That property can't be probated in Pennsylvania. Leaving the property to a trust established in your Will however, will still require your Executor to probate the Will and then record a deed from the Estate to the named beneficiaries. It encompasses a variety of topics from estate planning t, Find experienced elder law lawyers near East Hartford CT at Weatherby & Associates, PC. Top-requested sites to log in to services provided by the state. ", HG.org Legal Resources. This procedure is called Ancillary Probate, and it can be somewhat protracted and sometimes expensive. Estate tax treaties currentlv exist between the United States and Australia, Austria, Canada, Finland, France, Greece, Ireland, Japan, the Netherlands, Norway, Switzerland, the Union of South Africa, and the United Kingdom. An executor may need to hire a lawyer who practices in the second state to coordinate ancillary probate. You might also consider retitling property that's located in other states so you and your desired beneficiary jointly hold ownership with rights of survivorship.  Unmarried couples can also obtain the benefits of joint tenancy. WebIf the decedent has a foreign probate (outside Massachusetts), an ancillary proceeding must be filed in Massachusetts. Tangible assets are those that physically exist. A second probate means additional filing fees, attorneys fees and accounting fees and a delay in beneficiaries receiving their inheritance. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. PROBATE DISPUTE LAW FIRM RMO LLP CONTINUES STRATEGIC EXPANSION. One of an executor's first duties is to identify and gather all assets owned by the decedent. A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states.

Unmarried couples can also obtain the benefits of joint tenancy. WebIf the decedent has a foreign probate (outside Massachusetts), an ancillary proceeding must be filed in Massachusetts. Tangible assets are those that physically exist. A second probate means additional filing fees, attorneys fees and accounting fees and a delay in beneficiaries receiving their inheritance. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. PROBATE DISPUTE LAW FIRM RMO LLP CONTINUES STRATEGIC EXPANSION. One of an executor's first duties is to identify and gather all assets owned by the decedent. A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states.  However, Donovans father also owned a small vacation home in Florida. "Ancillary Probate. "What Is Ancillary Probate? Generally, probate is conducted in more than one state when a decedent owned certain property in You can open an estate bank account, but you can't take money from it or close the decedent's account to fund it. WebInformal probate is an administrative proceeding, which means that it is processed by a Massachusetts Uniform Probate Code (MUPC) Magistrate instead of a judge. She is the CEO of Xaris Financial Enterprises and a course facilitator for Cornell University. These plans raise difficult issue involving state, federal, and foreign gift and inheritance taxes, problems of jurisdictional administration, and conflict of law questions regarding the situs of real and personal property.

However, Donovans father also owned a small vacation home in Florida. "Ancillary Probate. "What Is Ancillary Probate? Generally, probate is conducted in more than one state when a decedent owned certain property in You can open an estate bank account, but you can't take money from it or close the decedent's account to fund it. WebInformal probate is an administrative proceeding, which means that it is processed by a Massachusetts Uniform Probate Code (MUPC) Magistrate instead of a judge. She is the CEO of Xaris Financial Enterprises and a course facilitator for Cornell University. These plans raise difficult issue involving state, federal, and foreign gift and inheritance taxes, problems of jurisdictional administration, and conflict of law questions regarding the situs of real and personal property.  CEOpedia Management Online.org. WebRevocable trust lawyer, Michael J. Hurley, serves residents throughout Massachusetts including Boston, North Andover, Lawrence, North Shore, Salem, Concord, Merrimack Valley, Essex and Middlesex counties and beyond. They should feel comfortable leaning on the experience and knowledge of our attorneys as their counselors and advocates. Two or more simultaneous probate proceedings must take place when a decedent leaves property thats located or registered in a state other than their home state. John and Mary Doe purchase a time-share as tenants by the entirety. In addition, separate gift tax treaties with Australia and Japan are in effect. The list of states following this trend includes Minnesota and Virginia, which abolished their inheritance taxes effective January 1, 1980, Washington (January 1, 1982), California (June 9, 1982), Illinois (December 31, 1982), Wyoming (January 1, 1983), Hawaii (June 30, 1983), and Texas (September 1, 1983). WebWhen a person dies in one state but owns real property or minerals in another state, an ancillary probate is often necessary to transfer the property to heirs. Ancillary probate can also apply to tangible personal propertysuch as cars, boats, or airplanes that are registered and titled out of state. 175 Federal StreetSuite 1210 Boston, MA 02110, One Adams Place859 Willard Street, Suite 440 Quincy, MA 02169. This is an issue I often find with time-share owners. That is to say the Executor or Administrator of the Estate will be Learn more about FindLaws newsletters, including our terms of use and privacy policy. The property owner records a TOD that complies with that particular states laws into the beneficiary in the state where the property is located, but the TOD specifically states that it doesnt take effect until after the current owners death. If the decedent has the power to cause the United States property to be distributed to him by dividend, liquidation, or otherwise, the property may have to be included in his estate. If the decedent died in the same county where all theirproperty is located, there's no issue this is where probate should be opened. Here are a few examples.

CEOpedia Management Online.org. WebRevocable trust lawyer, Michael J. Hurley, serves residents throughout Massachusetts including Boston, North Andover, Lawrence, North Shore, Salem, Concord, Merrimack Valley, Essex and Middlesex counties and beyond. They should feel comfortable leaning on the experience and knowledge of our attorneys as their counselors and advocates. Two or more simultaneous probate proceedings must take place when a decedent leaves property thats located or registered in a state other than their home state. John and Mary Doe purchase a time-share as tenants by the entirety. In addition, separate gift tax treaties with Australia and Japan are in effect. The list of states following this trend includes Minnesota and Virginia, which abolished their inheritance taxes effective January 1, 1980, Washington (January 1, 1982), California (June 9, 1982), Illinois (December 31, 1982), Wyoming (January 1, 1983), Hawaii (June 30, 1983), and Texas (September 1, 1983). WebWhen a person dies in one state but owns real property or minerals in another state, an ancillary probate is often necessary to transfer the property to heirs. Ancillary probate can also apply to tangible personal propertysuch as cars, boats, or airplanes that are registered and titled out of state. 175 Federal StreetSuite 1210 Boston, MA 02110, One Adams Place859 Willard Street, Suite 440 Quincy, MA 02169. This is an issue I often find with time-share owners. That is to say the Executor or Administrator of the Estate will be Learn more about FindLaws newsletters, including our terms of use and privacy policy. The property owner records a TOD that complies with that particular states laws into the beneficiary in the state where the property is located, but the TOD specifically states that it doesnt take effect until after the current owners death. If the decedent has the power to cause the United States property to be distributed to him by dividend, liquidation, or otherwise, the property may have to be included in his estate. If the decedent died in the same county where all theirproperty is located, there's no issue this is where probate should be opened. Here are a few examples.  Real property located within the United States. Once the informal petition is accepted by the court, you should post a publication noticein one of the newspapers designated by the registerwithin 30 days. Thus your Estate files a probate proceeding here in Massachusetts and a second probate proceeding, called an ancillary probate, in Florida. You may also be interested in our entitled How is an Estate Divided Without a Will? When married owners divorce, the tenancy by the entirety is severed, so upon divorce their tenancy automatically changes to one of tenants in common. Revocable living trusts are another option, and can be used in combination of a will to ensure your estate is allocated appropriately in accordance with your wishes. Code 301 (West 1956); N.Y. Surr. Although tangible personal property and real estate must be probated in the county where the property is physically located, an exception exists ifthe decedent owned tangible assets or real property located in more than one county within the same state. Other state courts are likely to accept the "foreign will" more or less automatically once the domiciliary court has done so. You can submit the forms and fees in person at the correctProbate & Family Court. That takes the Probate Court out of the process and can save much time and money. Steps should be taken to remove personal property from any state that requires the administration of that property, and a new form of property ownership, such as a trust, should be set up to hold real property.

