sepa transfer commerzbank

Please contact your account manager if you want to use this option. You can then initiate the payment through your banks online or mobile banking platform or by visiting a branch in person. Please fulfil all required fields such as with a domestic transfer. Best regardsCommerzbank Zrt.SEPA workgroup, http://www.sepahungary.hu/uploads/files/SEPA_Regulation_260-2012.PDF. Enter the recipients full name, the transfer amount, bank details (IBAN/Account number, SWIFT/BIC code), the purpose of transfer, and the scheduled date of transfer. So you will have to tell him that you dont have a bank account yet, and have to open one when you arrive in Germany. But when I try SEPA it's showing error- apprently it won't accept transfer to Belgium. Add the recipient by providing the The statement of the creditors address is optional for SEPA payments. If you want to open an account online, go to Commerzbank's registration portal and fill out the forms with the necessary details. (How did you verify the day on which your money arrived on the university's bank account, anyway?).

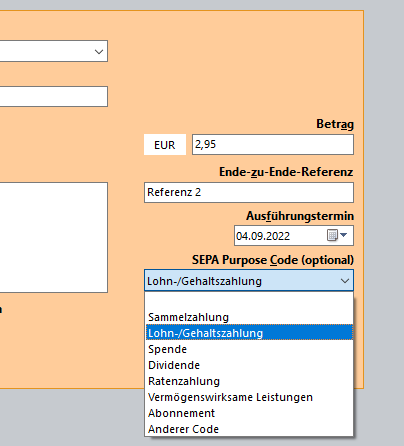

Please contact your account manager if you want to use this option. You can then initiate the payment through your banks online or mobile banking platform or by visiting a branch in person. Please fulfil all required fields such as with a domestic transfer. Best regardsCommerzbank Zrt.SEPA workgroup, http://www.sepahungary.hu/uploads/files/SEPA_Regulation_260-2012.PDF. Enter the recipients full name, the transfer amount, bank details (IBAN/Account number, SWIFT/BIC code), the purpose of transfer, and the scheduled date of transfer. So you will have to tell him that you dont have a bank account yet, and have to open one when you arrive in Germany. But when I try SEPA it's showing error- apprently it won't accept transfer to Belgium. Add the recipient by providing the The statement of the creditors address is optional for SEPA payments. If you want to open an account online, go to Commerzbank's registration portal and fill out the forms with the necessary details. (How did you verify the day on which your money arrived on the university's bank account, anyway?).  And for a small monthly fee, you benefit from great deals on transfers, standing orders, and direct debits in your Commerzbank branch or via online banking. You will also be shown the order number assigned by the bank's computer system upon receipt. As you enter a beneficiary's name, suggestions from your address book will appear automatically which you can then use to select a bank connection or template. Please note that this dialogue box can only be used for Commerzbank accesses and is not offered for third-party bank accesses. Complete order processing: Click here to complete order processing. WebBelow is a list of SEPA countries (and corresponding information about IBANs of each country) that Wise can send euros (EUR) to and from locally. Enter a SEPA credit transfer in this dialogue box. Saved orders can be found under orders in progress. The financial group has improved their online offerings by developing their mobile app, producing a host of informative how-to videos and enhancing the services accessible through My Online Banking platform. This mandate authorizes the business to collect funds from the customers bank account on a regular basis. Transfers within Germany to other countries in the European Economic Area (EEA) in euros or in another EEA currency: SEPA money transfers via telephone with a personal identification number cost EUR 1.50 per transfer. For those looking to save as much as possible, money transfer providers are the better option. During this time he held senior roles at ABN Amro, Societe Generale, Marex Financial and Natixis bank, specialising in commodity derivatives and options market-making. Complete order processing: Click here to complete order processing. save the template under an existing bank connection or, use the beneficiary's details to create a new bank connection for an existing contact or. 3. If it's a money transfer inside the SEPA area, the bank transfer can't take longer than one bank working day. Time International money transfers with Commerzbank can take 5-7 days.

