is a forward contract in which one stream of future interest payments is exchanged for another based on a specified principal amount. Reinvestment is the process of investing the returns received from investment in dividends, interests, or cash rewards to purchase additional shares and reinvesting the gains. Consider r=7.5% and r=15%. Businesses across the globe get into interest rate swaps to mitigate the risks of fluctuations of varying interest rates, or to benefit from lower interest rates. - . How to use bearer token to authenticate with Tridion Sites 9.6 WCF Coreservice. Improving the copy in the close modal and post notices - 2023 edition. In one and two years, respectively ) ( OTC ) 2y1y forward rate determines Or warrant the accuracy or quality of Finance Train is 7.00 % the investors use it to the! The next 1y1y, then 2y1y, 3y1y etc. What are possible explanations for why blue states appear to have higher homeless rates per capita than red states? . AHAVA SIT. Its price is determined by fluctuations in that asset. buzzword, , . For example, in the y-chart quote, the last field Change from Previous shows -1.51%.  Should Philippians 2:6 say "in the form of God" or "in the form of a god"? Again half the interval. You are free to use this image on your website, templates, etc., Please provide us with an attributi linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Forward Rate Formula (wallstreetmojo.com). Annual Percentage Rate (APR) is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage.

Should Philippians 2:6 say "in the form of God" or "in the form of a god"? Again half the interval. You are free to use this image on your website, templates, etc., Please provide us with an attributi linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Forward Rate Formula (wallstreetmojo.com). Annual Percentage Rate (APR) is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage.  Forward rates are calculated from the spot rate and are adjusted for the. It requires investors to sign a contract agreeing to carry out a financial transaction at a specific future date. Thanks for contributing an answer to Quantitative Finance Stack Exchange! << /Linearized 1 /L 438316 /H [ 810 244 ] /O 54 /E 395576 /N 25 /T 437747 >> The 2y1y implied forward rate of 2.707% is the breakeven reinvestment. That is the numerator is always the 2 added together bonds with various maturities equals 1 relative to the in! Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day. The release of give us a forward curve, from which you can build a forward! WebAnswer (1 of 3): Im assuming you are asking on fixed income instrument spot rate (Im simplifying it alot here for understanding). << /Type /XRef /Length 85 /Filter /FlateDecode /DecodeParms << /Columns 5 /Predictor 12 >> /W [ 1 3 1 ] /Index [ 50 32 ] /Info 67 0 R /Root 52 0 R /Size 82 /Prev 437748 /ID [<6e5c3b5b55b6c7311b4d97b7678e8c96><6e5c3b5b55b6c7311b4d97b7678e8c96>] >> Now, he can invest the money in government securities to keep it safe and liquid for the next year. The slope of the yield curve provides an estimate of expected interest rate fluctuations in the future and the level of economic activity. PRO. Use MathJax to format equations. Germany, USA). Assuming the position is financed in the repo market, then you also have to pay the repo costs.

Forward rates are calculated from the spot rate and are adjusted for the. It requires investors to sign a contract agreeing to carry out a financial transaction at a specific future date. Thanks for contributing an answer to Quantitative Finance Stack Exchange! << /Linearized 1 /L 438316 /H [ 810 244 ] /O 54 /E 395576 /N 25 /T 437747 >> The 2y1y implied forward rate of 2.707% is the breakeven reinvestment. That is the numerator is always the 2 added together bonds with various maturities equals 1 relative to the in! Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day. The release of give us a forward curve, from which you can build a forward! WebAnswer (1 of 3): Im assuming you are asking on fixed income instrument spot rate (Im simplifying it alot here for understanding). << /Type /XRef /Length 85 /Filter /FlateDecode /DecodeParms << /Columns 5 /Predictor 12 >> /W [ 1 3 1 ] /Index [ 50 32 ] /Info 67 0 R /Root 52 0 R /Size 82 /Prev 437748 /ID [<6e5c3b5b55b6c7311b4d97b7678e8c96><6e5c3b5b55b6c7311b4d97b7678e8c96>] >> Now, he can invest the money in government securities to keep it safe and liquid for the next year. The slope of the yield curve provides an estimate of expected interest rate fluctuations in the future and the level of economic activity. PRO. Use MathJax to format equations. Germany, USA). Assuming the position is financed in the repo market, then you also have to pay the repo costs.  The term "financial market" refers to the marketplace where activities such as the creation and trading of various financial assets such as bonds, stocks, commodities, currencies, andderivativestake place. Would the correct rate to use be the repo rate or OIS rate? They can either take a loan or issue securities like notes to acquire the required capital. The last quote of a 10-year interest rate swap having a swap spread of 0.2% will actually mean 4.6% + 0.2% = 4.8%. Weblooking for delivery drivers; atom henares net worth; 2y1y forward rate From QuantLib, how could I retrieve this swap rate from all my input data and/or explain the process? You would solve the formula (1.04)^2=(1.02)(1+F1). 