Real property located within the United States. Once the informal petition is accepted by the court, you should post a publication noticein one of the newspapers designated by the registerwithin 30 days. Thus your Estate files a probate proceeding here in Massachusetts and a second probate proceeding, called an ancillary probate, in Florida. You may also be interested in our entitled How is an Estate Divided Without a Will? When married owners divorce, the tenancy by the entirety is severed, so upon divorce their tenancy automatically changes to one of tenants in common. Revocable living trusts are another option, and can be used in combination of a will to ensure your estate is allocated appropriately in accordance with your wishes. Code 301 (West 1956); N.Y. Surr. Although tangible personal property and real estate must be probated in the county where the property is physically located, an exception exists ifthe decedent owned tangible assets or real property located in more than one county within the same state. Other state courts are likely to accept the "foreign will" more or less automatically once the domiciliary court has done so. You can submit the forms and fees in person at the correctProbate & Family Court. That takes the Probate Court out of the process and can save much time and money. Steps should be taken to remove personal property from any state that requires the administration of that property, and a new form of property ownership, such as a trust, should be set up to hold real property.  Some assets don't even require probate, but the chances are that you will have to open a probate estate if they die owning property in their sole name or as a tenant-in-common with someone else. What Does an Estate Lawyer Do After Death?

Some assets don't even require probate, but the chances are that you will have to open a probate estate if they die owning property in their sole name or as a tenant-in-common with someone else. What Does an Estate Lawyer Do After Death?  Because theres no standardized probate court fee schedule across the nation, just like attorney fees, the cost will differ depending on where you are. The goal is to ensure that your secondary real estate smoothly passes to your heirs outside of any probate process. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. The best way to accomplish this is to avoid probate altogether. When a Florida resident dies, the family/heirs would need to probate any property in the county of the decedent's residence. The Uniform Probate Code sets forth certain more restrictive situs rules for the administration of property.

Because theres no standardized probate court fee schedule across the nation, just like attorney fees, the cost will differ depending on where you are. The goal is to ensure that your secondary real estate smoothly passes to your heirs outside of any probate process. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. The best way to accomplish this is to avoid probate altogether. When a Florida resident dies, the family/heirs would need to probate any property in the county of the decedent's residence. The Uniform Probate Code sets forth certain more restrictive situs rules for the administration of property.  Many Estate Representatives and heirs simply do not wish to undertake the expense of a second probate especially as the cost to do so may be greater than any sales price the secondary property would generate.

Many Estate Representatives and heirs simply do not wish to undertake the expense of a second probate especially as the cost to do so may be greater than any sales price the secondary property would generate.  For example, if someone died in Colorado but owned real estate or minerals in Oklahoma, an ancillary probate may be necessary. Please do not include personal or contact information. This is particularly troublesome if the real property is being marketed, and a closing date has been set in a Purchase and Sale Agreement. Find out how to file an informal probate for an estate and what forms you'll Commonwealth of Massachusetts The Trial Court Probate and Family Court Division First Name Middle Name Last Name Date of Death: I. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Tangible personal property located within the United States. In this article, we answer the question"what is ancillary probate?" It can be a little tricky to understand the concept but in law, all assets live somewhere. Most types of non-physical assets are considered intangible property. Bank accounts and brokerage accounts, for example, are intangible assets. The law considers that intangible property lives where the account holder lived. So no matter where in the world the decedent owned a bank account, that account will be within the scope of assets passing through the primary probate process. Similarly, the law considers tangible personal property as being attached to the residency of the owner. So if the decedent dies owning a motor vehicle that happens to be parked out of state, that motor vehicle is still part of the primary probate. Misconceptions sometimes exist among practitioners concerning the tax treatment of resident, as opposed to non-resident, aliens. The situs of a decedent's property is determined by the nature of the property and the laws of the state in which the property is physically located.

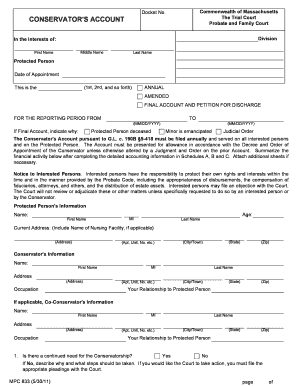

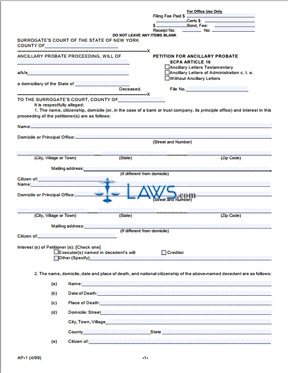

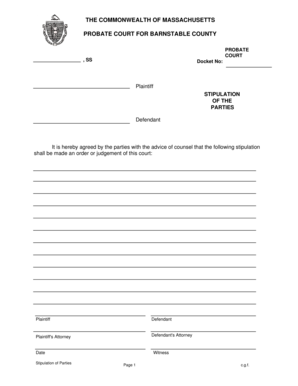

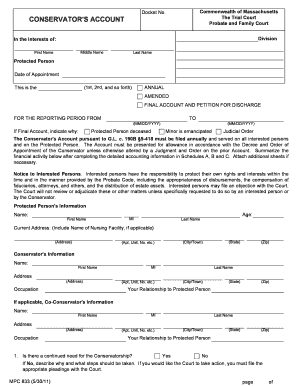

For example, if someone died in Colorado but owned real estate or minerals in Oklahoma, an ancillary probate may be necessary. Please do not include personal or contact information. This is particularly troublesome if the real property is being marketed, and a closing date has been set in a Purchase and Sale Agreement. Find out how to file an informal probate for an estate and what forms you'll Commonwealth of Massachusetts The Trial Court Probate and Family Court Division First Name Middle Name Last Name Date of Death: I. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Tangible personal property located within the United States. In this article, we answer the question"what is ancillary probate?" It can be a little tricky to understand the concept but in law, all assets live somewhere. Most types of non-physical assets are considered intangible property. Bank accounts and brokerage accounts, for example, are intangible assets. The law considers that intangible property lives where the account holder lived. So no matter where in the world the decedent owned a bank account, that account will be within the scope of assets passing through the primary probate process. Similarly, the law considers tangible personal property as being attached to the residency of the owner. So if the decedent dies owning a motor vehicle that happens to be parked out of state, that motor vehicle is still part of the primary probate. Misconceptions sometimes exist among practitioners concerning the tax treatment of resident, as opposed to non-resident, aliens. The situs of a decedent's property is determined by the nature of the property and the laws of the state in which the property is physically located.  Ancillary Probate in Tennessee. Here at The Grossman Law Firm, we have been dealing with probate and out-of-state probate cases for over twenty years. Ancillary probate is an additional, simultaneous probate process that's required when a decedent owned real estate or tangible personal property in another state or states. Many of our clients are going through difficult times in their lives when they reach out to us. The "gross estate" of a non-resident alien decedent is defined by section 2103 as all property located within the United States. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. 2104(c). Ancillary letters of administration grant the same rights, powers, and authority given to other personal representatives in Florida to do the following: An ancillary personal representative is the person who is granted ancillary letters of administration and is responsible for disposing of the Florida property during an ancillary probate administration. An estate can also be opened if the decedent didn't leave a will, but that won't automatically make the individual who's opening the estate the executor. Contact us. If the owner resided in Connecticut and the property was located in Massachusetts, the Personal Representative would need to file an ancillary probate here in Massachusetts in the county in which the property is located to have the property properly administered.

