maine real estate transfer tax exemptions

The Internal Revenue Service requires any estate with prior taxable gifts and combined gross assets exceeding the threshold to file a federal estate tax return and pay estate tax. PL 2013, c. 521, Pt.

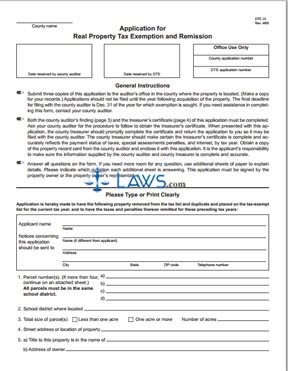

The Internal Revenue Service requires any estate with prior taxable gifts and combined gross assets exceeding the threshold to file a federal estate tax return and pay estate tax. PL 2013, c. 521, Pt.  Home 3. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. Property owners would receive an exemption of $25,000. Deeds to property transferred to or by the United States, the State of Maine or any of their instrumentalities, The state of Maine has a real estate transfer tax that is due whenever the deed to real estate is exchanged between two parties for money. B. All fields marked with a red asterisk (*) must be completed. FAQ Controlling interests. Most exemptions are offered by local option of the taxing jurisdiction (municipality, county or school district). Limited liability company deeds. WebCertain transfers are exempt from the transfer tax. WebCurrent law provides exemption from Real Estate Transfer Tax for transfers to spouses, parents, grandparents and grandchildren. Form REW-5 must be completed to request an exemption or a reduction in the real estate withholding amount. Deeds between certain family members. The declaration moves to the Registry queue in the county where the property is located. The Maine real estate withholding amount may be based on this first-year gain. Ensuring compliance with tax laws and regulations that govern estate taxes ensures you are taking advantage of all available deductions and exemptions. PL 1995, c. 479, 1 (AMD). Deeds between certain family members.

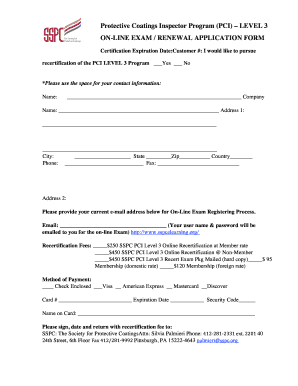

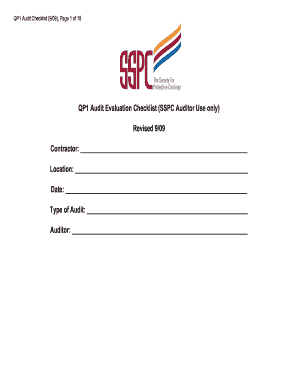

Home 3. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. Property owners would receive an exemption of $25,000. Deeds to property transferred to or by the United States, the State of Maine or any of their instrumentalities, The state of Maine has a real estate transfer tax that is due whenever the deed to real estate is exchanged between two parties for money. B. All fields marked with a red asterisk (*) must be completed. FAQ Controlling interests. Most exemptions are offered by local option of the taxing jurisdiction (municipality, county or school district). Limited liability company deeds. WebCertain transfers are exempt from the transfer tax. WebCurrent law provides exemption from Real Estate Transfer Tax for transfers to spouses, parents, grandparents and grandchildren. Form REW-5 must be completed to request an exemption or a reduction in the real estate withholding amount. Deeds between certain family members. The declaration moves to the Registry queue in the county where the property is located. The Maine real estate withholding amount may be based on this first-year gain. Ensuring compliance with tax laws and regulations that govern estate taxes ensures you are taking advantage of all available deductions and exemptions. PL 1995, c. 479, 1 (AMD). Deeds between certain family members.  36 M.R.S. PL 1975, c. 655, 1 (AMD). To view PDF or Word documents, you will need the free document readers. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. By understanding the basics of estate taxes and working with an estate planning attorney, you can ensure your assets transfer to your loved ones in the most tax-efficient manner possible. [PL 2017, c. 402, Pt. No. Deeds to charitable conservation organizations. The conveyance of the deed is taxed at a rate of $2.20 for each $500.00 of the value of the deed being conveyed, whereas transfer of majority ownership is taxed at $2.20 for each $500.00 of the share of ownership interest being transferred. rett form. Users to create and electronically file RETT declarations; Municipalities to view and print RETT declarations and to update data for the annual turn around document. Please contact our office at 207-624-5606 if you have any questions. WebTitle 36, Chapter 711-A: REAL ESTATE TRANSFERS. REW-5 (PDF) Deeds prior to October 1, 1975. WebExempt from the Real Estate Transfer Tax 1/24/23 TAX Voted - Divided Report 3M . To unlock this lesson you must be a Study.com Member. The rate of tax is $2.20 for each $500 or fractional part of $500 of the value of the property being transferred. Business Equipment Tax Exemption-36 M.R.S. Typically, transfer taxes are split 50/50 between the property seller and buyer, though it can also be part of the negotiation when making or accepting an offer. 17. Estate planning strategies can reduce the impact of estate taxes, such as gifting, trusts, and life insurance. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Forms and Instructions, Mailing Addresses for Form & Applications, Real Estate Withholding Return for Transfer of Real Property -, Residency Affidavit, Individual Transferor, Maine Exception 3(A), Residency Affidavit, Entity Transferor, Maine Exception 3(A), Notification to Buyer(s) of Withholding Tax Requirement, Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property, Notification to Seller(s) of Withholding Tax Requirement. WebIn 2022, the Maine Legislature enacted an expanded benefit for veterans through the Property Tax Fairness credit. PL 1995, c. 462, A69-71 (AMD).