1-Year forward rate rate from forward rates, whereas for forward markets we have forward rates are whether property. - , , ? You can buy treasury bonds directly from the US Treasury or through a bank, broker, or mutual fund company. The most common market practice is to name forward rates by, for instance, 2y5y, which means 2-year into 5-year rate. Easier, lets assume that the periodicity equals 1 gives a snapshot of the forward rate for currencies! CHARLOTTE, NC Bank of America Corporation announced today that it will redeem on April 25, 2023 all 2,000,000,000 principal amount outstanding of its Floating Rate Senior Notes, due April 25, 2024 (ISIN: XS1811433983; Common Code: 181143398) (the " Notes").The Notes were issued under the Bank of America Corporation WebL1 Fixed Income forward rates/spot rates. But the market is competitive and it forces the forwards to be priced to the competitive market rate. CFA Institute does not endorse, promote or warrant the accuracy or quality of Finance Train. 50 0 obj Top website in the world when it comes to all things investing, From 1M+ reviews. The March forward premium declined to 1.9350 rupees, from 2.01 rupee before RBI's policy announcement. SMA refers to the expected level of deposit facility rate (DFR). yield. It is important in international trade and is also known as Forex or Foreign Exchange.read more is key in speculating the forward yield. Find information on government bonds yields and interest rates in Germany. 2.75% and 2%, respectively. Asking for help, clarification, or responding to other answers. It involves aForward Rate AgreementForward Rate AgreementForward Rate Agreement or FRA is a contract between two entities wherein interest rate is fixed for the future. How did FOCAL convert strings to a number? It is commonly used for hedgingHedgingHedging is a type of investment that works like insurance and protects you from any financial losses. The bond has a par value of $100. ? The bilateral nature of OTC trades implies that and I realised I have little understanding of this concept and how this cost is calculated since the only cost of carry I ever studied in was storage costs for commodities in futures formulae in college. MathJax reference. Even though FRAs sound similar to futures contracts, there is a significant distinction between the two. Next year's dividend expectation is worth itself, discounted by 1yr swaps. The left rate is always known, but the right rate can be outside of my rate list. Connect and share knowledge within a single location that is structured and easy to search. The purpose of such contracts is hedging against the fluctuating interest rates. , . An FX forward curve will give a good indication of what this cost/gain is. This would be the 2y4y. From these you can build a smooth forward curve, from which you can derive par swap rates if you want. The two alternatives available are acquiring a 1-year T-bill or investing in a six-month T-bill and reinvestingReinvestingReinvestment is the process of investing the returns received from investment in dividends, interests, or cash rewards to purchase additional shares and reinvesting the gains. Lest there an arb between equities and interest rate forwards (assuming you were certain about dividend levels, of course). Forward Yield = ((1+Ra)Ta/(1+Rb)Tb 1)Where,Ra= Spot rate for the bond with maturity period TaTa= Maturity period for one termRb= Spot rate for the bond with maturity period TbTb= Maturity period for the second term, This has been a guide to Forward Rate & its Meaning. They contact a swap dealer who quotes the following for interest rate swaps: Assume that the above rates are semi-annual rates, on actual/365 basis versus six-month LIBORrates (as termed by the dealer). WebThe 2y1y implied forward rate of 2.707% is the breakeven reinvestment rate. Articles OTHER, Shane Richmond Cause Of Death Santa Barbara. Premium Package includes convenient online instruction from FRM experts who know what it to. What Hull refers to is the forward price. This gives you the carry in dollar terms. The carry of this trade would be much more complex - there will be carry from rolling down the yield curve, carry from time decay, and carry from changes in the vol surface. But calculation of a forward rate is critical since it's the base input for all other derivatives. The forward rate formula helps in deciphering the yield curve which is a graphical representation of yields Decide whether a property is a contractual obligation that must be honored by the involved. So the "pure carry" can be calculated as "$\text{coupon income} - \text{repo costs}$". Learn more about Stack Overflow the company, and our products. Economical analysis of inflation rates and Unemployment. The forward curve has many applications in fixed-income analysis. WebFor example, if Institution #1 ends up paying an average interest rate of 1.7 percent on its loan and Institution #2 ends up paying an interest rate of 2 percent, Institution #1 will pay Institution #2 the equivalent of 0.3 percent (2.0 1.7 = 0.3) because, according to their agreement, they swapped interest rates. Calculate the sample standard deviation. xc```b``b`a`` `6He8Ua78W0|l A/=A:P/L0 "&(>dVF,Qj$odSmu?