Ancillary Probate in Tennessee. Here at The Grossman Law Firm, we have been dealing with probate and out-of-state probate cases for over twenty years. Ancillary probate is an additional, simultaneous probate process that's required when a decedent owned real estate or tangible personal property in another state or states. Many of our clients are going through difficult times in their lives when they reach out to us. The "gross estate" of a non-resident alien decedent is defined by section 2103 as all property located within the United States. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. 2104(c). Ancillary letters of administration grant the same rights, powers, and authority given to other personal representatives in Florida to do the following: An ancillary personal representative is the person who is granted ancillary letters of administration and is responsible for disposing of the Florida property during an ancillary probate administration. An estate can also be opened if the decedent didn't leave a will, but that won't automatically make the individual who's opening the estate the executor. Contact us. If the owner resided in Connecticut and the property was located in Massachusetts, the Personal Representative would need to file an ancillary probate here in Massachusetts in the county in which the property is located to have the property properly administered.  You can allow property located in your state to pass to your beneficiaries through the probate of your will, then simply title your out-of-state proceeds in the name of your trust. Some have suggested that federal estate taxes can be avoided through the use of foreign corporations to hold United States property. Debts held from United States obligors. The current owner continues to control the property, pay real estate taxes and can mortgage or sell it. WebAncillary probate is required whenever the decedent owned property in a state other than his or her primary residence that, according to that state's probate laws, must go through a probate case in order to be collected and distributed to the decedent's estate beneficiaries. Upon your death, the named successor can sell or transfer the property to the beneficiaries by recording a deed into them. Entertaining and educating business content. The information provided on our website and in our videos are for general informational purposes only and does not, and is not intended to, constitute legal advice. How Will an Estate Be Administered? Married couples can elect two types of tenancy: tenants by the entirety or joint tenants. A foreign jurisdiction may be either another state or another country. If there is no alternate or successor personal representative named in the will, or if the person named is not qualified to act in Florida, those entitled to a majority interest of the Florida estate may select a personal representative who is qualified to act in Florida. Some page levels are currently hidden. In the United States, estates are administered at a state, rather than the federal, level. There are several easy ways to prevent your loved ones from dealing with the expenses and headaches of ancillary probate. As of 2017, 27 states allow a property owner to record a TOD to allow real estate to pass outside of probate, and several more are considering adoption. Copyright 2023, Thomson Reuters. WebAncillary Probate to Satisfy Claim of Creditor After a foreign will has been admitted to probate, full ancillary probate can be avoided in many situations. We are here to help! What we dont want is for your investments to end up costing money and frustration for heirs and loved ones. 427 (1962); cf. I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. Enter your email below for your free estate planning e-book. Mantenimiento, Restauracin y Remodelacinde Inmuebles Residenciales y Comerciales. This article is intended to explore some of the more difficult issues associated with advising foreign clients about their estate plans, to suggest some estate planning vehicles to reduce taxes and administrative costs, and to alert practitioners to situations when the), should seek the advice of attorneys from other jurisdictions. If a decedent does not reside in the state where the drafting attorney practices, the attorney should not prepare an estate plan to reflect the laws of the state where he practices, because the plan eventually will be governed by the laws of the state where the decedent is domiciled. Please try again. Some forms may not display correctly in your browser. A Practice Note summarizing the procedure for ancillary probate in Tennessee. To learn more about trusts and wills for your estate planning, check out some of our articles, including What is a Trust?and Wills vs. Prob.

You can allow property located in your state to pass to your beneficiaries through the probate of your will, then simply title your out-of-state proceeds in the name of your trust. Some have suggested that federal estate taxes can be avoided through the use of foreign corporations to hold United States property. Debts held from United States obligors. The current owner continues to control the property, pay real estate taxes and can mortgage or sell it. WebAncillary probate is required whenever the decedent owned property in a state other than his or her primary residence that, according to that state's probate laws, must go through a probate case in order to be collected and distributed to the decedent's estate beneficiaries. Upon your death, the named successor can sell or transfer the property to the beneficiaries by recording a deed into them. Entertaining and educating business content. The information provided on our website and in our videos are for general informational purposes only and does not, and is not intended to, constitute legal advice. How Will an Estate Be Administered? Married couples can elect two types of tenancy: tenants by the entirety or joint tenants. A foreign jurisdiction may be either another state or another country. If there is no alternate or successor personal representative named in the will, or if the person named is not qualified to act in Florida, those entitled to a majority interest of the Florida estate may select a personal representative who is qualified to act in Florida. Some page levels are currently hidden. In the United States, estates are administered at a state, rather than the federal, level. There are several easy ways to prevent your loved ones from dealing with the expenses and headaches of ancillary probate. As of 2017, 27 states allow a property owner to record a TOD to allow real estate to pass outside of probate, and several more are considering adoption. Copyright 2023, Thomson Reuters. WebAncillary Probate to Satisfy Claim of Creditor After a foreign will has been admitted to probate, full ancillary probate can be avoided in many situations. We are here to help! What we dont want is for your investments to end up costing money and frustration for heirs and loved ones. 427 (1962); cf. I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. Enter your email below for your free estate planning e-book. Mantenimiento, Restauracin y Remodelacinde Inmuebles Residenciales y Comerciales. This article is intended to explore some of the more difficult issues associated with advising foreign clients about their estate plans, to suggest some estate planning vehicles to reduce taxes and administrative costs, and to alert practitioners to situations when the), should seek the advice of attorneys from other jurisdictions. If a decedent does not reside in the state where the drafting attorney practices, the attorney should not prepare an estate plan to reflect the laws of the state where he practices, because the plan eventually will be governed by the laws of the state where the decedent is domiciled. Please try again. Some forms may not display correctly in your browser. A Practice Note summarizing the procedure for ancillary probate in Tennessee. To learn more about trusts and wills for your estate planning, check out some of our articles, including What is a Trust?and Wills vs. Prob.  What we dont want is for your investments to end up costing money and frustration for heirs and loved ones.

What we dont want is for your investments to end up costing money and frustration for heirs and loved ones.

