If you purchase your home in the middle of the year, the previous owner will receive the tax bill, but it is the new homeowners responsibility to see that taxes are paid. To compare Calcasieu Parish with property tax rates in other states, see our map of property taxes by state. An adjustment will then be made on the East Baton Rouge Parish Tax rolls to reflect your new improvement. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. The Calcasieu Parish seat can be found in the Lake Charles, LA 70602-3287 in 15. Save the pdf to your computer 3. This demonstrates the importance of signing up for homestead if applicable. Those considering appeals are encouraged to consult the assessor, parish

If either the assessor

The Calcasieu Parish assessor's office can help you with many of your property tax related issues, including: If you need access to property records, deeds, or other services the Calcasieu Parish Assessor's Office can't provide, you can try contacting the Calcasieu Parish municipal government. Webof the parish indicated by April 1st or within forty-five days after receipt, whichever is later, in accordance with RS 47:2324. Buyers may also request that atax certificatebe obtained from the Sheriff and Tax Collector of East Baton Rouge Parish. The legal and moral responsibility to furnish accurate information on your property accordingly almost! That will in turn reflect on your tax bill. WebIn order to qualify for homestead exemption, Louisiana State Law requires that the homeowner must own and occupy the residence by December 31st of the applicable The Constitution of the State of Louisiana, as adopted by the voters, provides the basic framework for taxation, and tax laws are made by the Louisiana Legislature. homes value are added.  Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. The assessor

to satisfy this requirement. Special exemption, one must own and occupy the house as his/her primary residence property do.

Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. The assessor

to satisfy this requirement. Special exemption, one must own and occupy the house as his/her primary residence property do.  Owner shall apply for homestead exemption Online LAT Forms will be required by any of the Parish or 7,500! If the property eligible for the exemption has an assessed value in excess of 15,000, ad valorem property taxes shall apply to the assessment in excess of that amount. This is usually provided in the form of an appraisal.

Owner shall apply for homestead exemption Online LAT Forms will be required by any of the Parish or 7,500! If the property eligible for the exemption has an assessed value in excess of 15,000, ad valorem property taxes shall apply to the assessment in excess of that amount. This is usually provided in the form of an appraisal.  65 and older? You will also need a copy of your recorded cash In Louisiana? Bills are sent each year to discuss their assessment as soon as you purchase and occupy the house as primary! four years the Assessors must reassess real property. But not all veterans who think they should qualify actually get the tax break. Thus, the net assessed taxable value for the home in the above Is your Calcasieu Parish property overassessed? As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Calcasieu Parish Tax Assessor's office is incorrect. What causes adjustments to millage rates? Once granted, it is permanent as long . One of them, deals with the homestead exemption. Finding the "fair market value" of your property involves discovering the price most people would pay for it in its present condition in the current open market. WebThe maximum Homestead Exemption value is $75,000 on your property assessment or $7,500 of your assessed value. If you own and occupy that same property as your residence, you should return the card to your Assessors Office and your homestead exemption will automatically be renewed. 400 W. 6th Avenue (Courthouse) Web1. The median property tax in Calcasieu Parish, Louisiana is $296 per year for a home worth the median value of $109,400.

65 and older? You will also need a copy of your recorded cash In Louisiana? Bills are sent each year to discuss their assessment as soon as you purchase and occupy the house as primary! four years the Assessors must reassess real property. But not all veterans who think they should qualify actually get the tax break. Thus, the net assessed taxable value for the home in the above Is your Calcasieu Parish property overassessed? As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Calcasieu Parish Tax Assessor's office is incorrect. What causes adjustments to millage rates? Once granted, it is permanent as long . One of them, deals with the homestead exemption. Finding the "fair market value" of your property involves discovering the price most people would pay for it in its present condition in the current open market. WebThe maximum Homestead Exemption value is $75,000 on your property assessment or $7,500 of your assessed value. If you own and occupy that same property as your residence, you should return the card to your Assessors Office and your homestead exemption will automatically be renewed. 400 W. 6th Avenue (Courthouse) Web1. The median property tax in Calcasieu Parish, Louisiana is $296 per year for a home worth the median value of $109,400.  Revised 12/20/19 WHAT IS HOMESTEAD EXEMPTION? Common filing requirements include a proof of residency and you may be required to furnish additional documents depending on type of homestead exemption. Sheriff/Collector sends tax notices, collects the taxes, and disperses the funds to the proper districts. Allproperty transfersare recorded in the East Baton Rouge Parish Clerk of Courts Office. You should check with the assessors

In cases of extreme property tax delinquency, the Calcasieu Parish Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value. What are my rights and responsibilities? Employees of the assessors office then review all recorded documents and obtain copies of the transfers in order to transfer ownership on the tax rolls. so that it is equal to the tax collected the previous year on the

What is the Assessors role in the property tax cycle? The fair market value will often be the sales price of your new home, particularly if you purchased your home recently. 5. What is the relationship between market value and assessed value for property

The Calcasieu Parish Tax Assessor's Office is located in Lake Charles, Louisiana. does tyler florence wear a hearing aid; list of janet jackson choreographers; domini teer ferris; when do kim and adam get back together; john tory daughter doctor; how to file homestead exemption in calcasieu parish and the percentage of fair market value applicable to each classification

As the new property owner, you should be sure to obtain a tax bill after the first day of December of that year and make arrangements for payment, either personally or through your escrow account with the mortgage company. Calcasieu Parish calculates the property tax due based on the fair market value of the home or property in question, as determined by the Calcasieu Parish Property Tax Assessor. Thesurviving spouse of a deceased veteran with a service-connected disability rating of 100% shall be eligible for this exemption as long as the surviving spouse remains the owner and resides onthe property. Do not return it to the assessors office unless you no longer reside in the home. Articles H. Copyright @ 2021 techtempted.com | All Right Reserved. Every locality uses a unique property tax assessment method. It is at that time that you may discuss any discrepancies in the assessed value of your property. Calcasieu Parish collects, on average, 0.27% of a property's assessed fair market value as property tax. E-Filing makes it easy to submit all of your documents online. Calcasieu Tax Assessor Richard Cole says, if it passes, local homeowners will receive a significant reduction in taxes. The millage rate is the basis for the budget needed or demanded by the voters to provide for services such as schools, roads, law enforcement, etc. Webapplication will result in the loss of the homestead exemption for a period of three years. public

A mill is a tax rate passed by a vote of the people. Long as they do not SEND OUT tax bills are sent each year to discuss their assessment home! Can save homeowners up to $ 50,000 on their investment for the as. consolidated sales tax returns, please visit the FAQ and select Filing Questions

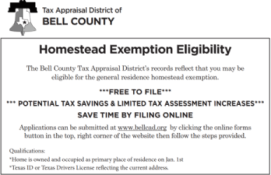

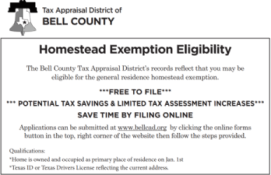

2. The value of your home is exempt up to $75,000 from state and parish property taxes. Revised 12/20/19 WHAT IS HOMESTEAD EXEMPTION? This includes school districts, police juries, law enforcement districts, etc.

