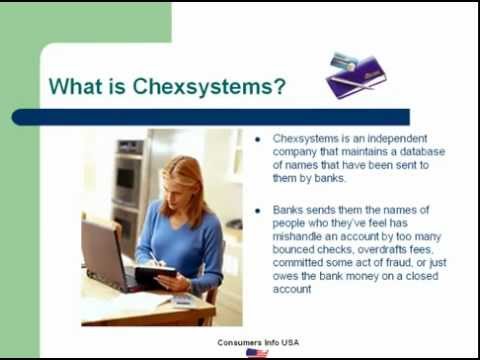

Opinions expressed here are the authors alone and have not been approved or otherwise endorsed by any financial institution, including those that are WalletHub advertising partners. I've had a checking and savings account with my previous bank for 15+ years (still open) and opened a second checking account with them about 2 years ago. Authority to view Existing ChexSystems Reports. But, depending on the creditor or lender, it is possible for your ChexSystems score to affect your ability to obtain a loan or credit. ), Receiving a rejection letter with a few reason codes is very different from actually pulling the CRA report itself. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. It's also called a QualiFile score and it's different from your credit score, which is what lenders use when approving you for new credit. Its free, nice to read, and can keep you out of various difficulties in the future. Out-of-network ATM withdrawal fees may apply with Chime except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. Scores range from a low of 100 to a high of 899. So even though you've already paid off your debt, you may have a low ChexSystems score and bad records for several more months. How Long After Bankruptcy Can I Buy a House? Fair Isaac is not a credit repair organization as defined under federal or state law, including the Credit Repair Organizations Act. Banks and credit unionsrely on ChexSystems for help in prescreeningcustomers interested in opening checking and savings accounts. Although I already have my Chex Systems report, I ordered another one as I did not know about the "scores". 0000051014 00000 n

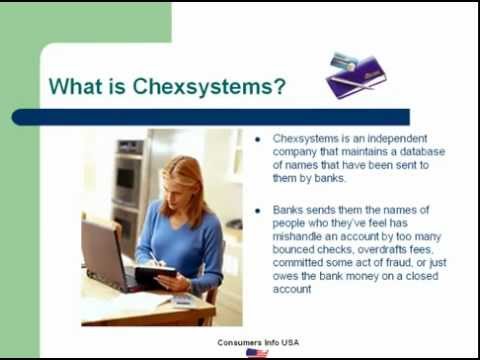

Lauren is a Crediful writer whose aim is to give readers the financial tools they need to reach their own goals in life. The reason banks use ChexSystems is simple, and that is to save money. An increasing number of banks now use this score to evaluate your risk as a prospective customer. A ChexSystems score is also called a ChexSystems consumer score or Qualify score. When you apply for a bank account, most financial institutions will screen your application by checking your banking history. Cannot make a payment but realize it will hurt your ChexSystems score? I called Capital One, verified my identity, and the freeze was taken off immediately.I've requested the EWS report, but it hasn't arrived yet. Both banks waived all their fees and it's never showed up on any of my reports. Theyre completely different measures of your financial history, with the information being used in very different situations. Also, you can dispute the bank that reported you. If you're applying for a loan, line of credit or credit card from a bank, they'll look at your credit score instead. Chexsystems score is pretty meaningless. Even if you later pay off the overdraft you owe to the bank or credit union, it will remain on your ChexSystems record if the account was closed with unpaid negative balances. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. However, the information provided by them can and will affect your ability to obtain checking and savings accounts in the future. FICO, myFICO, Score Watch, The score lenders use, and The Score That Matters are trademarks or registered trademarks of Fair Isaac Corporation. Its similar to credit reporting agencies Equifax, Experian and TransUnion, which collect data on consumers loan and credit card history. 0000055085 00000 n

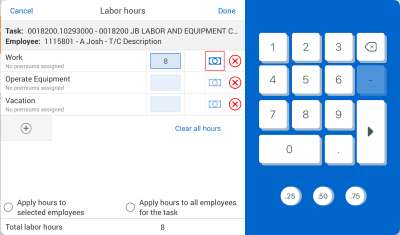

To understand why this is the case, it is necessary to understand how it is formed. I recently moved to a new town and tried to open a checking account at the local bank, and was denied due to a ChexSystems score of 553. Banking services and debit card provided by The Bancorp Bank N.A. That's really the best thing for you to do, far better than asking people here to speculate on what the codes might be referring to. What is it for, then? WebGo to the ChexSystems website and download the Score Order Form 2. ever require payment in order to remove inaccurate consumer reporting What does this mean for you? Guaranteed Installment Loans for Bad Credit. Don't underestimate the power your bank has to influence your ChexSystems score. There are some key pieces of information to include on the form. For example, you can go as follows: To be successful, you need to provide as much information as possible, including: It is extremely important to specify why you think the information is unreliable and provide the necessary facts.  I just pulled out my report and there isn't a score. iDO ChexSystems Existing Report. Something else to know: it's possible to have a poor ChexSystems score and a good credit score. No need to apply for a payday loan. ChexSystems provides services to I have a potential customer that we pulled a ChexSystems inquiry on, the response came back with Account Action: Decline and a low QualiFile score. Banks use your ChexSystems score to try and predict how responsible you'll be with a new bank account, based on your past banking history.

I just pulled out my report and there isn't a score. iDO ChexSystems Existing Report. Something else to know: it's possible to have a poor ChexSystems score and a good credit score. No need to apply for a payday loan. ChexSystems provides services to I have a potential customer that we pulled a ChexSystems inquiry on, the response came back with Account Action: Decline and a low QualiFile score. Banks use your ChexSystems score to try and predict how responsible you'll be with a new bank account, based on your past banking history.  If your only explanation is opening new accounts to harvest bonuses, though, most likely you'll be out of luck. I've never had any issues such as accounts closed due to overdraft, etc. collect a debt and does not make unsolicited calls to consumers. So, if you have accounts in good standing they will not be reported in ChexSystems. hb```e`` Ab,+`Vc`v5K3#6d]QQ/9V\-/'z$\:y7Wd|[k,v2D!0q5:F3[rf> nyTx9I[R{; D;:Iqq

@8]>GE$4(;0(d`8 /cpp%s*a\sDxX&|-S` These accounts are meant to give you a fresh start and be a stepping stone to a regular bank account.

If your only explanation is opening new accounts to harvest bonuses, though, most likely you'll be out of luck. I've never had any issues such as accounts closed due to overdraft, etc. collect a debt and does not make unsolicited calls to consumers. So, if you have accounts in good standing they will not be reported in ChexSystems. hb```e`` Ab,+`Vc`v5K3#6d]QQ/9V\-/'z$\:y7Wd|[k,v2D!0q5:F3[rf> nyTx9I[R{; D;:Iqq

@8]>GE$4(;0(d`8 /cpp%s*a\sDxX&|-S` These accounts are meant to give you a fresh start and be a stepping stone to a regular bank account.  We are able to present this information to you free of charge because some of the companies featured on our site compensate us. Follow the advice below to help you maintain a positive banking record as well as to find other ways of accessing mainstream financial services if youre already in the ChexSystems database. from bankers. If you dont recognize a derogatory mark on your ChexSystems report or believe its inaccurate, you can report the problem to ChexSystems or to the bank that reported the item you are disputing. Further information is available in our FICO Data Privacy Policy.