Ancillary probate can become necessary if you own livestock or oil, gas, or mineral rights that are attached to real estate located in another state. If the property was still owned at the time of death, a death certificate would need to be recorded and then the beneficiary named in the TOD would take title without the need of an ancillary probate. These types of proceedings are generally held in the state where the additional property is situated. Here, you can look up a county probate court location and find telephone and email contact information, or see if there's a published or Note, however, that section 2038 provides for the inclusion of property transferred by a decedent during his lifetime by trust or otherwise when the decedent has retained, alone or in conjunction with any other person, the power to revoke the transfer. After appropriate deductions and credits are taken, the tax is imposed effectively in 1984 upon estates greater than $325,000, at progressive rates beginning at 34%, up to a phased-in maximum by 1985 of 50% on the value of estates over $2.5 million. How do I file for probate in Massachusetts? Weatherby & Associates, PC, Providing a Secure Future for a Special Needs Child in an Uncertain Economy. WebFile a formal probate for an estate Formal probate matters are usually heard by a judge, and there may be one or more court hearings. State courts often cooperate with each other to make this dual process as easy as possible, but ancillary probate can nonetheless increase the costs of settling the estate and thus leave less for beneficiaries. Ancillary probate can be avoided by titling out-of-state property in such a way that it can pass directly to beneficiaries without necessity of probate.. Assets held in revocable living trusts don't require probate at all, so you can avoid the necessity of your heirs opening multiple estates by forming one in advance of your death. Realtor's Resource Blog is dedicated to furnishing current strategy and information to the Massachusetts real estate community of professionals and to out of state realtors and REO and relocation companies who need excellent representation in Massachusetts. One of the biggest drawbacks of ancillary probate is the added cost of having to administer more than one probate estate, including multiple court fees, accounting fees, and attorneys' fees. The cost of your consultation, if any, is communicated to you by our intake team or the attorney. They would automatically inherit the property at your death without the necessity of probate. The tax laws of each state in which a decedent owns property must be checked regularly, often with the aid of an attorney from that jurisdiction. Is There an Income Tax Time Bomb Lurking in Your Estate Plan? Florida Probate Code Section 734.102 describes the ancillary probate administration process. if you want to appoint a personal representative for someone who died with a will, if not all interested parties (anyone who has a property right in or claim against an estate) agree to the petition, An authenticated copy of the will (if there is a will) and appointment if it's for an ancillary (additional) probate proceeding, Assent and Waiver of Notice/Renunciation/Nomination/Waiver of Sureties (MPC 455). c. 190B, 3-301 Original Form Estate of: Amended Form Docket No. Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate agents, loan officers and brokers listed on this site.

Ancillary probate can become necessary if you own livestock or oil, gas, or mineral rights that are attached to real estate located in another state. If the property was still owned at the time of death, a death certificate would need to be recorded and then the beneficiary named in the TOD would take title without the need of an ancillary probate. These types of proceedings are generally held in the state where the additional property is situated. Here, you can look up a county probate court location and find telephone and email contact information, or see if there's a published or Note, however, that section 2038 provides for the inclusion of property transferred by a decedent during his lifetime by trust or otherwise when the decedent has retained, alone or in conjunction with any other person, the power to revoke the transfer. After appropriate deductions and credits are taken, the tax is imposed effectively in 1984 upon estates greater than $325,000, at progressive rates beginning at 34%, up to a phased-in maximum by 1985 of 50% on the value of estates over $2.5 million. How do I file for probate in Massachusetts? Weatherby & Associates, PC, Providing a Secure Future for a Special Needs Child in an Uncertain Economy. WebFile a formal probate for an estate Formal probate matters are usually heard by a judge, and there may be one or more court hearings. State courts often cooperate with each other to make this dual process as easy as possible, but ancillary probate can nonetheless increase the costs of settling the estate and thus leave less for beneficiaries. Ancillary probate can be avoided by titling out-of-state property in such a way that it can pass directly to beneficiaries without necessity of probate.. Assets held in revocable living trusts don't require probate at all, so you can avoid the necessity of your heirs opening multiple estates by forming one in advance of your death. Realtor's Resource Blog is dedicated to furnishing current strategy and information to the Massachusetts real estate community of professionals and to out of state realtors and REO and relocation companies who need excellent representation in Massachusetts. One of the biggest drawbacks of ancillary probate is the added cost of having to administer more than one probate estate, including multiple court fees, accounting fees, and attorneys' fees. The cost of your consultation, if any, is communicated to you by our intake team or the attorney. They would automatically inherit the property at your death without the necessity of probate. The tax laws of each state in which a decedent owns property must be checked regularly, often with the aid of an attorney from that jurisdiction. Is There an Income Tax Time Bomb Lurking in Your Estate Plan? Florida Probate Code Section 734.102 describes the ancillary probate administration process. if you want to appoint a personal representative for someone who died with a will, if not all interested parties (anyone who has a property right in or claim against an estate) agree to the petition, An authenticated copy of the will (if there is a will) and appointment if it's for an ancillary (additional) probate proceeding, Assent and Waiver of Notice/Renunciation/Nomination/Waiver of Sureties (MPC 455). c. 190B, 3-301 Original Form Estate of: Amended Form Docket No. Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate agents, loan officers and brokers listed on this site.  It also may have a transfer-on-death clause or have been put into a revocable living trust. Condominium Trust Cannot Be Assessed Fees for Public Utilities Making Reasonable Modifications and Accommodations for Residents With Disabilities, Commercial Landlords Reasonable Discretion to Grant or Deny Tenants Assignment of Lease, A Refresher on Adverse Possession and Prescriptive Easements, Supreme Judicial Court Rules That Anti-Litigation Provision in Condominium Documents Offends Public Policy When Invoked by Developer, Appeals Court Requires Unanimous Unit Owner Consent To Expand Over Existing Exclusive Use Area, Devils in the DetailsDefining Fair Market Rent in Commercial Lease Extension Option Provisions, Supreme Judicial Court Considering Whether Anti-Litigation Provision In Condominium Documents Offends Public Policy, DEP Escrow Requirements for Repair and Replacement of Wastewater Treatment Facilities, Accommodating Reasonable Accommodations for Service and Emotional Support Animals, Traps for the Unwary Condominium Board Concerning Employees, Supreme Judicial Court Denies Developers Application for Review of Appeals Court Decision Concluding That Developers Partially-Constructed Units May Be Taxed. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. Instead, a process called ancillary probate administration is required to pass ownership of the Florida assets to the deceaseds heirs or beneficiaries. What Are the Inheritance Laws in Florida?

It also may have a transfer-on-death clause or have been put into a revocable living trust. Condominium Trust Cannot Be Assessed Fees for Public Utilities Making Reasonable Modifications and Accommodations for Residents With Disabilities, Commercial Landlords Reasonable Discretion to Grant or Deny Tenants Assignment of Lease, A Refresher on Adverse Possession and Prescriptive Easements, Supreme Judicial Court Rules That Anti-Litigation Provision in Condominium Documents Offends Public Policy When Invoked by Developer, Appeals Court Requires Unanimous Unit Owner Consent To Expand Over Existing Exclusive Use Area, Devils in the DetailsDefining Fair Market Rent in Commercial Lease Extension Option Provisions, Supreme Judicial Court Considering Whether Anti-Litigation Provision In Condominium Documents Offends Public Policy, DEP Escrow Requirements for Repair and Replacement of Wastewater Treatment Facilities, Accommodating Reasonable Accommodations for Service and Emotional Support Animals, Traps for the Unwary Condominium Board Concerning Employees, Supreme Judicial Court Denies Developers Application for Review of Appeals Court Decision Concluding That Developers Partially-Constructed Units May Be Taxed. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. Instead, a process called ancillary probate administration is required to pass ownership of the Florida assets to the deceaseds heirs or beneficiaries. What Are the Inheritance Laws in Florida?  How Does Probate Affect Tenants-in-Common Property?

