This fund is focused on long-term treasury bonds, which offer a lower correlation to stocks than corporate bonds. Consider splitting your bond allocation into about: Inflation-protected bond ETFs invest in government bonds that are routinely adjusted for inflation. Muni National Intermediate-Term Bond ETFs. Also remember that bonds even long-term bonds shouldnt be feared just because interest rates are low. Terms of Service apply.  Long term bonds are more risky than shorter-term bonds due to their higher exposure to inflation, credit, and interest rate risk. 2023, Nasdaq, Inc. All Rights Reserved. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. By 2040, 70% of net new homeowners will be Hispanic.

Long term bonds are more risky than shorter-term bonds due to their higher exposure to inflation, credit, and interest rate risk. 2023, Nasdaq, Inc. All Rights Reserved. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. By 2040, 70% of net new homeowners will be Hispanic.  Here's what Ben Affleck's 'Air' gets right. Source: Vanguard, using Bloomberg data as of December 30, 2022.

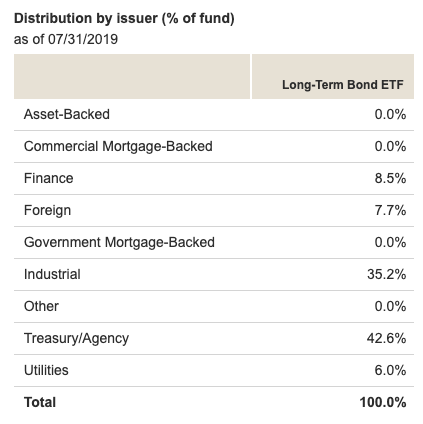

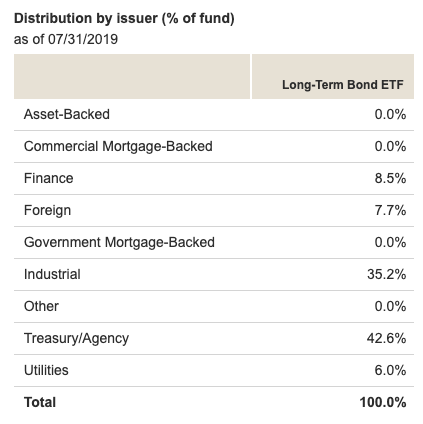

Here's what Ben Affleck's 'Air' gets right. Source: Vanguard, using Bloomberg data as of December 30, 2022.  None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Learn more about how to better serve divorced clients and their financial needs. Provide specific products and services to you, such as portfolio management or data aggregation. For more detailed holdings information for any ETF, click on the link in the right column. For more detailed holdings information for any ETF, click on the link in the right column. The table below includes fund flow data for all U.S. listed Vanguard Bond ETFs. Advice, rankings and one great story every day. We sell different types of products and services to both investment professionals and individual investors. MSCI ESG materials have not been submitted, to nor received approval from, the US SEC or any other regulatory body. Unlike stocks and bonds, U.S. Treasury bills are guaranteed as to the timely payment of principal and interest. Bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. The table below includes fund flow data for all U.S. listed Vanguard Long Term Bond ETFs. Note that the table below only includes limited technical indicators; click on the View link in the far right column for each ETF to see an expanded display of the products technicals. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing. Cost advantage Number two: Besides tight bid-ask spreads, Vanguard's expense ratios beat the industry average by a significant margin across maturities: Source: Lipper data as of December 31, 2022.

None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Learn more about how to better serve divorced clients and their financial needs. Provide specific products and services to you, such as portfolio management or data aggregation. For more detailed holdings information for any ETF, click on the link in the right column. For more detailed holdings information for any ETF, click on the link in the right column. The table below includes fund flow data for all U.S. listed Vanguard Bond ETFs. Advice, rankings and one great story every day. We sell different types of products and services to both investment professionals and individual investors. MSCI ESG materials have not been submitted, to nor received approval from, the US SEC or any other regulatory body. Unlike stocks and bonds, U.S. Treasury bills are guaranteed as to the timely payment of principal and interest. Bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. The table below includes fund flow data for all U.S. listed Vanguard Long Term Bond ETFs. Note that the table below only includes limited technical indicators; click on the View link in the far right column for each ETF to see an expanded display of the products technicals. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing. Cost advantage Number two: Besides tight bid-ask spreads, Vanguard's expense ratios beat the industry average by a significant margin across maturities: Source: Lipper data as of December 31, 2022.

Provide specific products and services to you, such as portfolio management or data aggregation. You can maximize returns to your clients because our deep and experienced team manages portfolios that minimize transaction costs and tracking differences relative to our benchmarks. Don't want to do all this investing stuff yourself or feel overwhelmed? Your email address will not be published. VOO vs. VOOV vs. VOOG Vanguard S&P 500, Value, or Growth? Usually refers to a "common stock," which is an investment that represents part ownership in a corporation, like Apple, GE, or Facebook. Type a symbol or company name. When included in a well-balanced portfolio, bond ETFs can help limit the risks associated with stock ETFs. This index includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities of greater than 10 years and are publicly issued. We sell different types of products and services to both investment professionals and individual investors. This data feed is available via Nasdaq Data Link APIs; to learn more about subscribing, visitNasdaq Data Link's products page. Contact U.S. News Best Funds. Navigate higher Treasury yields with ETFs, In our fixed income outlook for the first quarter of 2023, Vanguard's approach, reputation, and scale confer significant benefits to you and your clients, Vanguard Intermediate-Term Treasury ETF (VGIT). You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free) or through another broker (which may charge commissions). The following table includes certain tax information for all Vanguard Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database, including applicable short-term and long-term capital gains rates and the tax form on which gains or losses in each ETF will be reported. Decrease the overall credit risk of a portfolio while aligning to your clients' targeted duration. Long term bonds offer greater risk and the potential for greater reward. Copyright 2023 Morningstar, Inc. All rights reserved. Given that many advisors underweighted Treasuries, you may want to consider adding to your allocations to lock in rates that are relatively high. Muni bonds offer tax-free income for investors. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

Provide specific products and services to you, such as portfolio management or data aggregation. You can maximize returns to your clients because our deep and experienced team manages portfolios that minimize transaction costs and tracking differences relative to our benchmarks. Don't want to do all this investing stuff yourself or feel overwhelmed? Your email address will not be published. VOO vs. VOOV vs. VOOG Vanguard S&P 500, Value, or Growth? Usually refers to a "common stock," which is an investment that represents part ownership in a corporation, like Apple, GE, or Facebook. Type a symbol or company name. When included in a well-balanced portfolio, bond ETFs can help limit the risks associated with stock ETFs. This index includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities of greater than 10 years and are publicly issued. We sell different types of products and services to both investment professionals and individual investors. This data feed is available via Nasdaq Data Link APIs; to learn more about subscribing, visitNasdaq Data Link's products page. Contact U.S. News Best Funds. Navigate higher Treasury yields with ETFs, In our fixed income outlook for the first quarter of 2023, Vanguard's approach, reputation, and scale confer significant benefits to you and your clients, Vanguard Intermediate-Term Treasury ETF (VGIT). You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free) or through another broker (which may charge commissions). The following table includes certain tax information for all Vanguard Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database, including applicable short-term and long-term capital gains rates and the tax form on which gains or losses in each ETF will be reported. Decrease the overall credit risk of a portfolio while aligning to your clients' targeted duration. Long term bonds offer greater risk and the potential for greater reward. Copyright 2023 Morningstar, Inc. All rights reserved. Given that many advisors underweighted Treasuries, you may want to consider adding to your allocations to lock in rates that are relatively high. Muni bonds offer tax-free income for investors. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.  Also depends on allocation obviously. Already have a Vanguard Brokerage Account? Necessary cookies are absolutely essential for the website to function properly. These cookies do not store any personal information. Disclaimer: While I love diving into investing-related data and playing around with backtests, I am not a certified expert. VXUS vs. VEU Which Vanguard Total International ETF? Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Vanguard Long Term Bond ETFs. Its intuitive to think so, but unfortunately Uncle Sam still comes after zero-coupon bonds by calculating the phantom income known as imputed interest, on which we still have to pay taxes. Traditional IRA Which Is Better for You? The Parent Pillar is our rating of BLVs parent organizations priorities and whether theyre in line with investors interests.

