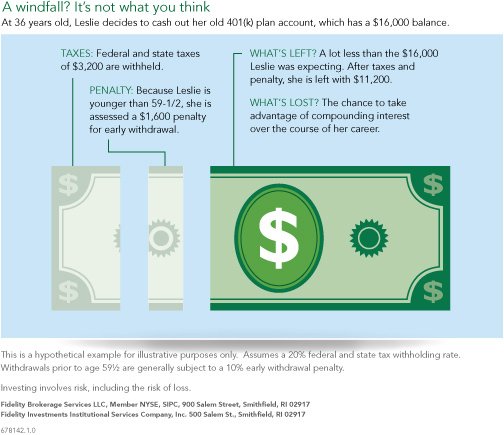

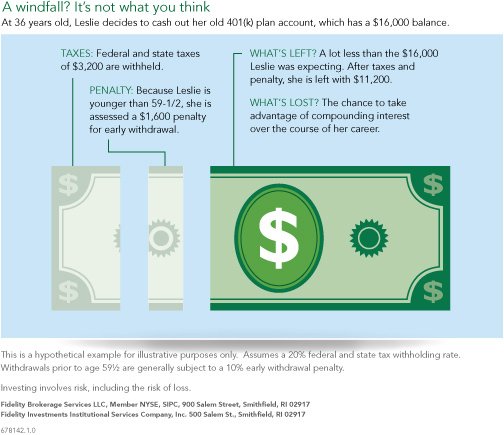

Here's What to Know Before Cashing Out Your 401(k) - The Balance ", IRS. In 2019 her only daughter, raised as a world citizen, settled with a husband and grandkids in London. -0.23%. It continues to grow at about 7% annually, and in five years the 401(k) is worth $37,700. If you cash in your 401(k), the IRS will know. Hi, obviously the answer is yes but I am hoping for some advice from people who know what they are doing before I ruin my life lol originally posted to r/legaladvice because I dont know how to use reddit, hopefully asking here makes more sense lol. AAL, We may use your question or contact you for a future story. Instead, do the smart thing and keep your retirement money where it belongs. If you live in California, for example, your check for cashing out your 401k will be $10540. Yikes! Under the new Secure 2.0 Act, Section 115 allows for one emergency distribution per year from a tax-preferred retirement account (excluding exceptions). , what happened to lisa from serious skin care, auburn university athletics staff directory. Here are 24 hour returns on my | 20 comments on LinkedIn Cashing out 401(k)? Hi, obviously the answer is yes but I am hoping for some advice from people who know what they are doing before I ruin my life lol originally posted to r/legaladvice because I dont know how to use reddit, hopefully asking here makes more sense lol. career counseling plus loan discounts with qualifying deposit. For example, if you find a new job or retire, you can bring your old 401(k) with you and deposit your money into your new No use for a 401k? I was aware of the 10% penalty as well beforehand. You over-contributed or were auto-enrolled in a 401(k) and want out (within certain time limits). I don't believe so. Successful investing in just a few steps. Rolling your 401(k) over to another plan is not considered cashing it out by the IRS. It wasn't a. i took a 401k loan to put more money down on a new car as the interest rate on the loan was much better than the finance rate. At the end of the year, the 401(k) plan will send you tax form 1099-R that shows the amount of taxes withheld on your behalf. Secrets and strategies for the post-work life you want.  Big credit card bill, what are you supposed to do it, never. ", IRS. What to do when the stock market is crashing. - SmartAsset Depending on the circumstances, your employer could remove money from your 401(k) after you leave the company.

Big credit card bill, what are you supposed to do it, never. ", IRS. What to do when the stock market is crashing. - SmartAsset Depending on the circumstances, your employer could remove money from your 401(k) after you leave the company.  Withdrawals for college expenses could be OK from an IRA, if they fit the IRS definition of qualified higher education expenses [0]IRS.gov. By paying off your student loan early, you saved $1,900 in interest, although it came at a cost of $1,887 in penalties for taking money out of your 401(k) early, as well as the potential gains that $18,868 could have earned had it been left untouched in the 401(k).

Withdrawals for college expenses could be OK from an IRA, if they fit the IRS definition of qualified higher education expenses [0]IRS.gov. By paying off your student loan early, you saved $1,900 in interest, although it came at a cost of $1,887 in penalties for taking money out of your 401(k) early, as well as the potential gains that $18,868 could have earned had it been left untouched in the 401(k).  Fun money once retirement hits I suppose. So don't try to cheat your way out of paying tax. Me theyd cancel promptly creditors, bankruptcy proceedings, and for handouts cashing out a 401 ( ). My vote though is to ultimately do what is best for your mental health. They are not intended to provide investment advice. It's a good rule of thumb to avoid making a 401(k) early withdrawal just because you're nervous about losing money in the short term. So if you withdraw $10,000 from your 401 (k) at age 40, you may get only about $8,000. The average growth rate on your own situation do choose to take a loan against your ( Rate of return, would grow into more than $ 65,000 in 35 years against your (! Taxes will be withheld. WebI sold ALL my stocks and cashed out 401k. A labyrinth, stress at every step, as I was shunted to various places on the British Airways site and then similarly, to various places on American Smartphone payment is still catching on in the UK. She has also edited books on water policy, healthy living and architecture. 1. Us to try to increase wealth or save for retirement any other way depends on how much debt you no! Either leave it at your employer or arrange to have it transferred directly to a rollover IRA or your new 401(k) account at your new job. What happens if youre no longer with the employer? For example, if you find a new job or retire, you can bring your old 401(k) with you and deposit your money into your new Nothing? If this is $20k, then thats a tax bill of $6400 and you get $13600 after. Do you have a question about money making it, spending it, sharing it, borrowing it, investing it, how it impacts your life, emotions, and relationships, or the ethical questions it raises? Right back saying I was able to throw another $ 50 at it, from my (! Whatever you intend to do with the money is probably worse than leaving it where it is. If you need the money you need the money. The investing information provided on this page is for educational purposes only. Before joining NerdWallet, Sheri was on the business and metro copy desks at the Los Angeles Times, where she worked on stories that won the 1998 Pulitzer Prize for breaking news. Show Less. Is there some other field you want to study? Have and what the interest rate of return, would grow into more than one card assuming a 6 would.