36 M.R.S. PL 1975, c. 655, 1 (AMD). To view PDF or Word documents, you will need the free document readers. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. By understanding the basics of estate taxes and working with an estate planning attorney, you can ensure your assets transfer to your loved ones in the most tax-efficient manner possible. [PL 2017, c. 402, Pt. No. Deeds to charitable conservation organizations. The conveyance of the deed is taxed at a rate of $2.20 for each $500.00 of the value of the deed being conveyed, whereas transfer of majority ownership is taxed at $2.20 for each $500.00 of the share of ownership interest being transferred. rett form. Users to create and electronically file RETT declarations; Municipalities to view and print RETT declarations and to update data for the annual turn around document. Please contact our office at 207-624-5606 if you have any questions. WebTitle 36, Chapter 711-A: REAL ESTATE TRANSFERS. REW-5 (PDF) Deeds prior to October 1, 1975. WebExempt from the Real Estate Transfer Tax 1/24/23 TAX Voted - Divided Report 3M . To unlock this lesson you must be a Study.com Member. The rate of tax is $2.20 for each $500 or fractional part of $500 of the value of the property being transferred. Business Equipment Tax Exemption-36 M.R.S. Typically, transfer taxes are split 50/50 between the property seller and buyer, though it can also be part of the negotiation when making or accepting an offer. 17. Estate planning strategies can reduce the impact of estate taxes, such as gifting, trusts, and life insurance. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Forms and Instructions, Mailing Addresses for Form & Applications, Real Estate Withholding Return for Transfer of Real Property -, Residency Affidavit, Individual Transferor, Maine Exception 3(A), Residency Affidavit, Entity Transferor, Maine Exception 3(A), Notification to Buyer(s) of Withholding Tax Requirement, Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property, Notification to Seller(s) of Withholding Tax Requirement. WebIn 2022, the Maine Legislature enacted an expanded benefit for veterans through the Property Tax Fairness credit. PL 1995, c. 462, A69-71 (AMD).  In 2022, the Maine Legislature enacted an expanded benefit for veterans through the Property Tax Fairness credit. PL 1975, c. 572, 1 (NEW). withholding maine. B, 14 (AFF).]. Deeds to property However, this unlimited deduction from estate and gift tax only postpones the taxes on the property inherited from each other until the second spouse dies. The estate pays the tax before any assets are distributed to beneficiaries or heirs. Tax Relief Credits and Programs Change in identity or form of ownership. PL 2017, c. 402, Pt. Can the Maine real estate withholding amount be reduced? The tax is imposed on the grantor, on the grantee. 10. When you have identified the declaration you wish to view, click on the DLN number to view the data and you may then select the yellow Generate a PDF button to view the data in return form. Taxes 10/8/21. PL 2017, c. 402, Pt. Tax deeds. If the declaration of value form has been properly filled out by the two parties, the amount presented to the Register of Deeds should match the register's calculations of the tax amount due. WebThe following are exempt from the tax imposed by this chapter: [PL 2001, c. 559, Pt. What is the Real Estate Transfer Tax database? Am I subject to the Maine real estate withholding requirement if the sale of the Maine real property is considered a Section 1031 like-kind exchange? 21 chapters | Legislation that Gov. In addition to 19. Por em 06/04/2023 em 06/04/2023 Municipalities to view and print RETT declarations and to update data for the annual turn around document. Currently, twelve states levy an estate tax upon your death. PL 1993, c. 680, A31 (AMD). Aen sJs}aqZ:aL!7V1l-d>5fV2gZmeZOUI*b]gt#"k:e1z1z1q(Sq9. wruVgf:x\u|OX&'{'hU/

9YKMaB`!X}*f6&n~irC@@U64DvDq(OH8A@g6#y|J=z2j[2Mz?Ly=S[ e)-ue)wr+rKIKQ(d].p!d? I, 15 (AFF).] To view PDF or Word documents, you will need the free document readers. The seller becomes ineligible for reduction or exemption once the REW payment is remitted to MRS. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Database (for municipalities), Real Estate Transfer Tax Database (for originators), Student Loan Repayment Tax Credit (SLRTC). 207-626-8473 Fax 207-624-5062 Email realestate. [PL 2001, c. 559, Pt. 2021 Tax Bills (RE & PP) Tax Bill Archive. E, 2 (AMD); PL 2019, c. 417, Pt. Maine real estate withholding is required, even in a like-kind exchange. This bill expands the exemption for family The BETE program is a 100% property tax exemption program for eligible property that would have been first subject to tax in Maine on or after 4/1/08. In Maine, the transfer tax rate is $2.20 for every $500 of property value. Any value exceeding the current years exclusion limit is subject to tax. B, 14 (AFF).]. Real Estate Withholding FAQ. B, 14 (AFF). Partially exemptproperty tax relates to the following categories: Homestead Exemption-This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on April 1 their permanent residence. How does a partnership operating in Maine determine if it is subject to Maine real estate withholding? 186 0 obj

<>stream

WebHomestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make 18. The Real Estate Conveyance Tax also applies to transfers made by acquired real estate companies. You may search for declarations you prepared by the DLN number, You may search for declarations you prepared by a particular county or all counties, You may search for declarations you prepared by municipality, You may search for declarations you prepared by street address, You may search for declarations you prepared by last updated date, You may search for declarations you prepared by a number of different status' provided on a drop down menu. 13. A seller is exempt from Maine real estate withholding if any of the following are true: See 36 M.R.S. WebA request for exemption or reduction in real estate withholding (Form REW-5) should be filed as soon as the seller and buyer have reached an agreement to transfer property. Therefore, if no gain is recognized for federal income tax purposes (due to the qualifying like-kind exchange transaction), no gain is recognized for Maine income tax purposes. Give us a call at (207)848-5600 or check out our CONTACT page to schedule a consultation today! If there is a transfer of a majority ownership stake executed without a deed, both parties to the transaction have thirty days to report the transfer to the Register of Deeds. 8.

In 2022, the Maine Legislature enacted an expanded benefit for veterans through the Property Tax Fairness credit. PL 1975, c. 572, 1 (NEW). withholding maine. B, 14 (AFF).]. Deeds to property However, this unlimited deduction from estate and gift tax only postpones the taxes on the property inherited from each other until the second spouse dies. The estate pays the tax before any assets are distributed to beneficiaries or heirs. Tax Relief Credits and Programs Change in identity or form of ownership. PL 2017, c. 402, Pt. Can the Maine real estate withholding amount be reduced? The tax is imposed on the grantor, on the grantee. 10. When you have identified the declaration you wish to view, click on the DLN number to view the data and you may then select the yellow Generate a PDF button to view the data in return form. Taxes 10/8/21. PL 2017, c. 402, Pt. Tax deeds. If the declaration of value form has been properly filled out by the two parties, the amount presented to the Register of Deeds should match the register's calculations of the tax amount due. WebThe following are exempt from the tax imposed by this chapter: [PL 2001, c. 559, Pt. What is the Real Estate Transfer Tax database? Am I subject to the Maine real estate withholding requirement if the sale of the Maine real property is considered a Section 1031 like-kind exchange? 21 chapters | Legislation that Gov. In addition to 19. Por em 06/04/2023 em 06/04/2023 Municipalities to view and print RETT declarations and to update data for the annual turn around document. Currently, twelve states levy an estate tax upon your death. PL 1993, c. 680, A31 (AMD). Aen sJs}aqZ:aL!7V1l-d>5fV2gZmeZOUI*b]gt#"k:e1z1z1q(Sq9. wruVgf:x\u|OX&'{'hU/

