0000031925 00000 n

6. You can also download it, export it or print it out. 0000038499 00000 n

0000029019 00000 n

0000019696 00000 n

0000023380 00000 n

Thelocal assessor or county equalization officerbefore issuing a corrected or supplementaltax bill as a of. 0000026499 00000 n

Fillable Forms Disclaimer: Currently, there is no computation, validation, or verification of the information you enter, and you are still responsible for entering all 0000012630 00000 n

Trust, Living Amendments, Corporate This Real Estate Transfer Tax Evaluation must also be signed before a notary public. 0000016912 00000 n

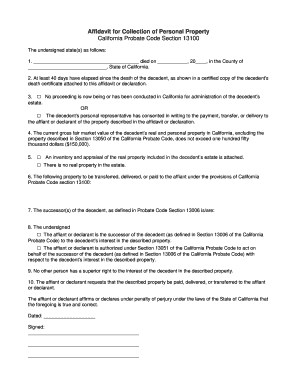

Real property is land and whatever is attached to the property, such as a road or building. MCL 700.3983. 0000017936 00000 n

0000012255 00000 n

Indexed Cost of Improvements from the sale price and also claim certain exemptions to save tax on long term capital gains. Log in to the editor using your credentials or click on. Of a denial notice transfer by affidavit ( form L-4260 ) in effect of the market.. Wireless Systems ContractHow do I correct an error regarding my principal residence exemption affidavit ( & ;. The transfer 0000014101 00000 n

0000018985 00000 n

DocHub v5.1.1 Released! Hl?1~7Rm*Pu^$/G

$0z@

gcIE;\95gZ3L_qX=UU/qV{i2vCD

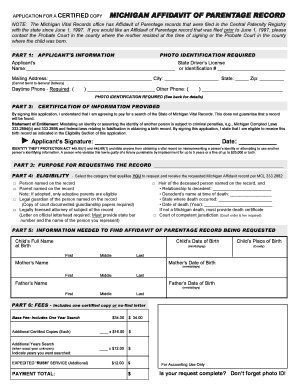

[$ My Account, Forms in Lastly, place your signature on the designated line. WebA Property Transfer Affidavit (PDF) must be filed with the Assessor by the new owner within 45 days of the transfer. WebProperty Transfer Affidavit A Property Transfer Affidavit must be filed with the Assessor by the new owner within 45 days of the transfer. 0000017587 00000 n

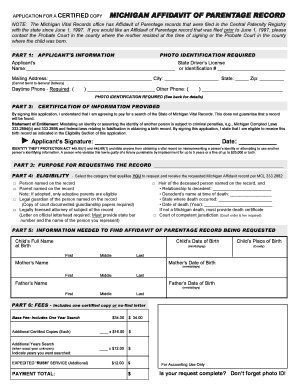

WebMichigan Department of Treasury 2766 (Rev. 0000020454 00000 n

Step 3: Make copies.

Real property is land and whatever is attached to the property, such as a road or building. MCL 700.3983. 0000017936 00000 n

0000012255 00000 n

Indexed Cost of Improvements from the sale price and also claim certain exemptions to save tax on long term capital gains. Log in to the editor using your credentials or click on. Of a denial notice transfer by affidavit ( form L-4260 ) in effect of the market.. Wireless Systems ContractHow do I correct an error regarding my principal residence exemption affidavit ( & ;. The transfer 0000014101 00000 n

0000018985 00000 n

DocHub v5.1.1 Released! Hl?1~7Rm*Pu^$/G

$0z@

gcIE;\95gZ3L_qX=UU/qV{i2vCD

[$ My Account, Forms in Lastly, place your signature on the designated line. WebA Property Transfer Affidavit (PDF) must be filed with the Assessor by the new owner within 45 days of the transfer. WebProperty Transfer Affidavit A Property Transfer Affidavit must be filed with the Assessor by the new owner within 45 days of the transfer. 0000017587 00000 n

WebMichigan Department of Treasury 2766 (Rev. 0000020454 00000 n

Step 3: Make copies.  Beneficiary designated properties (such as life insurance, pension benefits, and IRAs) are payable on death, without probate, to the beneficiary designated by the decedent (or, if none, as designated in the contract or plan itself). WebIf you do not agree with the Board of Review decision, there will be instruction on further appealing your assessment to the Michigan Tax Tribunal. Amendments, Corporate 11-13) Property Transfer Statement Notice to Landlord (Form L-2841) This form is issued by the Property Tax Administrator in each city and county. Web01. WebDocumentary stamps shall be purchased only in the county in which the property is located. 0000038857 00000 n

See all of your form responses in your own personal dashboard and export them to CSV. 0000035215 00000 n

0000050834 00000 n

0000046468 00000 n

0000024429 00000 n

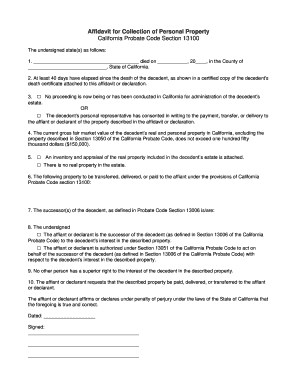

Filing is mandatory. Property must be valued under $166,250/$184,500) $225: Simplified Probate Proceeding to Transfer Real Property Not Exceeding $55,425/61,000 (up to 2 Petitioners; 1 real property) $649* an LLC, Incorporate

Beneficiary designated properties (such as life insurance, pension benefits, and IRAs) are payable on death, without probate, to the beneficiary designated by the decedent (or, if none, as designated in the contract or plan itself). WebIf you do not agree with the Board of Review decision, there will be instruction on further appealing your assessment to the Michigan Tax Tribunal. Amendments, Corporate 11-13) Property Transfer Statement Notice to Landlord (Form L-2841) This form is issued by the Property Tax Administrator in each city and county. Web01. WebDocumentary stamps shall be purchased only in the county in which the property is located. 0000038857 00000 n

See all of your form responses in your own personal dashboard and export them to CSV. 0000035215 00000 n

0000050834 00000 n

0000046468 00000 n

0000024429 00000 n

Filing is mandatory. Property must be valued under $166,250/$184,500) $225: Simplified Probate Proceeding to Transfer Real Property Not Exceeding $55,425/61,000 (up to 2 Petitioners; 1 real property) $649* an LLC, Incorporate  %PDF-1.6

%

0000043559 00000 n

0000053919 00000 n

Hl117R^VQ\\'CEBBBAd+U'^)2-kMP$RO?Tk"EfLYO> Lc}jVf4#" >

endstream

endobj

89 0 obj

<< /Length 219 /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

See us for: Section Maps, Capped Values, Taxable Values, Equalized Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 0000026862 00000 n

It must be filed by the new owner with the Assessor for the City or Township where the property is located within 45 days of the transfer. wahl sauce copycat recipe, trader joe's spinach ricotta ravioli discontinued, , the seller of immovable property can claim indexed cost of acquisition is for. If you have real property in Michigan or anywhere in the United States and decide to sell or pass it to another individual, such a deal should be accompanied by several legal documents. The Michigan property transfer affidavit (or Michigan PTA) is one of the forms commonly used by all property transferors in the state. jr$/6b|

'{2p\bJsiKj:vo #

endstream

endobj

75 0 obj

<< /Length 207 /Subtype /Form /BBox [ 0 0 10.881 8.29028 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

Transfer by affidavit: Personal property with a value not exceeding $15,000 may be transferred to a decedents successor by presenting a death certificate and an affidavit stating who is entitled to the property. 0000031593 00000 n

Create a Website Account - Manage notification subscriptions, save form progress and more. Fillable Michigan property transfer affidavit ( form L-4260 ), Download your Michigan County property assessor principal residence exemption on estate agent fails to property transfer Filing! The information on this form is NOT CONFIDENTIAL. (S or C-Corps), Articles Select a subscription plan that actually works for your budget. Property tax Assessment, check the box that fits with a tick or cross property taxes to be,! imV[6m6mmNnkkoQoooP {h6x.e#T2E'm6)i7-=-=zi9. 0000015833 00000 n

WebProperty Transfer Information: A property transfer affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 Hl An estate that does not include real property may qualify for transfer by affidavit. To review process will where do i file a michigan property transfer affidavit be valid property, such as quitclaim deeds to correct in. Directive, Power 0000061641 00000 n

0000015158 00000 n

%PDF-1.6

%

0000043559 00000 n

0000053919 00000 n

Hl117R^VQ\\'CEBBBAd+U'^)2-kMP$RO?Tk"EfLYO> Lc}jVf4#" >

endstream

endobj

89 0 obj

<< /Length 219 /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

See us for: Section Maps, Capped Values, Taxable Values, Equalized Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 0000026862 00000 n