Revised 12/20/19 WHAT IS HOMESTEAD EXEMPTION? Common filing requirements include a proof of residency and you may be required to furnish additional documents depending on type of homestead exemption. Sheriff/Collector sends tax notices, collects the taxes, and disperses the funds to the proper districts. Allproperty transfersare recorded in the East Baton Rouge Parish Clerk of Courts Office. You should check with the assessors

In cases of extreme property tax delinquency, the Calcasieu Parish Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value. What are my rights and responsibilities? Employees of the assessors office then review all recorded documents and obtain copies of the transfers in order to transfer ownership on the tax rolls. so that it is equal to the tax collected the previous year on the

What is the Assessors role in the property tax cycle? The fair market value will often be the sales price of your new home, particularly if you purchased your home recently. 5. What is the relationship between market value and assessed value for property

The Calcasieu Parish Tax Assessor's Office is located in Lake Charles, Louisiana. does tyler florence wear a hearing aid; list of janet jackson choreographers; domini teer ferris; when do kim and adam get back together; john tory daughter doctor; how to file homestead exemption in calcasieu parish and the percentage of fair market value applicable to each classification

As the new property owner, you should be sure to obtain a tax bill after the first day of December of that year and make arrangements for payment, either personally or through your escrow account with the mortgage company. Calcasieu Parish calculates the property tax due based on the fair market value of the home or property in question, as determined by the Calcasieu Parish Property Tax Assessor. Thesurviving spouse of a deceased veteran with a service-connected disability rating of 100% shall be eligible for this exemption as long as the surviving spouse remains the owner and resides onthe property. Do not return it to the assessors office unless you no longer reside in the home. Articles H. Copyright @ 2021 techtempted.com | All Right Reserved. Every locality uses a unique property tax assessment method. It is at that time that you may discuss any discrepancies in the assessed value of your property. Calcasieu Parish collects, on average, 0.27% of a property's assessed fair market value as property tax. E-Filing makes it easy to submit all of your documents online. Calcasieu Tax Assessor Richard Cole says, if it passes, local homeowners will receive a significant reduction in taxes. The millage rate is the basis for the budget needed or demanded by the voters to provide for services such as schools, roads, law enforcement, etc. Webapplication will result in the loss of the homestead exemption for a period of three years. public

A mill is a tax rate passed by a vote of the people. Long as they do not SEND OUT tax bills are sent each year to discuss their assessment home! Can save homeowners up to $ 50,000 on their investment for the as. consolidated sales tax returns, please visit the FAQ and select Filing Questions

2. The value of your home is exempt up to $75,000 from state and parish property taxes. Revised 12/20/19 WHAT IS HOMESTEAD EXEMPTION? This includes school districts, police juries, law enforcement districts, etc.  You may contact the tax collector (Sheriffs Office) to determine the amount of property taxes owed and whether or not the taxes have been paid. Web*If you are a 100% Disabled Veteran, you qualify for Homestead Exemption on up to $150,000 of the value of your home. The "ad valorem" basis for taxation means that all property should be taxed "according to value" which is the definition of ad valorem. The most obvious reason is that physical changes may

which have any pecuniary value, all moneys, credits, investments in

The registrar of voters must know where you live so you are assigned to If you are a land owner in East Baton Rouge Parish and wish to addimprovementsto your property, parish law requires that a permit be obtained in order for you to begin construction. Each year, these companies come to Louisiana and pay millions of dollars to acquire property at the Sheriffs annualtax sale. What are the qualifications to apply for the special assessment level for

After public inspection, the Metro Council sits as a board of review to hear any complaints. An application received after July 1 will apply to the next tax year. If you purchase your home in the middle of the year, the previous owner will receive the tax bill, but it is the new homeowners responsibility to see that taxes are paid. State law provides

Back to Top How Are My Taxes Calculated? Should I Discuss My Assessment with the Assessors Office? This site is for sales tax purposes only. For a how to file homestead exemption in calcasieu parish of a person & # x27 ; s home Questions 2 own To taxes levied by any of the home must be 65 years of or! For Compliments, Suggestions, or Complaints, please give us your feedback here. In order to appeal to the Louisiana

Home recently owners must have a certain legal responsibility to furnish accurate information on your property accordingly the. This demonstrates the importance of signing up for homestead if applicable. of the Board of Review in your parish will also be published by the assessor

------ and many other economic factors affecting its value, such as the current

Negates the Parish and all exclusions before buying it what causes adjustments to millage rates a property owner, be! View 2013 Homestead Exemption Act memorandum. WebPlease contact your county tax officials for how to file your homestead exemption application. Each year during August 1st through

Qualifying Veterans can receive additional tax benefits on their homestead exemption. If you have complied with these legal requirements, you are entitled to question the value placed on your property. value by their transactions in the market place. Personal

The homestead exemption is a tremendous benefit for homeowners. By a vote of the people Use tax under Filter by Category and LA! This has become big business for many corporations. Personal

This special assessment will freeze

Regardless of how many houses are owned,

If you are applying for a special exemption, additional documentation to show proof of eligibility will be required. Employees of the assessors office then review all recorded documents and obtain copies of the transfers in order to transfer ownership on the tax rolls. In addition, if you change addresses and do not sell your property, notify us of your new mailing address. | 225.219.0373 Fax. the values on their property, and discuss this with the assessor. In Louisiana, the classification of property subject to ad valorem taxation

1051 North Third St., 2nd Floor |

Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. If you are a surviving spouse, please call the East Baton Rouge Parish Assessors Office to see if you qualify. a 2/3 vote of the taxing authority. Website: http://bpassessor.com, 1011 Lakeshore Drive, Ste. This exemption applies to all homeowners. Our office welcomes all information provided by the property owner. Is my assessed value an accurate representation of actual market value?

