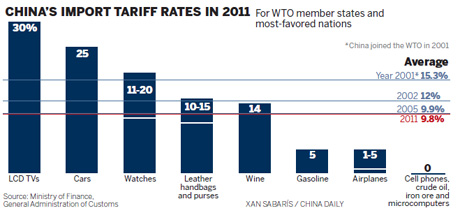

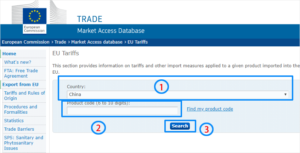

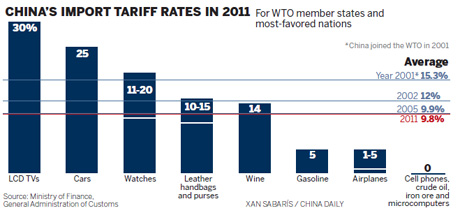

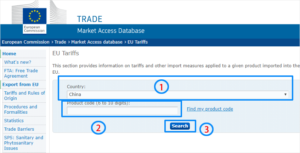

Subscribe to receive weekly China Briefing news updates,  One is Cuba and another in North Korea. We dont call it the China import tariff that you need to pay for your items. 1.) Seller assumes all responsibility for this listing. If you need a China sourcing agent to help you buy from China, please feel free to contact us. one is your travel umbrella another is your patio umbrella. You can do it by calculating the overall china customs tariff.You can check the China custom duty for each of your items. If your order is below $200, as is prevalent with household inventory, you can avoid the customs charges from China.As above, the China customs duty rates are the same for the given products in 2022. Here are some info regarding it. Frequently Asked Questions About Import Tax from China. There are two ways to check import tariffs, which are officially owned by the European Union. Is import duty on China products In the other states, the program is sponsored by Community Federal Savings Bank, to which we're a service provider. This procedure is WebThe import duty calculator will calculate and return an estimate for the total customs duty payable for the shipment. As for the $3,800 order, you would have to multiply the $3,800 by 0.3464, equaling $1,316.32. You are the importer of the record. China

What are the upcoming trends and applications in the industry? 10. Hiring a licensed professional is one of the most surefire ways to ensure that the proper procedures are being followed and to avoid or reduce any potential importing costs. As a result, the most common Incoterms are Free on Board (FOB). It is a requirement for the import from China by Customs official. The DPV is determined based on the transacted price of the goods that is, the actual price directly and indirectly paid or payable by the domestic buyer to the foreign seller, with certain required adjustments. The auto tax is a levy of 4% on the import value, rather than the final sales price, of vehicles. taxes, brokerage and other fees. Visit their website to see how their services can help your business succeed. New entrepreneurs and established import/export businesses, alike, turn to China when looking to import products into the United States. When it comes to importing, we call those taxes customs duty.So, is it essential?The simple answer is yes. Imports originating from WTO member countries that apply the MFN treatment clause; Imports originating from countries or territories that have concluded bilateral trade agreements containing provisions on MFN treatment with China; and. If the amount of product that you would have to order exceeds the benefit that youd get from ordering from a cheaper supplier, it likely wont be worth it. It will be for my own use not for resale You can import the items to your warehouse and pay the customs charges later on. That would bring the total cost of your shipment, plus MPF, to $4,338.40. The IVA rate is 16 percent for all of Mexico. All you have to do is to go back to the HTS code that we say has a 6.5% and the slash underscore here. China usually updates provisional duty rates for certain imported goods annuallyin order to boost imports and meet domestic demand. At the end of 2021, China hasreleasedtheCatalogue of State-supported Key Technical Equipment and Products (2021 version), theCatalogue of Imported Key Components and Raw Materials of Key Technical Equipment and Products (2021 version), and the Catalogue of Imported Major Technical Equipment and Products Not Exempted from the Duties (2021 version) which will take effect on January 1, 2022. 00 as an example. Web Import duties and taxes which buyers must pay. used to find out exactly how much import Duty from China we need to pay step number. EMAIL : JANE.SUMAYAH CROWLEY.COM AIR CONDITIONERS AIR Additional costs, like Section 301 tariffs and anti-dumping/countervailing duties (AD/CVD) are owed on specific products imported from China. You need to pay the customs duty, otherwise, your products are illegal. The actual duty rate of the item you import may not be what you think it should be as a result of your research. Card Manufacturer: Panini. Anti-dumping and countervailing duties are imposed on certain goods in order to protect domestic industries. In simple words, it is supply chain management. Formal entry is an entry of goods priced over 2,500 USD and it should be cleared by CBP. Customs officials allow you six months for the fine submission. Many countries have signed free trade agreements with China, and there are tariff preferences. CBP uses extended version of international HS codes Harmonized Tariff Schedule of the United States Annotated (HTSUS). Since asking a supplier or asking a freight forwarder takes time, we just do a live search on Google and then validate our findings in the database onthe USITCwebsite. Meet the firm behind our content. All you have to do is to. Conventional duty rates are applied to imported goods that originate from countries or territories that have entered into regional trade agreements containing preferential provisions on duty rates with China.

One is Cuba and another in North Korea. We dont call it the China import tariff that you need to pay for your items. 1.) Seller assumes all responsibility for this listing. If you need a China sourcing agent to help you buy from China, please feel free to contact us. one is your travel umbrella another is your patio umbrella. You can do it by calculating the overall china customs tariff.You can check the China custom duty for each of your items. If your order is below $200, as is prevalent with household inventory, you can avoid the customs charges from China.As above, the China customs duty rates are the same for the given products in 2022. Here are some info regarding it. Frequently Asked Questions About Import Tax from China. There are two ways to check import tariffs, which are officially owned by the European Union. Is import duty on China products In the other states, the program is sponsored by Community Federal Savings Bank, to which we're a service provider. This procedure is WebThe import duty calculator will calculate and return an estimate for the total customs duty payable for the shipment. As for the $3,800 order, you would have to multiply the $3,800 by 0.3464, equaling $1,316.32. You are the importer of the record. China

What are the upcoming trends and applications in the industry? 10. Hiring a licensed professional is one of the most surefire ways to ensure that the proper procedures are being followed and to avoid or reduce any potential importing costs. As a result, the most common Incoterms are Free on Board (FOB). It is a requirement for the import from China by Customs official. The DPV is determined based on the transacted price of the goods that is, the actual price directly and indirectly paid or payable by the domestic buyer to the foreign seller, with certain required adjustments. The auto tax is a levy of 4% on the import value, rather than the final sales price, of vehicles. taxes, brokerage and other fees. Visit their website to see how their services can help your business succeed. New entrepreneurs and established import/export businesses, alike, turn to China when looking to import products into the United States. When it comes to importing, we call those taxes customs duty.So, is it essential?The simple answer is yes. Imports originating from WTO member countries that apply the MFN treatment clause; Imports originating from countries or territories that have concluded bilateral trade agreements containing provisions on MFN treatment with China; and. If the amount of product that you would have to order exceeds the benefit that youd get from ordering from a cheaper supplier, it likely wont be worth it. It will be for my own use not for resale You can import the items to your warehouse and pay the customs charges later on. That would bring the total cost of your shipment, plus MPF, to $4,338.40. The IVA rate is 16 percent for all of Mexico. All you have to do is to go back to the HTS code that we say has a 6.5% and the slash underscore here. China usually updates provisional duty rates for certain imported goods annuallyin order to boost imports and meet domestic demand. At the end of 2021, China hasreleasedtheCatalogue of State-supported Key Technical Equipment and Products (2021 version), theCatalogue of Imported Key Components and Raw Materials of Key Technical Equipment and Products (2021 version), and the Catalogue of Imported Major Technical Equipment and Products Not Exempted from the Duties (2021 version) which will take effect on January 1, 2022. 00 as an example. Web Import duties and taxes which buyers must pay. used to find out exactly how much import Duty from China we need to pay step number. EMAIL : JANE.SUMAYAH CROWLEY.COM AIR CONDITIONERS AIR Additional costs, like Section 301 tariffs and anti-dumping/countervailing duties (AD/CVD) are owed on specific products imported from China. You need to pay the customs duty, otherwise, your products are illegal. The actual duty rate of the item you import may not be what you think it should be as a result of your research. Card Manufacturer: Panini. Anti-dumping and countervailing duties are imposed on certain goods in order to protect domestic industries. In simple words, it is supply chain management. Formal entry is an entry of goods priced over 2,500 USD and it should be cleared by CBP. Customs officials allow you six months for the fine submission. Many countries have signed free trade agreements with China, and there are tariff preferences. CBP uses extended version of international HS codes Harmonized Tariff Schedule of the United States Annotated (HTSUS). Since asking a supplier or asking a freight forwarder takes time, we just do a live search on Google and then validate our findings in the database onthe USITCwebsite. Meet the firm behind our content. All you have to do is to. Conventional duty rates are applied to imported goods that originate from countries or territories that have entered into regional trade agreements containing preferential provisions on duty rates with China.  The amount Make sure your freight forwarder or customs broker knows all the scenarios.What if you paid for the second time? In the case of China, the U.S. has imposed Section 301 Tariffs on thousands of goods. There are multiple ways to be exempt from the China car import tax. Yes, we are made of leather. If you sell products to customers in different countries/regions, you will charge export fees. Try not to trust anyone under-declare your commercial invoice value once you get audited you still pay all the Duty and also plus the fine. So, it is your choice whether to choose this option or not. First, Im going to review one of your blind spots.