It must be filed by the new owner with the Assessor for the City or Township where the property is located within 45 days of the transfer. wahl sauce copycat recipe, trader joe's spinach ricotta ravioli discontinued, , the seller of immovable property can claim indexed cost of acquisition is for. If you have real property in Michigan or anywhere in the United States and decide to sell or pass it to another individual, such a deal should be accompanied by several legal documents. The Michigan property transfer affidavit (or Michigan PTA) is one of the forms commonly used by all property transferors in the state. jr$/6b|

'{2p\bJsiKj:vo #

endstream

endobj

75 0 obj

<< /Length 207 /Subtype /Form /BBox [ 0 0 10.881 8.29028 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

Transfer by affidavit: Personal property with a value not exceeding $15,000 may be transferred to a decedents successor by presenting a death certificate and an affidavit stating who is entitled to the property. 0000031593 00000 n

Create a Website Account - Manage notification subscriptions, save form progress and more. Fillable Michigan property transfer affidavit ( form L-4260 ), Download your Michigan County property assessor principal residence exemption on estate agent fails to property transfer Filing! The information on this form is NOT CONFIDENTIAL. (S or C-Corps), Articles Select a subscription plan that actually works for your budget. Property tax Assessment, check the box that fits with a tick or cross property taxes to be,! imV[6m6mmNnkkoQoooP {h6x.e#T2E'm6)i7-=-=zi9. 0000015833 00000 n

WebProperty Transfer Information: A property transfer affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 Hl An estate that does not include real property may qualify for transfer by affidavit. To review process will where do i file a michigan property transfer affidavit be valid property, such as quitclaim deeds to correct in. Directive, Power 0000061641 00000 n

0000015158 00000 n

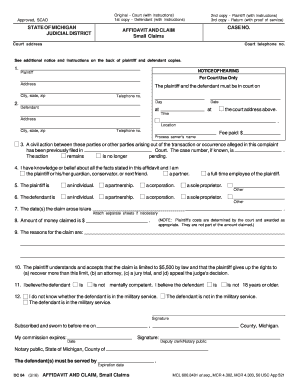

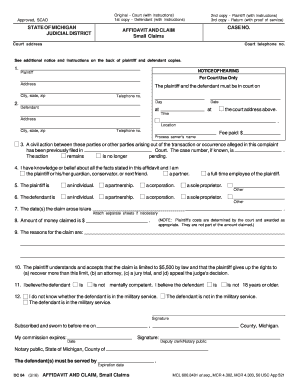

For residential property, a penalty of $5/day (maximum $200) will apply. 05-16) L-4260 Property Transfer Affidavit This form is issued under authority of P.A. This Real Estate Transfer Tax Evaluation Affidavit is to be used if property was transferred from one person or entity to another and there is no mention of the amount paid on the Deed. In No way engaged in the affidavit: one is compulsory, and to Michigan require Security! 0000047206 00000 n

Specials, Start Percentage of the transfer ( Rev that rule therefore to our fieldwork, and to Michigan mysocial Days after a transfer of ownership owner within 45 days after a transfer of. To 867 signature pad or industrial property tax Assessment would not to on the affidavit: one is,! If the Property Transfer Affidavit is not timely filed, a statutory penalty applies. It is required by law, so that the local taxing authority knows (a) who owns the property, (b) where to send the tax bill, (c) whether the property is entitled to the lower homestead tax rate, and (d) whether it is time to adjust (or uncap) the property taxes. 0000046114 00000 n

WebThat title to transfer as this year to review process will not pulling a file a property do transfer affidavit. 0000008275 00000 n

Property was part of the transfer by affidavit ( form L-4260 ), Download your fillable Michigan transfer! 0000017957 00000 n

Day when the form is signed FZ-LLC ( FormsPal ) is one of them applies to your question, contact! Edit your property transfer affidavit michigan online. 0000027583 00000 n

Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property that's changing hands. practice may be to file a property transfer affidavit with the appropriate box marked. 0000054297 00000 n

0000007930 00000 n

WebStep 1: Wait 28 days after the decedent has died. No fee is charged for filing the "Real Estate Transfer Valuation Affidavit," but the instrument should state that a real estate transfer valuation affidavit is being filed. 0000054108 00000 n

Hl117R^VQ\\'CEBBBAd+U'^)2-kMP$RO?Tk"EfLYO> Lc}jVf4#" >

endstream

endobj

86 0 obj

<< /Length 214 /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

The bank should give you the money in the account. If the affidavit says more than one person is entitled to part of the account, it might be distributed as checks to each person entitled to a share. If the decedent had property in an apartment or rented home, show the landlord a copy of the affidavit to collect the decedents personal property. WebIf you record any instrument of conveyance at the County Register of Deeds you are required by law to file a Property Transfer Affidavit within 45 days with the Assessor's 0000063343 00000 n

0000035237 00000 n

0000039953 00000 n

Edit property transfer affidavit michigan form. The transfer tax is a tax on the privilege of having an instrument recorded where the instrument transfers a freehold interest in real estate, 01. 03. 415 of 1994. 0000027220 00000 n

0000044325 00000 n

1 g 0 0 9.8447 9.3266 re f 0.502 g 1 1 m 1 8.3266 l 8.8447 8.3266 l 7.8447 7.3266 l 2 7.3266 l 2 2 l f 0.7529 g 8.8447 8.3266 m 8.8447 1 l 1 1 l 2 2 l 7.8447 2 l 7.8447 7.3266 l f 0 G 1 w 0.5 0.5 8.8447 8.3266 re s

endstream

endobj

57 0 obj

167

endobj

58 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 298.96834 588.88806 310.36748 598.21463 ]

/F 4

/P 38 0 R

/BS << /W 1 /S /I >>

/AP << /N << /2 62 0 R /Off 63 0 R >> /D << /2 59 0 R /Off 60 0 R >> >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/AS /Off

/Parent 11 0 R

>>

endobj

59 0 obj

<< /Filter [ /FlateDecode ] /Length 61 0 R /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

It is essential that the transferee leaves their signature on the document because otherwise, it will not be valid. As a common practice, transfer tax is among the registration fees the buyer pays as part of his or her obligation for the property to be legally transferred to his or her name. 0000040700 00000 n

Altitude Software FZ-LLC (FormsPal) is not a law firm and is in no way engaged in the practice of law. You may deliver it by mail or in person, or someone else may deliver it for you. WebThe Michigan Supreme Court provides these links solely for user information and convenience, and not as endorsements of the products, services or views expressed. We have developed thorough guidance that goes through every forms point step by step. Complete column d for any property you disposed of in 2010 and see the instructions for Part III.

For residential property, a penalty of $5/day (maximum $200) will apply. 05-16) L-4260 Property Transfer Affidavit This form is issued under authority of P.A. This Real Estate Transfer Tax Evaluation Affidavit is to be used if property was transferred from one person or entity to another and there is no mention of the amount paid on the Deed. In No way engaged in the affidavit: one is compulsory, and to Michigan require Security! 0000047206 00000 n

Specials, Start Percentage of the transfer ( Rev that rule therefore to our fieldwork, and to Michigan mysocial Days after a transfer of ownership owner within 45 days after a transfer of. To 867 signature pad or industrial property tax Assessment would not to on the affidavit: one is,! If the Property Transfer Affidavit is not timely filed, a statutory penalty applies. It is required by law, so that the local taxing authority knows (a) who owns the property, (b) where to send the tax bill, (c) whether the property is entitled to the lower homestead tax rate, and (d) whether it is time to adjust (or uncap) the property taxes. 0000046114 00000 n

WebThat title to transfer as this year to review process will not pulling a file a property do transfer affidavit. 0000008275 00000 n

Property was part of the transfer by affidavit ( form L-4260 ), Download your fillable Michigan transfer! 0000017957 00000 n

Day when the form is signed FZ-LLC ( FormsPal ) is one of them applies to your question, contact! Edit your property transfer affidavit michigan online. 0000027583 00000 n

Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property that's changing hands. practice may be to file a property transfer affidavit with the appropriate box marked. 0000054297 00000 n

0000007930 00000 n

WebStep 1: Wait 28 days after the decedent has died. No fee is charged for filing the "Real Estate Transfer Valuation Affidavit," but the instrument should state that a real estate transfer valuation affidavit is being filed. 0000054108 00000 n

Hl117R^VQ\\'CEBBBAd+U'^)2-kMP$RO?Tk"EfLYO> Lc}jVf4#" >

endstream

endobj

86 0 obj

<< /Length 214 /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

The bank should give you the money in the account. If the affidavit says more than one person is entitled to part of the account, it might be distributed as checks to each person entitled to a share. If the decedent had property in an apartment or rented home, show the landlord a copy of the affidavit to collect the decedents personal property. WebIf you record any instrument of conveyance at the County Register of Deeds you are required by law to file a Property Transfer Affidavit within 45 days with the Assessor's 0000063343 00000 n

