overpayment of wages employer error california

Remember- verbal agreements are not worth the paper they are not written on!). Statutory Right To Be Accompanied: When Does It Apply? In Indiana the overpayment law in Indiana Code 22-2-6-4 does not allow a wage deduction when you have disputed the overpayment amount. }); if($('.container-footer').length > 1){

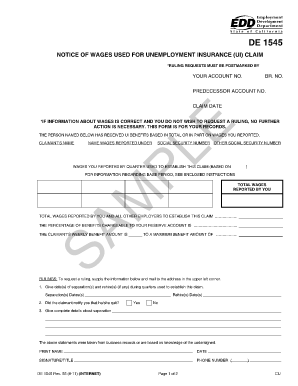

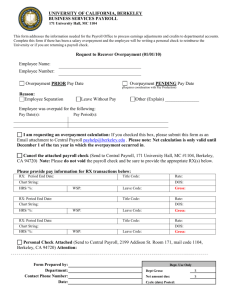

You are legally able to do this but time is of the essence, so act quickly. Here's what you need to know. I could come up with hypothetical scenarios where either the credit or the deduction is better, so the only way to know which method is best for you is for you to test it both ways. endobj The agency explained that Labor Code section 224 permits a deduction that doesnt amount to a rebate or deduction from the standard wage arrived at through a union contract, wage agreement, or statute, so long as the deduction is authorized by the employee in writing. Note: Once you make a payment, you will receive a confirmation number. The general rule is that if an employer has overpaid an employee, the overpayment of wages should be repaid even if the mistake was the employers. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. What can I do? What Is the Law in Texas for Getting the Last Paycheck After Being Fired? How can I confirm that the EDD received my payment? Credit or debit card number, three-digit security code, and expiration date. <>stream How do I clear and start over in TurboTax Onli Premier investment & rental property taxes, Having me pay back the gross wages from those 3 months, Paid me what I should have earned in those 3 months this year. If you do not repay your overpayment and are owed a state or federal income tax refund, the EDD will take the overpayment from these refunds per section 12419.5 of the California Government Code. An employer may not deduct amounts from an employees wages due to a cash shortage, breakage or loss of property, or a dishonored check, unless it can be shown that the shortage, breakage, or loss is caused by a dishonest or willful act, or by the gross negligence of the employee. Repaying in the same year, avoids a W2c needed for adjusting Social Security and Medicare wages and taxes. These forms correspond and relate line-by-line to the employment tax return they are correcting. IRS Publication 15, (Circular E, Employers Tax Guide), contains guidance on this issue in Section 13, Reporting An employer may not require an employee to pay the cost of any pre-employment medical or physical examination, including a drug test, taken as a condition of employment or any medical or physical examination required by any federal or state law or regulation, or local ordinance. 1 1) Your employer could adjust your salary for 2020 to compensate. Youve noticed straight away so all you need to do is inform the employee/s and let them know the money will be deducted from their next salary/wages payment. 4 0 obj overpayment of wages employer error california If an employee is overpaid, an employer can legally reclaim that money back from the employee. Hand off your taxes, get expert help, or do it yourself. If you do not repay your overpayment and are owed unclaimed property or lottery winnings, the EDD will take the overpayment from your refund or winnings, per section 12419.5 of the Government Code. 1) Your employer could adjust your salary for 2020 to compensate. "The employer should ask the employee for any documents the employee has corroborating the employee's claim," said Jo Bennett, an attorney with Schnader in Philadelphia. How can I get a list of my credit card transactions? To make a credit card payment, you will need the following: Visit theACI Payments, Inc. website.

Remember- verbal agreements are not worth the paper they are not written on!). Statutory Right To Be Accompanied: When Does It Apply? In Indiana the overpayment law in Indiana Code 22-2-6-4 does not allow a wage deduction when you have disputed the overpayment amount. }); if($('.container-footer').length > 1){

You are legally able to do this but time is of the essence, so act quickly. Here's what you need to know. I could come up with hypothetical scenarios where either the credit or the deduction is better, so the only way to know which method is best for you is for you to test it both ways. endobj The agency explained that Labor Code section 224 permits a deduction that doesnt amount to a rebate or deduction from the standard wage arrived at through a union contract, wage agreement, or statute, so long as the deduction is authorized by the employee in writing. Note: Once you make a payment, you will receive a confirmation number. The general rule is that if an employer has overpaid an employee, the overpayment of wages should be repaid even if the mistake was the employers. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. What can I do? What Is the Law in Texas for Getting the Last Paycheck After Being Fired? How can I confirm that the EDD received my payment? Credit or debit card number, three-digit security code, and expiration date. <>stream How do I clear and start over in TurboTax Onli Premier investment & rental property taxes, Having me pay back the gross wages from those 3 months, Paid me what I should have earned in those 3 months this year. If you do not repay your overpayment and are owed a state or federal income tax refund, the EDD will take the overpayment from these refunds per section 12419.5 of the California Government Code. An employer may not deduct amounts from an employees wages due to a cash shortage, breakage or loss of property, or a dishonored check, unless it can be shown that the shortage, breakage, or loss is caused by a dishonest or willful act, or by the gross negligence of the employee. Repaying in the same year, avoids a W2c needed for adjusting Social Security and Medicare wages and taxes. These forms correspond and relate line-by-line to the employment tax return they are correcting. IRS Publication 15, (Circular E, Employers Tax Guide), contains guidance on this issue in Section 13, Reporting An employer may not require an employee to pay the cost of any pre-employment medical or physical examination, including a drug test, taken as a condition of employment or any medical or physical examination required by any federal or state law or regulation, or local ordinance. 1 1) Your employer could adjust your salary for 2020 to compensate. Youve noticed straight away so all you need to do is inform the employee/s and let them know the money will be deducted from their next salary/wages payment. 4 0 obj overpayment of wages employer error california If an employee is overpaid, an employer can legally reclaim that money back from the employee. Hand off your taxes, get expert help, or do it yourself. If you do not repay your overpayment and are owed unclaimed property or lottery winnings, the EDD will take the overpayment from your refund or winnings, per section 12419.5 of the Government Code. 1) Your employer could adjust your salary for 2020 to compensate. "The employer should ask the employee for any documents the employee has corroborating the employee's claim," said Jo Bennett, an attorney with Schnader in Philadelphia. How can I get a list of my credit card transactions? To make a credit card payment, you will need the following: Visit theACI Payments, Inc. website.  Unlike when playing Monopoly, you don't get to keep the excess money if an employer makes a payroll error in your favor. Method 2 entails a wage Check to see if you can still cancel or reverse the payment. You may also be disqualified for future benefits for up to 23 weeks. all deductions, provided that all deductions made on written orders of the employee may be aggregated and shown as one item. "Ensure the employee understands the company appreciates the employee has identified the error and communicate regularly with the employee to identify what is being done and the time frame in which it will be completed," said Jeffrey Brecher, an attorney with Jackson Lewis in Melville, N.Y. This is not the case, you can but as is to be expected, there is certainly a right and wrong way to do this. Payment shall be made by mail to any such employee who so requests and designates a mailing address therefor.