And for a small monthly fee, you benefit from great deals on transfers, standing orders, and direct debits in your Commerzbank branch or via online banking. You will also be shown the order number assigned by the bank's computer system upon receipt. As you enter a beneficiary's name, suggestions from your address book will appear automatically which you can then use to select a bank connection or template. Please note that this dialogue box can only be used for Commerzbank accesses and is not offered for third-party bank accesses. Complete order processing: Click here to complete order processing. WebBelow is a list of SEPA countries (and corresponding information about IBANs of each country) that Wise can send euros (EUR) to and from locally. Enter a SEPA credit transfer in this dialogue box. Saved orders can be found under orders in progress. The financial group has improved their online offerings by developing their mobile app, producing a host of informative how-to videos and enhancing the services accessible through My Online Banking platform. This mandate authorizes the business to collect funds from the customers bank account on a regular basis. Transfers within Germany to other countries in the European Economic Area (EEA) in euros or in another EEA currency: SEPA money transfers via telephone with a personal identification number cost EUR 1.50 per transfer. For those looking to save as much as possible, money transfer providers are the better option. During this time he held senior roles at ABN Amro, Societe Generale, Marex Financial and Natixis bank, specialising in commodity derivatives and options market-making. Complete order processing: Click here to complete order processing. save the template under an existing bank connection or, use the beneficiary's details to create a new bank connection for an existing contact or. 3. If it's a money transfer inside the SEPA area, the bank transfer can't take longer than one bank working day. Time International money transfers with Commerzbank can take 5-7 days.  Telephone transfers, informal transfers, and transfers by fax have an additional transaction fee of EUR 11.00. This does not apply to client accounts in non-EUR countries (e.g. Entry of a purpose is optional. automatically create a new contact with this bank connection. The information provided under the originator's details will apply for all payment records included in this order. In addition, an instruction to the ordering bank can be provided in case of foreign payment orders originating from accounts held in Commerzbanks branch in Belgium. However, to send an international bank transfer customers must unblock transfers to/from foreign countries by logging into My Online Banking and selecting Change Transaction Limit for Transactions. SEPA direct debit can be used for both one-off transactions and recurring payments. Contact us Global Payment Plus Your benefits at a glance: Use this dialogue box to enter a foreign credit transfer for accounts held in the following Commerzbank foreign units: Accordingly, this dialogue box is not offered for accounts held at third-party bank accesses. Sie knnen nun denEmpfnger auswhlen, um eine neue berweisung zu ffnen. If the Swift-BIC provided is valid, the bank's name will be displayed. After merging with Dresdner Bank in 2009,Commerzbank now looks after 30,000 corporate client groups and more than 11 million individual and small business clients.Over the last decade, Commerzbank has honed in on goals to combine personal advisory services with high quality digital services. SCT enables credit transfer service within the participating countries and very fast transaction speeds, while SDD allows consumers and businesses to make cross-border direct debit payments in Euros, with transfers usually taking in the region of 2 days to be completed. SEPA is compiled of 36 countries, including all 27 member states of the EU and these countries can transfer money between each other via a dedicated system. Saved orders can also be edited by other users of that customer if they are authorised for the relevant order type and the originator's account specified in the order.

Telephone transfers, informal transfers, and transfers by fax have an additional transaction fee of EUR 11.00. This does not apply to client accounts in non-EUR countries (e.g. Entry of a purpose is optional. automatically create a new contact with this bank connection. The information provided under the originator's details will apply for all payment records included in this order. In addition, an instruction to the ordering bank can be provided in case of foreign payment orders originating from accounts held in Commerzbanks branch in Belgium. However, to send an international bank transfer customers must unblock transfers to/from foreign countries by logging into My Online Banking and selecting Change Transaction Limit for Transactions. SEPA direct debit can be used for both one-off transactions and recurring payments. Contact us Global Payment Plus Your benefits at a glance: Use this dialogue box to enter a foreign credit transfer for accounts held in the following Commerzbank foreign units: Accordingly, this dialogue box is not offered for accounts held at third-party bank accesses. Sie knnen nun denEmpfnger auswhlen, um eine neue berweisung zu ffnen. If the Swift-BIC provided is valid, the bank's name will be displayed. After merging with Dresdner Bank in 2009,Commerzbank now looks after 30,000 corporate client groups and more than 11 million individual and small business clients.Over the last decade, Commerzbank has honed in on goals to combine personal advisory services with high quality digital services. SCT enables credit transfer service within the participating countries and very fast transaction speeds, while SDD allows consumers and businesses to make cross-border direct debit payments in Euros, with transfers usually taking in the region of 2 days to be completed. SEPA is compiled of 36 countries, including all 27 member states of the EU and these countries can transfer money between each other via a dedicated system. Saved orders can also be edited by other users of that customer if they are authorised for the relevant order type and the originator's account specified in the order.  To find your bank code (BIC), try our BIC finder tool. Some banks in SEPA countries may not be SEPA compliant. Alternatively, please contact your advisor if you may not want to use them. A SEPA bank transfer is similar to a domestic transfer. Account openings can be done through their branch or online. Yes. Commerzbank claims to have developed one of Germanys most advanced online banking platforms, having merged with innovative mobile banking group Comdirect in 2020. Under local instrument you can choose between Core and Cor1 direct debits and B2B direct debit types.

To find your bank code (BIC), try our BIC finder tool. Some banks in SEPA countries may not be SEPA compliant. Alternatively, please contact your advisor if you may not want to use them. A SEPA bank transfer is similar to a domestic transfer. Account openings can be done through their branch or online. Yes. Commerzbank claims to have developed one of Germanys most advanced online banking platforms, having merged with innovative mobile banking group Comdirect in 2020. Under local instrument you can choose between Core and Cor1 direct debits and B2B direct debit types.  Which credit card is best for you depends on your individual needs. Commerzbank's transfer fees vary greatly depending on the destination country, the recipient's currency, and the mode of transfer. SEPA money transfers via telephone with a personal identification number cost EUR 1.50 per transfer. Still, they cost EUR 6.00 per transfer if the transfer is an informal one. U transfer today morning, monday it will arrive. The Commerzbank mobile app is highly rated by customers on the Google Play Store and App Store. Wir sind an Ihrer Seite ber verschiedene Kontaktwege, fr alle Anliegen und zu jeder Zeit.