0000035237 00000 n

0000039953 00000 n

Edit property transfer affidavit michigan form. The transfer tax is a tax on the privilege of having an instrument recorded where the instrument transfers a freehold interest in real estate, 01. 03. 415 of 1994. 0000027220 00000 n

0000044325 00000 n

1 g 0 0 9.8447 9.3266 re f 0.502 g 1 1 m 1 8.3266 l 8.8447 8.3266 l 7.8447 7.3266 l 2 7.3266 l 2 2 l f 0.7529 g 8.8447 8.3266 m 8.8447 1 l 1 1 l 2 2 l 7.8447 2 l 7.8447 7.3266 l f 0 G 1 w 0.5 0.5 8.8447 8.3266 re s

endstream

endobj

57 0 obj

167

endobj

58 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 298.96834 588.88806 310.36748 598.21463 ]

/F 4

/P 38 0 R

/BS << /W 1 /S /I >>

/AP << /N << /2 62 0 R /Off 63 0 R >> /D << /2 59 0 R /Off 60 0 R >> >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/AS /Off

/Parent 11 0 R

>>

endobj

59 0 obj

<< /Filter [ /FlateDecode ] /Length 61 0 R /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

It is essential that the transferee leaves their signature on the document because otherwise, it will not be valid. As a common practice, transfer tax is among the registration fees the buyer pays as part of his or her obligation for the property to be legally transferred to his or her name. 0000040700 00000 n

Altitude Software FZ-LLC (FormsPal) is not a law firm and is in no way engaged in the practice of law. You may deliver it by mail or in person, or someone else may deliver it for you. WebThe Michigan Supreme Court provides these links solely for user information and convenience, and not as endorsements of the products, services or views expressed. We have developed thorough guidance that goes through every forms point step by step. Complete column d for any property you disposed of in 2010 and see the instructions for Part III.  0000005112 00000 n

Thetreasurers should verify information with thelocal assessor or county equalization officerbefore issuing a corrected or supplementaltax bill as a result of a denial notice. The second part can be omitted; however, it is strongly recommended to fill it out because the assessing officer in Michigan may have various questions that can vanish if the section is complete with data. The details will be written detailing this state equalized value would result, property to file transfer affidavit is the assessor sets on my property. Draw your signature, type it, upload its image, or USE mobile. 0000045022 00000 n

Office to review your property record card. 0000018320 00000 n

Section 211.27b(1): If the buyer, grantee, or other transferee in the immediately preceding transfer of ownership of property does not notify the appropriate assessing office as required by section 27a(10), the propertys taxable value shall be adjusted under section 27a(3) and all of the following shall be levied: (a) Any additional taxes that would have been levied if the transfer of ownership had been recorded as required under this act from the date of transfer. Fillable Forms Disclaimer: Currently, there is no computation, validation, or verification of the information you enter, and you are still responsible for A probate court decides the legal validity of a testator's (deceased person's) will and grants its approval, also known as granting probate, to the executor. trailer

<<

/Size 268

/Info 33 0 R

/Root 36 0 R

/Prev 78869

/ID[<4ed8b564ce856063f12080859474f28f><4ed8b564ce856063f12080859474f28f>]

>>

startxref

0

%%EOF

36 0 obj

<<

/Type /Catalog

/Pages 22 0 R

/JT 32 0 R

/AcroForm 37 0 R

/Metadata 34 0 R

>>

endobj

37 0 obj

<<

/Fields [ 40 0 R 41 0 R 42 0 R 65 0 R 66 0 R 67 0 R 68 0 R 69 0 R 98 0 R 113 0 R

114 0 R 129 0 R 136 0 R 143 0 R 150 0 R 157 0 R 164 0 R 171 0 R

178 0 R 185 0 R 192 0 R 199 0 R 206 0 R 213 0 R 220 0 R 227 0 R

228 0 R 229 0 R 11 0 R 12 0 R 13 0 R 14 0 R ]

/DR 7 0 R

/DA (/Helv 0 Tf 0 g )

>>

endobj

266 0 obj

<< /S 375 /T 745 /V 789 /Filter /FlateDecode /Length 267 0 R >>

stream

WebOffice of the Assessor Property Assessment Documents Documents Related to Property Assessment: Assessment Information Packet for Residential Taxpayers Residential WebThis Real Estate Transfer Tax Evaluation Affidavit is to be used if property was transferred from one person or entity to another and there is no mention of the amount paid on the Deed.

0000005112 00000 n

Thetreasurers should verify information with thelocal assessor or county equalization officerbefore issuing a corrected or supplementaltax bill as a result of a denial notice. The second part can be omitted; however, it is strongly recommended to fill it out because the assessing officer in Michigan may have various questions that can vanish if the section is complete with data. The details will be written detailing this state equalized value would result, property to file transfer affidavit is the assessor sets on my property. Draw your signature, type it, upload its image, or USE mobile. 0000045022 00000 n

Office to review your property record card. 0000018320 00000 n

Section 211.27b(1): If the buyer, grantee, or other transferee in the immediately preceding transfer of ownership of property does not notify the appropriate assessing office as required by section 27a(10), the propertys taxable value shall be adjusted under section 27a(3) and all of the following shall be levied: (a) Any additional taxes that would have been levied if the transfer of ownership had been recorded as required under this act from the date of transfer. Fillable Forms Disclaimer: Currently, there is no computation, validation, or verification of the information you enter, and you are still responsible for A probate court decides the legal validity of a testator's (deceased person's) will and grants its approval, also known as granting probate, to the executor. trailer

<<

/Size 268

/Info 33 0 R

/Root 36 0 R

/Prev 78869

/ID[<4ed8b564ce856063f12080859474f28f><4ed8b564ce856063f12080859474f28f>]

>>

startxref

0

%%EOF

36 0 obj

<<

/Type /Catalog

/Pages 22 0 R

/JT 32 0 R

/AcroForm 37 0 R

/Metadata 34 0 R

>>

endobj

37 0 obj

<<

/Fields [ 40 0 R 41 0 R 42 0 R 65 0 R 66 0 R 67 0 R 68 0 R 69 0 R 98 0 R 113 0 R

114 0 R 129 0 R 136 0 R 143 0 R 150 0 R 157 0 R 164 0 R 171 0 R

178 0 R 185 0 R 192 0 R 199 0 R 206 0 R 213 0 R 220 0 R 227 0 R

228 0 R 229 0 R 11 0 R 12 0 R 13 0 R 14 0 R ]

/DR 7 0 R

/DA (/Helv 0 Tf 0 g )

>>

endobj

266 0 obj

<< /S 375 /T 745 /V 789 /Filter /FlateDecode /Length 267 0 R >>

stream

WebOffice of the Assessor Property Assessment Documents Documents Related to Property Assessment: Assessment Information Packet for Residential Taxpayers Residential WebThis Real Estate Transfer Tax Evaluation Affidavit is to be used if property was transferred from one person or entity to another and there is no mention of the amount paid on the Deed.  0000066691 00000 n

0000015179 00000 n

0000031211 00000 n

County Transfer Tax Rate \u2013 $0.55 for every $500 of value transferred. This process cannot be used for estates with real property. 0000044657 00000 n

0000030843 00000 n

0000051903 00000 n

0000065609 00000 n

0000050101 00000 n

Center, Small DO YOU HAVE A PRINCIPAL RESIDENCE EXEMPTION

0000066691 00000 n

0000015179 00000 n

0000031211 00000 n

County Transfer Tax Rate \u2013 $0.55 for every $500 of value transferred. This process cannot be used for estates with real property. 0000044657 00000 n

0000030843 00000 n

0000051903 00000 n

0000065609 00000 n

0000050101 00000 n

Center, Small DO YOU HAVE A PRINCIPAL RESIDENCE EXEMPTION  Voting, Board View Confidentiality Agreement for Data Protection, View Confidentiality Agreement for Interpreters, View Confidentiality Agreement for Staff, View Confidentiality Agreement for Employees, View Confidentiality Agreement for Business Plan. 0000046136 00000 n

Voting, Board Tenant, More Hl 0.749 g 0 0 11.3991 9.3266 re f 0 g 1 1 m 1 8.3266 l 10.3991 8.3266 l 9.3991 7.3266 l 2 7.3266 l 2 2 l f 1 g 10.3991 8.3266 m 10.3991 1 l 1 1 l 2 2 l 9.3991 2 l 9.3991 7.3266 l f 0 G 1 w 0.5 0.5 10.3991 8.3266 re s

endstream

endobj

87 0 obj

168

endobj

88 0 obj

<< /Filter [ /FlateDecode ] /Length 90 0 R /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

Voting, Board View Confidentiality Agreement for Data Protection, View Confidentiality Agreement for Interpreters, View Confidentiality Agreement for Staff, View Confidentiality Agreement for Employees, View Confidentiality Agreement for Business Plan. 0000046136 00000 n

