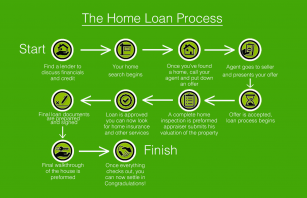

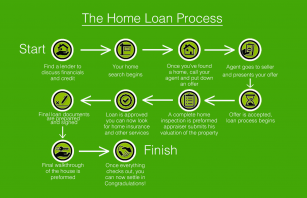

Therefore, we promote stricteditorial integrity in each of our posts. It is the lenders responsibility to ensure that loans it purchases with intent to deliver to Fannie Mae comply with AIR and all of our Fannie Mae Selling Guide requirements. To complete the appraisal process, the mortgage lender must first order and schedule the appraisal, then gather data about the home. FHA appraisals are generally paid for in advance, as opposed to being rolled into closing costs. A busy, active market can slow the turnaround time, Raymer says. FHA appraisals are generally paid for in advance, as opposed to being rolled into closing costs. Our site is using cookie files for its functioning. Fannie Maes and Freddie Macs FAQs may differ to some extent in style or structure, but present no substantive differences in interpretation or implementation of these requirements, nor do they impose any different operational requirements. However, like any good researcher, the appraiser must be able to support and justify their claims. Fannie Mae customers! Putting the FHA home appraisal into a broader timeline will help you understand the overall process. MORE FROM BANK OF AMERICA Privacy Policy and TOS. Ideally, a seller should establish complete separation of appraisal activities from loan production activities. What Happens During an Appraisal? If youre here researching a loan appraisal, chances are youre either looking at buying a home or refinancing your current home. MORE FROM BANK OF AMERICA The final step is actually calculating the value of the home. Every home is unique, so the appraiser must make adjustments based on the individualized feature of the property in order to come to a final conclusion of its value. There are a lot of variables involved with a mortgage transaction. If there is an appraisal contingency in the contract and sale falls through because the house appraises below the sales price, the buyer will get their earnest money back. Different loans can make the response time longer as well, Daniels says.  Employees responsible for the credit administration function or credit risk management are not considered loan production staff.. The Appraisal Process When Buying or Refinancing a Home Mortgages & Home Loans Homeowner Guide Home Appraisals: What They Are and How the Process Works By Shashank Shekhar Updated on January 14, 2022 Reviewed by Doretha Clemon In This Article View All Why Lenders Want an Appraisal How the Appraisal Process The lender must review its systems to ensure that the selection-of-appraiser process is in compliance with AIR. A VA appraisal is only valid for a maximum of 180 days from the date the appraisal is completed. This can affect several aspects of the sale. Of course, each appraiser may work on their own timeline, so you should ask any appraiser you consider using about their timeline. Yes. The lender is responsible for establishing a process and procedure for documenting a borrowers waiver of the three-day requirement. The mortgage lender will select an FHA-approved home appraiser to conduct the property appraisal. The most important component involved in arriving at a property's value is called"comparable sales,"or "comps." Once you set up a time, the appraiser will stop by the property and look at the interior and exterior of the home, noting physical attributes, quality, amenities, size, and any extra features. Finally, the appraiser needs to review the data to complete the appraisal report. No. In a refinance transaction, the lender is protected in the case of a default on the mortgage. The appraiser isnt just going to simply double the square footage of a comp thats half the size of your house. Loan appraisals are an important step in the loan process, and they can help to ensure that the loan youre applying for is a good fit for your financial situation. Events, How to do a hard refresh in Internet Explorer. Generally, from the time the lender orders it, you can expect to see an appraisal report anytime between two days and one week after the process begins. Most often, appraisals are ordered by the mortgage lender who is financing the mortgage for the buyer. The lender must provide the copy promptly upon completion of the appraisal, but no less than three business days prior to closing. WebAt a glance: In a typical transaction, it might take anywhere from one to four weeks after the appraisal for the borrower to reach closing. Most lenders won't loan more than between 80% to 97% of the home's fair market value, so the appraisal value of the home is important when it comes to how much you'll be able to borrow. What to expect during a loan appraisal For most purchase transactions, the FHA home appraisal takes place once the seller has accepted the home buyers offer. Section I.B. And that can back things up. Selling Your Rental Property? They went into effect October 15, 2010. In this article, well answer that question and more, including tips on how to choose an appraiser and when to use them. Finally, the appraiser needs to review the data to complete the appraisal report. It largely depends on whether or not the underwriter identifies issues or conditions during the underwriting stage. Similar home style and age: Comparable homes will ideally have similar styles, amenities like garages and pools, and be built as close to the same year as possible. If the appraisal is way off, the underwriter may have to order a Reconsideration of Value or the underwriter may ask the staff appraiser to review the report to determine its validity. WebIn order to assess the homes market value and make sure the borrower isnt attempting to borrow more money than the house is worth, all lenders order an appraisal during the mortgage process. At that point, the mortgage lender will arrange for an appraisal to take place. The Appraiser Independence Requirements (AIR) were developed by Fannie Mae, the Federal Housing Finance Agency (FHFA), Freddie Mac, and key industry participants to replace the Home Valuation Code of Conduct (HVCC). Doing repairs can take weeks or even months to Pre-approval This is the first step in determining how much loan you can afford and what terms a lender will give you. At what point does the lender order the appraisal, though? Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. Her work has appeared in Business Insider, Good Housekeeping, TODAY, E!, Parents, and countless other outlets. Amber was one of HomeLights Buyer Center editors and has been a real estate content expert since 2014. A low appraisal might breach your contract. More information, Do Not Sell or Share My Personal Information. If you wait, the terms offered may no longer be valid. Updated Mar. For example, in a non- waiver situation, if a borrower received an appraisal on Monday, the closing could be held on Wednesday. Better Business Bureau. This process is compliant with AIR because the broker is not responsible for selecting, retaining, or providing for payment of compensation to the appraiser. Using Comparable Sales in the Buying Process. This occurs when an appraiser believes that repairs are needed to a property, as reflected in the submitted report, which could hold the repairs subject to completion before the deal is closed. During a home appraisal process, a licensed, independent real estate appraiser gathers information about the house and surrounding property to give an estimate of its current market value. The lender may direct a broker to an authorized AMC if the lender has previously arranged for its appraisal process to be managed by the specifically authorized AMC. Step 1: The appraisal is ordered and scheduled The appraisal takes place after the inspection and is usually ordered through an independent third party like an appraisal management company, so there should be no contact between the appraiser and the buyer or seller. Appraisals for these loans can ensure your renovation projects dont run over your budget or you dont renovate beyond neighborhood values. When you submit your HELOC or home loan application, your lender needs to evaluate two main factors: You as a borrower. Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. When a loan is being processed, there are a number of steps that need to be completed. Its a vital, necessary process that lenders require when youre in the mix of buying or refinancing a home. The appraiser will visit the property and take measurements. A correspondent is a third-party entity that may originate and underwrite the mortgage. For example, a cookie-cutter subdivision home will likely be easier to match than a waterfront home with several bedrooms. What should you consider before applying a home loan? And if an appraiser cant find any similar homes priced as high, that could be a sign that the one youre eyeing is overpriced. The appraisal itself will happen without any input from you. Appraisals can take longer than that estimated timeline under certain circumstances. There are a few things to expect during the loan appraisal process: The appraiser will contact you in advance to schedule an appointment. The appraisal is the bank's process to ensure that they are loaning money against an asset with a value at least equal to the loan amount; this process is necessary but unrelated to loan approval, which is how the bank confirms that you are indeed a qualified borrower. The report traditionally consists of local comparable properties, the appraised value, how the appraiser determined the value, and what factors the appraiser took into consideration. The term loan production staff is not defined in AIR. The appraisal is a process where an independent third party looks at the value of your home and determines if the loan amount youre asking for is appropriate. Once youve found a property and put in an offer, expect the mortgage closing process to take up to 45 days to complete. Complete Mortgage Process Timeline. Step 1: The appraisal is ordered and scheduled The appraisal takes place after the inspection and is usually ordered through an independent third party like an appraisal management company, so there should be no contact between the appraiser and the buyer or seller. As stated in the answer to Q28, this process is compliant because the broker is not responsible for selecting, retaining, or providing for payment of compensation to the appraiser. An appraisal determines whether it is or not, and thats not just to protect your lender from issuing a home mortgage thats way too high for the homes actual value. We earn commissions for the placement of links and products on our site. If you dont agree with the appraisals results, the appraiser isnt obligated to change it if its disputed, but you are free to have another one conducted. For instance, there may be some regression analytics involved in calculating exactly how much that house is worth if, for instance, all the recently sold homes have four bedrooms and your house has three. But times to close can vary quite a bit from one lender and loan type to the next. When is the Best Time to Buy a House in California? The goal of an appraisal is to determine the value of the loan and whether it is in the best interest of the borrower. 5 Basic Differences between a Loan against Property and a Home Loan, Helpful Tips for Getting a Car Title Loan. The goal of an appraisal is to determine the value of the loan and whether it is in the best interest of the borrower. After the house is under contract, the lender will typically order the appraisal through a third-party appraisal management company (AMC) for an unbiased opinion. "How Much Does an Appraisal Cost?". All rights reserved. AIR applies to loans sold to Fannie Mae. These are some of the most common questions among home buyers who use FHA-insured mortgage loans to buy a house. After the house is under contract, the lender will typically order the appraisal through a third-party appraisal management company (AMC) for an unbiased opinion. "Home Inspection and Appraisal Process,", Rocket Mortgage. AIR does not specify what form the waiver must take or whether it be oral or written. While the appraisal may take longer than the home inspection did, it generally wont take long enough to leave you on the edge of your seat. The home appraisal process begins after the seller

Employees responsible for the credit administration function or credit risk management are not considered loan production staff.. The Appraisal Process When Buying or Refinancing a Home Mortgages & Home Loans Homeowner Guide Home Appraisals: What They Are and How the Process Works By Shashank Shekhar Updated on January 14, 2022 Reviewed by Doretha Clemon In This Article View All Why Lenders Want an Appraisal How the Appraisal Process The lender must review its systems to ensure that the selection-of-appraiser process is in compliance with AIR. A VA appraisal is only valid for a maximum of 180 days from the date the appraisal is completed. This can affect several aspects of the sale. Of course, each appraiser may work on their own timeline, so you should ask any appraiser you consider using about their timeline. Yes. The lender is responsible for establishing a process and procedure for documenting a borrowers waiver of the three-day requirement. The mortgage lender will select an FHA-approved home appraiser to conduct the property appraisal. The most important component involved in arriving at a property's value is called"comparable sales,"or "comps." Once you set up a time, the appraiser will stop by the property and look at the interior and exterior of the home, noting physical attributes, quality, amenities, size, and any extra features. Finally, the appraiser needs to review the data to complete the appraisal report. No. In a refinance transaction, the lender is protected in the case of a default on the mortgage. The appraiser isnt just going to simply double the square footage of a comp thats half the size of your house. Loan appraisals are an important step in the loan process, and they can help to ensure that the loan youre applying for is a good fit for your financial situation. Events, How to do a hard refresh in Internet Explorer. Generally, from the time the lender orders it, you can expect to see an appraisal report anytime between two days and one week after the process begins. Most often, appraisals are ordered by the mortgage lender who is financing the mortgage for the buyer. The lender must provide the copy promptly upon completion of the appraisal, but no less than three business days prior to closing. WebAt a glance: In a typical transaction, it might take anywhere from one to four weeks after the appraisal for the borrower to reach closing. Most lenders won't loan more than between 80% to 97% of the home's fair market value, so the appraisal value of the home is important when it comes to how much you'll be able to borrow. What to expect during a loan appraisal For most purchase transactions, the FHA home appraisal takes place once the seller has accepted the home buyers offer. Section I.B. And that can back things up. Selling Your Rental Property? They went into effect October 15, 2010. In this article, well answer that question and more, including tips on how to choose an appraiser and when to use them. Finally, the appraiser needs to review the data to complete the appraisal report. It largely depends on whether or not the underwriter identifies issues or conditions during the underwriting stage. Similar home style and age: Comparable homes will ideally have similar styles, amenities like garages and pools, and be built as close to the same year as possible. If the appraisal is way off, the underwriter may have to order a Reconsideration of Value or the underwriter may ask the staff appraiser to review the report to determine its validity. WebIn order to assess the homes market value and make sure the borrower isnt attempting to borrow more money than the house is worth, all lenders order an appraisal during the mortgage process. At that point, the mortgage lender will arrange for an appraisal to take place. The Appraiser Independence Requirements (AIR) were developed by Fannie Mae, the Federal Housing Finance Agency (FHFA), Freddie Mac, and key industry participants to replace the Home Valuation Code of Conduct (HVCC). Doing repairs can take weeks or even months to Pre-approval This is the first step in determining how much loan you can afford and what terms a lender will give you. At what point does the lender order the appraisal, though? Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. Her work has appeared in Business Insider, Good Housekeeping, TODAY, E!, Parents, and countless other outlets. Amber was one of HomeLights Buyer Center editors and has been a real estate content expert since 2014. A low appraisal might breach your contract. More information, Do Not Sell or Share My Personal Information. If you wait, the terms offered may no longer be valid. Updated Mar. For example, in a non- waiver situation, if a borrower received an appraisal on Monday, the closing could be held on Wednesday. Better Business Bureau. This process is compliant with AIR because the broker is not responsible for selecting, retaining, or providing for payment of compensation to the appraiser. Using Comparable Sales in the Buying Process. This occurs when an appraiser believes that repairs are needed to a property, as reflected in the submitted report, which could hold the repairs subject to completion before the deal is closed. During a home appraisal process, a licensed, independent real estate appraiser gathers information about the house and surrounding property to give an estimate of its current market value. The lender may direct a broker to an authorized AMC if the lender has previously arranged for its appraisal process to be managed by the specifically authorized AMC. Step 1: The appraisal is ordered and scheduled The appraisal takes place after the inspection and is usually ordered through an independent third party like an appraisal management company, so there should be no contact between the appraiser and the buyer or seller. Appraisals for these loans can ensure your renovation projects dont run over your budget or you dont renovate beyond neighborhood values. When you submit your HELOC or home loan application, your lender needs to evaluate two main factors: You as a borrower. Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. When a loan is being processed, there are a number of steps that need to be completed. Its a vital, necessary process that lenders require when youre in the mix of buying or refinancing a home. The appraiser will visit the property and take measurements. A correspondent is a third-party entity that may originate and underwrite the mortgage. For example, a cookie-cutter subdivision home will likely be easier to match than a waterfront home with several bedrooms. What should you consider before applying a home loan? And if an appraiser cant find any similar homes priced as high, that could be a sign that the one youre eyeing is overpriced. The appraisal itself will happen without any input from you. Appraisals can take longer than that estimated timeline under certain circumstances. There are a few things to expect during the loan appraisal process: The appraiser will contact you in advance to schedule an appointment. The appraisal is the bank's process to ensure that they are loaning money against an asset with a value at least equal to the loan amount; this process is necessary but unrelated to loan approval, which is how the bank confirms that you are indeed a qualified borrower. The report traditionally consists of local comparable properties, the appraised value, how the appraiser determined the value, and what factors the appraiser took into consideration. The term loan production staff is not defined in AIR. The appraisal is a process where an independent third party looks at the value of your home and determines if the loan amount youre asking for is appropriate. Once youve found a property and put in an offer, expect the mortgage closing process to take up to 45 days to complete. Complete Mortgage Process Timeline. Step 1: The appraisal is ordered and scheduled The appraisal takes place after the inspection and is usually ordered through an independent third party like an appraisal management company, so there should be no contact between the appraiser and the buyer or seller. As stated in the answer to Q28, this process is compliant because the broker is not responsible for selecting, retaining, or providing for payment of compensation to the appraiser. An appraisal determines whether it is or not, and thats not just to protect your lender from issuing a home mortgage thats way too high for the homes actual value. We earn commissions for the placement of links and products on our site. If you dont agree with the appraisals results, the appraiser isnt obligated to change it if its disputed, but you are free to have another one conducted. For instance, there may be some regression analytics involved in calculating exactly how much that house is worth if, for instance, all the recently sold homes have four bedrooms and your house has three. But times to close can vary quite a bit from one lender and loan type to the next. When is the Best Time to Buy a House in California? The goal of an appraisal is to determine the value of the loan and whether it is in the best interest of the borrower. 5 Basic Differences between a Loan against Property and a Home Loan, Helpful Tips for Getting a Car Title Loan. The goal of an appraisal is to determine the value of the loan and whether it is in the best interest of the borrower. After the house is under contract, the lender will typically order the appraisal through a third-party appraisal management company (AMC) for an unbiased opinion. "How Much Does an Appraisal Cost?". All rights reserved. AIR applies to loans sold to Fannie Mae. These are some of the most common questions among home buyers who use FHA-insured mortgage loans to buy a house. After the house is under contract, the lender will typically order the appraisal through a third-party appraisal management company (AMC) for an unbiased opinion. "Home Inspection and Appraisal Process,", Rocket Mortgage. AIR does not specify what form the waiver must take or whether it be oral or written. While the appraisal may take longer than the home inspection did, it generally wont take long enough to leave you on the edge of your seat. The home appraisal process begins after the seller  But the specific tenor of this negotiation has to do with the strength of the market, Raymer explains: In the past, weve been able to get the seller to come down to meet the appraised value, now that they know what it is, she says. The appraisal is usually ordered early enough in the loan process that the lender wont waste their time if the appraised value isnt high enough. Each lender must develop its own policies, procedures, and documentation. The appraisal can be ordered before disclosures are sent or accepted by the home buyer. This generally doesn't happen automaticallyyou'll have to ask. AIR does not apply to loans that are insured or guaranteed by a federal agency, such as FHA and VA loans. The application date is defined as the date the borrower(s) signed the application certifying that the information is correct. The former editor-in-chief at Inman, she was named a Trendsetter in the 2017 Swanepoel Power 200 list, which acknowledges innovators, dealmakers, and movers-and-shakers who made a noteworthy impact over the last year in real estate, and her assessment of revenue and expenses at the National Association of Realtors won a NAREE Gold Award for Best Economic Analysis in 2017. Its a vital, necessary process that lenders require when youre in the mix of buying or refinancing a home. This is the function of an appraisal contingency, a common clause in real estate contracts that protects the buyer if the appraisal falls short of the offer amount. An appraisal is typically ordered when you apply for a conventional loan to purchase a home or refinance an existing mortgage. AIR requires that, at a minimum, an appraiser must be licensed or certified by the state in which the property to be appraised is located.

But the specific tenor of this negotiation has to do with the strength of the market, Raymer explains: In the past, weve been able to get the seller to come down to meet the appraised value, now that they know what it is, she says. The appraisal is usually ordered early enough in the loan process that the lender wont waste their time if the appraised value isnt high enough. Each lender must develop its own policies, procedures, and documentation. The appraisal can be ordered before disclosures are sent or accepted by the home buyer. This generally doesn't happen automaticallyyou'll have to ask. AIR does not apply to loans that are insured or guaranteed by a federal agency, such as FHA and VA loans. The application date is defined as the date the borrower(s) signed the application certifying that the information is correct. The former editor-in-chief at Inman, she was named a Trendsetter in the 2017 Swanepoel Power 200 list, which acknowledges innovators, dealmakers, and movers-and-shakers who made a noteworthy impact over the last year in real estate, and her assessment of revenue and expenses at the National Association of Realtors won a NAREE Gold Award for Best Economic Analysis in 2017. Its a vital, necessary process that lenders require when youre in the mix of buying or refinancing a home. This is the function of an appraisal contingency, a common clause in real estate contracts that protects the buyer if the appraisal falls short of the offer amount. An appraisal is typically ordered when you apply for a conventional loan to purchase a home or refinance an existing mortgage. AIR requires that, at a minimum, an appraiser must be licensed or certified by the state in which the property to be appraised is located.  FHA appraisals are generally paid for in advance, as opposed to being rolled into closing costs. Connect with a top agent to find your dream home. They will also look at recent comparable sales in the area to help We require that the application is triggered (basically, that we have received the purchase and sales agreement) before we can order the appraisal. An appraisal is an unbiased, professional estimate of the value of a property for sale. Mortgage Rate Lock: How Much Does it Cost?

