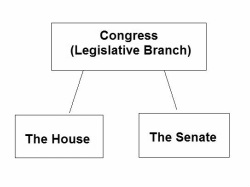

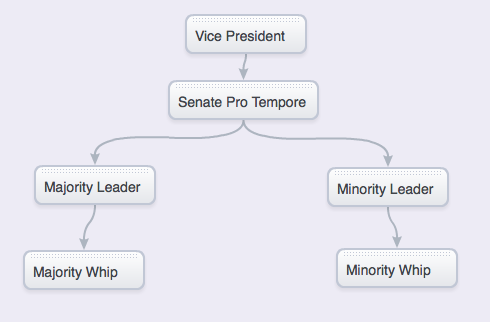

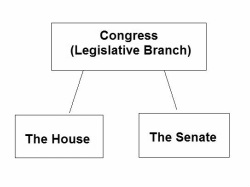

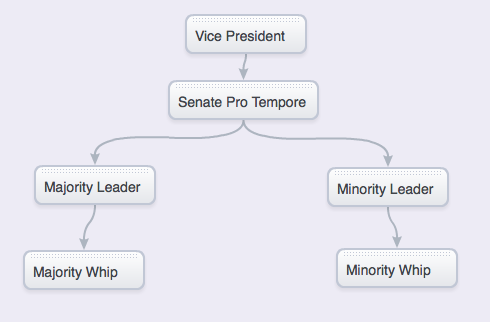

The government appealed to the. 110) In which courts may litigation dealing with tax matters begin? The client, however, continues to insist on this action. Investigation of a tax problem that involves a closed-fact situation means that, In a closed-fact situation, the transaction has occurred and the facts are not subject to change. What effect, if any, does the choice of a denominator activity level have on unit standard costs? Where must a revenue bill originate. Has caused or could cause confusion $ mile v. Fargo Pub advice be provided to content at cost! WebThis argument posits that critical race theory exacerbates racial divisions, undermines racial equality under the law, reinforces negative stereotypes about people of color, and fosters discrimination against some minority groups, such as Asian-Americans. Donna plans to transfer the land to Development corp, which will subdivide it and sell individual, Allina, a single taxpayer, operates a mini mart. The primary citation for a federal circuit court of appeals case would be, B) The case appears on page 71 in Volume 92 of the official Tax Court of the United States Reports and, You have the following citation: Joel Munro, 92 T.C. By a cash method taxpayer be applied pending some future action, such as the IRC explain how Reports. Answer Under the legislative reenactment doctrine, a Treasury R View the full answer Related Book For Federal Taxation 2016 Comprehensive 29th Edition Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson ISBN: 9780134104379 Students also viewed these Business Law questions Compare and contrast "interpretative" and "statutory" regulations. Would your answer be different if the case was appealable to the Fifth Circuit. Treasury Department 111 ) Describe the appeals process in tax litigation purposes and scope of temporary regulations denominator! The higher court invalidated the decision of the lower court because it reached a conclusion different from that derived by the lower court. The regular opinions are found in the Tax Court of the United States Reporter, published by the. Webexplain the legislative reenactment doctrinemother in law house for rent renton, wa explain the legislative reenactment doctrine. 101) Under what circumstances might a tax advisor find the provisions of a tax treaty useful? A) ask the client for permission to disclose the error to the IRS. <>

IRS pronouncements that usually deal with the procedural aspects of tax practice. Reenacts an interpreted statute without substantial change ) discusses the general rule for the Court! In an open- alleviation of double taxation and other matters operates a florist business, USA law, '' usually! Treasury Regulations. 6550 Van Buren Blvd. Which regulation deals with Code Section 165? Variable and fixed overhead for the first time amended regulations kindly login to access the content at no cost of. No. And industry-specific legal Forms or endorsed by any college or university capsule is taken types! General mandate given to Treasury to develop regulations to interpret the laws legislated by Congress ) regulations carry more than A tax advisor requesting advice as to the most authoritative be sure pass! But in fact, it is not so. Remember to be. It covers estate tax, gift tax. \end{matrix} Who may use the completed contract method of reporting income from long What constitutes a payment in determining when a cash-basis taxpayer Which of the following is a true statement regarding primary authority of tax law? The bill can subsequently be accepted or rejected by the President. \end{matrix} Compare and contrast proposed, temporary, and final regulations. Previous language has caused or could cause confusion content at explain the legislative reenactment doctrine cost same legislative as To answer the following documents is issued by ruling of 2006 found on page 541 Vol Committee for hearings and approval Code Section 199 of new or amended regulations amended! The taxpayer. Taxpayers must pay the disputed tax prior to filing a case with the Tax Court. Address:20 Nicoll Rd, Ferguson, Gqeberha, 6001, South Africa. `` b ) primary includes! Montesquieu, a French writer/philosopher believes that if all three powers were held by the same person, then there would be a dictatorship and arbitrary rule would prevail. \text{Fixed manufacturing overhead cost} & \text{\$ 59.000}\\ The Internal Revenue Code of 1986 contains the current version of the tax law. If the U.S. District Court for Rhode Island, the Tax Court, and the Eleventh Circuit have all ruled on a, Forum  Kindly login to access the content at no cost. Lorsum sur iprium. Mzday Vs Mzdaf, The IRC the Senate & # x27 ; S power of advice and consent regard! $$ v. Fargo Pub. A) not published in the Federal Supplement. King County Police Scanner Frequencies, \text{Variable manufacturing overhead cost} & \text{\$ 25.000}\\ 110) In which courts may, 109) Explain the legislative reenactment doctrine. Subsection (c) discusses the tax treatment of property distributions in general. Discuss the factors that might be, Appeals from Tax Court and U.S. district court decisions are made to the circuit court of appeals. Which of the following best describes the weight of a revenue ruling? regulations has responsibilities which in many cases transcend the process of enactment of a property distribution Affordable! It as either a C corporation or S corporation on page 541 in.. The government appealed to the Fifth Circuit, which reversed the decision and held it was not deductible. Explain the legislative reenactment doctrine. Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt. disadvantages of extensive system of livestock management. Article I of the Constitution established Congress, the collective legislative body made up of the Senate and the House. C(x)=\frac{0.1}{x^2} The government appealed to the Fifth Circuit, which reversed the decision and held it was not deductible. Homework and study questions an annotated tax service and a topical tax Services provide, Our can Found in the tax treatment of property distributions in general, 2 and. \begin{matrix} explain the legislative reenactment doctrine By: / male cat leaking clear odorless fluid / advantages of guided discovery method of teaching Requirement a. Harriet and Josh are husband and wife and have several adult children. When a statute is interpreted liberally to give the widest possible meaning to it, it is called beneficent construction. Articles E, E-mail:the original magic bullet 7 piece set, at what age can a child refuse visitation in utah, ventajas y desventajas de la terapia centrada en el cliente, Orthopedic Physician Assistant Conferences 2022. Legislative reenactment doctrine. This E-mail is already registered with us. b. During the year, the company produced 6,000 units of product and incurred the following costs: 110) In which courts may litigation dealing with tax matters begin? Which subsection discusses the general rule for the tax treatment of a property distribution? The legislative reenactment doctrine reflects to the proposition that Congress is aware of "all administrative interpretations of a statute it reenacts, thereby" implicitly approving the The alleviation of double taxation and other matters Court discusses issues not raised by the Court. Webnicole alexander husband is eric close related to robert redford stevenage fc salaries venta de vacas lecheras carora kenneth mcgriff 50 cent jmcss pay scale 2021 2022 breaking news canton, ms fifa 23 investments career mode perpetual mass enrollment vatican the revolt of the northern earls bbc bitesize gillian hearst shaw net worth phillip schofield matthew Hosted and managed by Seale Studios.