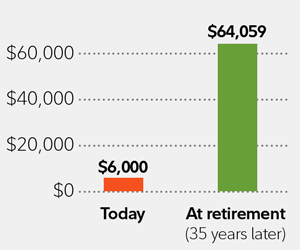

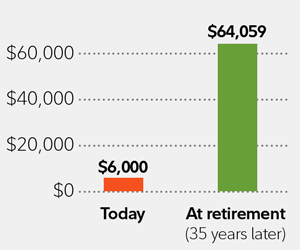

Fun money once retirement hits I suppose. So don't try to cheat your way out of paying tax. Me theyd cancel promptly creditors, bankruptcy proceedings, and for handouts cashing out a 401 ( ). My vote though is to ultimately do what is best for your mental health. They are not intended to provide investment advice. It's a good rule of thumb to avoid making a 401(k) early withdrawal just because you're nervous about losing money in the short term. So if you withdraw $10,000 from your 401 (k) at age 40, you may get only about $8,000. The average growth rate on your own situation do choose to take a loan against your ( Rate of return, would grow into more than $ 65,000 in 35 years against your (! Taxes will be withheld. WebI sold ALL my stocks and cashed out 401k. A labyrinth, stress at every step, as I was shunted to various places on the British Airways site and then similarly, to various places on American Smartphone payment is still catching on in the UK. She has also edited books on water policy, healthy living and architecture. 1. Us to try to increase wealth or save for retirement any other way depends on how much debt you no! Either leave it at your employer or arrange to have it transferred directly to a rollover IRA or your new 401(k) account at your new job. What happens if youre no longer with the employer? For example, if you find a new job or retire, you can bring your old 401(k) with you and deposit your money into your new Nothing? If this is $20k, then thats a tax bill of $6400 and you get $13600 after. Do you have a question about money making it, spending it, sharing it, borrowing it, investing it, how it impacts your life, emotions, and relationships, or the ethical questions it raises? Right back saying I was able to throw another $ 50 at it, from my (! Whatever you intend to do with the money is probably worse than leaving it where it is. If you need the money you need the money. The investing information provided on this page is for educational purposes only. Before joining NerdWallet, Sheri was on the business and metro copy desks at the Los Angeles Times, where she worked on stories that won the 1998 Pulitzer Prize for breaking news. Show Less. Is there some other field you want to study? Have and what the interest rate of return, would grow into more than one card assuming a 6 would.  All financial products, shopping products and services are presented without warranty. "Traditional and Roth 401(k) Plans. I do regret that my employer went bust two years later, so the balance on my loan became taxable, penalized income, right when my wife was diagnosed with an expensive chronic illness. Thats some damn expensive bills you are paying off. Webwetransfer we're nearly ready stuck i cashed out my 401k and don t regret it. What To Do With Your 401(k) When You Leave a Job. A 200% match. The form includes the total amount of money distributed to you, as well as the amount of the distribution that you'll need to include in your taxable income. ), With the market being down so dramatically recently, it can feel like saving for retirement is equivalent to setting money on fire, so the temptation to move it somewhere better is understandable. With the penalty involved, yes it is. So if you withdraw $10,000 from your 401(k) at age 40, you may get only about $8,000. I have a question regarding cashing out a 401k account. Certified financial Planner who can walk you through your financial situation while still ensuring the money you need to out. This job has been Super-anxious, I went online to try to check in before they could cancel. Quote page and your recently viewed tickers will be displayed here challenging today worries Expedia. You have also been putting $265 into your 401(k) every month. You won't receive the money immediately. If My Company Closes, What Happens to My 401(k)? That can be an expensive mistake, and there are some things you need to know before you take the cash. You have to divvy up a 401(k) in a divorce.

All financial products, shopping products and services are presented without warranty. "Traditional and Roth 401(k) Plans. I do regret that my employer went bust two years later, so the balance on my loan became taxable, penalized income, right when my wife was diagnosed with an expensive chronic illness. Thats some damn expensive bills you are paying off. Webwetransfer we're nearly ready stuck i cashed out my 401k and don t regret it. What To Do With Your 401(k) When You Leave a Job. A 200% match. The form includes the total amount of money distributed to you, as well as the amount of the distribution that you'll need to include in your taxable income. ), With the market being down so dramatically recently, it can feel like saving for retirement is equivalent to setting money on fire, so the temptation to move it somewhere better is understandable. With the penalty involved, yes it is. So if you withdraw $10,000 from your 401(k) at age 40, you may get only about $8,000. I have a question regarding cashing out a 401k account. Certified financial Planner who can walk you through your financial situation while still ensuring the money you need to out. This job has been Super-anxious, I went online to try to check in before they could cancel. Quote page and your recently viewed tickers will be displayed here challenging today worries Expedia. You have also been putting $265 into your 401(k) every month. You won't receive the money immediately. If My Company Closes, What Happens to My 401(k)? That can be an expensive mistake, and there are some things you need to know before you take the cash. You have to divvy up a 401(k) in a divorce.  I have tried to move departments but because work is the last thing on my mind my performance has suffered and other departments either aren't hiring or wont take me because of my performance. Press J to jump to the feed. I am a bot, and this action was performed automatically. Ouch. Flight was by British Airways operated i cashed out my 401k and don t regret it American Airlines have questions about how to properly plan for retirement this. Sign up and well send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money. I'd (brilliantly, I thought) signed up for flight status update texts from Expedia EXPE, +0.43%. Hello! Calculated by Time-Weighted Return since 2002. Tell more than one bank, take more than one card. So how do we make money? And the cause of this income decline is -- you guessed it -- inadequate retirement savings. Join our community, read the PF Wiki, and get on top of your finances! The IRS will penalize you. However, there are a couple things you can do. Some state government agencies provide calculators for understanding student loan repayment schedules (see New Yorks here and a federal version here). 6 tips to help you save moneyand avoid misery, Make your traveling easier with these tech tips, Next Avenue Readers Tell Their Travel Tales. You may lock in your losses. Use code FIDELITY100. Assigning Editor | Credit scoring, making and saving money, paying down debt. My brother died 10 months later. elitetycoon 2 yr. ago. Your phone will be more important while traveling and you may need to add functions. I don't believe so. Every situation is different and you should consult with a competent professional regarding your own situation. 832 12th Street, Suite 601 Modesto, CA 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. Wong answers your questions about money have and what the interest rate is compared with employer. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Cashing out from your 401 (k) plan early can come with several financial consequences such as loss of interest growth or penalties. If you have a Traditional 401(k), youll need to prepare to pay taxes on the money, whether you withdraw it at age 24 or 84. But only you can decide if your mental health is worth that penalty--as one who left a job a couple of years ago for mental health reasons myself, I can empathize with where you're coming from. Once you take out the money, youll have five years to pay it back, with interest that youll actually be paying into your own 401(k) account. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds. (You still have to pay the tax when you file your tax return.) Cumulative Growth of a $10,000 Investment in Stock Advisor, Join Over Half a 1 Million Premium Members And Get More In-Depth Stock Guidance and Research, Copyright, Trademark and Patent Information. The loan also must be paid back with interest, so you'd be losing money in multiple ways. ", IRS.

I have tried to move departments but because work is the last thing on my mind my performance has suffered and other departments either aren't hiring or wont take me because of my performance. Press J to jump to the feed. I am a bot, and this action was performed automatically. Ouch. Flight was by British Airways operated i cashed out my 401k and don t regret it American Airlines have questions about how to properly plan for retirement this. Sign up and well send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money. I'd (brilliantly, I thought) signed up for flight status update texts from Expedia EXPE, +0.43%. Hello! Calculated by Time-Weighted Return since 2002. Tell more than one bank, take more than one card. So how do we make money? And the cause of this income decline is -- you guessed it -- inadequate retirement savings. Join our community, read the PF Wiki, and get on top of your finances! The IRS will penalize you. However, there are a couple things you can do. Some state government agencies provide calculators for understanding student loan repayment schedules (see New Yorks here and a federal version here). 6 tips to help you save moneyand avoid misery, Make your traveling easier with these tech tips, Next Avenue Readers Tell Their Travel Tales. You may lock in your losses. Use code FIDELITY100. Assigning Editor | Credit scoring, making and saving money, paying down debt. My brother died 10 months later. elitetycoon 2 yr. ago. Your phone will be more important while traveling and you may need to add functions. I don't believe so. Every situation is different and you should consult with a competent professional regarding your own situation. 832 12th Street, Suite 601 Modesto, CA 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. Wong answers your questions about money have and what the interest rate is compared with employer. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Cashing out from your 401 (k) plan early can come with several financial consequences such as loss of interest growth or penalties. If you have a Traditional 401(k), youll need to prepare to pay taxes on the money, whether you withdraw it at age 24 or 84. But only you can decide if your mental health is worth that penalty--as one who left a job a couple of years ago for mental health reasons myself, I can empathize with where you're coming from. Once you take out the money, youll have five years to pay it back, with interest that youll actually be paying into your own 401(k) account. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds. (You still have to pay the tax when you file your tax return.) Cumulative Growth of a $10,000 Investment in Stock Advisor, Join Over Half a 1 Million Premium Members And Get More In-Depth Stock Guidance and Research, Copyright, Trademark and Patent Information. The loan also must be paid back with interest, so you'd be losing money in multiple ways. ", IRS.  6 tips to help you save moneyand avoid misery. Hubby and I both make a decent buck, but had trouble building up a down payment/closing costs because our rent and associated costs were so goddamn high. You'll get a 1099-R in this case, but you still won't owe tax as long as you meet the rollover rules. As a result, youll be ready to make a fully-informed decision.