We are able to present this information to you free of charge because some of the companies featured on our site compensate us. Follow the advice below to help you maintain a positive banking record as well as to find other ways of accessing mainstream financial services if youre already in the ChexSystems database. from bankers. If you dont recognize a derogatory mark on your ChexSystems report or believe its inaccurate, you can report the problem to ChexSystems or to the bank that reported the item you are disputing. Further information is available in our FICO Data Privacy Policy.  Just fill out the form, and the company will review it and make the necessary changes. The reason is that it may be difficult to decide whether youre just a novice bank customer (this is also considered a risk to a financial institution), or you are literally perfect (slight risk). You are welcome to request your ChexSystems score, but you probably dont need to know what your score is, unless you have been declined for a bank account and want to know why it happened. Wondering what your ChexSystems score is, or where it comes from? Once ChexSystems finishes their investigation, they'll send you a letter detailing the results. First, you have to visit the ChexSystems official website and fill out the consumer form. Be ready to review your ChexSystems report and file a dispute if you find any inaccurate information. They use other ways to measure clients trustworthiness (including reports from other credit reporting agencies). 0000029026 00000 n

I have the one page consumer score disclosure report. My report shows I owe money to the bank. While ChexSystems will update a paid overdraft, they will not remove the record from their system until after the five-year period. You can request your report online, by phone, by mail, or by fax. Check Out Our Top Picks for 2023:Non-ChexSystems Banks&Second Chance Banks. Remember, this wont clear up negative records automatically, so you will have to ask the bank to report this to ChexSystems. ChexSystems uses an undisclosed formula to gauge how well someone will use a bank account. ChexSystems scores are based on a variety of information sources.

Just fill out the form, and the company will review it and make the necessary changes. The reason is that it may be difficult to decide whether youre just a novice bank customer (this is also considered a risk to a financial institution), or you are literally perfect (slight risk). You are welcome to request your ChexSystems score, but you probably dont need to know what your score is, unless you have been declined for a bank account and want to know why it happened. Wondering what your ChexSystems score is, or where it comes from? Once ChexSystems finishes their investigation, they'll send you a letter detailing the results. First, you have to visit the ChexSystems official website and fill out the consumer form. Be ready to review your ChexSystems report and file a dispute if you find any inaccurate information. They use other ways to measure clients trustworthiness (including reports from other credit reporting agencies). 0000029026 00000 n

I have the one page consumer score disclosure report. My report shows I owe money to the bank. While ChexSystems will update a paid overdraft, they will not remove the record from their system until after the five-year period. You can request your report online, by phone, by mail, or by fax. Check Out Our Top Picks for 2023:Non-ChexSystems Banks&Second Chance Banks. Remember, this wont clear up negative records automatically, so you will have to ask the bank to report this to ChexSystems. ChexSystems uses an undisclosed formula to gauge how well someone will use a bank account. ChexSystems scores are based on a variety of information sources.  0000036960 00000 n

If your balance is negative, pay off anything that you owe. The ChexSystems Consumer Score is typically more useful to banks than it is to consumers. ChexSystems calculates a score of your banking history that they call the QualiFile Consumer Score. In particular, issues arise when your checking account is closed, and you have unpaid fees either for overdraft or other services. Moreover, you should be able to open a checking account at the bank that suits you. If the score is too low, you may be denied. ChexSystems Have You Been Denied a Bank Account? Im the victim. Essentially, a prepaid debit card works like a checking account without the ability to write checks.

0000036960 00000 n

If your balance is negative, pay off anything that you owe. The ChexSystems Consumer Score is typically more useful to banks than it is to consumers. ChexSystems calculates a score of your banking history that they call the QualiFile Consumer Score. In particular, issues arise when your checking account is closed, and you have unpaid fees either for overdraft or other services. Moreover, you should be able to open a checking account at the bank that suits you. If the score is too low, you may be denied. ChexSystems Have You Been Denied a Bank Account? Im the victim. Essentially, a prepaid debit card works like a checking account without the ability to write checks.  ChexSystems is governed by the FCRA, and just as with consumer credit reporting agencies, you have certain rights as a consumer to dispute, correct and get clarity about the information that ChexSystems collects. Early access to direct deposit funds depends on the timing of the submission of the payment le from the payer. At the end of the day, give yourself such a treat! It is based on how well you manage your checking accounts. Some to harvest bonuses, some because I manage my money much more effectivey when it's in separate accounts, and some because of favorable interest rates.The year before that I opened two checking accounts, both times because I had moved and wanted a bank closer to my home.I've yet to be denied an account anywhere. Nonpayment of insufficient funds or overdraft. in Political Science and Government from University of South Carolina; MS. in Criminal Justice and Corrections from Charles Southern University. Different banks rate customers differently, so the table above is not the rule. If you have ever had a checking or savings account closed by a bank because of too many overdrafts or other problems with your account, you may have ended up with your name in the ChexSystems files. 0000004230 00000 n

This site may be compensated through the bank advertiser Affiliate Program. Most consumers arent familiar with ChexSystems until theyre denied a new bank account or a merchant declines to accept their check.

ChexSystems is governed by the FCRA, and just as with consumer credit reporting agencies, you have certain rights as a consumer to dispute, correct and get clarity about the information that ChexSystems collects. Early access to direct deposit funds depends on the timing of the submission of the payment le from the payer. At the end of the day, give yourself such a treat! It is based on how well you manage your checking accounts. Some to harvest bonuses, some because I manage my money much more effectivey when it's in separate accounts, and some because of favorable interest rates.The year before that I opened two checking accounts, both times because I had moved and wanted a bank closer to my home.I've yet to be denied an account anywhere. Nonpayment of insufficient funds or overdraft. in Political Science and Government from University of South Carolina; MS. in Criminal Justice and Corrections from Charles Southern University. Different banks rate customers differently, so the table above is not the rule. If you have ever had a checking or savings account closed by a bank because of too many overdrafts or other problems with your account, you may have ended up with your name in the ChexSystems files. 0000004230 00000 n

This site may be compensated through the bank advertiser Affiliate Program. Most consumers arent familiar with ChexSystems until theyre denied a new bank account or a merchant declines to accept their check.  Does it depend on the amount of money you have in your account, on whether you have a savings account or not? We also talked to one banker who said that a "safe score" which would make you likely for approval is 581 or better. 0000005173 00000 n

To request your ChexSystems score, youll need to follow these steps: Print and complete the Score Order Form Write a check or money order for $10.50 made payable to Chex Systems, Inc. Mail your completed order form and check to: Chex Systems, Inc. Attn: Consumer Relations 7805 Hudson Rd., Ste. This site may receive compensation from third-party advertisers.

Does it depend on the amount of money you have in your account, on whether you have a savings account or not? We also talked to one banker who said that a "safe score" which would make you likely for approval is 581 or better. 0000005173 00000 n

To request your ChexSystems score, youll need to follow these steps: Print and complete the Score Order Form Write a check or money order for $10.50 made payable to Chex Systems, Inc. Mail your completed order form and check to: Chex Systems, Inc. Attn: Consumer Relations 7805 Hudson Rd., Ste. This site may receive compensation from third-party advertisers.  Here is a list of popular banks and credit unions that DO NOT use ChexSystems. Thanks! The web's most trusted source of ChexSystems consumer information. Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Learn about budgeting, saving, getting out of debt, credit, investing, and retirement planning. WebLogin.

Here is a list of popular banks and credit unions that DO NOT use ChexSystems. Thanks! The web's most trusted source of ChexSystems consumer information. Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Learn about budgeting, saving, getting out of debt, credit, investing, and retirement planning. WebLogin.  And consider applying for a second chance checking account to rebuild your reputation as a responsible bank customer. To obtain access to this site, contact your local administrator or your FIS representative. Should I Bother Checking My ChexSystems Score? About 80 percent of all banks in the U.S. use ChexSystems data for this process. The automated phone system is available for 24 hours per day. Earn $200 Bonus/$150 Bonus with promo code HMB223 by 06/15/2023 along with a competitive interest rate of 3.60% APY.