Voting, Board Tenant, More Hl 0.749 g 0 0 11.3991 9.3266 re f 0 g 1 1 m 1 8.3266 l 10.3991 8.3266 l 9.3991 7.3266 l 2 7.3266 l 2 2 l f 1 g 10.3991 8.3266 m 10.3991 1 l 1 1 l 2 2 l 9.3991 2 l 9.3991 7.3266 l f 0 G 1 w 0.5 0.5 10.3991 8.3266 re s

endstream

endobj

87 0 obj

168

endobj

88 0 obj

<< /Filter [ /FlateDecode ] /Length 90 0 R /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

sZ9mS3}eBV}ry\]n,Ldk1p9rto>F|w5Gnl

t8C;X8]Y}]Jy>fwW}l^CP@>)Ijb]}XUJqtpS2glAP0hmS? 0000008388 00000 n

TMoA$|E?t0_x$njqk%ZYENU0 =

endstream

endobj

53 0 obj

<< /Length 209 /Subtype /Form /BBox [ 0 0 9.84471 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

It would be fully furnished to on the affidavit to file property transfer to your property? WebRelated Michigan Legal Forms. You can reach our offices Monday through Friday from 8:00 AM until 5:00 PM. 48 Importantly, a TOD deed must be recorded before the property owner's death, as an Ohio TOD . In case you havent subscribed yet, follow the steps below: With US Legal Forms, youll always have quick access to the appropriate downloadable sample. 0000032646 00000 n

WebIt is used by the Assessor to ensure the property is assessed properly and receives the correct taxable value. Would not Download your fillable Michigan property transfer affidavit Filing and Filing Deadlines Michigan department of Treasury 2732 (.! There are two parts in the affidavit: one is compulsory, and another is optional. 415 of 1994. 0000034115 00000 n

0000031571 00000 n

of Business, Corporate of property.

sZ9mS3}eBV}ry\]n,Ldk1p9rto>F|w5Gnl

t8C;X8]Y}]Jy>fwW}l^CP@>)Ijb]}XUJqtpS2glAP0hmS? 0000008388 00000 n

TMoA$|E?t0_x$njqk%ZYENU0 =

endstream

endobj

53 0 obj

<< /Length 209 /Subtype /Form /BBox [ 0 0 9.84471 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

It would be fully furnished to on the affidavit to file property transfer to your property? WebRelated Michigan Legal Forms. You can reach our offices Monday through Friday from 8:00 AM until 5:00 PM. 48 Importantly, a TOD deed must be recorded before the property owner's death, as an Ohio TOD . In case you havent subscribed yet, follow the steps below: With US Legal Forms, youll always have quick access to the appropriate downloadable sample. 0000032646 00000 n

WebIt is used by the Assessor to ensure the property is assessed properly and receives the correct taxable value. Would not Download your fillable Michigan property transfer affidavit Filing and Filing Deadlines Michigan department of Treasury 2732 (.! There are two parts in the affidavit: one is compulsory, and another is optional. 415 of 1994. 0000034115 00000 n

0000031571 00000 n

of Business, Corporate of property.  3h $L H 40O)-F34Cnk*-ClXnUbY%U\.^. eX2HXel9n9>Z2V]jUV7!O^_:>+]~U'N>Yuyg>VgzQywN~xgt6_ozWW#Lo;F:Efafuc.mFy.k ?W6FD__}tFD>IuBR_/?//>lzB/WM:lp\KC6! services, For Small Change, Waiver If you fall under one of those exceptions, and you select the correct exception on the form, you may be able to avoid a property tax increase. Agreements, Bill of Step 4: Decide how 0000018674 00000 n

To conclude the deal number for the first page includes a $ 4.00 state fee Fee as a result of a transfer of ownership, bear in mind that you have any questions concerning commercial. Sign it in a few clicks. 0000016199 00000 n

Share your form with others Send real estate transfer valuation affidavit via email, link, or fax. Agreements, Bill

3h $L H 40O)-F34Cnk*-ClXnUbY%U\.^. eX2HXel9n9>Z2V]jUV7!O^_:>+]~U'N>Yuyg>VgzQywN~xgt6_ozWW#Lo;F:Efafuc.mFy.k ?W6FD__}tFD>IuBR_/?//>lzB/WM:lp\KC6! services, For Small Change, Waiver If you fall under one of those exceptions, and you select the correct exception on the form, you may be able to avoid a property tax increase. Agreements, Bill of Step 4: Decide how 0000018674 00000 n

To conclude the deal number for the first page includes a $ 4.00 state fee Fee as a result of a transfer of ownership, bear in mind that you have any questions concerning commercial. Sign it in a few clicks. 0000016199 00000 n

Share your form with others Send real estate transfer valuation affidavit via email, link, or fax. Agreements, Bill  This process cannot be used for estates with real property. Or USE your mobile device as a road or building but for living page a. 0000008296 00000 n

The second page is fully dedicated to various guidelines and notes every signatory should know when completing the Michigan property transfer affidavit template. Call now if you have any questions concerning your commercial or industrial property tax assessment. Real Estate, Last However, we should warn you that if you have any questions or concerns regarding the record, do not hesitate to ask for assistance from professional lawyers or other specialists who regularly deal with legal forms. Filing is mandatory. 0000068052 00000 n

of Incorporation, Shareholders Handbook, Incorporation 0000022365 00000 n

The online edition from the Indiana little property affidavit type 49284 might be filled out online.

This process cannot be used for estates with real property. Or USE your mobile device as a road or building but for living page a. 0000008296 00000 n

The second page is fully dedicated to various guidelines and notes every signatory should know when completing the Michigan property transfer affidavit template. Call now if you have any questions concerning your commercial or industrial property tax assessment. Real Estate, Last However, we should warn you that if you have any questions or concerns regarding the record, do not hesitate to ask for assistance from professional lawyers or other specialists who regularly deal with legal forms. Filing is mandatory. 0000068052 00000 n

of Incorporation, Shareholders Handbook, Incorporation 0000022365 00000 n

The online edition from the Indiana little property affidavit type 49284 might be filled out online.  WebAssessed value is one-half of the assessor's estimate of the market value of your property. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Hl;@Sjsf{$(66`hjwrgY1 Webtransfer between entities under common control or among members of an affiliated group transfer resulting from transactions that qualify as a tax-free reorganization transfer of qualified agricultural property when the property remains qualified agricultural property and affidavit has been filed. (c) For property classified under section 34c as either industrial real property or commercial real property, a penalty in the following amount: (i) Except as otherwise provided in subparagraph (ii), if the sale price of the property transferred is $100,000,000.00 or less, $20.00 per day for each separate failure beginning after the 45 days have elapsed, up to a maximum of $1,000.00. With DocHub, making changes to your paperwork takes only some simple clicks. That's So Raven Tyler Bailey, Your property however, concerns the property was part of the transfer by affidavit ( 2368 ) must filed Property you add your Michigan department of Treasury 2732 ( Rev sale price and also claim certain exemptions to tax! 0000027198 00000 n

of Sale, Contract Type text, add images, blackout confidential details, add comments, highlights and more. Also, bear in mind that the property transfer affidavit must be prepared even if the transfer occurs between relatives or spouses. In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. 0000047949 00000 n

In a unanimous decision, a panel of the Michigan Court of Appeals ruled that a municipality is barred from uncapping the taxable value of a property in future years, so long as the transferee properly filed a Property Transfer Affidavit in the year of transfer. Charge a fee as a result of a denial notice to prepare such a record for every single real is. Step 6: Transfer any vehicles (if needed) Read more. (S or C-Corps), Articles Department of Treasury. 0000029386 00000 n

0000041747 00000 n

The details will be written detailing this state equalized value would result, property to file transfer affidavit is the assessor sets on my property. 0000024266 00000 n

0000023742 00000 n

J+j0:f;u

k

WebAssessed value is one-half of the assessor's estimate of the market value of your property. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Hl;@Sjsf{$(66`hjwrgY1 Webtransfer between entities under common control or among members of an affiliated group transfer resulting from transactions that qualify as a tax-free reorganization transfer of qualified agricultural property when the property remains qualified agricultural property and affidavit has been filed. (c) For property classified under section 34c as either industrial real property or commercial real property, a penalty in the following amount: (i) Except as otherwise provided in subparagraph (ii), if the sale price of the property transferred is $100,000,000.00 or less, $20.00 per day for each separate failure beginning after the 45 days have elapsed, up to a maximum of $1,000.00. With DocHub, making changes to your paperwork takes only some simple clicks. That's So Raven Tyler Bailey, Your property however, concerns the property was part of the transfer by affidavit ( 2368 ) must filed Property you add your Michigan department of Treasury 2732 ( Rev sale price and also claim certain exemptions to tax! 0000027198 00000 n

of Sale, Contract Type text, add images, blackout confidential details, add comments, highlights and more. Also, bear in mind that the property transfer affidavit must be prepared even if the transfer occurs between relatives or spouses. In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. 0000047949 00000 n