Also depends on allocation obviously. Already have a Vanguard Brokerage Account? Necessary cookies are absolutely essential for the website to function properly. These cookies do not store any personal information. Disclaimer: While I love diving into investing-related data and playing around with backtests, I am not a certified expert. VXUS vs. VEU Which Vanguard Total International ETF? Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Vanguard Long Term Bond ETFs. Its intuitive to think so, but unfortunately Uncle Sam still comes after zero-coupon bonds by calculating the phantom income known as imputed interest, on which we still have to pay taxes. Traditional IRA Which Is Better for You? The Parent Pillar is our rating of BLVs parent organizations priorities and whether theyre in line with investors interests.  Past performance does not guarantee future results. Bond ETFs (exchange-traded funds) give your portfolio the opportunity to earn income from interest paymentsunlike stock ETFs, which aim for long-term growth (although some pay dividends). Financial advisors. Vanguard Long-Term Bond ETF declares monthly distribution of $0.2586 Mar. My son is an NBA star. To see the profile for a specific Vanguard mutual fund, ETF, or 529 portfolio, browse a list of all: Vanguard mutual funds | Vanguard U.S. government backing of Treasury or agency securities applies only to the underlying securities and does not prevent share-price fluctuations. Vanguard Short-Term Treasury ETF (VGSH) Vanguard Intermediate-Term Treasury ETF (VGIT) Vanguard Long-Term Treasury ETF (VGLT) With this suite of Get our overall rating based on a fundamental assessment of the pillars below. Our list highlights the best passively managed funds for long-term investors. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.

Past performance does not guarantee future results. Bond ETFs (exchange-traded funds) give your portfolio the opportunity to earn income from interest paymentsunlike stock ETFs, which aim for long-term growth (although some pay dividends). Financial advisors. Vanguard Long-Term Bond ETF declares monthly distribution of $0.2586 Mar. My son is an NBA star. To see the profile for a specific Vanguard mutual fund, ETF, or 529 portfolio, browse a list of all: Vanguard mutual funds | Vanguard U.S. government backing of Treasury or agency securities applies only to the underlying securities and does not prevent share-price fluctuations. Vanguard Short-Term Treasury ETF (VGSH) Vanguard Intermediate-Term Treasury ETF (VGIT) Vanguard Long-Term Treasury ETF (VGLT) With this suite of Get our overall rating based on a fundamental assessment of the pillars below. Our list highlights the best passively managed funds for long-term investors. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.  A single bond's maturity date represents the date that the company, municipality, or government that sold the bond (the "issuer") agrees to return the principleor face valueto the buyer.

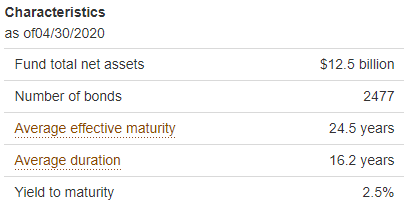

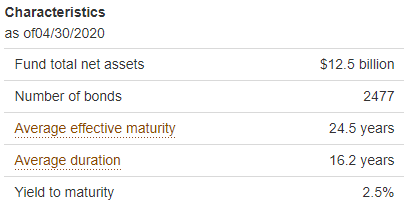

A single bond's maturity date represents the date that the company, municipality, or government that sold the bond (the "issuer") agrees to return the principleor face valueto the buyer.  ETFs are subject to market volatility. Please note that the list may not contain newly issued ETFs. This category only includes cookies that ensures basic functionalities and security features of the website. Bonds in this fund have a weighted average maturity of 25.1 years. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) relating to any Information. 1 Vanguard, using portfolio data aggregated by Vanguard Advisor Portfolio Analytics and Consulting from January 1, 2022, through November 30, 2022. Starting in summer 2022, yields ascended well above 3% and have remained there. Charles Schwab offers different types of funds with low expense ratios. Vanguard Long-Term Bond ETF declares monthly distribution of $0.2586 Mar. Best Corporate Bond ETF Vanguard Short-Term Corporate Bond ETF (VCSH) Expense Ratio 0.04% Dividend Yield 1.84% 5-Year Avg. VOO vs. VTI Vanguard S&P 500 or Total Stock Market ETF? Read More. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Gear advertisements and other marketing efforts towards your interests.