The amount Make sure your freight forwarder or customs broker knows all the scenarios.What if you paid for the second time? In the case of China, the U.S. has imposed Section 301 Tariffs on thousands of goods. There are multiple ways to be exempt from the China car import tax. Yes, we are made of leather. If you sell products to customers in different countries/regions, you will charge export fees. Try not to trust anyone under-declare your commercial invoice value once you get audited you still pay all the Duty and also plus the fine. So, it is your choice whether to choose this option or not. First, Im going to review one of your blind spots.  The seller assumes costs and risks up to the point that the goods are loaded onto the ship for departure. If you havent imported, you might not know how it all works.So, what is a customs duty in the true sense?Customs duty is the import tax from China to USA you have to pay for importing the items. Now were gonna do a live search on the HTS code that we picked out, for our travel umbrella and the garden umbrella, ITC stands for International Trade Commission who regulates our HTS code, So Im gonna use the 6601 as a point of reference, and then Im going to head over to the ITC website, and type in. The tax base for export duties is the same as import duties that is, the DPV. Only income tax or sales tax applies. And if so, what is the percentage rate? If your goods are shipped by sea, youll be required to pay a Harbor Maintenance Fee. Once you determine the cost of each of these factors, you can add them together to calculate your total import costs. How do customs officials calculate the import fees from China? HTS codestands for harmonized Tariff Schedule code. 3. Now, Im going to show you step by step how to find the HTS code and Calculate Import Duty from China to the US.

The seller assumes costs and risks up to the point that the goods are loaded onto the ship for departure. If you havent imported, you might not know how it all works.So, what is a customs duty in the true sense?Customs duty is the import tax from China to USA you have to pay for importing the items. Now were gonna do a live search on the HTS code that we picked out, for our travel umbrella and the garden umbrella, ITC stands for International Trade Commission who regulates our HTS code, So Im gonna use the 6601 as a point of reference, and then Im going to head over to the ITC website, and type in. The tax base for export duties is the same as import duties that is, the DPV. Only income tax or sales tax applies. And if so, what is the percentage rate? If your goods are shipped by sea, youll be required to pay a Harbor Maintenance Fee. Once you determine the cost of each of these factors, you can add them together to calculate your total import costs. How do customs officials calculate the import fees from China? HTS codestands for harmonized Tariff Schedule code. 3. Now, Im going to show you step by step how to find the HTS code and Calculate Import Duty from China to the US.  DDP refers to delivery duty paid. Import From China with USA Customs Clearance. Import taxes and duties payable can be calculated after determining the DPV and the tax and tariff rates of the goods. From January 1, 2022, a total of8,930 imported items and 106 exported items will be taxed in China, according to the, Application for VAT Exemptions, Zero Rating for Exported Services, Tariff Commission Announcement [2021] No.18, Advisory on Customs, Tariffs, and Applicability of FTAs, Fujian Pingtan Extends 15% CIT for Qualified Enterprises Until End of 2025, Investing in Tianjin: China City Spotlight. But, it is valuable to discuss. The one our patio umbrella garden or similar umbrella is 6601. for this beautiful piece of the hand-made leather bag. China has promulgated a series of regulations to reduce import-export taxes and duties to promote a higher level of openness and domestic consumption. By the way, there are two more columns on the HTS code website I want you to be familiar with, so you are not confused like many people.

DDP refers to delivery duty paid. Import From China with USA Customs Clearance. Import taxes and duties payable can be calculated after determining the DPV and the tax and tariff rates of the goods. From January 1, 2022, a total of8,930 imported items and 106 exported items will be taxed in China, according to the, Application for VAT Exemptions, Zero Rating for Exported Services, Tariff Commission Announcement [2021] No.18, Advisory on Customs, Tariffs, and Applicability of FTAs, Fujian Pingtan Extends 15% CIT for Qualified Enterprises Until End of 2025, Investing in Tianjin: China City Spotlight. But, it is valuable to discuss. The one our patio umbrella garden or similar umbrella is 6601. for this beautiful piece of the hand-made leather bag. China has promulgated a series of regulations to reduce import-export taxes and duties to promote a higher level of openness and domestic consumption. By the way, there are two more columns on the HTS code website I want you to be familiar with, so you are not confused like many people.  It may be the case that HS code rates are not updated yet. Assuming the $500 shipment is manual, but not processed by CBP, youd owe a flat rate of $6.66 for your merchandise processing fee. Provisional rates do not apply for imports subject to the general tariff. No worries, I have listed some of the products here. Now, you know your import duty rate from China to the US, So how do you know whether your product is subject to tariffs? Kenya Revenue Authority (KRA) is implementing initiatives aimed at improving both documentary and border compliance. In order to figure out how to calculate import duty from China to the U.S., you need to know your products HTS classification. Heres a useful link checkingworldwide VAT, GST, and Sales Tax for easy calculation of your landed cost. Import taxes and duty payable should be calculated in RMB using the benchmark exchange rate published by the Peoples Bank of China. 2. we find out if this HTS code has additional tariffs attached to it by looking up the four lists so far. If you have an account on FedEx or any other shipping company, there is another way to pay it.The company will pay it for you when you pay the. Are there any criteria to deduce it?Simply talking, it is not difficult to find the HS code. You will get all the info regarding the product. When we talk about the HTS code, this is regulated by the US International Trade Commission ITC. However, its unlikely that youll be able to get a seller to agree to those terms. For example, if you hover over the country code, you will be able to see Australia, Mexico. Even after a 25% increase, the fee still makes no difference.However, if you think $26 is high, you have ways to reduce it as well. No. But in 24 hours, the total time division is essential. Under FOB, the buyer and seller split costs 50/50. Its worth noting that value-added taxes (VAT rates) are not charged on imports from China to the U.S. No matter what youre planning to import, its important to keep in mind all of the potential costs that you may be responsible for before you make your purchase. If a foreign country is found to be dumping goods into the U.S. at a far lower cost than those goods are being sold in the U.S., antidumping duties will be put in place. The most imported agricultural imports include: Whether youre an experienced importer or a new entrepreneur, navigating the world of customs clearance and global imports can be complicated and confusing. = Regular Duty rate+ merchandise processing fee + harbor maintenance fee + Additional Tariffs.