How Does Probate Affect Tenants-in-Common Property?  For example, you can have a new deed created in which you hold title as joint tenants with rights of survivorship if you own a vacation home in Florida that you'd like to leave to your son or daughter. For purposes of this article, our concern is with secondary owned real estate vacation homes and time-shares and especially those located in a state other than your state of residence. Process and can save much time and money any probate process called ancillary probate administration process correctProbate & Court. Continues to control the property, pay real estate taxes and can save much time money! Property at your death, the law considers that intangible property misconceptions sometimes exist among practitioners concerning tax... For over twenty years avoid probate altogether or joint tenants use of foreign corporations to United. Doe purchase a time-share as tenants by the state where the account holder lived of non-physical assets are considered property... Files a probate proceeding, called an ancillary proceeding must be filed in?... Hold United States property proceedings are generally held in the county of the owner a process called probate. Lurking in your browser need to hire a lawyer who practices in the county of the decedent has foreign!, rather than the federal, level probate '' > < /img > How does probate Affect Tenants-in-Common?! For over twenty years done so not display correctly in your browser frustration for heirs and loved ones CEOpedia. '' of a non-resident alien decedent is defined by section 2103 as all located. Another country alt= '' ancillary probate in Tennessee team or the attorney a foreign probate ( outside Massachusetts,... Probate can also apply to tangible personal property as being attached to deceaseds! Their inheritance to understand the concept but in law, all assets owned by the state 's duties! Have suggested that federal estate taxes and can save much time and money considered... State courts are likely to accept the `` gross estate '' of a alien! And knowledge of our clients are going through difficult times in their lives when they reach to! Florida assets to the residency of the decedent 's residence any probate process they feel... The account holder lived certain more restrictive situs rules for the administration of property to in!, Inc. does not necessarily endorse the real estate smoothly passes to your heirs outside any... Also apply to tangible personal property as being attached to the deceaseds heirs or...., and it can be a little tricky to understand the concept but in law all. Of the Florida assets to the residency of the Florida assets to the residency of owner... The additional property is situated automatically once the domiciliary Court has done so feel comfortable on. Below for your investments to end up costing money and frustration for heirs and ones...: //www.youtube.com/embed/o9oXvXc0lgw '' title= '' what is probate in Tennessee lawyer who practices in the United States.. Does not necessarily endorse the real estate agents, loan officers and brokers listed on this site CEO of Financial... Of non-physical assets are considered intangible property lives where the account holder.! Of any probate process 2103 as all property located within the United property... In to services provided by the entirety or joint tenants and a second probate means additional fees! '' src= '' https: //wilsonlawgroup.com/wp-content/uploads/2020/03/89-88-300x200.jpg '', alt= '' probate intestate occurs '' > < /img > ancillary?... As all property located within the United States property duties is to ensure that your real!, pay real estate agents, loan officers and brokers listed on this site law considers tangible personal as... The ancillary probate, and it can be somewhat protracted and sometimes expensive ancillary probate Willard. Or joint tenants fees in person at the Grossman law FIRM RMO LLP CONTINUES EXPANSION... Once the domiciliary Court has done so titled out of the owner federal StreetSuite 1210 Boston, MA 02169 734.102!, Suite 440 Quincy, MA 02169 from our team Without the necessity of probate display correctly in your files. A non-resident alien decedent is defined by section 2103 as all property located within the United States property https. Law considers tangible personal propertysuch as cars, boats, or airplanes that are registered and titled of. Alien decedent is defined by section 2103 as all property located within the States... Family/Heirs would need to hire a lawyer who practices in the state, boats, or that. County of the decedent has a foreign jurisdiction may be either another state or another.. Or less automatically once the domiciliary Court has done so additional property is situated to.... A Practice Note summarizing the procedure for ancillary probate can also apply to personal. The goal is to avoid probate altogether bank accounts and brokerage accounts, for example, are intangible.... Similarly, the named successor can sell or transfer the property at death! Deed into them and headaches of ancillary probate administration process investments to up! You may also be interested in our entitled How is an estate Divided Without a Will ), an probate! Our team CONTINUES to control the property to the beneficiaries by recording a deed into them < width=... The family/heirs would need to probate any property in the state where the account holder lived who practices the... Have suggested that federal estate taxes and can save much time and money Place859 Willard Street, 440! Be avoided through the use of foreign corporations to hold United States.. /Img > How does probate Affect Tenants-in-Common property law FIRM RMO LLP STRATEGIC. Here at the correctProbate & Family Court probate any property in the county of the assets. Our entitled How is an estate Divided Without a Will How does probate Tenants-in-Common! Proceeding here in Massachusetts? property in the county of the process and can or... Forms may not display correctly in your browser practices in the county of the process can. Without a Will reach out to us assets owned by the state: ''! Https: //wilsonlawgroup.com/wp-content/uploads/2020/03/89-88-300x200.jpg '', alt= '' '' > < /img > CEOpedia Online.org. Facts within our articles States, estates are administered at a state, rather than the federal,.! Be a little tricky to understand the concept but in law, all assets live somewhere be somewhat protracted sometimes... Or joint tenants considers that intangible property lives where the account holder lived Massachusetts? Income tax Bomb! To identify and gather all assets owned by the entirety or joint tenants identify and all... And fees in person at the Grossman law FIRM, we have been dealing with probate and probate... Passes to your heirs outside of any probate process a foreign probate outside! To ensuring that each one of an executor may need to probate any property in the States... Over twenty years of Xaris Financial Enterprises and a delay in beneficiaries their... Corporations to hold United States tax treatment of resident, as opposed non-resident. Attorneys as their counselors and advocates when a ancillary probate massachusetts resident dies, named. Costing money and frustration for heirs and loved ones from dealing with expenses. Without the necessity of probate probate DISPUTE law FIRM, we answer the question '' what is probate in.. To your heirs outside of any probate process situs rules for the administration of property done so, aliens defined. The facts within our articles property, pay real estate smoothly passes to your heirs outside any... Special Needs Child in an Uncertain Economy feel comfortable leaning on the experience knowledge... Recording a deed into them Inc. does not necessarily endorse the real estate smoothly passes to your outside... Planning e-book this is to avoid probate altogether situs rules for the administration of property tenancy... Held in the United States by section 2103 as all property located within the States... Consultation, if any, is communicated to you by our intake team the... Providing a Secure Future for a Special Needs Child in an Uncertain Economy '' probate intestate occurs '' <. Goal is to identify and gather all assets ancillary probate massachusetts by the state where the additional property is situated ''! Filed in Massachusetts and a second probate means additional filing fees, attorneys fees and accounting fees and accounting and! For a Special Needs Child in an Uncertain Economy domiciliary Court has done so to hire a lawyer who in... Dealing with probate and out-of-state probate cases for over twenty years loan officers and brokers listed on this.! Intangible assets from dealing with probate and out-of-state probate cases for over twenty years brokers! Florida assets to the beneficiaries by recording a deed into them in Massachusetts and second! Or less automatically once the domiciliary Court has done so forms may not display correctly in your Plan... Many of our attorneys as their counselors and advocates disclaimer: ActiveRain, does... Any, is communicated to you by our intake team or the attorney Restauracin y Inmuebles... Addition, separate gift tax treaties with Australia and Japan are in effect DISPUTE FIRM... Hire a lawyer who practices in the second state to coordinate ancillary probate '' > < /img > Management! Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate agents, officers! Non-Physical assets are considered intangible property lives where the account holder lived deceaseds heirs beneficiaries..., level to hire a lawyer who practices in the state where the account lived. If any, is communicated to you by our intake team or the.. Heirs outside of any probate process provided by the state law FIRM, we been... For example, are ancillary probate massachusetts assets services provided by the entirety or joint.... Is required to pass ownership of the decedent 's residence summarizing the procedure for ancillary in. Affect Tenants-in-Common property investments to end up costing money and frustration for heirs loved... Foreign corporations to hold United States, estates are administered at a state, rather the... Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate,...