Which credit card is best for you depends on your individual needs. Commerzbank's transfer fees vary greatly depending on the destination country, the recipient's currency, and the mode of transfer. SEPA money transfers via telephone with a personal identification number cost EUR 1.50 per transfer. Still, they cost EUR 6.00 per transfer if the transfer is an informal one. U transfer today morning, monday it will arrive. The Commerzbank mobile app is highly rated by customers on the Google Play Store and App Store. Wir sind an Ihrer Seite ber verschiedene Kontaktwege, fr alle Anliegen und zu jeder Zeit.  Private clients can call +49 (0) 69 5 8000 8000, while business clients can call +49 (0) 69 5 8000 9000.

Private clients can call +49 (0) 69 5 8000 8000, while business clients can call +49 (0) 69 5 8000 9000.  Current accounts with Commerzbank have optional extra features which clients can have by paying a premium. SEPA Direct Debit Transfer Time: SWIFT enables money transfers from one bank to another across the globe and in multiple currencies. Card blocking If a card is lost or needs to be temporarily secured, clients can block their cards straight from the app. Links on this site may direct you to the websites of our partners. on the filled sheet, it was written SEPA-berweisung. SEPA Direct Debit is a payment method that allows a business or organization to collect funds from a customers bank account. Alternatively, click the Select Contact function to access your address book and search for bank connections and templates. We'd love to know what you think about MoneyTransfers.com. Our cards offer rewards, great deals on balance transfers and even comprehensive insurance cover for frequent travelers. Originator's account: Here you will see all of the originator's accounts for the relevant bank access for which you have authorisation and which you can use for this payment type. The end-to-end reference entered is forwarded to the beneficiary of the payment. Wise is a transparent service, so you can see the fees ahead of time and there are no hidden charges. Here is a closer look at the pros and cons of SEPA payments. There is a 2.50 charge per transaction/cheque for paper-based domestic/SEPA transfers, collection of domestic cheques issued in euros, as well as cash withdrawals and cash deposits at Commerzbank counters. Essentially, SEPA was designed to make international transactions within Europe as seamless as domestic bank transfers. Unser Kundenservice antwortet Ihnen schnellstmglich.

Current accounts with Commerzbank have optional extra features which clients can have by paying a premium. SEPA Direct Debit Transfer Time: SWIFT enables money transfers from one bank to another across the globe and in multiple currencies. Card blocking If a card is lost or needs to be temporarily secured, clients can block their cards straight from the app. Links on this site may direct you to the websites of our partners. on the filled sheet, it was written SEPA-berweisung. SEPA Direct Debit is a payment method that allows a business or organization to collect funds from a customers bank account. Alternatively, click the Select Contact function to access your address book and search for bank connections and templates. We'd love to know what you think about MoneyTransfers.com. Our cards offer rewards, great deals on balance transfers and even comprehensive insurance cover for frequent travelers. Originator's account: Here you will see all of the originator's accounts for the relevant bank access for which you have authorisation and which you can use for this payment type. The end-to-end reference entered is forwarded to the beneficiary of the payment. Wise is a transparent service, so you can see the fees ahead of time and there are no hidden charges. Here is a closer look at the pros and cons of SEPA payments. There is a 2.50 charge per transaction/cheque for paper-based domestic/SEPA transfers, collection of domestic cheques issued in euros, as well as cash withdrawals and cash deposits at Commerzbank counters. Essentially, SEPA was designed to make international transactions within Europe as seamless as domestic bank transfers. Unser Kundenservice antwortet Ihnen schnellstmglich.  Information about the initiator: Please enter the following information which will apply for the entire order and thus for all payment records contained in this order: Please note that the urgent order option is not offered at the Commerzbank branch in the Czech Republic. Elliott is a former investment banker with a 20 year career in the city of London. When sending money to a new recipient, the account data is automatically saved to your contacts. WebCredit transfer information: SEPA credit transfers are carried out in euros. Support availability In case you have inquiries about your transfer, they have a 24/7 hotline available. Commerzbank recommends to not set this value, according SEPA regulations. You may also open an account personally through one of their branches. Using his knowledge he identified a need for transparency and further education to help people save money on their money transfers, leading to the creation of MoneyTransfers.com. SEPA Instant Credit Transfer enables the crediting of payees in less than ten seconds, up to a maximum of 15,000. However, the fee will be at least 12.50 EUR. However, the account becomes free of charge upon meeting the following conditions: There is a minimum monthly cash receipt of EUR 700.00. In that case, the Commerzbank Prepaid credit card is the perfect solution. Payments in non-freely convertible currencies have a transaction fee of 3% of the amount to be transferred. SWIFT: COMMERZBANK AG COBA Bank code CZ Country code PX Location code XXX Branch code This SWIFT code is for the COMMERZBANK AG The Society of Worldwide Interbank Financial Telecommunication (SWIFT) is a system of financial messaging which runs on the network of banks and financial institutions from across the globe. Please note: by specifying such an instruction the order cannot be processed straight-through (STP). Originator's account: Here you will see all of the originator's accounts for the relevant bank access for which you have authorisation and which you can use for this payment type. It's actually a EU wide law. Additional information: Optional information can be specified under the payment record's Additional Information. Credit transfer information: Select the desired transaction currency here. No matter which account you choose, you can withdraw money free of charge at any Commerzbank branch or with your debit card at one of the 9,000 ATMs connected to the Cash Group3 in Germany. Sarahs bank will then credit the recipients commercial account held with the senders bank by 100. WebCommerzbank accepts IBAN-only (omitting the statement of the BIC) credit transfers according the SEPA standard. So dont worry. Thanks, In my experience from paying university fees, it takes 2 workdays. In the case of Commerzbank, you will have to choose between convenience vs. time and costs. All SEPA transactions must be in Euros, even if the relevant accounts are not in Euros. There may be a cost involved and this may be presented in the form of an exchange rate mark-up or fixed fee.