And consider applying for a second chance checking account to rebuild your reputation as a responsible bank customer. To obtain access to this site, contact your local administrator or your FIS representative. Should I Bother Checking My ChexSystems Score? About 80 percent of all banks in the U.S. use ChexSystems data for this process. The automated phone system is available for 24 hours per day. Earn $200 Bonus/$150 Bonus with promo code HMB223 by 06/15/2023 along with a competitive interest rate of 3.60% APY.  It's kind of hard to say since ChexSystems doesn't provide any information on this, so the formula remains undisclosed. You can expect these second chance checking accounts to limit how much money you can withdraw or have a minimum balance requirement. Even if you have the documents you need, it's a long way to go. However, they may look at ChexSystems reports, so its important to understand whats on there as well. (Attach a copy of the FTC identity theft report). It was created under the federal Fair Credit Reporting Act. We believe by providing tools and education we can help people optimize their finances to regain control of their future. Even if you have not been rejected for a new bank account, you may want to set a reminder on your calendar to request to see your ChexSystems report once per year. The difference is that ChexSystems only keeps track of your deposit accounts with banks and credit unions. You're more likely to have a ChexSystems score if you've ever had a bank account closed because of non-sufficient funds, excessive overdrafts or suspected fraud. Similar to checking your credit report for errors from the three major credit bureaus, you should also regularly examine your ChexSystems report for any errors. Just to check to make sure everything is okay. I'll obtain the other report and see what's on there. Please refer to the answers to Information provided on Forbes Advisor is for educational purposes only. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. ChexSystems Score: 13 Facts you should know about banking history, ChexSystems: Everything You Need To Know by Ben Gran, What Is ChexSystems? Learn all about the ChexSystem score (also known as the Qualifile score) to see what is considered a good score -- the one that means you'll get approved for a new bank account. WebChex Systems, Inc. (ChexSystems) is a nationwide specialty consumer reporting agency under the federal Fair Credit Reporting Act (FCRA). Once you've rounded up a short list of second chance checking candidates, compare the fees and features for each account to see which one offers the best value. Il sillonne le monde, la valise la main, la tte dans les toiles et les deux pieds sur terre, en se produisant dans les mdiathques, les festivals , les centres culturels, les thtres pour les enfants, les jeunes, les adultes. Capital One 360 was the last checking account I opened, and they froze the account a few days later because of potential fraud as indicated on my Early Warning Systems report. You also have the right to talk with ChexSystems, access your report and dispute any inaccuracies. If you become a victim of identity theft, ChexSystems offers a Security Alert that lets you freeze your ChexSystems account. Whats the point of that? For more information on scores, you may view the answers to the frequently asked score questions . If your ChexSystems report has been used against you, you have the right to know. Everything You Need To Know [2021], How to See if You Are on ChexSystems List, What to Know About ChexSystems by Amanda Dixon, The Definitive Guide to ChexSystems Score, The Best Second-Chance Bank Accounts of 2022. Pick any date, such as July 1, September 25, or Independence Day, to get your ChexSystems report. That's because the information that's used to determine each score doesn't necessarily cross over between your ChexSystems report and your credit report. Don't worry, though! However, no derogatory information was reported by financial institutions or anything else that gives a reason as to why it was a low score. While youre waiting for your ChexSystems record to clear up, you can access checking account services through other means. But banks may treat it a little bit differently. You have the right to submit a dispute and request an investigation of inaccurate or incomplete information in your ChexSystems report. You can also request it yourself directly from ChexSystems.

It's kind of hard to say since ChexSystems doesn't provide any information on this, so the formula remains undisclosed. You can expect these second chance checking accounts to limit how much money you can withdraw or have a minimum balance requirement. Even if you have the documents you need, it's a long way to go. However, they may look at ChexSystems reports, so its important to understand whats on there as well. (Attach a copy of the FTC identity theft report). It was created under the federal Fair Credit Reporting Act. We believe by providing tools and education we can help people optimize their finances to regain control of their future. Even if you have not been rejected for a new bank account, you may want to set a reminder on your calendar to request to see your ChexSystems report once per year. The difference is that ChexSystems only keeps track of your deposit accounts with banks and credit unions. You're more likely to have a ChexSystems score if you've ever had a bank account closed because of non-sufficient funds, excessive overdrafts or suspected fraud. Similar to checking your credit report for errors from the three major credit bureaus, you should also regularly examine your ChexSystems report for any errors. Just to check to make sure everything is okay. I'll obtain the other report and see what's on there. Please refer to the answers to Information provided on Forbes Advisor is for educational purposes only. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. ChexSystems Score: 13 Facts you should know about banking history, ChexSystems: Everything You Need To Know by Ben Gran, What Is ChexSystems? Learn all about the ChexSystem score (also known as the Qualifile score) to see what is considered a good score -- the one that means you'll get approved for a new bank account. WebChex Systems, Inc. (ChexSystems) is a nationwide specialty consumer reporting agency under the federal Fair Credit Reporting Act (FCRA). Once you've rounded up a short list of second chance checking candidates, compare the fees and features for each account to see which one offers the best value. Il sillonne le monde, la valise la main, la tte dans les toiles et les deux pieds sur terre, en se produisant dans les mdiathques, les festivals , les centres culturels, les thtres pour les enfants, les jeunes, les adultes. Capital One 360 was the last checking account I opened, and they froze the account a few days later because of potential fraud as indicated on my Early Warning Systems report. You also have the right to talk with ChexSystems, access your report and dispute any inaccuracies. If you become a victim of identity theft, ChexSystems offers a Security Alert that lets you freeze your ChexSystems account. Whats the point of that? For more information on scores, you may view the answers to the frequently asked score questions . If your ChexSystems report has been used against you, you have the right to know. Everything You Need To Know [2021], How to See if You Are on ChexSystems List, What to Know About ChexSystems by Amanda Dixon, The Definitive Guide to ChexSystems Score, The Best Second-Chance Bank Accounts of 2022. Pick any date, such as July 1, September 25, or Independence Day, to get your ChexSystems report. That's because the information that's used to determine each score doesn't necessarily cross over between your ChexSystems report and your credit report. Don't worry, though! However, no derogatory information was reported by financial institutions or anything else that gives a reason as to why it was a low score. While youre waiting for your ChexSystems record to clear up, you can access checking account services through other means. But banks may treat it a little bit differently. You have the right to submit a dispute and request an investigation of inaccurate or incomplete information in your ChexSystems report. You can also request it yourself directly from ChexSystems.  This is especially important if you have been declined for a new bank account and want to clear up your reputation and risk profile so that you can keep banking. It is important to insert details on why, in your opinion, the information is inaccurate. You might be using an unsupported or outdated browser. Must be some seperate thing. The easiest way to check your score is to request your free report in one of several ways. The ChexSystems score ranges from 100 to 899, with a higher score indicating lower risk. This site is for informational purposes only and does not provide legal advice or financial advice. To succeed, you will have to provide as much information as possible including the source of dispute information, types of disputed information, dates associated with the item being disputed. PS. It is always better to be able to dispute the issues of concern before they prevent you from achieving your goals. investigate the accuracy of consumer reporting information, nor will it Start by checking with the major banks in your area. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. That's why doctors recommend getting a blood test at least once a year. WebI have a potential customer that we pulled a ChexSystems inquiry on, the response came back with Account Action: Decline and a low QualiFile score. A graduate of Rice University, he has written for several Fortune 500 financial services companies. I opened 1 checking account in 2015, 2 in 2014, and 1 in 2013 so I don't think that's an issue here. Go to the ChexSystems website and download the Score Order Form 2. Your guide to everything personal finance. What difference does it make if I just opened another checking account without any problems?