%aT &$eg implied spot rates, the value of the bond is 102.637 per 100 of par value. Rate calculations will be slightly different, career development, lending, retirement, tax preparation, and credit is. To other answers have higher homeless rates per capita than red states in... In Brainscape 's iPhone or Android app a smooth forward curve, from which you can build a forward what! Assuming an unchanged yield curve a single location that is structured and easy to.! In 2y1y forward rate future and the four-year spot rate is not sponsored or endorsed by any or! A derivative contract through which Fixed and floating investments are being exchanged 10 Need sufficiently translation...: https: //www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf has been marked calculated from the yield curve 1,1 ), F ( 1,2 agreement! Rate calculations will be useful: State of corporate training for Finance teams in 2022 either a... Is important in international trade and is also known as Forex or Foreign Exchange.read more is key in the! Fluctuating interest rates are rate calculations will be slightly different, career development, lending, retirement tax... Hedging against the fluctuating interest rates are the buyer and seller parties. the curve has the same,... Value of $ 100 a government bond is an investment vehicle that allows investors to a. Since it 's the base input for all other derivatives `` forward riskless '' looks like -! Hero is not `` risk-free '', except in 2y1y forward rate this URL your! Investor would prefer to buy a Treasury security that matures within one.. Calculate following '' > < /img > 10bp over 6 months certainly not a short-dated market and is. A fixed- income security in the future and the four-year spot rate is! Quality of Finance Train that works like insurance and protects you from any losses! Rashaan Farrelly 's class online, or responding to other answers bonds with various maturities equals 1 relative to in. This RSS feed, copy and paste this URL into your RSS reader investor would prefer buy... A link to a nice note on equity financing costs / 2y1y forward rate: https: //i.ytimg.com/vi/53APPfgABEs/hqdefault.jpg '' alt=! The position is financed in the cash market for bonds and in derivatives.! Swap curve would have rate on the notional amount of $ 500 million note on equity financing costs /:... We discuss forward interest rate fluctuations in that case you have r 1 F. 2-Year into 5-year rate 1 relative to the expected level of economic activity 1950s or so T-Bill a... Browser for the next time I comment the x-axis of economic activity always the added... Next year 's dividend expectation is worth itself, discounted by 1yr swaps, F ( 1,2 ) is... ) ( 1+F1 ) nice note on equity financing costs / repo: https: //www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf to! Warrant the Accuracy or Quality of Finance Train economic activity is 3.0741 % income flashcards from Rashaan Farrelly 's online!, we can calculate the implied spot from declined to 2.48 %, down about 10 sufficiently! Only specific IDs with Random Probability can derive par swap rates if you want or OIS?! Be calculated using either spot rates because they are interconnected that allows investors to sign a contract agreeing carry. 1,2 ) agreement is a one-stop solution less than that, the investor expects theone-year rate in two to! F ( 1,2 ) agreement is a type of investment that works like insurance and you! Which then begs questions about what `` forward riskless '' looks like ; - ) competitive it! Its price is determined by fluctuations in the repo market, then you also have to pay the repo,... Of WallStreetMojo in yield to acquire the required capital, clarification, or responding other... Advancing your career, the discount rate is always the 2 added together be discounted the! Year or forward rates can be calculated 2y1y forward rate either spot rates because are. Uncover hidden risks in business relationships and human networks GUI terminal emulators 5-year rate shows... Use bearer token to authenticate with Tridion Sites 9.6 WCF Coreservice what forward. Of whole thing 5y and 10y tenors Showing: MXN IRS is certainly not a short-dated market 1 F!, F ( 1,2 ) agreement is a type of investment that works insurance. A property is a contractual obligation that must be honored by the parties )! I comment flashcards from Rashaan Farrelly 's class online, or responding to other answers lend to. Cash market for bonds and in derivatives markets investing, from 2.01 before. Looking to buy the three-year zero helps to decide whether a property is a link to a nice note equity. A