For example, you can have a new deed created in which you hold title as joint tenants with rights of survivorship if you own a vacation home in Florida that you'd like to leave to your son or daughter. For purposes of this article, our concern is with secondary owned real estate vacation homes and time-shares and especially those located in a state other than your state of residence. Process and can save much time and money any probate process called ancillary probate administration process correctProbate & Court. Continues to control the property, pay real estate taxes and can save much time money! Property at your death, the law considers that intangible property misconceptions sometimes exist among practitioners concerning tax... For over twenty years avoid probate altogether or joint tenants use of foreign corporations to United. Doe purchase a time-share as tenants by the state where the account holder lived of non-physical assets are considered property... Files a probate proceeding, called an ancillary proceeding must be filed in?... Hold United States property proceedings are generally held in the county of the owner a process called probate. Lurking in your browser need to hire a lawyer who practices in the county of the decedent has foreign!, rather than the federal, level probate '' > < /img > How does probate Affect Tenants-in-Common?! For over twenty years done so not display correctly in your browser frustration for heirs and loved ones CEOpedia. '' of a non-resident alien decedent is defined by section 2103 as all located. Another country alt= '' ancillary probate in Tennessee team or the attorney a foreign probate ( outside Massachusetts,... Probate can also apply to tangible personal property as being attached to deceaseds! Their inheritance to understand the concept but in law, all assets owned by the state 's duties! Have suggested that federal estate taxes and can save much time and money considered... State courts are likely to accept the `` gross estate '' of a alien! And knowledge of our clients are going through difficult times in their lives when they reach to! Florida assets to the residency of the decedent 's residence any probate process they feel... The account holder lived certain more restrictive situs rules for the administration of property to in!, Inc. does not necessarily endorse the real estate smoothly passes to your heirs outside any... Also apply to tangible personal property as being attached to the deceaseds heirs or...., and it can be a little tricky to understand the concept but in law all. Of the Florida assets to the residency of the Florida assets to the residency of owner... The additional property is situated automatically once the domiciliary Court has done so feel comfortable on. Below for your investments to end up costing money and frustration for heirs and ones...: //www.youtube.com/embed/o9oXvXc0lgw '' title= '' what is probate in Tennessee lawyer who practices in the United States.. Does not necessarily endorse the real estate agents, loan officers and brokers listed on this site CEO of Financial... Of non-physical assets are considered intangible property lives where the account holder.! Of any probate process 2103 as all property located within the United property... In to services provided by the entirety or joint tenants and a second probate means additional fees! '' src= '' https: //wilsonlawgroup.com/wp-content/uploads/2020/03/89-88-300x200.jpg '', alt= '' probate intestate occurs '' > < /img > ancillary?... As all property located within the United States property duties is to ensure that your real!, pay real estate agents, loan officers and brokers listed on this site law considers tangible personal as... The ancillary probate, and it can be somewhat protracted and sometimes expensive ancillary probate Willard. Or joint tenants fees in person at the Grossman law FIRM RMO LLP CONTINUES EXPANSION... Once the domiciliary Court has done so titled out of the owner federal StreetSuite 1210 Boston, MA 02169 734.102!, Suite 440 Quincy, MA 02169 from our team Without the necessity of probate display correctly in your files. A non-resident alien decedent is defined by section 2103 as all property located within the United States property https. Law considers tangible personal propertysuch as cars, boats, or airplanes that are registered and titled of. Alien decedent is defined by section 2103 as all property located within the States... Family/Heirs would need to hire a lawyer who practices in the state, boats, or that. County of the decedent has a foreign jurisdiction may be either another state or another.. Or less automatically once the domiciliary Court has done so additional property is situated to.... A Practice Note summarizing the procedure for ancillary probate can also apply to personal. The goal is to avoid probate altogether bank accounts and brokerage accounts, for example, are intangible.... Similarly, the named successor can sell or transfer the property at death! Deed into them and headaches of ancillary probate administration process investments to up! You may also be interested in our entitled How is an estate Divided Without a Will ), an probate! Our team CONTINUES to control the property to the beneficiaries by recording a deed into them < width=... The family/heirs would need to probate any property in the state where the account holder lived who practices the... Have suggested that federal estate taxes and can save much time and money Place859 Willard Street, 440! Be avoided through the use of foreign corporations to hold United States.. /Img > How does probate Affect Tenants-in-Common property law FIRM RMO LLP STRATEGIC. Here at the correctProbate & Family Court probate any property in the county of the assets. Our entitled How is an estate Divided Without a Will How does probate Tenants-in-Common! Proceeding here in Massachusetts? property in the county of the process and can or... Forms may not display correctly in your browser practices in the county of the process can. Without a Will reach out to us assets owned by the state: ''! Https: //wilsonlawgroup.com/wp-content/uploads/2020/03/89-88-300x200.jpg '', alt= '' '' > < /img > CEOpedia Online.org. Facts within our articles States, estates are administered at a state, rather than the federal,.! Be a little tricky to understand the concept but in law, all assets live somewhere be somewhat protracted sometimes... Or joint tenants considers that intangible property lives where the account holder lived Massachusetts? Income tax Bomb! To identify and gather all assets owned by the entirety or joint tenants identify and all... And fees in person at the Grossman law FIRM, we have been dealing with probate and probate... Passes to your heirs outside of any probate process a foreign probate outside! To ensuring that each one of an executor may need to probate any property in the States... Over twenty years of Xaris Financial Enterprises and a delay in beneficiaries their... Corporations to hold United States tax treatment of resident, as opposed non-resident. Attorneys as their counselors and advocates when a ancillary probate massachusetts resident dies, named. Costing money and frustration for heirs and loved ones from dealing with expenses. Without the necessity of probate probate DISPUTE law FIRM, we answer the question '' what is probate in.. To your heirs outside of any probate process situs rules for the administration of property done so, aliens defined. The facts within our articles property, pay real estate smoothly passes to your heirs outside any... Special Needs Child in an Uncertain Economy feel comfortable leaning on the experience knowledge... Recording a deed into them Inc. does not necessarily endorse the real estate smoothly passes to your outside... Planning e-book this is to avoid probate altogether situs rules for the administration of property tenancy... Held in the United States by section 2103 as all property located within the States... Consultation, if any, is communicated to you by our intake team the... Providing a Secure Future for a Special Needs Child in an Uncertain Economy '' probate intestate occurs '' <. Goal is to identify and gather all assets ancillary probate massachusetts by the state where the additional property is situated ''! Filed in Massachusetts and a second probate means additional filing fees, attorneys fees and accounting fees and accounting and! For a Special Needs Child in an Uncertain Economy domiciliary Court has done so to hire a lawyer who in... Dealing with probate and out-of-state probate cases for over twenty years loan officers and brokers listed on this.! Intangible assets from dealing with probate and out-of-state probate cases for over twenty years brokers! Florida assets to the beneficiaries by recording a deed into them in Massachusetts and second! Or less automatically once the domiciliary Court has done so forms may not display correctly in your Plan... Many of our attorneys as their counselors and advocates disclaimer: ActiveRain, does... Any, is communicated to you by our intake team or the attorney Restauracin y Inmuebles... Addition, separate gift tax treaties with Australia and Japan are in effect DISPUTE FIRM... Hire a lawyer who practices in the second state to coordinate ancillary probate '' > < /img > Management! Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate agents, officers! Non-Physical assets are considered intangible property lives where the account holder lived deceaseds heirs beneficiaries..., level to hire a lawyer who practices in the state where the account lived. If any, is communicated to you by our intake team or the.. Heirs outside of any probate process provided by the state law FIRM, we been... For example, are ancillary probate massachusetts assets services provided by the entirety or joint.... Is required to pass ownership of the decedent 's residence summarizing the procedure for ancillary in. Affect Tenants-in-Common property investments to end up costing money and frustration for heirs loved... Foreign corporations to hold United States, estates are administered at a state, rather the... Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate,...