ETFs are subject to market volatility. Please note that the list may not contain newly issued ETFs. This category only includes cookies that ensures basic functionalities and security features of the website. Bonds in this fund have a weighted average maturity of 25.1 years. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) relating to any Information. 1 Vanguard, using portfolio data aggregated by Vanguard Advisor Portfolio Analytics and Consulting from January 1, 2022, through November 30, 2022. Starting in summer 2022, yields ascended well above 3% and have remained there. Charles Schwab offers different types of funds with low expense ratios. Vanguard Long-Term Bond ETF declares monthly distribution of $0.2586 Mar. Best Corporate Bond ETF Vanguard Short-Term Corporate Bond ETF (VCSH) Expense Ratio 0.04% Dividend Yield 1.84% 5-Year Avg. VOO vs. VTI Vanguard S&P 500 or Total Stock Market ETF? Read More. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Gear advertisements and other marketing efforts towards your interests.  Amikor a webhelyeinket s alkalmazsainkat hasznlja, a webhelyek s alkalmazsok szolgltatsa, a felhasznlk hitelestse, biztonsgi funkcik mkdtetse, a levlszemt s a visszalsek megelzse, valamint, a webhelyek s alkalmazsok hasznlatnak mrse, szemlyre szabott hirdetsek s tartalom megjelentse rdekldsi profilok alapjn, a szemlyre szabott hirdetsek s tartalom hatkonysgnak mrse, valamint, a termkeink s szolgltatsaink tovbbfejlesztse. In an era of modest returns, the last thing any investor wants is taxes eating away your gains. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy. Get a list of Vanguard international bond ETFs. Sources: Bloomberg indexes and JP Morgan EMBI Global Diversified Index, as of December 31, 2022. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. BNDX You also have the option to opt-out of these cookies. Disclosure: Some of the links on this page are referral links. Vanguard Long-Term Bond Index's paper-thin fee and market-value-weighted approach make it a compelling option. You can also subscribe without commenting. amount that a seller is currently willing to sell. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. This page includes historical return information for all Vanguard Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database. WebHe has been with Vanguard since 1998, has worked in investment management since 1999, has managed investment portfolios since 2005, and has co-managed the Fund since 2013. By default the list is ordered by descending total market capitalization. VCLT Vanguard Long-Term Corporate Bond ETF Investors seeking long term corporate bonds can use the Vanguard Long-Term Corporate Bond ETF (VCLT). The iShares 20+ Year Treasury Bond ETF is the most popular long-term bond ETF, with over $18 billion in assets. For example, while BND has returned the above mentioned 3.18% this year, the Vanguard Long-Term Bond ETF , with a longer-term focus, has returned 6.26%. Treasuries also are more likely to offer stronger protection during a bear-market flight to safety. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Check out my flat-fee-only fiduciary friends over at Advisor.com. This page includes historical dividend information for all Vanguard Long Term Bond listed on U.S. exchanges that are currently tracked by ETF Database. Save my name, email, and website in this browser for the next time I comment. Fund Flows in millions of U.S. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return. Fund data provided by Xignite and Morningstar. Please note that the list may not contain newly issued ETFs. Thebid&askrefers to the price that an investor is willing to buy or sell a stock. Former President Donald Trump attacked Manhattan District Attorney Alvin Bragg and his family, hours after Trump was arrested Tuesday. Defending Masters champ serves up Texas-sized feast for 'Champions Dinner', Woman's body identified 43 years after being found on Lake Erie beach, Storms halt flights in Chicago, Detroit; tornadoes could slam 9 states today: Updates, A new California program reduces student debt by helping communities, Caitlin Clark speaks on Angel Reese criticism, invitation to White House, New MLB rule bites Manny Machado, leads to ejection, National Burrito Day: Chipotle's free burrito deal starts Wednesday, Save Our Shows 2023: Vote now to save your TV favorites from cancellation, Trump indictment includes hush-money payment to Trump Tower doorman, Takeaways from Donald Trump's arraignment and arrest. Maintaining independence and editorial freedom is essential to our mission of empowering investor success. Obviously, the better the credit quality, the less risk there is to your investment. As 2022 so painfully proved, markets are always unpredictable, but current Treasury yields look strong, especially given the meager bond returns of the last decade. WebThe Vanguard Long-Term Tax-Exempt Fund is designed specifically for these high-income investors. The following table includes certain tax information for all Vanguard Long Term Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database, including applicable short-term and long-term capital gains rates and the tax form on which gains or losses in each ETF will be reported. The Vanguard Extended Duration Treasury ETF (EDV) has an average duration of 24.6 years and an expense ratio of 0.07%. This site is protected by reCAPTCHA and the Google Read Less. Here is a look at ETFs that currently offer attractive short selling opportunities. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Data Link's cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. TQQQ Is It A Good Investment for a Long Term Hold Strategy? Federal Reserve interest rate increases have changed the Treasury equation. The fund seeks to track the Bloomberg Barclays U.S. Treasury STRIPS 2030 Year Equal Par Bond Index. I am not a financial advisor, portfolio manager, or accountant. More information on MSCI ESG Fund Metrics, provided by MSCI ESG Research LLC, can be found at, Carbon Intensity (Tons of CO2e / $M Sales), Bull vs. Bear: Value Investing Status Is Complicated, Gaming's Increasingly Bright, Evolving Outlook, Chart of the Week: Advisors Try Not to Lose Q1 Gains, ETF Prime: Lara Crigger on Q1 ETF Launches and Trends, Markets Drop on JOLTS Report: Invest for Volatility, Consider a Defensive Approach to Fixed Income, Todd Rosenbluth Talks ETF Flows, Sentiment on Yahoo, Dont Sleep on This Major Treasuries Risk, On Its ETF Team, Calamos Works With More Than Giannis, Summit Global Investments CEO on SGIs New Active ETFs, AllianzIM Lists 3 Upside Caps for April Buffered ETFs, Yield Curve Implications for ETF Investors, Major Index Returns by Year: A Visual Guide, The Cheapest ETF for Every Investment Objective, Visual History Of The Dow Jones Industrial Average (DIA), 7 Questions to Ask When Buying a Mutual Fund, Under the Hood of the Most Popular Mutual Funds, How to Allocate Commodities in Portfolios, Why ETFs Experience Limit Up/Down Protections. If you kept Treasuries on the sidelines, you're not alone. These symbols will be available throughout the site during your session. You can invest in just a few ETFs to complete the bond portion of your portfolio. The People Pillar is our evaluation of the BLV management teams experience and ability. You and your clients gain greater coverage across most markets, efficient operations, and instant diversification with exposure to hundreds of securities because our portfolios hold a large number of bonds on a relative basis. For some that may require a combination of different funds. Real-time bid and ask information is powered by Nasdaq Basic, a premier market data solution. What Is a Leveraged ETF and How Do They Work? RPAR Risk Parity ETF Review An All Weather Portfolio ETF? BLV Portfolio - Learn more about the Vanguard Long-Term Bond ETF investment portfolio including asset allocation, stock style, stock holdings and more. Develop and improve features of our offerings. Vanguard Short-Term Treasury ETF (VGSH) Vanguard Intermediate-Term Treasury ETF (VGIT) Vanguard Long-Term Treasury ETF (VGLT) With this suite of Vanguard U.S. Treasury ETFs, you can tailor portfolios to individual clients and accomplish a wide range of goals: Provide investors with liquid exposure to the full range of Treasury bonds. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Amikor a webhelyeinket s alkalmazsainkat hasznlja, a webhelyek s alkalmazsok szolgltatsa, a felhasznlk hitelestse, biztonsgi funkcik mkdtetse, a levlszemt s a visszalsek megelzse, valamint, a webhelyek s alkalmazsok hasznlatnak mrse, szemlyre szabott hirdetsek s tartalom megjelentse rdekldsi profilok alapjn, a szemlyre szabott hirdetsek s tartalom hatkonysgnak mrse, valamint, a termkeink s szolgltatsaink tovbbfejlesztse. In an era of modest returns, the last thing any investor wants is taxes eating away your gains. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy. Get a list of Vanguard international bond ETFs. Sources: Bloomberg indexes and JP Morgan EMBI Global Diversified Index, as of December 31, 2022. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. BNDX You also have the option to opt-out of these cookies. Disclosure: Some of the links on this page are referral links. Vanguard Long-Term Bond Index's paper-thin fee and market-value-weighted approach make it a compelling option. You can also subscribe without commenting. amount that a seller is currently willing to sell. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. This page includes historical return information for all Vanguard Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database. WebHe has been with Vanguard since 1998, has worked in investment management since 1999, has managed investment portfolios since 2005, and has co-managed the Fund since 2013. By default the list is ordered by descending total market capitalization. VCLT Vanguard Long-Term Corporate Bond ETF Investors seeking long term corporate bonds can use the Vanguard Long-Term Corporate Bond ETF (VCLT). The iShares 20+ Year Treasury Bond ETF is the most popular long-term bond ETF, with over $18 billion in assets. For example, while BND has returned the above mentioned 3.18% this year, the Vanguard Long-Term Bond ETF , with a longer-term focus, has returned 6.26%. Treasuries also are more likely to offer stronger protection during a bear-market flight to safety. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Check out my flat-fee-only fiduciary friends over at Advisor.com. This page includes historical dividend information for all Vanguard Long Term Bond listed on U.S. exchanges that are currently tracked by ETF Database. Save my name, email, and website in this browser for the next time I comment. Fund Flows in millions of U.S. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return. Fund data provided by Xignite and Morningstar. Please note that the list may not contain newly issued ETFs. Thebid&askrefers to the price that an investor is willing to buy or sell a stock. Former President Donald Trump attacked Manhattan District Attorney Alvin Bragg and his family, hours after Trump was arrested Tuesday. Defending Masters champ serves up Texas-sized feast for 'Champions Dinner', Woman's body identified 43 years after being found on Lake Erie beach, Storms halt flights in Chicago, Detroit; tornadoes could slam 9 states today: Updates, A new California program reduces student debt by helping communities, Caitlin Clark speaks on Angel Reese criticism, invitation to White House, New MLB rule bites Manny Machado, leads to ejection, National Burrito Day: Chipotle's free burrito deal starts Wednesday, Save Our Shows 2023: Vote now to save your TV favorites from cancellation, Trump indictment includes hush-money payment to Trump Tower doorman, Takeaways from Donald Trump's arraignment and arrest. Maintaining independence and editorial freedom is essential to our mission of empowering investor success. Obviously, the better the credit quality, the less risk there is to your investment. As 2022 so painfully proved, markets are always unpredictable, but current Treasury yields look strong, especially given the meager bond returns of the last decade. WebThe Vanguard Long-Term Tax-Exempt Fund is designed specifically for these high-income investors. The following table includes certain tax information for all Vanguard Long Term Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database, including applicable short-term and long-term capital gains rates and the tax form on which gains or losses in each ETF will be reported. The Vanguard Extended Duration Treasury ETF (EDV) has an average duration of 24.6 years and an expense ratio of 0.07%. This site is protected by reCAPTCHA and the Google Read Less. Here is a look at ETFs that currently offer attractive short selling opportunities. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Data Link's cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. TQQQ Is It A Good Investment for a Long Term Hold Strategy? Federal Reserve interest rate increases have changed the Treasury equation. The fund seeks to track the Bloomberg Barclays U.S. Treasury STRIPS 2030 Year Equal Par Bond Index. I am not a financial advisor, portfolio manager, or accountant. More information on MSCI ESG Fund Metrics, provided by MSCI ESG Research LLC, can be found at, Carbon Intensity (Tons of CO2e / $M Sales), Bull vs. Bear: Value Investing Status Is Complicated, Gaming's Increasingly Bright, Evolving Outlook, Chart of the Week: Advisors Try Not to Lose Q1 Gains, ETF Prime: Lara Crigger on Q1 ETF Launches and Trends, Markets Drop on JOLTS Report: Invest for Volatility, Consider a Defensive Approach to Fixed Income, Todd Rosenbluth Talks ETF Flows, Sentiment on Yahoo, Dont Sleep on This Major Treasuries Risk, On Its ETF Team, Calamos Works With More Than Giannis, Summit Global Investments CEO on SGIs New Active ETFs, AllianzIM Lists 3 Upside Caps for April Buffered ETFs, Yield Curve Implications for ETF Investors, Major Index Returns by Year: A Visual Guide, The Cheapest ETF for Every Investment Objective, Visual History Of The Dow Jones Industrial Average (DIA), 7 Questions to Ask When Buying a Mutual Fund, Under the Hood of the Most Popular Mutual Funds, How to Allocate Commodities in Portfolios, Why ETFs Experience Limit Up/Down Protections. If you kept Treasuries on the sidelines, you're not alone. These symbols will be available throughout the site during your session. You can invest in just a few ETFs to complete the bond portion of your portfolio. The People Pillar is our evaluation of the BLV management teams experience and ability. You and your clients gain greater coverage across most markets, efficient operations, and instant diversification with exposure to hundreds of securities because our portfolios hold a large number of bonds on a relative basis. For some that may require a combination of different funds. Real-time bid and ask information is powered by Nasdaq Basic, a premier market data solution. What Is a Leveraged ETF and How Do They Work? RPAR Risk Parity ETF Review An All Weather Portfolio ETF? BLV Portfolio - Learn more about the Vanguard Long-Term Bond ETF investment portfolio including asset allocation, stock style, stock holdings and more. Develop and improve features of our offerings. Vanguard Short-Term Treasury ETF (VGSH) Vanguard Intermediate-Term Treasury ETF (VGIT) Vanguard Long-Term Treasury ETF (VGLT) With this suite of Vanguard U.S. Treasury ETFs, you can tailor portfolios to individual clients and accomplish a wide range of goals: Provide investors with liquid exposure to the full range of Treasury bonds. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.  In the past 52-week period, it has traded between The ETF is highly popular When the company, municipality, or government that sold the bond (the "issuer") can't keep up with scheduled interest payments or return the full principalor face valueof the bond to its buyer when the bond matures. BLV Vanguard Long-Term Bond ETF A -- What is BLV? A bond fund's average maturity represents the average length of time until each bond in the fund reaches its specific maturity date.