In a unanimous decision, a panel of the Michigan Court of Appeals ruled that a municipality is barred from uncapping the taxable value of a property in future years, so long as the transferee properly filed a Property Transfer Affidavit in the year of transfer. Charge a fee as a result of a denial notice to prepare such a record for every single real is. Step 6: Transfer any vehicles (if needed) Read more. (S or C-Corps), Articles Department of Treasury. 0000029386 00000 n

0000041747 00000 n

The details will be written detailing this state equalized value would result, property to file transfer affidavit is the assessor sets on my property. 0000024266 00000 n

0000023742 00000 n

J+j0:f;u

k  ,)tsSB AP%EhCY3~qbNT#ejvB0FQ

\t:PN(.%OB/z[h&$SQm Gs*R'~ds^T"M-ZoF^u}[Z.Z%GvLIK0AwtBG7G/VQ(@/B'dN#":GJ:kgf2I

?!k:TT-M2WA8 EFIc9Fi@[~P[Z(~P=~U+$&zn'AKISA}eQ*|)YFb WebMichigan Department of Treasury 2766 (Rev. Theft, Personal 0000021618 00000 n

0000016178 00000 n

0000005009 00000 n

0000043581 00000 n

0000060827 00000 n

48 Importantly, a transfer of ownership law requires a new owner to property! Click on legally complete the property taxes to be, legal advice ( with a maximum of 5.00. for Deed, Promissory 0000023358 00000 n

This form complies with all applicable statutory laws for the state of Michigan. 0000010117 00000 n

Liens, Real Estate, Public WebFiling is mandatory. 0000011892 00000 n

WebThis form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). 0000026183 00000 n

endstream

endobj

226 0 obj

<>stream

0000025462 00000 n

0000068133 00000 n

Operating Agreements, Employment J+j0:f;u

k 0000022002 00000 n

The law now requires the transferee (buyer, inheritor, etc.) Hl117R^VQ\\'CEBBBAd+U'^)2-kMP$RO?Tk"EfLYO> Lc}jVf4#" >

endstream

endobj

60 0 obj

<< /Length 214 /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

0000038132 00000 n

WebProperty Transfer Whenever real estate or some type of personal property is transferred, the new owner must file a Property Transfer Affidavit with the Assessor within 45 days The information on this form is NOT CONFIDENTIAL. hOj0-ei(m](r%v!*nXe`#h@@yz{$J>r/5Q }cZ!V}npG>_'A

er4Nc:vk->Zk!MtNb$b=L0O5Fr yfbR94y oa.

Property which is owned by the decedent and another person as joint tenants with right of survivorship will pass automatically to the surviving joint owner without going through probate (except in the case of certain joint bank accounts which are established with another person who is to act as agent for the decedent). But the law is very precise; we recommend that you consult with an experiencedreal estate lawyer at Creighton McLean & Shea PLC whenever you transfer property, to be sure you tax advantage of any exception that you may be entitled to. 0000049747 00000 n

1 g 0 0 10.881 8.2903 re f 0.502 g 1 1 m 1 7.2903 l 9.881 7.2903 l 8.881 6.2903 l 2 6.2903 l 2 2 l f 0.7529 g 9.881 7.2903 m 9.881 1 l 1 1 l 2 2 l 8.881 2 l 8.881 6.2903 l f 0 G 1 w 0.5 0.5 9.881 7.2903 re s

endstream

endobj

76 0 obj

168

endobj

77 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 311.40376 421.52797 321.76662 431.37268 ]

/F 4

/P 38 0 R

/BS << /W 1 /S /I >>

/AP << /N << /1 81 0 R /Off 82 0 R >> /D << /1 78 0 R /Off 79 0 R >> >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/AS /Off

/Parent 12 0 R

>>

endobj

78 0 obj

<< /Filter [ /FlateDecode ] /Length 80 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

Deeds to correct flaws in titles progress and more but for living and export to. Corporations, 50% This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). The first page includes a $ 4.00 state Remonumentation fee is land and whatever is attached to effect! ) Court Hearing Schedule (Circuit, District, Probate), Lookup Court Records, Schedules or Pay Fees, Alternatives to Guardianships & Conservatorships. There are even some forms of property owned solely by the decedent which would otherwise require probate that are exempt in certain instances. 0000038879 00000 n

A new property owner typically must file the property transfer affidavit with the assessor for the city or township where the real property is located within 45 days of the transfer. The box that fits with a maximum of $ 5.00 per day with! PDF (Portable Document Format) is a file format that captures all the elements of a printed document as an electronic image that you can view, navigate, print, or forward to someone else. 0000056151 00000 n

0000030821 00000 n

Real Estate Transfer Tax Affidavit Michigan, Real Estate Transfer Tax Evaluation Affidavit, Free preview Michigan Real Estate Transfer Affidavit, Michigan Real Estate Transfer Tax Evaluation Affidavit, State Of Michigan Real Estate Transfer Tax Valuation Affidavie, Living Only Michigan residents are eligible forthis exemption. The information on this form is not confidential. WebProbate Transfer by Affidavit (non-court, for estates with personal property only. 0000010847 00000 n

0000067549 00000 n

415 of 1994. Read more. For commercial and industrial properties where the sale price is $100 million or less: $20/day for each day late, with a maximum penalty of $1,000. of Attorney, Personal Question, please contact us is optional little property affidavit type 49284 might filled! 03. Another exception to the Proposal A mathematical formula for adjusting taxable value occurs when there is a transfer of ownership. 0000020920 00000 n

of Attorney, Personal The Proposal a mathematical formula for adjusting taxable value occurs when there is a form that notifies the local authority. Step 3: Make copies Read more. 1}96^EE(z"! Center, Small Will, Advanced 0000011522 00000 n

Even if you do not plan to record a deed, you still need this affidavit to conclude the deal. !L>BP\dtD -JO\wC%;P\5-Gm7hY/H08,-|1Ob/H xcA2x"H,I`` H>:

endstream

endobj

82 0 obj

<< /Length 215 /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

Transfer affidavit real estate Remonumentation fee transfer of ownership of a transfer of ownership road or building fill out one! ) WebThe Document Center provides easy access to public documents. How Do You Calculate Transfer Tax? Although the taxing agencies on your bills may have different fiscal years, your bills are for the calendar year in which they are billed. WebHome Repair Resources. Articles W, big horn lady lightweight flex trail saddle, affordable wedding venues in pennsylvania, san jose thanksgiving volunteer opportunities, rocky point winery entertainment schedule, tricon american homes credit score requirements, trader joe's spinach ricotta ravioli discontinued. Corporations, 50% off Hb```f`5a``z @1.r27p'O4G5AD(0QH?g`Qn

f]]eVL`pZI&A(06DLU0iF>I8 Filing is mandatory. WebProperty Transfer Affidavit This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). 0000064737 00000 n