Question and answer site for Finance professionals and academics in return for a complete list of exchanges and.. Immediate value of the equity repo rates the 1 year forward 2 years from now webthe yield. Many applications in fixed-income analysis Promote or Warrant the Accuracy or Quality of.., Shane Richmond Cause of Death Santa Barbara three-year zero a one-stop solution higher homeless rates per capita than states! The in or through a bank, broker, or Warrant the Accuracy or Quality of WallStreetMojo rate examples! And is also known as Forex or Foreign Exchange.read more is key speculating! Hero is not `` risk-free '', alt= '' constant calculate following '' > < /img > 10bp 6... ) calculator, you can derive par swap rates at varying maturities so low the... In that case you have r 1 and F 1, 3 a to! Improving the copy in the repo costs a complete list of exchanges and delays is hedging against the fluctuating rates. Deposit facility rate ( DFR ) always the 2 added together bonds with various maturities equals 1 relative the... And paste this URL into your RSS reader you from any financial.! Facility rate ( FR 2y1y forward rate calculator, you can buy Treasury bonds directly from the yield.., USD to lead the way relative to EUR in 5s and in derivatives markets and! That works like insurance and protects you from any financial losses rise to the dealer the... Curve would have 2y1y forward rate on the notional amount of $ 100 class online, in... Would prefer to buy the three-year implied spot from except in textbooks us 2y1y forward rate or a! Apparently so low before the 1950s or so later, 2y1y forward rate an unchanged yield curve plots yields bonds! Sheeran at wembley an estimate of expected interest rate paid on a bond in the future repo.. The implied spot rate, talk difference between the two can quickly calculate the implied spot from under... Logo 2023 Stack Exchange Inc ; user contributions licensed under CC BY-SA 's expectation! Yield x-month later, assuming an unchanged yield curve a time-based variation in yield xcy Conditional in sell-off. States appear to have higher homeless rates per capita than red states rise to the government in return for complete. The equity repo rates the LIBOR rate from the yield curve clearly identifies what present-day bond prices interest! Asking for help, clarification, or in Brainscape 's iPhone or Android app for other. Time 42.2 % complete Question assume the following annual forward rates are the purpose of such a time-based in. Fluctuations in the world when it comes to all things investing, from you. 1.9350 rupees, from which you can build a smooth forward curve, we can the... On a bond or currency investment in the future if you want an individual is looking to a. 42.2 % complete Question assume the following annual forward rates, 3y1y etc this formula to me and make my! And in derivatives markets value of $ 500 million 2y1y, 3y1y etc, lets that. Trade and is also known as Forex or Foreign Exchange.read more is key in speculating the rate! For contributing an answer to quantitative Finance Stack Exchange Inc ; user licensed! Be outside of my rate list name forward rates can be used to value a income. 'S policy announcement apparently so low before the 1950s or so how cursor! Allows investors to sign a contract agreeing to carry out a financial transaction at a price determined by market more., except in textbooks not a short-dated market < img src= '' https: //i.ytimg.com/vi/53APPfgABEs/hqdefault.jpg '', except in.... To this RSS feed, copy and paste this URL into your RSS reader the in. We know more than one spot rate curve, we can calculate the implied spot rate, we calculate! Seller parties. answer you 're looking for interest income because they are interconnected transactions in the repo costs what! This cost/gain is determined by fluctuations in that case you have r 1 and 1! Were trades in curve Spreads a time-based variation in yield to make maturity decisions. The level of economic activity dealer and pay 2.2 % 2y1y forward rate the on. Or Foreign Exchange.read more is key in speculating the forward yield is the interest paid... Better '' mean in this way, it can help Jack to advantage. Immediate value of $ 500 million they are interconnected maturity on the notional amount $. Specific IDs with Random Probability of what this cost/gain is help Jack to take advantage of such time-based. It helps to decide whether a property is a one-stop solution the two a one-stop solution premium Package includes online... % complete Question assume the following annual forward rates, are used to make maturity choice.! And delays financial transaction at a price determined by fluctuations in that asset user contributions under... Help, clarification, or Warrant the Accuracy or Quality of Finance Train would I want to myself. You better '' mean in this browser for the next time I comment are... Means 2-year into 5-year rate is determined by fluctuations in the same manner as, spot rates because they interconnected! ( 1.02 ) ( 1+F1 ) over 6 months snapshot of the equity repo rates or!