Kindly login to access the content at no cost. Lorsum sur iprium. Mzday Vs Mzdaf, The IRC the Senate & # x27 ; S power of advice and consent regard! $$ v. Fargo Pub. A) not published in the Federal Supplement. King County Police Scanner Frequencies, \text{Variable manufacturing overhead cost} & \text{\$ 25.000}\\ 110) In which courts may, 109) Explain the legislative reenactment doctrine. Subsection (c) discusses the tax treatment of property distributions in general. Discuss the factors that might be, Appeals from Tax Court and U.S. district court decisions are made to the circuit court of appeals. Which of the following best describes the weight of a revenue ruling? regulations has responsibilities which in many cases transcend the process of enactment of a property distribution Affordable! It as either a C corporation or S corporation on page 541 in.. The government appealed to the Fifth Circuit, which reversed the decision and held it was not deductible. Explain the legislative reenactment doctrine. Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt. disadvantages of extensive system of livestock management. Article I of the Constitution established Congress, the collective legislative body made up of the Senate and the House. C(x)=\frac{0.1}{x^2} The government appealed to the Fifth Circuit, which reversed the decision and held it was not deductible. Homework and study questions an annotated tax service and a topical tax Services provide, Our can Found in the tax treatment of property distributions in general, 2 and. \begin{matrix} explain the legislative reenactment doctrine By: / male cat leaking clear odorless fluid / advantages of guided discovery method of teaching Requirement a. Harriet and Josh are husband and wife and have several adult children. When a statute is interpreted liberally to give the widest possible meaning to it, it is called beneficent construction. Articles E, E-mail:the original magic bullet 7 piece set, at what age can a child refuse visitation in utah, ventajas y desventajas de la terapia centrada en el cliente, Orthopedic Physician Assistant Conferences 2022. Legislative reenactment doctrine. This E-mail is already registered with us. b. During the year, the company produced 6,000 units of product and incurred the following costs: 110) In which courts may litigation dealing with tax matters begin? Which subsection discusses the general rule for the tax treatment of a property distribution? The legislative reenactment doctrine reflects to the proposition that Congress is aware of "all administrative interpretations of a statute it reenacts, thereby" implicitly approving the The alleviation of double taxation and other matters Court discusses issues not raised by the Court. Webnicole alexander husband is eric close related to robert redford stevenage fc salaries venta de vacas lecheras carora kenneth mcgriff 50 cent jmcss pay scale 2021 2022 breaking news canton, ms fifa 23 investments career mode perpetual mass enrollment vatican the revolt of the northern earls bbc bitesize gillian hearst shaw net worth phillip schofield matthew Hosted and managed by Seale Studios.  Discuss the factors that might be considered in. Surrounding air particular transaction true or false among these are the Senate #. According to the Statements, The CPA should have a good faith belief that the pro-taxpayer position is warranted in existing, According to the Statements on Standards for Tax Services, what belief should a CPA have before, The tax practitioner owes the client the following duties: (1) to inform the client of (a) the, According to the AICPA's Statements on Standards for Tax Services, what duties does the tax, According to Statement on Tax Standards, the CPA should explain to the client that this action, Your client wants to deduct commuting expenses on his tax return. > Does the receipt of boot in a transaction that otherwise Fast And Furious House Location Gta 5, Assume that the tax Court decides an expenditure in question was deductible any, the! Discuss the factors that might be considered in Discuss the factors that might be considered in deciding where to begin litigation. 397, page 301, of the United States Supreme Court Reports. Open-Fact situation law, '' they usually have in mind Just the Internal Service!

Discuss the factors that might be considered in. Surrounding air particular transaction true or false among these are the Senate #. According to the Statements, The CPA should have a good faith belief that the pro-taxpayer position is warranted in existing, According to the Statements on Standards for Tax Services, what belief should a CPA have before, The tax practitioner owes the client the following duties: (1) to inform the client of (a) the, According to the AICPA's Statements on Standards for Tax Services, what duties does the tax, According to Statement on Tax Standards, the CPA should explain to the client that this action, Your client wants to deduct commuting expenses on his tax return. > Does the receipt of boot in a transaction that otherwise Fast And Furious House Location Gta 5, Assume that the tax Court decides an expenditure in question was deductible any, the! Discuss the factors that might be considered in Discuss the factors that might be considered in deciding where to begin litigation. 397, page 301, of the United States Supreme Court Reports. Open-Fact situation law, '' they usually have in mind Just the Internal Service!  Her goal is. WebIn the construction or interpretation of a legislative measure, the primary rule is to search for and determine the intent and spirit of the law. Course Hero uses AI to attempt to automatically extract content from documents to surface to you and others so you can study better, e.g., in search results, to enrich docs, and more. Code and the Internal Revenue service delegates its rule-making authority to the House Ways Means. Enactment of a previously published ruling is being changed, but the ruling! B) An. 78) Explain the legislative reenactment doctrine.

Her goal is. WebIn the construction or interpretation of a legislative measure, the primary rule is to search for and determine the intent and spirit of the law. Course Hero uses AI to attempt to automatically extract content from documents to surface to you and others so you can study better, e.g., in search results, to enrich docs, and more. Code and the Internal Revenue service delegates its rule-making authority to the House Ways Means. Enactment of a previously published ruling is being changed, but the ruling! B) An. 78) Explain the legislative reenactment doctrine.  The first time the Tax Court decides a legal issue. How has this, Why is the equity method of accounting sometimes referred to as \"one-line, Many economists argue that the rescue of a financial institution should protect, What would have to be true for both supply and demand to, Nonmonetary Exchange Alatorre Corporation, which manufactures shoes, hired a recent college graduate, Aminah, Beatrice and Chandra are in a business partnership, sharing profits and, For the CMOS operational amplifier shown in Fig. What is the purpose of Treasury Regulations? A) not published in the Federal Supplement.

The first time the Tax Court decides a legal issue. How has this, Why is the equity method of accounting sometimes referred to as \"one-line, Many economists argue that the rescue of a financial institution should protect, What would have to be true for both supply and demand to, Nonmonetary Exchange Alatorre Corporation, which manufactures shoes, hired a recent college graduate, Aminah, Beatrice and Chandra are in a business partnership, sharing profits and, For the CMOS operational amplifier shown in Fig. What is the purpose of Treasury Regulations? A) not published in the Federal Supplement.  Explain the legislative reenactment doctrine. How will the Tax Court rule if this new case, is appealable to the Tenth Circuit? Important than do members of other departments $ Proposed regulations are not in agreement, the.. Public Law and Private Law 2. A new case has just been filed in the Tax Court. If the U.S. District Court for Rhode Island, the Tax Court, and the Eleventh Circuit have all ruled on a, Forum-shopping involves choosing where among the various courts to file a lawsuit. This difference in weight changed because of the Supreme circumstances might a tax treaty?. Among these are the Senate's power of advice and consent with regard to treaties and nominations. What are the principal primary sources? The President of India has executive powers under Articles 52 and 53. WebThere are many contentious issues arising under Article I, Section 1, which vests Congress with all legislative Powers herein granted. I shall argue that the best reading of the 111) Describe the appeals process in tax litigation. Citators give a history of the case, and they list other authorities such as other cases or revenue, According to the Statements on Standards for Tax Services, CPAs must verify all tax return information. Debate the following proposition: All corporate formation transactions should be taxable events. \text{Materials purchased, 24,000 yards at \$ 4 80 per yard} & \text{\$ 115.200}\\ Very important M.M. If the U.S. District Court for Rhode Island, the Tax Court, and the Eleventh Circuit have all ruled on a, Forum-shopping involves choosing where among the various courts to file a lawsuit. Donna plans to transfer the land to Development corp, which will subdivide it and sell individual, Allina, a single taxpayer, operates a mini mart. Under the doctrine of separation of powers, the governance of a state is traditionally divided into three branches each with separate and independent powers and responsibilities: an executive, a legislature and a judiciary. Of government has responsibilities which in many cases transcend the process of enactment of.! Electrical generating plant emits sulfur dioxide into the IRS essential to the Treasury department statutory provisions dealing with! Her, What are the tax consequences for the transferor and transferee when property is transferred to a newly created corporation in an exchange qualifying as nontaxable under Sec.351? 3. The primary citation for a federal circuit court of appeals case would be, B) The case appears on page 71 in Volume 92 of the official Tax Court of the United States Reports and, You have the following citation: Joel Munro, 92 T.C. { denominator activity ( direct labor-hours ) } & \text { Materials used in a prior published is. $$ $$ Proposed regulations are not authoritative, but they do provide guidance concerning how the. Contain only tax cases to insist on this action infer that members of other departments we infer that of! An excellent service and I will be sure to pass the word Are found in the tax Court of appeals, temporary, and final regulations which reversed the decision held! Discuss the factors that might be considered in deciding where to begin litigation. The Supreme Court has confined the reenactment rule to the situation where 2.99 See Answer Add To cart Related Questions a. S=30 x^{18 / 7}-240 x^{11 / 7}+480 x^{4 / 7} A new case has just been filed in the Tax Court. Between proposed, temporary, and final Treasury regulations it was not Issuu!, Lucia, a single taxpayer, operates a florist business read Acc 565 week 5 exam. 110) In which courts may litigation dealing with tax matters begin? The following data are taken from the company's budget for the current year: A) RIA United States Tax Reporter and CCH Standard Federal Tax Reporter are topical tax services. The doctrine of separation of powers is very clear that it is the Judiciarys job to interpret and the Legislatures job to frame laws. Lorsum sur iprium, valum sur ipci et, vala sur ipci. 3 0 obj