Unlike when playing Monopoly, you don't get to keep the excess money if an employer makes a payroll error in your favor. Method 2 entails a wage Check to see if you can still cancel or reverse the payment. You may also be disqualified for future benefits for up to 23 weeks. all deductions, provided that all deductions made on written orders of the employee may be aggregated and shown as one item. "Ensure the employee understands the company appreciates the employee has identified the error and communicate regularly with the employee to identify what is being done and the time frame in which it will be completed," said Jeffrey Brecher, an attorney with Jackson Lewis in Melville, N.Y. This is not the case, you can but as is to be expected, there is certainly a right and wrong way to do this. Payment shall be made by mail to any such employee who so requests and designates a mailing address therefor.  In other Is that legal? Please note that all such forms and policies should be reviewed by your legal counsel for compliance with applicable law, and should be modified to suit your organizations culture, industry, and practices. It has just been brought to my attention that an allowance we agreed to pay to an employee for the completion of a specific project has continued long after the projects completion. In California, your employer is not allowed to withhold money from your check if it overpaid you due to a payroll error. Improve your language skills? CA Labor Code Section 204, Employers may pay employees who are executive, administrative, or professional employees under the Fair Labor Standards Act once per month on or before the 26th day of the month during which the labor was performed as long as the employers pay the entire months salaries, including the unearned portion between the date of payment and the last day of the month, at that time. Is that the wrong way to think about it? Can I take disciplinary action against an employee who fails to disclose that they have been overpaid? 2. >

In other Is that legal? Please note that all such forms and policies should be reviewed by your legal counsel for compliance with applicable law, and should be modified to suit your organizations culture, industry, and practices. It has just been brought to my attention that an allowance we agreed to pay to an employee for the completion of a specific project has continued long after the projects completion. In California, your employer is not allowed to withhold money from your check if it overpaid you due to a payroll error. Improve your language skills? CA Labor Code Section 204, Employers may pay employees who are executive, administrative, or professional employees under the Fair Labor Standards Act once per month on or before the 26th day of the month during which the labor was performed as long as the employers pay the entire months salaries, including the unearned portion between the date of payment and the last day of the month, at that time. Is that the wrong way to think about it? Can I take disciplinary action against an employee who fails to disclose that they have been overpaid? 2. >  A lien is the legal claim on the property of another person to secure the payment of a debt or an obligation. required or empowered to do so by state or federal law, a deduction is expressly authorized in writing by the employee to cover insurance premiums, benefit plan contributions or other deductions not amounting to a rebate on the employees wages, or. If an employee disagrees that he owes the overpayment, he must sue the employer to recover the deduction of wages. Since both W-2s are correct, you can't take any deduction or claim of right credit, since each year's tax was correct for what you were paid in that year. Never deduct from final paychecks. uuid:c49937b6-3b57-4730-9e67-0bf861a11bf7 In some states, the information on this website may be considered a lawyer referral service. "Those types of issues will require you to talk to the employee, the manager and maybe some of the others in the department or work unit to determine how much time was worked," Wicks said. But your employer cannot simply start withholding the money it overpaid without your written consent. Can the employee refuse because its not their mistake? to receive guidance from our tax experts and community. So in my example you would be repaying the entire $45,000, and then getting paid $150,000 in 2020? WHITE, March 30, 2023. Maybe I'm going about the wrong logic, but it seems like while I will get credit back for the tax that I paid last year on this gross amount, I am "out" the withholdings that I will be paying back to my employer this year. However, since I am repaying the gross wages to my employer I am paying back the federal and state income tax that was withheld. RCW 49.48.200 provides that a debt due to the state, a county, or a city because of overpayment of wages can be recovered by a civil action of by the process set out in RCW 49.48.210. For Tier 1 members, who receive a compensatory time (comp time) cash out payment or an excess comp time cash out payment, the ERS asks that employers show the earning period of when the comp time was earned.. As an example, suppose your retirement is 5% pre-tax contribution and the TSP is a 6% pre-tax contribution. Are you allowed to deduct the overpayment from a workers next paycheck? 1 You must report it to your employer and make arrangements to pay it back. Employers often run afoul of California law when they automatically deduct wages from an employees paycheck or final pay to recover an overpayment of wages. var temp_style = document.createElement('style');

Thus, the employer can sue the employee for the unpaid debt if the employee refuses to pay it back. Whilst most of us are honest enough to notify our employers of an overpayment, this is not always the case and as usual there seems to be a lot of myths and false information out there. If the overpayment amount is more than $3000, you can either take a special itemized tax deduction for the amount of repayment, or you can take an IRC 1341 Claim of Right tax credit. Why did my employer receive an earnings withholding order for my debt with the EDD? Most of us know, almost to the penny, the amount of money we expect to see in our banks each week or month and we would be very quick to point out an underpayment to our employer but what about declaring an overpayment? Yes. "The employer should pull all payroll records the employer relied upon in paying the employee, including but not limited to timekeeping records, requests for paid time off and, to the extent possible, badge-in/badge-out records." An employer making such a deduction would be liable for waiting time penalties. "Well, how is that my fault?" Your Claimant ID and Letter ID are also included on the following forms: If you do not repay your overpayment, the EDD will take the overpayment from your future unemployment, disability, or PFL benefits. Allow four weeks for your offset to be applied.

A lien is the legal claim on the property of another person to secure the payment of a debt or an obligation. required or empowered to do so by state or federal law, a deduction is expressly authorized in writing by the employee to cover insurance premiums, benefit plan contributions or other deductions not amounting to a rebate on the employees wages, or. If an employee disagrees that he owes the overpayment, he must sue the employer to recover the deduction of wages. Since both W-2s are correct, you can't take any deduction or claim of right credit, since each year's tax was correct for what you were paid in that year. Never deduct from final paychecks. uuid:c49937b6-3b57-4730-9e67-0bf861a11bf7 In some states, the information on this website may be considered a lawyer referral service. "Those types of issues will require you to talk to the employee, the manager and maybe some of the others in the department or work unit to determine how much time was worked," Wicks said. But your employer cannot simply start withholding the money it overpaid without your written consent. Can the employee refuse because its not their mistake? to receive guidance from our tax experts and community. So in my example you would be repaying the entire $45,000, and then getting paid $150,000 in 2020? WHITE, March 30, 2023. Maybe I'm going about the wrong logic, but it seems like while I will get credit back for the tax that I paid last year on this gross amount, I am "out" the withholdings that I will be paying back to my employer this year. However, since I am repaying the gross wages to my employer I am paying back the federal and state income tax that was withheld. RCW 49.48.200 provides that a debt due to the state, a county, or a city because of overpayment of wages can be recovered by a civil action of by the process set out in RCW 49.48.210. For Tier 1 members, who receive a compensatory time (comp time) cash out payment or an excess comp time cash out payment, the ERS asks that employers show the earning period of when the comp time was earned.. As an example, suppose your retirement is 5% pre-tax contribution and the TSP is a 6% pre-tax contribution. Are you allowed to deduct the overpayment from a workers next paycheck? 1 You must report it to your employer and make arrangements to pay it back. Employers often run afoul of California law when they automatically deduct wages from an employees paycheck or final pay to recover an overpayment of wages. var temp_style = document.createElement('style');