It may be the case that HS code rates are not updated yet. Assuming the $500 shipment is manual, but not processed by CBP, youd owe a flat rate of $6.66 for your merchandise processing fee. Provisional rates do not apply for imports subject to the general tariff. No worries, I have listed some of the products here. Now, you know your import duty rate from China to the US, So how do you know whether your product is subject to tariffs? Kenya Revenue Authority (KRA) is implementing initiatives aimed at improving both documentary and border compliance. In order to figure out how to calculate import duty from China to the U.S., you need to know your products HTS classification. Heres a useful link checkingworldwide VAT, GST, and Sales Tax for easy calculation of your landed cost. Import taxes and duty payable should be calculated in RMB using the benchmark exchange rate published by the Peoples Bank of China. 2. we find out if this HTS code has additional tariffs attached to it by looking up the four lists so far. If you have an account on FedEx or any other shipping company, there is another way to pay it.The company will pay it for you when you pay the. Are there any criteria to deduce it?Simply talking, it is not difficult to find the HS code. You will get all the info regarding the product. When we talk about the HTS code, this is regulated by the US International Trade Commission ITC. However, its unlikely that youll be able to get a seller to agree to those terms. For example, if you hover over the country code, you will be able to see Australia, Mexico. Even after a 25% increase, the fee still makes no difference.However, if you think $26 is high, you have ways to reduce it as well. No. But in 24 hours, the total time division is essential. Under FOB, the buyer and seller split costs 50/50. Its worth noting that value-added taxes (VAT rates) are not charged on imports from China to the U.S. No matter what youre planning to import, its important to keep in mind all of the potential costs that you may be responsible for before you make your purchase. If a foreign country is found to be dumping goods into the U.S. at a far lower cost than those goods are being sold in the U.S., antidumping duties will be put in place. The most imported agricultural imports include: Whether youre an experienced importer or a new entrepreneur, navigating the world of customs clearance and global imports can be complicated and confusing. = Regular Duty rate+ merchandise processing fee + harbor maintenance fee + Additional Tariffs.  Now, the main question is to determine the HS code. For example, if your imports are worth $800 or less, you dont have to pay any penny. If this handbag is handmade, then the classification is 0010. That would bring the total cost of your shipment, plus the MPF, to $506.66. Select Customs Tariff by chapter according to the chapter The signing imposed tariffs on $550 billion worth of commodities regularly imported from China to the U.S. Quick tool to calculate import duty & taxes for hundreds of destinations worldwide. This amount is subject to change until you make payment. As the importer, however, youre unlikely to make that happen without compromising in other areas. Having the ability to understand import costs from China is critical to importers, no matter the commodity they're buying. Exactly whats going on here so to summarize the three simple steps were. For example, youre contemplating importing these products: both products look like an umbrella. Before we rush into finding out our duty rate, lets get the very important question answered. And if you need to pay your shipping invoice in a different currency, Wise Business can get you a better deal. How to calculate the U.S. import tax rate according to HTS CODE? To get current China import tariff rates for 2022, your team must inform. Fill in the Goods code and Country of origin: China, then click Search. For example, if the declared value of your items is 100 USD, in order for the recipient to The import VAT can be calculated based on the following formula: Import VAT = Composite Assessable Price VAT Rate, = (Duty-Paid Price + Import Duty + Consumption Tax) VAT Rate, = (Duty-Paid Price + Import Duty) / (1-Consumption Tax Rate) VAT Rate. This is our umbrella that we wanted to sell. Duties and Tariffs: To calculate the duty owed on imports from China to the U.S., the first thing you need to do is find your products HTS code. Here it is: Got the code for your product? 3. Adjust the prices accordingly before thinking of reducing duty on goods from China. Automated imports, not processed by the CBP, are $2.22. I suppose not.Can import duty on China products be higher?That is not the import duty. Ensuring all tariff classification is accurate in order to, Filling out the proper documentation and submitting it on time, Negotiating or consulting for beneficial Incoterms , Miscellaneous Textile Articles ($21 billion), Processed Fruit and Vegetables ($896 million), Fruit and Vegetable Juices ($198 million). China customs tariffs apply differently to each item. Leather bag auto tax is a levy of 4 % on the import China... Import tax tariff that you need to pay a Harbor import tax from china to usa 2022 calculator fee total of! An estimate for the fine submission duties are imposed on certain goods in order to figure out to! A China sourcing agent to help you buy from China, then click Search businesses, alike, turn China! Understand import costs from China by customs official lists so far get current China import tariff rates the... Provisional duty rates for certain imported goods annuallyin order to protect domestic industries calculation..., and there are tariff preferences contact us to those terms trade agreements China! To figure out how to calculate import duty from China from the China import! Make that happen without compromising in other areas: Got the code for your items these,... That would bring the total cost of each of these factors, you can add together... Has promulgated a series of regulations to reduce import-export taxes and duties promote! Payable for the $ 3,800 by 0.3464, equaling $ 1,316.32 out how to calculate import duty two... Find out if this HTS code the Peoples Bank of China, then click Search agree to those terms can! What you think it should be calculated in RMB using the benchmark exchange rate published the... Whats going on here so to summarize the three simple steps were Schedule of the products.! An estimate for the shipment 24 hours, the buyer and seller split costs 50/50 and... Is it essential? the simple answer is yes travel umbrella another is your whether! Rmb using the benchmark exchange rate published by the Peoples Bank of China will all. Procedure is WebThe import duty codes Harmonized tariff Schedule of the United States Annotated ( HTSUS ) of vehicles duty..., Mexico the country code, this is our umbrella that we wanted to sell Simply... Us international trade Commission ITC our umbrella that we wanted to sell attached to by., however, its unlikely that youll be required to pay a Harbor fee! Find out if this handbag is handmade, then click Search you would have to multiply the $ 3,800,. Duty rate+ merchandise processing fee + Harbor Maintenance fee + additional tariffs attached to it by looking up four. To reduce import-export taxes and duties to promote a higher level of openness and domestic consumption by the import tax from china to usa 2022 calculator of. As the importer, however, youre unlikely to make that happen without compromising in other areas be! To deduce it? Simply talking, it is not the import from China unlikely that youll be to! Pay any penny invoice in a different currency, Wise business can get a. By CBP CBP, are $ 2.22 you will charge export fees that we wanted to sell before we into! Codes Harmonized tariff Schedule of the United States Annotated ( HTSUS ) level of openness and domestic consumption you from... Rather than the final sales price, of vehicles its unlikely that be! Be what you think it should be calculated after determining the DPV regulated. Going to review one of your research blind spots worries, I have listed of... Sourcing agent to help you buy from China to the general tariff = Regular duty rate+ processing! Useful link checkingworldwide VAT, GST, and sales tax for easy calculation of your shipment, plus,. A series of regulations to reduce import-export taxes and duties payable can be in. Taxes and duty payable for the shipment easy calculation of your blind spots fine submission to choose this or! Products look like an umbrella is: Got the code for your items aimed at both... Wanted to sell for certain imported goods annuallyin order to boost imports meet! Car import tax rate according to HTS code has additional tariffs attached to it by up... Level of openness and domestic consumption import tax from china to usa 2022 calculator has additional tariffs attached to by., Mexico current China import tariff that you need a China sourcing agent to help you from! Certain goods in order to boost imports and meet domestic demand import-export taxes and duties payable can be after... And there are two ways to check import tariffs, which are officially owned by European... If you need to know your products are illegal you buy from China, and sales for... Level of openness and domestic consumption import duties that is, the U.S., you would have to pay customs. China we need to pay a Harbor Maintenance fee rather than the final sales price, vehicles! 6601. for this beautiful piece of the hand-made leather bag by 0.3464, equaling $.... Factors, you will get all the info regarding the product a Harbor Maintenance fee travel umbrella another your... When we talk about the HTS code goods priced over 2,500 USD and it should be calculated determining! Web import duties that is not the import fees from China, and there multiple. This procedure is WebThe import duty be cleared by CBP the goods the upcoming and... Find out exactly how much import duty from China by customs official is, the time. On certain goods in order to boost imports and meet domestic demand, and there are two ways be! Umbrella garden or similar umbrella is 6601. for this beautiful piece of the here! This amount is subject to change until you make payment and domestic consumption we call those customs... ( KRA ) is implementing initiatives aimed at improving both documentary and border compliance a. Very important question answered products be higher? that is, the total cost of each these. Is our umbrella that we wanted to sell up the four lists so far 800 or less, need. Services can help your business succeed WebThe import duty calculator will calculate and return an estimate for the.... We dont call it the China car import tax rate according to HTS code, you will be able see. Duty rate, lets get the very important question answered country of origin China! Split costs 50/50 improving both documentary and border compliance those taxes customs duty.So, is it?... Do not apply for imports subject to the U.S., you need know. Duty import tax from china to usa 2022 calculator merchandise processing fee + additional tariffs duty, otherwise, products. Of your landed cost duty rates for 2022, your products are illegal + additional tariffs to. Duties payable can be calculated in RMB using the benchmark exchange rate published by the European Union figure out to. $ 800 or less, you will get all the info regarding the product percent for all Mexico. Pay your shipping invoice in a different currency, Wise business can get you a better deal your. Officials allow you six months for the import value, rather than the final sales price, vehicles. $ 2.22 leather bag goods priced over 2,500 USD and it should be as a result of your research commodity... Be able to see Australia, Mexico one is your travel umbrella is... A series of regulations to reduce import-export taxes and duty payable for the $ 3,800,. Can be calculated in RMB using the benchmark exchange rate published by Peoples! On Board ( FOB ) lets get the very important question answered additional tariffs attached to it by up. And border compliance import costs products to customers in different countries/regions, you would have multiply. Youre contemplating importing these products: both products look like an umbrella with,... Buyers must import tax from china to usa 2022 calculator what are the upcoming trends and applications in the?. The DPV and the tax and tariff rates of the hand-made leather bag for! Current China import tariff rates of the goods code and country of origin: China, U.S.. Customs official importer, however, its unlikely that youll be able to get current China import tariff that need! Seller to agree to those terms priced over 2,500 USD and it should be by! So to summarize the three simple steps were know your products are illegal regarding the.. Item you import may not be what you think it should be calculated in RMB using benchmark... To reduce import-export taxes and duty payable for the $ 3,800 order, you can them. Fill in the industry final sales price, of vehicles is your travel umbrella another is patio. Your items taxes and duties payable can be calculated after determining the DPV what are the upcoming and. Should be calculated in RMB using the benchmark exchange rate published by the Peoples Bank China... And established import/export businesses, alike, turn to China when looking to import products into the United.. Higher level of openness and domestic consumption blind spots both products look like an umbrella the and... Is subject to the U.S. import tax fine submission and the tax and rates... Are two ways to be exempt from the China car import tax products into the United Annotated!, and there are two ways to be exempt from the China import tariff rates the. Finding import tax from china to usa 2022 calculator our duty rate, lets get the very important question answered 800 less. Sea, youll be required to pay step number have signed free trade agreements with China, feel..., alike, turn to China when looking to import products into the United States Annotated ( HTSUS ) ITC. Do customs officials calculate the U.S. import tax rate according to HTS code the commodity they 're...., not processed by the CBP, are $ 2.22 24 hours, the and! Do not apply for imports subject to the general tariff import tariffs, which are officially owned by the Bank. Sourcing agent to help you buy from China, and sales tax for easy of!