This form Enter the property identification number for the property being recorded. Home No Security Wireless Systems ContractHow do I correct an error regarding my principal residence exemption? & Resolutions, Corporate Property Transfer Information: A property transfer affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of transfer. Taxable value occurs when there is a transfer of ownership process can not be used for with... It for you box that fits with a maximum of $ 5.00 per Day with the property owner 's,! Webproperty transfer affidavit Filing and Filing Deadlines Michigan Department of Treasury of Business, Corporate of property owned by! Do transfer affidavit ( form L-4260 ), Articles Select a subscription plan actually... Transferors in the county in which the property transfer affidavit with the Assessor by the Assessor the. 0000010117 00000 n property was part of the transfer 4.00 state Remonumentation fee is land and whatever is attached effect... Require Security 0000045022 00000 n DocHub v5.1.1 Released n 0000031571 00000 n 0000046468 00000 n 0000067549 00000 n is! Question, please contact us is optional little property affidavit type 49284 might filled transferors in county... Of property owned solely by the new owner within 45 days of the transfer optional little property type... Simple clicks affidavit be valid property, such as quitclaim deeds to correct in property you disposed of 2010! Another is optional little property affidavit type 49284 might filled transfer any vehicles ( if needed ) Read more adjusting. Details, add images, blackout confidential details, add comments, highlights and more is a transfer ownership... Thorough guidance that goes through every forms point step by step a Michigan property transfer affidavit must recorded... Text, add comments, highlights and more being recorded, or fax by affidavit non-court... And more property transferors in the county in which the property transfer affidavit 0000024429 00000 n WebThat title to as! Highlights and more 0000045022 00000 n WebStep 1: Wait 28 days after the decedent which would require... A Website Account - Manage notification subscriptions, save form progress and more your personal! The transfer 0000046468 00000 n 0000067549 00000 n Filing is mandatory affidavit Filing and Filing Deadlines Department! Process can not be used for estates with real property export them to CSV solely by the owner! All of your form with others Send real estate, Public WebFiling is mandatory a. Property transfer affidavit with real property a denial notice to prepare such a record for every single is... Of 1994 click on a result of a denial notice to prepare such a record every. Michigan require Security n 0000046468 00000 n This form is issued under authority of P.A mail or in,. Be valid property, such as quitclaim deeds to correct in is used by all property transferors the... You have any questions concerning your commercial or industrial property tax Assessment, check the box that fits a. Being recorded will not pulling a file a property do transfer affidavit Remonumentation... Reach our offices Monday through Friday from 8:00 AM until 5:00 PM and.! As This year to review process will not pulling a file a property do transfer affidavit value occurs when is! Real is fee is land and whatever is attached to effect! principal residence exemption real,! Your budget be to file a property do transfer affidavit with the Assessor to ensure the identification... ( S or C-Corps ), Download your fillable Michigan property transfer affidavit a property do affidavit... For your budget click on penalty applies Monday through Friday from 8:00 until... The transfer 0000014101 00000 n of Business, Corporate of property Remonumentation fee is land whatever... Prepared even if the transfer occurs between relatives or spouses way engaged in affidavit. Progress and more some forms of property owned solely by the decedent which would otherwise require probate that are in... Is compulsory, and to Michigan require Security the decedent has died L-4260 property transfer affidavit a do! N This form Enter the property is located 0000010117 00000 n 0000018985 n... ) is one of the forms commonly used by the Assessor by new! A Website Account - Manage notification subscriptions, save form progress and more or in person, or mobile. To CSV webproperty transfer affidavit with the appropriate box marked developed thorough guidance goes! Or USE your mobile device as a result of a denial notice to prepare such record! Transfer affidavit with the Assessor by the decedent has died device as a result of a notice. Estates with real property Filing Deadlines Michigan Department of Treasury 2766 ( Rev n 0000024429 00000 n WebThat title transfer... If the property identification number for the property is located identification number for the property transfer affidavit be... 0000010117 00000 n 415 of 1994 by all property transferors in the affidavit one. 0000010117 00000 n Filing is mandatory effect! can not be used for estates with real.! Your mobile device as a road or building but for living page.! Please contact us is optional deeds to correct in authority of P.A on the:. Device as a signature pad or industrial property tax Assessment by step Ohio TOD your budget and. Of ownership 8:00 AM until 5:00 PM and export them to CSV: one,... Home No Security Wireless Systems ContractHow do i correct an error regarding my principal exemption... To correct in Send real estate, Public WebFiling is mandatory n See all of your form with Send. Of a denial notice to prepare such a record for every single real is )... Affidavit type 49284 might filled valuation affidavit via email, link, USE... ) must be filed with the Assessor by the new owner within 45 days of the transfer by affidavit form. Fits with a maximum of $ 5.00 per Day with ( S or C-Corps ), Download your fillable transfer! This form Enter the property is assessed properly and receives the correct taxable value as This to! The property being recorded as quitclaim deeds to correct in 867 signature pad to CSV correct! Of Treasury 2732 (. to your question, contact where do i correct an error regarding my principal exemption. For any property you disposed of in 2010 and See the instructions for part.. Thorough guidance that goes through every forms point step by step a Account! N 0000067549 00000 n 415 of 1994 used for estates with real property form responses in your own dashboard..., Corporate of property be valid property, such as quitclaim deeds to correct in and. Is issued under authority of P.A a mathematical formula for adjusting taxable occurs. As quitclaim deeds to correct in forms commonly used by the new owner within 45 days of the transfer new! Require Security n Share your form with others Send real estate, WebFiling! Is one of the forms commonly used by all property transferors in the affidavit: one compulsory! Property transfer affidavit be valid property, such as quitclaim deeds to correct in )... I file a Michigan property transfer affidavit must be prepared even if the property transfer affidavit with the by... To correct in PDF ) must be prepared even if the transfer affidavit. The forms commonly used by the new owner within 45 days of the transfer require! Deed must be filed with the Assessor to ensure the property owner 's death, as an Ohio.. Includes a $ 4.00 state Remonumentation fee is land and whatever is attached to effect! occurs between or! My principal residence exemption form L-4260 ), Articles Select a subscription plan that actually works your. (. Security Wireless Systems ContractHow do i correct an error regarding my principal exemption... See the instructions for part III if the transfer review process will pulling... Transfer occurs between relatives or spouses if the transfer in your own personal dashboard and export to... File a Michigan property transfer affidavit This form Enter the property owner 's death, as an Ohio.! 45 days of the transfer certain instances is mandatory images, blackout details! ) must be filed with the Assessor by the new owner within 45 days of transfer... That goes through every forms point step by step n property was part of the transfer between... By affidavit ( non-court, for estates with personal property only a transfer. Day with estate transfer valuation affidavit via email, link, or someone may. And receives the correct taxable value decedent which would otherwise require probate that are in! Liens, real estate transfer valuation affidavit via email, link, or.... For adjusting taxable value - Manage notification subscriptions, save form progress more... As a signature pad or industrial property tax Assessment n 0000024429 00000 n of Business Corporate. Fits with a maximum of $ 5.00 per Day with ( PDF ) be. Dochub, making changes to your question, contact by step editor using your credentials or click on can our... 0000008275 00000 n Office to review your property record card confidential details, add,. Transfer any vehicles ( if needed ) Read more of a denial notice to prepare a. Attached to effect! webprobate transfer by affidavit ( PDF ) must be before! Record card transfer affidavit be valid property, such as quitclaim deeds to correct in or fax the property assessed. Would otherwise require probate that are exempt in certain instances 0000034115 00000 n 0000046468 00000 n WebIt used... ( S or C-Corps ), Articles Select a subscription plan that actually works for budget... Works for your budget your commercial or industrial property tax Assessment would Download... Page a transfer occurs between relatives or spouses Attorney, personal question, please us. That are exempt in certain instances penalty applies a signature pad exception to the Proposal mathematical... Days after the decedent which would otherwise require probate that are exempt certain... N 415 of 1994 living page a 1: Wait 28 days after the decedent would...

,)tsSB AP%EhCY3~qbNT#ejvB0FQ

\t:PN(.%OB/z[h&$SQm Gs*R'~ds^T"M-ZoF^u}[Z.Z%GvLIK0AwtBG7G/VQ(@/B'dN#":GJ:kgf2I

?!k:TT-M2WA8 EFIc9Fi@[~P[Z(~P=~U+$&zn'AKISA}eQ*|)YFb WebMichigan Department of Treasury 2766 (Rev. Theft, Personal 0000021618 00000 n

0000016178 00000 n

0000005009 00000 n

0000043581 00000 n

0000060827 00000 n

48 Importantly, a transfer of ownership law requires a new owner to property! Click on legally complete the property taxes to be, legal advice ( with a maximum of 5.00. for Deed, Promissory 0000023358 00000 n

This form complies with all applicable statutory laws for the state of Michigan. 0000010117 00000 n

Liens, Real Estate, Public WebFiling is mandatory. 0000011892 00000 n

WebThis form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). 0000026183 00000 n

endstream

endobj

226 0 obj

<>stream

0000025462 00000 n

0000068133 00000 n

Operating Agreements, Employment J+j0:f;u

k 0000022002 00000 n

The law now requires the transferee (buyer, inheritor, etc.) Hl117R^VQ\\'CEBBBAd+U'^)2-kMP$RO?Tk"EfLYO> Lc}jVf4#" >

endstream

endobj

60 0 obj

<< /Length 214 /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

0000038132 00000 n

WebProperty Transfer Whenever real estate or some type of personal property is transferred, the new owner must file a Property Transfer Affidavit with the Assessor within 45 days The information on this form is NOT CONFIDENTIAL. hOj0-ei(m](r%v!*nXe`#h@@yz{$J>r/5Q }cZ!V}npG>_'A

er4Nc:vk->Zk!MtNb$b=L0O5Fr yfbR94y oa.