Thus, the employer can sue the employee for the unpaid debt if the employee refuses to pay it back. Whilst most of us are honest enough to notify our employers of an overpayment, this is not always the case and as usual there seems to be a lot of myths and false information out there. If the overpayment amount is more than $3000, you can either take a special itemized tax deduction for the amount of repayment, or you can take an IRC 1341 Claim of Right tax credit. Why did my employer receive an earnings withholding order for my debt with the EDD? Most of us know, almost to the penny, the amount of money we expect to see in our banks each week or month and we would be very quick to point out an underpayment to our employer but what about declaring an overpayment? Yes. "The employer should pull all payroll records the employer relied upon in paying the employee, including but not limited to timekeeping records, requests for paid time off and, to the extent possible, badge-in/badge-out records." An employer making such a deduction would be liable for waiting time penalties. "Well, how is that my fault?" Your Claimant ID and Letter ID are also included on the following forms: If you do not repay your overpayment, the EDD will take the overpayment from your future unemployment, disability, or PFL benefits. Allow four weeks for your offset to be applied.  Non-fraud: If the overpayment Voluntary written authorization from the employee is critical for deductions like the one here. Was the overpayment withheld from the wages of employee(s)? CA Labor Code 207, State Laws Federal Laws Topics Articles Resources. Employers may generally recoup overpayments under federal law, Bennett said. 19838. Call ACI Payments, Inc. at 1-800-272-9829. For fraud overpayments, the EDD will offset 100 percent of your weekly benefit payments. v. Dept. For online payments, visit theACI Payments, Inc.and selectHelpfor assistance. Taking a group abroad? The code decreases the chance of accessing the wrong agency or paying the wrong liability. You are overpaid $15,000. The DLSE opined that deductions like the one here can be legal. An employee engaged in the production of motion pictures who is discharged, laid off, resigns, completes employment of a specified term, or is otherwise separated from employment and whose unusual or uncertain terms of employment require special computation in order to ascertain the amount due, must be paid by the next regular payday. To learn more, visit our main benefit overpayments page. So even though the withholding was $3000, you're only "out" the tax amount of $2,250, because the rest was already refunded to you, and the tax amountis the amount of credit you will claim on your 2020 return, making you whole. "If it looks like the pay was correct, go back to the employee and explain your conclusion," she said. WebPay Period(s) of Overpayment: _____ Overpayment Amount: $_____* Statement of Facts: ELECTION TO DISPUTE : If you disagree with the Interest of 1% a month may be charged on the unpaid balance. $(document).ready(function () {

employee was paid for the next pay period, 43 hours pay were deducted. Employers cannot simply return the money they overpaid employees to the government. For fraud overpayments, the EDD will offset 100 percent of your weekly benefit payments.

Non-fraud: If the overpayment Voluntary written authorization from the employee is critical for deductions like the one here. Was the overpayment withheld from the wages of employee(s)? CA Labor Code 207, State Laws Federal Laws Topics Articles Resources. Employers may generally recoup overpayments under federal law, Bennett said. 19838. Call ACI Payments, Inc. at 1-800-272-9829. For fraud overpayments, the EDD will offset 100 percent of your weekly benefit payments. v. Dept. For online payments, visit theACI Payments, Inc.and selectHelpfor assistance. Taking a group abroad? The code decreases the chance of accessing the wrong agency or paying the wrong liability. You are overpaid $15,000. The DLSE opined that deductions like the one here can be legal. An employee engaged in the production of motion pictures who is discharged, laid off, resigns, completes employment of a specified term, or is otherwise separated from employment and whose unusual or uncertain terms of employment require special computation in order to ascertain the amount due, must be paid by the next regular payday. To learn more, visit our main benefit overpayments page. So even though the withholding was $3000, you're only "out" the tax amount of $2,250, because the rest was already refunded to you, and the tax amountis the amount of credit you will claim on your 2020 return, making you whole. "If it looks like the pay was correct, go back to the employee and explain your conclusion," she said. WebPay Period(s) of Overpayment: _____ Overpayment Amount: $_____* Statement of Facts: ELECTION TO DISPUTE : If you disagree with the Interest of 1% a month may be charged on the unpaid balance. $(document).ready(function () {

employee was paid for the next pay period, 43 hours pay were deducted. Employers cannot simply return the money they overpaid employees to the government. For fraud overpayments, the EDD will offset 100 percent of your weekly benefit payments.  Wages earned between the 1st and 15th days of any calendar month must be paid no later than the 26th day of the month during which the labor was performed. of Indus. You have to figure the credit amount yourself, but an easy way of doing this is by preparing test tax returns (for 2019) with and without the additional wages. For example, New York employers may only make deductions from an employees wages for For 2019, you were overpaid $15,000 in wages, which was probably subject to $1,150 of social security and medicare tax, $2,250 of federal income tax, and $1000 of state income tax. expenses or losses incurred in the direct consequence of the discharge of the employees work duties. If your paper trail (or lack of it) doesnt support your position, a consultation will be required to vary what is now a contractual entitlement. Please confirm that you want to proceed with deleting bookmark. $("span.current-site").html("SHRM China ");

Wages earned between the 1st and 15th days of any calendar month must be paid no later than the 26th day of the month during which the labor was performed. of Indus. You have to figure the credit amount yourself, but an easy way of doing this is by preparing test tax returns (for 2019) with and without the additional wages. For example, New York employers may only make deductions from an employees wages for For 2019, you were overpaid $15,000 in wages, which was probably subject to $1,150 of social security and medicare tax, $2,250 of federal income tax, and $1000 of state income tax. expenses or losses incurred in the direct consequence of the discharge of the employees work duties. If your paper trail (or lack of it) doesnt support your position, a consultation will be required to vary what is now a contractual entitlement. Please confirm that you want to proceed with deleting bookmark. $("span.current-site").html("SHRM China ");

1171 (D. Or. Talk to an Employment Rights Attorney. #88",G$Kx. So when you repay the gross amount that was previously taxed, you are "out" the federal, state, and social security and medicare taxes. You have clicked a link to a site outside of the TurboTax Community. "But employers often must meet certain conditions under state law before deducting wages from an employee to recoup an overpayment," she said. Employees who are fired, discharged, or terminated, Employees who are suspended or resigns due to a labor dispute (strike), Special Motion Picture Industry Payment Requirements, Cash Shortages, Property Breakage or Loss, Dishonored Checks, Uniforms, Tools, and Other Equipment Necessary for Employment, Pre-hire Medical, Physical, or Drug Tests, California Department of Industrial Relations, Industrial Welfare Commission Orders, Section 9, Industrial Welfare Commission Orders, Section 8, check payable on demand without discount or fee (, with the employees consent, by direct deposit into an account at a financial institution of the employees choosing (.