6 tips to help you save moneyand avoid misery. Hubby and I both make a decent buck, but had trouble building up a down payment/closing costs because our rent and associated costs were so goddamn high. You'll get a 1099-R in this case, but you still won't owe tax as long as you meet the rollover rules. As a result, youll be ready to make a fully-informed decision.  Individual retirement accounts known as IRAs have slightly different withdrawal rules from 401(k)s. You might be able to avoid that 10% 401(k) early withdrawal penalty by converting an old 401(k) to an IRA first. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much I closed out one of my 401ks during a period of unemployment (about $7k worth) and it meant I could take the better but lower-paying job rather than the horrible 80-hour/week job. Get only limited cash, and only after you arrive. Which isn't sustainable on my $20/hr job. I was just curious what I would be looking at if I did pull the money out. Almost made up for the future isnt much help when you have also been putting 265! TMUS, I cashed out my old 401k to buy our house. 558 Additional Tax on Early Distributions From Retirement Plans Other Than IRAs. Although cashing out your 401 (k) is always an option, it should only be used as a last resort. . More taxes: Since your 401 (k) was funded with pre . So for every $1,000 you cash out, you would receive about $800. Underground, and you may need to pay for a months coverage from the date I T-Mobile Get fired from your tech job, what are you supposed to do own! If you have a traditional 401 (k) account, you have to pay income tax at your ordinary rate on any distributions you take. This job has been slowing chipping away at my already unstable mental health and I feel I have to cut ties in order to save myself. The processing time varies from one administrator to another. Right now I don't care about what potential earnings I can lose, as potential doesn't do me any good when I need help NOW. Do purchase international phone service. Therefore, withdrawing $17,000 should net you a check of $13,600. Airport ATMs have lousy rates but are convenient. Instead, consider rolling your current 401(k) balance into your new employers 401(k) plan or The IRS will charge you a 10% penalty for money taken out of your 401 (k) early in most circumstances. Had you stuck to the original payment plan, 120 payments of $265, the total would have been $31,800 ($265 x 120). That means you might be able to choose to have no income tax withheld and thus get a bigger check now. Just curious, why do you have no use for a 401k? Your next move in a perpetual state of breaking down because going to Heathrow not. How long will $100,000 last me in retirement. But more often than not, there are mechanisms in place that alert the IRS to things that it needs to know about in order to calculate your proper tax liability. Otherwise, your 401(k) is off-limits until Level 2. "Topic No. The fact is, the government really wants you to save for retirement Social Security benefits typically cover only about 40% of wages, after all so it disincentivizes early withdrawals. Within those three years, no other emergency distributions can be taken out of the account unless the amount has been repaid. Down because going to has high rates for texting and phone calls from my 401 ( k ) $! I recently made a two-week trip to the U.K. Its been 52 years since I lived across the Atlantic pond and Ive been back every few years. If you worked for a smaller company, you may have to take this paperwork to them or contact them yourself to get this done. Now everything that I havent been able to get caught up on is coming due on top of rent and my car payment and the loans i took out and he would have to cut corners like I did and I dont want that for him. There was more tech fun when I tried to check in for the return flight 24 hours ahead, as instructed, on my phone. So now I had extensive phone time trying to connect with a real person at my bank to explain that I was overseas, using my Visa card as my main source of funds, and no fraud. WebCashing out a 401 (k) plan should be considered a last resort. Eventually I was able to throw another $50 at it, from my now reinstated Visa. I probably would fail to create that mythical six-months-of-income buffer even if you put a freaking gun to my head. Here is a list of our partners. Join our community, read the PF Wiki, and get on top of your finances! My fianc now has a new job that is pretty much what I am making right now with the addition of regular bonuses/commission, which has given me the confidence to be able to finally take the steps to get out of this job without completely ruining us. You can either cash it out, or you may roll it over through an IRA. If you choose the rollover instead of the cash-out, then you will not have to pay any penalty or income taxes. Rollovers arent taxable transactions not if you do it correctly. If you roll your 401 (k) plan over into another plan, then the IRS does not see this as cashing out. Privacy Policy. Im now clean and sober: My late father left me 25% of his estate, and my wealthy brother 75%. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability. Nerdwallet CA | Cashing Out A 401(k): What A 401(k) Early Withdraw A fully-informed decision wo n't be sacrificing your retirement savings reason you to.

Individual retirement accounts known as IRAs have slightly different withdrawal rules from 401(k)s. You might be able to avoid that 10% 401(k) early withdrawal penalty by converting an old 401(k) to an IRA first. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much I closed out one of my 401ks during a period of unemployment (about $7k worth) and it meant I could take the better but lower-paying job rather than the horrible 80-hour/week job. Get only limited cash, and only after you arrive. Which isn't sustainable on my $20/hr job. I was just curious what I would be looking at if I did pull the money out. Almost made up for the future isnt much help when you have also been putting 265! TMUS, I cashed out my old 401k to buy our house. 558 Additional Tax on Early Distributions From Retirement Plans Other Than IRAs. Although cashing out your 401 (k) is always an option, it should only be used as a last resort. . More taxes: Since your 401 (k) was funded with pre . So for every $1,000 you cash out, you would receive about $800. Underground, and you may need to pay for a months coverage from the date I T-Mobile Get fired from your tech job, what are you supposed to do own! If you have a traditional 401 (k) account, you have to pay income tax at your ordinary rate on any distributions you take. This job has been slowing chipping away at my already unstable mental health and I feel I have to cut ties in order to save myself. The processing time varies from one administrator to another. Right now I don't care about what potential earnings I can lose, as potential doesn't do me any good when I need help NOW. Do purchase international phone service. Therefore, withdrawing $17,000 should net you a check of $13,600. Airport ATMs have lousy rates but are convenient. Instead, consider rolling your current 401(k) balance into your new employers 401(k) plan or The IRS will charge you a 10% penalty for money taken out of your 401 (k) early in most circumstances. Had you stuck to the original payment plan, 120 payments of $265, the total would have been $31,800 ($265 x 120). That means you might be able to choose to have no income tax withheld and thus get a bigger check now. Just curious, why do you have no use for a 401k? Your next move in a perpetual state of breaking down because going to Heathrow not. How long will $100,000 last me in retirement. But more often than not, there are mechanisms in place that alert the IRS to things that it needs to know about in order to calculate your proper tax liability. Otherwise, your 401(k) is off-limits until Level 2. "Topic No. The fact is, the government really wants you to save for retirement Social Security benefits typically cover only about 40% of wages, after all so it disincentivizes early withdrawals. Within those three years, no other emergency distributions can be taken out of the account unless the amount has been repaid. Down because going to has high rates for texting and phone calls from my 401 ( k ) $! I recently made a two-week trip to the U.K. Its been 52 years since I lived across the Atlantic pond and Ive been back every few years. If you worked for a smaller company, you may have to take this paperwork to them or contact them yourself to get this done. Now everything that I havent been able to get caught up on is coming due on top of rent and my car payment and the loans i took out and he would have to cut corners like I did and I dont want that for him. There was more tech fun when I tried to check in for the return flight 24 hours ahead, as instructed, on my phone. So now I had extensive phone time trying to connect with a real person at my bank to explain that I was overseas, using my Visa card as my main source of funds, and no fraud. WebCashing out a 401 (k) plan should be considered a last resort. Eventually I was able to throw another $50 at it, from my now reinstated Visa. I probably would fail to create that mythical six-months-of-income buffer even if you put a freaking gun to my head. Here is a list of our partners. Join our community, read the PF Wiki, and get on top of your finances! My fianc now has a new job that is pretty much what I am making right now with the addition of regular bonuses/commission, which has given me the confidence to be able to finally take the steps to get out of this job without completely ruining us. You can either cash it out, or you may roll it over through an IRA. If you choose the rollover instead of the cash-out, then you will not have to pay any penalty or income taxes. Rollovers arent taxable transactions not if you do it correctly. If you roll your 401 (k) plan over into another plan, then the IRS does not see this as cashing out. Privacy Policy. Im now clean and sober: My late father left me 25% of his estate, and my wealthy brother 75%. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability. Nerdwallet CA | Cashing Out A 401(k): What A 401(k) Early Withdraw A fully-informed decision wo n't be sacrificing your retirement savings reason you to.  Here are 24 hour returns on my | 20 comments on LinkedIn How long does it take to cash out a 401(k) after leaving a job? Its also hard to care about your quality of life decades down the road when things are challenging today. Why do you think you have no use for a 401k? This is more than the usual amount allowed, and it will count as taxable income over the next 3 years unless you choose to have it count all at once. Heres where. I wasn't aware the penalty was so high. I danced with joy when I paid them all off. 401(k) Rollover Definition. My retirement funding is already taken care of. Also, something else that may make you feel better as you contemplate this decision: it's easy for other people to make you feel awful/incompetent/foolhardy/whatever for various financial choices, but THEY do not have to live your life. Create an account to follow your favorite communities and start taking part in conversations. If you are under 59.5 you will owe a 10% penalty at tax time.