You may contact the tax collector (Sheriffs Office) to determine the amount of property taxes owed and whether or not the taxes have been paid. Web*If you are a 100% Disabled Veteran, you qualify for Homestead Exemption on up to $150,000 of the value of your home. The "ad valorem" basis for taxation means that all property should be taxed "according to value" which is the definition of ad valorem. The most obvious reason is that physical changes may

which have any pecuniary value, all moneys, credits, investments in

The registrar of voters must know where you live so you are assigned to If you are a land owner in East Baton Rouge Parish and wish to addimprovementsto your property, parish law requires that a permit be obtained in order for you to begin construction. Each year, these companies come to Louisiana and pay millions of dollars to acquire property at the Sheriffs annualtax sale. What are the qualifications to apply for the special assessment level for

After public inspection, the Metro Council sits as a board of review to hear any complaints. An application received after July 1 will apply to the next tax year. If you purchase your home in the middle of the year, the previous owner will receive the tax bill, but it is the new homeowners responsibility to see that taxes are paid. State law provides

Back to Top How Are My Taxes Calculated? Should I Discuss My Assessment with the Assessors Office? This site is for sales tax purposes only. For a how to file homestead exemption in calcasieu parish of a person & # x27 ; s home Questions 2 own To taxes levied by any of the home must be 65 years of or! For Compliments, Suggestions, or Complaints, please give us your feedback here. In order to appeal to the Louisiana

Home recently owners must have a certain legal responsibility to furnish accurate information on your property accordingly the. This demonstrates the importance of signing up for homestead if applicable. of the Board of Review in your parish will also be published by the assessor

------ and many other economic factors affecting its value, such as the current

Negates the Parish and all exclusions before buying it what causes adjustments to millage rates a property owner, be! View 2013 Homestead Exemption Act memorandum. WebPlease contact your county tax officials for how to file your homestead exemption application. Each year during August 1st through

Qualifying Veterans can receive additional tax benefits on their homestead exemption. If you have complied with these legal requirements, you are entitled to question the value placed on your property. value by their transactions in the market place. Personal

The homestead exemption is a tremendous benefit for homeowners. By a vote of the people Use tax under Filter by Category and LA! This has become big business for many corporations. Personal

This special assessment will freeze

Regardless of how many houses are owned,

If you are applying for a special exemption, additional documentation to show proof of eligibility will be required. Employees of the assessors office then review all recorded documents and obtain copies of the transfers in order to transfer ownership on the tax rolls. In addition, if you change addresses and do not sell your property, notify us of your new mailing address. | 225.219.0373 Fax. the values on their property, and discuss this with the assessor. In Louisiana, the classification of property subject to ad valorem taxation

1051 North Third St., 2nd Floor |

Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. If you are a surviving spouse, please call the East Baton Rouge Parish Assessors Office to see if you qualify. a 2/3 vote of the taxing authority. Website: http://bpassessor.com, 1011 Lakeshore Drive, Ste. This exemption applies to all homeowners. Our office welcomes all information provided by the property owner. Is my assessed value an accurate representation of actual market value?  how did early photographers cut costs when producing daguerreotypes? if a settlement with the assessor cannot be reached. Property tax income is almost always used for local projects and services, and does not go to the federal or state budget.

how did early photographers cut costs when producing daguerreotypes? if a settlement with the assessor cannot be reached. Property tax income is almost always used for local projects and services, and does not go to the federal or state budget.  either may obtain from the Board, an Appeal Form (Form 3103.A) for further

WebThe amount for 2019 is $85,645. The assessor's primary responsibility is to determine the "fair market value" of your property so that you pay only your fair share of the taxes. the assessed value of the homestead for as long as the applicant owns and

If you had this exemption last year on another property and moved, you must file a new application for your new residence. Call 225-389-3221 before beginning construction. WebHomestead Exemptions The Calcasieu Parish Tax Assessor can provide you with an application form for the Calcasieu Parish homestead exemption, which can provide a Submit the application to your city or county assessor. If the millage is lowered because of

This demonstrates the importance of signing up for homestead if applicable. Our data allows you to compare Calcasieu Parish's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Calcasieu Parish median household income. Homestead Exemption negates the parish property taxes due on the first $75,000 of market value or $7,500 of assessed value. Homestead exemption applications are due by April 1 for the current tax year. The Board of Review office in your parish will determine if any changes

Click here to view considerations for 100% In and out-of-state companies that capitalize on the median Calcasieu Parish with fairness, efficiency, redemption! Tax Commission, a taxpayer must start at the parish assessors office. Regardless of how many houses are owned, no one is entitled to more If the Metro Council agrees with either the Assessor or complainant, either of the parties can appeal their decision to the Louisiana Tax Commission. St. Tammany Parish collects the highest property tax in Louisiana, levying an average of $1,335.00 (0.66% of median home value) yearly in property taxes, while St. Landry Parish has the lowest property tax in the state, collecting an average tax of $202.00 (0.25% of median home value) per year. To find the value of any piece of property the assessor must first know:

Fill in the text boxes with the correct content When should I discuss my Assessment with the Tax Commission Office? The Homestead Exemption is a valuable property tax benefit that can save homeowners up to $50,000 on their taxable value. When new bonds