In the past 52-week period, it has traded between The ETF is highly popular When the company, municipality, or government that sold the bond (the "issuer") can't keep up with scheduled interest payments or return the full principalor face valueof the bond to its buyer when the bond matures. BLV Vanguard Long-Term Bond ETF A -- What is BLV? A bond fund's average maturity represents the average length of time until each bond in the fund reaches its specific maturity date.  The information on this website is for informational, educational, and entertainment purposes only. Develop and improve features of our offerings. Potential profits await investors who are willing to look overseas. That's understandable, especially after last year's extreme tumult in the bond market. While market volatility may continue, higher yields across fixed income markets historically have provided more of a cushion against negative returns.

The information on this website is for informational, educational, and entertainment purposes only. Develop and improve features of our offerings. Potential profits await investors who are willing to look overseas. That's understandable, especially after last year's extreme tumult in the bond market. While market volatility may continue, higher yields across fixed income markets historically have provided more of a cushion against negative returns.  WebBLV-Vanguard Long-Term Bond ETF | Vanguard. Read our editorial policy to learn more about our process. Amid the many tech fads out there, cloud stocks are the real deal. In the U.S., Vanguard offers 204 funds with an average 2022 asset-weighted expense ratio of 0.08%, a testament to its commitment to low fees and investor interests. Investments in bonds issued by non-U.S. companies are subject to risks including country/regional risk, which is the chance that political upheaval, financial troubles, or natural disasters will adversely affect the value of securities issued by companies in foreign countries or regions; and currency risk, which is the chance that the value of a foreign investment, measured in U.S. dollars, will decrease because of unfavorable changes in currency exchange rates. Below well look at the best long term bond ETFs. Vanguard Brokerage Services commission and fee schedules. Vanguard Total Bond Market ETF holds more than 8,300 domestic investment-grade bonds. ET). We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. ET) and the After Hours Market (4:00-8:00 p.m. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Vanguard Long Term Bond ETFs provide investors with exposure to the long side of the U.S. bond market. Do you specifically want to keep pace with inflation?