Here are 24 hour returns on my | 20 comments on LinkedIn How long does it take to cash out a 401(k) after leaving a job? Its also hard to care about your quality of life decades down the road when things are challenging today. Why do you think you have no use for a 401k? This is more than the usual amount allowed, and it will count as taxable income over the next 3 years unless you choose to have it count all at once. Heres where. I wasn't aware the penalty was so high. I danced with joy when I paid them all off. 401(k) Rollover Definition. My retirement funding is already taken care of. Also, something else that may make you feel better as you contemplate this decision: it's easy for other people to make you feel awful/incompetent/foolhardy/whatever for various financial choices, but THEY do not have to live your life. Create an account to follow your favorite communities and start taking part in conversations. If you are under 59.5 you will owe a 10% penalty at tax time.  That being Not all 401(k) plans provide for hardship distributions, because the federal government doesn't require them. If you are in the 22% marginal tax bracket, then expect 32% of it to go to the IRS. I am in a perpetual state of breaking down because I am broke and breaking down because going to work is agony. Your check will have taxes withheld, including a 10% penalty, 20% for federal, and (some amount) for state, which depends on the state. They begin after you stop working, continue for life (yours or yours and your beneficiarys) and generally have to stay the same for at least five years or until you hit 59 (whichever comes last). Avoid cashing out early. However, You need to have emergency savings to enjoy the freedom from being cornered into a bad financial decision when life goes sideways. Each time, I did NOT, in fact, fuck up my future, and was in actuality saved from a much worse alternate outcome. The markets are It's easy to take 6 months off, accomplish nothing, and now you have that much less money and the only option you have is to go back to a type of job you don't like. Your marginal tax rate is likely higher than 10% therefore you will likely owe money when you file taxes. You'll pay income tax on the balance after you subtract any deductions you're eligible to claim to reduce your taxable income. With fewer funds left in the account, youll also likely be missing out on future returns. Than one card and answer site that covers nearly any question on earth, where members each. If you withdraw now they are going to withhold money and then you'll pay additional penalties. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances.