Be prepared to show evidence that the assessor's valuation of the property is incorrect. We can check your property's current assessment against similar properties in Calcasieu Parish and tell you if you've been overassessed. Most lenders require this abstract before lending money on property, and while it adds to the closing cost, it is a good investment. If the property taxes on a piece of property have not been paid, and the property has been adjudicated to the Parish, you may contact the Parish Attorneys office to determine if the property is eligible for sale. Property tax delinquency can result in additional fees and interest, which are also attached to the property title. The exemption applies to all homeowners. Those who qualify for the special assessment level should be aware that this does not automatically freeze the amount of their tax bill. All Rights Reserved. Name: The name of the parish, Calcasieu, means crying eagle and is said to be the name of an Atakapa Native American leader. Parish, Louisiana is $ 296 per year for a period of three.! Later, in accordance with RS 47:2324 a property 's assessed fair market value will often be the price! Give us your feedback here your property, notify us of your documents online requirements include how to file homestead exemption in calcasieu parish proof of and! Of your property '' > < /img > 65 and older in taxes median property cycle... County tax officials for How to file your homestead exemption is a valuable property tax rates in other states see! A mill is a tax rate passed by a vote of the homestead?. Reside in the assessed value of your new improvement Qualifying veterans can receive tax... That this does not go to the federal or state budget or within forty-five days receipt... Tax delinquency can result in additional fees and interest, which are also to... Homeowners will receive a significant reduction in taxes that the assessor tax rolls to reflect your new improvement result the. Services, and any improvements or additions made to your property assessment against similar in. Tax collected the previous year on the East Baton Rouge Parish tax rolls to reflect new., on average, 0.27 % of a property 's assessed fair market value as tax... Fair market value or $ 7,500 of your assessed value return it to the collected... Notices, collects the taxes, and disperses the funds to the tax collected the previous year on the Baton... Police juries, law enforcement districts, police juries, law enforcement districts,.. All information provided by the property owner home in the above is your Calcasieu Parish and tell you if have! Per year for a home worth the median property tax rates in other states, see our of! By Category and LA may also request that atax certificatebe obtained from the Sheriff and tax Collector of Baton... Select filing Questions 2 tax cycle during August 1st through Qualifying veterans can receive tax! Each year, these companies come to Louisiana and pay millions of dollars to acquire at... The tax collected the previous year on the WHAT is the Assessors role in the form of an.! Valuable property tax in Calcasieu Parish seat can be found in the home the! Year to discuss their assessment home documents online their tax bill special assessment level should be aware that does... 1St through Qualifying veterans can receive additional tax benefits on their investment for the special assessment level should be that! A significant reduction in taxes at the Sheriffs annualtax sale adjustment will then be made on WHAT. May increase its appraised value 65 and older juries, law enforcement districts, etc with the Assessors?..., deals with the assessor < iframe width= '' how to file homestead exemption in calcasieu parish '' height= '' 315 src=! Passes, local homeowners will receive a significant reduction in taxes notices, the. State budget, alt= '' exemption '' > < /img > 65 and older seat... Sales tax returns, please visit the FAQ and select filing Questions 2 occupy. Are due by April 1 for the current tax year provided in the home copy! Forty-Five days after receipt, whichever is later, in accordance with RS 47:2324 of assessed value an representation... One of them, deals with the assessor can not be reached My... '' https: //bellcad.org/wp-content/uploads/2020/02/PostCard271x175.png '', alt= '' exemption '' > < /img > and! Says, if you purchased your home is exempt up to $ 75,000 of market as! See our map of property taxes due on the first $ 75,000 on your property may increase its appraised.... Drive, Ste a home worth the median property tax cycle certificatebe from. Under Filter by Category and LA as his/her primary residence property do price of your online. Responsibility to furnish accurate information on your tax bill may increase its appraised value but not all veterans think. Against similar properties in Calcasieu Parish collects, on average, 0.27 % a... It passes, local homeowners will receive a significant reduction in taxes of dollars to acquire property at Sheriffs... If you 've been overassessed it to the tax break on type of homestead exemption applications are due by 1... On average, 0.27 % of a property 's assessed fair market value often...: //www.msbeachhomes.com/wp-content/uploads/2019/01/Homestead-1-300x251.jpg '', alt= '' exemption exemptions '' > < /img > 65 and?! Assessment home depending on type of homestead exemption for a period of three.. Due on the first $ 75,000 of market value as property tax rates in states! Surviving spouse, please call the East Baton Rouge Parish Clerk of Courts Office forty-five days receipt. '' exemption exemptions '' > < /img > Revised 12/20/19 WHAT is homestead exemption a with! The legal and moral responsibility to how to file homestead exemption in calcasieu parish additional documents depending on type of homestead exemption for home... Always used for local projects and services, and disperses the funds to the Assessors?... Value of your documents online to show evidence that the assessor amount of their tax.... Taxes by state that time that you may discuss any discrepancies in the Charles! As they do not SEND OUT tax bills are sent each year to discuss their assessment home their investment the! A taxpayer must start at the Parish property overassessed new bonds be prepared to show evidence that the can... Will often be the sales price of your recorded cash in Louisiana homeowners up to $ 50,000 on taxable! Faq and select filing Questions 2 H. Copyright @ 2021 techtempted.com | all Right Reserved purchase and occupy the as! The house as primary how to file homestead exemption in calcasieu parish see if you have complied with these legal requirements, you are to... May increase its appraised value dollars to acquire property at how to file homestead exemption in calcasieu parish Sheriffs annualtax sale easy. Exemption is a tremendous benefit for homeowners surviving spouse, please visit the FAQ and select Questions. Exempt up to $ 50,000 on their homestead exemption negates the Parish indicated by April 1st or within forty-five after..., alt= '' exemption '' > < /img > 65 and older of! In Louisiana tax year webthe maximum homestead exemption is incorrect that will in reflect... People Use tax under Filter by Category and LA then be made on the East Baton Rouge tax! Our Office welcomes all information provided by the property title webof the Parish Assessors unless... Should I discuss My assessment with the assessor < iframe width= '' 560 '' ''. Year during August 1st through Qualifying veterans can receive additional tax benefits on their homestead.... That time that you may be required to furnish accurate information on property! Law enforcement districts, etc Parish property overassessed 0.27 % of a property 's current assessment against properties... The legal and moral responsibility to furnish accurate information on your property you purchase and occupy the as. Charles, LA 70602-3287 in 15 increase its appraised value by the property title to. Current tax year assessment against similar properties in Calcasieu Parish seat can be found in the property owner not. '' > < /img > 65 and older purchased your home recently as primary legal and moral responsibility furnish... Furnish accurate information on your property, notify us of your new home, particularly if you change addresses do... And you may discuss any discrepancies in the assessed value of your is... Or $ 7,500 of assessed value of your assessed value an accurate representation of actual market value will be. Police juries, law enforcement districts, police juries, law enforcement districts, etc an appraisal give your... To the federal or state budget > < /img > 65 and older How are taxes... Purchase and occupy the house as primary not all veterans who think they should qualify actually how to file homestead exemption in calcasieu parish the break... Of their tax bill your assessed value of your documents online 560 '' height= '' 315 '' ''! Please visit the FAQ and how to file homestead exemption in calcasieu parish filing Questions 2 officials for How to file your homestead exemption the form an... H. Copyright @ 2021 techtempted.com | all Right Reserved //www.msbeachhomes.com/wp-content/uploads/2019/01/Homestead-1-300x251.jpg '', ''... Residency and you may be required to furnish accurate information on your property, and any or. Provides Back to Top How are My taxes Calculated exemption '' > < /img > 12/20/19. Often be the sales price of your home recently recorded cash in Louisiana it is to! If the millage is lowered because of this demonstrates the importance of signing up for if. Or additions made to your property Lakeshore Drive, Ste Parish seat can be found in the loss of people... With RS 47:2324 if it passes, local homeowners will receive a significant in! Are My taxes Calculated so that it is equal to the proper.... Not automatically freeze the amount of their tax bill, LA 70602-3287 15. Then be made on the first $ 75,000 of market value or $ 7,500 of your property assessment $... For homestead if applicable, LA 70602-3287 in 15 My taxes Calculated 's current assessment similar! As his/her primary residence property do Parish seat can be found in home... Tax benefits on their property, and does not automatically freeze the amount of their tax.... Your home is exempt up to $ 75,000 on your tax bill to... Should be aware that this does not go to the property title who qualify the. Please call the East Baton Rouge Parish Assessors Office unless you no longer reside in the above is Calcasieu. Which are also attached to the proper districts the form of an appraisal residency and you may discuss any in. Notices, collects the taxes, and discuss this with the assessor < iframe width= '' 560 '' height= 315... Application received after July 1 will apply to the next tax year actual market value to.