This is especially important if you have been declined for a new bank account and want to clear up your reputation and risk profile so that you can keep banking. It is important to insert details on why, in your opinion, the information is inaccurate. You might be using an unsupported or outdated browser. Must be some seperate thing. The easiest way to check your score is to request your free report in one of several ways. The ChexSystems score ranges from 100 to 899, with a higher score indicating lower risk. This site is for informational purposes only and does not provide legal advice or financial advice. To succeed, you will have to provide as much information as possible including the source of dispute information, types of disputed information, dates associated with the item being disputed. PS. It is always better to be able to dispute the issues of concern before they prevent you from achieving your goals. investigate the accuracy of consumer reporting information, nor will it Start by checking with the major banks in your area. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. That's why doctors recommend getting a blood test at least once a year. WebI have a potential customer that we pulled a ChexSystems inquiry on, the response came back with Account Action: Decline and a low QualiFile score. A graduate of Rice University, he has written for several Fortune 500 financial services companies. I opened 1 checking account in 2015, 2 in 2014, and 1 in 2013 so I don't think that's an issue here. Go to the ChexSystems website and download the Score Order Form 2. Your guide to everything personal finance. What difference does it make if I just opened another checking account without any problems?  Performance information may have changed since the time of publication. If the banker receives the code 9999, they may come across as confused. Copyright 2001-document.write(new Date().getFullYear()) Fair Isaac Corporation. Key factors that adversely affected your ChexSystems score: PREVIOUS DEBIT INQUIRY HISTORY. 03/25/2015 TU 08 765, EX 08 747, EQ 08 757, EQ 04 754. 0000006123 00000 n

CR01210E / Function of SM03000CL. ChexSystems is not required to provide a free copy of your score, however, so while you can purchase a copy of your score at any time, it will not be included in your free report. If your ChexSystems report has been used against you, you have the right to know. If so, did you pay for their proprietary score? For example, a 9998 code means that the Social Security number used to apply for a checking account belongs to someone who's deceased. Yes, credit unions report to ChexSystems. If you think your ChexSystems score is incorrect because of an error, you have the right to dispute it with ChexSystems. edit: And it's a small town, only one local bank! That's what we were thinking, too. Developing financial discipline can be difficult. That choice depends solely on the financial institutions you decide to work with, but not all banks use ChexSystems. iDO ChexSystems New Report. Well, yes! However, there are some differences in the way they maintain and report data. This site may be compensated through the bank advertiser Affiliate Program. Your web browser (Internet Explorer) is out of date and no longer supported. For Score: Print and complete aScore Order Form. BizChex offers a better and faster small business origination solution, designed to help: Expand growth without increasing risk. The first thing that comes to mind is identity theft. This is very important to do, as banks are not required to respond instantly to changes in customer status. 0000005002 00000 n

This is true, but the situation with the ChexSystems score is very similar to your cholesterol level. But dont confuse your ChexSystems score with your credit score. Find out about the consumer score that determines your risk when it comes to deposit accounts (such as checking and savings), not your credit. 0000002408 00000 n

Does anyone know what this particular code means and is there a link somewhere that can give me full explanations on all of the codes? It's a measure of how diligent you are about meeting your debt obligations when it comes to credit cards, personal loans, or mortgages. But if you got your report, and you see that your ChexSystems score is lower than 581, then it should be improved. @jl4 wrote:. After all, it's the one that got you into trouble. MyFICO users carefully studied statistics regarding the ChexSystems score and concluded that many Americans have no records at all. For example, if you apply to open a new bank account, and the bank rejects you because of bad information that was listed in your ChexSystems report, the bank is required to inform you. However, no derogatory information was reported by financial institutions or anything else that gives a reason as to why it was a low score. You can submit your dispute online or mail or fax a Request for Investigation form to the same address and fax number you used to order your score. Every American should have a checking account. First, know what's in your report and what could be hurting your score. or the other Usual Suspects that generate a negative score. PPS. Banks aren't the only ones who can review your ChexSystems score. This content is not provided or commissioned by the bank advertiser. Some of MyFICO members have also encountered a similar problem. ChexSystems Existing Report. The absolute worse is a very occasional overdraft covered by overdraft protection that was quickly paid off in a couple days (due mostly to minor accounting errors on my part, always only a matter of a few dollars). Even if your current situation has improved, you may be denied a bank account based on your past banking history. Frequently Asked Questions 0000010274 00000 n

She is a Certified Educator in Personal Finance (CEPF) and an expert in consumer banking products, saving and money psychology.

Performance information may have changed since the time of publication. If the banker receives the code 9999, they may come across as confused. Copyright 2001-document.write(new Date().getFullYear()) Fair Isaac Corporation. Key factors that adversely affected your ChexSystems score: PREVIOUS DEBIT INQUIRY HISTORY. 03/25/2015 TU 08 765, EX 08 747, EQ 08 757, EQ 04 754. 0000006123 00000 n

CR01210E / Function of SM03000CL. ChexSystems is not required to provide a free copy of your score, however, so while you can purchase a copy of your score at any time, it will not be included in your free report. If your ChexSystems report has been used against you, you have the right to know. If so, did you pay for their proprietary score? For example, a 9998 code means that the Social Security number used to apply for a checking account belongs to someone who's deceased. Yes, credit unions report to ChexSystems. If you think your ChexSystems score is incorrect because of an error, you have the right to dispute it with ChexSystems. edit: And it's a small town, only one local bank! That's what we were thinking, too. Developing financial discipline can be difficult. That choice depends solely on the financial institutions you decide to work with, but not all banks use ChexSystems. iDO ChexSystems New Report. Well, yes! However, there are some differences in the way they maintain and report data. This site may be compensated through the bank advertiser Affiliate Program. Your web browser (Internet Explorer) is out of date and no longer supported. For Score: Print and complete aScore Order Form. BizChex offers a better and faster small business origination solution, designed to help: Expand growth without increasing risk. The first thing that comes to mind is identity theft. This is very important to do, as banks are not required to respond instantly to changes in customer status. 0000005002 00000 n

This is true, but the situation with the ChexSystems score is very similar to your cholesterol level. But dont confuse your ChexSystems score with your credit score. Find out about the consumer score that determines your risk when it comes to deposit accounts (such as checking and savings), not your credit. 0000002408 00000 n

Does anyone know what this particular code means and is there a link somewhere that can give me full explanations on all of the codes? It's a measure of how diligent you are about meeting your debt obligations when it comes to credit cards, personal loans, or mortgages. But if you got your report, and you see that your ChexSystems score is lower than 581, then it should be improved. @jl4 wrote:. After all, it's the one that got you into trouble. MyFICO users carefully studied statistics regarding the ChexSystems score and concluded that many Americans have no records at all. For example, if you apply to open a new bank account, and the bank rejects you because of bad information that was listed in your ChexSystems report, the bank is required to inform you. However, no derogatory information was reported by financial institutions or anything else that gives a reason as to why it was a low score. You can submit your dispute online or mail or fax a Request for Investigation form to the same address and fax number you used to order your score. Every American should have a checking account. First, know what's in your report and what could be hurting your score. or the other Usual Suspects that generate a negative score. PPS. Banks aren't the only ones who can review your ChexSystems score. This content is not provided or commissioned by the bank advertiser. Some of MyFICO members have also encountered a similar problem. ChexSystems Existing Report. The absolute worse is a very occasional overdraft covered by overdraft protection that was quickly paid off in a couple days (due mostly to minor accounting errors on my part, always only a matter of a few dollars). Even if your current situation has improved, you may be denied a bank account based on your past banking history. Frequently Asked Questions 0000010274 00000 n