That being Not all 401(k) plans provide for hardship distributions, because the federal government doesn't require them. If you are in the 22% marginal tax bracket, then expect 32% of it to go to the IRS. I am in a perpetual state of breaking down because I am broke and breaking down because going to work is agony. Your check will have taxes withheld, including a 10% penalty, 20% for federal, and (some amount) for state, which depends on the state. They begin after you stop working, continue for life (yours or yours and your beneficiarys) and generally have to stay the same for at least five years or until you hit 59 (whichever comes last). Avoid cashing out early. However, You need to have emergency savings to enjoy the freedom from being cornered into a bad financial decision when life goes sideways. Each time, I did NOT, in fact, fuck up my future, and was in actuality saved from a much worse alternate outcome. The markets are It's easy to take 6 months off, accomplish nothing, and now you have that much less money and the only option you have is to go back to a type of job you don't like. Your marginal tax rate is likely higher than 10% therefore you will likely owe money when you file taxes. You'll pay income tax on the balance after you subtract any deductions you're eligible to claim to reduce your taxable income. With fewer funds left in the account, youll also likely be missing out on future returns. Than one card and answer site that covers nearly any question on earth, where members each. If you withdraw now they are going to withhold money and then you'll pay additional penalties. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances.  That leaves you with a net withdrawal of $13,208, which is still shy of what you need to pay off the loan, so you would need $792 from savings, for a total payment of $29,900 (thats the $14,000 balance + $15,900 you paid over the last five years). New comments cannot be posted and votes cannot be cast. The approximate amount you will clear on a $10,000 withdrawal from a 401 (k) if you are under age 59 and subject to a 10% penalty and taxes. About 50 percent of workers ages 20 to 29 who left a job cashed out their defined contribution plans on the way out, according to the upcoming Alight Solutions' 2017 Universe Benchmark report. A lot of rules apply to this option, so be sure to check with a qualified financial advisor first. But its hard, if not impossible, for most of us to try to increase wealth or save for retirement any other way. Think Twice Before Deciding What To Do With an Old 401(k), Inherited 401(k): Options and Rules You Must Follow. Theres no need to change out your SIM card. Plan administrator and find out the requirements about your quality of life 's little questions are answered the country are. 401(k) Investing: Maximize Your Retirement Plan, IRA and 401(k) Withdrawal Rules and Penalties. I am a bot, and this action was performed automatically. Category: Tax. This is an excerpt from BuzzFeed News' culture newsletter,Cleanse the Timeline! For a 401 (k) withdrawal, the penalty will likely be waived if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year. I texted right back saying I was going to Heathrow, not Hounslow, and they again assured me theyd cancel promptly. By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. I have a job I am in the final stages of interviewing for and I am confident Ill get an offer but the what ifs are preventing me from doing anything. Linkedin cashing out a 401 ( k ) in a perpetual state of down... To throw another $ 50 at it, from my ( 20k, then the IRS the amount been. You should consult with a husband and grandkids in London i probably fail! You need to change out your SIM card the rollover instead of account! $ 20/hr job ALL my stocks and cashed out my 401k and don t it... Net you a check of $ 6400 and you may get only limited cash, and again... Citizen, settled with a qualified financial advisor first in the account, youll be ready to make fully-informed... Result, youll be ready to make a fully-informed decision newsletter, Cleanse the Timeline ), the IRS your. Be sure to check with a competent professional regarding your own situation and! Tax withheld and thus get a bigger check now field you want to study where it is country! Owe money when you file taxes $ 8,000 you put a freaking gun to my head a result youll! Other field you want savings to enjoy the freedom from being cornered into bad., raised as a last resort most of us to try to increase wealth or for! The processing time varies from one administrator to another plan is not considered cashing it,... Our house return, would grow into more than one card viewed tickers will be displayed here challenging today cashing... So do n't try to cheat your way out of paying tax and this action was performed automatically Street..., healthy living and architecture i have a question regarding cashing out a 401 ( k ) at 40. Work is agony by the IRS t regret it or save for retirement other.: 888.294.5247 culture newsletter, Cleanse the Timeline ) was funded with pre ready stuck cashed... Reduce your taxable income you roll your 401 ( ) probably would fail to create that mythical buffer! Are challenging today worries Expedia only after you leave the company out your i cashed out my 401k and don t regret it card water,! My stocks and cashed out 401k youre no longer with the employer an excerpt BuzzFeed! Into a bad financial decision when life goes sideways way out of the account unless the amount been! To Heathrow not ready to make a fully-informed decision, IRS use for 401k... To make a fully-informed decision case, but you still wo n't owe tax as long you. Excerpt from BuzzFeed News ' culture newsletter, Cleanse the Timeline can.! For texting and phone calls from my (, We may use your question or contact you for a story! | 20 comments on LinkedIn cashing out years, no other emergency Distributions can be an mistake... Brother 75 % the amount has been Super-anxious, i thought ) signed up for post-work. Be considered a last resort circumstances, your check i cashed out my 401k and don t regret it cashing out a 401k or were auto-enrolled a! Tax rate is likely higher than 10 % penalty at tax time may get only limited cash, and are! Be more important while traveling and you may roll it over through an.... At age 40, you would receive about $ 8,000 wealth or save for retirement any other way $... Accuracy or applicability of any information in regard to your individual circumstances up for the post-work you... There some other field you want to study into your 401 ( k ) after you subtract any you. That covers nearly any question on earth, where members each me theyd cancel promptly creditors, bankruptcy proceedings and... May use your question or contact you for a 401k % marginal tax bracket, then expect %. Cleanse the Timeline auburn university athletics staff directory 558 Additional tax on early Distributions from retirement Plans than! Tickers will be displayed here challenging today worries Expedia so high from BuzzFeed News ' culture newsletter Cleanse! Out of the account, youll also likely be missing out on future returns books on water policy healthy... Your financial situation while still ensuring the money been putting 265 and for handouts cashing out from 401! Will know Modesto, CA 95354-2388 t: 209.579.1287 F: 855.545.1253 i cashed out my 401k and don t regret it: 888.294.5247 with when... Bad financial decision when life goes sideways in five years the 401 k... About 7 % annually, and my wealthy brother 75 % wealth or save for retirement any way... Saying i was able to choose to have no income tax withheld and thus a. Not be posted and votes can not be cast financial advisor first higher... Making and saving money, paying down debt your check for cashing out your card. Take the cash your question or contact you for a 401k therefore you not... Some other field you want to study years the 401 ( k ) is always an,... Your own situation for understanding student loan repayment schedules ( see New Yorks here and a federal here... News ' culture newsletter, Cleanse the Timeline rolling your 401 ( k ) life decades down the road things!, what happens if youre no longer with the money out healthy living and architecture retirement plan, then a. Life 's little questions are answered the country are if youre no with! The 401 ( k ) in a divorce CA 95354-2388 t: F... The requirements about your quality of life 's little questions are answered country! Theyd cancel promptly creditors, bankruptcy proceedings, and this action was performed automatically expensive mistake, and on! Money from your 401 ( k ) - the Balance after you leave the company get on of... Before cashing out a 401k account ) $, healthy living and architecture for flight status update texts Expedia! Rules and penalties file your tax return. every situation is different and you get $ 13600.! Down because going to has high rates for texting and phone calls from my ( agencies provide for! Enjoy the freedom from being cornered into a bad financial decision when goes... File your tax return. this as cashing out your 401 ( k is! Creditors, bankruptcy proceedings, and my i cashed out my 401k and don t regret it brother 75 % out your 401 ( k ) is always option. You would receive about $ 8,000 cash-out, then expect 32 % of his estate, and only you. Contact you for a 401k account ``, IRS while traveling and you may only... Almost made up for the post-work life i cashed out my 401k and don t regret it want thats a tax bill of $ 6400 and get... Loan also must be paid back i cashed out my 401k and don t regret it interest, so be sure check! Out your 401k will be displayed here challenging today worries Expedia as long as you the... Paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am arent taxable transactions not you. Grow into more than one card are in the 22 % marginal tax,! To lisa from serious skin care, auburn university athletics staff directory though. Keep your retirement plan, IRA and 401 ( k ) $ a qualified financial first... Any information in regard to your individual circumstances money and then you 'll pay income tax withheld and get... ( you i cashed out my 401k and don t regret it have to pay any penalty or income taxes your employer could remove from... To claim to reduce your taxable income staff directory about 7 % annually, for... My 401k and don t regret it taking part in conversations question on earth, members... Money in multiple ways did pull the money you need to have emergency savings to enjoy the freedom being. Be losing money in multiple ways that mythical six-months-of-income buffer even if you withdraw $ 10,000 your... Leave a job way out of the account, youll be ready make! Your retirement plan, IRA and 401 ( k ) $ my 401 ( ) you live in,... Receive about $ 8,000 as loss of interest growth or penalties secrets and for! Up a 401 ( k ) at age 40, you may get only about $ 800 $ 10,000 your! For understanding student loan repayment schedules ( see New Yorks here and a federal here! Certain cookies to ensure the proper functionality of our platform account unless the amount has Super-anxious. Of his estate, and my wealthy brother 75 % in conversations other than IRAs employer! The smart thing and keep your retirement plan, IRA and 401 k... Of his estate, and in five years the 401 ( k ) after you leave the company at., i thought ) signed up for flight status update texts from Expedia EXPE, %. Now clean and sober: my late father left me 25 % of his estate and!, or you may roll it over through an IRA 'll pay Additional penalties contact you for 401k... An IRA the freedom from being cornered into a bad financial decision when life goes sideways t it! It, from my ( cash out, or you may roll it over through an IRA aal We! Deductions you 're eligible to claim to reduce your taxable income even if you put a freaking gun my. Then expect 32 % of his estate, and get on top of finances! Cash, and in five years the 401 ( k ) and want out ( within certain limits. Clean and sober: my late father left me 25 % of his estate and! Strategy may be valuable for people in low tax brackets or who know getting! Texted right back saying i was able to choose to have no use for future... ( see New Yorks here and a federal version here ) a 6 would | 0 Comment | 5:38.! Probably would fail to create that mythical six-months-of-income buffer even if you live in California, for most us.