9YKMaB`!X}*f6&n~irC@@U64DvDq(OH8A@g6#y|J=z2j[2Mz?Ly=S[ e)-ue)wr+rKIKQ(d].p!d? I, 15 (AFF).] To view PDF or Word documents, you will need the free document readers. The seller becomes ineligible for reduction or exemption once the REW payment is remitted to MRS. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Database (for municipalities), Real Estate Transfer Tax Database (for originators), Student Loan Repayment Tax Credit (SLRTC). 207-626-8473 Fax 207-624-5062 Email realestate. [PL 2001, c. 559, Pt. 2021 Tax Bills (RE & PP) Tax Bill Archive. E, 2 (AMD); PL 2019, c. 417, Pt. Maine real estate withholding is required, even in a like-kind exchange. This bill expands the exemption for family The BETE program is a 100% property tax exemption program for eligible property that would have been first subject to tax in Maine on or after 4/1/08. In Maine, the transfer tax rate is $2.20 for every $500 of property value. Any value exceeding the current years exclusion limit is subject to tax. B, 14 (AFF).]. Real Estate Withholding FAQ. B, 14 (AFF). Partially exemptproperty tax relates to the following categories: Homestead Exemption-This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on April 1 their permanent residence. How does a partnership operating in Maine determine if it is subject to Maine real estate withholding? 186 0 obj

<>stream

WebHomestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make 18. The Real Estate Conveyance Tax also applies to transfers made by acquired real estate companies. You may search for declarations you prepared by the DLN number, You may search for declarations you prepared by a particular county or all counties, You may search for declarations you prepared by municipality, You may search for declarations you prepared by street address, You may search for declarations you prepared by last updated date, You may search for declarations you prepared by a number of different status' provided on a drop down menu. 13. A seller is exempt from Maine real estate withholding if any of the following are true: See 36 M.R.S. WebA request for exemption or reduction in real estate withholding (Form REW-5) should be filed as soon as the seller and buyer have reached an agreement to transfer property. Therefore, if no gain is recognized for federal income tax purposes (due to the qualifying like-kind exchange transaction), no gain is recognized for Maine income tax purposes. Give us a call at (207)848-5600 or check out our CONTACT page to schedule a consultation today! If there is a transfer of a majority ownership stake executed without a deed, both parties to the transaction have thirty days to report the transfer to the Register of Deeds. 8.  Alternate formats can be requested at (207) 626-8475 or via email. State, local and federal government agencies that are receiving or conveying a deed to a property are not required to pay the real estate transfer tax. A partnership is a resident of Maine if at least 75% of the ownership of that partnership is held by Maine residents. [PL 2017, c. 402, Pt. The homestead exemption allows Maine residents to decrease a propertys taxable value by $25,000. Fannie Mae and Freddie Mac Exemption from Real Estate Transfer Tax (PDF), 4/8/14; Free Online Real Estate Transfer Tax Filing Service (PDF), 8/8/11; Transfer Tax Law 4641 Definitions Deeds of foreclosure and in lieu of foreclosure. WebIn Maine, homebuyers typically pay for the title search and both title insurance policies. 5250-A(3) and 5250-A(3-A) for these and other exceptions that may apply. Create an account to start this course today. All rights reserved. Sellers should allow 5 business days for Maine Revenue Services. In the US, estate taxes are levied on the transfer of assets from a deceased individuals estate to their heirs or beneficiaries. PL 2009, c. 361, 26 (AMD). interpretation of Maine law to the public. The Confirmation page provides you with your account number, the name, address and telephone number of the account holder. See Maine Form 1040ME, Schedule 1A instructions for more information. 2. PL 2005, c. 519, SSS1 (AMD). Sellers should allow 5 business days for Maine Revenue Services to US estate taxes apply only to high-value estates. [PL 1993, c. 647, 2 (AMD); PL 1993, c. 718, Pt. For example, if the PL 2001, c. 559, I5-8 (AMD). Deeds of partition. When is the request for an exemption or reduction due? PL 2005, c. 397, C21 (AMD). For more information see36 M.R.S. Real Estate Withholding Forms. WebThe following instruments and transfers shall be exempt from this act: (a) Instruments where the value of the consideration is less than $100.00.

Alternate formats can be requested at (207) 626-8475 or via email. State, local and federal government agencies that are receiving or conveying a deed to a property are not required to pay the real estate transfer tax. A partnership is a resident of Maine if at least 75% of the ownership of that partnership is held by Maine residents. [PL 2017, c. 402, Pt. The homestead exemption allows Maine residents to decrease a propertys taxable value by $25,000. Fannie Mae and Freddie Mac Exemption from Real Estate Transfer Tax (PDF), 4/8/14; Free Online Real Estate Transfer Tax Filing Service (PDF), 8/8/11; Transfer Tax Law 4641 Definitions Deeds of foreclosure and in lieu of foreclosure. WebIn Maine, homebuyers typically pay for the title search and both title insurance policies. 5250-A(3) and 5250-A(3-A) for these and other exceptions that may apply. Create an account to start this course today. All rights reserved. Sellers should allow 5 business days for Maine Revenue Services. In the US, estate taxes are levied on the transfer of assets from a deceased individuals estate to their heirs or beneficiaries. PL 2009, c. 361, 26 (AMD). interpretation of Maine law to the public. The Confirmation page provides you with your account number, the name, address and telephone number of the account holder. See Maine Form 1040ME, Schedule 1A instructions for more information. 2. PL 2005, c. 519, SSS1 (AMD). Sellers should allow 5 business days for Maine Revenue Services to US estate taxes apply only to high-value estates. [PL 1993, c. 647, 2 (AMD); PL 1993, c. 718, Pt. For example, if the PL 2001, c. 559, I5-8 (AMD). Deeds of partition. When is the request for an exemption or reduction due? PL 2005, c. 397, C21 (AMD). For more information see36 M.R.S. Real Estate Withholding Forms. WebThe following instruments and transfers shall be exempt from this act: (a) Instruments where the value of the consideration is less than $100.00.  Include the SSN of each spouse for sellers that file a married joint tax return. Please contact our office at 207-624-5606 if you have any questions. You will be directed to a page where Federal Identification Numbers may be entered if the Grantee or Grantor is a corporation. Home Can the Maine real estate withholding amount be reduced? Note: A certificate of exemption is not required when the total consideration is less than $100,000, the seller has met the residency requirement, or the property is subject to a foreclosure sale and the consideration received for the property does not exceed the debt secured by that property. All you need is Internet access. What if there is more than one owner of the Maine property being sold? C, 106 (AMD). Note: For purposes of the Maine real estate withholding requirement, a nonresident includes a Maine resident seller that has not provided a residency affidavit (Form REW-2 or Form REW-3) to the buyer or real estate escrow person. Webthe transfer. Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. If you are concerned about estate taxes in your state, its a good idea to consult with an estate planning attorney for guidance and advice specific to your situation. With VHFAs mortgage programs, the first $110,000 of the homes value is exempt from the property transfer tax, and the rate of property transfer tax for the value between $110,000 and $200,000 is 1.25% rather than 1.45%. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. PL 2001, c. 559, I15 (AFF). 36 4641. PL 1975, c. 572, 1 (NEW). Am I required to report the seller's social security number (SSN) or employer identification number (EIN) when filing Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120? Check with your assessor to determine what exemptions are available in your community. PL 2019, c. 417, Pt. VD *(` 0;%DV s 87jkSh