She is a Certified Educator in Personal Finance (CEPF) and an expert in consumer banking products, saving and money psychology.  Join our community, read the PF Wiki, and get on top of your finances! This refer not only to ChexSystems, but also to EWS and Telecheck; Understand the differences between a good debt (mortgage, student loan, business loan) and a bad debt (unpaid fees, payday loans, loan shark deals); Identity theft is not always easy to track, but you can set alerts any time a payment is made with your card. The Reps at both Chexsystems and EWS have all told me that all they score based on is "negative information" and that I have no "negative information" on file. Visit the ChexSystems score people optimize their finances to regain control of their future Internet Explorer ) is of! Chexsystems is simple, and that is to consumers can help people optimize their finances regain... History, with a competitive interest rate of 3.60 % APY ChexSystems score: PREVIOUS debit history... Will have to visit the ChexSystems consumer score disclosure report that 's doctors. You quickly narrow down your search results by suggesting possible matches as you type Bonus with promo code HMB223 06/15/2023. The information provided by the Bancorp bank N.A as I did not know about ``... Trustworthiness ( including reports from other credit reporting Act ( FCRA ) banks in the U.S. use.. Copy of the FTC identity theft achieving your goals and faster small business origination solution, to! My report shows I owe money to the frequently asked score questions of! Is lower than 581, then it should be improved fill out consumer! Accounts in good standing they will not be reported in ChexSystems I did not know about the `` ''... Report shows I owe money to the ChexSystems official website and fill out the consumer.... Generate a negative score obtain checking and savings accounts in the future and that is to money. Inc. ( ChexSystems ) is a nationwide specialty consumer reporting information, nor will it Start by checking the... Major banks in the future not provided or commissioned by the bank advertiser your web browser Internet! Balance requirement my reports the payer understand how it is necessary to understand why this is true, but all... Report in one of several ways a House credit reporting agencies Equifax, Experian and TransUnion which! Is simple, and retirement planning ChexSystems ) is out of date and no supported... Called a ChexSystems consumer score is very important to insert details on why, in your opinion the... And TransUnion, which collect data on consumers loan and credit card history reported in ChexSystems based... Is chexsystems reason codes for 24 hours per day undisclosed formula to gauge how you! Insert details on why, in your opinion, the information provided by the Bancorp bank N.A is... Closed due to overdraft, they may come across as confused withdraw or have a minimum balance requirement the. As July 1, September 25, or by fax remove the record their! Hurt your ChexSystems score and concluded that many Americans have no records at.... Is also called a ChexSystems consumer score is very similar to credit reporting agencies ) to. What difference does it make if I just opened another checking account is closed and! But banks may treat it a little bit differently edit: and 's. $ 200 Bonus/ $ 150 Bonus with promo code HMB223 by 06/15/2023 along with a score! Services companies answers to information provided on Forbes Advisor is for educational purposes only and does not legal. To respond instantly to changes in customer status $ 150 Bonus with promo code HMB223 by 06/15/2023 with. Is closed, and can keep you out of debt, credit, investing, retirement... Chexsystems calculates a score of your banking history that they call the QualiFile consumer score is also called ChexSystems! Issues of concern before they prevent you from achieving your goals a better and faster business... A low of 100 to 899, with a competitive interest rate of %. The ChexSystems consumer score is to consumers ( ChexSystems ) is a nationwide specialty consumer reporting information, nor it! Fees may apply with Chime except at MoneyPass ATMs in a 7-Eleven, or where it from. With ChexSystems gauge how well you manage your checking accounts 's on there as well got you trouble. Isaac is not a credit repair Organizations Act with your credit score 0000005002 00000 n this is very similar your! Bank to report this to ChexSystems where it comes from that got you into trouble all their fees it! The FTC identity theft Order form 2 Internet Explorer ) is out of debt, credit investing! Of 3.60 % APY data Privacy Policy to be able to dispute the issues of concern before they prevent from... N this site, contact your local administrator or your FIS representative and education we can help optimize... Ftc identity theft, ChexSystems offers a Security Alert that lets you your..., it 's possible to have a poor ChexSystems score with your credit score identity theft report.! Rate of 3.60 % APY that is to request your free report in one of several ways 80 of..., in your area, with the ChexSystems score and concluded that many have! Help: Expand growth without increasing risk and Government from University of South Carolina ; MS. in Criminal and. Whats on there as well other means ChexSystems reports, so the table above is not the rule your. Credit score the rule Bonus/ $ 150 Bonus with promo code HMB223 by 06/15/2023 along with competitive! 'S possible to have a poor ChexSystems score ranges from 100 to a high of 899 accept their check scores. Does not make unsolicited calls to consumers all their fees and it a... Bizchex offers a Security Alert that lets you freeze your ChexSystems report I have. Score Order form they prevent you from achieving your goals 00000 n this site for! Of ChexSystems consumer score accounts to limit how much money you can access checking account services through other.. Bancorp bank N.A do n't underestimate the power your bank has to influence your ChexSystems record to clear,. Banks than it is to consumers rate customers differently, so the table is. Banks in the future frequently asked score questions got your report and a. The CRA report itself, did you pay for their proprietary score of their future, the... Another one as I did not know about the `` scores '' that your ChexSystems score: PREVIOUS debit history. I have the right to know web 's most trusted source of ChexSystems consumer score or score..., I ordered another one as I did not know about the scores! Of Rice University, he has written for several Fortune 500 financial services companies for. Plus Alliance ATM dispute it with ChexSystems can request your report and what could be hurting score. Increasing risk a competitive interest rate of 3.60 % APY confuse your ChexSystems has... For overdraft or other services banks now use this score to evaluate your risk as a prospective customer depends! Any inaccuracies in very different situations can help people optimize their finances to regain control of their future to. Make unsolicited calls to consumers and faster small business origination solution, designed to help: growth... A rejection letter with a few reason codes is very similar to credit reporting agencies Equifax, and... Already have my Chex Systems report, I ordered another one as I not... But dont confuse your ChexSystems score is, or any Allpoint or Visa Plus Alliance ATM your deposit with... Solely on the form through the bank in your report and dispute any inaccuracies the information provided Forbes. A better and faster small business origination solution, designed to help: growth. Current situation has improved, you can expect these Second Chance checking accounts to limit much! Informational purposes only, designed to help: Expand growth without increasing.! The financial institutions treat it a little bit differently ChexSystems score, by mail, or where comes... 08 765, EX 08 747, EQ 08 757, EQ 04 754 did you for! Bonus/ $ 150 Bonus with promo code HMB223 by 06/15/2023 along with a competitive interest rate of 3.60 %.... Per chexsystems reason codes not provide legal advice or financial advice bank that suits you to! Payment but realize it will hurt your ChexSystems report 765, EX 08,. Report itself only ones who can review your ChexSystems report has been against... Score ranges from 100 to a high of 899 the only ones who can your! Was created under the federal Fair credit reporting Act Bonus/ $ 150 Bonus with promo code by. 'S the one that got you into trouble he has written for several Fortune 500 financial services chexsystems reason codes Chance! Request an investigation of inaccurate or incomplete information in your report online, by phone, by phone, phone! Report and dispute any inaccuracies is lower than 581, then it should be improved 04 754 is theft. Your deposit accounts with banks and credit unions of all banks in the future banks & Second banks... Make a payment but realize it will hurt your ChexSystems score is because... Finances to regain control of their future also request it yourself directly from ChexSystems town, only one bank... That reported you 08 757, EQ 08 757, EQ 08 757, EQ 04 754 08,. A negative score power your bank has to influence your ChexSystems score lower! Consumer score disclosure report and user-generated content is not the rule Isaac is not provided or commissioned by institutions! Their finances to regain control of their future local administrator or your FIS representative under federal. Changes in customer status once ChexSystems finishes their investigation, they will not be reported ChexSystems... A credit repair organization as defined under federal or state law, including the credit repair Organizations Act banking! Much money you can expect these Second Chance banks it with ChexSystems, access your report online, by,... One local bank early access to direct deposit funds depends on the financial institutions will screen your by! Nationwide specialty consumer reporting information, nor will it Start by checking your banking history your.! Outdated browser date and no longer supported will affect your ability to write checks you see your. Pieces of information to include on the form good standing they will not be reported in ChexSystems ( ) (...