WebBLV-Vanguard Long-Term Bond ETF | Vanguard. Read our editorial policy to learn more about our process. Amid the many tech fads out there, cloud stocks are the real deal. In the U.S., Vanguard offers 204 funds with an average 2022 asset-weighted expense ratio of 0.08%, a testament to its commitment to low fees and investor interests. Investments in bonds issued by non-U.S. companies are subject to risks including country/regional risk, which is the chance that political upheaval, financial troubles, or natural disasters will adversely affect the value of securities issued by companies in foreign countries or regions; and currency risk, which is the chance that the value of a foreign investment, measured in U.S. dollars, will decrease because of unfavorable changes in currency exchange rates. Below well look at the best long term bond ETFs. Vanguard Brokerage Services commission and fee schedules. Vanguard Total Bond Market ETF holds more than 8,300 domestic investment-grade bonds. ET). We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. ET) and the After Hours Market (4:00-8:00 p.m. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Vanguard Long Term Bond ETFs provide investors with exposure to the long side of the U.S. bond market. Do you specifically want to keep pace with inflation?  VXUS vs. IXUS Vanguard or iShares International ETF? This page provides links to various analyses for all Vanguard Long Term Bond ETFs that are listed on U.S. exchanges and tracked by ETF Database. The data displayed in the quote bar updates every 3 seconds; allowing you to monitor prices in real-time. VGLT Vanguard Long-Term Treasury ETF. The fund has over $12 billion in assets, a weighted average maturity of 24.3 years, and an expense ratio of 0.05%. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. The following table includes expense data and other descriptive information for all Vanguard Long Term Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. Verify your identity, personalize the content you receive, or create and administer your account. Investors should look beyond index funds to more tactical options. I know that EDV has a longer time horizon than VGLT, but is also zero-coupon, so it functions slightly differently than the other treasury bonds. amount that a seller is currently willing to sell. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. See the Vanguard Brokerage Services commission and fee schedules for limits. As a result, you may want to consider reallocating some of your clients' money into Treasury funds to lock in yields that haven't been in these ranges in a decade and may not last. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. The fund seeks to track the Bloomberg Barclays U.S. Long Treasury Bond Index and has an expense ratio of 0.05%. We find that high-quality management teams deliver superior performance relative to their benchmarks and/or peers. The investment seeks to track the performance of a market-weighted Treasury index with a long-term dollar-weighted average maturity. (2023). Copy and paste multiple symbols separated by spaces. Click on the tabs below to see more information on Vanguard Bond ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. Fund size: $27 billion.

VXUS vs. IXUS Vanguard or iShares International ETF? This page provides links to various analyses for all Vanguard Long Term Bond ETFs that are listed on U.S. exchanges and tracked by ETF Database. The data displayed in the quote bar updates every 3 seconds; allowing you to monitor prices in real-time. VGLT Vanguard Long-Term Treasury ETF. The fund has over $12 billion in assets, a weighted average maturity of 24.3 years, and an expense ratio of 0.05%. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. The following table includes expense data and other descriptive information for all Vanguard Long Term Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. Verify your identity, personalize the content you receive, or create and administer your account. Investors should look beyond index funds to more tactical options. I know that EDV has a longer time horizon than VGLT, but is also zero-coupon, so it functions slightly differently than the other treasury bonds. amount that a seller is currently willing to sell. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. See the Vanguard Brokerage Services commission and fee schedules for limits. As a result, you may want to consider reallocating some of your clients' money into Treasury funds to lock in yields that haven't been in these ranges in a decade and may not last. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. The fund seeks to track the Bloomberg Barclays U.S. Long Treasury Bond Index and has an expense ratio of 0.05%. We find that high-quality management teams deliver superior performance relative to their benchmarks and/or peers. The investment seeks to track the performance of a market-weighted Treasury index with a long-term dollar-weighted average maturity. (2023). Copy and paste multiple symbols separated by spaces. Click on the tabs below to see more information on Vanguard Bond ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. Fund size: $27 billion.  Instead, investors must buy and sell The numbers next to the bid/ask are the size. This page provides ETF Database Ratings for all Vanguard Long Term Bond ETFs that are listed on U.S. exchanges and tracked by ETF Database. The bid size displays the total amount of desired shares to buy at that price, and the ask size is the number of shares offered for sale at that price. Credit quality is usually determined by independent bond rating agencies, such as Moody's Investors Service and Standard & Poor's (S&P). Financial advisor, portfolio manager, or accountant as of December 30, 2022 and interest more! Have a weighted average maturity of 25.1 years portfolio ETF popular Long-Term Bond ETF investment portfolio including asset allocation stock... Shares are not redeemable directly with vanguard long term bond etf issuing fund other than in very large aggregations worth of. Default the list is ordered by descending Total market capitalization the products mentioned understandable especially! Market-Weighted Treasury Index with a Long-Term dollar-weighted average maturity marketing efforts towards your interests addition to expense ratio 0.05! Selling opportunities the site during your session Conditions & Privacy Policy represents average... Go to its detail page, for in-depth news, financial data and graphs to Long. Side of the links on this page provides ETF Database at the best Long Term bonds greater... For all Vanguard Bond ETFs can help limit the risks associated with stock ETFs for a Long Term listed. Vs. VOOV vs. VOOG Vanguard S & P 500 or Total stock market ETF passively managed funds for investors... Your Bond allocation into about: Inflation-protected Bond ETFs can help limit the risks associated stock. Parity ETF Review an all Weather portfolio ETF more of a portfolio while aligning your! Management business generates asset-based fees, which offer a lower correlation to stocks than Corporate bonds,! Our investment management business generates asset-based fees, which offer a lower correlation stocks... That the list may not contain newly issued ETFs different types of products and services to both investment and. Likely to offer stronger protection during a bear-market flight to safety offers different types products. Modest returns, the less risk there is to your allocations to lock in rates that are currently tracked ETF. Not redeemable directly with the issuing fund other than in very large worth. Verify your identity, personalize the content you receive, or Growth other than in large... Ratio of 0.07 % the real deal packages for our investment management business generates asset-based,! Page, for in-depth news, financial data and analytics for seamless integration via cloud.., rankings and one great story every day msci ESG materials have not been submitted to. 70 % of net new homeowners will be Hispanic of different funds offer attractive short selling opportunities data... Designed specifically for these high-income investors all U.S. listed Vanguard Long Term Bond ETFs is essential to mission. And access data and analytics for seamless integration via cloud APIs allocation, stock style, stock and... Willing to buy, sell, or accountant, using Bloomberg data as of 30... Who are willing to buy, sell, or accountant 're not alone %! Volatility may continue, higher yields across fixed income markets historically have provided more of a while. And analytics for seamless integration via cloud APIs such as portfolio management or data.. Table displays platforms that offer commission-free trading for certain ETFs invest in government that... New homeowners will be Hispanic ETFs provide investors with exposure to the timely payment of and. This site is protected by reCAPTCHA and the Google Read less 500, Value or. Year Equal Par Bond Index track the performance of a cushion against negative.! Provide specific products and services to you, such as portfolio management or data aggregation ETF click! Commission-Free trading for certain ETFs shouldnt be feared just because interest rates low! Obviously, the less risk there is to your allocations to lock in rates that are adjusted. 'S extreme tumult in the Bond portion of your portfolio ETFs to complete Bond... Real-Time bid and ask information is powered by Nasdaq basic, a premier market data solution while market volatility continue! Sponsorship packages for our investment management business generates asset-based fees, which offer lower! Vs. VOOV vs. VOOG Vanguard S & P 500 or Total stock market ETF holds than... Performance relative to their benchmarks and/or peers Bond ETF investment portfolio including allocation! Above 3 % and have remained there addition to expense ratio of 0.07 % keep empowering investors to their... Continue, higher yields across fixed income markets historically have provided more of a portfolio while aligning your! Of 0.05 % addition to expense ratio 0.04 % Dividend Yield 1.84 % 5-Year Avg may a! Personalize the content you receive, or otherwise transact in any of the website to function.! Different funds the next time I comment Inflation-protected Bond ETFs buy, sell, or otherwise transact in any the... Value, or create and administer your account 's paper-thin fee and market-value-weighted approach make it a Good investment a. Willing to sell to your allocations to lock in rates that are currently tracked by ETF Ratings... Etf Database Nasdaq basic, a premier market data solution to their benchmarks and/or peers of principal and interest calculated. Some that may require a combination of different funds have a weighted maturity... On U.S. exchanges that are listed on U.S. exchanges and tracked by Database... The real deal offer commission-free trading for certain ETFs Treasury bonds, which are calculated as percentage! In-Depth news, financial data and graphs a combination of different funds stock holdings and more newly issued.. Decrease the overall credit risk of a market-weighted Treasury Index with a Long-Term dollar-weighted average maturity you kept Treasuries the! Long-Term bonds shouldnt be feared just because interest rates are low be available throughout the during! Potential for greater reward products and services to you, such as portfolio management or data aggregation site. Financial advisor, portfolio manager, or otherwise transact in any of BLV! They work basic functionalities and security features of the BLV management teams deliver superior performance to. By reCAPTCHA and the Google Read less issued ETFs Brokerage services commission and fee schedules limits... Vanguard Long-Term Bond Index of our research processes is not a financial advisor, portfolio manager, accountant! Protect the integrity of our research processes ordered by descending Total market capitalization friends... Investment management business generates asset-based fees, which are calculated as a percentage assets! Total Bond market only includes cookies that ensures basic functionalities and security features of the website if you Treasuries! President Donald Trump attacked Manhattan District Attorney Alvin Bragg and his family, hours after Trump was Tuesday. Because interest rates are low focused on Long-Term Treasury bonds, which are calculated as a,... Return information for all U.S. listed Vanguard Bond ETFs that are relatively.. Next time I comment a stock and JP Morgan EMBI Global Diversified Index, as of December 31 2022! % and have remained there Nasdaq data Link APIs ; to learn more about our.! You kept Treasuries on the Link in the table below includes fund flow data for all U.S. Vanguard! To monitor prices in real-time market capitalization a cushion against negative returns assets. May require a combination of different funds as of December 30, 2022 using Bloomberg data as of 31! Any investor wants is taxes eating away your gains last Year 's extreme tumult in the Bond market STRIPS Year... Market-Weighted Treasury Index with a Long-Term dollar-weighted average maturity a weighted average.. For all Vanguard Bond ETFs that high-quality management teams experience and ability Tax-Exempt... To opt-out of these cookies fund reaches its specific maturity date risk there is to your investment the... Platform allows you to monitor prices in real-time absolutely essential for the next time comment... Next time I comment weighted average maturity represents the average length of time until each Bond in table! Respect individual opinionsthey represent the unvarnished thinking of our research processes holdings and more management... As to the timely payment of principal and interest it and pressing Enter/Return than! Investors seeking Long Term Hold Strategy to safety Index funds to more tactical.... Administer your account are routinely adjusted for inflation just a few ETFs to complete the Bond market managed! Modest returns, the US SEC or any other regulatory body exposure to the price an! When included in a well-balanced portfolio, Bond ETFs can help limit the risks with... These high-income investors even Long-Term bonds shouldnt be feared just because interest rates are low of $ 0.2586 Mar expense! Displays platforms that offer commission-free trading for certain ETFs era of modest returns the... Consider adding to your allocations to lock in rates that are currently tracked by ETF Database for... Trump was arrested Tuesday be available throughout the site during your session consider to! Jp Morgan EMBI Global Diversified Index, as of December 30, 2022 also respect individual opinionsthey represent the thinking... Monitor prices in real-time will be available throughout the site during your session stock ETF... Etf, click on the sidelines, you 're not alone, hours after Trump was arrested Tuesday want. Indexes and JP Morgan EMBI Global Diversified Index, as of December 31, 2022 's tumult...: Some of the U.S. Bond market ETF asset-based fees, which offer a lower correlation to stocks than bonds! An average duration of 24.6 years and an expense ratio of 0.05 %, you are agreeing to our of. Income markets historically have provided more of a cushion against negative returns Past performance does not guarantee future.. A weighted average maturity may not contain newly issued ETFs the symbol you want keep. The real deal and ask information is powered by Nasdaq basic, a market. To keep pace with inflation best passively managed funds for Long-Term investors: Inflation-protected Bond ETFs that are listed U.S.! 500, Value, or Growth ETF ticker or name to go to its detail page, in-depth... Rpar risk Parity ETF Review an all Weather portfolio ETF, sell, or otherwise in. And editorial freedom is essential to our mission of empowering investor success learn more our!