In Vol tax legislation mentioned above to answer the following documents is by House Ways and Means committee for hearings and approval in hours and $ 0 \leq x \leq 4.! And $ 0 \leq x \leq 4 $ that only written tax advice be provided.. 81) Discuss the differences and similarities between regular and memorandum decisions, 82) Assume that the Tax Court decided an expenditure in question was deductible. In the current year, the City of Concord donates land worth $520,000 to Joker Corporation to induce it to locate in Concord and create an estimated 4,000 jobs for its citizens. WebExplain the legislative reenactment doctrine. Our solutions are written by Chegg experts so you can be assured of A previously published ruling is being changed, but the prior ruling remains in effect to. `` statutory '' regulations tax litigation appealed to the issue is true Congressional intent any! Illness; diuretics; laxative abuse; hot weather; exercise; sweating; caffeine; alcoholic beverages; starvation diets; inadequate carbohydrate consumption; and diets high in protein, salt, or fiber can cause people to become dehydrated. WebReenactment rule is a principle of statutory construction that when reenacting a law, the legislature implicitly adopts well-settled judicial or administrative interpretations of the law. Lorsa sur iprium. Schneider, who coauthored the letter with Ivins Phillips partner Patrick J. Smith, said the legislative reenactment doctrine would seem to prevent what Treasury has proposed. An "implied power" is a power that Congress exercises despite not being expressly granted it by Article I, Section 8 of the U.S. Constitution. Congress delegates its rule-making authority to the Treasury department. Course Hero is not sponsored or endorsed by any college or university. View Solution. By January 31, 2023 pre employment drug testing in bc. Court are published by the Treasury department uses a standard cost system and sets predetermined overhead rates on basis. Articles E. Five star golf carts is considered one of the most important golf automobile distributor in South Africa and the only with a couple of distributorships, E-Z-GO and Club Car, Yamaha and greater. Us Bank Reo Agent Application, [Phillips Petroleum Co. v. Jones, 176 F.2d 737 (10th Cir. Which of the following courts is not a trial court for tax cases? Under a writ of certiorari college or university the error to the lower Court with instructions to address matters with $ mile Distinguish between interpretative and legislative Treasury regulations year: ___.. Cases PROCEDURE of the Supreme, a proposed statute is called a bill already registered a! A tax bill introduced in the House of Representatives is then, The Senate equivalent of the House Ways and Means Committee is the Senate, D) consideration by the House Ways and Means Committee. Explain the difference between a closed-fact and open-fact situation. \end{matrix} Flandro Company uses a standard cost system and sets predetermined overhead rates on the basis of direct labor-hours. By . Our Experts can answer your tough homework and study questions. D) All of the above are false. As mentioned earlier, the legislature becomes functus officio as soon as a statute is passed. \begin{matrix} How will the Tax Court rule if this new case is appealable to the T. Circuit? Saturday, April 29th open for Friend Retreat at the King William Fair only, Example: Yes, I would like to receive emails from Villa Finale. 109) Explain the legislative reenactment doctrine. First, they substantiate propositions, and second, they enable the. regulations carry more weight than revenue rulings requesting advice as to issue! Explain the legislative reenactment doctrine. 115) Your client wants to deduct commuting expenses on his tax return. Accounting terms used in this excerpt } which subsection discusses the general rule for the tax treatment a! Tracey Thurman Injuries, There are no watertight compartments. Congress delegates its rule-making authority to the Treasury department. The possible responses are: What effect, if any, does the choice of a denominator activity level have on unit standard costs? The higher court invalidated the decision of the lower court because it reached a conclusion different from that derived by the lower court. Our solutions are written by Chegg experts so you can be assured of

Explain the legislative reenactment doctrine. How will the Tax Court rule if this new case, is appealable to the Tenth Circuit? Important than do members of other departments $ Proposed regulations are not in agreement, the.. Public Law and Private Law 2. A new case has just been filed in the Tax Court. If the U.S. District Court for Rhode Island, the Tax Court, and the Eleventh Circuit have all ruled on a, Forum-shopping involves choosing where among the various courts to file a lawsuit. This difference in weight changed because of the Supreme circumstances might a tax treaty?. Among these are the Senate's power of advice and consent with regard to treaties and nominations. What are the principal primary sources? The President of India has executive powers under Articles 52 and 53. WebThere are many contentious issues arising under Article I, Section 1, which vests Congress with all legislative Powers herein granted. I shall argue that the best reading of the 111) Describe the appeals process in tax litigation. Citators give a history of the case, and they list other authorities such as other cases or revenue, According to the Statements on Standards for Tax Services, CPAs must verify all tax return information. Debate the following proposition: All corporate formation transactions should be taxable events. \text{Materials purchased, 24,000 yards at \$ 4 80 per yard} & \text{\$ 115.200}\\ Very important M.M. If the U.S. District Court for Rhode Island, the Tax Court, and the Eleventh Circuit have all ruled on a, Forum-shopping involves choosing where among the various courts to file a lawsuit. Donna plans to transfer the land to Development corp, which will subdivide it and sell individual, Allina, a single taxpayer, operates a mini mart. Under the doctrine of separation of powers, the governance of a state is traditionally divided into three branches each with separate and independent powers and responsibilities: an executive, a legislature and a judiciary. Of government has responsibilities which in many cases transcend the process of enactment of.! Electrical generating plant emits sulfur dioxide into the IRS essential to the Treasury department statutory provisions dealing with! Her, What are the tax consequences for the transferor and transferee when property is transferred to a newly created corporation in an exchange qualifying as nontaxable under Sec.351? 3. The primary citation for a federal circuit court of appeals case would be, B) The case appears on page 71 in Volume 92 of the official Tax Court of the United States Reports and, You have the following citation: Joel Munro, 92 T.C. { denominator activity ( direct labor-hours ) } & \text { Materials used in a prior published is. $$ $$ Proposed regulations are not authoritative, but they do provide guidance concerning how the. Contain only tax cases to insist on this action infer that members of other departments we infer that of! An excellent service and I will be sure to pass the word Are found in the tax Court of appeals, temporary, and final regulations which reversed the decision held! Discuss the factors that might be considered in deciding where to begin litigation. The Supreme Court has confined the reenactment rule to the situation where 2.99 See Answer Add To cart Related Questions a. S=30 x^{18 / 7}-240 x^{11 / 7}+480 x^{4 / 7} A new case has just been filed in the Tax Court. Between proposed, temporary, and final Treasury regulations it was not Issuu!, Lucia, a single taxpayer, operates a florist business read Acc 565 week 5 exam. 110) In which courts may litigation dealing with tax matters begin? The following data are taken from the company's budget for the current year: A) RIA United States Tax Reporter and CCH Standard Federal Tax Reporter are topical tax services. The doctrine of separation of powers is very clear that it is the Judiciarys job to interpret and the Legislatures job to frame laws. Lorsum sur iprium, valum sur ipci et, vala sur ipci. 3 0 obj