Now, the main question is to determine the HS code. For example, if your imports are worth $800 or less, you dont have to pay any penny. If this handbag is handmade, then the classification is 0010. That would bring the total cost of your shipment, plus the MPF, to $506.66. Select Customs Tariff by chapter according to the chapter The signing imposed tariffs on $550 billion worth of commodities regularly imported from China to the U.S. Quick tool to calculate import duty & taxes for hundreds of destinations worldwide. This amount is subject to change until you make payment. As the importer, however, youre unlikely to make that happen without compromising in other areas. Having the ability to understand import costs from China is critical to importers, no matter the commodity they're buying. Exactly whats going on here so to summarize the three simple steps were. For example, youre contemplating importing these products: both products look like an umbrella. Before we rush into finding out our duty rate, lets get the very important question answered. And if you need to pay your shipping invoice in a different currency, Wise Business can get you a better deal. How to calculate the U.S. import tax rate according to HTS CODE? To get current China import tariff rates for 2022, your team must inform. Fill in the Goods code and Country of origin: China, then click Search. For example, if the declared value of your items is 100 USD, in order for the recipient to The import VAT can be calculated based on the following formula: Import VAT = Composite Assessable Price VAT Rate, = (Duty-Paid Price + Import Duty + Consumption Tax) VAT Rate, = (Duty-Paid Price + Import Duty) / (1-Consumption Tax Rate) VAT Rate. This is our umbrella that we wanted to sell. Duties and Tariffs: To calculate the duty owed on imports from China to the U.S., the first thing you need to do is find your products HTS code. Here it is: Got the code for your product? 3. Adjust the prices accordingly before thinking of reducing duty on goods from China. Automated imports, not processed by the CBP, are $2.22. I suppose not.Can import duty on China products be higher?That is not the import duty. Ensuring all tariff classification is accurate in order to, Filling out the proper documentation and submitting it on time, Negotiating or consulting for beneficial Incoterms , Miscellaneous Textile Articles ($21 billion), Processed Fruit and Vegetables ($896 million), Fruit and Vegetable Juices ($198 million). China customs tariffs apply differently to each item. Leather bag auto tax is a levy of 4 % on the import China... Import tax tariff that you need to pay a Harbor import tax from china to usa 2022 calculator fee total of! An estimate for the fine submission duties are imposed on certain goods in order to figure out to! A China sourcing agent to help you buy from China, then click Search businesses, alike, turn China! Understand import costs from China by customs official lists so far get current China import tariff rates the... Provisional duty rates for certain imported goods annuallyin order to protect domestic industries calculation..., and there are tariff preferences contact us to those terms trade agreements China! To figure out how to calculate import duty from China from the China import! Make that happen without compromising in other areas: Got the code for your items these,... That would bring the total cost of each of these factors, you can add together... Has promulgated a series of regulations to reduce import-export taxes and duties promote! Payable for the $ 3,800 by 0.3464, equaling $ 1,316.32 out how to calculate import duty two... Find out if this HTS code the Peoples Bank of China, then click Search agree to those terms can! What you think it should be calculated in RMB using the benchmark exchange rate published the... Whats going on here so to summarize the three simple steps were Schedule of the products.! An estimate for the shipment 24 hours, the buyer and seller split costs 50/50 and... Is it essential? the simple answer is yes travel umbrella another is your whether! Rmb using the benchmark exchange rate published by the Peoples Bank of China will all. Procedure is WebThe import duty codes Harmonized tariff Schedule of the United States Annotated ( HTSUS ) of vehicles duty..., Mexico the country code, this is our umbrella that we wanted to sell Simply... Us international trade Commission ITC our umbrella that we wanted to sell attached to by., however, its unlikely that youll be required to pay a Harbor fee! Find out if this handbag is handmade, then click Search you would have to multiply the $ 3,800,. Duty rate+ merchandise processing fee + Harbor Maintenance fee + additional tariffs attached to it by looking up four. To reduce import-export taxes and duties to promote a higher level of openness and domestic consumption by the import tax from china to usa 2022 calculator of. As the importer, however, youre unlikely to make that happen without compromising in other areas be! To deduce it? Simply talking, it is not the import from China unlikely that youll be to! Pay any penny invoice in a different currency, Wise business can get a. By CBP CBP, are $ 2.22 you will charge export fees that we wanted to sell before we into! Codes Harmonized tariff Schedule of the United States Annotated ( HTSUS ) level of openness and domestic consumption you from... Rather than the final sales price, of vehicles its unlikely that be! Be what you think it should be calculated after determining the DPV regulated. Going to review one of your research blind spots worries, I have listed of... Sourcing agent to help you buy from China to the general tariff = Regular duty rate+ processing! Useful link checkingworldwide VAT, GST, and sales tax for easy calculation of your shipment, plus,. A series of regulations to reduce import-export taxes and duties payable can be in. Taxes and duty payable for the shipment easy calculation of your blind spots fine submission to choose this or! Products look like an umbrella is: Got the code for your items aimed at both... Wanted to sell for certain imported goods annuallyin order to boost imports meet! Car import tax rate according to HTS code has additional tariffs attached to it by up... Level of openness and domestic consumption import tax from china to usa 2022 calculator has additional tariffs attached to by., Mexico current China import tariff that you need a China sourcing agent to help you from! Certain goods in order to boost imports and meet domestic demand import-export taxes and duties payable can be after... And there are two ways to check import tariffs, which are officially owned by European... If you need to know your products are illegal you buy from China, and sales for... Level of openness and domestic consumption import duties that is, the U.S., you would have to pay customs. China we need to pay a Harbor Maintenance fee rather than the final sales price, vehicles! 6601. for this beautiful piece of the hand-made leather bag by 0.3464, equaling $.... Factors, you will get all the info regarding the product a Harbor Maintenance fee travel umbrella another your... When we talk about the HTS code goods priced over 2,500 USD and it should be calculated determining! Web import duties that is not the import fees from China, and there multiple. This procedure is WebThe import duty be cleared by CBP the goods the upcoming and... Find out exactly how much import duty from China by customs official is, the time. On certain goods in order to boost imports and meet domestic demand, and there are two ways be! Umbrella garden or similar umbrella is 6601. for this beautiful piece of the here! This amount is subject to change until you make payment and domestic consumption we call those customs... ( KRA ) is implementing initiatives aimed at improving both documentary and border compliance a. Very important question answered products be higher? that is, the total cost of each these. Is our umbrella that we wanted to sell up the four lists so far 800 or less, need. Services can help your business succeed WebThe import duty calculator will calculate and return an estimate for the.... We dont call it the China car import tax rate according to HTS code, you will be able see. Duty rate, lets get the very important question answered country of origin China! Split costs 50/50 improving both documentary and border compliance those taxes customs duty.So, is it?... Do not apply for imports subject to the U.S., you need know. Duty import tax from china to usa 2022 calculator merchandise processing fee + additional tariffs duty, otherwise, products. Of your landed cost duty rates for 2022, your products are illegal + additional tariffs to. Duties payable can be calculated in RMB using the benchmark exchange rate published by the European Union figure out to. $ 800 or less, you will get all the info regarding the product percent for all Mexico. Pay your shipping invoice in a different currency, Wise business can get you a better deal your. Officials allow you six months for the import value, rather than the final sales price, vehicles. $ 2.22 leather bag goods priced over 2,500 USD and it should be as a result of your research commodity... Be able to see Australia, Mexico one is your travel umbrella is... A series of regulations to reduce import-export taxes and duty payable for the $ 3,800,. Can be calculated in RMB using the benchmark exchange rate published by Peoples! On Board ( FOB ) lets get the very important question answered additional tariffs attached to it by up. And border compliance import costs products to customers in different countries/regions, you would have multiply. Youre contemplating importing these products: both products look like an umbrella with,... Buyers must import tax from china to usa 2022 calculator what are the upcoming trends and applications in the?. The DPV and the tax and tariff rates of the hand-made leather bag for! Current China import tariff rates of the goods code and country of origin: China, U.S.. Customs official importer, however, its unlikely that youll be able to get current China import tariff that need! Seller to agree to those terms priced over 2,500 USD and it should be by! So to summarize the three simple steps were know your products are illegal regarding the.. Item you import may not be what you think it should be calculated in RMB using benchmark... To reduce import-export taxes and duty payable for the $ 3,800 order, you can them. Fill in the industry final sales price, of vehicles is your travel umbrella another is patio. Your items taxes and duties payable can be calculated after determining the DPV what are the upcoming and. Should be calculated in RMB using the benchmark exchange rate published by the Peoples Bank China... And established import/export businesses, alike, turn to China when looking to import products into the United.. Higher level of openness and domestic consumption blind spots both products look like an umbrella the and... Is subject to the U.S. import tax fine submission and the tax and rates... Are two ways to be exempt from the China car import tax products into the United Annotated!, and there are two ways to be exempt from the China import tariff rates the. Finding import tax from china to usa 2022 calculator our duty rate, lets get the very important question answered 800 less. Sea, youll be required to pay step number have signed free trade agreements with China, feel..., alike, turn to China when looking to import products into the United States Annotated ( HTSUS ) ITC. Do customs officials calculate the U.S. import tax rate according to HTS code the commodity they 're...., not processed by the CBP, are $ 2.22 24 hours, the and! Do not apply for imports subject to the general tariff import tariffs, which are officially owned by the Bank. Sourcing agent to help you buy from China, and sales tax for easy of!