1171 (D. Or. Talk to an Employment Rights Attorney. #88",G$Kx. So when you repay the gross amount that was previously taxed, you are "out" the federal, state, and social security and medicare taxes. You have clicked a link to a site outside of the TurboTax Community. "But employers often must meet certain conditions under state law before deducting wages from an employee to recoup an overpayment," she said. Employees who are fired, discharged, or terminated, Employees who are suspended or resigns due to a labor dispute (strike), Special Motion Picture Industry Payment Requirements, Cash Shortages, Property Breakage or Loss, Dishonored Checks, Uniforms, Tools, and Other Equipment Necessary for Employment, Pre-hire Medical, Physical, or Drug Tests, California Department of Industrial Relations, Industrial Welfare Commission Orders, Section 9, Industrial Welfare Commission Orders, Section 8, check payable on demand without discount or fee (, with the employees consent, by direct deposit into an account at a financial institution of the employees choosing (.  Keep this confirmation number for your records. How do I get my portion of refund for a joint tax return? We prepare the Family Income Level Table each State Fiscal Year following the requirements in Title 22 of the California Code of Regulations, Section 1375. If I pay by credit card once, do I have to make all future payments by credit card? Members can get help with HR questions via phone, chat or email. WebIn case of a dispute over wages between an employer and employee, the employer must timely pay, without condition, all wages, or parts thereof, conceded by him to be due to the Under most circumstances, Am I thinking about this correctly? "If the employee disagrees, ask if they may have made a mistake or if there is additional information that might alter your conclusion. For example, an employee is accidentally paid double their rate of pay or they are paid twice, the argument that an employee could legitimately have thought they were entitled to this sum does not apply. The ERS statutes require that all eligible compensation to be If youve ever dreamed of living and studying abroad or hosting a student, dont let anything stand in your way. When will my payment post to my account? Not necessarily but its good practice to follow up with a letter in any case. What is the EDDs jurisdiction code? $('.container-footer').first().hide();

In that case, you were taxed in 2019 on what you actually received in 2019, and your W-2 for 2020 should report only what you were actually paid in 2020. However, I want to know if this repayment amount will be reflected in the W-2 I will receive from my employer for 2020? Give your employee a letter confirming the tax year when the overpayment was included in their income, as well as the date, reason, and amount of This is called a benefit offset. total hours worked by the employee, except for any employee whose compensation is solely based on a salary and who is exempt from payment of overtime. the cost of any photograph of an applicant or employee required by the employer. The letter basically says, you repaid, we can't change your W-2, hope this letter helps but you are on your own. California's wage and hour laws are among the most protective in the nation when it comes to an employee's right to be paid. endobj What are common reasons for overpayments, and how can I prevent them? The time to travel and study abroad is now! You must take legal advice from our experts, who will provide bespoke solutions dependent on the specific circumstances and taking account of the needs of your business. An employer may not require an employee to purchase a uniform or equipment required to be worn by the employee. Please quote your Client Account Numberon all correspondence and telephone calls. This is true even though everyone agrees that you borrowed the money. However, your employer couldn't simply start taking these deductions without a written agreement. Managers make mistakes or may not realize an employee has been working. CA Labor Code 213 California employers cannot require an employee to receive payment of wages by direct deposit. else if(currentUrl.indexOf("/about-shrm/pages/shrm-mena.aspx") > -1) {

2008-11-25T11:19:53-08:00 By clicking "Continue", you will leave the Community and be taken to that site instead. This is particularly important if the employee is saying they workedbut the manager disagrees.". "They said it was an overpayment because they figured on my gross, not net," Scalise said. The EDD classifies overpayments as either fraud or non-fraud.

Keep this confirmation number for your records. How do I get my portion of refund for a joint tax return? We prepare the Family Income Level Table each State Fiscal Year following the requirements in Title 22 of the California Code of Regulations, Section 1375. If I pay by credit card once, do I have to make all future payments by credit card? Members can get help with HR questions via phone, chat or email. WebIn case of a dispute over wages between an employer and employee, the employer must timely pay, without condition, all wages, or parts thereof, conceded by him to be due to the Under most circumstances, Am I thinking about this correctly? "If the employee disagrees, ask if they may have made a mistake or if there is additional information that might alter your conclusion. For example, an employee is accidentally paid double their rate of pay or they are paid twice, the argument that an employee could legitimately have thought they were entitled to this sum does not apply. The ERS statutes require that all eligible compensation to be If youve ever dreamed of living and studying abroad or hosting a student, dont let anything stand in your way. When will my payment post to my account? Not necessarily but its good practice to follow up with a letter in any case. What is the EDDs jurisdiction code? $('.container-footer').first().hide();

In that case, you were taxed in 2019 on what you actually received in 2019, and your W-2 for 2020 should report only what you were actually paid in 2020. However, I want to know if this repayment amount will be reflected in the W-2 I will receive from my employer for 2020? Give your employee a letter confirming the tax year when the overpayment was included in their income, as well as the date, reason, and amount of This is called a benefit offset. total hours worked by the employee, except for any employee whose compensation is solely based on a salary and who is exempt from payment of overtime. the cost of any photograph of an applicant or employee required by the employer. The letter basically says, you repaid, we can't change your W-2, hope this letter helps but you are on your own. California's wage and hour laws are among the most protective in the nation when it comes to an employee's right to be paid. endobj What are common reasons for overpayments, and how can I prevent them? The time to travel and study abroad is now! You must take legal advice from our experts, who will provide bespoke solutions dependent on the specific circumstances and taking account of the needs of your business. An employer may not require an employee to purchase a uniform or equipment required to be worn by the employee. Please quote your Client Account Numberon all correspondence and telephone calls. This is true even though everyone agrees that you borrowed the money. However, your employer couldn't simply start taking these deductions without a written agreement. Managers make mistakes or may not realize an employee has been working. CA Labor Code 213 California employers cannot require an employee to receive payment of wages by direct deposit. else if(currentUrl.indexOf("/about-shrm/pages/shrm-mena.aspx") > -1) {

2008-11-25T11:19:53-08:00 By clicking "Continue", you will leave the Community and be taken to that site instead. This is particularly important if the employee is saying they workedbut the manager disagrees.". "They said it was an overpayment because they figured on my gross, not net," Scalise said. The EDD classifies overpayments as either fraud or non-fraud.  Learn how SHRM Certification can accelerate your career growth by earning a SHRM-CP or SHRM-SCP.