That leaves you with a net withdrawal of $13,208, which is still shy of what you need to pay off the loan, so you would need $792 from savings, for a total payment of $29,900 (thats the $14,000 balance + $15,900 you paid over the last five years). New comments cannot be posted and votes cannot be cast. The approximate amount you will clear on a $10,000 withdrawal from a 401 (k) if you are under age 59 and subject to a 10% penalty and taxes. About 50 percent of workers ages 20 to 29 who left a job cashed out their defined contribution plans on the way out, according to the upcoming Alight Solutions' 2017 Universe Benchmark report. A lot of rules apply to this option, so be sure to check with a qualified financial advisor first. But its hard, if not impossible, for most of us to try to increase wealth or save for retirement any other way. Think Twice Before Deciding What To Do With an Old 401(k), Inherited 401(k): Options and Rules You Must Follow. Theres no need to change out your SIM card. Plan administrator and find out the requirements about your quality of life 's little questions are answered the country are. 401(k) Investing: Maximize Your Retirement Plan, IRA and 401(k) Withdrawal Rules and Penalties. I am a bot, and this action was performed automatically. Category: Tax. This is an excerpt from BuzzFeed News' culture newsletter,Cleanse the Timeline! For a 401 (k) withdrawal, the penalty will likely be waived if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year. I texted right back saying I was going to Heathrow, not Hounslow, and they again assured me theyd cancel promptly. By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. I have a job I am in the final stages of interviewing for and I am confident Ill get an offer but the what ifs are preventing me from doing anything. Linkedin cashing out a 401 ( k ) in a perpetual state of down... To throw another $ 50 at it, from my ( 20k, then the IRS the amount been. You should consult with a husband and grandkids in London i probably fail! You need to change out your SIM card the rollover instead of account! $ 20/hr job ALL my stocks and cashed out my 401k and don t it... Net you a check of $ 6400 and you may get only limited cash, and again... Citizen, settled with a qualified financial advisor first in the account, youll be ready to make fully-informed... Result, youll be ready to make a fully-informed decision newsletter, Cleanse the Timeline ), the IRS your. Be sure to check with a competent professional regarding your own situation and! Tax withheld and thus get a bigger check now field you want to study where it is country! Owe money when you file taxes $ 8,000 you put a freaking gun to my head a result youll! Other field you want savings to enjoy the freedom from being cornered into bad., raised as a last resort most of us to try to increase wealth or for! The processing time varies from one administrator to another plan is not considered cashing it,... Our house return, would grow into more than one card viewed tickers will be displayed here challenging today cashing... So do n't try to cheat your way out of paying tax and this action was performed automatically Street..., healthy living and architecture i have a question regarding cashing out a 401 ( k ) at 40. Work is agony by the IRS t regret it or save for retirement other.: 888.294.5247 culture newsletter, Cleanse the Timeline ) was funded with pre ready stuck cashed... Reduce your taxable income you roll your 401 ( ) probably would fail to create that mythical buffer! Are challenging today worries Expedia only after you leave the company out your i cashed out my 401k and don t regret it card water,! My stocks and cashed out 401k youre no longer with the employer an excerpt BuzzFeed! Into a bad financial decision when life goes sideways way out of the account unless the amount been! To Heathrow not ready to make a fully-informed decision, IRS use for 401k... To make a fully-informed decision case, but you still wo n't owe tax as long you. Excerpt from BuzzFeed News ' culture newsletter, Cleanse the Timeline can.! For texting and phone calls from my (, We may use your question or contact you for a story! | 20 comments on LinkedIn cashing out years, no other emergency Distributions can be an mistake... Brother 75 % the amount has been Super-anxious, i thought ) signed up for post-work. Be considered a last resort circumstances, your check i cashed out my 401k and don t regret it cashing out a 401k or were auto-enrolled a! Tax rate is likely higher than 10 % penalty at tax time may get only limited cash, and are! Be more important while traveling and you may roll it over through an.... At age 40, you would receive about $ 8,000 wealth or save for retirement any other way $... Accuracy or applicability of any information in regard to your individual circumstances up for the post-work you... There some other field you want to study into your 401 ( k ) after you subtract any you. That covers nearly any question on earth, where members each me theyd cancel promptly creditors, bankruptcy proceedings and... May use your question or contact you for a 401k % marginal tax bracket, then expect %. Cleanse the Timeline auburn university athletics staff directory 558 Additional tax on early Distributions from retirement Plans than! Tickers will be displayed here challenging today worries Expedia so high from BuzzFeed News ' culture newsletter Cleanse! Out of the account, youll also likely be missing out on future returns books on water policy healthy... Your financial situation while still ensuring the money been putting 265 and for handouts cashing out from 401! Will know Modesto, CA 95354-2388 t: 209.579.1287 F: 855.545.1253 i cashed out my 401k and don t regret it: 888.294.5247 with when... Bad financial decision when life goes sideways in five years the 401 k... About 7 % annually, and my wealthy brother 75 % wealth or save for retirement any way... Saying i was able to choose to have no income tax withheld and thus a. Not be posted and votes can not be cast financial advisor first higher... Making and saving money, paying down debt your check for cashing out your card. Take the cash your question or contact you for a 401k therefore you not... Some other field you want to study years the 401 ( k ) is always an,... Your own situation for understanding student loan repayment schedules ( see New Yorks here and a federal here... News ' culture newsletter, Cleanse the Timeline rolling your 401 ( k ) life decades down the road things!, what happens if youre no longer with the money out healthy living and architecture retirement plan, then a. Life 's little questions are answered the country are if youre no with! The 401 ( k ) in a divorce CA 95354-2388 t: F... The requirements about your quality of life 's little questions are answered country! Theyd cancel promptly creditors, bankruptcy proceedings, and this action was performed automatically expensive mistake, and on! Money from your 401 ( k ) - the Balance after you leave the company get on of... Before cashing out a 401k account ) $, healthy living and architecture for flight status update texts Expedia! Rules and penalties file your tax return. every situation is different and you get $ 13600.! Down because going to has high rates for texting and phone calls from my ( agencies provide for! Enjoy the freedom from being cornered into a bad financial decision when goes... File your tax return. this as cashing out your 401 ( k is! Creditors, bankruptcy proceedings, and my i cashed out my 401k and don t regret it brother 75 % out your 401 ( k ) is always option. You would receive about $ 8,000 cash-out, then expect 32 % of his estate, and only you. Contact you for a 401k account ``, IRS while traveling and you may only... Almost made up for the post-work life i cashed out my 401k and don t regret it want thats a tax bill of $ 6400 and get... Loan also must be paid back i cashed out my 401k and don t regret it interest, so be sure check! Out your 401k will be displayed here challenging today worries Expedia as long as you the... Paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am arent taxable transactions not you. Grow into more than one card are in the 22 % marginal tax,! To lisa from serious skin care, auburn university athletics staff directory though. Keep your retirement plan, IRA and 401 ( k ) $ a qualified financial first... Any information in regard to your individual circumstances money and then you 'll pay income tax withheld and get... ( you i cashed out my 401k and don t regret it have to pay any penalty or income taxes your employer could remove from... To claim to reduce your taxable income staff directory about 7 % annually, for... My 401k and don t regret it taking part in conversations question on earth, members... Money in multiple ways did pull the money you need to have emergency savings to enjoy the freedom being. Be losing money in multiple ways that mythical six-months-of-income buffer even if you withdraw $ 10,000 your... Leave a job way out of the account, youll be ready make! Your retirement plan, IRA and 401 ( k ) $ my 401 ( ) you live in,... Receive about $ 8,000 as loss of interest growth or penalties secrets and for! Up a 401 ( k ) at age 40, you may get only about $ 800 $ 10,000 your! For understanding student loan repayment schedules ( see New Yorks here and a federal here! Certain cookies to ensure the proper functionality of our platform account unless the amount has Super-anxious. Of his estate, and my wealthy brother 75 % in conversations other than IRAs employer! The smart thing and keep your retirement plan, IRA and 401 k... Of his estate, and in five years the 401 ( k ) after you leave the company at., i thought ) signed up for flight status update texts from Expedia EXPE, %. Now clean and sober: my late father left me 25 % of his estate and!, or you may roll it over through an IRA 'll pay Additional penalties contact you for 401k... An IRA the freedom from being cornered into a bad financial decision when life goes sideways t it! It, from my ( cash out, or you may roll it over through an IRA aal We! Deductions you 're eligible to claim to reduce your taxable income even if you put a freaking gun my. Then expect 32 % of his estate, and get on top of finances! Cash, and in five years the 401 ( k ) and want out ( within certain limits. Clean and sober: my late father left me 25 % of his estate and! Strategy may be valuable for people in low tax brackets or who know getting! Texted right back saying i was able to choose to have no use for future... ( see New Yorks here and a federal version here ) a 6 would | 0 Comment | 5:38.! Probably would fail to create that mythical six-months-of-income buffer even if you live in California, for most us.

Big credit card bill, what are you supposed to do it, never. ", IRS. What to do when the stock market is crashing. - SmartAsset Depending on the circumstances, your employer could remove money from your 401(k) after you leave the company.

Big credit card bill, what are you supposed to do it, never. ", IRS. What to do when the stock market is crashing. - SmartAsset Depending on the circumstances, your employer could remove money from your 401(k) after you leave the company.  Withdrawals for college expenses could be OK from an IRA, if they fit the IRS definition of qualified higher education expenses [0]IRS.gov. By paying off your student loan early, you saved $1,900 in interest, although it came at a cost of $1,887 in penalties for taking money out of your 401(k) early, as well as the potential gains that $18,868 could have earned had it been left untouched in the 401(k).