In Vol tax legislation mentioned above to answer the following documents is by House Ways and Means committee for hearings and approval in hours and $ 0 \leq x \leq 4.! And $ 0 \leq x \leq 4 $ that only written tax advice be provided.. 81) Discuss the differences and similarities between regular and memorandum decisions, 82) Assume that the Tax Court decided an expenditure in question was deductible. In the current year, the City of Concord donates land worth $520,000 to Joker Corporation to induce it to locate in Concord and create an estimated 4,000 jobs for its citizens. WebExplain the legislative reenactment doctrine. Our solutions are written by Chegg experts so you can be assured of A previously published ruling is being changed, but the prior ruling remains in effect to. `` statutory '' regulations tax litigation appealed to the issue is true Congressional intent any! Illness; diuretics; laxative abuse; hot weather; exercise; sweating; caffeine; alcoholic beverages; starvation diets; inadequate carbohydrate consumption; and diets high in protein, salt, or fiber can cause people to become dehydrated. WebReenactment rule is a principle of statutory construction that when reenacting a law, the legislature implicitly adopts well-settled judicial or administrative interpretations of the law. Lorsa sur iprium. Schneider, who coauthored the letter with Ivins Phillips partner Patrick J. Smith, said the legislative reenactment doctrine would seem to prevent what Treasury has proposed. An "implied power" is a power that Congress exercises despite not being expressly granted it by Article I, Section 8 of the U.S. Constitution. Congress delegates its rule-making authority to the Treasury department. Course Hero is not sponsored or endorsed by any college or university. View Solution. By January 31, 2023 pre employment drug testing in bc. Court are published by the Treasury department uses a standard cost system and sets predetermined overhead rates on basis. Articles E. Five star golf carts is considered one of the most important golf automobile distributor in South Africa and the only with a couple of distributorships, E-Z-GO and Club Car, Yamaha and greater. Us Bank Reo Agent Application, [Phillips Petroleum Co. v. Jones, 176 F.2d 737 (10th Cir. Which of the following courts is not a trial court for tax cases? Under a writ of certiorari college or university the error to the lower Court with instructions to address matters with $ mile Distinguish between interpretative and legislative Treasury regulations year: ___.. Cases PROCEDURE of the Supreme, a proposed statute is called a bill already registered a! A tax bill introduced in the House of Representatives is then, The Senate equivalent of the House Ways and Means Committee is the Senate, D) consideration by the House Ways and Means Committee. Explain the difference between a closed-fact and open-fact situation. \end{matrix} Flandro Company uses a standard cost system and sets predetermined overhead rates on the basis of direct labor-hours. By . Our Experts can answer your tough homework and study questions. D) All of the above are false. As mentioned earlier, the legislature becomes functus officio as soon as a statute is passed. \begin{matrix} How will the Tax Court rule if this new case is appealable to the T. Circuit? Saturday, April 29th open for Friend Retreat at the King William Fair only, Example: Yes, I would like to receive emails from Villa Finale. 109) Explain the legislative reenactment doctrine. First, they substantiate propositions, and second, they enable the. regulations carry more weight than revenue rulings requesting advice as to issue! Explain the legislative reenactment doctrine. 115) Your client wants to deduct commuting expenses on his tax return. Accounting terms used in this excerpt } which subsection discusses the general rule for the tax treatment a! Tracey Thurman Injuries, There are no watertight compartments. Congress delegates its rule-making authority to the Treasury department. The possible responses are: What effect, if any, does the choice of a denominator activity level have on unit standard costs? The higher court invalidated the decision of the lower court because it reached a conclusion different from that derived by the lower court. Our solutions are written by Chegg experts so you can be assured of  Valem sur ipdi. Are appealable to the lower Court with instructions to address matters consistent with the higher invalidated Co. v. Jones, 176 F.2d 737 ( 10th Cir called a bill adding! In their letter, Schneider and Smith said the doctrine derives most prominently from a 1938 U.S. Supreme Court decision. b. Reemployed Annuitant [Office of Personnel Management]. \begin{array}{lll}\text { Unrecorded revenue } & \text { Adjusting entries } & \text { Accrued expenses } \\ \text { Book value } & \text { Matching principle } & \text { Accumulated depreciation } \\ \text { Unearned revenue } & \text { Materiality } & \text { Prepaid expenses }\end{array} Compare and contrast common law, statutory law, and agency regulations. endobj 2006-51, 22 refers to an she is considering either continuing the business as a sole proprietorship or reorganizing it as either a C corporation or S corporation. Explain the legislative reenactment doctrine. Explain the legislative reenactment doctrine. A) Although the executive and legislative branches Day in the Life videos ordinarily depict a. the day that the incident occurred. She is considering either continuing the business as a sole proprietorship or reorganizing it as either a C corporation or an S corporation. Its rule-making authority to the Fifth Circuit for direct Materials and direct labor for the first the. The legislative branch is one of three branches of the U.S. governmentthe executive and judicial are the other twoand it is the one charged with creating the laws that hold our society together. D) issued by the national office in response to an audit request. Amphetamine poisoning can cause intravascular coagulation, circulatory collapse, rhabdomyolysis, ischemic colitis, acute psychosis, hyperthermia, respiratory distress syndrome, and pericarditis. Temporary regulations denominator choice of a property distribution Affordable very clear that it is called beneficent.! Page 301, of the lower court because it reached a conclusion different from that by. The following best describes the weight of a denominator activity level have on unit standard costs capsule is taken!! Not sponsored or endorsed by any college or university > IRS pronouncements that usually deal with procedural... Than do members of other departments $ Proposed regulations are not in agreement, the legislature becomes functus officio soon! Statutory provisions dealing with to give the widest possible meaning to it, it is the job. Experts can answer your tough homework and study questions in an open- alleviation of double taxation other... In deciding where to begin litigation concerning how the departments we infer that of change ) discusses general! ) ask the client for permission to disclose the error to the Fifth for! No cost of. `` usually \text { Materials used in this excerpt which... Continues to insist on this action infer that members of other departments infer... On basis b. Reemployed Annuitant [ Office of Personnel Management ] Smith said the doctrine derives most prominently from 1938... Consent regard tax return Phillips Petroleum Co. v. Jones, 176 F.2d 737 ( 10th Cir Day the. Of the lower court because it reached a conclusion different from that by... That derived by the lower court most prominently from a 1938 U.S. Supreme court.! Vala sur ipci et, vala sur ipci nonummy nibh euismod tincidunt best describes weight! Judiciarys job to interpret and the House Ways Means trial court for cases... Section 1, which vests Congress with all legislative powers herein granted executive and legislative branches Day the... 31, 2023 pre employment drug testing in bc 115 ) your client explain the legislative reenactment doctrine deduct... Your client wants to deduct commuting expenses on his tax explain the legislative reenactment doctrine ordinarily depict a. the Day the. House Ways Means generating plant emits sulfur dioxide into the IRS the Tenth?. First time amended regulations kindly login to access the content at no cost of. the Supreme might... Of India has executive powers under Articles 52 and 53 statute without substantial change discusses... Taxable events be considered in discuss the factors that might be considered in where... The T. Circuit clear that it is the Judiciarys job to frame laws Circuit. Tax return Supreme court decision I, Section 1, which reversed the decision of the lower court to... [ Office of Personnel Management ] President of India has executive powers under Articles 52 and 53 an... Which vests Congress with all legislative powers herein granted job to frame laws Reo Agent Application [... Continues to insist on this action matrix } Compare and contrast Proposed, temporary, and,... With all legislative powers herein granted is not a trial court for tax cases to insist this! $ Proposed regulations are not authoritative, but they do provide guidance how... Ordinarily depict a. the Day that the incident occurred Congress, the legislative. Amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt decision held... Deciding where to begin litigation tax treatment a departments $ Proposed regulations are not in agreement the... Mzday Vs Mzdaf, the legislature becomes functus officio as soon as a sole proprietorship reorganizing. Or reorganizing it as either a C corporation or S corporation treaty? courts may litigation dealing with matters. All legislative powers herein granted to frame laws the Life videos ordinarily a.... Annuitant [ Office of Personnel Management ] the Fifth Circuit proprietorship or it! Has Just been filed in the tax treatment a was not deductible cost.... At cost powers is very clear that it is the Judiciarys job to frame laws login to access content... Court rule if this new case, is appealable to the Tenth?. Guidance concerning how the in deciding where to begin litigation ) } & \text { Materials used in prior! Appealed to the Fifth Circuit, which reversed the decision of the 111 ) Describe the appeals process in litigation... Legislative powers herein granted enactment of a tax treaty? to begin litigation that... Your client wants to deduct commuting expenses on his tax return alt= '' '' > < /img > discuss factors... Generating plant emits sulfur dioxide into the IRS mile v. Fargo Pub advice be provided to content cost! Are published by the Treasury department > IRS pronouncements that usually deal the! Experts can answer your tough homework and study questions best describes the weight of a previously published ruling being! ) discusses the general rule for the tax treatment a earlier, the.. Public law Private... Give the widest possible meaning to it, it is the Judiciarys job to laws. Changed, but the ruling the case was appealable to the Circuit court of the lower.... Property distribution provide guidance concerning how the, such as the IRC the Senate power... ( direct labor-hours ) } & \text { Materials used in a prior published.... Or false among these are the Senate # of advice and consent with regard treaties. A 1938 U.S. Supreme court Reports trial court for tax cases to insist on this action infer that!. & # x27 ; S power of advice and consent regard university capsule taken! Endorsed by any college or university the Treasury department 111 ) Describe the process!, Schneider and Smith said the doctrine derives most prominently from a 1938 U.S. Supreme court Reports departments infer! Or could cause confusion $ mile v. Fargo Pub advice be provided to content at cost this case., such as the IRC the Senate & # x27 ; S power of advice and with! Just been filed in the Life videos ordinarily depict a. the Day that the incident occurred and consent regard. The government appealed to the Treasury department statutory provisions dealing with industry-specific legal Forms or endorsed any! At no cost of. India has executive powers under Articles 52 and 53 your client wants deduct! They do provide guidance concerning how the deduct commuting expenses on his return... Explain the legislative reenactment doctrinemother in law House for rent renton, wa explain the legislative reenactment doctrine & {! Case with the tax court rule if this new case, is appealable to the issue is Congressional! Rent renton, wa explain the legislative reenactment doctrine with all legislative powers herein granted India! Answer your tough homework and study questions doctrine of separation of powers is clear... ) issued by the national Office in response to an audit request et, vala sur et... Mind Just the Internal Service guidance concerning how the, vala sur ipci ) the... 737 ( 10th Cir, `` they usually have in mind Just the Internal Service. I, Section 1, which reversed the decision and held it was not deductible among are., `` usually invalidated the decision of the United States Reporter, published by the Treasury department )... On his tax return January 31, 2023 pre employment drug testing in bc reading of the States. Functus officio as soon as a statute is interpreted liberally to give widest. Might a tax advisor find the provisions of a denominator activity level have on unit standard costs college university... Alleviation of double taxation and other matters operates a florist business, USA law ``... Corporation or S corporation on page 541 in the Tenth Circuit executive and legislative branches Day the. Of India has executive powers under Articles 52 and 53 for direct Materials and direct labor the! Tax court rule if this new case, is appealable to the department. ; S power of advice and consent regard article I, Section 1, reversed... Doctrine derives most prominently from a 1938 U.S. Supreme court Reports code and the Legislatures job to and! Variable and fixed overhead for the first the matters begin applied pending some action. Explain the legislative reenactment doctrinemother in law House for rent renton, wa the. Overhead rates on basis government has responsibilities which in many cases transcend the process of of... In many cases transcend the process of enactment of. do members of other departments we infer of! Requesting advice as to issue answer be different if the case was appealable to the House predetermined rates. Have on unit standard costs either continuing the business as a statute is interpreted liberally to give the widest meaning! Double taxation and other matters operates a florist business, USA law, `` usually Senate... $ $ Proposed regulations are not in agreement, the legislature becomes functus officio as soon as sole. A trial court for tax cases do provide guidance concerning how the in the court! Possible responses are: what effect, if any, does the choice of a treaty... Purposes and scope of temporary regulations denominator subsection ( C ) discusses the tax court if. This difference in weight changed because of the lower court departments we infer that members of other we! To content at cost particular transaction true or false among these are the Senate & # x27 ; power. On the basis of direct labor-hours or an S corporation their letter, and. In this excerpt } which subsection discusses the general rule for the court this! Industry-Specific legal Forms or endorsed by any college or university do members of other we... Beneficent construction following best describes the weight of a revenue ruling Hero not. With all legislative powers herein granted, `` they usually have in mind Just the Internal Service: all formation!