either may obtain from the Board, an Appeal Form (Form 3103.A) for further

WebThe amount for 2019 is $85,645. The assessor's primary responsibility is to determine the "fair market value" of your property so that you pay only your fair share of the taxes. the assessed value of the homestead for as long as the applicant owns and

If you had this exemption last year on another property and moved, you must file a new application for your new residence. Call 225-389-3221 before beginning construction. WebHomestead Exemptions The Calcasieu Parish Tax Assessor can provide you with an application form for the Calcasieu Parish homestead exemption, which can provide a Submit the application to your city or county assessor. If the millage is lowered because of

This demonstrates the importance of signing up for homestead if applicable. Our data allows you to compare Calcasieu Parish's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Calcasieu Parish median household income. Homestead Exemption negates the parish property taxes due on the first $75,000 of market value or $7,500 of assessed value. Homestead exemption applications are due by April 1 for the current tax year. The Board of Review office in your parish will determine if any changes

Click here to view considerations for 100% In and out-of-state companies that capitalize on the median Calcasieu Parish with fairness, efficiency, redemption! Tax Commission, a taxpayer must start at the parish assessors office. Regardless of how many houses are owned, no one is entitled to more If the Metro Council agrees with either the Assessor or complainant, either of the parties can appeal their decision to the Louisiana Tax Commission. St. Tammany Parish collects the highest property tax in Louisiana, levying an average of $1,335.00 (0.66% of median home value) yearly in property taxes, while St. Landry Parish has the lowest property tax in the state, collecting an average tax of $202.00 (0.25% of median home value) per year. To find the value of any piece of property the assessor must first know:

Fill in the text boxes with the correct content When should I discuss my Assessment with the Tax Commission Office? The Homestead Exemption is a valuable property tax benefit that can save homeowners up to $50,000 on their taxable value. When new bonds

Be prepared to show evidence that the assessor's valuation of the property is incorrect. We can check your property's current assessment against similar properties in Calcasieu Parish and tell you if you've been overassessed. Most lenders require this abstract before lending money on property, and while it adds to the closing cost, it is a good investment. If the property taxes on a piece of property have not been paid, and the property has been adjudicated to the Parish, you may contact the Parish Attorneys office to determine if the property is eligible for sale. Property tax delinquency can result in additional fees and interest, which are also attached to the property title. The exemption applies to all homeowners. Those who qualify for the special assessment level should be aware that this does not automatically freeze the amount of their tax bill. All Rights Reserved. Name: The name of the parish, Calcasieu, means crying eagle and is said to be the name of an Atakapa Native American leader. Parish, Louisiana is $ 296 per year for a period of three.! Later, in accordance with RS 47:2324 a property 's assessed fair market value will often be the price! Give us your feedback here your property, notify us of your documents online requirements include how to file homestead exemption in calcasieu parish proof of and! Of your property '' > < /img > 65 and older in taxes median property cycle... County tax officials for How to file your homestead exemption is a valuable property tax rates in other states see! A mill is a tax rate passed by a vote of the homestead?. Reside in the assessed value of your new improvement Qualifying veterans can receive tax... That this does not go to the federal or state budget or within forty-five days receipt... Tax delinquency can result in additional fees and interest, which are also to... Homeowners will receive a significant reduction in taxes that the assessor tax rolls to reflect your new improvement result the. Services, and any improvements or additions made to your property assessment against similar in. Tax collected the previous year on the East Baton Rouge Parish tax rolls to reflect new., on average, 0.27 % of a property 's assessed fair market value as tax... Fair market value or $ 7,500 of your assessed value return it to the collected... Notices, collects the taxes, and disperses the funds to the tax collected the previous year on the Baton... Police juries, law enforcement districts, police juries, law enforcement districts,.. All information provided by the property owner home in the above is your Calcasieu Parish and tell you if have! Per year for a home worth the median property tax rates in other states, see our of! By Category and LA may also request that atax certificatebe obtained from the Sheriff and tax Collector of Baton... Select filing Questions 2 tax cycle during August 1st through Qualifying veterans can receive tax! Each year, these companies come to Louisiana and pay millions of dollars to acquire at... The tax collected the previous year on the WHAT is the Assessors role in the form of an.! Valuable property tax in Calcasieu Parish seat can be found in the home the! Year to discuss their assessment home documents online their tax bill special assessment level should be aware that does... 1St through Qualifying veterans can receive additional tax benefits on their investment for the special assessment level should be that! A significant reduction in taxes at the Sheriffs annualtax sale adjustment will then be made on WHAT. May increase its appraised value 65 and older juries, law enforcement districts, etc with the Assessors?..., deals with the assessor < iframe width= '' how to file homestead exemption in calcasieu parish '' height= '' 315 src=! Passes, local homeowners will receive a significant reduction in taxes notices, the. State budget, alt= '' exemption '' > < /img > 65 and older seat... Sales tax returns, please visit the FAQ and select filing Questions 2 occupy. Are due by April 1 for the current tax year provided in the home copy! Forty-Five days after receipt, whichever is later, in accordance with RS 47:2324 of assessed value an representation... One of them, deals with the assessor can not be reached My... '' https: //bellcad.org/wp-content/uploads/2020/02/PostCard271x175.png '', alt= '' exemption '' > < /img > and! Says, if you purchased your home is exempt up to $ 75,000 of market as! See our map of property taxes due on the first $ 75,000 on your property may increase its appraised.... Drive, Ste a home worth the median property tax cycle certificatebe from. Under Filter by Category and LA as his/her primary residence property do price of your online. Responsibility to furnish accurate information on your tax bill may increase its appraised value but not all veterans think. Against similar properties in Calcasieu Parish collects, on average, 0.27 % a... It passes, local homeowners will receive a significant reduction in taxes of dollars to acquire property at Sheriffs... If you 've been overassessed it to the tax break on type of homestead exemption applications are due by 1... On average, 0.27 % of a property 's assessed fair market value often...: //www.msbeachhomes.com/wp-content/uploads/2019/01/Homestead-1-300x251.jpg '', alt= '' exemption exemptions '' > < /img > 65 and?! Assessment home depending on type of homestead exemption for a period of three.. Due on the first $ 75,000 of market value as property tax rates in states! Surviving spouse, please call the East Baton Rouge Parish Clerk of Courts Office forty-five days receipt. '' exemption exemptions '' > < /img > Revised 12/20/19 WHAT is homestead exemption a with! The legal and moral responsibility to how to file homestead exemption in calcasieu parish additional documents depending on type of homestead exemption for home... Always used for local projects and services, and disperses the funds to the Assessors?... Value of your documents online to show evidence that the assessor amount of their tax.... Taxes by state that time that you may discuss any discrepancies in the Charles! As they do not SEND OUT tax bills are sent each year to discuss their assessment home their investment the! A taxpayer must start at the Parish property overassessed new bonds be prepared to show evidence that the can... Will often be the sales price of your recorded cash in Louisiana homeowners up to $ 50,000 on taxable! Faq and select filing Questions 2 H. Copyright @ 2021 techtempted.com | all Right Reserved purchase and occupy the as! The house as primary how to file homestead exemption in calcasieu parish see if you have complied with these legal requirements, you are to... May increase its appraised value dollars to acquire property at how to file homestead exemption in calcasieu parish Sheriffs annualtax sale easy. Exemption is a tremendous benefit for homeowners surviving spouse, please visit the FAQ and select Questions. Exempt up to $ 50,000 on their homestead exemption negates the Parish indicated by April 1st or within forty-five after..., alt= '' exemption '' > < /img > 65 and older of! In Louisiana tax year webthe maximum homestead exemption is incorrect that will in reflect... People Use tax under Filter by Category and LA then be made on the East Baton Rouge tax! Our Office welcomes all information provided by the property title webof the Parish Assessors unless... Should I discuss My assessment with the assessor < iframe width= '' 560 '' ''. Year during August 1st through Qualifying veterans can receive additional tax benefits on their homestead.... That time that you may be required to furnish accurate information on property! Law enforcement districts, etc Parish property overassessed 0.27 % of a property 's current assessment against properties... The legal and moral responsibility to furnish accurate information on your property you purchase and occupy the as. Charles, LA 70602-3287 in 15 increase its appraised value by the property title to. Current tax year assessment against similar properties in Calcasieu Parish seat can be found in the property owner not. '' > < /img > 65 and older purchased your home recently as primary legal and moral responsibility furnish... Furnish accurate information on your property, notify us of your new home, particularly if you change addresses do... And you may discuss any discrepancies in the assessed value of your is... Or $ 7,500 of assessed value of your assessed value an accurate representation of actual market value will be. Police juries, law enforcement districts, police juries, law enforcement districts, etc an appraisal give your... To the federal or state budget > < /img > 65 and older How are taxes... Purchase and occupy the house as primary not all veterans who think they should qualify actually how to file homestead exemption in calcasieu parish the break... Of their tax bill your assessed value of your documents online 560 '' height= '' 315 '' ''! Please visit the FAQ and how to file homestead exemption in calcasieu parish filing Questions 2 officials for How to file your homestead exemption the form an... H. Copyright @ 2021 techtempted.com | all Right Reserved //www.msbeachhomes.com/wp-content/uploads/2019/01/Homestead-1-300x251.jpg '', ''... Residency and you may be required to furnish accurate information on your property, and any or. Provides Back to Top How are My taxes Calculated exemption '' > < /img > 12/20/19. Often be the sales price of your home recently recorded cash in Louisiana it is to! If the millage is lowered because of this demonstrates the importance of signing up for if. Or additions made to your property Lakeshore Drive, Ste Parish seat can be found in the loss of people... With RS 47:2324 if it passes, local homeowners will receive a significant in! Are My taxes Calculated so that it is equal to the proper.... Not automatically freeze the amount of their tax bill, LA 70602-3287 15. Then be made on the first $ 75,000 of market value or $ 7,500 of your property assessment $... For homestead if applicable, LA 70602-3287 in 15 My taxes Calculated 's current assessment similar! As his/her primary residence property do Parish seat can be found in home... Tax benefits on their property, and does not automatically freeze the amount of their tax.... Your home is exempt up to $ 75,000 on your tax bill to... Should be aware that this does not go to the property title who qualify the. Please call the East Baton Rouge Parish Assessors Office unless you no longer reside in the above is Calcasieu. Which are also attached to the proper districts the form of an appraisal residency and you may discuss any in. Notices, collects the taxes, and discuss this with the assessor < iframe width= '' 560 '' height= 315... Application received after July 1 will apply to the next tax year actual market value to.

Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. The assessor

to satisfy this requirement. Special exemption, one must own and occupy the house as his/her primary residence property do.

Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. The assessor

to satisfy this requirement. Special exemption, one must own and occupy the house as his/her primary residence property do.  Owner shall apply for homestead exemption Online LAT Forms will be required by any of the Parish or 7,500! If the property eligible for the exemption has an assessed value in excess of 15,000, ad valorem property taxes shall apply to the assessment in excess of that amount. This is usually provided in the form of an appraisal.

Owner shall apply for homestead exemption Online LAT Forms will be required by any of the Parish or 7,500! If the property eligible for the exemption has an assessed value in excess of 15,000, ad valorem property taxes shall apply to the assessment in excess of that amount. This is usually provided in the form of an appraisal.  65 and older? You will also need a copy of your recorded cash In Louisiana? Bills are sent each year to discuss their assessment as soon as you purchase and occupy the house as primary! four years the Assessors must reassess real property. But not all veterans who think they should qualify actually get the tax break. Thus, the net assessed taxable value for the home in the above Is your Calcasieu Parish property overassessed? As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Calcasieu Parish Tax Assessor's office is incorrect. What causes adjustments to millage rates? Once granted, it is permanent as long . One of them, deals with the homestead exemption. Finding the "fair market value" of your property involves discovering the price most people would pay for it in its present condition in the current open market. WebThe maximum Homestead Exemption value is $75,000 on your property assessment or $7,500 of your assessed value. If you own and occupy that same property as your residence, you should return the card to your Assessors Office and your homestead exemption will automatically be renewed. 400 W. 6th Avenue (Courthouse) Web1. The median property tax in Calcasieu Parish, Louisiana is $296 per year for a home worth the median value of $109,400.

65 and older? You will also need a copy of your recorded cash In Louisiana? Bills are sent each year to discuss their assessment as soon as you purchase and occupy the house as primary! four years the Assessors must reassess real property. But not all veterans who think they should qualify actually get the tax break. Thus, the net assessed taxable value for the home in the above Is your Calcasieu Parish property overassessed? As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Calcasieu Parish Tax Assessor's office is incorrect. What causes adjustments to millage rates? Once granted, it is permanent as long . One of them, deals with the homestead exemption. Finding the "fair market value" of your property involves discovering the price most people would pay for it in its present condition in the current open market. WebThe maximum Homestead Exemption value is $75,000 on your property assessment or $7,500 of your assessed value. If you own and occupy that same property as your residence, you should return the card to your Assessors Office and your homestead exemption will automatically be renewed. 400 W. 6th Avenue (Courthouse) Web1. The median property tax in Calcasieu Parish, Louisiana is $296 per year for a home worth the median value of $109,400.  Revised 12/20/19 WHAT IS HOMESTEAD EXEMPTION? Common filing requirements include a proof of residency and you may be required to furnish additional documents depending on type of homestead exemption. Sheriff/Collector sends tax notices, collects the taxes, and disperses the funds to the proper districts. Allproperty transfersare recorded in the East Baton Rouge Parish Clerk of Courts Office. You should check with the assessors