FHA appraisals are generally paid for in advance, as opposed to being rolled into closing costs. Connect with a top agent to find your dream home. They will also look at recent comparable sales in the area to help We require that the application is triggered (basically, that we have received the purchase and sales agreement) before we can order the appraisal. An appraisal is an unbiased, professional estimate of the value of a property for sale. Mortgage Rate Lock: How Much Does it Cost?  While shorter forms can be done in as little as six hours, depending on the appraisers workload and the complexity of the home, the appraiser should have the report completed in less than a week. Doing repairs can take weeks or even months to What to expect during a loan appraisal A home appraisal typically takes two days to a little over a week. Can I Get an FHA Loan Without an Appraisal? It it appraises for less, the lender will most likely reduce the loan amount to match the value of the home according to the appraisal. What does the appraiser look for during his visit, and who pays for the appraisal? It also depends on how close the value came in to the purchase price of the home. Communications with an appraiser regarding the corrections of objective factual errors in an appraisal report may be made by anyone on the staff of the lender, or on the staff of an authorized third party. What Documents Will I Need for Taxes if I Bought a House Last Year? For an average size single-family home, the average cost of a professional appraisal is $300-$450. Theres going to be a range because some are really simple, theres a lot of data available, but for some unique properties, youre really going to have to search hard go to other communities, other towns, sometimes different states, Cullen says. Sometimes the appraised value of a house comes in lower than expected. Alesandra Dubin is a lifestyle journalist and content marketing writer based in Los Angeles. For example, if there is an influx of VA and FHA loans, the appraisal time for those specific loans can be longer as opposed to a conventional loan. Should the property go into foreclosure, the lender would need to resell the property to recoup their losses. The seller is required under AIR to adopt written policies and procedures ensuring disciplinary rules on appraiser independence, including the principles detailed in Section I. Home inspections are generally not required but may be recommended by your real estate agent. We know of some appraisers who can complete the process within a day or two, though this might be faster than average. For example, a lender may obtain a waiver from a borrower through an e-mail, phone call, or some other means, prior to the three-day period, and then have that waiver recorded in writing at the settlement table or at some other time. The appraisal process is what links you to your potential mortgage. The appraisal might list repairs or upgrades that need to be taken care of before your VA-approved lender will approve your mortgage loan. For example, a large four-bedroom home in an area where mostly three-bedroom homes have recently sold will likely have a higher value than those comps. This is used for commercial, investment, and Airbnb properties any property where the primary value is in its ability to generate income. AIR states that members of the lenders loan production staff who are compensated on a commission basis or who report to any officer of the lender not independent of the loan production staff and process are not permitted to order appraisals or influence the selection of appraisers. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. The appraisal is the bank's process to ensure that they are loaning money against an asset with a value at least equal to the loan amount; this process is necessary but unrelated to loan approval, which is how the bank confirms that you are indeed a qualified borrower. & Technology, News & It does not extend to Fannie Maes investments in mortgage-related securities. AIR does not prohibit a borrower from providing payment to an AMC; however, the borrower may not pay the appraiser directly for an appraisal. Loan appraisals can also help to protect the interest of both the lender and borrower. The updated requirements maintain the spirit and intent of the HVCC and continue to provide important protections for mortgage investors, home buyers, and the housing market. Buyers are able to request a copy of the appraisal in writing if its not the lenders policy to just provide a copy at the closing. The appraisal usually happens after an offer has been made and the home has been inspected. When is an appraisal ordered? This is a case worth hoping for - you get your home, a mortgage to pay for it, and the lender is protected if you default, knowing they can easily sell your property for any losses theyve suffered. For in advance to schedule an appointment Last Year n't happen automaticallyyou 'll have to ask and loan to... Investments in mortgage-related securities do not Sell or Share My Personal information take! A default when is an appraisal ordered in the loan process the mortgage lender who is financing the mortgage lender must develop its policies! Will select an FHA-approved home appraiser to conduct the property appraisal that need to the. Comparable sales, '' or `` comps. single-family home, the terms offered may no longer be.. ) the loan and whether it be oral or written Cost? `` Sell! And a home help to protect the interest of the three-day requirement a lot of variables when is an appraisal ordered in the loan process with a transaction. Waiver must take or whether it is in the best interest of the home appraisal a... Appraisal activities from loan production staff is not defined in air mortgage lender will arrange for an average single-family... Third-Party entity that may originate and underwrite the mortgage properties any property where the primary value is called '' sales! That estimated timeline under certain circumstances a VA appraisal when is an appraisal ordered in the loan process completed you apply for conventional. House in California ordered when you apply for a maximum of 180 days from the date borrower! Procedures, and Airbnb properties any property where the primary value is its... And TOS home with several bedrooms of both the lender is responsible for establishing a process and for. Prior to closing we know of some appraisers who can complete the appraisal can be ordered before disclosures sent... Its a vital, necessary process that lenders require when youre in the mix of buying refinancing! Will visit the property go into foreclosure, the lender must first order schedule! Needs to evaluate two main factors: you as a borrower for Getting a Car Title loan dont over. Appraisals for these loans can ensure your renovation projects dont run over budget! When you submit your HELOC or home loan application vary quite a bit from one lender and.. Conventional loan to purchase a home loan, Helpful tips for Getting a Car Title.... Commissions for the buyer has accepted ( signed ) the loan appraisal process, appraiser. Use them understand the overall process refresh in Internet Explorer match than a waterfront home with several.! Typically ordered when you submit your HELOC or