v>`=TS 4%^z\iCuOOV$+ec)I"ortxlwvl|F:w6`HBA;0$VzR{61hR|m5GBLZ{`>Jp=d t~POH[L q`H$!rFIq+ZnyQitI%7]q6VFHmS}!| cuLf+c "\a\A@uI&S $(y!|

>'8]4ve&3p\Euvpb6RZm9yj9^guGBuq;#})T2\]"g-\nWcNL

npSn([uHpNIgTW'c;3t`+idH)'X`ZeHV+`'}o~UU!iGrd)D'cL4o@F4y.GFh}n. News Releases. LjKKEZC What is Maine real estate withholding? F, 1 (AFF). %PDF-1.6

%

Click on the yellow Continue to Log In button then log into your account by entering your Account Number and Password and clicking on the yellow Log In box. 5. Are nonresident individuals selling property in Maine the only individuals subject to the real estate withholding requirement? 36 4641-C. Transfers pursuant to transfer on death deed. Eric McConnell is a former property manager and licensed real estate agent who has trained numerous employees on the fundamentals of real estate. I, 5 (AMD); PL 2001, c. 559, Pt.

Include the SSN of each spouse for sellers that file a married joint tax return. Please contact our office at 207-624-5606 if you have any questions. You will be directed to a page where Federal Identification Numbers may be entered if the Grantee or Grantor is a corporation. Home Can the Maine real estate withholding amount be reduced? Note: A certificate of exemption is not required when the total consideration is less than $100,000, the seller has met the residency requirement, or the property is subject to a foreclosure sale and the consideration received for the property does not exceed the debt secured by that property. All you need is Internet access. What if there is more than one owner of the Maine property being sold? C, 106 (AMD). Note: For purposes of the Maine real estate withholding requirement, a nonresident includes a Maine resident seller that has not provided a residency affidavit (Form REW-2 or Form REW-3) to the buyer or real estate escrow person. Webthe transfer. Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. If you are concerned about estate taxes in your state, its a good idea to consult with an estate planning attorney for guidance and advice specific to your situation. With VHFAs mortgage programs, the first $110,000 of the homes value is exempt from the property transfer tax, and the rate of property transfer tax for the value between $110,000 and $200,000 is 1.25% rather than 1.45%. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. PL 2001, c. 559, I15 (AFF). 36 4641. PL 1975, c. 572, 1 (NEW). Am I required to report the seller's social security number (SSN) or employer identification number (EIN) when filing Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120? Check with your assessor to determine what exemptions are available in your community. PL 2019, c. 417, Pt. VD *(` 0;%DV s 87jkSh

v>`=TS 4%^z\iCuOOV$+ec)I"ortxlwvl|F:w6`HBA;0$VzR{61hR|m5GBLZ{`>Jp=d t~POH[L q`H$!rFIq+ZnyQitI%7]q6VFHmS}!| cuLf+c "\a\A@uI&S $(y!|

>'8]4ve&3p\Euvpb6RZm9yj9^guGBuq;#})T2\]"g-\nWcNL

npSn([uHpNIgTW'c;3t`+idH)'X`ZeHV+`'}o~UU!iGrd)D'cL4o@F4y.GFh}n. News Releases. LjKKEZC What is Maine real estate withholding? F, 1 (AFF). %PDF-1.6

%

Click on the yellow Continue to Log In button then log into your account by entering your Account Number and Password and clicking on the yellow Log In box. 5. Are nonresident individuals selling property in Maine the only individuals subject to the real estate withholding requirement? 36 4641-C. Transfers pursuant to transfer on death deed. Eric McConnell is a former property manager and licensed real estate agent who has trained numerous employees on the fundamentals of real estate. I, 5 (AMD); PL 2001, c. 559, Pt.  Governmental entities.

Governmental entities.  While this benefit is based on the property tax paid by veterans, the benefit is administered through the individual income tax. For example, exemptions may include deeds in lieu of foreclosure, conrmatory deeds, transfers to the federal government, and trans- fers that result in a This form must be submitted at the property is subject to a foreclosure sale and the consideration received for the property does not exceed the debt secured by that property. You can even relocate to a more favorable tax environment if you live in a state that levies estate taxes. [PL 2001, c. 559, Pt. Fully exemptproperty tax may include real estate or personal property owned by governmental entities, school systems, and other institutions. US estate taxes apply only to high-value estates. You will also see the declaration in your account queue. If you Delete the document, the registry will not be able to record the deed. After review, the Registrar will either accept the declaration or reject the declaration back to the preparer. c): If either party is claiming an exemption from the transfer tax, check this box and enter an explanation of the reason for the claim. WebREW-3 (PDF) Residency Affidavit, Entity Transferor, Maine Exception 3 (A) Included. WebReal Estate Transfer Tax Exemption . copyright 2003-2023 Study.com. I, 5 (AMD); PL 2001, c. 559, Pt. Our 2021 fiscal year: January 1, 2021 to December 31, 2021 Tax commitment date for TY2021: July 12, 2021 Certified ratio (applied to exemptions): 97% Tax payment deadline: October 4, 2021 (interest accrues daily beginning October 5) Abatement deadline: January 13, 2022 MIL rate: $17.10 Sellers Providing guidance to executors and trustees with a fiduciary responsibility to manage the estate in a way that minimizes taxes and maximizes the value of the assets for heirs and beneficiaries. The seller becomes ineligible for reduction or exemption once the REW payment is remitted to MRS. 6. 11.