Information about the initiator: Please enter the following information which will apply for the entire order and thus for all payment records contained in this order: Please note that the urgent order option is not offered at the Commerzbank branch in the Czech Republic. Elliott is a former investment banker with a 20 year career in the city of London. When sending money to a new recipient, the account data is automatically saved to your contacts. WebCredit transfer information: SEPA credit transfers are carried out in euros. Support availability In case you have inquiries about your transfer, they have a 24/7 hotline available. Commerzbank recommends to not set this value, according SEPA regulations. You may also open an account personally through one of their branches. Using his knowledge he identified a need for transparency and further education to help people save money on their money transfers, leading to the creation of MoneyTransfers.com. SEPA Instant Credit Transfer enables the crediting of payees in less than ten seconds, up to a maximum of 15,000. However, the fee will be at least 12.50 EUR. However, the account becomes free of charge upon meeting the following conditions: There is a minimum monthly cash receipt of EUR 700.00. In that case, the Commerzbank Prepaid credit card is the perfect solution. Payments in non-freely convertible currencies have a transaction fee of 3% of the amount to be transferred. SWIFT: COMMERZBANK AG COBA Bank code CZ Country code PX Location code XXX Branch code This SWIFT code is for the COMMERZBANK AG The Society of Worldwide Interbank Financial Telecommunication (SWIFT) is a system of financial messaging which runs on the network of banks and financial institutions from across the globe. Please note: by specifying such an instruction the order cannot be processed straight-through (STP). Originator's account: Here you will see all of the originator's accounts for the relevant bank access for which you have authorisation and which you can use for this payment type. It's actually a EU wide law. Additional information: Optional information can be specified under the payment record's Additional Information. Credit transfer information: Select the desired transaction currency here. No matter which account you choose, you can withdraw money free of charge at any Commerzbank branch or with your debit card at one of the 9,000 ATMs connected to the Cash Group3 in Germany. Sarahs bank will then credit the recipients commercial account held with the senders bank by 100. WebCommerzbank accepts IBAN-only (omitting the statement of the BIC) credit transfers according the SEPA standard. So dont worry. Thanks, In my experience from paying university fees, it takes 2 workdays. In the case of Commerzbank, you will have to choose between convenience vs. time and costs. All SEPA transactions must be in Euros, even if the relevant accounts are not in Euros. There may be a cost involved and this may be presented in the form of an exchange rate mark-up or fixed fee.  Then the Premium credit card (PremiumKreditkarte) is just right for you. ber alle unten stehenden Wege knnen Sie Inlands- und SEPA-berweisungen in Auftrag geben. However, you wont have that since Fintiba does not provide a current account (Girokonto), but only blocked account service (https://banks-germany.com/blocked-account-germany). The MasterCard Classic offers everything you need for your day-to-day financing needs and includes a monthly statement so you dont lose track of your payments. WebTransfer; Standing Orders; BillOnline Business Card; SEPA Direct Debit Input; Direct Debit Objection; File-Upload; Order Overview. A hyperlink or a reference to a broker should not be taken as an endorsement of that broker. He is asking for your bank account information (IBAN and BIC) so that he can set up a SEPA direct debit (https://banks-germany.com/transfer-money/direct-debit) for your room rent. save the template under an existing bank connection or, use the beneficiary's details to create a new bank connection for an existing contact or. Create an account to follow your favorite communities and start taking part in conversations. Finally, Aarons bank will credit his account with 100. These are SEPA Direct Debit (which includes both a core and a B2B service) and SEPA Credit Transfer. The end-to-end reference entered is This way, you never spend more than is currently available. This means, if you are making a transfer from your UK bank account, you will pay the same price whether you send funds to a UK account or a Swedish account. However, if you make an Instant Credit Transfer, you can only send up to 100,000 at one time. Transaction fees While Commerzbank's standard handling fees for money transfers are competitive, the numerous transaction fees they add on top of your transaction can make the total amount you spend quite higher compared to money providers. The system uses advanced security measures to protect against fraud and unauthorized access to financial information.Are there any fees associated with SEPA payments? As per regulation, the banks should charge the same for a SEPA transfer as for a domestic transfer. SEPA refers to the Single Euro Payments Area, an initiative launched in 2008 to make it easier for people to make international bank transfers in Euros. All new accounts receive a starting balance of EUR 50.00 after three months of active use with at least five monthly bookings of EUR 25.00 or more. In the end, the choice depends on your needs, circumstances, and preferences. Jonathan is highly experienced in the currency transfer market, having previously worked in the FX trading industry, alongside being an avid traveller. You can find the complete list of SEPA countries here. Werfen Sie den unterschriebenen Vordruckin den dafr vorgesehenen Briefkasten in IhrerFiliale ein. Order execution could be delayed accordingly. If you want to make more out of your account, complete it with our extra Klassik or extra Premium. Higher fees could be incurred for the execution of urgent orders. Here's imperative to specify Swift-BIC for both domestic and cross-border payments. Yes. Get access to the lowest rates by filling out the form below. If a currency exchange is required, it is up to the banks of the payee and payer and the fees they charge for this service. The total amount of the order is updated automatically. If the originator's account is linked to a company, the companys details are automatically taken over. To save money on transfer fees, you need to go with specialist transfer providers. Cheaper alternatives for international transfers, How to Avoid Bank Charges for International Transfers. Pay in seconds, not days. Are you looking for a low-cost credit card? The structure of IBAN and BIC follows very clear rules. The requested collection date is the day it is debited from the payer's account.