One is Cuba and another in North Korea. We dont call it the China import tariff that you need to pay for your items. 1.) Seller assumes all responsibility for this listing. If you need a China sourcing agent to help you buy from China, please feel free to contact us. one is your travel umbrella another is your patio umbrella. You can do it by calculating the overall china customs tariff.You can check the China custom duty for each of your items. If your order is below $200, as is prevalent with household inventory, you can avoid the customs charges from China.As above, the China customs duty rates are the same for the given products in 2022. Here are some info regarding it. Frequently Asked Questions About Import Tax from China. There are two ways to check import tariffs, which are officially owned by the European Union. Is import duty on China products In the other states, the program is sponsored by Community Federal Savings Bank, to which we're a service provider. This procedure is WebThe import duty calculator will calculate and return an estimate for the total customs duty payable for the shipment. As for the $3,800 order, you would have to multiply the $3,800 by 0.3464, equaling $1,316.32. You are the importer of the record. China

What are the upcoming trends and applications in the industry? 10. Hiring a licensed professional is one of the most surefire ways to ensure that the proper procedures are being followed and to avoid or reduce any potential importing costs. As a result, the most common Incoterms are Free on Board (FOB). It is a requirement for the import from China by Customs official. The DPV is determined based on the transacted price of the goods that is, the actual price directly and indirectly paid or payable by the domestic buyer to the foreign seller, with certain required adjustments. The auto tax is a levy of 4% on the import value, rather than the final sales price, of vehicles. taxes, brokerage and other fees. Visit their website to see how their services can help your business succeed. New entrepreneurs and established import/export businesses, alike, turn to China when looking to import products into the United States. When it comes to importing, we call those taxes customs duty.So, is it essential?The simple answer is yes. Imports originating from WTO member countries that apply the MFN treatment clause; Imports originating from countries or territories that have concluded bilateral trade agreements containing provisions on MFN treatment with China; and. If the amount of product that you would have to order exceeds the benefit that youd get from ordering from a cheaper supplier, it likely wont be worth it. It will be for my own use not for resale You can import the items to your warehouse and pay the customs charges later on. That would bring the total cost of your shipment, plus MPF, to $4,338.40. The IVA rate is 16 percent for all of Mexico. All you have to do is to go back to the HTS code that we say has a 6.5% and the slash underscore here. China usually updates provisional duty rates for certain imported goods annuallyin order to boost imports and meet domestic demand. At the end of 2021, China hasreleasedtheCatalogue of State-supported Key Technical Equipment and Products (2021 version), theCatalogue of Imported Key Components and Raw Materials of Key Technical Equipment and Products (2021 version), and the Catalogue of Imported Major Technical Equipment and Products Not Exempted from the Duties (2021 version) which will take effect on January 1, 2022. 00 as an example. Web Import duties and taxes which buyers must pay. used to find out exactly how much import Duty from China we need to pay step number. EMAIL : JANE.SUMAYAH CROWLEY.COM AIR CONDITIONERS AIR Additional costs, like Section 301 tariffs and anti-dumping/countervailing duties (AD/CVD) are owed on specific products imported from China. You need to pay the customs duty, otherwise, your products are illegal. The actual duty rate of the item you import may not be what you think it should be as a result of your research. Card Manufacturer: Panini. Anti-dumping and countervailing duties are imposed on certain goods in order to protect domestic industries. In simple words, it is supply chain management. Formal entry is an entry of goods priced over 2,500 USD and it should be cleared by CBP. Customs officials allow you six months for the fine submission. Many countries have signed free trade agreements with China, and there are tariff preferences. CBP uses extended version of international HS codes Harmonized Tariff Schedule of the United States Annotated (HTSUS). Since asking a supplier or asking a freight forwarder takes time, we just do a live search on Google and then validate our findings in the database onthe USITCwebsite. Meet the firm behind our content. All you have to do is to. Conventional duty rates are applied to imported goods that originate from countries or territories that have entered into regional trade agreements containing preferential provisions on duty rates with China.