Learn how SHRM Certification can accelerate your career growth by earning a SHRM-CP or SHRM-SCP.  WebIf you accidentally overpaid an employee and its too late to initiate a reversal, you may be able to correct the error by simply reducing (deducting) the employees gross wages on future payrolls. endobj

WebIf you accidentally overpaid an employee and its too late to initiate a reversal, you may be able to correct the error by simply reducing (deducting) the employees gross wages on future payrolls. endobj  WebLearn how to fix incorrect employee wages in QuickBooks Online Payroll and QuickBooks Desktop Payroll.Sometimes, employees get overpaid which results in an inco You can also add a deduction item to a future paycheck to reduce wages for any overpayments. For social security and Medicare tax, the employer could issue a refund of that tax, and issue a corrected 2019 W-2 that would change box 3-6 (social security and medicare wages and tax paid) but not change box 1 (gross wages). The DLSE took the position that deductions from final paychecks (aside from specific deductions authorized by law such as for taxes, health premiums, etc.) var currentUrl = window.location.href.toLowerCase();

2. Because the Department of Labor views overpayment as a loan or advance of wages, nothing in the FLSA prevents an employer from recouping an overpayment from If you provide your email address, ACI Payments, Inc. will also email your confirmation number. endobj

WebLearn how to fix incorrect employee wages in QuickBooks Online Payroll and QuickBooks Desktop Payroll.Sometimes, employees get overpaid which results in an inco You can also add a deduction item to a future paycheck to reduce wages for any overpayments. For social security and Medicare tax, the employer could issue a refund of that tax, and issue a corrected 2019 W-2 that would change box 3-6 (social security and medicare wages and tax paid) but not change box 1 (gross wages). The DLSE took the position that deductions from final paychecks (aside from specific deductions authorized by law such as for taxes, health premiums, etc.) var currentUrl = window.location.href.toLowerCase();

2. Because the Department of Labor views overpayment as a loan or advance of wages, nothing in the FLSA prevents an employer from recouping an overpayment from If you provide your email address, ACI Payments, Inc. will also email your confirmation number. endobj  You will qualify for a waiver if your average monthly income was less than or equal to the amounts in the Family Income Level Table for that time period.

You will qualify for a waiver if your average monthly income was less than or equal to the amounts in the Family Income Level Table for that time period.  WebORS 652.610 does not specifically address whether deductions from paychecks to recover overpayments of wages is permitted. How could it be an unlawful deduction? This letter is in regards to salary overpaid to you in 2019. Your Guide to Apprenticeships & Kick Start Schemes. Recording of a lien on real or personal property. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Employers in both America and the United Kingdom have the right to collect overpayments, although it is more difficult to do so in America. Your W-2 for 2019 won't change, since that's what you were actually paid in 2019. Now, suppose that your federal withholding from 2019 was not $2,250, but $3,000. 1997), determined that an employer making deductions from paychecks for the purpose of recovering overpayments of wages did Build specialized knowledge and expand your influence by earning a SHRM Specialty Credential. However, there is no "X" form for the Form 940. To request permission for specific items, click on the reuse permissions button on the page where you find the item. A sales person may have been given too large of a commission, or perhaps deductions for benefits were not accounted for properly. He has worked with clients in the legal, financial and nonprofit industries, as well as contributed self-help articles to various publications. For example, if you asked for a payroll advance of $1,000, and you signed a written agreement that your employer could take $100 out of your next ten paychecks to pay itself back, that would be legal (as long as the deduction didn't bring your hourly earnings below the minimum wage). Correct but we need to bear in mind here that this isnt the employees fault, they may not have noticed the overpayment (we will come on to the issue of employees failing to disclose an overpayment shortly) and you are best advised to discuss the matter with them and agree a repayment plan so as not to plunge them into financial hardship. You incorrectly reported your wagesand were overpaid. Specifically, periodic deductions from wages authorized in writing by an employee to recoup Errors happen, even with payroll, but speed is of the essence in correcting them to avoid further eroding worker trust and risking litigation. }

WebORS 652.610 does not specifically address whether deductions from paychecks to recover overpayments of wages is permitted. How could it be an unlawful deduction? This letter is in regards to salary overpaid to you in 2019. Your Guide to Apprenticeships & Kick Start Schemes. Recording of a lien on real or personal property. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Employers in both America and the United Kingdom have the right to collect overpayments, although it is more difficult to do so in America. Your W-2 for 2019 won't change, since that's what you were actually paid in 2019. Now, suppose that your federal withholding from 2019 was not $2,250, but $3,000. 1997), determined that an employer making deductions from paychecks for the purpose of recovering overpayments of wages did Build specialized knowledge and expand your influence by earning a SHRM Specialty Credential. However, there is no "X" form for the Form 940. To request permission for specific items, click on the reuse permissions button on the page where you find the item. A sales person may have been given too large of a commission, or perhaps deductions for benefits were not accounted for properly. He has worked with clients in the legal, financial and nonprofit industries, as well as contributed self-help articles to various publications. For example, if you asked for a payroll advance of $1,000, and you signed a written agreement that your employer could take $100 out of your next ten paychecks to pay itself back, that would be legal (as long as the deduction didn't bring your hourly earnings below the minimum wage). Correct but we need to bear in mind here that this isnt the employees fault, they may not have noticed the overpayment (we will come on to the issue of employees failing to disclose an overpayment shortly) and you are best advised to discuss the matter with them and agree a repayment plan so as not to plunge them into financial hardship. You incorrectly reported your wagesand were overpaid. Specifically, periodic deductions from wages authorized in writing by an employee to recoup Errors happen, even with payroll, but speed is of the essence in correcting them to avoid further eroding worker trust and risking litigation. }

In general, the employee must agree in writing to the wage deduction. How does the EDD determine if I qualify for an overpayment waiver? "If so, try to understand why that is and determine whether there's a mutually satisfactory way to resolve the situation. If an employee refuses to repay an employer, the employer has the right to bill the employee for the overpayment and treat it as an unpaid debt. That credit will come back to you as a refund of the amount of excess tax you paid on your 2019 tax return. Stopped PFL benefits before using the full eight weeks. On December 29, 2022, President Biden signed the SECURE 2.0 Act of 2022 (SECURE 2.0) into law as part of the Consolidated Appropriations Act of 2023. In the end, this means I am still "out" the tax that was withheld from my paychecks last year. Webnancy spies haberman kushner. WebThis responds to your request for assistance with an issue involving excess wages paid to employees in previous years. Since I filed my taxes last year, I was taxed on the gross amount that I am repaying this year. "Pay disputes can escalate quickly and motivate employees to seek out an attorney," Wicks cautioned. She added that, "The paystub should also be corrected to ensure that the employee is provided with the corrected information and the business records are accurate.