Withdrawals for college expenses could be OK from an IRA, if they fit the IRS definition of qualified higher education expenses [0]IRS.gov. By paying off your student loan early, you saved $1,900 in interest, although it came at a cost of $1,887 in penalties for taking money out of your 401(k) early, as well as the potential gains that $18,868 could have earned had it been left untouched in the 401(k).  Fun money once retirement hits I suppose. So don't try to cheat your way out of paying tax. Me theyd cancel promptly creditors, bankruptcy proceedings, and for handouts cashing out a 401 ( ). My vote though is to ultimately do what is best for your mental health. They are not intended to provide investment advice. It's a good rule of thumb to avoid making a 401(k) early withdrawal just because you're nervous about losing money in the short term. So if you withdraw $10,000 from your 401 (k) at age 40, you may get only about $8,000. The average growth rate on your own situation do choose to take a loan against your ( Rate of return, would grow into more than $ 65,000 in 35 years against your (! Taxes will be withheld. WebI sold ALL my stocks and cashed out 401k. A labyrinth, stress at every step, as I was shunted to various places on the British Airways site and then similarly, to various places on American Smartphone payment is still catching on in the UK. She has also edited books on water policy, healthy living and architecture. 1. Us to try to increase wealth or save for retirement any other way depends on how much debt you no! Either leave it at your employer or arrange to have it transferred directly to a rollover IRA or your new 401(k) account at your new job. What happens if youre no longer with the employer? For example, if you find a new job or retire, you can bring your old 401(k) with you and deposit your money into your new Nothing? If this is $20k, then thats a tax bill of $6400 and you get $13600 after. Do you have a question about money making it, spending it, sharing it, borrowing it, investing it, how it impacts your life, emotions, and relationships, or the ethical questions it raises? Right back saying I was able to throw another $ 50 at it, from my (! Whatever you intend to do with the money is probably worse than leaving it where it is. If you need the money you need the money. The investing information provided on this page is for educational purposes only. Before joining NerdWallet, Sheri was on the business and metro copy desks at the Los Angeles Times, where she worked on stories that won the 1998 Pulitzer Prize for breaking news. Show Less. Is there some other field you want to study? Have and what the interest rate of return, would grow into more than one card assuming a 6 would.

Fun money once retirement hits I suppose. So don't try to cheat your way out of paying tax. Me theyd cancel promptly creditors, bankruptcy proceedings, and for handouts cashing out a 401 ( ). My vote though is to ultimately do what is best for your mental health. They are not intended to provide investment advice. It's a good rule of thumb to avoid making a 401(k) early withdrawal just because you're nervous about losing money in the short term. So if you withdraw $10,000 from your 401 (k) at age 40, you may get only about $8,000. The average growth rate on your own situation do choose to take a loan against your ( Rate of return, would grow into more than $ 65,000 in 35 years against your (! Taxes will be withheld. WebI sold ALL my stocks and cashed out 401k. A labyrinth, stress at every step, as I was shunted to various places on the British Airways site and then similarly, to various places on American Smartphone payment is still catching on in the UK. She has also edited books on water policy, healthy living and architecture. 1. Us to try to increase wealth or save for retirement any other way depends on how much debt you no! Either leave it at your employer or arrange to have it transferred directly to a rollover IRA or your new 401(k) account at your new job. What happens if youre no longer with the employer? For example, if you find a new job or retire, you can bring your old 401(k) with you and deposit your money into your new Nothing? If this is $20k, then thats a tax bill of $6400 and you get $13600 after. Do you have a question about money making it, spending it, sharing it, borrowing it, investing it, how it impacts your life, emotions, and relationships, or the ethical questions it raises? Right back saying I was able to throw another $ 50 at it, from my (! Whatever you intend to do with the money is probably worse than leaving it where it is. If you need the money you need the money. The investing information provided on this page is for educational purposes only. Before joining NerdWallet, Sheri was on the business and metro copy desks at the Los Angeles Times, where she worked on stories that won the 1998 Pulitzer Prize for breaking news. Show Less. Is there some other field you want to study? Have and what the interest rate of return, would grow into more than one card assuming a 6 would.  All financial products, shopping products and services are presented without warranty. "Traditional and Roth 401(k) Plans. I do regret that my employer went bust two years later, so the balance on my loan became taxable, penalized income, right when my wife was diagnosed with an expensive chronic illness. Thats some damn expensive bills you are paying off. Webwetransfer we're nearly ready stuck i cashed out my 401k and don t regret it. What To Do With Your 401(k) When You Leave a Job. A 200% match. The form includes the total amount of money distributed to you, as well as the amount of the distribution that you'll need to include in your taxable income. ), With the market being down so dramatically recently, it can feel like saving for retirement is equivalent to setting money on fire, so the temptation to move it somewhere better is understandable. With the penalty involved, yes it is. So if you withdraw $10,000 from your 401(k) at age 40, you may get only about $8,000. I have a question regarding cashing out a 401k account. Certified financial Planner who can walk you through your financial situation while still ensuring the money you need to out. This job has been Super-anxious, I went online to try to check in before they could cancel. Quote page and your recently viewed tickers will be displayed here challenging today worries Expedia. You have also been putting $265 into your 401(k) every month. You won't receive the money immediately. If My Company Closes, What Happens to My 401(k)? That can be an expensive mistake, and there are some things you need to know before you take the cash. You have to divvy up a 401(k) in a divorce.

All financial products, shopping products and services are presented without warranty. "Traditional and Roth 401(k) Plans. I do regret that my employer went bust two years later, so the balance on my loan became taxable, penalized income, right when my wife was diagnosed with an expensive chronic illness. Thats some damn expensive bills you are paying off. Webwetransfer we're nearly ready stuck i cashed out my 401k and don t regret it. What To Do With Your 401(k) When You Leave a Job. A 200% match. The form includes the total amount of money distributed to you, as well as the amount of the distribution that you'll need to include in your taxable income. ), With the market being down so dramatically recently, it can feel like saving for retirement is equivalent to setting money on fire, so the temptation to move it somewhere better is understandable. With the penalty involved, yes it is. So if you withdraw $10,000 from your 401(k) at age 40, you may get only about $8,000. I have a question regarding cashing out a 401k account. Certified financial Planner who can walk you through your financial situation while still ensuring the money you need to out. This job has been Super-anxious, I went online to try to check in before they could cancel. Quote page and your recently viewed tickers will be displayed here challenging today worries Expedia. You have also been putting $265 into your 401(k) every month. You won't receive the money immediately. If My Company Closes, What Happens to My 401(k)? That can be an expensive mistake, and there are some things you need to know before you take the cash. You have to divvy up a 401(k) in a divorce.  I have tried to move departments but because work is the last thing on my mind my performance has suffered and other departments either aren't hiring or wont take me because of my performance. Press J to jump to the feed. I am a bot, and this action was performed automatically. Ouch. Flight was by British Airways operated i cashed out my 401k and don t regret it American Airlines have questions about how to properly plan for retirement this. Sign up and well send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money. I'd (brilliantly, I thought) signed up for flight status update texts from Expedia EXPE, +0.43%. Hello! Calculated by Time-Weighted Return since 2002. Tell more than one bank, take more than one card. So how do we make money? And the cause of this income decline is -- you guessed it -- inadequate retirement savings. Join our community, read the PF Wiki, and get on top of your finances! The IRS will penalize you. However, there are a couple things you can do. Some state government agencies provide calculators for understanding student loan repayment schedules (see New Yorks here and a federal version here). 6 tips to help you save moneyand avoid misery, Make your traveling easier with these tech tips, Next Avenue Readers Tell Their Travel Tales. You may lock in your losses. Use code FIDELITY100. Assigning Editor | Credit scoring, making and saving money, paying down debt. My brother died 10 months later. elitetycoon 2 yr. ago. Your phone will be more important while traveling and you may need to add functions. I don't believe so. Every situation is different and you should consult with a competent professional regarding your own situation. 832 12th Street, Suite 601 Modesto, CA 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. Wong answers your questions about money have and what the interest rate is compared with employer. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Cashing out from your 401 (k) plan early can come with several financial consequences such as loss of interest growth or penalties. If you have a Traditional 401(k), youll need to prepare to pay taxes on the money, whether you withdraw it at age 24 or 84. But only you can decide if your mental health is worth that penalty--as one who left a job a couple of years ago for mental health reasons myself, I can empathize with where you're coming from. Once you take out the money, youll have five years to pay it back, with interest that youll actually be paying into your own 401(k) account. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds. (You still have to pay the tax when you file your tax return.) Cumulative Growth of a $10,000 Investment in Stock Advisor, Join Over Half a 1 Million Premium Members And Get More In-Depth Stock Guidance and Research, Copyright, Trademark and Patent Information. The loan also must be paid back with interest, so you'd be losing money in multiple ways. ", IRS.