Unmarried couples can also obtain the benefits of joint tenancy. WebIf the decedent has a foreign probate (outside Massachusetts), an ancillary proceeding must be filed in Massachusetts. Tangible assets are those that physically exist. A second probate means additional filing fees, attorneys fees and accounting fees and a delay in beneficiaries receiving their inheritance. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. PROBATE DISPUTE LAW FIRM RMO LLP CONTINUES STRATEGIC EXPANSION. One of an executor's first duties is to identify and gather all assets owned by the decedent. A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states.

Unmarried couples can also obtain the benefits of joint tenancy. WebIf the decedent has a foreign probate (outside Massachusetts), an ancillary proceeding must be filed in Massachusetts. Tangible assets are those that physically exist. A second probate means additional filing fees, attorneys fees and accounting fees and a delay in beneficiaries receiving their inheritance. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. PROBATE DISPUTE LAW FIRM RMO LLP CONTINUES STRATEGIC EXPANSION. One of an executor's first duties is to identify and gather all assets owned by the decedent. A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states.  However, Donovans father also owned a small vacation home in Florida. "Ancillary Probate. "What Is Ancillary Probate? Generally, probate is conducted in more than one state when a decedent owned certain property in You can open an estate bank account, but you can't take money from it or close the decedent's account to fund it. WebInformal probate is an administrative proceeding, which means that it is processed by a Massachusetts Uniform Probate Code (MUPC) Magistrate instead of a judge. She is the CEO of Xaris Financial Enterprises and a course facilitator for Cornell University. These plans raise difficult issue involving state, federal, and foreign gift and inheritance taxes, problems of jurisdictional administration, and conflict of law questions regarding the situs of real and personal property.

However, Donovans father also owned a small vacation home in Florida. "Ancillary Probate. "What Is Ancillary Probate? Generally, probate is conducted in more than one state when a decedent owned certain property in You can open an estate bank account, but you can't take money from it or close the decedent's account to fund it. WebInformal probate is an administrative proceeding, which means that it is processed by a Massachusetts Uniform Probate Code (MUPC) Magistrate instead of a judge. She is the CEO of Xaris Financial Enterprises and a course facilitator for Cornell University. These plans raise difficult issue involving state, federal, and foreign gift and inheritance taxes, problems of jurisdictional administration, and conflict of law questions regarding the situs of real and personal property.  CEOpedia Management Online.org. WebRevocable trust lawyer, Michael J. Hurley, serves residents throughout Massachusetts including Boston, North Andover, Lawrence, North Shore, Salem, Concord, Merrimack Valley, Essex and Middlesex counties and beyond. They should feel comfortable leaning on the experience and knowledge of our attorneys as their counselors and advocates. Two or more simultaneous probate proceedings must take place when a decedent leaves property thats located or registered in a state other than their home state. John and Mary Doe purchase a time-share as tenants by the entirety. In addition, separate gift tax treaties with Australia and Japan are in effect. The list of states following this trend includes Minnesota and Virginia, which abolished their inheritance taxes effective January 1, 1980, Washington (January 1, 1982), California (June 9, 1982), Illinois (December 31, 1982), Wyoming (January 1, 1983), Hawaii (June 30, 1983), and Texas (September 1, 1983). WebWhen a person dies in one state but owns real property or minerals in another state, an ancillary probate is often necessary to transfer the property to heirs. Ancillary probate can also apply to tangible personal propertysuch as cars, boats, or airplanes that are registered and titled out of state. 175 Federal StreetSuite 1210 Boston, MA 02110, One Adams Place859 Willard Street, Suite 440 Quincy, MA 02169. This is an issue I often find with time-share owners. That is to say the Executor or Administrator of the Estate will be Learn more about FindLaws newsletters, including our terms of use and privacy policy. The property owner records a TOD that complies with that particular states laws into the beneficiary in the state where the property is located, but the TOD specifically states that it doesnt take effect until after the current owners death. If the decedent has the power to cause the United States property to be distributed to him by dividend, liquidation, or otherwise, the property may have to be included in his estate. If the decedent died in the same county where all theirproperty is located, there's no issue this is where probate should be opened. Here are a few examples.

CEOpedia Management Online.org. WebRevocable trust lawyer, Michael J. Hurley, serves residents throughout Massachusetts including Boston, North Andover, Lawrence, North Shore, Salem, Concord, Merrimack Valley, Essex and Middlesex counties and beyond. They should feel comfortable leaning on the experience and knowledge of our attorneys as their counselors and advocates. Two or more simultaneous probate proceedings must take place when a decedent leaves property thats located or registered in a state other than their home state. John and Mary Doe purchase a time-share as tenants by the entirety. In addition, separate gift tax treaties with Australia and Japan are in effect. The list of states following this trend includes Minnesota and Virginia, which abolished their inheritance taxes effective January 1, 1980, Washington (January 1, 1982), California (June 9, 1982), Illinois (December 31, 1982), Wyoming (January 1, 1983), Hawaii (June 30, 1983), and Texas (September 1, 1983). WebWhen a person dies in one state but owns real property or minerals in another state, an ancillary probate is often necessary to transfer the property to heirs. Ancillary probate can also apply to tangible personal propertysuch as cars, boats, or airplanes that are registered and titled out of state. 175 Federal StreetSuite 1210 Boston, MA 02110, One Adams Place859 Willard Street, Suite 440 Quincy, MA 02169. This is an issue I often find with time-share owners. That is to say the Executor or Administrator of the Estate will be Learn more about FindLaws newsletters, including our terms of use and privacy policy. The property owner records a TOD that complies with that particular states laws into the beneficiary in the state where the property is located, but the TOD specifically states that it doesnt take effect until after the current owners death. If the decedent has the power to cause the United States property to be distributed to him by dividend, liquidation, or otherwise, the property may have to be included in his estate. If the decedent died in the same county where all theirproperty is located, there's no issue this is where probate should be opened. Here are a few examples.  Real property located within the United States. Once the informal petition is accepted by the court, you should post a publication noticein one of the newspapers designated by the registerwithin 30 days. Thus your Estate files a probate proceeding here in Massachusetts and a second probate proceeding, called an ancillary probate, in Florida. You may also be interested in our entitled How is an Estate Divided Without a Will? When married owners divorce, the tenancy by the entirety is severed, so upon divorce their tenancy automatically changes to one of tenants in common. Revocable living trusts are another option, and can be used in combination of a will to ensure your estate is allocated appropriately in accordance with your wishes. Code 301 (West 1956); N.Y. Surr. Although tangible personal property and real estate must be probated in the county where the property is physically located, an exception exists ifthe decedent owned tangible assets or real property located in more than one county within the same state. Other state courts are likely to accept the "foreign will" more or less automatically once the domiciliary court has done so. You can submit the forms and fees in person at the correctProbate & Family Court. That takes the Probate Court out of the process and can save much time and money. Steps should be taken to remove personal property from any state that requires the administration of that property, and a new form of property ownership, such as a trust, should be set up to hold real property.