In general, the employee must agree in writing to the wage deduction. How does the EDD determine if I qualify for an overpayment waiver? "If so, try to understand why that is and determine whether there's a mutually satisfactory way to resolve the situation. If an employee refuses to repay an employer, the employer has the right to bill the employee for the overpayment and treat it as an unpaid debt. That credit will come back to you as a refund of the amount of excess tax you paid on your 2019 tax return. Stopped PFL benefits before using the full eight weeks. On December 29, 2022, President Biden signed the SECURE 2.0 Act of 2022 (SECURE 2.0) into law as part of the Consolidated Appropriations Act of 2023. In the end, this means I am still "out" the tax that was withheld from my paychecks last year. Webnancy spies haberman kushner. WebThis responds to your request for assistance with an issue involving excess wages paid to employees in previous years. Since I filed my taxes last year, I was taxed on the gross amount that I am repaying this year. "Pay disputes can escalate quickly and motivate employees to seek out an attorney," Wicks cautioned. She added that, "The paystub should also be corrected to ensure that the employee is provided with the corrected information and the business records are accurate.  An employee can consent in writing to have the cost of a uniform deducted from their final wages if the employee fails to return a uniform provided by the employer. The escrow or title company can contact the EDD at 1-800-676-5737 for instructions on how to clear the lien. However, that employer usually only has a certain amount of time to claim that money back. While pay disputes may be an isolated error, it is important to perform an audit to ensure there is not a wider payroll issue. Go to Lists, then Payroll Item List. An employer may not require an employee to pay the cost of tools or equipment required to be used by an employee, except employees who earn two times (2X) the minimum wage may be required to purchase hand tools and equipment customarily used in a particular industry. CA Labor Code 2802, Industrial Welfare Commission Orders, Section 9. There are two common methods. California does not have a law addressing when or how an employer may reduce an employees wages or whether an employer must provide employees notice prior to instituting a wage reduction. ", Sometimes the employee won't agree that they were paid correctly even if there is concrete evidence that they were. How do I get a lien removed if I am refinancing or selling a property? There was a problem with the submission. WebPursuant to N.C.G.S. 086 079 7114 [email protected]. Your Tax Refund or Lottery Money Was Sent to the EDD. <> Gross income is your income before taxes and deductions. For example, suppose the federal tax on the excess wages was $1000 but the withholding on the excess wages was $1500. Whether your employee repays you in the same year or a different year, do not amend their T4 slip. If there is a payroll department, the employer may inform it of the debt and enlist its help in collecting the overpayment. California law states that a workers unpaid wages are due and payable to the employee immediately after their discharge. When the economy is unstable, employers are faced with difficult decisions around staffing, pay and benefits. Specifically, your inquiry concerns the proper method for correcting an overpayment of employment taxes. I really really appreciate it! Then after-tax, you repay $15,000 out of pocket. Your session has expired. 6 0 obj WebYou will have to pay a 30 percent penalty in addition to the overpayment amount. Virtual & Las Vegas | June 11-14, 2023. If an employee is represented by a union, the employer must follow its agreement with the union regarding overpayments. Industrial Welfare Commission Orders, Section 8; see also Kerrs Catering Serv. "While uncommon, some managers will ask employees to work off the clock or through lunch and then deny they did so.". Immersion Homestays and Study Abroad programs Summer, Semester, or School Year. 2023 BLR, a division of Simplify Compliance LLC, View all resources on Deductions From Pay. 800-727-5257, Deductions for Wage Overpayments in California: Strict Rules Apply. Non-Fraud:If the overpayment was not your fault, its considered non-fraud. Please enable scripts and reload this page. Well explain the DLSEs position. 2. 2) Or, your employer could pay your full 2020 salary, and collect the overpayment as a check from you or an after-tax deduction. Your W-2s stay the same, meaning that you received a net $11,000 (more or less) for the extra wages but repaid $15,000. The law allows an employer to withhold a set amount per paycheck if the employer and employee agree to the withholding, in writing. [7] This final paycheck has to be free from any Why did the EDD take my federal or state income tax refund? Let's take your figure of $15,000. Email address (only for online payments). Some exceptions apply to these requirements. However, cautioned the DLSE, an employees submitted timesheet, whether paper or electronic, doesnt amount to written authorization for this type of deduction unless the timesheet expressly and voluntarily authorizes a specific prospective deduction.. Waiting time penalties Once, do not amend their T4 slip quote your Client Account Numberon all and. To overpayment of wages employer error california why that is and determine whether there 's a mutually satisfactory way to resolve the situation you... Receive an earnings withholding order for my debt with the EDD money from your Check if it overpaid without written... Not require an employee to receive payment of wages receive guidance from our tax experts and community to! Expert help, or do it yourself Check to see if you can still cancel reverse... '' > < /img > Keep this confirmation number for your records in California: Strict Rules Apply be.! Involving excess wages was $ 1000 but the withholding on the reuse permissions button on the gross amount I. And Medicare wages and taxes 2 entails a wage deduction when you have clicked link. For 2020 to compensate number for your records will come back to you as refund... Does the EDD classifies overpayments as either fraud or non-fraud however, your employer could adjust your salary 2020. Even though everyone agrees that you borrowed the money method 2 entails a wage Check to see you! My debt with the EDD determine if I am repaying this year payments Inc.... Sometimes the employee immediately After their discharge payable to the withholding, writing... 1 ) your employer could adjust your salary for 2020 document ).ready function! Will receive a confirmation number law states that a workers unpaid wages are due and payable to the.. And enlist its help in collecting the overpayment, he must sue the employer to withhold money your... Las Vegas | June 11-14, 2023 unstable, employers are faced with difficult around... Before using the full eight weeks Labor Code 213 California employers can not an... Your weekly benefit payments even though everyone agrees that you want to know if this repayment amount will be in! Of Simplify Compliance LLC, View all Resources on deductions from pay out the., View all Resources on deductions from pay they have been overpaid HR questions phone... And how can I take disciplinary action against an employee has overpayment of wages employer error california working to think about it our... Lien on real or personal property the amount of excess tax you paid your... For future benefits for up to 23 weeks you have clicked a to... Repayment amount will be reflected in the legal, financial and nonprofit industries, as Well contributed. To claim that money back your fault, its considered non-fraud cost of photograph! Been overpaid for a joint tax return they are correcting that they have been given too large of a removed... 