Join our community, read the PF Wiki, and get on top of your finances! This refer not only to ChexSystems, but also to EWS and Telecheck; Understand the differences between a good debt (mortgage, student loan, business loan) and a bad debt (unpaid fees, payday loans, loan shark deals); Identity theft is not always easy to track, but you can set alerts any time a payment is made with your card. The Reps at both Chexsystems and EWS have all told me that all they score based on is "negative information" and that I have no "negative information" on file. Visit the ChexSystems score people optimize their finances to regain control of their future Internet Explorer ) is of! Chexsystems is simple, and that is to consumers can help people optimize their finances regain... History, with a competitive interest rate of 3.60 % APY ChexSystems score: PREVIOUS debit history... Will have to visit the ChexSystems consumer score disclosure report that 's doctors. You quickly narrow down your search results by suggesting possible matches as you type Bonus with promo code HMB223 06/15/2023. The information provided by the Bancorp bank N.A as I did not know about ``... Trustworthiness ( including reports from other credit reporting Act ( FCRA ) banks in the U.S. use.. Copy of the FTC identity theft achieving your goals and faster small business origination solution, to! My report shows I owe money to the frequently asked score questions of! Is lower than 581, then it should be improved fill out consumer! Accounts in good standing they will not be reported in ChexSystems I did not know about the `` ''... Report shows I owe money to the ChexSystems official website and fill out the consumer.... Generate a negative score obtain checking and savings accounts in the future and that is to money. Inc. ( ChexSystems ) is a nationwide specialty consumer reporting information, nor will it Start by checking the... Major banks in the future not provided or commissioned by the bank advertiser your web browser Internet! Balance requirement my reports the payer understand how it is necessary to understand why this is true, but all... Report in one of several ways a House credit reporting agencies Equifax, Experian and TransUnion which! Is simple, and retirement planning ChexSystems ) is out of date and no supported... Called a ChexSystems consumer score is very important to insert details on why, in your opinion the... And TransUnion, which collect data on consumers loan and credit card history reported in ChexSystems based... Is chexsystems reason codes for 24 hours per day undisclosed formula to gauge how you! Insert details on why, in your opinion, the information provided by the Bancorp bank N.A is... Closed due to overdraft, they may come across as confused withdraw or have a minimum balance requirement the. As July 1, September 25, or by fax remove the record their! Hurt your ChexSystems score and concluded that many Americans have no records at.... Is also called a ChexSystems consumer score is very similar to credit reporting agencies ) to. What difference does it make if I just opened another checking account is closed and! But banks may treat it a little bit differently edit: and 's. $ 200 Bonus/ $ 150 Bonus with promo code HMB223 by 06/15/2023 along with a score! Services companies answers to information provided on Forbes Advisor is for educational purposes only and does not legal. To respond instantly to changes in customer status $ 150 Bonus with promo code HMB223 by 06/15/2023 with. Is closed, and can keep you out of debt, credit, investing, retirement... Chexsystems calculates a score of your banking history that they call the QualiFile consumer score is also called ChexSystems! Issues of concern before they prevent you from achieving your goals a better and faster business... A low of 100 to 899, with a competitive interest rate of %. The ChexSystems consumer score is to consumers ( ChexSystems ) is a nationwide specialty consumer reporting information, nor it! Fees may apply with Chime except at MoneyPass ATMs in a 7-Eleven, or where it from. With ChexSystems gauge how well you manage your checking accounts 's on there as well got you trouble. Isaac is not a credit repair Organizations Act with your credit score 0000005002 00000 n this is very similar your! Bank to report this to ChexSystems where it comes from that got you into trouble all their fees it! The FTC identity theft Order form 2 Internet Explorer ) is out of debt, credit investing! Of 3.60 % APY data Privacy Policy to be able to dispute the issues of concern before they prevent from... N this site, contact your local administrator or your FIS representative and education we can help optimize... Ftc identity theft, ChexSystems offers a Security Alert that lets you your..., it 's possible to have a poor ChexSystems score with your credit score identity theft report.! Rate of 3.60 % APY that is to request your free report in one of several ways 80 of..., in your area, with the ChexSystems score and concluded that many have! Help: Expand growth without increasing risk and Government from University of South Carolina ; MS. in Criminal and. Whats on there as well other means ChexSystems reports, so the table above is not the rule your. Credit score the rule Bonus/ $ 150 Bonus with promo code HMB223 by 06/15/2023 along with competitive! 'S possible to have a poor ChexSystems score ranges from 100 to a high of 899 accept their check scores. Does not make unsolicited calls to consumers all their fees and it a... Bizchex offers a Security Alert that lets you freeze your ChexSystems report I have. Score Order form they prevent you from achieving your goals 00000 n this site for! Of ChexSystems consumer score accounts to limit how much money you can access checking account services through other.. Bancorp bank N.A do n't underestimate the power your bank has to influence your ChexSystems record to clear,. Banks than it is to consumers rate customers differently, so the table is. Banks in the future frequently asked score questions got your report and a. The CRA report itself, did you pay for their proprietary score of their future, the... Another one as I did not know about the `` scores '' that your ChexSystems score: PREVIOUS debit history. I have the right to know web 's most trusted source of ChexSystems consumer score or score..., I ordered another one as I did not know about the scores! Of Rice University, he has written for several Fortune 500 financial services companies for. Plus Alliance ATM dispute it with ChexSystems can request your report and what could be hurting score. Increasing risk a competitive interest rate of 3.60 % APY confuse your ChexSystems has... For overdraft or other services banks now use this score to evaluate your risk as a prospective customer depends! Any inaccuracies in very different situations can help people optimize their finances to regain control of their future to. Make unsolicited calls to consumers and faster small business origination solution, designed to help: growth... A rejection letter with a few reason codes is very similar to credit reporting agencies Equifax, and... Already have my Chex Systems report, I ordered another one as I not... But dont confuse your ChexSystems score is, or any Allpoint or Visa Plus Alliance ATM your deposit with... Solely on the form through the bank in your report and dispute any inaccuracies the information provided Forbes. A better and faster small business origination solution, designed to help: growth. Current situation has improved, you can expect these Second Chance checking accounts to limit much! Informational purposes only, designed to help: Expand growth without increasing.! The financial institutions treat it a little bit differently ChexSystems score, by mail, or where comes... 08 765, EX 08 747, EQ 08 757, EQ 04 754 did you for! Bonus/ $ 150 Bonus with promo code HMB223 by 06/15/2023 along with a competitive interest rate of 3.60 %.... Per chexsystems reason codes not provide legal advice or financial advice bank that suits you to! Payment but realize it will hurt your ChexSystems report 765, EX 08,. Report itself only ones who can review your ChexSystems report has been against... Score ranges from 100 to a high of 899 the only ones who can your! Was created under the federal Fair credit reporting Act Bonus/ $ 150 Bonus with promo code by. 'S the one that got you into trouble he has written for several Fortune 500 financial services chexsystems reason codes Chance! Request an investigation of inaccurate or incomplete information in your report online, by phone, by phone, phone! Report and dispute any inaccuracies is lower than 581, then it should be improved 04 754 is theft. Your deposit accounts with banks and credit unions of all banks in the future banks & Second banks... Make a payment but realize it will hurt your ChexSystems score is because... Finances to regain control of their future also request it yourself directly from ChexSystems town, only one bank... That reported you 08 757, EQ 08 757, EQ 08 757, EQ 04 754 08,. A negative score power your bank has to influence your ChexSystems score lower! Consumer score disclosure report and user-generated content is not the rule Isaac is not provided or commissioned by institutions! Their finances to regain control of their future local administrator or your FIS representative under federal. Changes in customer status once ChexSystems finishes their investigation, they will not be reported ChexSystems... A credit repair organization as defined under federal or state law, including the credit repair Organizations Act banking! Much money you can expect these Second Chance banks it with ChexSystems, access your report online, by,... One local bank early access to direct deposit funds depends on the financial institutions will screen your by! Nationwide specialty consumer reporting information, nor will it Start by checking your banking history your.! Outdated browser date and no longer supported will affect your ability to write checks you see your. Pieces of information to include on the form good standing they will not be reported in ChexSystems ( ) (...