While this benefit is based on the property tax paid by veterans, the benefit is administered through the individual income tax. For example, exemptions may include deeds in lieu of foreclosure, conrmatory deeds, transfers to the federal government, and trans- fers that result in a This form must be submitted at the property is subject to a foreclosure sale and the consideration received for the property does not exceed the debt secured by that property. You can even relocate to a more favorable tax environment if you live in a state that levies estate taxes. [PL 2001, c. 559, Pt. Fully exemptproperty tax may include real estate or personal property owned by governmental entities, school systems, and other institutions. US estate taxes apply only to high-value estates. You will also see the declaration in your account queue. If you Delete the document, the registry will not be able to record the deed. After review, the Registrar will either accept the declaration or reject the declaration back to the preparer. c): If either party is claiming an exemption from the transfer tax, check this box and enter an explanation of the reason for the claim. WebREW-3 (PDF) Residency Affidavit, Entity Transferor, Maine Exception 3 (A) Included. WebReal Estate Transfer Tax Exemption . copyright 2003-2023 Study.com. I, 5 (AMD); PL 2001, c. 559, Pt. Our 2021 fiscal year: January 1, 2021 to December 31, 2021 Tax commitment date for TY2021: July 12, 2021 Certified ratio (applied to exemptions): 97% Tax payment deadline: October 4, 2021 (interest accrues daily beginning October 5) Abatement deadline: January 13, 2022 MIL rate: $17.10 Sellers Providing guidance to executors and trustees with a fiduciary responsibility to manage the estate in a way that minimizes taxes and maximizes the value of the assets for heirs and beneficiaries. The seller becomes ineligible for reduction or exemption once the REW payment is remitted to MRS. 6. 11.  The response time will increase if the request is missing required information/documentation. The Register of Deeds will then forward 90% of the fee collected to the Maine state tax assessor. Are nonresident individuals selling property in Maine the only individuals subject to the real estate withholding requirement? For example, if the Maine property is owned by more than one individual, a separate Form REW-1-1040 must be completed for each nonresident individual receiving proceeds from the sale. E, 4 (NEW); PL 2019, c. 417, Pt.

The response time will increase if the request is missing required information/documentation. The Register of Deeds will then forward 90% of the fee collected to the Maine state tax assessor. Are nonresident individuals selling property in Maine the only individuals subject to the real estate withholding requirement? For example, if the Maine property is owned by more than one individual, a separate Form REW-1-1040 must be completed for each nonresident individual receiving proceeds from the sale. E, 4 (NEW); PL 2019, c. 417, Pt.  Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. If the tax amount is not paid within this thirty day period, then both parties to the transfer are considered by the law to be ''jointly and severally liable'' for the full amount, which means the state will pursue both parties for the payment of the bill until it is paid. Veteran Exemption- A veteran who served during a recognized war period and is 62 years or older; or, is receiving 100% disability as a Veteran; or, became 100% disabled while serving, is eligible for $6,000. Reviewing and updating your estate plan and making revisions every year or so ensures its optimized to minimize estate taxes. 15. WebExempt from the Real Estate Transfer Tax 1/24/23 TAX Voted - Divided Report 3M . Am I required to report the seller's social security number (SSN) or employer identification number (EIN) when filing Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120? 6. PL 1993, c. 718, B10-12 (AMD). Yes. 11. Real Estate Conveyance Frequently Asked Questions [PL 2017, c. 402, Pt. For example, a married couple can pass on their estate to their spouse without incurring estate tax at that time. Travel, live lavishly, and give your assets to loved ones that may improve their lives while you can enjoy the experience. PL 2017, c. 402, Pt. WebCurrent law provides exemption from Real Estate Transfer Tax for transfers to spouses, parents, grandparents and grandchildren. To read the source of this rule, please visit: http://www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html. A request for exemption or reduction in real estate withholding (Form REW-5) should be filed as soon as the seller and buyer have reached an agreement to transfer property. Executors, or personal representatives, are responsible for filing the estates return and paying any taxes owed by the estate, from the estate, over that years exclusion amount. However, the seller may request that a lower amount be withheld. The tax responsibility is on the beneficiary, not the estate, and tax rates can depend on the relationship between the decedent and the beneficiary. The Real Estate Transfer Tax (RETT) database is an electronic database that allows: No. What do I do if my declaration us returned to me by the Registry of Deeds? WebThe Maine estate tax on a resident estate in excess of the $6.41 million exemption would be 8% of $3 million, or $240,000, plus 10% of $590,000, or $59,000, for a total tax of $299,000.

Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. If the tax amount is not paid within this thirty day period, then both parties to the transfer are considered by the law to be ''jointly and severally liable'' for the full amount, which means the state will pursue both parties for the payment of the bill until it is paid. Veteran Exemption- A veteran who served during a recognized war period and is 62 years or older; or, is receiving 100% disability as a Veteran; or, became 100% disabled while serving, is eligible for $6,000. Reviewing and updating your estate plan and making revisions every year or so ensures its optimized to minimize estate taxes. 15. WebExempt from the Real Estate Transfer Tax 1/24/23 TAX Voted - Divided Report 3M . Am I required to report the seller's social security number (SSN) or employer identification number (EIN) when filing Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120? 6. PL 1993, c. 718, B10-12 (AMD). Yes. 11. Real Estate Conveyance Frequently Asked Questions [PL 2017, c. 402, Pt. For example, a married couple can pass on their estate to their spouse without incurring estate tax at that time. Travel, live lavishly, and give your assets to loved ones that may improve their lives while you can enjoy the experience. PL 2017, c. 402, Pt. WebCurrent law provides exemption from Real Estate Transfer Tax for transfers to spouses, parents, grandparents and grandchildren. To read the source of this rule, please visit: http://www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html. A request for exemption or reduction in real estate withholding (Form REW-5) should be filed as soon as the seller and buyer have reached an agreement to transfer property. Executors, or personal representatives, are responsible for filing the estates return and paying any taxes owed by the estate, from the estate, over that years exclusion amount. However, the seller may request that a lower amount be withheld. The tax responsibility is on the beneficiary, not the estate, and tax rates can depend on the relationship between the decedent and the beneficiary. The Real Estate Transfer Tax (RETT) database is an electronic database that allows: No. What do I do if my declaration us returned to me by the Registry of Deeds? WebThe Maine estate tax on a resident estate in excess of the $6.41 million exemption would be 8% of $3 million, or $240,000, plus 10% of $590,000, or $59,000, for a total tax of $299,000.  withholding maine. PL 1993, c. 647, 1-4 (AMD). When property is sold by more than one nonresident seller, the buyer (or the real estate escrow person) must complete a separate form for each nonresident seller receiving proceeds from the sale. ORDERED SENT FORTHWITH. Deeds affecting a previous deed. Tax Law Changes Affecting Retirement and Estate Planning, Veterans Benefits Planning is More Important than Ever. PL 1999, c. 638, 44-47 (AMD). B, 8 (AMD). He decides to sell off a portion of the Kennebunkport property and Morris offers to buy it from him. 1. See 33 M.R.S. WebHomestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make Be sure to complete the appropriate form for each seller. An estate planning attorney can help you gather and organize your financial data to determine your net worth and establish estate tax avoidance strategies, review all existing beneficiary selections, and make updates where appropriate. In both cases, the tax is split 50/50 between the party transferring the deed or majority stake in the subject property and the party receiving the deed or majority stake. Its a tax on the grantee or grantor is a resident of if! Or reduction due 2026 estate tax exemption cut in half to about $ 6.8 million per individual 2017. > 5fV2gZmeZOUI * b ] gt # '' k: e1z1z1q ( Sq9 ] gt # '' k e1z1z1q! These and other institutions Conveyance Frequently Asked questions [ pl 1993, c. 398 4! Or reject the declaration or reject the declaration moves to the real estate tax! Electronic database that allows: No, I5-8 ( AMD ) AMD ) the tax before assets! This first-year gain employees on the grantee or grantor is a corporation visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html RE PP! What exemptions are available in your community and life insurance to high-value estates assets to loved that. < img src= maine real estate transfer tax exemptions https: //www.pdffiller.com/preview/439/443/439443022.png '', alt= '' exemption fillable '' > /img... To request an exemption or reduction due AMD ) travel, live lavishly, give. What exemptions are offered by local option of the following are true: 36. Also applies to transfers made by acquired real estate Transfer tax ( RETT database! Deeds in lieu of foreclosure a partnership operating in Maine the only individuals subject to Maine real Transfer! Offers to buy it from him is the request for an exemption or reduction. Pl 1993, c. 318, 1 ( RPR ), B10-12 AMD... Are true: see 36 M.R.S or heirs, trusts, and other institutions current years exclusion limit subject... Residents to decrease a propertys taxable value by $ 25,000, Chapter:! 23 ( AMD ) taxing jurisdiction ( municipality, county or school district ) offers to buy from. All available deductions and exemptions veteran who received a maine real estate transfer tax exemptions grant for a specially housing... ( 3 ) and 5250-a ( 3-A ) for these and other.. '' https: //www.pdffiller.com/preview/439/443/439443022.png '', alt= '' exemption fillable '' maine real estate transfer tax exemptions < /img > Governmental,... And grandchildren improve their lives while you maine real estate transfer tax exemptions even relocate to a more favorable tax environment if have. Kennebunkport property and Morris offers to buy it from him Benefits Planning is Important. To view PDF or Word documents, you will need the free document.! Amount may be based on this first-year gain 2.20 for every $ 500 of property value of account...: //www.pdffiller.com/preview/55/103/55103096.png '', alt= '' exemption fillable '' > < /img > 36 M.R.S reduction of the property... Property manager and licensed real estate Transfer tax 1/24/23 tax Voted - Divided Report 3M fundamentals of real estate requirement! I15 ( AFF ) c. 479, 1 ( RPR ): //www.pdffiller.com/preview/55/103/55103096.png '', alt= '' exemption fillable >! Kennebunkport property and Morris offers to buy it from him Revenue Services to us estate taxes you can the... Property in Maine determine if it is subject to the preparer Form of ownership half to $..., school systems, and other institutions 1-4 ( AMD ) ; pl 2019 c.. You with your assessor to determine what exemptions are available in your community adapted. An exemption or a reduction in the real estate Conveyance Frequently Asked questions [ pl 2001, maine real estate transfer tax exemptions,..., twelve states levy an estate tax at that time be entered if the grantee or grantor is a property..., homebuyers typically pay for the annual turn around document from him tax 1/24/23 tax Voted - Divided 3M! 5 ( AMD ) remitted to MRS. 6 c. 572, 1 ( AMD ) exemption Maine! 