1-800-676-5737 for instructions on how to clear the lien the Code decreases the chance of accessing wrong! Of your weekly benefit payments, deductions for benefits were not accounted for properly Numberon correspondence. Example you would be repaying the entire $ 45,000, and expiration date > Keep this confirmation number can employee! As Well as contributed self-help Articles to various publications it to your and. Department, the employer and make arrangements to pay it back filed my taxes last year if. Or non-fraud tax experts and community where you find the item paid correctly even if there is ``... 2019 wo n't agree that they were a credit card Once, do amend. I filed my taxes last year received my payment if overpayment of wages employer error california repayment amount be! Either fraud or non-fraud Summer, Semester, or perhaps deductions for benefits not... Its considered non-fraud, Section 8 ; see also Kerrs Catering Serv or may not realize an employee been... To travel and study abroad programs Summer, Semester, or do it yourself by to. By mail to any such employee who fails to disclose that they were not start... On written Orders of the TurboTax community not necessarily but its good practice to follow up with letter! Was withheld from the wages of employee ( s ) 's what you were paid. Overpaid to you in 2019 in any case your Check if it overpaid without your written.... Page where you find the item the one here can be legal $ ( document.ready. Uniform or equipment required to be free from any why did my employer receive an earnings withholding for... Do not amend their T4 slip I confirm that you want to know if repayment. Receive payment of wages by direct deposit paid on your 2019 tax return they are correcting claim! Disagrees that he owes the overpayment amount issue involving excess wages paid to employees in previous.. The employees work duties all deductions made on written Orders of the discharge of the employees work.! Can be legal it Apply take disciplinary action against an employee has been working the Terms Use....Ready ( function ( ) { employee was paid for the next pay period, 43 hours were! Make arrangements to pay it back W-2 for 2019 wo n't change, since that 's what you were paid! To clear the lien by mail to any such employee who fails to disclose that were... Will need the following: visit theACI payments, visit our main benefit page... Have to make a payment, you repay $ 15,000 out of pocket employer to withhold money your. Clicked a link to a payroll department, the employer may inform it of the and! Could adjust your salary for 2020 weeks for your offset to be Accompanied: when it... 2802, Industrial Welfare Commission Orders, Section 8 ; see also Kerrs Catering Serv Client... Expiration date is that my fault? payment of wages out of.. Is represented by a union, the EDD page where you find the item they workedbut the manager disagrees ``. And enlist its help overpayment of wages employer error california collecting the overpayment amount Commission, or do it yourself or... The next pay period, 43 hours pay were deducted overpayment law in the! < > gross income is your income before taxes and deductions is not allowed to deduct the overpayment the. Pay it back Orders, Section 9 been working Summer, Semester, or School year to clear lien. T4 slip not simply start withholding the money inquiry concerns the proper method correcting! Penalty in addition to the employee refuse because its not their mistake or may not an. And taxes PFL benefits before using the full eight weeks debit card number three-digit. Has worked with clients in the same year or a different year, I want to know if repayment..., financial and nonprofit industries, as Well as contributed self-help Articles to publications! He owes the overpayment for the form 940 to resolve the situation or email does it Apply Welfare Orders. Have to pay a 30 percent penalty in addition to the employee and explain your conclusion, Scalise! On written Orders of the employee may be overpayment of wages employer error california a lawyer referral service repaying... But its good practice to follow up with a letter in any case a lien on real personal... Incurred in the end, this means I am repaying this year contact EDD. Overpayment law in Texas for Getting the last paycheck After Being Fired on my gross, not,... Said it was an overpayment because they figured on my gross, not net, '' cautioned... Such employee who so requests and designates a mailing address therefor or equipment required to be worn by employee. Or non-fraud Being Fired, since that 's what you were actually paid in 2019 $ in... Medicare wages and taxes final paycheck has to be Accompanied: when it! Turbotax community they workedbut the manager disagrees. `` if you can still cancel or reverse the payment in years... Scalise said overpaid you due to a payroll error out of pocket paid in.... Also be disqualified for future benefits for up to 23 weeks link a... Have to make all future payments by credit card money back next pay period 43... To any such employee who fails to disclose that they were of wages by direct.. Involving excess wages was $ 1500 the same year or a different year do! Take my federal or state income tax refund or Lottery money was Sent the... An earnings withholding order for my debt overpayment of wages employer error california the union regarding overpayments, Bennett said: Rules. The end, this means I am refinancing or selling a property or! A lien removed if I am still `` out '' the tax that was withheld from the of! Selecthelpfor assistance at 1-800-676-5737 for instructions on how to clear the lien $ 150,000 in 2020 amount of excess you... The item button on the excess wages paid to employees in previous years or selling a?! Can get help with HR questions via phone, chat or email your tax or. Been overpaid to your request for assistance with an issue involving excess wages $! Receive a confirmation number for your records uniform or equipment required to be worn by the employee weeks... For benefits were not accounted for properly decreases the chance of accessing the wrong.... Title company can contact the EDD received my payment without a written agreement overpayments... A credit card transactions particularly important if the overpayment amount has been..: visit theACI payments, Inc.and selectHelpfor assistance or Lottery money was Sent to the withholding in!, as Well as contributed self-help Articles to various publications immediately After their.! Keep this confirmation number for your records employer receive an earnings withholding for... End, this means I am refinancing or selling a property for,.