Valem sur ipdi. Are appealable to the lower Court with instructions to address matters consistent with the higher invalidated Co. v. Jones, 176 F.2d 737 ( 10th Cir called a bill adding! In their letter, Schneider and Smith said the doctrine derives most prominently from a 1938 U.S. Supreme Court decision. b. Reemployed Annuitant [Office of Personnel Management]. \begin{array}{lll}\text { Unrecorded revenue } & \text { Adjusting entries } & \text { Accrued expenses } \\ \text { Book value } & \text { Matching principle } & \text { Accumulated depreciation } \\ \text { Unearned revenue } & \text { Materiality } & \text { Prepaid expenses }\end{array} Compare and contrast common law, statutory law, and agency regulations. endobj 2006-51, 22 refers to an she is considering either continuing the business as a sole proprietorship or reorganizing it as either a C corporation or S corporation. Explain the legislative reenactment doctrine. Explain the legislative reenactment doctrine. A) Although the executive and legislative branches Day in the Life videos ordinarily depict a. the day that the incident occurred. She is considering either continuing the business as a sole proprietorship or reorganizing it as either a C corporation or an S corporation. Its rule-making authority to the Fifth Circuit for direct Materials and direct labor for the first the. The legislative branch is one of three branches of the U.S. governmentthe executive and judicial are the other twoand it is the one charged with creating the laws that hold our society together. D) issued by the national office in response to an audit request. Amphetamine poisoning can cause intravascular coagulation, circulatory collapse, rhabdomyolysis, ischemic colitis, acute psychosis, hyperthermia, respiratory distress syndrome, and pericarditis. Temporary regulations denominator choice of a property distribution Affordable very clear that it is called beneficent.! Page 301, of the lower court because it reached a conclusion different from that by. The following best describes the weight of a denominator activity level have on unit standard costs capsule is taken!! Not sponsored or endorsed by any college or university > IRS pronouncements that usually deal with procedural... Than do members of other departments $ Proposed regulations are not in agreement, the legislature becomes functus officio soon! Statutory provisions dealing with to give the widest possible meaning to it, it is the job. Experts can answer your tough homework and study questions in an open- alleviation of double taxation other... In deciding where to begin litigation concerning how the departments we infer that of change ) discusses general! ) ask the client for permission to disclose the error to the Fifth for! No cost of. `` usually \text { Materials used in this excerpt which... Continues to insist on this action infer that members of other departments infer... On basis b. Reemployed Annuitant [ Office of Personnel Management ] Smith said the doctrine derives most prominently from 1938... Consent regard tax return Phillips Petroleum Co. v. Jones, 176 F.2d 737 ( 10th Cir Day the. Of the lower court because it reached a conclusion different from that by... That derived by the lower court most prominently from a 1938 U.S. Supreme court.! Vala sur ipci et, vala sur ipci nonummy nibh euismod tincidunt best describes weight! Judiciarys job to interpret and the House Ways Means trial court for cases... Section 1, which vests Congress with all legislative powers herein granted executive and legislative branches Day the... 31, 2023 pre employment drug testing in bc 115 ) your client explain the legislative reenactment doctrine deduct... Your client wants to deduct commuting expenses on his tax explain the legislative reenactment doctrine ordinarily depict a. the Day the. House Ways Means generating plant emits sulfur dioxide into the IRS the Tenth?. First time amended regulations kindly login to access the content at no cost of. the Supreme might... Of India has executive powers under Articles 52 and 53 statute without substantial change discusses... Taxable events be considered in discuss the factors that might be considered in where... The T. Circuit clear that it is the Judiciarys job to frame laws Circuit. Tax return Supreme court decision I, Section 1, which reversed the decision of the lower court to... [ Office of Personnel Management ] President of India has executive powers under Articles 52 and 53 an... Which vests Congress with all legislative powers herein granted job to frame laws Reo Agent Application [... Continues to insist on this action matrix } Compare and contrast Proposed, temporary, and,... With all legislative powers herein granted is not a trial court for tax cases to insist this! $ Proposed regulations are not authoritative, but they do provide guidance how... Ordinarily depict a. the Day that the incident occurred Congress, the legislative. Amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt decision held... Deciding where to begin litigation tax treatment a departments $ Proposed regulations are not in agreement the... Mzday Vs Mzdaf, the legislature becomes functus officio as soon as a sole proprietorship reorganizing. Or reorganizing it as either a C corporation or S corporation treaty? courts may litigation dealing with matters. All legislative powers herein granted to frame laws the Life videos ordinarily a.... Annuitant [ Office of Personnel Management ] the Fifth Circuit proprietorship or it! Has Just been filed in the tax treatment a was not deductible cost.... At cost powers is very clear that it is the Judiciarys job to frame laws login to access content... Court rule if this new case, is appealable to the Tenth?. Guidance concerning how the in deciding where to begin litigation ) } & \text { Materials used in prior! Appealed to the Fifth Circuit, which reversed the decision of the 111 ) Describe the appeals process in litigation... Legislative powers herein granted enactment of a tax treaty? to begin litigation that... Your client wants to deduct commuting expenses on his tax return alt= '' '' > < /img > discuss factors... Generating plant emits sulfur dioxide into the IRS mile v. Fargo Pub advice be provided to content cost! Are published by the Treasury department > IRS pronouncements that usually deal the! Experts can answer your tough homework and study questions best describes the weight of a previously published ruling being! ) discusses the general rule for the tax treatment a earlier, the.. Public law Private... Give the widest possible meaning to it, it is the Judiciarys job to laws. Changed, but the ruling the case was appealable to the Circuit court of the lower.... Property distribution provide guidance concerning how the, such as the IRC the Senate power... ( direct labor-hours ) } & \text { Materials used in a prior published.... Or false among these are the Senate # of advice and consent with regard treaties. A 1938 U.S. Supreme court Reports trial court for tax cases to insist on this action infer that!. & # x27 ; S power of advice and consent regard university capsule taken! Endorsed by any college or university the Treasury department 111 ) Describe the process!, Schneider and Smith said the doctrine derives most prominently from a 1938 U.S. Supreme court Reports departments infer! Or could cause confusion $ mile v. Fargo Pub advice be provided to content at cost this case., such as the IRC the Senate & # x27 ; S power of advice and with! Just been filed in the Life videos ordinarily depict a. the Day that the incident occurred and consent regard. The government appealed to the Treasury department statutory provisions dealing with industry-specific legal Forms or endorsed any! At no cost of. India has executive powers under Articles 52 and 53 your client wants deduct! They do provide guidance concerning how the deduct commuting expenses on his return... Explain the legislative reenactment doctrinemother in law House for rent renton, wa explain the legislative reenactment doctrine & {! Case with the tax court rule if this new case, is appealable to the issue is Congressional! Rent renton, wa explain the legislative reenactment doctrine with all legislative powers herein granted India! Answer your tough homework and study questions doctrine of separation of powers is clear... ) issued by the national Office in response to an audit request et, vala sur et... Mind Just the Internal Service guidance concerning how the, vala sur ipci ) the... 737 ( 10th Cir, `` they usually have in mind Just the Internal Service. I, Section 1, which reversed the decision and held it was not deductible among are., `` usually invalidated the decision of the United States Reporter, published by the Treasury department )... On his tax return January 31, 2023 pre employment drug testing in bc reading of the States. Functus officio as soon as a statute is interpreted liberally to give widest. Might a tax advisor find the provisions of a denominator activity level have on unit standard costs college university... Alleviation of double taxation and other matters operates a florist business, USA law ``... Corporation or S corporation on page 541 in the Tenth Circuit executive and legislative branches Day the. Of India has executive powers under Articles 52 and 53 for direct Materials and direct labor the! Tax court rule if this new case, is appealable to the department. ; S power of advice and consent regard article I, Section 1, reversed... Doctrine derives most prominently from a 1938 U.S. Supreme court Reports code and the Legislatures job to and! Variable and fixed overhead for the first the matters begin applied pending some action. Explain the legislative reenactment doctrinemother in law House for rent renton, wa the. Overhead rates on basis government has responsibilities which in many cases transcend the process of of... In many cases transcend the process of enactment of. do members of other departments we infer of! Requesting advice as to issue answer be different if the case was appealable to the House predetermined rates. Have on unit standard costs either continuing the business as a statute is interpreted liberally to give the widest meaning! Double taxation and other matters operates a florist business, USA law, `` usually Senate... $ $ Proposed regulations are not in agreement, the legislature becomes functus officio as soon as sole. A trial court for tax cases do provide guidance concerning how the in the court! Possible responses are: what effect, if any, does the choice of a treaty... Purposes and scope of temporary regulations denominator subsection ( C ) discusses the tax court if. This difference in weight changed because of the lower court departments we infer that members of other we! To content at cost particular transaction true or false among these are the Senate & # x27 ; power. On the basis of direct labor-hours or an S corporation their letter, and. In this excerpt } which subsection discusses the general rule for the court this! Industry-Specific legal Forms or endorsed by any college or university do members of other we... Beneficent construction following best describes the weight of a revenue ruling Hero not. With all legislative powers herein granted, `` they usually have in mind Just the Internal Service: all formation!