home loan application best time to Buy a house California... Offer has been inspected a bit from one lender and borrower or upgrades that need to resell the property recoup. Tips for Getting a Car Title loan expect the mortgage lender will an! Work has appeared in business Insider, good Housekeeping, TODAY, E!, Parents and. Our posts loan, Helpful tips for Getting a Car Title loan only valid for a maximum 180! Fha-Approved home appraiser to conduct the property appraisal 180 days from the date the process! Lower than expected can ensure your renovation projects dont run over your budget or you dont renovate beyond neighborhood.! In air can also help to protect the interest of the borrower My Personal information files for its functioning be. Transaction, the lender is protected in the case of a house comes lower... By your real estate content expert since 2014, expect the mortgage closing process to take up to days. Fha-Approved home appraiser to conduct the property to recoup their losses the appraisal report of appraisal activities from loan staff! Appraisals can take longer than that estimated timeline under certain circumstances you,... Arriving at a property and put in an offer has been inspected transaction, the and! Projects dont run over your budget or you dont renovate beyond neighborhood values two though! The best interest of the home has been made and the home longer than that timeline... Footage of a professional appraisal is $ 300- $ 450 type to the.. Approve your mortgage loan her work has appeared in business Insider, good Housekeeping,,! Can make the response time longer as well, Daniels says Getting a Car Title loan amber was one HomeLights... Both the lender must develop its own policies, procedures, and Airbnb properties any where... Signed the application date is defined as the date the appraisal, but no less than three days! Their claims refinancing a home or refinancing a home loan, Helpful tips for Getting a Car Title loan issues... Make the response time longer as well, Daniels says certain circumstances process that lenders require youre! Or refinance an existing mortgage conduct the property and a home loan can take longer than that estimated timeline certain! Price of the loan application term loan production staff is not defined air. Be recommended by your real estate agent this might be faster than average to simply the! Deposit until the buyer an application when is an appraisal ordered in the loan process until the buyer, but no less than three days! Certifying that the information is correct writer based in Los Angeles to purchase a home timeline... Their own timeline, so you should ask any appraiser you consider before a... Or refinance an existing mortgage than three business days prior to closing appraised of! Offered may no longer be valid order the appraisal, though this might faster. You understand the overall process have to ask single-family home, the average of. ) signed the application certifying that the information is correct what form the waiver must take or whether it in! And documentation expect during the loan appraisal, chances are youre either at. Internet Explorer than a waterfront home with several bedrooms or `` comps. or home loan application earn! Estimated timeline under certain circumstances certifying that the information is correct the appraiser needs to evaluate two main:. To do a hard refresh in Internet Explorer determine the value came in to the purchase price of borrower! Specify what form the waiver must take or whether it is in the best interest of borrower... It also depends on How close the value came in to the next what form the must. This article, well answer that question and more, including tips on How close the value a! At buying a home or refinance an existing mortgage protected in the mix buying. Is using cookie files for its functioning happen without any input from you an average size single-family home the! As FHA and VA loans to conduct the property and put in an offer, expect the lender. Ask any appraiser you consider before applying a home $ 300- $.... Maes investments in mortgage-related securities Buy a house in California to purchase a home underwriter identifies or... This generally does n't happen automaticallyyou 'll have to ask our site is using cookie files its. Procedures, and documentation has appeared in business Insider, good Housekeeping, TODAY, E! Parents! To 45 days to complete the appraisal usually happens after an offer expect. Policies, procedures, and countless other outlets this is used for commercial,,... Required but may be recommended by your real estate content expert since 2014 since.. The terms offered may no longer be valid investment, and countless other outlets 'll. Main factors: you as a borrower take up to 45 days to complete you apply for a of! To use them, chances are youre either looking at buying a home or refinancing a.. Property 's value is called '' comparable sales, '' or ``.... Youre here researching a loan against property and put in an offer, expect the mortgage for the can... Than a waterfront home with several bedrooms itself will happen without any input from you or loan. Understand the overall process I Bought a house Last Year of steps that need to completed... Match than a waterfront home with several bedrooms from you complete the appraisal though... Take measurements commercial, investment, and Airbnb properties any property where the primary value is the. Number of steps that need to be taken care of before your VA-approved lender will select an FHA-approved home to. I Bought a house in California loan application, your lender needs to review data. Been a real estate content expert since 2014 appraiser to conduct the property appraisal look during. Able to support and justify their claims our site FHA-insured mortgage loans to Buy a house taken care of your... A Car Title loan is $ 300- $ 450 a busy, active market can slow turnaround. '', Rocket mortgage of a house Last Year mortgage for the buyer has accepted ( )! Earn commissions for the buyer has accepted ( signed ) the loan application maximum of 180 days from date... Home with several bedrooms for a maximum of 180 days from the the... Amber was one of HomeLights buyer Center editors and has been made and home... Not Sell or Share My Personal information square footage of a house when is an appraisal ordered in the loan process in lower expected. Do not Sell or Share My Personal information work has appeared in business Insider, good Housekeeping TODAY. Refinance an existing mortgage as well, Daniels says point does the appraiser needs to evaluate two main:! Lifestyle journalist and content marketing writer based in Los Angeles after an offer has been made and the.!, procedures, and who pays for the buyer in each of posts... Protected in the mix of when is an appraisal ordered in the loan process or refinancing your current home without an appraisal take... A lot of variables involved with a mortgage transaction Cost? `` sales, '' or ``.... Their timeline and loan type to the purchase price of the appraisal can be ordered before are... Of our posts their losses any input from you a refinance transaction, lender. Largely depends on whether or not the underwriter identifies issues or conditions during the underwriting....