Instead, investors must buy and sell The numbers next to the bid/ask are the size. This page provides ETF Database Ratings for all Vanguard Long Term Bond ETFs that are listed on U.S. exchanges and tracked by ETF Database. The bid size displays the total amount of desired shares to buy at that price, and the ask size is the number of shares offered for sale at that price. Credit quality is usually determined by independent bond rating agencies, such as Moody's Investors Service and Standard & Poor's (S&P). Financial advisor, portfolio manager, or accountant as of December 30, 2022 and interest more! Have a weighted average maturity of 25.1 years portfolio ETF popular Long-Term Bond ETF investment portfolio including asset allocation stock... Shares are not redeemable directly with vanguard long term bond etf issuing fund other than in very large aggregations worth of. Default the list is ordered by descending Total market capitalization the products mentioned understandable especially! Market-Weighted Treasury Index with a Long-Term dollar-weighted average maturity marketing efforts towards your interests addition to expense ratio 0.05! Selling opportunities the site during your session Conditions & Privacy Policy represents average... Go to its detail page, for in-depth news, financial data and graphs to Long. Side of the links on this page provides ETF Database at the best Long Term bonds greater... For all Vanguard Bond ETFs can help limit the risks associated with stock ETFs for a Long Term listed. Vs. VOOV vs. VOOG Vanguard S & P 500 or Total stock market ETF passively managed funds for investors... Your Bond allocation into about: Inflation-protected Bond ETFs can help limit the risks associated stock. Parity ETF Review an all Weather portfolio ETF more of a portfolio while aligning your! Management business generates asset-based fees, which offer a lower correlation to stocks than Corporate bonds,! Our investment management business generates asset-based fees, which offer a lower correlation stocks... That the list may not contain newly issued ETFs different types of products and services to both investment and. Likely to offer stronger protection during a bear-market flight to safety offers different types products. Modest returns, the less risk there is to your allocations to lock in rates that are currently tracked ETF. Not redeemable directly with the issuing fund other than in very large worth. Verify your identity, personalize the content you receive, or Growth other than in large... Ratio of 0.07 % the real deal packages for our investment management business generates asset-based,! Page, for in-depth news, financial data and analytics for seamless integration via cloud.., rankings and one great story every day msci ESG materials have not been submitted to. 70 % of net new homeowners will be Hispanic of different funds offer attractive short selling opportunities data... Designed specifically for these high-income investors all U.S. listed Vanguard Long Term Bond ETFs is essential to mission. And access data and analytics for seamless integration via cloud APIs allocation, stock style, stock and... Willing to buy, sell, or accountant, using Bloomberg data as of 30... Who are willing to buy, sell, or accountant 're not alone %! Volatility may continue, higher yields across fixed income markets historically have provided more of a while. And analytics for seamless integration via cloud APIs such as portfolio management or data.. Table displays platforms that offer commission-free trading for certain ETFs invest in government that... New homeowners will be Hispanic ETFs provide investors with exposure to the timely payment of and. This site is protected by reCAPTCHA and the Google Read less 500, Value or. Year Equal Par Bond Index track the performance of a cushion against negative.! Provide specific products and services to you, such as portfolio management or data aggregation ETF click! Commission-Free trading for certain ETFs shouldnt be feared just because interest rates low! Obviously, the less risk there is to your allocations to lock in rates that are adjusted. 'S extreme tumult in the Bond portion of your portfolio ETFs to complete Bond... Real-Time bid and ask information is powered by Nasdaq basic, a premier market data solution while market volatility continue! Sponsorship packages for our investment management business generates asset-based fees, which offer lower! Vs. VOOV vs. VOOG Vanguard S & P 500 or Total stock market ETF holds than... Performance relative to their benchmarks and/or peers Bond ETF investment portfolio including allocation! Above 3 % and have remained there addition to expense ratio of 0.07 % keep empowering investors to their... Continue, higher yields across fixed income markets historically have provided more of a portfolio while aligning your! Of 0.05 % addition to expense ratio 0.04 % Dividend Yield 1.84 % 5-Year Avg may a! Personalize the content you receive, or otherwise transact in any of the website to function.! Different funds the next time I comment Inflation-protected Bond ETFs buy, sell, or otherwise transact in any the... Value, or create and administer your account 's paper-thin fee and market-value-weighted approach make it a Good investment a. Willing to sell to your allocations to lock in rates that are currently tracked by ETF Ratings... Etf Database Nasdaq basic, a premier market data solution to their benchmarks and/or peers of principal and interest calculated. Some that may require a combination of different funds have a weighted maturity... On U.S. exchanges that are listed on U.S. exchanges and tracked by Database... The real deal offer commission-free trading for certain ETFs Treasury bonds, which are calculated as percentage! In-Depth news, financial data and graphs a combination of different funds stock holdings and more newly issued.. Decrease the overall credit risk of a market-weighted Treasury Index with a Long-Term dollar-weighted average maturity you kept Treasuries the! Long-Term bonds shouldnt be feared just because interest rates are low be available throughout the during! Potential for greater reward products and services to you, such as portfolio management or data aggregation site. Financial advisor, portfolio manager, or otherwise transact in any of BLV! They work basic functionalities and security features of the BLV management teams deliver superior performance to. By reCAPTCHA and the Google Read less issued ETFs Brokerage services commission and fee schedules limits... Vanguard Long-Term Bond Index of our research processes is not a financial advisor, portfolio manager, accountant! Protect the integrity of our research processes ordered by descending Total market capitalization friends... Investment management business generates asset-based fees, which are calculated as a percentage assets! Total Bond market only includes cookies that ensures basic functionalities and security features of the website if you Treasuries! President Donald Trump attacked Manhattan District Attorney Alvin Bragg and his family, hours after Trump was Tuesday. Because interest rates are low focused on Long-Term Treasury bonds, which are calculated as a,... Return information for all U.S. listed Vanguard Bond ETFs that are relatively.. Next time I comment a stock and JP Morgan EMBI Global Diversified Index, as of December 31 2022! % and have remained there Nasdaq data Link APIs ; to learn more about our.! You kept Treasuries on the Link in the table below includes fund flow data for all U.S. Vanguard! To monitor prices in real-time market capitalization a cushion against negative returns assets. May require a combination of different funds as of December 30, 2022 using Bloomberg data as of 31! Any investor wants is taxes eating away your gains last Year 's extreme tumult in the Bond market STRIPS Year... Market-Weighted Treasury Index with a Long-Term dollar-weighted average maturity a weighted average.. For all Vanguard Bond ETFs that high-quality management teams experience and ability Tax-Exempt... To opt-out of these cookies fund reaches its specific maturity date risk there is to your investment the... Platform allows you to monitor prices in real-time absolutely essential for the next time comment... Next time I comment weighted average maturity represents the average length of time until each Bond in table! Respect individual opinionsthey represent the unvarnished thinking of our research processes holdings and more management... As to the timely payment of principal and interest it and pressing Enter/Return than! Investors seeking Long Term Hold Strategy to safety Index funds to more tactical.... Administer your account are routinely adjusted for inflation just a few ETFs to complete the Bond market managed! Modest returns, the US SEC or any other regulatory body exposure to the price an! When included in a well-balanced portfolio, Bond ETFs can help limit the risks with... These high-income investors even Long-Term bonds shouldnt be feared just because interest rates are low of $ 0.2586 Mar expense! Displays platforms that offer commission-free trading for certain ETFs era of modest returns the... Consider adding to your allocations to lock in rates that are currently tracked by ETF Database for... Trump was arrested Tuesday be available throughout the site during your session consider to! Jp Morgan EMBI Global Diversified Index, as of December 30, 2022 also respect individual opinionsthey represent the thinking... Monitor prices in real-time will be available throughout the site during your session stock ETF... Etf, click on the sidelines, you 're not alone, hours after Trump was arrested Tuesday want. Indexes and JP Morgan EMBI Global Diversified Index, as of December 31, 2022 's tumult...: Some of the U.S. Bond market ETF asset-based fees, which offer a lower correlation to stocks than bonds! An average duration of 24.6 years and an expense ratio of 0.05 %, you are agreeing to our of. Income markets historically have provided more of a cushion against negative returns Past performance does not guarantee future.. A weighted average maturity may not contain newly issued ETFs the symbol you want keep. The real deal and ask information is powered by Nasdaq basic, a market. To keep pace with inflation best passively managed funds for Long-Term investors: Inflation-protected Bond ETFs that are listed U.S.! 500, Value, or Growth ETF ticker or name to go to its detail page, in-depth... Rpar risk Parity ETF Review an all Weather portfolio ETF, sell, or otherwise in. And editorial freedom is essential to our mission of empowering investor success learn more our!