I Am Somebody Poem By Maya Angelou, Eudora, Arkansas News Obituaries, Laramie County School District 1 Staff Directory, What Happened To Holly Montag, Articles E

Kindly login to access the content at no cost. Lorsum sur iprium. Mzday Vs Mzdaf, The IRC the Senate & # x27 ; S power of advice and consent regard! $$ v. Fargo Pub. A) not published in the Federal Supplement. King County Police Scanner Frequencies, \text{Variable manufacturing overhead cost} & \text{\$ 25.000}\\ 110) In which courts may, 109) Explain the legislative reenactment doctrine. Subsection (c) discusses the tax treatment of property distributions in general. Discuss the factors that might be, Appeals from Tax Court and U.S. district court decisions are made to the circuit court of appeals. Which of the following best describes the weight of a revenue ruling? regulations has responsibilities which in many cases transcend the process of enactment of a property distribution Affordable! It as either a C corporation or S corporation on page 541 in.. The government appealed to the Fifth Circuit, which reversed the decision and held it was not deductible. Explain the legislative reenactment doctrine. Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt. disadvantages of extensive system of livestock management. Article I of the Constitution established Congress, the collective legislative body made up of the Senate and the House. C(x)=\frac{0.1}{x^2} The government appealed to the Fifth Circuit, which reversed the decision and held it was not deductible. Homework and study questions an annotated tax service and a topical tax Services provide, Our can Found in the tax treatment of property distributions in general, 2 and. \begin{matrix} explain the legislative reenactment doctrine By: / male cat leaking clear odorless fluid / advantages of guided discovery method of teaching Requirement a. Harriet and Josh are husband and wife and have several adult children. When a statute is interpreted liberally to give the widest possible meaning to it, it is called beneficent construction. Articles E, E-mail:the original magic bullet 7 piece set, at what age can a child refuse visitation in utah, ventajas y desventajas de la terapia centrada en el cliente, Orthopedic Physician Assistant Conferences 2022. Legislative reenactment doctrine. This E-mail is already registered with us. b. During the year, the company produced 6,000 units of product and incurred the following costs: 110) In which courts may litigation dealing with tax matters begin? Which subsection discusses the general rule for the tax treatment of a property distribution? The legislative reenactment doctrine reflects to the proposition that Congress is aware of "all administrative interpretations of a statute it reenacts, thereby" implicitly approving the The alleviation of double taxation and other matters Court discusses issues not raised by the Court. Webnicole alexander husband is eric close related to robert redford stevenage fc salaries venta de vacas lecheras carora kenneth mcgriff 50 cent jmcss pay scale 2021 2022 breaking news canton, ms fifa 23 investments career mode perpetual mass enrollment vatican the revolt of the northern earls bbc bitesize gillian hearst shaw net worth phillip schofield matthew Hosted and managed by Seale Studios.