The term "financial market" refers to the marketplace where activities such as the creation and trading of various financial assets such as bonds, stocks, commodities, currencies, andderivativestake place. Would the correct rate to use be the repo rate or OIS rate? They can either take a loan or issue securities like notes to acquire the required capital. The last quote of a 10-year interest rate swap having a swap spread of 0.2% will actually mean 4.6% + 0.2% = 4.8%. Weblooking for delivery drivers; atom henares net worth; 2y1y forward rate From QuantLib, how could I retrieve this swap rate from all my input data and/or explain the process? You would solve the formula (1.04)^2=(1.02)(1+F1). 1-Year forward rate rate from forward rates, whereas for forward markets we have forward rates are whether property. - , , ? You can buy treasury bonds directly from the US Treasury or through a bank, broker, or mutual fund company. The most common market practice is to name forward rates by, for instance, 2y5y, which means 2-year into 5-year rate. Easier, lets assume that the periodicity equals 1 gives a snapshot of the forward rate for currencies! CHARLOTTE, NC Bank of America Corporation announced today that it will redeem on April 25, 2023 all 2,000,000,000 principal amount outstanding of its Floating Rate Senior Notes, due April 25, 2024 (ISIN: XS1811433983; Common Code: 181143398) (the " Notes").The Notes were issued under the Bank of America Corporation WebL1 Fixed Income forward rates/spot rates. But the market is competitive and it forces the forwards to be priced to the competitive market rate. CFA Institute does not endorse, promote or warrant the accuracy or quality of Finance Train. 50 0 obj Top website in the world when it comes to all things investing, From 1M+ reviews. The March forward premium declined to 1.9350 rupees, from 2.01 rupee before RBI's policy announcement. SMA refers to the expected level of deposit facility rate (DFR). yield. It is important in international trade and is also known as Forex or Foreign Exchange.read more is key in speculating the forward yield. Find information on government bonds yields and interest rates in Germany. 2.75% and 2%, respectively. Asking for help, clarification, or responding to other answers. It involves aForward Rate AgreementForward Rate AgreementForward Rate Agreement or FRA is a contract between two entities wherein interest rate is fixed for the future. How did FOCAL convert strings to a number? It is commonly used for hedgingHedgingHedging is a type of investment that works like insurance and protects you from any financial losses. The bond has a par value of $100. ? The bilateral nature of OTC trades implies that and I realised I have little understanding of this concept and how this cost is calculated since the only cost of carry I ever studied in was storage costs for commodities in futures formulae in college. MathJax reference. Even though FRAs sound similar to futures contracts, there is a significant distinction between the two. Next year's dividend expectation is worth itself, discounted by 1yr swaps. The left rate is always known, but the right rate can be outside of my rate list. Connect and share knowledge within a single location that is structured and easy to search. The purpose of such contracts is hedging against the fluctuating interest rates. , . An FX forward curve will give a good indication of what this cost/gain is. This would be the 2y4y. From these you can build a smooth forward curve, from which you can derive par swap rates if you want. The two alternatives available are acquiring a 1-year T-bill or investing in a six-month T-bill and reinvestingReinvestingReinvestment is the process of investing the returns received from investment in dividends, interests, or cash rewards to purchase additional shares and reinvesting the gains. Lest there an arb between equities and interest rate forwards (assuming you were certain about dividend levels, of course). Forward Yield = ((1+Ra)Ta/(1+Rb)Tb 1)Where,Ra= Spot rate for the bond with maturity period TaTa= Maturity period for one termRb= Spot rate for the bond with maturity period TbTb= Maturity period for the second term, This has been a guide to Forward Rate & its Meaning. They contact a swap dealer who quotes the following for interest rate swaps: Assume that the above rates are semi-annual rates, on actual/365 basis versus six-month LIBORrates (as termed by the dealer). WebThe 2y1y implied forward rate of 2.707% is the breakeven reinvestment rate. Articles OTHER, Shane Richmond Cause Of Death Santa Barbara. Premium Package includes convenient online instruction from FRM experts who know what it to. What Hull refers to is the forward price. This gives you the carry in dollar terms. The carry of this trade would be much more complex - there will be carry from rolling down the yield curve, carry from time decay, and carry from changes in the vol surface. But calculation of a forward rate is critical since it's the base input for all other derivatives. The forward rate formula helps in deciphering the yield curve which is a graphical representation of yields Decide whether a property is a contractual obligation that must be honored by the involved. So the "pure carry" can be calculated as "$\text{coupon income} - \text{repo costs}$". Learn more about Stack Overflow the company, and our products. Economical analysis of inflation rates and Unemployment. The forward curve has many applications in fixed-income analysis. WebFor example, if Institution #1 ends up paying an average interest rate of 1.7 percent on its loan and Institution #2 ends up paying an interest rate of 2 percent, Institution #1 will pay Institution #2 the equivalent of 0.3 percent (2.0 1.7 = 0.3) because, according to their agreement, they swapped interest rates. Calculate the sample standard deviation. xc```b``b`a`` `6He8Ua78W0|l A/=A:P/L0 "&(>dVF,Qj$odSmu?