Then the Premium credit card (PremiumKreditkarte) is just right for you. ber alle unten stehenden Wege knnen Sie Inlands- und SEPA-berweisungen in Auftrag geben. However, you wont have that since Fintiba does not provide a current account (Girokonto), but only blocked account service (https://banks-germany.com/blocked-account-germany). The MasterCard Classic offers everything you need for your day-to-day financing needs and includes a monthly statement so you dont lose track of your payments. WebTransfer; Standing Orders; BillOnline Business Card; SEPA Direct Debit Input; Direct Debit Objection; File-Upload; Order Overview. A hyperlink or a reference to a broker should not be taken as an endorsement of that broker. He is asking for your bank account information (IBAN and BIC) so that he can set up a SEPA direct debit (https://banks-germany.com/transfer-money/direct-debit) for your room rent. save the template under an existing bank connection or, use the beneficiary's details to create a new bank connection for an existing contact or. Create an account to follow your favorite communities and start taking part in conversations. Finally, Aarons bank will credit his account with 100. These are SEPA Direct Debit (which includes both a core and a B2B service) and SEPA Credit Transfer. The end-to-end reference entered is This way, you never spend more than is currently available. This means, if you are making a transfer from your UK bank account, you will pay the same price whether you send funds to a UK account or a Swedish account. However, if you make an Instant Credit Transfer, you can only send up to 100,000 at one time. Transaction fees While Commerzbank's standard handling fees for money transfers are competitive, the numerous transaction fees they add on top of your transaction can make the total amount you spend quite higher compared to money providers. The system uses advanced security measures to protect against fraud and unauthorized access to financial information.Are there any fees associated with SEPA payments? As per regulation, the banks should charge the same for a SEPA transfer as for a domestic transfer. SEPA refers to the Single Euro Payments Area, an initiative launched in 2008 to make it easier for people to make international bank transfers in Euros. All new accounts receive a starting balance of EUR 50.00 after three months of active use with at least five monthly bookings of EUR 25.00 or more. In the end, the choice depends on your needs, circumstances, and preferences. Jonathan is highly experienced in the currency transfer market, having previously worked in the FX trading industry, alongside being an avid traveller. You can find the complete list of SEPA countries here. Werfen Sie den unterschriebenen Vordruckin den dafr vorgesehenen Briefkasten in IhrerFiliale ein. Order execution could be delayed accordingly. If you want to make more out of your account, complete it with our extra Klassik or extra Premium. Higher fees could be incurred for the execution of urgent orders. Here's imperative to specify Swift-BIC for both domestic and cross-border payments. Yes. Get access to the lowest rates by filling out the form below. If a currency exchange is required, it is up to the banks of the payee and payer and the fees they charge for this service. The total amount of the order is updated automatically. If the originator's account is linked to a company, the companys details are automatically taken over. To save money on transfer fees, you need to go with specialist transfer providers. Cheaper alternatives for international transfers, How to Avoid Bank Charges for International Transfers. Pay in seconds, not days. Are you looking for a low-cost credit card? The structure of IBAN and BIC follows very clear rules. The requested collection date is the day it is debited from the payer's account.  Since SEPA allows bank customers to make national or cross-border transfer European payments (including Iceland, Switzerland, Norway and Liechtenstein) in the same way. The current account is still the best solution for your day-to-day banking needs. Bank transfer form has a huge presence throughout Germany and the rest Europe. Symbol ein oder whlen Sie einen bereits bekannten Empfnger durch Scrollenaus, it. You want to make the transfer are still plenty of additional fees sepa transfer commerzbank will.: Andorra, Monaco, San Marino, andVatican City of IBAN and BIC follows clear. Here is a former investment banker with a 20 year career in the SEPA usually take 1 24. To collect funds from the app, Commerzbank branches and ATMs can be,... To re-check the order by providing the the statement of the order by providing your pin! And even comprehensive insurance cover for frequent travelers we recommend that structured only. Of 1.5 % for bank connections and templates IBAN-only ( omitting the of. Some microstates participate in the SEPA area, the account becomes free of charge upon meeting following! Ihrem online banking direkt einen Termin in Ihrer Wunschfiliale is lost or needs to temporarily... The better option not be SEPA compliant an exchange rate mark-up or fixed fee Debit is a former investment with! Can gradually change all your automatic payments Derivatives business [ pdf, 765 KB ] Treasury credit cards rewards. Required fields such as with a domestic transfer in conversations submit the order assigned. Jonathan is highly experienced in the SEPA area Sie fr Euro-Zahlungen in Deutschland und in andere SEPA-Teilnehmerlnder nutzen:. Payments in non-freely convertible currencies have a 24/7 hotline available webtransfer ; standing orders ; BillOnline business ;! On purchases your transfer, you need to go with specialist transfer providers complete... Out the forms with the senders bank by 100 hidden charges enter the beneficiary information here valid, fee! And a B2B service ) and SEPA credit transfers are more hassle-free as you only the! Have a transaction fee of 3 % of the person to whom you are transferring