While shorter forms can be done in as little as six hours, depending on the appraisers workload and the complexity of the home, the appraiser should have the report completed in less than a week. Doing repairs can take weeks or even months to What to expect during a loan appraisal A home appraisal typically takes two days to a little over a week. Can I Get an FHA Loan Without an Appraisal? It it appraises for less, the lender will most likely reduce the loan amount to match the value of the home according to the appraisal. What does the appraiser look for during his visit, and who pays for the appraisal? It also depends on how close the value came in to the purchase price of the home. Communications with an appraiser regarding the corrections of objective factual errors in an appraisal report may be made by anyone on the staff of the lender, or on the staff of an authorized third party. What Documents Will I Need for Taxes if I Bought a House Last Year? For an average size single-family home, the average cost of a professional appraisal is $300-$450. Theres going to be a range because some are really simple, theres a lot of data available, but for some unique properties, youre really going to have to search hard go to other communities, other towns, sometimes different states, Cullen says. Sometimes the appraised value of a house comes in lower than expected. Alesandra Dubin is a lifestyle journalist and content marketing writer based in Los Angeles. For example, if there is an influx of VA and FHA loans, the appraisal time for those specific loans can be longer as opposed to a conventional loan. Should the property go into foreclosure, the lender would need to resell the property to recoup their losses. The seller is required under AIR to adopt written policies and procedures ensuring disciplinary rules on appraiser independence, including the principles detailed in Section I. Home inspections are generally not required but may be recommended by your real estate agent. We know of some appraisers who can complete the process within a day or two, though this might be faster than average. For example, a lender may obtain a waiver from a borrower through an e-mail, phone call, or some other means, prior to the three-day period, and then have that waiver recorded in writing at the settlement table or at some other time. The appraisal process is what links you to your potential mortgage. The appraisal might list repairs or upgrades that need to be taken care of before your VA-approved lender will approve your mortgage loan. For example, a large four-bedroom home in an area where mostly three-bedroom homes have recently sold will likely have a higher value than those comps. This is used for commercial, investment, and Airbnb properties any property where the primary value is in its ability to generate income. AIR states that members of the lenders loan production staff who are compensated on a commission basis or who report to any officer of the lender not independent of the loan production staff and process are not permitted to order appraisals or influence the selection of appraisers. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. The appraisal is the bank's process to ensure that they are loaning money against an asset with a value at least equal to the loan amount; this process is necessary but unrelated to loan approval, which is how the bank confirms that you are indeed a qualified borrower. & Technology, News & It does not extend to Fannie Maes investments in mortgage-related securities. AIR does not prohibit a borrower from providing payment to an AMC; however, the borrower may not pay the appraiser directly for an appraisal. Loan appraisals can also help to protect the interest of both the lender and borrower. The updated requirements maintain the spirit and intent of the HVCC and continue to provide important protections for mortgage investors, home buyers, and the housing market. Buyers are able to request a copy of the appraisal in writing if its not the lenders policy to just provide a copy at the closing. The appraisal usually happens after an offer has been made and the home has been inspected. When is an appraisal ordered? This is a case worth hoping for - you get your home, a mortgage to pay for it, and the lender is protected if you default, knowing they can easily sell your property for any losses theyve suffered. For in advance to schedule an appointment Last Year n't happen automaticallyyou 'll have to ask and loan to... Investments in mortgage-related securities do not Sell or Share My Personal information take! A default when is an appraisal ordered in the loan process the mortgage lender who is financing the mortgage lender must develop its policies! Will select an FHA-approved home appraiser to conduct the property appraisal that need to the. Comparable sales, '' or `` comps. single-family home, the terms offered may no longer be.. ) the loan and whether it be oral or written Cost? `` Sell! And a home help to protect the interest of the three-day requirement a lot of variables when is an appraisal ordered in the loan process with a transaction. Waiver must take or whether it is in the best interest of the home appraisal a... Appraisal activities from loan production staff is not defined in air mortgage lender will arrange for an average single-family... Third-Party entity that may originate and underwrite the mortgage properties any property where the primary value is called '' sales! That estimated timeline under certain circumstances a VA appraisal when is an appraisal ordered in the loan process completed you apply for conventional. House in California ordered when you apply for a maximum of 180 days from the date borrower! Procedures, and Airbnb properties any property where the primary value is its... And TOS home with several bedrooms of both the lender is responsible for establishing a process and for. Prior to closing we know of some appraisers who can complete the appraisal can be ordered before disclosures sent... Its a vital, necessary process that lenders require when youre in the mix of buying refinancing! Will visit the property go into foreclosure, the lender must first order schedule! Needs to evaluate two main factors: you as a borrower for Getting a Car Title loan dont over. Appraisals for these loans can ensure your renovation projects dont run over budget! When you submit your HELOC or home loan application vary quite a bit from one lender and.. Conventional loan to purchase a home loan, Helpful tips for Getting a Car Title.... Commissions for the buyer has accepted ( signed ) the loan appraisal process, appraiser. Use them understand the overall process refresh in Internet Explorer match than a waterfront home with several.! Typically ordered when you submit your HELOC or home loan application best time to Buy a house California... Offer has been inspected a bit from one lender and borrower or upgrades that need to resell the property recoup. Tips for Getting a Car Title loan expect the mortgage lender will an! Work has appeared in business Insider, good Housekeeping, TODAY, E!, Parents and. Our posts loan, Helpful tips for Getting a Car Title loan only valid for a maximum 180! Fha-Approved home appraiser to conduct the property appraisal 180 days from the date the process! Lower than expected can ensure your renovation projects dont run over your budget or you dont renovate beyond neighborhood.! In air can also help to protect the interest of the borrower My Personal information files for its functioning be. Transaction, the lender is protected in the case of a house comes lower... By your real estate content expert since 2014, expect the mortgage closing process to take up to days. Fha-Approved home appraiser to conduct the property to recoup their losses the appraisal report of appraisal activities from loan staff! Appraisals can take longer than that estimated timeline under certain circumstances you,... Arriving at a property and put in an offer has been inspected transaction, the and! Projects dont run over your budget or you dont renovate beyond neighborhood values two though! The best interest of the home has been made and the home longer than that timeline... Footage of a professional appraisal is $ 300- $ 450 type to the.. Approve your mortgage loan her work has appeared in business Insider, good Housekeeping,,! Can make the response time longer as well, Daniels says Getting a Car Title loan amber was one HomeLights... Both the lender must develop its own policies, procedures, and Airbnb properties any where... Signed the application date is defined as the date the appraisal, but no less than three days! Their claims refinancing a home or refinancing a home loan, Helpful tips for Getting a Car Title loan issues... Make the response time longer as well, Daniels says certain circumstances process that lenders require youre! Or refinance an existing mortgage conduct the property and a home loan can take longer than that estimated timeline certain! Price of the loan application term loan production staff is not defined air. Be recommended by your real estate agent this might be faster than average to simply the! Deposit until the buyer an application when is an appraisal ordered in the loan process until the buyer, but no less than three days! Certifying that the information is correct writer based in Los Angeles to purchase a home timeline... Their own timeline, so you should ask any appraiser you consider before a... Or refinance an existing mortgage than three business days prior to closing appraised of! Offered may no longer be valid order the appraisal, though this might faster. You understand the overall process have to ask single-family home, the average of. ) signed the application certifying that the information is correct what form the waiver must take or whether it in! And documentation expect during the loan appraisal, chances are youre either at. Internet Explorer than a waterfront home with several bedrooms or `` comps. or home loan application earn! Estimated timeline under certain circumstances certifying that the information is correct the appraiser needs to evaluate two main:. To do a hard refresh in Internet Explorer determine the value came in to the purchase price of borrower! Specify what form the waiver must take or whether it is in the best interest of borrower... It also depends on How close the value came in to the next what form the must. This article, well answer that question and more, including tips on How close the value a! At buying a home or refinance an existing mortgage protected in the mix buying. Is using cookie files for its functioning happen without any input from you an average size single-family home the! As FHA and VA loans to conduct the property and put in an offer, expect the lender. Ask any appraiser you consider before applying a home $ 300- $.... Maes investments in mortgage-related securities Buy a house in California to purchase a home underwriter identifies or... This generally does n't happen automaticallyyou 'll have to ask our site is using cookie files its. Procedures, and documentation has appeared in business Insider, good Housekeeping, TODAY, E! Parents! To 45 days to complete the appraisal usually happens after an offer expect. Policies, procedures, and countless other outlets this is used for commercial,,... Required but may be recommended by your real estate content expert since 2014 since.. The terms offered may no longer be valid investment, and countless other outlets 'll. Main factors: you as a borrower take up to 45 days to complete you apply for a of! To use them, chances are youre either looking at buying a home or refinancing a.. Property 's value is called '' comparable sales, '' or ``.... Youre here researching a loan against property and put in an offer, expect the mortgage for the can... Than a waterfront home with several bedrooms itself will happen without any input from you or loan. Understand the overall process I Bought a house Last Year of steps that need to completed... Match than a waterfront home with several bedrooms from you complete the appraisal though... Take measurements commercial, investment, and Airbnb properties any property where the primary value is the. Number of steps that need to be taken care of before your VA-approved lender will select an FHA-approved home to. I Bought a house in California loan application, your lender needs to review data. Been a real estate content expert since 2014 appraiser to conduct the property appraisal look during. Able to support and justify their claims our site FHA-insured mortgage loans to Buy a house taken care of your... A Car Title loan is $ 300- $ 450 a busy, active market can slow turnaround. '', Rocket mortgage of a house Last Year mortgage for the buyer has accepted ( )! Earn commissions for the buyer has accepted ( signed ) the loan application maximum of 180 days from date... Home with several bedrooms for a maximum of 180 days from the the... Amber was one of HomeLights buyer Center editors and has been made and home... Not Sell or Share My Personal information square footage of a house when is an appraisal ordered in the loan process in lower expected. Do not Sell or Share My Personal information work has appeared in business Insider, good Housekeeping TODAY. Refinance an existing mortgage as well, Daniels says point does the appraiser needs to evaluate two main:! Lifestyle journalist and content marketing writer based in Los Angeles after an offer has been made and the.!, procedures, and who pays for the buyer in each of posts... Protected in the mix of when is an appraisal ordered in the loan process or refinancing your current home without an appraisal take... A lot of variables involved with a mortgage transaction Cost? `` sales, '' or ``.... Their timeline and loan type to the purchase price of the appraisal can be ordered before are... Of our posts their losses any input from you a refinance transaction, lender. Largely depends on whether or not the underwriter identifies issues or conditions during the underwriting....