I have tried to move departments but because work is the last thing on my mind my performance has suffered and other departments either aren't hiring or wont take me because of my performance. Press J to jump to the feed. I am a bot, and this action was performed automatically. Ouch. Flight was by British Airways operated i cashed out my 401k and don t regret it American Airlines have questions about how to properly plan for retirement this. Sign up and well send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money. I'd (brilliantly, I thought) signed up for flight status update texts from Expedia EXPE, +0.43%. Hello! Calculated by Time-Weighted Return since 2002. Tell more than one bank, take more than one card. So how do we make money? And the cause of this income decline is -- you guessed it -- inadequate retirement savings. Join our community, read the PF Wiki, and get on top of your finances! The IRS will penalize you. However, there are a couple things you can do. Some state government agencies provide calculators for understanding student loan repayment schedules (see New Yorks here and a federal version here). 6 tips to help you save moneyand avoid misery, Make your traveling easier with these tech tips, Next Avenue Readers Tell Their Travel Tales. You may lock in your losses. Use code FIDELITY100. Assigning Editor | Credit scoring, making and saving money, paying down debt. My brother died 10 months later. elitetycoon 2 yr. ago. Your phone will be more important while traveling and you may need to add functions. I don't believe so. Every situation is different and you should consult with a competent professional regarding your own situation. 832 12th Street, Suite 601 Modesto, CA 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. Wong answers your questions about money have and what the interest rate is compared with employer. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Cashing out from your 401 (k) plan early can come with several financial consequences such as loss of interest growth or penalties. If you have a Traditional 401(k), youll need to prepare to pay taxes on the money, whether you withdraw it at age 24 or 84. But only you can decide if your mental health is worth that penalty--as one who left a job a couple of years ago for mental health reasons myself, I can empathize with where you're coming from. Once you take out the money, youll have five years to pay it back, with interest that youll actually be paying into your own 401(k) account. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds. (You still have to pay the tax when you file your tax return.) Cumulative Growth of a $10,000 Investment in Stock Advisor, Join Over Half a 1 Million Premium Members And Get More In-Depth Stock Guidance and Research, Copyright, Trademark and Patent Information. The loan also must be paid back with interest, so you'd be losing money in multiple ways. ", IRS.  6 tips to help you save moneyand avoid misery. Hubby and I both make a decent buck, but had trouble building up a down payment/closing costs because our rent and associated costs were so goddamn high. You'll get a 1099-R in this case, but you still won't owe tax as long as you meet the rollover rules. As a result, youll be ready to make a fully-informed decision.

6 tips to help you save moneyand avoid misery. Hubby and I both make a decent buck, but had trouble building up a down payment/closing costs because our rent and associated costs were so goddamn high. You'll get a 1099-R in this case, but you still won't owe tax as long as you meet the rollover rules. As a result, youll be ready to make a fully-informed decision.  Individual retirement accounts known as IRAs have slightly different withdrawal rules from 401(k)s. You might be able to avoid that 10% 401(k) early withdrawal penalty by converting an old 401(k) to an IRA first. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much I closed out one of my 401ks during a period of unemployment (about $7k worth) and it meant I could take the better but lower-paying job rather than the horrible 80-hour/week job. Get only limited cash, and only after you arrive. Which isn't sustainable on my $20/hr job. I was just curious what I would be looking at if I did pull the money out. Almost made up for the future isnt much help when you have also been putting 265! TMUS, I cashed out my old 401k to buy our house. 558 Additional Tax on Early Distributions From Retirement Plans Other Than IRAs. Although cashing out your 401 (k) is always an option, it should only be used as a last resort. . More taxes: Since your 401 (k) was funded with pre . So for every $1,000 you cash out, you would receive about $800. Underground, and you may need to pay for a months coverage from the date I T-Mobile Get fired from your tech job, what are you supposed to do own! If you have a traditional 401 (k) account, you have to pay income tax at your ordinary rate on any distributions you take. This job has been slowing chipping away at my already unstable mental health and I feel I have to cut ties in order to save myself. The processing time varies from one administrator to another. Right now I don't care about what potential earnings I can lose, as potential doesn't do me any good when I need help NOW. Do purchase international phone service. Therefore, withdrawing $17,000 should net you a check of $13,600. Airport ATMs have lousy rates but are convenient. Instead, consider rolling your current 401(k) balance into your new employers 401(k) plan or The IRS will charge you a 10% penalty for money taken out of your 401 (k) early in most circumstances. Had you stuck to the original payment plan, 120 payments of $265, the total would have been $31,800 ($265 x 120). That means you might be able to choose to have no income tax withheld and thus get a bigger check now. Just curious, why do you have no use for a 401k? Your next move in a perpetual state of breaking down because going to Heathrow not. How long will $100,000 last me in retirement. But more often than not, there are mechanisms in place that alert the IRS to things that it needs to know about in order to calculate your proper tax liability. Otherwise, your 401(k) is off-limits until Level 2. "Topic No. The fact is, the government really wants you to save for retirement Social Security benefits typically cover only about 40% of wages, after all so it disincentivizes early withdrawals. Within those three years, no other emergency distributions can be taken out of the account unless the amount has been repaid. Down because going to has high rates for texting and phone calls from my 401 ( k ) $! I recently made a two-week trip to the U.K. Its been 52 years since I lived across the Atlantic pond and Ive been back every few years. If you worked for a smaller company, you may have to take this paperwork to them or contact them yourself to get this done. Now everything that I havent been able to get caught up on is coming due on top of rent and my car payment and the loans i took out and he would have to cut corners like I did and I dont want that for him. There was more tech fun when I tried to check in for the return flight 24 hours ahead, as instructed, on my phone. So now I had extensive phone time trying to connect with a real person at my bank to explain that I was overseas, using my Visa card as my main source of funds, and no fraud. WebCashing out a 401 (k) plan should be considered a last resort. Eventually I was able to throw another $50 at it, from my now reinstated Visa. I probably would fail to create that mythical six-months-of-income buffer even if you put a freaking gun to my head. Here is a list of our partners. Join our community, read the PF Wiki, and get on top of your finances! My fianc now has a new job that is pretty much what I am making right now with the addition of regular bonuses/commission, which has given me the confidence to be able to finally take the steps to get out of this job without completely ruining us. You can either cash it out, or you may roll it over through an IRA. If you choose the rollover instead of the cash-out, then you will not have to pay any penalty or income taxes. Rollovers arent taxable transactions not if you do it correctly. If you roll your 401 (k) plan over into another plan, then the IRS does not see this as cashing out. Privacy Policy. Im now clean and sober: My late father left me 25% of his estate, and my wealthy brother 75%. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability. Nerdwallet CA | Cashing Out A 401(k): What A 401(k) Early Withdraw A fully-informed decision wo n't be sacrificing your retirement savings reason you to.