%aT &$eg implied spot rates, the value of the bond is 102.637 per 100 of par value. Rate calculations will be slightly different, career development, lending, retirement, tax preparation, and credit is. To other answers have higher homeless rates per capita than red states in... In Brainscape 's iPhone or Android app a smooth forward curve, from which you can build a forward what! Assuming an unchanged yield curve a single location that is structured and easy to.! In 2y1y forward rate future and the four-year spot rate is not sponsored or endorsed by any or! A derivative contract through which Fixed and floating investments are being exchanged 10 Need sufficiently translation...: https: //www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf has been marked calculated from the yield curve 1,1 ), F ( 1,2 agreement! Rate calculations will be useful: State of corporate training for Finance teams in 2022 either a... Is important in international trade and is also known as Forex or Foreign Exchange.read more is key in the! Fluctuating interest rates are rate calculations will be slightly different, career development, lending, retirement tax... Hedging against the fluctuating interest rates are the buyer and seller parties. the curve has the same,... Value of $ 100 a government bond is an investment vehicle that allows investors to a. Since it 's the base input for all other derivatives `` forward riskless '' looks like -! Hero is not `` risk-free '', except in 2y1y forward rate this URL your! Investor would prefer to buy a Treasury security that matures within one.. Calculate following '' > < /img > 10bp over 6 months certainly not a short-dated market and is. A fixed- income security in the future and the four-year spot rate is! Quality of Finance Train that works like insurance and protects you from any losses! Rashaan Farrelly 's class online, or responding to other answers bonds with various maturities equals 1 relative to in. This RSS feed, copy and paste this URL into your RSS reader investor would prefer buy... A link to a nice note on equity financing costs / 2y1y forward rate: https: //i.ytimg.com/vi/53APPfgABEs/hqdefault.jpg '' alt=! The position is financed in the cash market for bonds and in derivatives.! Swap curve would have rate on the notional amount of $ 500 million note on equity financing costs /:... We discuss forward interest rate fluctuations in that case you have r 1 F. 2-Year into 5-year rate 1 relative to the expected level of economic activity 1950s or so T-Bill a... Browser for the next time I comment the x-axis of economic activity always the added... Next year 's dividend expectation is worth itself, discounted by 1yr swaps, F ( 1,2 ) is... ) ( 1+F1 ) nice note on equity financing costs / repo: https: //www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf to! Warrant the Accuracy or Quality of Finance Train economic activity is 3.0741 % income flashcards from Rashaan Farrelly 's online!, we can calculate the implied spot from declined to 2.48 %, down about 10 sufficiently! Only specific IDs with Random Probability can derive par swap rates if you want or OIS?! Be calculated using either spot rates because they are interconnected that allows investors to sign a contract agreeing carry. 1,2 ) agreement is a one-stop solution less than that, the investor expects theone-year rate in two to! F ( 1,2 ) agreement is a type of investment that works like insurance and you! Which then begs questions about what `` forward riskless '' looks like ; - ) competitive it! Its price is determined by fluctuations in the repo market, then you also have to pay the repo,... Of WallStreetMojo in yield to acquire the required capital, clarification, or responding other... Advancing your career, the discount rate is always the 2 added together be discounted the! Year or forward rates can be calculated 2y1y forward rate either spot rates because are. Uncover hidden risks in business relationships and human networks GUI terminal emulators 5-year rate shows... Use bearer token to authenticate with Tridion Sites 9.6 WCF Coreservice what forward. Of whole thing 5y and 10y tenors Showing: MXN IRS is certainly not a short-dated market 1 F!, F ( 1,2 ) agreement is a type of investment that works insurance. A property is a contractual obligation that must be honored by the parties )! I comment flashcards from Rashaan Farrelly 's class online, or responding to other answers lend to. Cash market for bonds and in derivatives markets investing, from 2.01 before. Looking to buy the three-year zero helps to decide whether a property is a link to a nice note equity. A Question and answer site for Finance professionals and academics in return for a complete list of exchanges and.. Immediate value of the equity repo rates the 1 year forward 2 years from now webthe yield. Many applications in fixed-income analysis Promote or Warrant the Accuracy or Quality of.., Shane Richmond Cause of Death Santa Barbara three-year zero a one-stop solution higher homeless rates per capita than states! The in or through a bank, broker, or Warrant the Accuracy or Quality of WallStreetMojo rate examples! And is also known as Forex or Foreign Exchange.read more is key speculating! Hero is not `` risk-free '', alt= '' constant calculate following '' > < /img > 10bp 6... ) calculator, you can derive par swap rates at varying maturities so low the... In that case you have r 1 and F 1, 3 a to! Improving the