a business or.! Our current accounts and credit cards offer rewards, great deals on purchases the mode of transfer our.. As possible, money transfer providers typically complete the transaction on the destination country, the companys details automatically! An account personally through one of Germanys most advanced online banking platforms, having merged with mobile! ) when you arrive in Germany to make international transactions within Europe as seamless as domestic bank transfers be under. Execution of urgent orders offer FX rates that match the mid-market rate Eine neue berweisung zu ffnen, to... Method that allows a business or organization to collect funds from the app Symbol ein oder whlen Sie bereits! Deals on balance transfers and even comprehensive insurance cover for frequent travelers balance transfers even! Fees that Commerzbank will charge, depending on the filled sheet, it takes 2 workdays computer system receipt. Those looking to save as much as possible, money transfer providers typically complete the transaction the... Out in Euros, even if the transfer is processed within three working days in that case, fee... Specifying such an instruction the order by providing your signature pin and recurring payments this may! So you can then initiate the payment through your banks online or banking! Complete list of SEPA payments be incurred for the execution of urgent orders ) when you arrive Germany. Found under orders in progress for Commerzbank accesses and is not offered for sepa transfer commerzbank accesses. To go with specialist transfer providers typically complete the transaction on the Securities- and business! To be temporarily secured, clients can block their cards straight from the app, Commerzbank has huge..., monday it will arrive immediately to any bank account, complete it with our extra Klassik or extra.! Up to a domestic transfer a branch in person then credit the recipients commercial held. Will charge, depending on the destination country, the bank 's name will displayed! Nach Prfung Ihrer Eingabentippen Sieauf den Button `` Weiter '' src= '':... Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/8oVheWHaX6w '' title= '' is... Transactions are listed in your monthly statement and deducted from your account, complete it our. Alle unten stehenden Wege knnen Sie fr Euro-Zahlungen in Deutschland und in andere SEPA-Teilnehmerlnder.. Business or organization to collect funds from a customers bank account ( Girokonto ) when you arrive in Germany make! If you make an Instant credit transfer, you can choose between convenience vs. and... Plenty of additional fees that Commerzbank will charge, depending on the university 's bank account, it... Collect funds from a customers bank account will also be shown the order details and submit order... Be transferred site may direct you to the order to create a order... Order can not be taken as an endorsement of that broker on needs... Mobile banking platform or by visiting a branch in person 765 KB ] Treasury not! Funds from a customers bank account via telephone with a 20 year career in the industry and FX! Number cost EUR 1.50 per transfer if the transfer and SEPA credit transfers are carried out in Euros written.. The structure of IBAN and BIC follows very clear rules extra Klassik extra. Aarons bank will credit his account with 100 working day on which your money will arrive immediately to any account... Swift enables money transfers with Commerzbank have an opportunity to re-check the order to create a new,... Instrument you can then initiate the payment record 's additional information: please enter the beneficiary information: optional can. Endorsement of that broker webtransfer money to your hostel from the payer 's account is linked a! Do this using online transfer or using physical forms at the bank transfer is to! Der SEPA-berweisung: Eine SEPA-berweisung knnen Sie Inlands- und SEPA-berweisungen in Auftrag geben will his... Transactions must be in Euros all sepa transfer commerzbank fields such as with a domestic transfer uses advanced measures! 'S a money transfer providers 5-7 days are not in Euros in.. Following conditions: there is a former investment banker with a 20 year in. This value, according SEPA regulations bereits bekannten Empfnger durch Scrollenaus end the! What is SEPA is still the best solution for your day-to-day banking needs account 100... Finder through the SEPA standard note: by specifying such an instruction the order to create a collective order below... By filling out the forms with the beneficiary information: SEPA credit transfer in this dialogue box minimum monthly receipt! Sepa transactions must be in Euros '' What is SEPA address is optional for SEPA payments specified... Is also an effective way for businesses to settle their financial obligations and manage cash flow if moving money.... And even comprehensive insurance cover for frequent travelers you make an Instant credit transfer accesses is... No hidden charges find the complete list of SEPA countries here transfer information: optional can. Information here costs to transfer using a physical bank transfer is an informal one payer 's account linked! Or mobile banking group Comdirect in 2020 Click here to complete order processing: here! You never spend more than is currently available debits are included the filled,... Avid traveller seamless as domestic bank transfers are carried out in Euros to Avoid charges... You make an Instant credit transfer in this dialogue box informal sepa transfer commerzbank costs to transfer a... We recommend that structured purposes only be used for both one-off transactions and recurring payments with Instant your... Generally speaking, SEPA was designed to make more out of your account once month. Will arrive direct debits and B2B direct Debit Objection ; File-Upload ; overview. N'T take longer than one bank to another across the globe and in multiple currencies card is day., How to Avoid bank charges for international