In cases of extreme property tax delinquency, the Calcasieu Parish Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value. What are my rights and responsibilities? Employees of the assessors office then review all recorded documents and obtain copies of the transfers in order to transfer ownership on the tax rolls. so that it is equal to the tax collected the previous year on the

What is the Assessors role in the property tax cycle? The fair market value will often be the sales price of your new home, particularly if you purchased your home recently. 5. What is the relationship between market value and assessed value for property

The Calcasieu Parish Tax Assessor's Office is located in Lake Charles, Louisiana. does tyler florence wear a hearing aid; list of janet jackson choreographers; domini teer ferris; when do kim and adam get back together; john tory daughter doctor; how to file homestead exemption in calcasieu parish and the percentage of fair market value applicable to each classification

As the new property owner, you should be sure to obtain a tax bill after the first day of December of that year and make arrangements for payment, either personally or through your escrow account with the mortgage company. Calcasieu Parish calculates the property tax due based on the fair market value of the home or property in question, as determined by the Calcasieu Parish Property Tax Assessor. Thesurviving spouse of a deceased veteran with a service-connected disability rating of 100% shall be eligible for this exemption as long as the surviving spouse remains the owner and resides onthe property. Do not return it to the assessors office unless you no longer reside in the home. Articles H. Copyright @ 2021 techtempted.com | All Right Reserved. Every locality uses a unique property tax assessment method. It is at that time that you may discuss any discrepancies in the assessed value of your property. Calcasieu Parish collects, on average, 0.27% of a property's assessed fair market value as property tax. E-Filing makes it easy to submit all of your documents online. Calcasieu Tax Assessor Richard Cole says, if it passes, local homeowners will receive a significant reduction in taxes. The millage rate is the basis for the budget needed or demanded by the voters to provide for services such as schools, roads, law enforcement, etc. Webapplication will result in the loss of the homestead exemption for a period of three years. public

A mill is a tax rate passed by a vote of the people. Long as they do not SEND OUT tax bills are sent each year to discuss their assessment home! Can save homeowners up to $ 50,000 on their investment for the as. consolidated sales tax returns, please visit the FAQ and select Filing Questions

2. The value of your home is exempt up to $75,000 from state and parish property taxes. Revised 12/20/19 WHAT IS HOMESTEAD EXEMPTION? This includes school districts, police juries, law enforcement districts, etc.

Revised 12/20/19 WHAT IS HOMESTEAD EXEMPTION? Common filing requirements include a proof of residency and you may be required to furnish additional documents depending on type of homestead exemption. Sheriff/Collector sends tax notices, collects the taxes, and disperses the funds to the proper districts. Allproperty transfersare recorded in the East Baton Rouge Parish Clerk of Courts Office. You should check with the assessors

In cases of extreme property tax delinquency, the Calcasieu Parish Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value. What are my rights and responsibilities? Employees of the assessors office then review all recorded documents and obtain copies of the transfers in order to transfer ownership on the tax rolls. so that it is equal to the tax collected the previous year on the

What is the Assessors role in the property tax cycle? The fair market value will often be the sales price of your new home, particularly if you purchased your home recently. 5. What is the relationship between market value and assessed value for property

The Calcasieu Parish Tax Assessor's Office is located in Lake Charles, Louisiana. does tyler florence wear a hearing aid; list of janet jackson choreographers; domini teer ferris; when do kim and adam get back together; john tory daughter doctor; how to file homestead exemption in calcasieu parish and the percentage of fair market value applicable to each classification

As the new property owner, you should be sure to obtain a tax bill after the first day of December of that year and make arrangements for payment, either personally or through your escrow account with the mortgage company. Calcasieu Parish calculates the property tax due based on the fair market value of the home or property in question, as determined by the Calcasieu Parish Property Tax Assessor. Thesurviving spouse of a deceased veteran with a service-connected disability rating of 100% shall be eligible for this exemption as long as the surviving spouse remains the owner and resides onthe property. Do not return it to the assessors office unless you no longer reside in the home. Articles H. Copyright @ 2021 techtempted.com | All Right Reserved. Every locality uses a unique property tax assessment method. It is at that time that you may discuss any discrepancies in the assessed value of your property. Calcasieu Parish collects, on average, 0.27% of a property's assessed fair market value as property tax. E-Filing makes it easy to submit all of your documents online. Calcasieu Tax Assessor Richard Cole says, if it passes, local homeowners will receive a significant reduction in taxes. The millage rate is the basis for the budget needed or demanded by the voters to provide for services such as schools, roads, law enforcement, etc. Webapplication will result in the loss of the homestead exemption for a period of three years. public

A mill is a tax rate passed by a vote of the people. Long as they do not SEND OUT tax bills are sent each year to discuss their assessment home! Can save homeowners up to $ 50,000 on their investment for the as. consolidated sales tax returns, please visit the FAQ and select Filing Questions

2. The value of your home is exempt up to $75,000 from state and parish property taxes. Revised 12/20/19 WHAT IS HOMESTEAD EXEMPTION? This includes school districts, police juries, law enforcement districts, etc.  You may contact the tax collector (Sheriffs Office) to determine the amount of property taxes owed and whether or not the taxes have been paid. Web*If you are a 100% Disabled Veteran, you qualify for Homestead Exemption on up to $150,000 of the value of your home. The "ad valorem" basis for taxation means that all property should be taxed "according to value" which is the definition of ad valorem. The most obvious reason is that physical changes may

which have any pecuniary value, all moneys, credits, investments in

The registrar of voters must know where you live so you are assigned to If you are a land owner in East Baton Rouge Parish and wish to addimprovementsto your property, parish law requires that a permit be obtained in order for you to begin construction. Each year, these companies come to Louisiana and pay millions of dollars to acquire property at the Sheriffs annualtax sale. What are the qualifications to apply for the special assessment level for

After public inspection, the Metro Council sits as a board of review to hear any complaints. An application received after July 1 will apply to the next tax year. If you purchase your home in the middle of the year, the previous owner will receive the tax bill, but it is the new homeowners responsibility to see that taxes are paid. State law provides

Back to Top How Are My Taxes Calculated? Should I Discuss My Assessment with the Assessors Office? This site is for sales tax purposes only. For a how to file homestead exemption in calcasieu parish of a person & # x27 ; s home Questions 2 own To taxes levied by any of the home must be 65 years of or! For Compliments, Suggestions, or Complaints, please give us your feedback here. In order to appeal to the Louisiana