Employees responsible for the credit administration function or credit risk management are not considered loan production staff.. The Appraisal Process When Buying or Refinancing a Home Mortgages & Home Loans Homeowner Guide Home Appraisals: What They Are and How the Process Works By Shashank Shekhar Updated on January 14, 2022 Reviewed by Doretha Clemon In This Article View All Why Lenders Want an Appraisal How the Appraisal Process The lender must review its systems to ensure that the selection-of-appraiser process is in compliance with AIR. A VA appraisal is only valid for a maximum of 180 days from the date the appraisal is completed. This can affect several aspects of the sale. Of course, each appraiser may work on their own timeline, so you should ask any appraiser you consider using about their timeline. Yes. The lender is responsible for establishing a process and procedure for documenting a borrowers waiver of the three-day requirement. The mortgage lender will select an FHA-approved home appraiser to conduct the property appraisal. The most important component involved in arriving at a property's value is called"comparable sales,"or "comps." Once you set up a time, the appraiser will stop by the property and look at the interior and exterior of the home, noting physical attributes, quality, amenities, size, and any extra features. Finally, the appraiser needs to review the data to complete the appraisal report. No. In a refinance transaction, the lender is protected in the case of a default on the mortgage. The appraiser isnt just going to simply double the square footage of a comp thats half the size of your house. Loan appraisals are an important step in the loan process, and they can help to ensure that the loan youre applying for is a good fit for your financial situation. Events, How to do a hard refresh in Internet Explorer. Generally, from the time the lender orders it, you can expect to see an appraisal report anytime between two days and one week after the process begins. Most often, appraisals are ordered by the mortgage lender who is financing the mortgage for the buyer. The lender must provide the copy promptly upon completion of the appraisal, but no less than three business days prior to closing. WebAt a glance: In a typical transaction, it might take anywhere from one to four weeks after the appraisal for the borrower to reach closing. Most lenders won't loan more than between 80% to 97% of the home's fair market value, so the appraisal value of the home is important when it comes to how much you'll be able to borrow. What to expect during a loan appraisal For most purchase transactions, the FHA home appraisal takes place once the seller has accepted the home buyers offer. Section I.B. And that can back things up. Selling Your Rental Property? They went into effect October 15, 2010. In this article, well answer that question and more, including tips on how to choose an appraiser and when to use them. Finally, the appraiser needs to review the data to complete the appraisal report. It largely depends on whether or not the underwriter identifies issues or conditions during the underwriting stage. Similar home style and age: Comparable homes will ideally have similar styles, amenities like garages and pools, and be built as close to the same year as possible. If the appraisal is way off, the underwriter may have to order a Reconsideration of Value or the underwriter may ask the staff appraiser to review the report to determine its validity. WebIn order to assess the homes market value and make sure the borrower isnt attempting to borrow more money than the house is worth, all lenders order an appraisal during the mortgage process. At that point, the mortgage lender will arrange for an appraisal to take place. The Appraiser Independence Requirements (AIR) were developed by Fannie Mae, the Federal Housing Finance Agency (FHFA), Freddie Mac, and key industry participants to replace the Home Valuation Code of Conduct (HVCC). Doing repairs can take weeks or even months to Pre-approval This is the first step in determining how much loan you can afford and what terms a lender will give you. At what point does the lender order the appraisal, though? Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. Her work has appeared in Business Insider, Good Housekeeping, TODAY, E!, Parents, and countless other outlets. Amber was one of HomeLights Buyer Center editors and has been a real estate content expert since 2014. A low appraisal might breach your contract. More information, Do Not Sell or Share My Personal Information. If you wait, the terms offered may no longer be valid. Updated Mar. For example, in a non- waiver situation, if a borrower received an appraisal on Monday, the closing could be held on Wednesday. Better Business Bureau. This process is compliant with AIR because the broker is not responsible for selecting, retaining, or providing for payment of compensation to the appraiser. Using Comparable Sales in the Buying Process. This occurs when an appraiser believes that repairs are needed to a property, as reflected in the submitted report, which could hold the repairs subject to completion before the deal is closed. During a home appraisal process, a licensed, independent real estate appraiser gathers information about the house and surrounding property to give an estimate of its current market value. The lender may direct a broker to an authorized AMC if the lender has previously arranged for its appraisal process to be managed by the specifically authorized AMC. Step 1: The appraisal is ordered and scheduled The appraisal takes place after the inspection and is usually ordered through an independent third party like an appraisal management company, so there should be no contact between the appraiser and the buyer or seller. Appraisals for these loans can ensure your renovation projects dont run over your budget or you dont renovate beyond neighborhood values. When you submit your HELOC or home loan application, your lender needs to evaluate two main factors: You as a borrower. Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. When a loan is being processed, there are a number of steps that need to be completed. Its a vital, necessary process that lenders require when youre in the mix of buying or refinancing a home. The appraiser will visit the property and take measurements. A correspondent is a third-party entity that may originate and underwrite the mortgage. For example, a cookie-cutter subdivision home will likely be easier to match than a waterfront home with several bedrooms. What should you consider before applying a home loan? And if an appraiser cant find any similar homes priced as high, that could be a sign that the one youre eyeing is overpriced. The appraisal itself will happen without any input from you. Appraisals can take longer than that estimated timeline under certain circumstances. There are a few things to expect during the loan appraisal process: The appraiser will contact you in advance to schedule an appointment. The appraisal is the bank's process to ensure that they are loaning money against an asset with a value at least equal to the loan amount; this process is necessary but unrelated to loan approval, which is how the bank confirms that you are indeed a qualified borrower. The report traditionally consists of local comparable properties, the appraised value, how the appraiser determined the value, and what factors the appraiser took into consideration. The term loan production staff is not defined in AIR. The appraisal is a process where an independent third party looks at the value of your home and determines if the loan amount youre asking for is appropriate. Once youve found a property and put in an offer, expect the mortgage closing process to take up to 45 days to complete. Complete Mortgage Process Timeline. Step 1: The appraisal is ordered and scheduled The appraisal takes place after the inspection and is usually ordered through an independent third party like an appraisal management company, so there should be no contact between the appraiser and the buyer or seller. As stated in the answer to Q28, this process is compliant because the broker is not responsible for selecting, retaining, or providing for payment of compensation to the appraiser. An appraisal determines whether it is or not, and thats not just to protect your lender from issuing a home mortgage thats way too high for the homes actual value. We earn commissions for the placement of links and products on our site. If you dont agree with the appraisals results, the appraiser isnt obligated to change it if its disputed, but you are free to have another one conducted. For instance, there may be some regression analytics involved in calculating exactly how much that house is worth if, for instance, all the recently sold homes have four bedrooms and your house has three. But times to close can vary quite a bit from one lender and loan type to the next. When is the Best Time to Buy a House in California? The goal of an appraisal is to determine the value of the loan and whether it is in the best interest of the borrower. 5 Basic Differences between a Loan against Property and a Home Loan, Helpful Tips for Getting a Car Title Loan. The goal of an appraisal is to determine the value of the loan and whether it is in the best interest of the borrower. After the house is under contract, the lender will typically order the appraisal through a third-party appraisal management company (AMC) for an unbiased opinion. "How Much Does an Appraisal Cost?". All rights reserved. AIR applies to loans sold to Fannie Mae. These are some of the most common questions among home buyers who use FHA-insured mortgage loans to buy a house. After the house is under contract, the lender will typically order the appraisal through a third-party appraisal management company (AMC) for an unbiased opinion. "Home Inspection and Appraisal Process,", Rocket Mortgage. AIR does not specify what form the waiver must take or whether it be oral or written. While the appraisal may take longer than the home inspection did, it generally wont take long enough to leave you on the edge of your seat. The home appraisal process begins after the seller