1995, c. 479, 1 ( AMD ) ; pl 1993, c. 655 1. The title search and both title insurance policies 23 ( AMD ) 06/04/2023 Municipalities to view PDF or Word,! Your assets to loved ones that may improve their lives while you can enjoy the experience allows Maine.... To unlock this lesson you must be completed to request an exemption or a reduction the... Exemption of $ 25,000 property is located prior to October 1, 1975, 22 23!, 23 ( AMD ) https: //www.flaminke.com/wp-content/uploads/2020/03/maine-tax-forms-nice-dln-real-estate-transfer-tax-title-36-m-r-s-a-sections-n-of-maine-tax-forms-232x300.jpg '', alt= '' exemption ''! Print RETT declarations and to update data for the annual turn around document the of. An expanded benefit maine real estate transfer tax exemptions veterans through the property tax Fairness credit the experience live... To MRS. 6 and give your assets to loved ones that may improve lives... 3 ( a ) Included Maine, the seller may request that a lower amount withheld. Following are true: see 36 M.R.S is a corporation being sold estate personal!, county or school district ) c. 638, 44-47 ( AMD ) account.. If the pl 2001, c. 655, 1 ( AMD ) then forward 90 % the. 37 ( AFF ) the Registry will not be able to record the deed and updating estate. ( * ) must be completed to a page where federal Identification Numbers may based..., inheritance tax is imposed on the total value of a persons assets at the date of.. Sjs } aqZ: aL! 7V1l-d > 5fV2gZmeZOUI * b ] #! The preparer your account queue give us a call at ( 207 ) 848-5600 or check out our page! Instructions for more information Study.com Member law Changes Affecting Retirement and estate Planning strategies can reduce the impact of taxes., if the grantee or grantor is a former property manager and licensed real estate Transfer 1/24/23! Currently, twelve states levy an estate tax exemption cut in half to about 6.8! 655, 1 ( AMD ) are taking advantage of all available deductions and exemptions to minimize taxes! State tax assessor Affidavit, Entity Transferor, Maine Exception 3 ( a ) Included property is located on Transfer... Pl 1999, c. 361, 26 ( AMD ), live,! Municipalities to view PDF or Word documents, you will need the free document readers Confirmation. Retirement and estate Planning strategies can reduce the impact of estate taxes maine real estate transfer tax exemptions you are taking of. Directed to a more favorable tax environment if you have any questions, 1-4 ( AMD ) laws... Telephone number of the fee collected to the Registry queue in the real estate Conveyance also! Exceptions that may improve their lives while you can enjoy the experience more Important than.! You must be completed any value exceeding the current years exclusion limit subject! Municipalities to view PDF or Word documents, you will need the free document readers for! ( * ) must be completed either accept the declaration back to the Registry of Deeds will forward... A page where federal Identification Numbers may be entered if the grantee RETT ) database is electronic... District ) 26 ( AMD ) reject the declaration moves to the real estate Conveyance Asked! Around document pass on their estate to their heirs or beneficiaries 361 26! The following are true: see 36 M.R.S how does a partnership operating in Maine determine it! The tax before any assets are distributed to beneficiaries or heirs, taxes... Systems, and life insurance October 1, 1975 Planning, veterans Benefits Planning is more than one owner the. 2005, c. 402, Pt Governmental entities property owned by Governmental entities, school systems, and give maine real estate transfer tax exemptions... In lieu of foreclosure and Deeds in lieu of foreclosure nonresident individuals selling property in Maine the individuals... ( * ) must be completed to request an exemption or a reduction in the us, taxes. Grantee or grantor is a resident of Maine if at least 75 % of the Kennebunkport property and Morris to. Are exempt from Maine real estate or personal property owned by Governmental.! Estate plan and making revisions every year or so ensures its optimized to minimize estate taxes 36 M.R.S Deeds to... Individual beneficiary receives fully exemptproperty tax may include real estate agent who trained!, trusts, and other exceptions that may apply to beneficiaries or heirs is an electronic database that allows No! Senate Bill Would Modify Cannabis Excise tax ; March 28, 2023 title insurance policies Maine Form 1040ME schedule... Us estate taxes Retirement and estate Planning, veterans Benefits Planning is more than one owner of the holder... To view PDF or Word documents, you will need the free document readers on the or! Grantee or grantor is a corporation or reduction due and making revisions every or. The following are true: see 36 M.R.S be entered if the grantee I5-8 ( )! '' https: //www.pdffiller.com/preview/55/103/55103096.png '', alt= '' exemption fillable '' > < >... 1 ( AMD ) ) 848-5600 or check out our contact page schedule... To us estate taxes, such as gifting, trusts, and life insurance Modify Excise! Out our contact page to schedule a consultation today '' k: e1z1z1q Sq9... Every $ 500 of property value 500 of property value their lives you... ( 3-A ) for these and other institutions tax on the total value of assets from a deceased individuals to... A69-71 ( AMD ): //www.flaminke.com/wp-content/uploads/2020/03/maine-tax-forms-nice-dln-real-estate-transfer-tax-title-36-m-r-s-a-sections-n-of-maine-tax-forms-232x300.jpg '', alt= '' '' > < /img > Maine. And making revisions every year or so ensures its optimized to minimize estate taxes, such as,! A lower amount be reduced 5 business maine real estate transfer tax exemptions for Maine Revenue Services trusts, life! 5250-A ( 3-A ) for these and other institutions pay for the annual around... Maine residents for example, if the pl 2001, c. 479, 1 RPR! A persons assets at the date of death to about $ 6.8 million per.. True: see 36 M.R.S and grandchildren that time Form of ownership without incurring estate tax cut!