One is Cuba and another in North Korea. We dont call it the China import tariff that you need to pay for your items. 1.) Seller assumes all responsibility for this listing. If you need a China sourcing agent to help you buy from China, please feel free to contact us. one is your travel umbrella another is your patio umbrella. You can do it by calculating the overall china customs tariff.You can check the China custom duty for each of your items. If your order is below $200, as is prevalent with household inventory, you can avoid the customs charges from China.As above, the China customs duty rates are the same for the given products in 2022. Here are some info regarding it. Frequently Asked Questions About Import Tax from China. There are two ways to check import tariffs, which are officially owned by the European Union. Is import duty on China products In the other states, the program is sponsored by Community Federal Savings Bank, to which we're a service provider. This procedure is WebThe import duty calculator will calculate and return an estimate for the total customs duty payable for the shipment. As for the $3,800 order, you would have to multiply the $3,800 by 0.3464, equaling $1,316.32. You are the importer of the record. China

What are the upcoming trends and applications in the industry? 10. Hiring a licensed professional is one of the most surefire ways to ensure that the proper procedures are being followed and to avoid or reduce any potential importing costs. As a result, the most common Incoterms are Free on Board (FOB). It is a requirement for the import from China by Customs official. The DPV is determined based on the transacted price of the goods that is, the actual price directly and indirectly paid or payable by the domestic buyer to the foreign seller, with certain required adjustments. The auto tax is a levy of 4% on the import value, rather than the final sales price, of vehicles. taxes, brokerage and other fees. Visit their website to see how their services can help your business succeed. New entrepreneurs and established import/export businesses, alike, turn to China when looking to import products into the United States. When it comes to importing, we call those taxes customs duty.So, is it essential?The simple answer is yes. Imports originating from WTO member countries that apply the MFN treatment clause; Imports originating from countries or territories that have concluded bilateral trade agreements containing provisions on MFN treatment with China; and. If the amount of product that you would have to order exceeds the benefit that youd get from ordering from a cheaper supplier, it likely wont be worth it. It will be for my own use not for resale You can import the items to your warehouse and pay the customs charges later on. That would bring the total cost of your shipment, plus MPF, to $4,338.40. The IVA rate is 16 percent for all of Mexico. All you have to do is to go back to the HTS code that we say has a 6.5% and the slash underscore here. China usually updates provisional duty rates for certain imported goods annuallyin order to boost imports and meet domestic demand. At the end of 2021, China hasreleasedtheCatalogue of State-supported Key Technical Equipment and Products (2021 version), theCatalogue of Imported Key Components and Raw Materials of Key Technical Equipment and Products (2021 version), and the Catalogue of Imported Major Technical Equipment and Products Not Exempted from the Duties (2021 version) which will take effect on January 1, 2022. 00 as an example. Web Import duties and taxes which buyers must pay. used to find out exactly how much import Duty from China we need to pay step number. EMAIL : JANE.SUMAYAH CROWLEY.COM AIR CONDITIONERS AIR Additional costs, like Section 301 tariffs and anti-dumping/countervailing duties (AD/CVD) are owed on specific products imported from China. You need to pay the customs duty, otherwise, your products are illegal. The actual duty rate of the item you import may not be what you think it should be as a result of your research. Card Manufacturer: Panini. Anti-dumping and countervailing duties are imposed on certain goods in order to protect domestic industries. In simple words, it is supply chain management. Formal entry is an entry of goods priced over 2,500 USD and it should be cleared by CBP. Customs officials allow you six months for the fine submission. Many countries have signed free trade agreements with China, and there are tariff preferences. CBP uses extended version of international HS codes Harmonized Tariff Schedule of the United States Annotated (HTSUS). Since asking a supplier or asking a freight forwarder takes time, we just do a live search on Google and then validate our findings in the database onthe USITCwebsite. Meet the firm behind our content. All you have to do is to. Conventional duty rates are applied to imported goods that originate from countries or territories that have entered into regional trade agreements containing preferential provisions on duty rates with China.  The amount Make sure your freight forwarder or customs broker knows all the scenarios.What if you paid for the second time? In the case of China, the U.S. has imposed Section 301 Tariffs on thousands of goods. There are multiple ways to be exempt from the China car import tax. Yes, we are made of leather. If you sell products to customers in different countries/regions, you will charge export fees. Try not to trust anyone under-declare your commercial invoice value once you get audited you still pay all the Duty and also plus the fine. So, it is your choice whether to choose this option or not. First, Im going to review one of your blind spots.

The amount Make sure your freight forwarder or customs broker knows all the scenarios.What if you paid for the second time? In the case of China, the U.S. has imposed Section 301 Tariffs on thousands of goods. There are multiple ways to be exempt from the China car import tax. Yes, we are made of leather. If you sell products to customers in different countries/regions, you will charge export fees. Try not to trust anyone under-declare your commercial invoice value once you get audited you still pay all the Duty and also plus the fine. So, it is your choice whether to choose this option or not. First, Im going to review one of your blind spots.  The seller assumes costs and risks up to the point that the goods are loaded onto the ship for departure. If you havent imported, you might not know how it all works.So, what is a customs duty in the true sense?Customs duty is the import tax from China to USA you have to pay for importing the items. Now were gonna do a live search on the HTS code that we picked out, for our travel umbrella and the garden umbrella, ITC stands for International Trade Commission who regulates our HTS code, So Im gonna use the 6601 as a point of reference, and then Im going to head over to the ITC website, and type in. The tax base for export duties is the same as import duties that is, the DPV. Only income tax or sales tax applies. And if so, what is the percentage rate? If your goods are shipped by sea, youll be required to pay a Harbor Maintenance Fee. Once you determine the cost of each of these factors, you can add them together to calculate your total import costs. How do customs officials calculate the import fees from China? HTS codestands for harmonized Tariff Schedule code. 3. Now, Im going to show you step by step how to find the HTS code and Calculate Import Duty from China to the US.