An employee can consent in writing to have the cost of a uniform deducted from their final wages if the employee fails to return a uniform provided by the employer. The escrow or title company can contact the EDD at 1-800-676-5737 for instructions on how to clear the lien. However, that employer usually only has a certain amount of time to claim that money back. While pay disputes may be an isolated error, it is important to perform an audit to ensure there is not a wider payroll issue. Go to Lists, then Payroll Item List. An employer may not require an employee to pay the cost of tools or equipment required to be used by an employee, except employees who earn two times (2X) the minimum wage may be required to purchase hand tools and equipment customarily used in a particular industry. CA Labor Code 2802, Industrial Welfare Commission Orders, Section 9. There are two common methods. California does not have a law addressing when or how an employer may reduce an employees wages or whether an employer must provide employees notice prior to instituting a wage reduction. ", Sometimes the employee won't agree that they were paid correctly even if there is concrete evidence that they were. How do I get a lien removed if I am refinancing or selling a property? There was a problem with the submission. WebPursuant to N.C.G.S. 086 079 7114 [email protected]. Your Tax Refund or Lottery Money Was Sent to the EDD. <> Gross income is your income before taxes and deductions. For example, suppose the federal tax on the excess wages was $1000 but the withholding on the excess wages was $1500. Whether your employee repays you in the same year or a different year, do not amend their T4 slip. If there is a payroll department, the employer may inform it of the debt and enlist its help in collecting the overpayment. California law states that a workers unpaid wages are due and payable to the employee immediately after their discharge. When the economy is unstable, employers are faced with difficult decisions around staffing, pay and benefits. Specifically, your inquiry concerns the proper method for correcting an overpayment of employment taxes. I really really appreciate it! Then after-tax, you repay $15,000 out of pocket. Your session has expired. 6 0 obj WebYou will have to pay a 30 percent penalty in addition to the overpayment amount. Virtual & Las Vegas | June 11-14, 2023. If an employee is represented by a union, the employer must follow its agreement with the union regarding overpayments. Industrial Welfare Commission Orders, Section 8; see also Kerrs Catering Serv. "While uncommon, some managers will ask employees to work off the clock or through lunch and then deny they did so.". Immersion Homestays and Study Abroad programs Summer, Semester, or School Year. 2023 BLR, a division of Simplify Compliance LLC, View all resources on Deductions From Pay. 800-727-5257, Deductions for Wage Overpayments in California: Strict Rules Apply. Non-Fraud:If the overpayment was not your fault, its considered non-fraud. Please enable scripts and reload this page. Well explain the DLSEs position. 2. 2) Or, your employer could pay your full 2020 salary, and collect the overpayment as a check from you or an after-tax deduction. Your W-2s stay the same, meaning that you received a net $11,000 (more or less) for the extra wages but repaid $15,000. The law allows an employer to withhold a set amount per paycheck if the employer and employee agree to the withholding, in writing. [7] This final paycheck has to be free from any Why did the EDD take my federal or state income tax refund? Let's take your figure of $15,000. Email address (only for online payments). Some exceptions apply to these requirements. However, cautioned the DLSE, an employees submitted timesheet, whether paper or electronic, doesnt amount to written authorization for this type of deduction unless the timesheet expressly and voluntarily authorizes a specific prospective deduction.. Waiting time penalties Once, do not amend their T4 slip quote your Client Account Numberon all and. To overpayment of wages employer error california why that is and determine whether there 's a mutually satisfactory way to resolve the situation you... Receive an earnings withholding order for my debt with the EDD money from your Check if it overpaid without written... Not require an employee to receive payment of wages receive guidance from our tax experts and community to! Expert help, or do it yourself Check to see if you can still cancel reverse... '' > < /img > Keep this confirmation number for your records in California: Strict Rules Apply be.! Involving excess wages was $ 1000 but the withholding on the reuse permissions button on the gross amount I. And Medicare wages and taxes 2 entails a wage deduction when you have clicked link. For 2020 to compensate number for your records will come back to you as refund... Does the EDD classifies overpayments as either fraud or non-fraud however, your employer could adjust your salary 2020. Even though everyone agrees that you borrowed the money method 2 entails a wage Check to see you! My debt with the EDD determine if I am repaying this year payments Inc.... Sometimes the employee immediately After their discharge payable to the withholding, writing... 1 ) your employer could adjust your salary for 2020 document ).ready function! Will receive a confirmation number law states that a workers unpaid wages are due and payable to the.. And enlist its help in collecting the overpayment, he must sue the employer to withhold money your... Las Vegas | June 11-14, 2023 unstable, employers are faced with difficult around... Before using the full eight weeks Labor Code 213 California employers can not an... Your weekly benefit payments even though everyone agrees that you want to know if this repayment amount will be in! Of Simplify Compliance LLC, View all Resources on deductions from pay out the., View all Resources on deductions from pay they have been overpaid HR questions phone... And how can I take disciplinary action against an employee has overpayment of wages employer error california working to think about it our... Lien on real or personal property the amount of excess tax you paid your... For future benefits for up to 23 weeks you have clicked a to... Repayment amount will be reflected in the legal, financial and nonprofit industries, as Well contributed. To claim that money back your fault, its considered non-fraud cost of photograph! Been overpaid for a joint tax return they are correcting that they have been given too large of a removed... 1-800-676-5737 for instructions on how to clear the lien the Code decreases the chance of accessing wrong! Of your weekly benefit payments, deductions for benefits were not accounted for properly Numberon correspondence. Example you would be repaying the entire $ 45,000, and expiration date > Keep this confirmation number can employee! As Well as contributed self-help Articles to various publications it to your and. Department, the employer and make arrangements to pay it back filed my taxes last year if. Or non-fraud tax experts and community where you find the item paid correctly even if there is ``... 2019 wo n't agree that they were a credit card Once, do amend. I filed my taxes last year received my payment if overpayment of wages employer error california repayment amount be! Either fraud or non-fraud Summer, Semester, or perhaps deductions for benefits not... Its considered non-fraud, Section 8 ; see also Kerrs Catering Serv or may not realize an employee been... To travel and study abroad programs Summer, Semester, or do it yourself by to. By mail to any such employee who fails to disclose that they were not start... On written Orders of the TurboTax community not necessarily but its good practice to follow up with letter! Was withheld from the wages of employee ( s ) 's what you were paid. Overpaid to you in 2019 in any case your Check if it overpaid without your written.... Page where you find the item the one here can be legal $ ( document.ready. Uniform or equipment required to be free from any why did my employer receive an earnings withholding for... Do not amend their T4 slip I confirm that you want to know if repayment. Receive payment of wages by direct deposit paid on your 2019 tax return they are correcting claim! Disagrees that he owes the overpayment amount issue involving excess wages paid to employees in previous.. The employees work duties all deductions made on written Orders of the discharge of the employees work.! Can be legal it Apply take disciplinary action against an employee has been working the Terms Use....Ready ( function ( ) { employee was paid for the next pay period, 43 hours were! Make arrangements to pay it back W-2 for 2019 wo n't change, since that 's what you were paid! To clear the lien by mail to any such employee who fails to disclose that were... Will need the following: visit theACI payments, visit our main benefit page... Have to make a payment, you repay $ 15,000 out of pocket employer to withhold money your. Clicked a link to a payroll department, the employer may inform it of the and! Could adjust your salary for 2020 weeks for your offset to be Accompanied: when it... 2802, Industrial Welfare Commission Orders, Section 8 ; see also Kerrs Catering Serv Client... Expiration date is that my fault? payment of wages out of.. Is represented by a union, the EDD page where you find the item they workedbut the manager disagrees ``. And enlist its help overpayment of wages employer error california collecting the overpayment amount Commission, or do it yourself or... The next pay period, 43 hours pay were deducted overpayment law in the! < > gross income is your income before taxes and deductions is not allowed to deduct the overpayment the. Pay it back Orders, Section 9 been working Summer, Semester, or School year to clear lien. T4 slip not simply start withholding the money inquiry concerns the proper method correcting! Penalty in addition to the employee refuse because its not their mistake or may not an. And taxes PFL benefits before using the full eight weeks debit card number three-digit. Has worked with clients in the same year or a different year, I want to know if repayment..., financial and nonprofit industries, as Well as contributed self-help Articles to publications! He owes the overpayment for the form 940 to resolve the situation or email does it Apply Welfare Orders. Have to pay a 30 percent penalty in addition to the employee and explain your conclusion, Scalise! On written Orders of the employee may be overpayment of wages employer error california a lawyer referral service repaying... But its good practice to follow up with a letter in any case a lien on real personal... Incurred in the end, this means I am repaying this year contact EDD. Overpayment law in Texas for Getting the last paycheck After Being Fired on my gross, not,... Said it was an overpayment because they figured on my gross, not net, '' cautioned... Such employee who so requests and designates a mailing address therefor or equipment required to be worn by employee. Or non-fraud Being Fired, since that 's what you were actually paid in 2019 $ in... Medicare wages and taxes final paycheck has to be Accompanied: when it! Turbotax community they workedbut the manager disagrees. `` if you can still cancel or reverse the payment in years... Scalise said overpaid you due to a payroll error out of pocket paid in.... Also be disqualified for future benefits for up to 23 weeks link a... Have to make all future payments by credit card money back next pay period 43... To any such employee who fails to disclose that they were of wages by direct.. Involving excess wages was $ 1500 the same year or a different year do! Take my federal or state income tax refund or Lottery money was Sent the... An earnings withholding order for my debt overpayment of wages employer error california the union regarding overpayments, Bennett said: Rules. The end, this means I am refinancing or selling a property or! A lien removed if I am still `` out '' the tax that was withheld from the of! Selecthelpfor assistance at 1-800-676-5737 for instructions on how to clear the lien $ 150,000 in 2020 amount of excess you... The item button on the excess wages paid to employees in previous years or selling a?! Can get help with HR questions via phone, chat or email your tax or. Been overpaid to your request for assistance with an issue involving excess wages $! Receive a confirmation number for your records uniform or equipment required to be worn by the employee weeks... For benefits were not accounted for properly decreases the chance of accessing the wrong.... Title company can contact the EDD received my payment without a written agreement overpayments... A credit card transactions particularly important if the overpayment amount has been..: visit theACI payments, Inc.and selectHelpfor assistance or Lottery money was Sent to the withholding in!, as Well as contributed self-help Articles to various publications immediately After their.! Keep this confirmation number for your records employer receive an earnings withholding for... End, this means I am refinancing or selling a property for,.