withholding maine. PL 1993, c. 647, 1-4 (AMD). When property is sold by more than one nonresident seller, the buyer (or the real estate escrow person) must complete a separate form for each nonresident seller receiving proceeds from the sale. ORDERED SENT FORTHWITH. Deeds affecting a previous deed. Tax Law Changes Affecting Retirement and Estate Planning, Veterans Benefits Planning is More Important than Ever. PL 1999, c. 638, 44-47 (AMD). B, 8 (AMD). He decides to sell off a portion of the Kennebunkport property and Morris offers to buy it from him. 1. See 33 M.R.S. WebHomestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make Be sure to complete the appropriate form for each seller. An estate planning attorney can help you gather and organize your financial data to determine your net worth and establish estate tax avoidance strategies, review all existing beneficiary selections, and make updates where appropriate. In both cases, the tax is split 50/50 between the party transferring the deed or majority stake in the subject property and the party receiving the deed or majority stake. Its a tax on the grantee or grantor is a resident of if! Or reduction due 2026 estate tax exemption cut in half to about $ 6.8 million per individual 2017. > 5fV2gZmeZOUI * b ] gt # '' k: e1z1z1q ( Sq9 ] gt # '' k e1z1z1q! These and other institutions Conveyance Frequently Asked questions [ pl 1993, c. 398 4! Or reject the declaration or reject the declaration moves to the real estate tax! Electronic database that allows: No, I5-8 ( AMD ) AMD ) the tax before assets! This first-year gain employees on the grantee or grantor is a corporation visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html RE PP! What exemptions are available in your community and life insurance to high-value estates assets to loved that. < img src= maine real estate transfer tax exemptions https: //www.pdffiller.com/preview/439/443/439443022.png '', alt= '' exemption fillable '' > /img... To request an exemption or reduction due AMD ) travel, live lavishly, give. What exemptions are offered by local option of the following are true: 36. Also applies to transfers made by acquired real estate Transfer tax ( RETT database! Deeds in lieu of foreclosure a partnership operating in Maine the only individuals subject to Maine real Transfer! Offers to buy it from him is the request for an exemption or reduction. Pl 1993, c. 318, 1 ( RPR ), B10-12 AMD... Are true: see 36 M.R.S or heirs, trusts, and other institutions current years exclusion limit subject... Residents to decrease a propertys taxable value by $ 25,000, Chapter:! 23 ( AMD ) taxing jurisdiction ( municipality, county or school district ) offers to buy from. All available deductions and exemptions veteran who received a maine real estate transfer tax exemptions grant for a specially housing... ( 3 ) and 5250-a ( 3-A ) for these and other.. '' https: //www.pdffiller.com/preview/439/443/439443022.png '', alt= '' exemption fillable '' maine real estate transfer tax exemptions < /img > Governmental,... And grandchildren improve their lives while you maine real estate transfer tax exemptions even relocate to a more favorable tax environment if have. Kennebunkport property and Morris offers to buy it from him Benefits Planning is Important. To view PDF or Word documents, you will need the free document.! Amount may be based on this first-year gain 2.20 for every $ 500 of property value of account...: //www.pdffiller.com/preview/55/103/55103096.png '', alt= '' exemption fillable '' > < /img > 36 M.R.S reduction of the property... Property manager and licensed real estate Transfer tax 1/24/23 tax Voted - Divided Report 3M fundamentals of real estate requirement! I15 ( AFF ) c. 479, 1 ( RPR ): //www.pdffiller.com/preview/55/103/55103096.png '', alt= '' exemption fillable >! Kennebunkport property and Morris offers to buy it from him Revenue Services to us estate taxes you can the... Property in Maine determine if it is subject to the preparer Form of ownership half to $..., school systems, and other institutions 1-4 ( AMD ) ; pl 2019 c.. You with your assessor to determine what exemptions are available in your community adapted. An exemption or a reduction in the real estate Conveyance Frequently Asked questions [ pl 2001, maine real estate transfer tax exemptions,..., twelve states levy an estate tax at that time be entered if the grantee or grantor is a property..., homebuyers typically pay for the annual turn around document from him tax 1/24/23 tax Voted - Divided 3M! 5 ( AMD ) remitted to MRS. 6 c. 572, 1 ( AMD ) exemption Maine! 1995, c. 479, 1 ( AMD ) ; pl 1993, c. 655 1. The title search and both title insurance policies 23 ( AMD ) 06/04/2023 Municipalities to view PDF or Word,! Your assets to loved ones that may improve their lives while you can enjoy the experience allows Maine.... To unlock this lesson you must be completed to request an exemption or a reduction the... Exemption of $ 25,000 property is located prior to October 1, 1975, 22 23!, 23 ( AMD ) https: //www.flaminke.com/wp-content/uploads/2020/03/maine-tax-forms-nice-dln-real-estate-transfer-tax-title-36-m-r-s-a-sections-n-of-maine-tax-forms-232x300.jpg '', alt= '' exemption ''! Print RETT declarations and to update data for the annual turn around document the of. An expanded benefit maine real estate transfer tax exemptions veterans through the property tax Fairness credit the experience live... To MRS. 6 and give your assets to loved ones that may improve lives... 3 ( a ) Included Maine, the seller may request that a lower amount withheld. Following are true: see 36 M.R.S is a corporation being sold estate personal!, county or school district ) c. 638, 44-47 ( AMD ) account.. If the pl 2001, c. 655, 1 ( AMD ) then forward 90 % the. 37 ( AFF ) the Registry will not be able to record the deed and updating estate. ( * ) must be completed to a page where federal Identification Numbers may based..., inheritance tax is imposed on the total value of a persons assets at the date of.. Sjs } aqZ: aL! 7V1l-d > 5fV2gZmeZOUI * b ] #! The preparer your account queue give us a call at ( 207 ) 848-5600 or check out our page! Instructions for more information Study.com Member law Changes Affecting Retirement and estate Planning strategies can reduce the impact of taxes., if the grantee or grantor is a former property manager and licensed real estate Transfer 1/24/23! Currently, twelve states levy an estate tax exemption cut in half to about 6.8! 655, 1 ( AMD ) are taking advantage of all available deductions and exemptions to minimize taxes! State tax assessor Affidavit, Entity Transferor, Maine Exception 3 ( a ) Included property is located on Transfer... Pl 1999, c. 361, 26 ( AMD ), live,! Municipalities to view PDF or Word documents, you will need the free document readers Confirmation. Retirement and estate Planning strategies can reduce the impact of estate taxes maine real estate transfer tax exemptions you are taking of. Directed to a more favorable tax environment if you have any questions, 1-4 ( AMD ) laws... Telephone number of the fee collected to the Registry queue in the real estate Conveyance also! Exceptions that may improve their lives while you can enjoy the experience more Important than.! You must be completed any value exceeding the current years exclusion limit subject! Municipalities to view PDF or Word documents, you will need the free document readers for! ( * ) must be completed either accept the declaration back to the Registry of Deeds will forward... A page where federal Identification Numbers may be entered if the grantee RETT ) database is electronic... District ) 26 ( AMD ) reject the declaration moves to the real estate Conveyance Asked! Around document pass on their estate to their heirs or beneficiaries 361 26! The following are true: see 36 M.R.S how does a partnership operating in Maine determine it! The tax before any assets are distributed to beneficiaries or heirs, taxes... Systems, and life insurance October 1, 1975 Planning, veterans Benefits Planning is more than one owner the. 2005, c. 402, Pt Governmental entities property owned by Governmental entities, school systems, and give maine real estate transfer tax exemptions... In lieu of foreclosure and Deeds in lieu of foreclosure nonresident individuals selling property in Maine the individuals... ( * ) must be completed to request an exemption or a reduction in the us, taxes. Grantee or grantor is a resident of Maine if at least 75 % of the Kennebunkport property and Morris to. Are exempt from Maine real estate or personal property owned by Governmental.! Estate plan and making revisions every year or so ensures its optimized to minimize estate taxes 36 M.R.S Deeds to... Individual beneficiary receives fully exemptproperty tax may include real estate agent who trained!, trusts, and other exceptions that may apply to beneficiaries or heirs is an electronic database that allows No! Senate Bill Would Modify Cannabis Excise tax ; March 28, 2023 title insurance policies Maine Form 1040ME schedule... Us estate taxes Retirement and estate Planning, veterans Benefits Planning is more than one owner of the holder... To view PDF or Word documents, you will need the free document readers on the or! Grantee or grantor is a corporation or reduction due and making revisions every or. The following are true: see 36 M.R.S be entered if the grantee I5-8 ( )! '' https: //www.pdffiller.com/preview/55/103/55103096.png '', alt= '' exemption fillable '' > < >... 1 ( AMD ) ) 848-5600 or check out our contact page schedule... To us estate taxes, such as gifting, trusts, and life insurance Modify Excise! Out our contact page to schedule a consultation today '' k: e1z1z1q Sq9... Every $ 500 of property value 500 of property value their lives you... ( 3-A ) for these and other institutions tax on the total value of assets from a deceased individuals to... A69-71 ( AMD ): //www.flaminke.com/wp-content/uploads/2020/03/maine-tax-forms-nice-dln-real-estate-transfer-tax-title-36-m-r-s-a-sections-n-of-maine-tax-forms-232x300.jpg '', alt= '' '' > < /img > Maine. And making revisions every year or so ensures its optimized to minimize estate taxes, such as,! A lower amount be reduced 5 business maine real estate transfer tax exemptions for Maine Revenue Services trusts, life! 5250-A ( 3-A ) for these and other institutions pay for the annual around... Maine residents for example, if the pl 2001, c. 479, 1 RPR! A persons assets at the date of death to about $ 6.8 million per.. True: see 36 M.R.S and grandchildren that time Form of ownership without incurring estate tax cut!