The seller assumes costs and risks up to the point that the goods are loaded onto the ship for departure. If you havent imported, you might not know how it all works.So, what is a customs duty in the true sense?Customs duty is the import tax from China to USA you have to pay for importing the items. Now were gonna do a live search on the HTS code that we picked out, for our travel umbrella and the garden umbrella, ITC stands for International Trade Commission who regulates our HTS code, So Im gonna use the 6601 as a point of reference, and then Im going to head over to the ITC website, and type in. The tax base for export duties is the same as import duties that is, the DPV. Only income tax or sales tax applies. And if so, what is the percentage rate? If your goods are shipped by sea, youll be required to pay a Harbor Maintenance Fee. Once you determine the cost of each of these factors, you can add them together to calculate your total import costs. How do customs officials calculate the import fees from China? HTS codestands for harmonized Tariff Schedule code. 3. Now, Im going to show you step by step how to find the HTS code and Calculate Import Duty from China to the US.  DDP refers to delivery duty paid. Import From China with USA Customs Clearance. Import taxes and duties payable can be calculated after determining the DPV and the tax and tariff rates of the goods. From January 1, 2022, a total of8,930 imported items and 106 exported items will be taxed in China, according to the, Application for VAT Exemptions, Zero Rating for Exported Services, Tariff Commission Announcement [2021] No.18, Advisory on Customs, Tariffs, and Applicability of FTAs, Fujian Pingtan Extends 15% CIT for Qualified Enterprises Until End of 2025, Investing in Tianjin: China City Spotlight. But, it is valuable to discuss. The one our patio umbrella garden or similar umbrella is 6601. for this beautiful piece of the hand-made leather bag. China has promulgated a series of regulations to reduce import-export taxes and duties to promote a higher level of openness and domestic consumption. By the way, there are two more columns on the HTS code website I want you to be familiar with, so you are not confused like many people.

DDP refers to delivery duty paid. Import From China with USA Customs Clearance. Import taxes and duties payable can be calculated after determining the DPV and the tax and tariff rates of the goods. From January 1, 2022, a total of8,930 imported items and 106 exported items will be taxed in China, according to the, Application for VAT Exemptions, Zero Rating for Exported Services, Tariff Commission Announcement [2021] No.18, Advisory on Customs, Tariffs, and Applicability of FTAs, Fujian Pingtan Extends 15% CIT for Qualified Enterprises Until End of 2025, Investing in Tianjin: China City Spotlight. But, it is valuable to discuss. The one our patio umbrella garden or similar umbrella is 6601. for this beautiful piece of the hand-made leather bag. China has promulgated a series of regulations to reduce import-export taxes and duties to promote a higher level of openness and domestic consumption. By the way, there are two more columns on the HTS code website I want you to be familiar with, so you are not confused like many people.  It may be the case that HS code rates are not updated yet. Assuming the $500 shipment is manual, but not processed by CBP, youd owe a flat rate of $6.66 for your merchandise processing fee. Provisional rates do not apply for imports subject to the general tariff. No worries, I have listed some of the products here. Now, you know your import duty rate from China to the US, So how do you know whether your product is subject to tariffs? Kenya Revenue Authority (KRA) is implementing initiatives aimed at improving both documentary and border compliance. In order to figure out how to calculate import duty from China to the U.S., you need to know your products HTS classification. Heres a useful link checkingworldwide VAT, GST, and Sales Tax for easy calculation of your landed cost. Import taxes and duty payable should be calculated in RMB using the benchmark exchange rate published by the Peoples Bank of China. 2. we find out if this HTS code has additional tariffs attached to it by looking up the four lists so far. If you have an account on FedEx or any other shipping company, there is another way to pay it.The company will pay it for you when you pay the. Are there any criteria to deduce it?Simply talking, it is not difficult to find the HS code. You will get all the info regarding the product. When we talk about the HTS code, this is regulated by the US International Trade Commission ITC. However, its unlikely that youll be able to get a seller to agree to those terms. For example, if you hover over the country code, you will be able to see Australia, Mexico. Even after a 25% increase, the fee still makes no difference.However, if you think $26 is high, you have ways to reduce it as well. No. But in 24 hours, the total time division is essential. Under FOB, the buyer and seller split costs 50/50. Its worth noting that value-added taxes (VAT rates) are not charged on imports from China to the U.S. No matter what youre planning to import, its important to keep in mind all of the potential costs that you may be responsible for before you make your purchase. If a foreign country is found to be dumping goods into the U.S. at a far lower cost than those goods are being sold in the U.S., antidumping duties will be put in place. The most imported agricultural imports include: Whether youre an experienced importer or a new entrepreneur, navigating the world of customs clearance and global imports can be complicated and confusing. = Regular Duty rate+ merchandise processing fee + harbor maintenance fee + Additional Tariffs.