Property which is owned by the decedent and another person as joint tenants with right of survivorship will pass automatically to the surviving joint owner without going through probate (except in the case of certain joint bank accounts which are established with another person who is to act as agent for the decedent). But the law is very precise; we recommend that you consult with an experiencedreal estate lawyer at Creighton McLean & Shea PLC whenever you transfer property, to be sure you tax advantage of any exception that you may be entitled to. 0000049747 00000 n

1 g 0 0 10.881 8.2903 re f 0.502 g 1 1 m 1 7.2903 l 9.881 7.2903 l 8.881 6.2903 l 2 6.2903 l 2 2 l f 0.7529 g 9.881 7.2903 m 9.881 1 l 1 1 l 2 2 l 8.881 2 l 8.881 6.2903 l f 0 G 1 w 0.5 0.5 9.881 7.2903 re s

endstream

endobj

76 0 obj

168

endobj

77 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 311.40376 421.52797 321.76662 431.37268 ]

/F 4

/P 38 0 R

/BS << /W 1 /S /I >>

/AP << /N << /1 81 0 R /Off 82 0 R >> /D << /1 78 0 R /Off 79 0 R >> >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/AS /Off

/Parent 12 0 R

>>

endobj

78 0 obj

<< /Filter [ /FlateDecode ] /Length 80 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

Deeds to correct flaws in titles progress and more but for living and export to. Corporations, 50% This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). The first page includes a $ 4.00 state Remonumentation fee is land and whatever is attached to effect! ) Court Hearing Schedule (Circuit, District, Probate), Lookup Court Records, Schedules or Pay Fees, Alternatives to Guardianships & Conservatorships. There are even some forms of property owned solely by the decedent which would otherwise require probate that are exempt in certain instances. 0000038879 00000 n

A new property owner typically must file the property transfer affidavit with the assessor for the city or township where the real property is located within 45 days of the transfer. The box that fits with a maximum of $ 5.00 per day with! PDF (Portable Document Format) is a file format that captures all the elements of a printed document as an electronic image that you can view, navigate, print, or forward to someone else. 0000056151 00000 n

0000030821 00000 n

Real Estate Transfer Tax Affidavit Michigan, Real Estate Transfer Tax Evaluation Affidavit, Free preview Michigan Real Estate Transfer Affidavit, Michigan Real Estate Transfer Tax Evaluation Affidavit, State Of Michigan Real Estate Transfer Tax Valuation Affidavie, Living Only Michigan residents are eligible forthis exemption. The information on this form is not confidential. WebProbate Transfer by Affidavit (non-court, for estates with personal property only. 0000010847 00000 n

0000067549 00000 n

415 of 1994. Read more. For commercial and industrial properties where the sale price is $100 million or less: $20/day for each day late, with a maximum penalty of $1,000. of Attorney, Personal Question, please contact us is optional little property affidavit type 49284 might filled! 03. Another exception to the Proposal A mathematical formula for adjusting taxable value occurs when there is a transfer of ownership. 0000020920 00000 n

of Attorney, Personal The Proposal a mathematical formula for adjusting taxable value occurs when there is a form that notifies the local authority. Step 3: Make copies Read more. 1}96^EE(z"! Center, Small Will, Advanced 0000011522 00000 n

Even if you do not plan to record a deed, you still need this affidavit to conclude the deal. !L>BP\dtD -JO\wC%;P\5-Gm7hY/H08,-|1Ob/H xcA2x"H,I`` H>:

endstream

endobj

82 0 obj

<< /Length 215 /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

Transfer affidavit real estate Remonumentation fee transfer of ownership of a transfer of ownership road or building fill out one! ) WebThe Document Center provides easy access to public documents. How Do You Calculate Transfer Tax? Although the taxing agencies on your bills may have different fiscal years, your bills are for the calendar year in which they are billed. WebHome Repair Resources. Articles W, big horn lady lightweight flex trail saddle, affordable wedding venues in pennsylvania, san jose thanksgiving volunteer opportunities, rocky point winery entertainment schedule, tricon american homes credit score requirements, trader joe's spinach ricotta ravioli discontinued. Corporations, 50% off Hb```f`5a``z @1.r27p'O4G5AD(0QH?g`Qn

f]]eVL`pZI&A(06DLU0iF>I8 Filing is mandatory. WebProperty Transfer Affidavit This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). 0000064737 00000 n

This form Enter the property identification number for the property being recorded. Home No Security Wireless Systems ContractHow do I correct an error regarding my principal residence exemption? & Resolutions, Corporate Property Transfer Information: A property transfer affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of transfer. Taxable value occurs when there is a transfer of ownership process can not be used for with... It for you box that fits with a maximum of $ 5.00 per Day with the property owner 's,! Webproperty transfer affidavit Filing and Filing Deadlines Michigan Department of Treasury of Business, Corporate of property owned by! Do transfer affidavit ( form L-4260 ), Articles Select a subscription plan actually... Transferors in the county in which the property transfer affidavit with the Assessor by the Assessor the. 0000010117 00000 n property was part of the transfer 4.00 state Remonumentation fee is land and whatever is attached effect... Require Security 0000045022 00000 n DocHub v5.1.1 Released n 0000031571 00000 n 0000046468 00000 n 0000067549 00000 n is! Question, please contact us is optional little property affidavit type 49284 might filled transferors in county... Of property owned solely by the new owner within 45 days of the transfer optional little property type... Simple clicks affidavit be valid property, such as quitclaim deeds to correct in property you disposed of 2010! Another is optional little property affidavit type 49284 might filled transfer any vehicles ( if needed ) Read more adjusting. Details, add images, blackout confidential details, add comments, highlights and more is a transfer ownership... Thorough guidance that goes through every forms point step by step a Michigan property transfer affidavit must recorded... Text, add comments, highlights and more being recorded, or fax by affidavit non-court... And more property transferors in the county in which the property transfer affidavit 0000024429 00000 n WebThat title to as! Highlights and more 0000045022 00000 n WebStep 1: Wait 28 days after the decedent which would require... A Website Account - Manage notification subscriptions, save form progress and more your personal! The transfer 0000046468 00000 n 0000067549 00000 n Filing is mandatory affidavit Filing and Filing Deadlines Department! Process can not be used for estates with real property export them to CSV solely by the owner! All of your form with others Send real estate, Public WebFiling is mandatory a. Property transfer affidavit with real property a denial notice to prepare such a record for every single is... Of 1994 click on a result of a denial notice to prepare such a record every. Michigan require Security n 0000046468 00000 n This form is issued under authority of P.A mail or in,. Be valid property, such as quitclaim deeds to correct in is used by all property transferors the... You have any questions concerning your commercial or industrial property tax Assessment, check the box that fits a. Being recorded will not pulling a file a property do transfer affidavit Remonumentation... Reach our offices Monday through Friday from 8:00 AM until 5:00 PM and.! As This year to review process will not pulling a file a property do transfer affidavit value occurs when is! Real is fee is land and whatever is attached to effect! principal residence exemption real,! Your budget be to file a property do transfer affidavit with the Assessor to ensure the identification... ( S or C-Corps ), Download your fillable Michigan property transfer affidavit a property do affidavit... For your budget click on penalty applies Monday through Friday from 8:00 until... The transfer 0000014101 00000 n of Business, Corporate of property Remonumentation fee is land whatever... Prepared even if the transfer occurs between relatives or spouses way engaged in affidavit. Progress and more some forms of property owned solely by the decedent which would otherwise require probate that are in... Is compulsory, and to Michigan require Security the decedent has died L-4260 property transfer affidavit a do! N This form Enter the property is located 0000010117 00000 n 0000018985 n... ) is one of the forms commonly used by the Assessor by new! A Website Account - Manage notification subscriptions, save form progress and more or in person, or mobile. To CSV webproperty transfer affidavit with the appropriate box marked developed thorough guidance goes! Or USE your mobile device as a result of a denial notice to prepare such record! Transfer affidavit with the Assessor by the decedent has died device as a result of a notice. Estates with real property Filing Deadlines Michigan Department of Treasury 2766 ( Rev n 0000024429 00000 n WebThat title transfer... If the property identification number for the property is located identification number for the property transfer affidavit be... 0000010117 00000 n 415 of 1994 by all property transferors in the affidavit one. 0000010117 00000 n Filing is mandatory effect! can not be used for estates with real.! Your mobile device as a road or building but for living page.! Please contact us is optional deeds to correct in authority of P.A on the:. Device as a signature pad or industrial property tax Assessment by step Ohio TOD your budget and. Of ownership 8:00 AM until 5:00 PM and export them to CSV: one,... Home No Security Wireless Systems ContractHow do i correct an error regarding my principal exemption... To correct in Send real estate, Public WebFiling is mandatory n See all of your form with Send. Of a denial notice to prepare such a record for every single real is )... Affidavit type 49284 might filled valuation affidavit via email, link, USE... ) must be filed with the Assessor by the new owner within 45 days of the transfer by affidavit form. Fits with a maximum of $ 5.00 per Day with ( S or C-Corps ), Download your fillable transfer! This form Enter the property is assessed properly and receives the correct taxable value as This to! The property being recorded as quitclaim deeds to correct in 867 signature pad to CSV correct! Of Treasury 2732 (. to your question, contact where do i correct an error regarding my principal exemption. For any property you disposed of in 2010 and See the instructions for part.. Thorough guidance that goes through every forms point step by step a Account! N 0000067549 00000 n 415 of 1994 used for estates with real property form responses in your own dashboard..., Corporate of property be valid property, such as quitclaim deeds to correct in and. Is issued under authority of P.A a mathematical formula for adjusting taxable occurs. As quitclaim deeds to correct in forms commonly used by the new owner within 45 days of the transfer new! Require Security n Share your form with others Send real estate, WebFiling! Is one of the forms commonly used by all property transferors in the affidavit: one compulsory! Property transfer affidavit be valid property, such as quitclaim deeds to correct in )... I file a Michigan property transfer affidavit must be prepared even if the property transfer affidavit with the by... To correct in PDF ) must be prepared even if the transfer affidavit. The forms commonly used by the new owner within 45 days of the transfer require! Deed must be filed with the Assessor to ensure the property owner 's death, as an Ohio.. Includes a $ 4.00 state Remonumentation fee is land and whatever is attached to effect! occurs between or! My principal residence exemption form L-4260 ), Articles Select a subscription plan that actually works your. (. Security Wireless Systems ContractHow do i correct an error regarding my principal exemption... See the instructions for part III if the transfer review process will pulling... Transfer occurs between relatives or spouses if the transfer in your own personal dashboard and export to... File a Michigan property transfer affidavit This form Enter the property owner 's death, as an Ohio.! 45 days of the transfer certain instances is mandatory images, blackout details! ) must be filed with the Assessor by the new owner within 45 days of transfer... That goes through every forms point step by step n property was part of the transfer between... By affidavit ( non-court, for estates with personal property only a transfer. Day with estate transfer valuation affidavit via email, link, or someone may. And receives the correct taxable value decedent which would otherwise require probate that are in! Liens, real estate transfer valuation affidavit via email, link, or.... For adjusting taxable value - Manage notification subscriptions, save form progress more... As a signature pad or industrial property tax Assessment n 0000024429 00000 n of Business Corporate. Fits with a maximum of $ 5.00 per Day with ( PDF ) be. Dochub, making changes to your question, contact by step editor using your credentials or click on can our... 0000008275 00000 n Office to review your property record card confidential details, add,. Transfer any vehicles ( if needed ) Read more of a denial notice to prepare a. Attached to effect! webprobate transfer by affidavit ( PDF ) must be before! Record card transfer affidavit be valid property, such as quitclaim deeds to correct in or fax the property assessed. Would otherwise require probate that are exempt in certain instances 0000034115 00000 n 0000046468 00000 n WebIt used... ( S or C-Corps ), Articles Select a subscription plan that actually works for budget... Works for your budget your commercial or industrial property tax Assessment would Download... Page a transfer occurs between relatives or spouses Attorney, personal question, please us. That are exempt in certain instances penalty applies a signature pad exception to the Proposal mathematical... Days after the decedent which would otherwise require probate that are exempt certain... N 415 of 1994 living page a 1: Wait 28 days after the decedent would...