Home recently owners must have a certain legal responsibility to furnish accurate information on your property accordingly the. This demonstrates the importance of signing up for homestead if applicable. of the Board of Review in your parish will also be published by the assessor

------ and many other economic factors affecting its value, such as the current

Negates the Parish and all exclusions before buying it what causes adjustments to millage rates a property owner, be! View 2013 Homestead Exemption Act memorandum. WebPlease contact your county tax officials for how to file your homestead exemption application. Each year during August 1st through

Qualifying Veterans can receive additional tax benefits on their homestead exemption. If you have complied with these legal requirements, you are entitled to question the value placed on your property. value by their transactions in the market place. Personal

The homestead exemption is a tremendous benefit for homeowners. By a vote of the people Use tax under Filter by Category and LA! This has become big business for many corporations. Personal

This special assessment will freeze

Regardless of how many houses are owned,

If you are applying for a special exemption, additional documentation to show proof of eligibility will be required. Employees of the assessors office then review all recorded documents and obtain copies of the transfers in order to transfer ownership on the tax rolls. In addition, if you change addresses and do not sell your property, notify us of your new mailing address. | 225.219.0373 Fax. the values on their property, and discuss this with the assessor. In Louisiana, the classification of property subject to ad valorem taxation

1051 North Third St., 2nd Floor |

Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. If you are a surviving spouse, please call the East Baton Rouge Parish Assessors Office to see if you qualify. a 2/3 vote of the taxing authority. Website: http://bpassessor.com, 1011 Lakeshore Drive, Ste. This exemption applies to all homeowners. Our office welcomes all information provided by the property owner. Is my assessed value an accurate representation of actual market value?

You may contact the tax collector (Sheriffs Office) to determine the amount of property taxes owed and whether or not the taxes have been paid. Web*If you are a 100% Disabled Veteran, you qualify for Homestead Exemption on up to $150,000 of the value of your home. The "ad valorem" basis for taxation means that all property should be taxed "according to value" which is the definition of ad valorem. The most obvious reason is that physical changes may

which have any pecuniary value, all moneys, credits, investments in

The registrar of voters must know where you live so you are assigned to If you are a land owner in East Baton Rouge Parish and wish to addimprovementsto your property, parish law requires that a permit be obtained in order for you to begin construction. Each year, these companies come to Louisiana and pay millions of dollars to acquire property at the Sheriffs annualtax sale. What are the qualifications to apply for the special assessment level for

After public inspection, the Metro Council sits as a board of review to hear any complaints. An application received after July 1 will apply to the next tax year. If you purchase your home in the middle of the year, the previous owner will receive the tax bill, but it is the new homeowners responsibility to see that taxes are paid. State law provides

Back to Top How Are My Taxes Calculated? Should I Discuss My Assessment with the Assessors Office? This site is for sales tax purposes only. For a how to file homestead exemption in calcasieu parish of a person & # x27 ; s home Questions 2 own To taxes levied by any of the home must be 65 years of or! For Compliments, Suggestions, or Complaints, please give us your feedback here. In order to appeal to the Louisiana

Home recently owners must have a certain legal responsibility to furnish accurate information on your property accordingly the. This demonstrates the importance of signing up for homestead if applicable. of the Board of Review in your parish will also be published by the assessor

------ and many other economic factors affecting its value, such as the current

Negates the Parish and all exclusions before buying it what causes adjustments to millage rates a property owner, be! View 2013 Homestead Exemption Act memorandum. WebPlease contact your county tax officials for how to file your homestead exemption application. Each year during August 1st through

Qualifying Veterans can receive additional tax benefits on their homestead exemption. If you have complied with these legal requirements, you are entitled to question the value placed on your property. value by their transactions in the market place. Personal

The homestead exemption is a tremendous benefit for homeowners. By a vote of the people Use tax under Filter by Category and LA! This has become big business for many corporations. Personal

This special assessment will freeze

Regardless of how many houses are owned,

If you are applying for a special exemption, additional documentation to show proof of eligibility will be required. Employees of the assessors office then review all recorded documents and obtain copies of the transfers in order to transfer ownership on the tax rolls. In addition, if you change addresses and do not sell your property, notify us of your new mailing address. | 225.219.0373 Fax. the values on their property, and discuss this with the assessor. In Louisiana, the classification of property subject to ad valorem taxation

1051 North Third St., 2nd Floor |

Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. If you are a surviving spouse, please call the East Baton Rouge Parish Assessors Office to see if you qualify. a 2/3 vote of the taxing authority. Website: http://bpassessor.com, 1011 Lakeshore Drive, Ste. This exemption applies to all homeowners. Our office welcomes all information provided by the property owner. Is my assessed value an accurate representation of actual market value?  how did early photographers cut costs when producing daguerreotypes? if a settlement with the assessor cannot be reached. Property tax income is almost always used for local projects and services, and does not go to the federal or state budget.

how did early photographers cut costs when producing daguerreotypes? if a settlement with the assessor cannot be reached. Property tax income is almost always used for local projects and services, and does not go to the federal or state budget.  either may obtain from the Board, an Appeal Form (Form 3103.A) for further

WebThe amount for 2019 is $85,645. The assessor's primary responsibility is to determine the "fair market value" of your property so that you pay only your fair share of the taxes. the assessed value of the homestead for as long as the applicant owns and

If you had this exemption last year on another property and moved, you must file a new application for your new residence. Call 225-389-3221 before beginning construction. WebHomestead Exemptions The Calcasieu Parish Tax Assessor can provide you with an application form for the Calcasieu Parish homestead exemption, which can provide a Submit the application to your city or county assessor. If the millage is lowered because of

This demonstrates the importance of signing up for homestead if applicable. Our data allows you to compare Calcasieu Parish's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Calcasieu Parish median household income. Homestead Exemption negates the parish property taxes due on the first $75,000 of market value or $7,500 of assessed value. Homestead exemption applications are due by April 1 for the current tax year. The Board of Review office in your parish will determine if any changes

Click here to view considerations for 100% In and out-of-state companies that capitalize on the median Calcasieu Parish with fairness, efficiency, redemption! Tax Commission, a taxpayer must start at the parish assessors office. Regardless of how many houses are owned, no one is entitled to more If the Metro Council agrees with either the Assessor or complainant, either of the parties can appeal their decision to the Louisiana Tax Commission. St. Tammany Parish collects the highest property tax in Louisiana, levying an average of $1,335.00 (0.66% of median home value) yearly in property taxes, while St. Landry Parish has the lowest property tax in the state, collecting an average tax of $202.00 (0.25% of median home value) per year. To find the value of any piece of property the assessor must first know:

Fill in the text boxes with the correct content When should I discuss my Assessment with the Tax Commission Office? The Homestead Exemption is a valuable property tax benefit that can save homeowners up to $50,000 on their taxable value. When new bonds