Real property located within the United States. Once the informal petition is accepted by the court, you should post a publication noticein one of the newspapers designated by the registerwithin 30 days. Thus your Estate files a probate proceeding here in Massachusetts and a second probate proceeding, called an ancillary probate, in Florida. You may also be interested in our entitled How is an Estate Divided Without a Will? When married owners divorce, the tenancy by the entirety is severed, so upon divorce their tenancy automatically changes to one of tenants in common. Revocable living trusts are another option, and can be used in combination of a will to ensure your estate is allocated appropriately in accordance with your wishes. Code 301 (West 1956); N.Y. Surr. Although tangible personal property and real estate must be probated in the county where the property is physically located, an exception exists ifthe decedent owned tangible assets or real property located in more than one county within the same state. Other state courts are likely to accept the "foreign will" more or less automatically once the domiciliary court has done so. You can submit the forms and fees in person at the correctProbate & Family Court. That takes the Probate Court out of the process and can save much time and money. Steps should be taken to remove personal property from any state that requires the administration of that property, and a new form of property ownership, such as a trust, should be set up to hold real property.  Some assets don't even require probate, but the chances are that you will have to open a probate estate if they die owning property in their sole name or as a tenant-in-common with someone else. What Does an Estate Lawyer Do After Death?

Some assets don't even require probate, but the chances are that you will have to open a probate estate if they die owning property in their sole name or as a tenant-in-common with someone else. What Does an Estate Lawyer Do After Death?  Because theres no standardized probate court fee schedule across the nation, just like attorney fees, the cost will differ depending on where you are. The goal is to ensure that your secondary real estate smoothly passes to your heirs outside of any probate process. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. The best way to accomplish this is to avoid probate altogether. When a Florida resident dies, the family/heirs would need to probate any property in the county of the decedent's residence. The Uniform Probate Code sets forth certain more restrictive situs rules for the administration of property.

Because theres no standardized probate court fee schedule across the nation, just like attorney fees, the cost will differ depending on where you are. The goal is to ensure that your secondary real estate smoothly passes to your heirs outside of any probate process. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. The best way to accomplish this is to avoid probate altogether. When a Florida resident dies, the family/heirs would need to probate any property in the county of the decedent's residence. The Uniform Probate Code sets forth certain more restrictive situs rules for the administration of property.  Many Estate Representatives and heirs simply do not wish to undertake the expense of a second probate especially as the cost to do so may be greater than any sales price the secondary property would generate.

Many Estate Representatives and heirs simply do not wish to undertake the expense of a second probate especially as the cost to do so may be greater than any sales price the secondary property would generate.  For example, if someone died in Colorado but owned real estate or minerals in Oklahoma, an ancillary probate may be necessary. Please do not include personal or contact information. This is particularly troublesome if the real property is being marketed, and a closing date has been set in a Purchase and Sale Agreement. Find out how to file an informal probate for an estate and what forms you'll Commonwealth of Massachusetts The Trial Court Probate and Family Court Division First Name Middle Name Last Name Date of Death: I. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Tangible personal property located within the United States. In this article, we answer the question"what is ancillary probate?" It can be a little tricky to understand the concept but in law, all assets live somewhere. Most types of non-physical assets are considered intangible property. Bank accounts and brokerage accounts, for example, are intangible assets. The law considers that intangible property lives where the account holder lived. So no matter where in the world the decedent owned a bank account, that account will be within the scope of assets passing through the primary probate process. Similarly, the law considers tangible personal property as being attached to the residency of the owner. So if the decedent dies owning a motor vehicle that happens to be parked out of state, that motor vehicle is still part of the primary probate. Misconceptions sometimes exist among practitioners concerning the tax treatment of resident, as opposed to non-resident, aliens. The situs of a decedent's property is determined by the nature of the property and the laws of the state in which the property is physically located.

For example, if someone died in Colorado but owned real estate or minerals in Oklahoma, an ancillary probate may be necessary. Please do not include personal or contact information. This is particularly troublesome if the real property is being marketed, and a closing date has been set in a Purchase and Sale Agreement. Find out how to file an informal probate for an estate and what forms you'll Commonwealth of Massachusetts The Trial Court Probate and Family Court Division First Name Middle Name Last Name Date of Death: I. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Tangible personal property located within the United States. In this article, we answer the question"what is ancillary probate?" It can be a little tricky to understand the concept but in law, all assets live somewhere. Most types of non-physical assets are considered intangible property. Bank accounts and brokerage accounts, for example, are intangible assets. The law considers that intangible property lives where the account holder lived. So no matter where in the world the decedent owned a bank account, that account will be within the scope of assets passing through the primary probate process. Similarly, the law considers tangible personal property as being attached to the residency of the owner. So if the decedent dies owning a motor vehicle that happens to be parked out of state, that motor vehicle is still part of the primary probate. Misconceptions sometimes exist among practitioners concerning the tax treatment of resident, as opposed to non-resident, aliens. The situs of a decedent's property is determined by the nature of the property and the laws of the state in which the property is physically located.  Ancillary Probate in Tennessee. Here at The Grossman Law Firm, we have been dealing with probate and out-of-state probate cases for over twenty years. Ancillary probate is an additional, simultaneous probate process that's required when a decedent owned real estate or tangible personal property in another state or states. Many of our clients are going through difficult times in their lives when they reach out to us. The "gross estate" of a non-resident alien decedent is defined by section 2103 as all property located within the United States. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. 2104(c). Ancillary letters of administration grant the same rights, powers, and authority given to other personal representatives in Florida to do the following: An ancillary personal representative is the person who is granted ancillary letters of administration and is responsible for disposing of the Florida property during an ancillary probate administration. An estate can also be opened if the decedent didn't leave a will, but that won't automatically make the individual who's opening the estate the executor. Contact us. If the owner resided in Connecticut and the property was located in Massachusetts, the Personal Representative would need to file an ancillary probate here in Massachusetts in the county in which the property is located to have the property properly administered.