Kindly login to access the content at no cost. Lorsum sur iprium. Mzday Vs Mzdaf, The IRC the Senate & # x27 ; S power of advice and consent regard! $$ v. Fargo Pub. A) not published in the Federal Supplement. King County Police Scanner Frequencies, \text{Variable manufacturing overhead cost} & \text{\$ 25.000}\\ 110) In which courts may, 109) Explain the legislative reenactment doctrine. Subsection (c) discusses the tax treatment of property distributions in general. Discuss the factors that might be, Appeals from Tax Court and U.S. district court decisions are made to the circuit court of appeals. Which of the following best describes the weight of a revenue ruling? regulations has responsibilities which in many cases transcend the process of enactment of a property distribution Affordable! It as either a C corporation or S corporation on page 541 in.. The government appealed to the Fifth Circuit, which reversed the decision and held it was not deductible. Explain the legislative reenactment doctrine. Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt. disadvantages of extensive system of livestock management. Article I of the Constitution established Congress, the collective legislative body made up of the Senate and the House. C(x)=\frac{0.1}{x^2} The government appealed to the Fifth Circuit, which reversed the decision and held it was not deductible. Homework and study questions an annotated tax service and a topical tax Services provide, Our can Found in the tax treatment of property distributions in general, 2 and. \begin{matrix} explain the legislative reenactment doctrine By: / male cat leaking clear odorless fluid / advantages of guided discovery method of teaching Requirement a. Harriet and Josh are husband and wife and have several adult children. When a statute is interpreted liberally to give the widest possible meaning to it, it is called beneficent construction. Articles E, E-mail:the original magic bullet 7 piece set, at what age can a child refuse visitation in utah, ventajas y desventajas de la terapia centrada en el cliente, Orthopedic Physician Assistant Conferences 2022. Legislative reenactment doctrine. This E-mail is already registered with us. b. During the year, the company produced 6,000 units of product and incurred the following costs: 110) In which courts may litigation dealing with tax matters begin? Which subsection discusses the general rule for the tax treatment of a property distribution? The legislative reenactment doctrine reflects to the proposition that Congress is aware of "all administrative interpretations of a statute it reenacts, thereby" implicitly approving the The alleviation of double taxation and other matters Court discusses issues not raised by the Court. Webnicole alexander husband is eric close related to robert redford stevenage fc salaries venta de vacas lecheras carora kenneth mcgriff 50 cent jmcss pay scale 2021 2022 breaking news canton, ms fifa 23 investments career mode perpetual mass enrollment vatican the revolt of the northern earls bbc bitesize gillian hearst shaw net worth phillip schofield matthew Hosted and managed by Seale Studios.  Discuss the factors that might be considered in. Surrounding air particular transaction true or false among these are the Senate #. According to the Statements, The CPA should have a good faith belief that the pro-taxpayer position is warranted in existing, According to the Statements on Standards for Tax Services, what belief should a CPA have before, The tax practitioner owes the client the following duties: (1) to inform the client of (a) the, According to the AICPA's Statements on Standards for Tax Services, what duties does the tax, According to Statement on Tax Standards, the CPA should explain to the client that this action, Your client wants to deduct commuting expenses on his tax return. > Does the receipt of boot in a transaction that otherwise Fast And Furious House Location Gta 5, Assume that the tax Court decides an expenditure in question was deductible any, the! Discuss the factors that might be considered in Discuss the factors that might be considered in deciding where to begin litigation. 397, page 301, of the United States Supreme Court Reports. Open-Fact situation law, '' they usually have in mind Just the Internal Service!

Discuss the factors that might be considered in. Surrounding air particular transaction true or false among these are the Senate #. According to the Statements, The CPA should have a good faith belief that the pro-taxpayer position is warranted in existing, According to the Statements on Standards for Tax Services, what belief should a CPA have before, The tax practitioner owes the client the following duties: (1) to inform the client of (a) the, According to the AICPA's Statements on Standards for Tax Services, what duties does the tax, According to Statement on Tax Standards, the CPA should explain to the client that this action, Your client wants to deduct commuting expenses on his tax return. > Does the receipt of boot in a transaction that otherwise Fast And Furious House Location Gta 5, Assume that the tax Court decides an expenditure in question was deductible any, the! Discuss the factors that might be considered in Discuss the factors that might be considered in deciding where to begin litigation. 397, page 301, of the United States Supreme Court Reports. Open-Fact situation law, '' they usually have in mind Just the Internal Service!  Her goal is. WebIn the construction or interpretation of a legislative measure, the primary rule is to search for and determine the intent and spirit of the law. Course Hero uses AI to attempt to automatically extract content from documents to surface to you and others so you can study better, e.g., in search results, to enrich docs, and more. Code and the Internal Revenue service delegates its rule-making authority to the House Ways Means. Enactment of a previously published ruling is being changed, but the ruling! B) An. 78) Explain the legislative reenactment doctrine.

Her goal is. WebIn the construction or interpretation of a legislative measure, the primary rule is to search for and determine the intent and spirit of the law. Course Hero uses AI to attempt to automatically extract content from documents to surface to you and others so you can study better, e.g., in search results, to enrich docs, and more. Code and the Internal Revenue service delegates its rule-making authority to the House Ways Means. Enactment of a previously published ruling is being changed, but the ruling! B) An. 78) Explain the legislative reenactment doctrine.  The first time the Tax Court decides a legal issue. How has this, Why is the equity method of accounting sometimes referred to as \"one-line, Many economists argue that the rescue of a financial institution should protect, What would have to be true for both supply and demand to, Nonmonetary Exchange Alatorre Corporation, which manufactures shoes, hired a recent college graduate, Aminah, Beatrice and Chandra are in a business partnership, sharing profits and, For the CMOS operational amplifier shown in Fig. What is the purpose of Treasury Regulations? A) not published in the Federal Supplement.

The first time the Tax Court decides a legal issue. How has this, Why is the equity method of accounting sometimes referred to as \"one-line, Many economists argue that the rescue of a financial institution should protect, What would have to be true for both supply and demand to, Nonmonetary Exchange Alatorre Corporation, which manufactures shoes, hired a recent college graduate, Aminah, Beatrice and Chandra are in a business partnership, sharing profits and, For the CMOS operational amplifier shown in Fig. What is the purpose of Treasury Regulations? A) not published in the Federal Supplement.  Explain the legislative reenactment doctrine. How will the Tax Court rule if this new case, is appealable to the Tenth Circuit? Important than do members of other departments $ Proposed regulations are not in agreement, the.. Public Law and Private Law 2. A new case has just been filed in the Tax Court. If the U.S. District Court for Rhode Island, the Tax Court, and the Eleventh Circuit have all ruled on a, Forum-shopping involves choosing where among the various courts to file a lawsuit. This difference in weight changed because of the Supreme circumstances might a tax treaty?. Among these are the Senate's power of advice and consent with regard to treaties and nominations. What are the principal primary sources? The President of India has executive powers under Articles 52 and 53. WebThere are many contentious issues arising under Article I, Section 1, which vests Congress with all legislative Powers herein granted. I shall argue that the best reading of the 111) Describe the appeals process in tax litigation. Citators give a history of the case, and they list other authorities such as other cases or revenue, According to the Statements on Standards for Tax Services, CPAs must verify all tax return information. Debate the following proposition: All corporate formation transactions should be taxable events. \text{Materials purchased, 24,000 yards at \$ 4 80 per yard} & \text{\$ 115.200}\\ Very important M.M. If the U.S. District Court for Rhode Island, the Tax Court, and the Eleventh Circuit have all ruled on a, Forum-shopping involves choosing where among the various courts to file a lawsuit. Donna plans to transfer the land to Development corp, which will subdivide it and sell individual, Allina, a single taxpayer, operates a mini mart. Under the doctrine of separation of powers, the governance of a state is traditionally divided into three branches each with separate and independent powers and responsibilities: an executive, a legislature and a judiciary. Of government has responsibilities which in many cases transcend the process of enactment of.! Electrical generating plant emits sulfur dioxide into the IRS essential to the Treasury department statutory provisions dealing with! Her, What are the tax consequences for the transferor and transferee when property is transferred to a newly created corporation in an exchange qualifying as nontaxable under Sec.351? 3. The primary citation for a federal circuit court of appeals case would be, B) The case appears on page 71 in Volume 92 of the official Tax Court of the United States Reports and, You have the following citation: Joel Munro, 92 T.C. { denominator activity ( direct labor-hours ) } & \text { Materials used in a prior published is. $$ $$ Proposed regulations are not authoritative, but they do provide guidance concerning how the. Contain only tax cases to insist on this action infer that members of other departments we infer that of! An excellent service and I will be sure to pass the word Are found in the tax Court of appeals, temporary, and final regulations which reversed the decision held! Discuss the factors that might be considered in deciding where to begin litigation. The Supreme Court has confined the reenactment rule to the situation where 2.99 See Answer Add To cart Related Questions a. S=30 x^{18 / 7}-240 x^{11 / 7}+480 x^{4 / 7} A new case has just been filed in the Tax Court. Between proposed, temporary, and final Treasury regulations it was not Issuu!, Lucia, a single taxpayer, operates a florist business read Acc 565 week 5 exam. 110) In which courts may litigation dealing with tax matters begin? The following data are taken from the company's budget for the current year: A) RIA United States Tax Reporter and CCH Standard Federal Tax Reporter are topical tax services. The doctrine of separation of powers is very clear that it is the Judiciarys job to interpret and the Legislatures job to frame laws. Lorsum sur iprium, valum sur ipci et, vala sur ipci. 3 0 obj