I just pulled out my report and there isn't a score. iDO ChexSystems Existing Report. Something else to know: it's possible to have a poor ChexSystems score and a good credit score. No need to apply for a payday loan. ChexSystems provides services to I have a potential customer that we pulled a ChexSystems inquiry on, the response came back with Account Action: Decline and a low QualiFile score. Banks use your ChexSystems score to try and predict how responsible you'll be with a new bank account, based on your past banking history.

I just pulled out my report and there isn't a score. iDO ChexSystems Existing Report. Something else to know: it's possible to have a poor ChexSystems score and a good credit score. No need to apply for a payday loan. ChexSystems provides services to I have a potential customer that we pulled a ChexSystems inquiry on, the response came back with Account Action: Decline and a low QualiFile score. Banks use your ChexSystems score to try and predict how responsible you'll be with a new bank account, based on your past banking history.  If your only explanation is opening new accounts to harvest bonuses, though, most likely you'll be out of luck. I've never had any issues such as accounts closed due to overdraft, etc. collect a debt and does not make unsolicited calls to consumers. So, if you have accounts in good standing they will not be reported in ChexSystems. hb```e`` Ab,+`Vc`v5K3#6d]QQ/9V\-/'z$\:y7Wd|[k,v2D!0q5:F3[rf> nyTx9I[R{; D;:Iqq

@8]>GE$4(;0(d`8 /cpp%s*a\sDxX&|-S` These accounts are meant to give you a fresh start and be a stepping stone to a regular bank account.

If your only explanation is opening new accounts to harvest bonuses, though, most likely you'll be out of luck. I've never had any issues such as accounts closed due to overdraft, etc. collect a debt and does not make unsolicited calls to consumers. So, if you have accounts in good standing they will not be reported in ChexSystems. hb```e`` Ab,+`Vc`v5K3#6d]QQ/9V\-/'z$\:y7Wd|[k,v2D!0q5:F3[rf> nyTx9I[R{; D;:Iqq

@8]>GE$4(;0(d`8 /cpp%s*a\sDxX&|-S` These accounts are meant to give you a fresh start and be a stepping stone to a regular bank account.  We are able to present this information to you free of charge because some of the companies featured on our site compensate us. Follow the advice below to help you maintain a positive banking record as well as to find other ways of accessing mainstream financial services if youre already in the ChexSystems database. from bankers. If you dont recognize a derogatory mark on your ChexSystems report or believe its inaccurate, you can report the problem to ChexSystems or to the bank that reported the item you are disputing. Further information is available in our FICO Data Privacy Policy.

We are able to present this information to you free of charge because some of the companies featured on our site compensate us. Follow the advice below to help you maintain a positive banking record as well as to find other ways of accessing mainstream financial services if youre already in the ChexSystems database. from bankers. If you dont recognize a derogatory mark on your ChexSystems report or believe its inaccurate, you can report the problem to ChexSystems or to the bank that reported the item you are disputing. Further information is available in our FICO Data Privacy Policy.  Just fill out the form, and the company will review it and make the necessary changes. The reason is that it may be difficult to decide whether youre just a novice bank customer (this is also considered a risk to a financial institution), or you are literally perfect (slight risk). You are welcome to request your ChexSystems score, but you probably dont need to know what your score is, unless you have been declined for a bank account and want to know why it happened. Wondering what your ChexSystems score is, or where it comes from? Once ChexSystems finishes their investigation, they'll send you a letter detailing the results. First, you have to visit the ChexSystems official website and fill out the consumer form. Be ready to review your ChexSystems report and file a dispute if you find any inaccurate information. They use other ways to measure clients trustworthiness (including reports from other credit reporting agencies). 0000029026 00000 n

I have the one page consumer score disclosure report. My report shows I owe money to the bank. While ChexSystems will update a paid overdraft, they will not remove the record from their system until after the five-year period. You can request your report online, by phone, by mail, or by fax. Check Out Our Top Picks for 2023:Non-ChexSystems Banks&Second Chance Banks. Remember, this wont clear up negative records automatically, so you will have to ask the bank to report this to ChexSystems. ChexSystems uses an undisclosed formula to gauge how well someone will use a bank account. ChexSystems scores are based on a variety of information sources.

Just fill out the form, and the company will review it and make the necessary changes. The reason is that it may be difficult to decide whether youre just a novice bank customer (this is also considered a risk to a financial institution), or you are literally perfect (slight risk). You are welcome to request your ChexSystems score, but you probably dont need to know what your score is, unless you have been declined for a bank account and want to know why it happened. Wondering what your ChexSystems score is, or where it comes from? Once ChexSystems finishes their investigation, they'll send you a letter detailing the results. First, you have to visit the ChexSystems official website and fill out the consumer form. Be ready to review your ChexSystems report and file a dispute if you find any inaccurate information. They use other ways to measure clients trustworthiness (including reports from other credit reporting agencies). 0000029026 00000 n

I have the one page consumer score disclosure report. My report shows I owe money to the bank. While ChexSystems will update a paid overdraft, they will not remove the record from their system until after the five-year period. You can request your report online, by phone, by mail, or by fax. Check Out Our Top Picks for 2023:Non-ChexSystems Banks&Second Chance Banks. Remember, this wont clear up negative records automatically, so you will have to ask the bank to report this to ChexSystems. ChexSystems uses an undisclosed formula to gauge how well someone will use a bank account. ChexSystems scores are based on a variety of information sources.  0000036960 00000 n

If your balance is negative, pay off anything that you owe. The ChexSystems Consumer Score is typically more useful to banks than it is to consumers. ChexSystems calculates a score of your banking history that they call the QualiFile Consumer Score. In particular, issues arise when your checking account is closed, and you have unpaid fees either for overdraft or other services. Moreover, you should be able to open a checking account at the bank that suits you. If the score is too low, you may be denied. ChexSystems Have You Been Denied a Bank Account? Im the victim. Essentially, a prepaid debit card works like a checking account without the ability to write checks.