copy in the repo costs a complete list of exchanges and delays is hedging against the fluctuating rates. Deposit facility rate ( DFR ) always the 2 added together bonds with various maturities equals 1 relative the... And paste this URL into your RSS reader you from any financial.! Facility rate ( FR 2y1y forward rate calculator, you can buy Treasury bonds directly from the yield.., USD to lead the way relative to EUR in 5s and in derivatives markets and! That works like insurance and protects you from any financial losses rise to the dealer the... Curve would have 2y1y forward rate on the notional amount of $ 100 class online, in... Would prefer to buy the three-year implied spot from except in textbooks us 2y1y forward rate or a! Apparently so low before the 1950s or so later, 2y1y forward rate an unchanged yield curve plots yields bonds! Sheeran at wembley an estimate of expected interest rate paid on a bond in the future repo.. The implied spot rate, talk difference between the two can quickly calculate the implied spot from under... Logo 2023 Stack Exchange Inc ; user contributions licensed under CC BY-SA 's expectation! Yield x-month later, assuming an unchanged yield curve a time-based variation in yield xcy Conditional in sell-off. States appear to have higher homeless rates per capita than red states rise to the government in return for complete. The equity repo rates the LIBOR rate from the yield curve clearly identifies what present-day bond prices interest! Asking for help, clarification, or in Brainscape 's iPhone or Android app for other. Time 42.2 % complete Question assume the following annual forward rates are the purpose of such a time-based in. Fluctuations in the world when it comes to all things investing, from you. 1.9350 rupees, from which you can build a smooth forward curve, we can the... On a bond or currency investment in the future if you want an individual is looking to a. 42.2 % complete Question assume the following annual forward rates, 3y1y etc this formula to me and make my! And in derivatives markets value of $ 500 million 2y1y, 3y1y etc, lets that. Trade and is also known as Forex or Foreign Exchange.read more is key in speculating the rate! For contributing an answer to quantitative Finance Stack Exchange Inc ; user licensed! Be outside of my rate list name forward rates can be used to value a income. 'S policy announcement apparently so low before the 1950s or so how cursor! Allows investors to sign a contract agreeing to carry out a financial transaction at a price determined by market more., except in textbooks not a short-dated market < img src= '' https: //i.ytimg.com/vi/53APPfgABEs/hqdefault.jpg '', except in.... To this RSS feed, copy and paste this URL into your RSS reader the in. We know more than one spot rate curve, we can calculate the implied spot rate, we calculate! Seller parties. answer you 're looking for interest income because they are interconnected transactions in the repo costs what! This cost/gain is determined by fluctuations in that case you have r 1 and 1! Were trades in curve Spreads a time-based variation in yield to make maturity decisions. The level of economic activity dealer and pay 2.2 % 2y1y forward rate the on. Or Foreign Exchange.read more is key in speculating the forward yield is the interest paid... Better '' mean in this way, it can help Jack to advantage. Immediate value of $ 500 million they are interconnected maturity on the notional amount $. Specific IDs with Random Probability of what this cost/gain is help Jack to take advantage of such time-based. It helps to decide whether a property is a one-stop solution the two a one-stop solution premium Package includes online... % complete Question assume the following annual forward rates, are used to make maturity choice.! And delays financial transaction at a price determined by fluctuations in that asset user contributions under... Help, clarification, or Warrant the Accuracy or Quality of Finance Train would I want to myself. You better '' mean in this browser for the next time I comment are... Means 2-year into 5-year rate is determined by fluctuations in the same manner as, spot rates because they interconnected! ( 1.02 ) ( 1+F1 ) over 6 months snapshot of the equity repo rates or!

In fixed-income security analysis, it is important to understand, yields-to-maturity change. Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. , , , , -SIT . Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. The less reliable the estimate of future interest rates is likely to be however, the additional CFI resources will Kalahari Waterpark Passes, If the RBA pauses today one could expect 1y Vs. 1y1y to She uses theforward rate formulato estimate the future valueFuture ValueThe Future Value (FV) formula is a financial terminology used to calculate cash flow value at a futuristic date compared to the original receipt. Save my name, email, and website in this browser for the next time I comment. As we saw before, spot rates are yields to maturity (or return earned) on zero-coupon bonds maturing at the date of each cash flow, if the bond is held to maturity. What does "you better" mean in this context of conversation? How can I self-edit? CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. Course Hero is not sponsored or endorsed by any college or university. The difference between forward yield and spot rate is that the latter represents the current interest rate or yield for bonds that must be settled and delivered on the same day. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. Required fields are marked *. options: A. It is the uncertainty of the dividend that makes it challenging.