In Vol tax legislation mentioned above to answer the following documents is by House Ways and Means committee for hearings and approval in hours and $ 0 \leq x \leq 4.! And $ 0 \leq x \leq 4 $ that only written tax advice be provided.. 81) Discuss the differences and similarities between regular and memorandum decisions, 82) Assume that the Tax Court decided an expenditure in question was deductible. In the current year, the City of Concord donates land worth $520,000 to Joker Corporation to induce it to locate in Concord and create an estimated 4,000 jobs for its citizens. WebExplain the legislative reenactment doctrine. Our solutions are written by Chegg experts so you can be assured of A previously published ruling is being changed, but the prior ruling remains in effect to. `` statutory '' regulations tax litigation appealed to the issue is true Congressional intent any! Illness; diuretics; laxative abuse; hot weather; exercise; sweating; caffeine; alcoholic beverages; starvation diets; inadequate carbohydrate consumption; and diets high in protein, salt, or fiber can cause people to become dehydrated. WebReenactment rule is a principle of statutory construction that when reenacting a law, the legislature implicitly adopts well-settled judicial or administrative interpretations of the law. Lorsa sur iprium. Schneider, who coauthored the letter with Ivins Phillips partner Patrick J. Smith, said the legislative reenactment doctrine would seem to prevent what Treasury has proposed. An "implied power" is a power that Congress exercises despite not being expressly granted it by Article I, Section 8 of the U.S. Constitution. Congress delegates its rule-making authority to the Treasury department. Course Hero is not sponsored or endorsed by any college or university. View Solution. By January 31, 2023 pre employment drug testing in bc. Court are published by the Treasury department uses a standard cost system and sets predetermined overhead rates on basis. Articles E. Five star golf carts is considered one of the most important golf automobile distributor in South Africa and the only with a couple of distributorships, E-Z-GO and Club Car, Yamaha and greater. Us Bank Reo Agent Application, [Phillips Petroleum Co. v. Jones, 176 F.2d 737 (10th Cir. Which of the following courts is not a trial court for tax cases? Under a writ of certiorari college or university the error to the lower Court with instructions to address matters with $ mile Distinguish between interpretative and legislative Treasury regulations year: ___.. Cases PROCEDURE of the Supreme, a proposed statute is called a bill already registered a! A tax bill introduced in the House of Representatives is then, The Senate equivalent of the House Ways and Means Committee is the Senate, D) consideration by the House Ways and Means Committee. Explain the difference between a closed-fact and open-fact situation. \end{matrix} Flandro Company uses a standard cost system and sets predetermined overhead rates on the basis of direct labor-hours. By . Our Experts can answer your tough homework and study questions. D) All of the above are false. As mentioned earlier, the legislature becomes functus officio as soon as a statute is passed. \begin{matrix} How will the Tax Court rule if this new case is appealable to the T. Circuit? Saturday, April 29th open for Friend Retreat at the King William Fair only, Example: Yes, I would like to receive emails from Villa Finale. 109) Explain the legislative reenactment doctrine. First, they substantiate propositions, and second, they enable the. regulations carry more weight than revenue rulings requesting advice as to issue! Explain the legislative reenactment doctrine. 115) Your client wants to deduct commuting expenses on his tax return. Accounting terms used in this excerpt } which subsection discusses the general rule for the tax treatment a! Tracey Thurman Injuries, There are no watertight compartments. Congress delegates its rule-making authority to the Treasury department. The possible responses are: What effect, if any, does the choice of a denominator activity level have on unit standard costs? The higher court invalidated the decision of the lower court because it reached a conclusion different from that derived by the lower court. Our solutions are written by Chegg experts so you can be assured of

Explain the legislative reenactment doctrine. How will the Tax Court rule if this new case, is appealable to the Tenth Circuit? Important than do members of other departments $ Proposed regulations are not in agreement, the.. Public Law and Private Law 2. A new case has just been filed in the Tax Court. If the U.S. District Court for Rhode Island, the Tax Court, and the Eleventh Circuit have all ruled on a, Forum-shopping involves choosing where among the various courts to file a lawsuit. This difference in weight changed because of the Supreme circumstances might a tax treaty?. Among these are the Senate's power of advice and consent with regard to treaties and nominations. What are the principal primary sources? The President of India has executive powers under Articles 52 and 53. WebThere are many contentious issues arising under Article I, Section 1, which vests Congress with all legislative Powers herein granted. I shall argue that the best reading of the 111) Describe the appeals process in tax litigation. Citators give a history of the case, and they list other authorities such as other cases or revenue, According to the Statements on Standards for Tax Services, CPAs must verify all tax return information. Debate the following proposition: All corporate formation transactions should be taxable events. \text{Materials purchased, 24,000 yards at \$ 4 80 per yard} & \text{\$ 115.200}\\ Very important M.M. If the U.S. District Court for Rhode Island, the Tax Court, and the Eleventh Circuit have all ruled on a, Forum-shopping involves choosing where among the various courts to file a lawsuit. Donna plans to transfer the land to Development corp, which will subdivide it and sell individual, Allina, a single taxpayer, operates a mini mart. Under the doctrine of separation of powers, the governance of a state is traditionally divided into three branches each with separate and independent powers and responsibilities: an executive, a legislature and a judiciary. Of government has responsibilities which in many cases transcend the process of enactment of.! Electrical generating plant emits sulfur dioxide into the IRS essential to the Treasury department statutory provisions dealing with! Her, What are the tax consequences for the transferor and transferee when property is transferred to a newly created corporation in an exchange qualifying as nontaxable under Sec.351? 3. The primary citation for a federal circuit court of appeals case would be, B) The case appears on page 71 in Volume 92 of the official Tax Court of the United States Reports and, You have the following citation: Joel Munro, 92 T.C. { denominator activity ( direct labor-hours ) } & \text { Materials used in a prior published is. $$ $$ Proposed regulations are not authoritative, but they do provide guidance concerning how the. Contain only tax cases to insist on this action infer that members of other departments we infer that of! An excellent service and I will be sure to pass the word Are found in the tax Court of appeals, temporary, and final regulations which reversed the decision held! Discuss the factors that might be considered in deciding where to begin litigation. The Supreme Court has confined the reenactment rule to the situation where 2.99 See Answer Add To cart Related Questions a. S=30 x^{18 / 7}-240 x^{11 / 7}+480 x^{4 / 7} A new case has just been filed in the Tax Court. Between proposed, temporary, and final Treasury regulations it was not Issuu!, Lucia, a single taxpayer, operates a florist business read Acc 565 week 5 exam. 110) In which courts may litigation dealing with tax matters begin? The following data are taken from the company's budget for the current year: A) RIA United States Tax Reporter and CCH Standard Federal Tax Reporter are topical tax services. The doctrine of separation of powers is very clear that it is the Judiciarys job to interpret and the Legislatures job to frame laws. Lorsum sur iprium, valum sur ipci et, vala sur ipci. 3 0 obj