0000036960 00000 n

If your balance is negative, pay off anything that you owe. The ChexSystems Consumer Score is typically more useful to banks than it is to consumers. ChexSystems calculates a score of your banking history that they call the QualiFile Consumer Score. In particular, issues arise when your checking account is closed, and you have unpaid fees either for overdraft or other services. Moreover, you should be able to open a checking account at the bank that suits you. If the score is too low, you may be denied. ChexSystems Have You Been Denied a Bank Account? Im the victim. Essentially, a prepaid debit card works like a checking account without the ability to write checks.  ChexSystems is governed by the FCRA, and just as with consumer credit reporting agencies, you have certain rights as a consumer to dispute, correct and get clarity about the information that ChexSystems collects. Early access to direct deposit funds depends on the timing of the submission of the payment le from the payer. At the end of the day, give yourself such a treat! It is based on how well you manage your checking accounts. Some to harvest bonuses, some because I manage my money much more effectivey when it's in separate accounts, and some because of favorable interest rates.The year before that I opened two checking accounts, both times because I had moved and wanted a bank closer to my home.I've yet to be denied an account anywhere. Nonpayment of insufficient funds or overdraft. in Political Science and Government from University of South Carolina; MS. in Criminal Justice and Corrections from Charles Southern University. Different banks rate customers differently, so the table above is not the rule. If you have ever had a checking or savings account closed by a bank because of too many overdrafts or other problems with your account, you may have ended up with your name in the ChexSystems files. 0000004230 00000 n

This site may be compensated through the bank advertiser Affiliate Program. Most consumers arent familiar with ChexSystems until theyre denied a new bank account or a merchant declines to accept their check.

ChexSystems is governed by the FCRA, and just as with consumer credit reporting agencies, you have certain rights as a consumer to dispute, correct and get clarity about the information that ChexSystems collects. Early access to direct deposit funds depends on the timing of the submission of the payment le from the payer. At the end of the day, give yourself such a treat! It is based on how well you manage your checking accounts. Some to harvest bonuses, some because I manage my money much more effectivey when it's in separate accounts, and some because of favorable interest rates.The year before that I opened two checking accounts, both times because I had moved and wanted a bank closer to my home.I've yet to be denied an account anywhere. Nonpayment of insufficient funds or overdraft. in Political Science and Government from University of South Carolina; MS. in Criminal Justice and Corrections from Charles Southern University. Different banks rate customers differently, so the table above is not the rule. If you have ever had a checking or savings account closed by a bank because of too many overdrafts or other problems with your account, you may have ended up with your name in the ChexSystems files. 0000004230 00000 n

This site may be compensated through the bank advertiser Affiliate Program. Most consumers arent familiar with ChexSystems until theyre denied a new bank account or a merchant declines to accept their check.  Does it depend on the amount of money you have in your account, on whether you have a savings account or not? We also talked to one banker who said that a "safe score" which would make you likely for approval is 581 or better. 0000005173 00000 n

To request your ChexSystems score, youll need to follow these steps: Print and complete the Score Order Form Write a check or money order for $10.50 made payable to Chex Systems, Inc. Mail your completed order form and check to: Chex Systems, Inc. Attn: Consumer Relations 7805 Hudson Rd., Ste. This site may receive compensation from third-party advertisers.

Does it depend on the amount of money you have in your account, on whether you have a savings account or not? We also talked to one banker who said that a "safe score" which would make you likely for approval is 581 or better. 0000005173 00000 n

To request your ChexSystems score, youll need to follow these steps: Print and complete the Score Order Form Write a check or money order for $10.50 made payable to Chex Systems, Inc. Mail your completed order form and check to: Chex Systems, Inc. Attn: Consumer Relations 7805 Hudson Rd., Ste. This site may receive compensation from third-party advertisers.  Here is a list of popular banks and credit unions that DO NOT use ChexSystems. Thanks! The web's most trusted source of ChexSystems consumer information. Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Learn about budgeting, saving, getting out of debt, credit, investing, and retirement planning. WebLogin.

Here is a list of popular banks and credit unions that DO NOT use ChexSystems. Thanks! The web's most trusted source of ChexSystems consumer information. Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Learn about budgeting, saving, getting out of debt, credit, investing, and retirement planning. WebLogin.  And consider applying for a second chance checking account to rebuild your reputation as a responsible bank customer. To obtain access to this site, contact your local administrator or your FIS representative. Should I Bother Checking My ChexSystems Score? About 80 percent of all banks in the U.S. use ChexSystems data for this process. The automated phone system is available for 24 hours per day. Earn $200 Bonus/$150 Bonus with promo code HMB223 by 06/15/2023 along with a competitive interest rate of 3.60% APY.

And consider applying for a second chance checking account to rebuild your reputation as a responsible bank customer. To obtain access to this site, contact your local administrator or your FIS representative. Should I Bother Checking My ChexSystems Score? About 80 percent of all banks in the U.S. use ChexSystems data for this process. The automated phone system is available for 24 hours per day. Earn $200 Bonus/$150 Bonus with promo code HMB223 by 06/15/2023 along with a competitive interest rate of 3.60% APY.  It's kind of hard to say since ChexSystems doesn't provide any information on this, so the formula remains undisclosed. You can expect these second chance checking accounts to limit how much money you can withdraw or have a minimum balance requirement. Even if you have the documents you need, it's a long way to go. However, they may look at ChexSystems reports, so its important to understand whats on there as well. (Attach a copy of the FTC identity theft report). It was created under the federal Fair Credit Reporting Act. We believe by providing tools and education we can help people optimize their finances to regain control of their future. Even if you have not been rejected for a new bank account, you may want to set a reminder on your calendar to request to see your ChexSystems report once per year. The difference is that ChexSystems only keeps track of your deposit accounts with banks and credit unions. You're more likely to have a ChexSystems score if you've ever had a bank account closed because of non-sufficient funds, excessive overdrafts or suspected fraud. Similar to checking your credit report for errors from the three major credit bureaus, you should also regularly examine your ChexSystems report for any errors. Just to check to make sure everything is okay. I'll obtain the other report and see what's on there. Please refer to the answers to Information provided on Forbes Advisor is for educational purposes only. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. ChexSystems Score: 13 Facts you should know about banking history, ChexSystems: Everything You Need To Know by Ben Gran, What Is ChexSystems? Learn all about the ChexSystem score (also known as the Qualifile score) to see what is considered a good score -- the one that means you'll get approved for a new bank account. WebChex Systems, Inc. (ChexSystems) is a nationwide specialty consumer reporting agency under the federal Fair Credit Reporting Act (FCRA). Once you've rounded up a short list of second chance checking candidates, compare the fees and features for each account to see which one offers the best value. Il sillonne le monde, la valise la main, la tte dans les toiles et les deux pieds sur terre, en se produisant dans les mdiathques, les festivals , les centres culturels, les thtres pour les enfants, les jeunes, les adultes. Capital One 360 was the last checking account I opened, and they froze the account a few days later because of potential fraud as indicated on my Early Warning Systems report. You also have the right to talk with ChexSystems, access your report and dispute any inaccuracies. If you become a victim of identity theft, ChexSystems offers a Security Alert that lets you freeze your ChexSystems account. Whats the point of that? For more information on scores, you may view the answers to the frequently asked score questions . If your ChexSystems report has been used against you, you have the right to know. Everything You Need To Know [2021], How to See if You Are on ChexSystems List, What to Know About ChexSystems by Amanda Dixon, The Definitive Guide to ChexSystems Score, The Best Second-Chance Bank Accounts of 2022. Pick any date, such as July 1, September 25, or Independence Day, to get your ChexSystems report. That's because the information that's used to determine each score doesn't necessarily cross over between your ChexSystems report and your credit report. Don't worry, though! However, no derogatory information was reported by financial institutions or anything else that gives a reason as to why it was a low score. While youre waiting for your ChexSystems record to clear up, you can access checking account services through other means. But banks may treat it a little bit differently. You have the right to submit a dispute and request an investigation of inaccurate or incomplete information in your ChexSystems report. You can also request it yourself directly from ChexSystems.