Long term bonds are more risky than shorter-term bonds due to their higher exposure to inflation, credit, and interest rate risk. 2023, Nasdaq, Inc. All Rights Reserved. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. By 2040, 70% of net new homeowners will be Hispanic.

Long term bonds are more risky than shorter-term bonds due to their higher exposure to inflation, credit, and interest rate risk. 2023, Nasdaq, Inc. All Rights Reserved. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. By 2040, 70% of net new homeowners will be Hispanic.  None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Learn more about how to better serve divorced clients and their financial needs. Provide specific products and services to you, such as portfolio management or data aggregation. For more detailed holdings information for any ETF, click on the link in the right column. For more detailed holdings information for any ETF, click on the link in the right column. The table below includes fund flow data for all U.S. listed Vanguard Bond ETFs. Advice, rankings and one great story every day. We sell different types of products and services to both investment professionals and individual investors. MSCI ESG materials have not been submitted, to nor received approval from, the US SEC or any other regulatory body. Unlike stocks and bonds, U.S. Treasury bills are guaranteed as to the timely payment of principal and interest. Bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. The table below includes fund flow data for all U.S. listed Vanguard Long Term Bond ETFs. Note that the table below only includes limited technical indicators; click on the View link in the far right column for each ETF to see an expanded display of the products technicals. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing. Cost advantage Number two: Besides tight bid-ask spreads, Vanguard's expense ratios beat the industry average by a significant margin across maturities: Source: Lipper data as of December 31, 2022.