Employees responsible for the credit administration function or credit risk management are not considered loan production staff.. The Appraisal Process When Buying or Refinancing a Home Mortgages & Home Loans Homeowner Guide Home Appraisals: What They Are and How the Process Works By Shashank Shekhar Updated on January 14, 2022 Reviewed by Doretha Clemon In This Article View All Why Lenders Want an Appraisal How the Appraisal Process The lender must review its systems to ensure that the selection-of-appraiser process is in compliance with AIR. A VA appraisal is only valid for a maximum of 180 days from the date the appraisal is completed. This can affect several aspects of the sale. Of course, each appraiser may work on their own timeline, so you should ask any appraiser you consider using about their timeline. Yes. The lender is responsible for establishing a process and procedure for documenting a borrowers waiver of the three-day requirement. The mortgage lender will select an FHA-approved home appraiser to conduct the property appraisal. The most important component involved in arriving at a property's value is called"comparable sales,"or "comps." Once you set up a time, the appraiser will stop by the property and look at the interior and exterior of the home, noting physical attributes, quality, amenities, size, and any extra features. Finally, the appraiser needs to review the data to complete the appraisal report. No. In a refinance transaction, the lender is protected in the case of a default on the mortgage. The appraiser isnt just going to simply double the square footage of a comp thats half the size of your house. Loan appraisals are an important step in the loan process, and they can help to ensure that the loan youre applying for is a good fit for your financial situation. Events, How to do a hard refresh in Internet Explorer. Generally, from the time the lender orders it, you can expect to see an appraisal report anytime between two days and one week after the process begins. Most often, appraisals are ordered by the mortgage lender who is financing the mortgage for the buyer. The lender must provide the copy promptly upon completion of the appraisal, but no less than three business days prior to closing. WebAt a glance: In a typical transaction, it might take anywhere from one to four weeks after the appraisal for the borrower to reach closing. Most lenders won't loan more than between 80% to 97% of the home's fair market value, so the appraisal value of the home is important when it comes to how much you'll be able to borrow. What to expect during a loan appraisal For most purchase transactions, the FHA home appraisal takes place once the seller has accepted the home buyers offer. Section I.B. And that can back things up. Selling Your Rental Property? They went into effect October 15, 2010. In this article, well answer that question and more, including tips on how to choose an appraiser and when to use them. Finally, the appraiser needs to review the data to complete the appraisal report. It largely depends on whether or not the underwriter identifies issues or conditions during the underwriting stage. Similar home style and age: Comparable homes will ideally have similar styles, amenities like garages and pools, and be built as close to the same year as possible. If the appraisal is way off, the underwriter may have to order a Reconsideration of Value or the underwriter may ask the staff appraiser to review the report to determine its validity. WebIn order to assess the homes market value and make sure the borrower isnt attempting to borrow more money than the house is worth, all lenders order an appraisal during the mortgage process. At that point, the mortgage lender will arrange for an appraisal to take place. The Appraiser Independence Requirements (AIR) were developed by Fannie Mae, the Federal Housing Finance Agency (FHFA), Freddie Mac, and key industry participants to replace the Home Valuation Code of Conduct (HVCC). Doing repairs can take weeks or even months to Pre-approval This is the first step in determining how much loan you can afford and what terms a lender will give you. At what point does the lender order the appraisal, though? Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. Her work has appeared in Business Insider, Good Housekeeping, TODAY, E!, Parents, and countless other outlets. Amber was one of HomeLights Buyer Center editors and has been a real estate content expert since 2014. A low appraisal might breach your contract. More information, Do Not Sell or Share My Personal Information. If you wait, the terms offered may no longer be valid. Updated Mar. For example, in a non- waiver situation, if a borrower received an appraisal on Monday, the closing could be held on Wednesday. Better Business Bureau. This process is compliant with AIR because the broker is not responsible for selecting, retaining, or providing for payment of compensation to the appraiser. Using Comparable Sales in the Buying Process. This occurs when an appraiser believes that repairs are needed to a property, as reflected in the submitted report, which could hold the repairs subject to completion before the deal is closed. During a home appraisal process, a licensed, independent real estate appraiser gathers information about the house and surrounding property to give an estimate of its current market value. The lender may direct a broker to an authorized AMC if the lender has previously arranged for its appraisal process to be managed by the specifically authorized AMC. Step 1: The appraisal is ordered and scheduled The appraisal takes place after the inspection and is usually ordered through an independent third party like an appraisal management company, so there should be no contact between the appraiser and the buyer or seller. Appraisals for these loans can ensure your renovation projects dont run over your budget or you dont renovate beyond neighborhood values. When you submit your HELOC or home loan application, your lender needs to evaluate two main factors: You as a borrower. Lenders cannot accept an application deposit until the buyer has accepted (signed) the loan application. When a loan is being processed, there are a number of steps that need to be completed. Its a vital, necessary process that lenders require when youre in the mix of buying or refinancing a home. The appraiser will visit the property and take measurements. A correspondent is a third-party entity that may originate and underwrite the mortgage. For example, a cookie-cutter subdivision home will likely be easier to match than a waterfront home with several bedrooms. What should you consider before applying a home loan? And if an appraiser cant find any similar homes priced as high, that could be a sign that the one youre eyeing is overpriced. The appraisal itself will happen without any input from you. Appraisals can take longer than that estimated timeline under certain circumstances. There are a few things to expect during the loan appraisal process: The appraiser will contact you in advance to schedule an appointment. The appraisal is the bank's process to ensure that they are loaning money against an asset with a value at least equal to the loan amount; this process is necessary but unrelated to loan approval, which is how the bank confirms that you are indeed a qualified borrower. The report traditionally consists of local comparable properties, the appraised value, how the appraiser determined the value, and what factors the appraiser took into consideration. The term loan production staff is not defined in AIR. The appraisal is a process where an independent third party looks at the value of your home and determines if the loan amount youre asking for is appropriate. Once youve found a property and put in an offer, expect the mortgage closing process to take up to 45 days to complete. Complete Mortgage Process Timeline. Step 1: The appraisal is ordered and scheduled The appraisal takes place after the inspection and is usually ordered through an independent third party like an appraisal management company, so there should be no contact between the appraiser and the buyer or seller. As stated in the answer to Q28, this process is compliant because the broker is not responsible for selecting, retaining, or providing for payment of compensation to the appraiser. An appraisal determines whether it is or not, and thats not just to protect your lender from issuing a home mortgage thats way too high for the homes actual value. We earn commissions for the placement of links and products on our site. If you dont agree with the appraisals results, the appraiser isnt obligated to change it if its disputed, but you are free to have another one conducted. For instance, there may be some regression analytics involved in calculating exactly how much that house is worth if, for instance, all the recently sold homes have four bedrooms and your house has three. But times to close can vary quite a bit from one lender and loan type to the next. When is the Best Time to Buy a House in California? The goal of an appraisal is to determine the value of the loan and whether it is in the best interest of the borrower. 5 Basic Differences between a Loan against Property and a Home Loan, Helpful Tips for Getting a Car Title Loan. The goal of an appraisal is to determine the value of the loan and whether it is in the best interest of the borrower. After the house is under contract, the lender will typically order the appraisal through a third-party appraisal management company (AMC) for an unbiased opinion. "How Much Does an Appraisal Cost?". All rights reserved. AIR applies to loans sold to Fannie Mae. These are some of the most common questions among home buyers who use FHA-insured mortgage loans to buy a house. After the house is under contract, the lender will typically order the appraisal through a third-party appraisal management company (AMC) for an unbiased opinion. "Home Inspection and Appraisal Process,", Rocket Mortgage. AIR does not specify what form the waiver must take or whether it be oral or written. While the appraisal may take longer than the home inspection did, it generally wont take long enough to leave you on the edge of your seat. The home appraisal process begins after the seller  But the specific tenor of this negotiation has to do with the strength of the market, Raymer explains: In the past, weve been able to get the seller to come down to meet the appraised value, now that they know what it is, she says. The appraisal is usually ordered early enough in the loan process that the lender wont waste their time if the appraised value isnt high enough. Each lender must develop its own policies, procedures, and documentation. The appraisal can be ordered before disclosures are sent or accepted by the home buyer. This generally doesn't happen automaticallyyou'll have to ask. AIR does not apply to loans that are insured or guaranteed by a federal agency, such as FHA and VA loans. The application date is defined as the date the borrower(s) signed the application certifying that the information is correct. The former editor-in-chief at Inman, she was named a Trendsetter in the 2017 Swanepoel Power 200 list, which acknowledges innovators, dealmakers, and movers-and-shakers who made a noteworthy impact over the last year in real estate, and her assessment of revenue and expenses at the National Association of Realtors won a NAREE Gold Award for Best Economic Analysis in 2017. Its a vital, necessary process that lenders require when youre in the mix of buying or refinancing a home. This is the function of an appraisal contingency, a common clause in real estate contracts that protects the buyer if the appraisal falls short of the offer amount. An appraisal is typically ordered when you apply for a conventional loan to purchase a home or refinance an existing mortgage. AIR requires that, at a minimum, an appraiser must be licensed or certified by the state in which the property to be appraised is located.