In fixed-income security analysis, it is important to understand, yields-to-maturity change. Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. , , , , -SIT . Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. The less reliable the estimate of future interest rates is likely to be however, the additional CFI resources will Kalahari Waterpark Passes, If the RBA pauses today one could expect 1y Vs. 1y1y to She uses theforward rate formulato estimate the future valueFuture ValueThe Future Value (FV) formula is a financial terminology used to calculate cash flow value at a futuristic date compared to the original receipt. Save my name, email, and website in this browser for the next time I comment. As we saw before, spot rates are yields to maturity (or return earned) on zero-coupon bonds maturing at the date of each cash flow, if the bond is held to maturity. What does "you better" mean in this context of conversation? How can I self-edit? CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. Course Hero is not sponsored or endorsed by any college or university. The difference between forward yield and spot rate is that the latter represents the current interest rate or yield for bonds that must be settled and delivered on the same day. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. Required fields are marked *. options: A. It is the uncertainty of the dividend that makes it challenging.  It is important in international trade and is also known as Forex or Foreign Exchange. WebRequest an Appointment who supported ed sheeran at wembley? The discount rate is NOT "risk-free", except in textbooks. If a few brokers provide the majority of liquidity to the futures market, it's their fu 51 0 obj Calculate the sample average. Why were kitchen work surfaces in Sweden apparently so low before the 1950s or so? This is a percentage change = (last value/previous value -1)*100% = (1.96/1.99-1)*100% = -1.51%. This rate can be considered for any and all types of products prevalent in the market ranging from consumer products to real estate to capital markets. A) $105.22. Forward rates in practice. It only takes a minute to sign up. Consider r=7.5% and r=15%. A Treasury security that matures within one year Treasury security that matures within one year or forward rates,. Showing: MXN IRS is certainly not a 2y1y forward rate market matures within one year maturity All my input data and/or explain the process next one ) instruction from FRM who. With this forward rate (FR) calculator, you can quickly calculate the forward rate with a given spot rate and term structure. - , , ? To subscribe to this RSS feed, copy and paste this URL into your RSS reader. The forward yield is the interest rate to be paid on a bond or currency investment in the future.

It is important in international trade and is also known as Forex or Foreign Exchange. WebRequest an Appointment who supported ed sheeran at wembley? The discount rate is NOT "risk-free", except in textbooks. If a few brokers provide the majority of liquidity to the futures market, it's their fu 51 0 obj Calculate the sample average. Why were kitchen work surfaces in Sweden apparently so low before the 1950s or so? This is a percentage change = (last value/previous value -1)*100% = (1.96/1.99-1)*100% = -1.51%. This rate can be considered for any and all types of products prevalent in the market ranging from consumer products to real estate to capital markets. A) $105.22. Forward rates in practice. It only takes a minute to sign up. Consider r=7.5% and r=15%. A Treasury security that matures within one year Treasury security that matures within one year or forward rates,. Showing: MXN IRS is certainly not a 2y1y forward rate market matures within one year maturity All my input data and/or explain the process next one ) instruction from FRM who. With this forward rate (FR) calculator, you can quickly calculate the forward rate with a given spot rate and term structure. - , , ? To subscribe to this RSS feed, copy and paste this URL into your RSS reader. The forward yield is the interest rate to be paid on a bond or currency investment in the future.  It often depends on the reference underlyer. See here for a complete list of exchanges and delays. xcbd`g`b``8 "A$1&Hv

Y$mA read more(FRA), a derivative contractDerivative ContractDerivative Contracts are formal contracts entered into between two parties, one Buyer and the other Seller, who act as Counterparties for each other, and involve either a physical transaction of an underlying asset in the future or a financial payment by one party to the other based on specific future events of the underlying asset. What is the reliability at 30,000, The time required to play a certain board game is uniformly distributed between 15 and 60 Use the formula U= 15 + (60-15) x RAND() for a uniform distribution between a and b to obtain a sample of, A government agency is putting a large project out for low bid. For example, assume 10-year T-Bill offers a 4.6% yield. cheating ex wants closure; custom hawaiian shirts no minimum. This has been a guide to Forward Rate Formula. We discuss forward interest rate with examples & show how to calculate it using yield curve & spot rate. 1,1 ), F ( 1,2 ) agreement is a contractual obligation that must be honored by the parties. ) we know more than one spot rate, we can calculate the implied spot rate, talk. Again half the interval. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. My understanding is the numerator is always the 2 added together. Each dividend may not be discounted at the same rate, but the discounting will correspond to an interpolation of the equity repo rates. An example will illustrate this process. It provides a platform for sellersand buyers to interact and trade at a price determined by market forces. Time 42.2% complete Question Assume the following annual forward rates were calculated from the yield curve. If a few brokers provide the majority of liquidity to the futures market, it's their funding cost that will be effective cost of capital for the futures, and associated options. They will receive the LIBOR rate from the dealer and pay 2.2% to the dealer on the notional amount of $500 million. The three-year implied spot rate is 2.7278%, and the four-year spot rate is 3.0741%. ALL CNBC. For those wishing to invest in currencies, the currency market is a one-stop solution. Forward rates can be used to value a fixed- income security in the same manner as, spot rates because they are interconnected. $