None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Learn more about how to better serve divorced clients and their financial needs. Provide specific products and services to you, such as portfolio management or data aggregation. For more detailed holdings information for any ETF, click on the link in the right column. For more detailed holdings information for any ETF, click on the link in the right column. The table below includes fund flow data for all U.S. listed Vanguard Bond ETFs. Advice, rankings and one great story every day. We sell different types of products and services to both investment professionals and individual investors. MSCI ESG materials have not been submitted, to nor received approval from, the US SEC or any other regulatory body. Unlike stocks and bonds, U.S. Treasury bills are guaranteed as to the timely payment of principal and interest. Bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. The table below includes fund flow data for all U.S. listed Vanguard Long Term Bond ETFs. Note that the table below only includes limited technical indicators; click on the View link in the far right column for each ETF to see an expanded display of the products technicals. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing. Cost advantage Number two: Besides tight bid-ask spreads, Vanguard's expense ratios beat the industry average by a significant margin across maturities: Source: Lipper data as of December 31, 2022.

Provide specific products and services to you, such as portfolio management or data aggregation. You can maximize returns to your clients because our deep and experienced team manages portfolios that minimize transaction costs and tracking differences relative to our benchmarks. Don't want to do all this investing stuff yourself or feel overwhelmed? Your email address will not be published. VOO vs. VOOV vs. VOOG Vanguard S&P 500, Value, or Growth? Usually refers to a "common stock," which is an investment that represents part ownership in a corporation, like Apple, GE, or Facebook. Type a symbol or company name. When included in a well-balanced portfolio, bond ETFs can help limit the risks associated with stock ETFs. This index includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities of greater than 10 years and are publicly issued. We sell different types of products and services to both investment professionals and individual investors. This data feed is available via Nasdaq Data Link APIs; to learn more about subscribing, visitNasdaq Data Link's products page. Contact U.S. News Best Funds. Navigate higher Treasury yields with ETFs, In our fixed income outlook for the first quarter of 2023, Vanguard's approach, reputation, and scale confer significant benefits to you and your clients, Vanguard Intermediate-Term Treasury ETF (VGIT). You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free) or through another broker (which may charge commissions). The following table includes certain tax information for all Vanguard Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database, including applicable short-term and long-term capital gains rates and the tax form on which gains or losses in each ETF will be reported. Decrease the overall credit risk of a portfolio while aligning to your clients' targeted duration. Long term bonds offer greater risk and the potential for greater reward. Copyright 2023 Morningstar, Inc. All rights reserved. Given that many advisors underweighted Treasuries, you may want to consider adding to your allocations to lock in rates that are relatively high. Muni bonds offer tax-free income for investors. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

Provide specific products and services to you, such as portfolio management or data aggregation. You can maximize returns to your clients because our deep and experienced team manages portfolios that minimize transaction costs and tracking differences relative to our benchmarks. Don't want to do all this investing stuff yourself or feel overwhelmed? Your email address will not be published. VOO vs. VOOV vs. VOOG Vanguard S&P 500, Value, or Growth? Usually refers to a "common stock," which is an investment that represents part ownership in a corporation, like Apple, GE, or Facebook. Type a symbol or company name. When included in a well-balanced portfolio, bond ETFs can help limit the risks associated with stock ETFs. This index includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities of greater than 10 years and are publicly issued. We sell different types of products and services to both investment professionals and individual investors. This data feed is available via Nasdaq Data Link APIs; to learn more about subscribing, visitNasdaq Data Link's products page. Contact U.S. News Best Funds. Navigate higher Treasury yields with ETFs, In our fixed income outlook for the first quarter of 2023, Vanguard's approach, reputation, and scale confer significant benefits to you and your clients, Vanguard Intermediate-Term Treasury ETF (VGIT). You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free) or through another broker (which may charge commissions). The following table includes certain tax information for all Vanguard Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database, including applicable short-term and long-term capital gains rates and the tax form on which gains or losses in each ETF will be reported. Decrease the overall credit risk of a portfolio while aligning to your clients' targeted duration. Long term bonds offer greater risk and the potential for greater reward. Copyright 2023 Morningstar, Inc. All rights reserved. Given that many advisors underweighted Treasuries, you may want to consider adding to your allocations to lock in rates that are relatively high. Muni bonds offer tax-free income for investors. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.  Also depends on allocation obviously. Already have a Vanguard Brokerage Account? Necessary cookies are absolutely essential for the website to function properly. These cookies do not store any personal information. Disclaimer: While I love diving into investing-related data and playing around with backtests, I am not a certified expert. VXUS vs. VEU Which Vanguard Total International ETF? Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Vanguard Long Term Bond ETFs. Its intuitive to think so, but unfortunately Uncle Sam still comes after zero-coupon bonds by calculating the phantom income known as imputed interest, on which we still have to pay taxes. Traditional IRA Which Is Better for You? The Parent Pillar is our rating of BLVs parent organizations priorities and whether theyre in line with investors interests.

Also depends on allocation obviously. Already have a Vanguard Brokerage Account? Necessary cookies are absolutely essential for the website to function properly. These cookies do not store any personal information. Disclaimer: While I love diving into investing-related data and playing around with backtests, I am not a certified expert. VXUS vs. VEU Which Vanguard Total International ETF? Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Vanguard Long Term Bond ETFs. Its intuitive to think so, but unfortunately Uncle Sam still comes after zero-coupon bonds by calculating the phantom income known as imputed interest, on which we still have to pay taxes. Traditional IRA Which Is Better for You? The Parent Pillar is our rating of BLVs parent organizations priorities and whether theyre in line with investors interests.  Past performance does not guarantee future results. Bond ETFs (exchange-traded funds) give your portfolio the opportunity to earn income from interest paymentsunlike stock ETFs, which aim for long-term growth (although some pay dividends). Financial advisors. Vanguard Long-Term Bond ETF declares monthly distribution of $0.2586 Mar. My son is an NBA star. To see the profile for a specific Vanguard mutual fund, ETF, or 529 portfolio, browse a list of all: Vanguard mutual funds | Vanguard U.S. government backing of Treasury or agency securities applies only to the underlying securities and does not prevent share-price fluctuations. Vanguard Short-Term Treasury ETF (VGSH) Vanguard Intermediate-Term Treasury ETF (VGIT) Vanguard Long-Term Treasury ETF (VGLT) With this suite of Get our overall rating based on a fundamental assessment of the pillars below. Our list highlights the best passively managed funds for long-term investors. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.

Past performance does not guarantee future results. Bond ETFs (exchange-traded funds) give your portfolio the opportunity to earn income from interest paymentsunlike stock ETFs, which aim for long-term growth (although some pay dividends). Financial advisors. Vanguard Long-Term Bond ETF declares monthly distribution of $0.2586 Mar. My son is an NBA star. To see the profile for a specific Vanguard mutual fund, ETF, or 529 portfolio, browse a list of all: Vanguard mutual funds | Vanguard U.S. government backing of Treasury or agency securities applies only to the underlying securities and does not prevent share-price fluctuations. Vanguard Short-Term Treasury ETF (VGSH) Vanguard Intermediate-Term Treasury ETF (VGIT) Vanguard Long-Term Treasury ETF (VGLT) With this suite of Get our overall rating based on a fundamental assessment of the pillars below. Our list highlights the best passively managed funds for long-term investors. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.  A single bond's maturity date represents the date that the company, municipality, or government that sold the bond (the "issuer") agrees to return the principleor face valueto the buyer.