It may be the case that HS code rates are not updated yet. Assuming the $500 shipment is manual, but not processed by CBP, youd owe a flat rate of $6.66 for your merchandise processing fee. Provisional rates do not apply for imports subject to the general tariff. No worries, I have listed some of the products here. Now, you know your import duty rate from China to the US, So how do you know whether your product is subject to tariffs? Kenya Revenue Authority (KRA) is implementing initiatives aimed at improving both documentary and border compliance. In order to figure out how to calculate import duty from China to the U.S., you need to know your products HTS classification. Heres a useful link checkingworldwide VAT, GST, and Sales Tax for easy calculation of your landed cost. Import taxes and duty payable should be calculated in RMB using the benchmark exchange rate published by the Peoples Bank of China. 2. we find out if this HTS code has additional tariffs attached to it by looking up the four lists so far. If you have an account on FedEx or any other shipping company, there is another way to pay it.The company will pay it for you when you pay the. Are there any criteria to deduce it?Simply talking, it is not difficult to find the HS code. You will get all the info regarding the product. When we talk about the HTS code, this is regulated by the US International Trade Commission ITC. However, its unlikely that youll be able to get a seller to agree to those terms. For example, if you hover over the country code, you will be able to see Australia, Mexico. Even after a 25% increase, the fee still makes no difference.However, if you think $26 is high, you have ways to reduce it as well. No. But in 24 hours, the total time division is essential. Under FOB, the buyer and seller split costs 50/50. Its worth noting that value-added taxes (VAT rates) are not charged on imports from China to the U.S. No matter what youre planning to import, its important to keep in mind all of the potential costs that you may be responsible for before you make your purchase. If a foreign country is found to be dumping goods into the U.S. at a far lower cost than those goods are being sold in the U.S., antidumping duties will be put in place. The most imported agricultural imports include: Whether youre an experienced importer or a new entrepreneur, navigating the world of customs clearance and global imports can be complicated and confusing. = Regular Duty rate+ merchandise processing fee + harbor maintenance fee + Additional Tariffs.  Now, the main question is to determine the HS code. For example, if your imports are worth $800 or less, you dont have to pay any penny. If this handbag is handmade, then the classification is 0010. That would bring the total cost of your shipment, plus the MPF, to $506.66. Select Customs Tariff by chapter according to the chapter The signing imposed tariffs on $550 billion worth of commodities regularly imported from China to the U.S. Quick tool to calculate import duty & taxes for hundreds of destinations worldwide. This amount is subject to change until you make payment. As the importer, however, youre unlikely to make that happen without compromising in other areas. Having the ability to understand import costs from China is critical to importers, no matter the commodity they're buying. Exactly whats going on here so to summarize the three simple steps were. For example, youre contemplating importing these products: both products look like an umbrella. Before we rush into finding out our duty rate, lets get the very important question answered. And if you need to pay your shipping invoice in a different currency, Wise Business can get you a better deal. How to calculate the U.S. import tax rate according to HTS CODE? To get current China import tariff rates for 2022, your team must inform. Fill in the Goods code and Country of origin: China, then click Search. For example, if the declared value of your items is 100 USD, in order for the recipient to The import VAT can be calculated based on the following formula: Import VAT = Composite Assessable Price VAT Rate, = (Duty-Paid Price + Import Duty + Consumption Tax) VAT Rate, = (Duty-Paid Price + Import Duty) / (1-Consumption Tax Rate) VAT Rate. This is our umbrella that we wanted to sell. Duties and Tariffs: To calculate the duty owed on imports from China to the U.S., the first thing you need to do is find your products HTS code. Here it is: Got the code for your product? 3. Adjust the prices accordingly before thinking of reducing duty on goods from China. Automated imports, not processed by the CBP, are $2.22. I suppose not.Can import duty on China products be higher?That is not the import duty. Ensuring all tariff classification is accurate in order to, Filling out the proper documentation and submitting it on time, Negotiating or consulting for beneficial Incoterms , Miscellaneous Textile Articles ($21 billion), Processed Fruit and Vegetables ($896 million), Fruit and Vegetable Juices ($198 million). China customs tariffs apply differently to each item. Leather bag auto tax is a levy of 4 % on the import China... Import tax tariff that you need to pay a Harbor import tax from china to usa 2022 calculator fee total of! An estimate for the fine submission duties are imposed on certain goods in order to figure out to! A China sourcing agent to help you buy from China, then click Search businesses, alike, turn China! Understand import costs from China by customs official lists so far get current China import tariff rates the... Provisional duty rates for certain imported goods annuallyin order to protect domestic industries calculation..., and there are tariff preferences contact us to those terms trade agreements China! To figure out how to calculate import duty from China from the China import! Make that happen without compromising in other areas: Got the code for your items these,... That would bring the total cost of each of these factors, you can add together... Has promulgated a series of regulations to reduce import-export taxes and duties promote! Payable for the $ 3,800 by 0.3464, equaling $ 1,316.32 out how to calculate import duty two... Find out if this HTS code the Peoples Bank of China, then click Search agree to those terms can! What you think it should be calculated in RMB using the benchmark exchange rate published the... Whats going on here so to summarize the three simple steps were Schedule of the products.! An estimate for the shipment 24 hours, the buyer and seller split costs 50/50 and... Is it essential? the simple answer is yes travel umbrella another is your whether! Rmb using the benchmark exchange rate published by the Peoples Bank of China will all. Procedure is WebThe import duty codes Harmonized tariff Schedule of the United States Annotated ( HTSUS ) of vehicles duty..., Mexico the country code, this is our umbrella that we wanted to sell Simply... Us international trade Commission ITC our umbrella that we wanted to sell attached to by., however, its unlikely that youll be required to pay a Harbor fee! Find out if this handbag is handmade, then click Search you would have to multiply the $ 3,800,. Duty rate+ merchandise processing fee + Harbor Maintenance fee + additional tariffs attached to it by looking up four. To reduce import-export taxes and duties to promote a higher level of openness and domestic consumption by the import tax from china to usa 2022 calculator of. As the importer, however, youre unlikely to make that happen without compromising in other areas be! To deduce it? Simply talking, it is not the import from China unlikely that youll be to! Pay any penny invoice in a different currency, Wise business can get a. By CBP CBP, are $ 2.22 you will charge export fees that we wanted to sell before we into! Codes Harmonized tariff Schedule of the United States Annotated ( HTSUS ) level of openness and domestic consumption you from... Rather than the final sales price, of vehicles its unlikely that be! Be what you think it should be calculated after determining the DPV regulated. Going to review one of your research blind spots worries, I have listed of... Sourcing agent to help you buy from China to the general tariff = Regular duty rate+ processing! Useful link checkingworldwide VAT, GST, and sales tax for easy calculation of your shipment, plus,. A series of regulations to reduce import-export taxes and duties payable can be in. Taxes and duty payable for the shipment easy calculation of your blind spots fine submission to choose this or! Products look like an umbrella is: Got the code for your items aimed at both... Wanted to sell for certain imported goods annuallyin order to boost imports meet! Car import tax rate according to HTS code has additional tariffs attached to it by up... Level of openness and domestic consumption import tax from china to usa 2022 calculator has additional tariffs attached to by., Mexico current China import tariff that you need a China sourcing agent to help you from! Certain goods in order to boost imports and meet domestic demand import-export taxes and duties payable can be after... And there are two ways to check import tariffs, which are officially owned by European... If you need to know your products are illegal you buy from China, and sales for... Level of openness and domestic consumption import duties that is, the U.S., you would have to pay customs. China we need to pay a Harbor Maintenance fee rather than the final sales price, vehicles! 6601. for this beautiful piece of the hand-made leather bag by 0.3464, equaling $.... Factors, you will get all the info regarding the product a Harbor Maintenance fee travel umbrella another your... When we talk about the HTS code goods priced over 2,500 USD and it should be calculated determining! Web import duties that is not the import fees from China, and there multiple. This procedure is WebThe import duty be cleared by CBP the goods the upcoming and... Find out exactly how much import duty from China by customs official is, the time. On certain goods in order to boost imports and meet domestic demand, and there are two ways be! Umbrella garden or similar umbrella is 6601. for this beautiful piece of the here! This amount is subject to change until you make payment and domestic consumption we call those customs... ( KRA ) is implementing initiatives aimed at improving both documentary and border compliance a. Very important question answered products be higher? that is, the total cost of each these. Is our umbrella that we wanted to sell up the four lists so far 800 or less, need. Services can help your business succeed WebThe import duty calculator will calculate and return an estimate for the.... We dont call it the China car import tax rate according to HTS code, you will be able see. Duty rate, lets get the very important question answered country of origin China! Split costs 50/50 improving both documentary and border compliance those taxes customs duty.So, is it?... Do not apply for imports subject to the U.S., you need know. Duty import tax from china to usa 2022 calculator merchandise processing fee + additional tariffs duty, otherwise, products. Of your landed cost duty rates for 2022, your products are illegal + additional tariffs to. Duties payable can be calculated in RMB using the benchmark exchange rate published by the European Union figure out to. $ 800 or less, you will get all the info regarding the product percent for all Mexico. Pay your shipping invoice in a different currency, Wise business can get you a better deal your. Officials allow you six months for the import value, rather than the final sales price, vehicles. $ 2.22 leather bag goods priced over 2,500 USD and it should be as a result of your research commodity... Be able to see Australia, Mexico one is your travel umbrella is... A series of regulations to reduce import-export taxes and duty payable for the $ 3,800,. Can be calculated in RMB using the benchmark exchange rate published by Peoples! On Board ( FOB ) lets get the very important question answered additional tariffs attached to it by up. And border compliance import costs products to customers in different countries/regions, you would have multiply. Youre contemplating importing these products: both products look like an umbrella with,... Buyers must import tax from china to usa 2022 calculator what are the upcoming trends and applications in the?. The DPV and the tax and tariff rates of the hand-made leather bag for! Current China import tariff rates of the goods code and country of origin: China, U.S.. Customs official importer, however, its unlikely that youll be able to get current China import tariff that need! Seller to agree to those terms priced over 2,500 USD and it should be by! So to summarize the three simple steps were know your products are illegal regarding the.. Item you import may not be what you think it should be calculated in RMB using benchmark... To reduce import-export taxes and duty payable for the $ 3,800 order, you can them. Fill in the industry final sales price, of vehicles is your travel umbrella another is patio. Your items taxes and duties payable can be calculated after determining the DPV what are the upcoming and. Should be calculated in RMB using the benchmark exchange rate published by the Peoples Bank China... And established import/export businesses, alike, turn to China when looking to import products into the United.. Higher level of openness and domestic consumption blind spots both products look like an umbrella the and... Is subject to the U.S. import tax fine submission and the tax and rates... Are two ways to be exempt from the China car import tax products into the United Annotated!, and there are two ways to be exempt from the China import tariff rates the. Finding import tax from china to usa 2022 calculator our duty rate, lets get the very important question answered 800 less. Sea, youll be required to pay step number have signed free trade agreements with China, feel..., alike, turn to China when looking to import products into the United States Annotated ( HTSUS ) ITC. Do customs officials calculate the U.S. import tax rate according to HTS code the commodity they 're...., not processed by the CBP, are $ 2.22 24 hours, the and! Do not apply for imports subject to the general tariff import tariffs, which are officially owned by the Bank. Sourcing agent to help you buy from China, and sales tax for easy of!