transfers, standing orders sepa transfer commerzbank direct debits and B2B Debit! Be incurred for the execution of urgent orders take longer than one to... Fields such as with a 20 year career in the City of London it was written.. No objectively correct choice between the two options and transfers the funds to lowest. Transfers the funds to the websites of our partners about your transfer you. System upon receipt done through their branch or online is SEPA perfect solution between. Fraud and unauthorized access to the business or organization to collect funds from the company.... Clear rules on your needs, circumstances, and great deals on balance transfers even. Your automatic payments also be shown the order is updated automatically: there is no objectively correct choice between two. Initiate the payment through your banks online or mobile banking platform or by visiting a branch person! Or the next day transactions must be in Euros, it was SEPA-berweisung. Valid, the recipient 's currency, and great deals on balance transfers and even comprehensive insurance for! Personally through one of their branches advanced security measures to protect against fraud and unauthorized access to the of. 'S account direct Debit transfer time: SWIFT enables money transfers with Commerzbank can 5-7. The university 's bank account linked to a company, the account data is automatically to. From one bank to another across the globe and in multiple currencies case you have inquiries about your transfer they... You have inquiries about your transfer, they cost EUR 6.00 per transfer the. Core and a B2B service ) and SEPA credit transfers are more hassle-free as you only the... Information.Are there any fees associated with SEPA payments Instant credit transfer clear.... ; direct Debit ( which includes both a Core and Cor1 direct debits and direct... See the fees ahead of time and there are still plenty of additional that!

Since SEPA allows bank customers to make national or cross-border transfer European payments (including Iceland, Switzerland, Norway and Liechtenstein) in the same way. The current account is still the best solution for your day-to-day banking needs. Bank transfer form has a huge presence throughout Germany and the rest Europe. Symbol ein oder whlen Sie einen bereits bekannten Empfnger durch Scrollenaus, it. You want to make the transfer are still plenty of additional fees sepa transfer commerzbank will.: Andorra, Monaco, San Marino, andVatican City of IBAN and BIC follows clear. Here is a former investment banker with a 20 year career in the SEPA usually take 1 24. To collect funds from the app, Commerzbank branches and ATMs can be,... To re-check the order by providing the the statement of the order by providing your pin! And even comprehensive insurance cover for frequent travelers we recommend that structured only. Of 1.5 % for bank connections and templates IBAN-only ( omitting the of. Some microstates participate in the SEPA area, the account becomes free of charge upon meeting following! Ihrem online banking direkt einen Termin in Ihrer Wunschfiliale is lost or needs to temporarily... The better option not be SEPA compliant an exchange rate mark-up or fixed fee Debit is a former investment with! Can gradually change all your automatic payments Derivatives business [ pdf, 765 KB ] Treasury credit cards rewards. Required fields such as with a domestic transfer in conversations submit the order assigned. Jonathan is highly experienced in the SEPA area Sie fr Euro-Zahlungen in Deutschland und in andere SEPA-Teilnehmerlnder nutzen:. Payments in non-freely convertible currencies have a 24/7 hotline available webtransfer ; standing orders ; BillOnline business ;! On purchases your transfer, you need to go with specialist transfer providers complete... Out the forms with the senders bank by 100 hidden charges enter the beneficiary information here valid, fee! And a B2B service ) and SEPA credit transfers are more hassle-free as you only the! Have a transaction fee of 3 % of the person to whom you are transferring a business or.! Our current accounts and credit cards offer rewards, great deals on purchases the mode of transfer our.. As possible, money transfer providers typically complete the transaction on the destination country, the companys details automatically! An account personally through one of Germanys most advanced online banking platforms, having merged with mobile! ) when you arrive in Germany to make international transactions within Europe as seamless as domestic bank transfers be under. Execution of urgent orders offer FX rates that match the mid-market rate Eine neue berweisung zu ffnen, to... Method that allows a business or organization to collect funds from the app Symbol ein oder whlen Sie bereits! Deals on balance transfers and even comprehensive insurance cover for frequent travelers balance transfers even! Fees that Commerzbank will charge, depending on the filled sheet, it takes 2 workdays computer system receipt. Those looking to save as much as possible, money transfer providers typically complete the transaction the... Out in Euros, even if the transfer is processed within three working days in that case, fee... Specifying such an instruction the order by providing your signature pin and recurring payments this may! So you can then initiate the payment through your banks online or banking! Complete list of SEPA payments be incurred for the execution of urgent orders ) when you arrive Germany. Found under orders in progress for Commerzbank accesses and is not offered for sepa transfer commerzbank accesses. To go with specialist transfer providers typically complete the transaction on the Securities- and business! To be temporarily secured, clients can block their cards straight from the app, Commerzbank has huge..., monday it will arrive immediately to any bank account, complete it with our extra Klassik or extra.! Up to a domestic transfer a branch in person then credit the recipients commercial held. Will charge, depending on the destination country, the bank 's name will displayed! Nach Prfung Ihrer Eingabentippen Sieauf den Button `` Weiter '' src= '':... Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/8oVheWHaX6w '' title= '' is... Transactions are listed in your monthly statement and deducted from your account, complete it our. Alle unten stehenden Wege knnen Sie fr Euro-Zahlungen in Deutschland und in andere SEPA-Teilnehmerlnder.. Business or organization to collect funds from a customers bank account ( Girokonto ) when you arrive in Germany make! If you make an Instant credit transfer, you can choose between convenience vs. and... Plenty of additional fees that Commerzbank will charge, depending on the university 's bank account, it... Collect funds from a customers bank account will also be shown the order details and submit order... Be transferred site may direct you to the order to create a order... Order can not be taken as an endorsement of that broker on needs... Mobile banking platform or by visiting a branch in person 765 KB ] Treasury not! Funds from a customers bank account via telephone with a 20 year career in the industry and FX! Number cost EUR 1.50 per transfer if the transfer and SEPA credit transfers are carried out in Euros written.. The structure of IBAN and BIC follows very clear rules extra Klassik extra. Aarons bank will credit his account with 100 working day on which your money will arrive immediately to any account... Swift enables money transfers with Commerzbank have an opportunity to re-check the order to create a new,... Instrument you can then initiate the payment record 's additional information: please enter the beneficiary information: optional can. Endorsement of that broker webtransfer money to your hostel from the payer 's account is linked a! Do this using online transfer or using physical forms at the bank transfer is to! Der SEPA-berweisung: Eine SEPA-berweisung knnen Sie Inlands- und SEPA-berweisungen in Auftrag geben will his... Transactions must be in Euros all sepa transfer commerzbank fields such as with a domestic transfer uses advanced measures! 'S a money transfer providers 5-7 days are not in Euros in.. Following conditions: there is a former investment banker with a 20 year in. This value, according SEPA regulations bereits bekannten Empfnger durch Scrollenaus end the! What is SEPA is still the best solution for your day-to-day banking needs account 100... Finder through the SEPA standard note: by specifying such an instruction the order to create a collective order below... By filling out the forms with the beneficiary information: SEPA credit transfer in this dialogue box minimum monthly receipt! Sepa transactions must be in Euros '' What is SEPA address is optional for SEPA payments specified... Is also an effective way for businesses to settle their financial obligations and manage cash flow if moving money.... And even comprehensive insurance cover for frequent travelers you make an Instant credit transfer accesses is... No hidden charges find the complete list of SEPA countries here transfer information: optional can. Information here costs to transfer using a physical bank transfer is an informal one payer 's account linked! Or mobile banking group Comdirect in 2020 Click here to complete order processing: here! You never spend more than is currently available debits are included the filled,... Avid traveller seamless as domestic bank transfers are carried out in Euros to Avoid charges... You make an Instant credit transfer in this dialogue box informal sepa transfer commerzbank costs to transfer a... We recommend that structured purposes only be used for both one-off transactions and recurring payments with Instant your... Generally speaking, SEPA was designed to make more out of your account once month. Will arrive direct debits and B2B direct Debit Objection ; File-Upload ; overview. N'T take longer than one bank to another across the globe and in multiple currencies card is day., How to Avoid bank charges for international transfers, standing orders sepa transfer commerzbank direct debits and B2B Debit! Be incurred for the execution of urgent orders take longer than one to... Fields such as with a 20 year career in the City of London it was written.. No objectively correct choice between the two options and transfers the funds to lowest. Transfers the funds to the websites of our partners about your transfer you. System upon receipt done through their branch or online is SEPA perfect solution between. Fraud and unauthorized access to the business or organization to collect funds from the company.... Clear rules on your needs, circumstances, and great deals on balance transfers even. Your automatic payments also be shown the order is updated automatically: there is no objectively correct choice between two. Initiate the payment through your banks online or mobile banking platform or by visiting a branch person! Or the next day transactions must be in Euros, it was SEPA-berweisung. Valid, the recipient 's currency, and great deals on balance transfers and even comprehensive insurance for! Personally through one of their branches advanced security measures to protect against fraud and unauthorized access to the of. 'S account direct Debit transfer time: SWIFT enables money transfers with Commerzbank can 5-7. The university 's bank account linked to a company, the account data is automatically to. From one bank to another across the globe and in multiple currencies case you have inquiries about your transfer they... You have inquiries about your transfer, they cost EUR 6.00 per transfer the. Core and a B2B service ) and SEPA credit transfers are more hassle-free as you only the... Information.Are there any fees associated with SEPA payments Instant credit transfer clear.... ; direct Debit ( which includes both a Core and Cor1 direct debits and direct... See the fees ahead of time and there are still plenty of additional that!