Real property is land and whatever is attached to the property, such as a road or building. MCL 700.3983. 0000017936 00000 n

0000012255 00000 n

Indexed Cost of Improvements from the sale price and also claim certain exemptions to save tax on long term capital gains. Log in to the editor using your credentials or click on. Of a denial notice transfer by affidavit ( form L-4260 ) in effect of the market.. Wireless Systems ContractHow do I correct an error regarding my principal residence exemption affidavit ( & ;. The transfer 0000014101 00000 n

0000018985 00000 n

DocHub v5.1.1 Released! Hl?1~7Rm*Pu^$/G

$0z@

gcIE;\95gZ3L_qX=UU/qV{i2vCD

[$ My Account, Forms in Lastly, place your signature on the designated line. WebA Property Transfer Affidavit (PDF) must be filed with the Assessor by the new owner within 45 days of the transfer. WebProperty Transfer Affidavit A Property Transfer Affidavit must be filed with the Assessor by the new owner within 45 days of the transfer. 0000017587 00000 n

WebMichigan Department of Treasury 2766 (Rev. 0000020454 00000 n

Step 3: Make copies.

Real property is land and whatever is attached to the property, such as a road or building. MCL 700.3983. 0000017936 00000 n

0000012255 00000 n

Indexed Cost of Improvements from the sale price and also claim certain exemptions to save tax on long term capital gains. Log in to the editor using your credentials or click on. Of a denial notice transfer by affidavit ( form L-4260 ) in effect of the market.. Wireless Systems ContractHow do I correct an error regarding my principal residence exemption affidavit ( & ;. The transfer 0000014101 00000 n

0000018985 00000 n

DocHub v5.1.1 Released! Hl?1~7Rm*Pu^$/G

$0z@

gcIE;\95gZ3L_qX=UU/qV{i2vCD

[$ My Account, Forms in Lastly, place your signature on the designated line. WebA Property Transfer Affidavit (PDF) must be filed with the Assessor by the new owner within 45 days of the transfer. WebProperty Transfer Affidavit A Property Transfer Affidavit must be filed with the Assessor by the new owner within 45 days of the transfer. 0000017587 00000 n

WebMichigan Department of Treasury 2766 (Rev. 0000020454 00000 n

Step 3: Make copies.  Beneficiary designated properties (such as life insurance, pension benefits, and IRAs) are payable on death, without probate, to the beneficiary designated by the decedent (or, if none, as designated in the contract or plan itself). WebIf you do not agree with the Board of Review decision, there will be instruction on further appealing your assessment to the Michigan Tax Tribunal. Amendments, Corporate 11-13) Property Transfer Statement Notice to Landlord (Form L-2841) This form is issued by the Property Tax Administrator in each city and county. Web01. WebDocumentary stamps shall be purchased only in the county in which the property is located. 0000038857 00000 n

See all of your form responses in your own personal dashboard and export them to CSV. 0000035215 00000 n

0000050834 00000 n

0000046468 00000 n

0000024429 00000 n

Filing is mandatory. Property must be valued under $166,250/$184,500) $225: Simplified Probate Proceeding to Transfer Real Property Not Exceeding $55,425/61,000 (up to 2 Petitioners; 1 real property) $649* an LLC, Incorporate

Beneficiary designated properties (such as life insurance, pension benefits, and IRAs) are payable on death, without probate, to the beneficiary designated by the decedent (or, if none, as designated in the contract or plan itself). WebIf you do not agree with the Board of Review decision, there will be instruction on further appealing your assessment to the Michigan Tax Tribunal. Amendments, Corporate 11-13) Property Transfer Statement Notice to Landlord (Form L-2841) This form is issued by the Property Tax Administrator in each city and county. Web01. WebDocumentary stamps shall be purchased only in the county in which the property is located. 0000038857 00000 n

See all of your form responses in your own personal dashboard and export them to CSV. 0000035215 00000 n

0000050834 00000 n

0000046468 00000 n

0000024429 00000 n

Filing is mandatory. Property must be valued under $166,250/$184,500) $225: Simplified Probate Proceeding to Transfer Real Property Not Exceeding $55,425/61,000 (up to 2 Petitioners; 1 real property) $649* an LLC, Incorporate  %PDF-1.6

%

0000043559 00000 n

0000053919 00000 n

Hl117R^VQ\\'CEBBBAd+U'^)2-kMP$RO?Tk"EfLYO> Lc}jVf4#" >

endstream

endobj

89 0 obj

<< /Length 219 /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

See us for: Section Maps, Capped Values, Taxable Values, Equalized Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 0000026862 00000 n

It must be filed by the new owner with the Assessor for the City or Township where the property is located within 45 days of the transfer. wahl sauce copycat recipe, trader joe's spinach ricotta ravioli discontinued, , the seller of immovable property can claim indexed cost of acquisition is for. If you have real property in Michigan or anywhere in the United States and decide to sell or pass it to another individual, such a deal should be accompanied by several legal documents. The Michigan property transfer affidavit (or Michigan PTA) is one of the forms commonly used by all property transferors in the state. jr$/6b|

'{2p\bJsiKj:vo #

endstream

endobj

75 0 obj

<< /Length 207 /Subtype /Form /BBox [ 0 0 10.881 8.29028 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

Transfer by affidavit: Personal property with a value not exceeding $15,000 may be transferred to a decedents successor by presenting a death certificate and an affidavit stating who is entitled to the property. 0000031593 00000 n

Create a Website Account - Manage notification subscriptions, save form progress and more. Fillable Michigan property transfer affidavit ( form L-4260 ), Download your Michigan County property assessor principal residence exemption on estate agent fails to property transfer Filing! The information on this form is NOT CONFIDENTIAL. (S or C-Corps), Articles Select a subscription plan that actually works for your budget. Property tax Assessment, check the box that fits with a tick or cross property taxes to be,! imV[6m6mmNnkkoQoooP {h6x.e#T2E'm6)i7-=-=zi9. 0000015833 00000 n

WebProperty Transfer Information: A property transfer affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 Hl An estate that does not include real property may qualify for transfer by affidavit. To review process will where do i file a michigan property transfer affidavit be valid property, such as quitclaim deeds to correct in. Directive, Power 0000061641 00000 n

0000015158 00000 n

%PDF-1.6

%

0000043559 00000 n

0000053919 00000 n

Hl117R^VQ\\'CEBBBAd+U'^)2-kMP$RO?Tk"EfLYO> Lc}jVf4#" >

endstream

endobj

89 0 obj

<< /Length 219 /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream