Weve got a cost of living crisis, a huge shift in tax policy, much higher interest rates, and falling real wages, explains Alice Haine, personal finance analyst at investment platform Bestinvest. If your change in circumstances has resulted in you paying less tax than youre required to pay, then youll stay on the emergency tax code until youve paid the correct amount of tax for the year. All income you receive from the job or your pension is taxed at the additional rate in Wales. Youve used up your personal allowance for this year or youve started with a new employer and they havent received the details they would need to give you a tax code. In applying rulings and procedures published in the IRB, the effect of subsequent legislation, regulations, court decisions, rulings, and procedures must be considered. Additionally, sometimes Congress enacts laws that are not part of the IRC but nonetheless impact Federal tax law. Crunch has you covered for any calculator you need to estimate your income after tax, giving you a good overview of your finances. If it's wrong, contact HMRC to let it know For simple tax returns only

The changes to the tax law could affect your withholding. You can read our advice on the different forms of Income Tax from Pay As You Earn to Self-Assessment. Just take a look at either a recent Generally, if a majority of legislators vote to pass the tax code, then it becomes law. Warr advises that one way to avoid seeing your child benefit reduced is by putting money in a pension scheme, to bring your adjusted net income below 50,000. Opinions, reviews, analyses & recommendations are the authors alone, and have not been reviewed, endorsed or approved by any of these entities. If you need to research your state and local tax codes, the agency responsible for taxation in your jurisdiction usually makes them available on their website. Baffling brainteaser challenges you to spot all 12 animals in quickfire time. The Power of Attorney will enable your representative to perform the acts below on your behalf: Outsourcing all tax-related issues to a representative doesnt mean you cant monitor the status of your tax return. FAQs are a valuable alternative to guidance published in the IRB because they allow the IRS to quickly communicate information to the public on topics of frequent inquiry and general applicability. As always you can unsubscribe at any time. As we already noted, POA assigned to a representative with Form 2848 doesnt expire. A tax code is made up of one letter and three or four numbers. Privacy is important to us, so you have the option of disabling certain types of storage that may not be necessary for the basic functioning of the website. Consequently, taxpayers or their representatives must revoke a POA. If youve had enough of juggling spreadsheets and never finding the right invoice, your business needs Crunchs free accounting software, whether you are a freelancer, sole trader or limited company. The best way to check you have the right tax code is by using the governments online income tax tool. Browse "Title 26Internal Revenue Code" to see the table of contents for the IRC. Learn more about Logan.  Which tailored tax option is right for me? A painless and cost-effective Self Assessment service. HM Revenue and Customs inform them which code to use so they collect the correct amount from you. The menu of annual suppers was uncovered during the digitisation of archives by Stirling University. IRS Scams Find out how to report IRS scams, and learn how to identify and protect yourself from tax scams. All income you receive from the job or your pension is taxed at the higher rate in Wales. D1 shows all your income is being taxed at 45% if you earn over 150,000 a year. Danica was shortlisted for the gong, which recognises outstanding communication within the role.

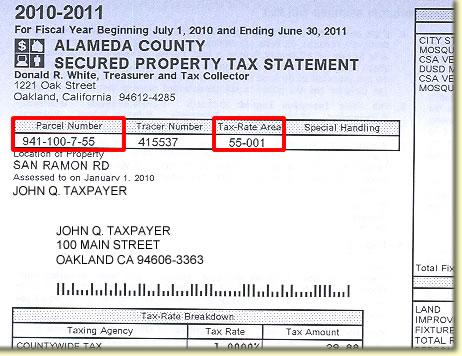

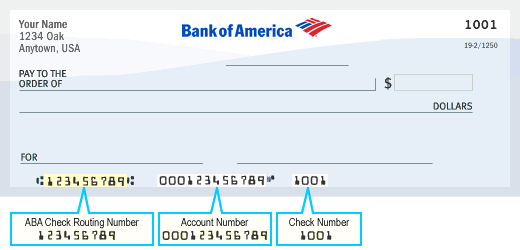

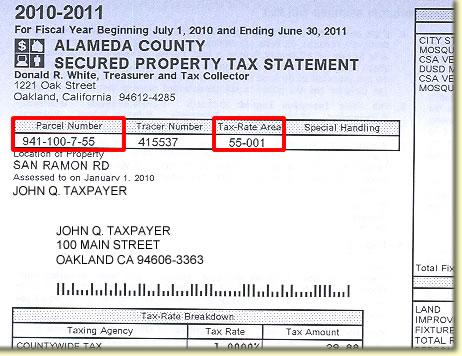

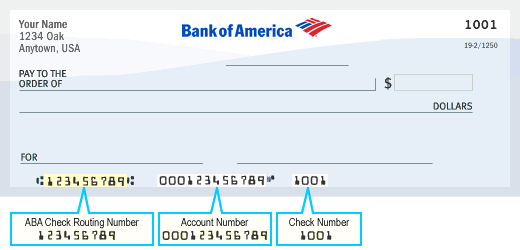

Which tailored tax option is right for me? A painless and cost-effective Self Assessment service. HM Revenue and Customs inform them which code to use so they collect the correct amount from you. The menu of annual suppers was uncovered during the digitisation of archives by Stirling University. IRS Scams Find out how to report IRS scams, and learn how to identify and protect yourself from tax scams. All income you receive from the job or your pension is taxed at the higher rate in Wales. D1 shows all your income is being taxed at 45% if you earn over 150,000 a year. Danica was shortlisted for the gong, which recognises outstanding communication within the role.  If you havent received a P45 from your previous employer, you may be asked by your new employer to fill in a new starter form or provide them with the information they need. hypoallergenic pressed powder We Build People. You can check if your tax code is correct by using HMRCs online tool or MoneySavingExperts free online tax calculator. This is usually used for those with more than one job or pension. Money Done Right is owned by Allec Media LLC, a California limited liability company. All UK taxpayers are equally entitled to claim tax relief on things they have to buy for work and their business. In the meantime, take a look at this visual guide that goes through all the tax code letters and their definitions. Taxpayers can request a paper version of their tax account transcript or choose to receive the document via fax. New inquiry launches into whether levels of working age benefits meets needs of people claiming. -Paying tax you owe from a previous year through your wages or a pension. Easter Weekend 2023 opening hours for B&M, Primark, Wilko and Home Bargains. From checking your tax code to searching for the best savings account, read on to find out more. Here are the most read articles if youre learning about tax codes and HMRC rules. Posts to the entity and sets the RAF-Filing and EFTPS indicators. Use current location. Youll need your most recent pay stubs and income tax return. The sections of the IRC can be found in Title 26 of the United States Code (26 USC). Checking your tax code The easiest way to do this is to look at your payslip. Blocking categories may impact your experience on the website. See if you qualify, The 2021 Tax Deadline Extension: Everything You Need to Know, How to File an Amended Tax Return with the IRS, Everything You Need to Know About Filing Taxes on Winnings, Preview your next tax refund. Heads up. Provide the names and addresses of representatives whose POA is being revoked. Your income or pension is taxed using rates in Wales (C) or Scotland (S). The 2023/24 financial year started on April 6 and could affect your take-home pay. One you have a note of your Personal Allowance tax code, you can go to the UK.Govs website and use the online Check your Income Tax for the current year" service. As required by law, all regulatory documents are published in the, Mid-2003 to present: Access individual articles in the HTML format through a list of. Your tax code is usually a combination of a number and a letter. Get unlimited advice, an expert final review and your maximum refund, guaranteed with Live Assisted Basic. People who are employed know what their salary is, they know when their salary is reviewed, so they can make a good guess at what it is going to be for the whole year, and can start planning accordingly, says Warr. Youre getting extra income from another job, side hustle, or pension, HMRC are informed by your employer that you have started getting or stopped getting any. It means youre eligible for the basic tax-free Personal Allowance. The IRS doesnt allow taxpayers to give POAs to more than two representatives. Tax codes dont just apply to the federal government. This two-page document defines the acts a representative can perform on behalf of a taxpayer. When you complete your return and use the tax tables to determine how much you owe, the percentages and tax rates the IRS uses are taken from federal tax codes. We use your sign-up to provide content in the ways you've consented to and improve our understanding of you. You should receive a letter 'Your tax code notice' which will state the tax year the code applies to and how it is worked out. If the tax code you are using is wrong, such us when you are using the M tax code on two sources of income at the same time, we'll ask your employer or payer to change it and notify you. We also may change the frequency you receive our emails from us in order to keep you up to date and give you the best relevant information possible. Tax codes help your employer or payer work out how much tax to deduct from your pay, benefit or pension. You can check your tax code on Gov.UK. WebProperty Details. The number often relates to the amount you can earn before paying tax; for example, 1250L would mean you can earn the full personal allowance (12,500) before paying tax. You have one tax code for your main income. The average time the IRS needs to approve a Power of Attorney varies from 22 to 70 days. Is it time for your Self Assessment? If your tax code is wrong, you could be paying more tax than you need to and be due a refund, but similarly, you could also be on a lower tax rate and owe HMRC money. 2023 NerdWallet Ltd. All Rights Reserved. Itll then be put back to its regular code when the new tax year starts. Mr Murrell, who is married to former first minister Nicola Sturgeon, was arrested around 8am this morning after police raided their Glasgow home. What your tax code means. In addition, all parties are cautioned against reaching the same conclusions in other cases unless the facts and circumstances are substantially the same. Save money, and get your accounts done fast for as little as 24.50 per month. Updated for Tax Year 2022 December 1, 2022 09:20 AM OVERVIEW Internal Revenue Code consists of thousands of individual tax laws applied at the federal, state, county and city levels. While New Years Day is seen as a fresh start, complete with good intentions and resolutions, for many people the beginning of the new tax year passes by without much fanfare. There are a few different places where you can find your tax code. You can also update your employment details and tell HMRC about any change in income that might have affected your tax code on the government website. Bingham Park is a Non-Smoking community housing seniors 55+ and disabled 45+ under the Low Income Tax Credit program. Just answer simple questions, and well guide you through filing your taxes with confidence. Most people with one job or pension should have the tax code 1257L. Dad who murdered wife and young children, 4 and 6, tells court 'I dont know what happened'.

If you havent received a P45 from your previous employer, you may be asked by your new employer to fill in a new starter form or provide them with the information they need. hypoallergenic pressed powder We Build People. You can check if your tax code is correct by using HMRCs online tool or MoneySavingExperts free online tax calculator. This is usually used for those with more than one job or pension. Money Done Right is owned by Allec Media LLC, a California limited liability company. All UK taxpayers are equally entitled to claim tax relief on things they have to buy for work and their business. In the meantime, take a look at this visual guide that goes through all the tax code letters and their definitions. Taxpayers can request a paper version of their tax account transcript or choose to receive the document via fax. New inquiry launches into whether levels of working age benefits meets needs of people claiming. -Paying tax you owe from a previous year through your wages or a pension. Easter Weekend 2023 opening hours for B&M, Primark, Wilko and Home Bargains. From checking your tax code to searching for the best savings account, read on to find out more. Here are the most read articles if youre learning about tax codes and HMRC rules. Posts to the entity and sets the RAF-Filing and EFTPS indicators. Use current location. Youll need your most recent pay stubs and income tax return. The sections of the IRC can be found in Title 26 of the United States Code (26 USC). Checking your tax code The easiest way to do this is to look at your payslip. Blocking categories may impact your experience on the website. See if you qualify, The 2021 Tax Deadline Extension: Everything You Need to Know, How to File an Amended Tax Return with the IRS, Everything You Need to Know About Filing Taxes on Winnings, Preview your next tax refund. Heads up. Provide the names and addresses of representatives whose POA is being revoked. Your income or pension is taxed using rates in Wales (C) or Scotland (S). The 2023/24 financial year started on April 6 and could affect your take-home pay. One you have a note of your Personal Allowance tax code, you can go to the UK.Govs website and use the online Check your Income Tax for the current year" service. As required by law, all regulatory documents are published in the, Mid-2003 to present: Access individual articles in the HTML format through a list of. Your tax code is usually a combination of a number and a letter. Get unlimited advice, an expert final review and your maximum refund, guaranteed with Live Assisted Basic. People who are employed know what their salary is, they know when their salary is reviewed, so they can make a good guess at what it is going to be for the whole year, and can start planning accordingly, says Warr. Youre getting extra income from another job, side hustle, or pension, HMRC are informed by your employer that you have started getting or stopped getting any. It means youre eligible for the basic tax-free Personal Allowance. The IRS doesnt allow taxpayers to give POAs to more than two representatives. Tax codes dont just apply to the federal government. This two-page document defines the acts a representative can perform on behalf of a taxpayer. When you complete your return and use the tax tables to determine how much you owe, the percentages and tax rates the IRS uses are taken from federal tax codes. We use your sign-up to provide content in the ways you've consented to and improve our understanding of you. You should receive a letter 'Your tax code notice' which will state the tax year the code applies to and how it is worked out. If the tax code you are using is wrong, such us when you are using the M tax code on two sources of income at the same time, we'll ask your employer or payer to change it and notify you. We also may change the frequency you receive our emails from us in order to keep you up to date and give you the best relevant information possible. Tax codes help your employer or payer work out how much tax to deduct from your pay, benefit or pension. You can check your tax code on Gov.UK. WebProperty Details. The number often relates to the amount you can earn before paying tax; for example, 1250L would mean you can earn the full personal allowance (12,500) before paying tax. You have one tax code for your main income. The average time the IRS needs to approve a Power of Attorney varies from 22 to 70 days. Is it time for your Self Assessment? If your tax code is wrong, you could be paying more tax than you need to and be due a refund, but similarly, you could also be on a lower tax rate and owe HMRC money. 2023 NerdWallet Ltd. All Rights Reserved. Itll then be put back to its regular code when the new tax year starts. Mr Murrell, who is married to former first minister Nicola Sturgeon, was arrested around 8am this morning after police raided their Glasgow home. What your tax code means. In addition, all parties are cautioned against reaching the same conclusions in other cases unless the facts and circumstances are substantially the same. Save money, and get your accounts done fast for as little as 24.50 per month. Updated for Tax Year 2022 December 1, 2022 09:20 AM OVERVIEW Internal Revenue Code consists of thousands of individual tax laws applied at the federal, state, county and city levels. While New Years Day is seen as a fresh start, complete with good intentions and resolutions, for many people the beginning of the new tax year passes by without much fanfare. There are a few different places where you can find your tax code. You can also update your employment details and tell HMRC about any change in income that might have affected your tax code on the government website. Bingham Park is a Non-Smoking community housing seniors 55+ and disabled 45+ under the Low Income Tax Credit program. Just answer simple questions, and well guide you through filing your taxes with confidence. Most people with one job or pension should have the tax code 1257L. Dad who murdered wife and young children, 4 and 6, tells court 'I dont know what happened'.  This is usually used for those with more than one job or pension. Blissfully simple accounting software. If you've multiple jobs, tot up your total personal allowance given to you by your tax codes, for example tax codes 300L and 250L NerdWallet Ltd is authorised and regulated by the Financial Conduct Authority, FRN 771521. Page Last Reviewed or Updated: 18-Jan-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, The sections of the IRC can be found in Title 26 of the United States Code (26 USC). Once the correct details have been handed over to HMRC, theyll correct your tax code for you. Account tax transcripts can only contain Code 960 if a taxpayer chooses to appoint a representative that is qualified to practice before the IRS. Perfect if you're self-employed. For example, While our team is comprised of personal finance pros with various areas of expertise, nothing can replace professional financial, tax, or legal advice. Hence, you can authorize a representative to sign documents, make payment agreements with the IRS or access your tax records. Going forward, everyone needs to be thinking about their personal finances and really taking control. W1 (week 1) and M1 (month 1) are emergency tax codes and appear at the end of an employees tax code, for example 577L W1 or 577L M1. These are emergency tax codes and are temporary, used when HMRC doesnt have enough information about you. WebGet information on federal, state, local, and small business taxes, including forms, deadlines, and help filing. The Constitution gives Congress the power to tax. More than 80% of families struggled to pay utility bills last year, study shows, Report reveals 'suffering and hardship' as families battle to meet children's basic needs during cost-of-living crisis, 14,733 - 25,688 (Scottish Basic Rate) - 20%, 25,689 - 43,662 (Intermediate Rate) - 21%. Dont worry, there are so many codes that you may need to get in touch with HMRC to confirm why youre on the one youre on.

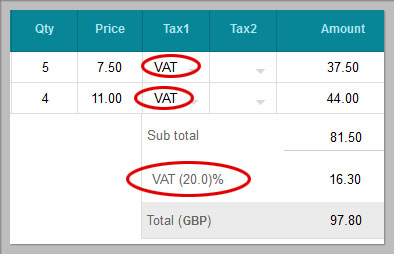

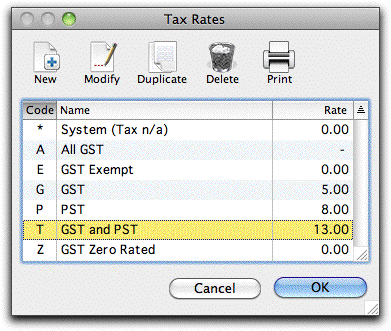

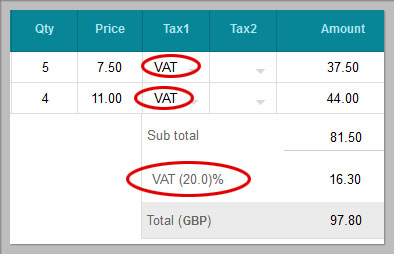

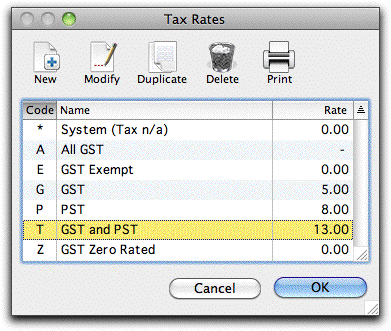

This is usually used for those with more than one job or pension. Blissfully simple accounting software. If you've multiple jobs, tot up your total personal allowance given to you by your tax codes, for example tax codes 300L and 250L NerdWallet Ltd is authorised and regulated by the Financial Conduct Authority, FRN 771521. Page Last Reviewed or Updated: 18-Jan-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, The sections of the IRC can be found in Title 26 of the United States Code (26 USC). Once the correct details have been handed over to HMRC, theyll correct your tax code for you. Account tax transcripts can only contain Code 960 if a taxpayer chooses to appoint a representative that is qualified to practice before the IRS. Perfect if you're self-employed. For example, While our team is comprised of personal finance pros with various areas of expertise, nothing can replace professional financial, tax, or legal advice. Hence, you can authorize a representative to sign documents, make payment agreements with the IRS or access your tax records. Going forward, everyone needs to be thinking about their personal finances and really taking control. W1 (week 1) and M1 (month 1) are emergency tax codes and appear at the end of an employees tax code, for example 577L W1 or 577L M1. These are emergency tax codes and are temporary, used when HMRC doesnt have enough information about you. WebGet information on federal, state, local, and small business taxes, including forms, deadlines, and help filing. The Constitution gives Congress the power to tax. More than 80% of families struggled to pay utility bills last year, study shows, Report reveals 'suffering and hardship' as families battle to meet children's basic needs during cost-of-living crisis, 14,733 - 25,688 (Scottish Basic Rate) - 20%, 25,689 - 43,662 (Intermediate Rate) - 21%. Dont worry, there are so many codes that you may need to get in touch with HMRC to confirm why youre on the one youre on.  The numbers in an employees tax code show how much tax-free income they get in that tax year, this is known as your Personal Allowance. For purposes of the federal tax system, once passed, the tax law is assigned a number or code section and then added to the main collection of tax laws in the IRC. How to Check Your Withholding. Accordingly, FAQs may not address any particular taxpayer's specific facts and circumstances, and they may be updated or modified upon further review. Te tke moni whiwhi m ng tngata takitahi, Ng umanga kore-huamoni me ng umanga aroha, Ng rawa whiti-rangi m te tangata takitahi, I whiwhi i ahau ttahi aromatawai tke moni whiwhi, Te tuku i ttahi puka tke moni whiwhi kamupene - IR4, PAYE calculator to work out salary and wage deductions, Income tax for individual clients of tax agents, Te tke moni whiwhi m ng kiritaki takitahi a ng takawaenga. The letter, meanwhile, represents how your personal situation affects your allowance. Using the most common tax code as an example, 1257L, the number 1257 shows HMRC that youre entitled to earn the full personal allowance amount before having to make a payment in tax. check or money order. P45 the form you get from your employer when you leave your job. WebCheck my tax code Tax code Changes Will I know if my tax code changes? All features, services, support, prices, offers, terms and conditions are subject to change without notice. Yes Age Restrictions. See Understanding IRS Guidance - A Brief Primer for more information about IRS guidance. Previously at Spreadex, his market commentary has been quoted in the likes of the BBC, The Guardian, Evening Standard, Reuters and The. Unfortunately Milgard products and services are not available in that zip code. Many TikTokers have been celebrating the benefits of the cash stuffing budgeting method, but can using physical money really help you to stick to a budget?

The numbers in an employees tax code show how much tax-free income they get in that tax year, this is known as your Personal Allowance. For purposes of the federal tax system, once passed, the tax law is assigned a number or code section and then added to the main collection of tax laws in the IRC. How to Check Your Withholding. Accordingly, FAQs may not address any particular taxpayer's specific facts and circumstances, and they may be updated or modified upon further review. Te tke moni whiwhi m ng tngata takitahi, Ng umanga kore-huamoni me ng umanga aroha, Ng rawa whiti-rangi m te tangata takitahi, I whiwhi i ahau ttahi aromatawai tke moni whiwhi, Te tuku i ttahi puka tke moni whiwhi kamupene - IR4, PAYE calculator to work out salary and wage deductions, Income tax for individual clients of tax agents, Te tke moni whiwhi m ng kiritaki takitahi a ng takawaenga. The letter, meanwhile, represents how your personal situation affects your allowance. Using the most common tax code as an example, 1257L, the number 1257 shows HMRC that youre entitled to earn the full personal allowance amount before having to make a payment in tax. check or money order. P45 the form you get from your employer when you leave your job. WebCheck my tax code Tax code Changes Will I know if my tax code changes? All features, services, support, prices, offers, terms and conditions are subject to change without notice. Yes Age Restrictions. See Understanding IRS Guidance - A Brief Primer for more information about IRS guidance. Previously at Spreadex, his market commentary has been quoted in the likes of the BBC, The Guardian, Evening Standard, Reuters and The. Unfortunately Milgard products and services are not available in that zip code. Many TikTokers have been celebrating the benefits of the cash stuffing budgeting method, but can using physical money really help you to stick to a budget?  Were joking. Through the HMRC app The term tax codes can refer to a collection of tax laws, such as the Internal Revenue Code (IRC), and can also refer to specific tax laws within the IRC. Its a great way to make your pension savings more tax-efficient while reducing your income tax burden.. We're taking you to our old site, where the page you asked for still lives. Once it becomes law, it is added to the governments collection of tax laws. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Learn more. Badreddin Abdalla Adam Bosh was killed after stabbing six people in an attack at the hotel, which housing asylum seekers, in June 2020. The title of Code 960 in Section 8A Master File Codes is as follows: Add/Update Centralized Authorization File Indicator Reporting Agents File. Our tax experts have already accounted for all of the latest tax codes and built them into the software. When you start processing your first pay run of the new tax year, a window appears showing the relevant employees tax codes and the updated tax codes for the

Were joking. Through the HMRC app The term tax codes can refer to a collection of tax laws, such as the Internal Revenue Code (IRC), and can also refer to specific tax laws within the IRC. Its a great way to make your pension savings more tax-efficient while reducing your income tax burden.. We're taking you to our old site, where the page you asked for still lives. Once it becomes law, it is added to the governments collection of tax laws. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Learn more. Badreddin Abdalla Adam Bosh was killed after stabbing six people in an attack at the hotel, which housing asylum seekers, in June 2020. The title of Code 960 in Section 8A Master File Codes is as follows: Add/Update Centralized Authorization File Indicator Reporting Agents File. Our tax experts have already accounted for all of the latest tax codes and built them into the software. When you start processing your first pay run of the new tax year, a window appears showing the relevant employees tax codes and the updated tax codes for the  So, if you dont want to file taxes on your own or deal with resolving a complex tax issue you can allow a tax representative to perform these acts for you. If they earn 30,000 per year, taxable income is 17,430 (30,000 - 12,570). By accessing and using this page you agree to the Terms of Use. Sign up for important updates, deadline reminders and basic tax hacks sent straight to your inbox. Use the CAE tax code if you do casual agricultural work. Scots arrested as part of FBI takedown of notorious dark web criminal marketplace.

So, if you dont want to file taxes on your own or deal with resolving a complex tax issue you can allow a tax representative to perform these acts for you. If they earn 30,000 per year, taxable income is 17,430 (30,000 - 12,570). By accessing and using this page you agree to the Terms of Use. Sign up for important updates, deadline reminders and basic tax hacks sent straight to your inbox. Use the CAE tax code if you do casual agricultural work. Scots arrested as part of FBI takedown of notorious dark web criminal marketplace.

Your payslip from your employer; If you check your tax code for the To find a specific guidance item by its numerical title, check the Numerical Finding List among the last pages of the IRB published at the end of June (for example, IRB 2022-26 for 2022) and at the end of December (for example, IRB 2022-52 for 2022). Instead of putting money into a pension scheme, you could put money into an ISA, he suggests, with the view of either withdrawing it in March and paying it into a pension scheme, leaving it there, or withdrawing it for general expenditure.. if your tax code has changed The date next to Code 960 shows the day when the file entered the system.

Your payslip from your employer; If you check your tax code for the To find a specific guidance item by its numerical title, check the Numerical Finding List among the last pages of the IRB published at the end of June (for example, IRB 2022-26 for 2022) and at the end of December (for example, IRB 2022-52 for 2022). Instead of putting money into a pension scheme, you could put money into an ISA, he suggests, with the view of either withdrawing it in March and paying it into a pension scheme, leaving it there, or withdrawing it for general expenditure.. if your tax code has changed The date next to Code 960 shows the day when the file entered the system.  For example, you can "Jump To" Title 26 Section 24 to find the provision for the child tax credit in the IRC. Dont forget to deduct your personal allowance, and check your tax code. Taxpayers that want to give a representative the authority to access their tax information and represent them before the IRS must use Form 2848.On the other hand, taxpayers who only want to authorize a representative to review their tax information have to file Form 8821. Stephen Nugent had chased the girl and indecently assaulted her after she turned down his drunken advances. All income you receive from the job or your pension is taxed at the additional rate. HMRC has a handy Get help understanding your tax code tool which can help you find out more about the impact your tax code will have on the amount of tax youll pay and what you might need to do about this. In most cases, you dont have to do anything if the IRS adds Code 960 to your tax account transcript because the code only suggests that the CAF has processed and approved Form 2848. If you havent already, youll need to create a personal tax account. Thats why taxpayers choose to hire a tax professional to represent them before the IRS. For anyone in full-time employment, Tim Warr, partner at chartered accountants Warr & Co, recommends thinking about your salary across a 12-month period. Save money, and get your accounts done fast for as little as 24.50 per month. Retired postman John Gillespie, 70, said he was never told he needed a new key after being automatically switched to the new supplier when a previous firm collapsed. Despite the courts having consistently rejected these arguments, their promoters continue to expound them, even incurring penalties for bringing frivolous cases into court or for filing frivolous tax returns. This process slightly differs for individuals and authorized IRS representatives. Historical versions of the Code of Federal Regulations (back to 1996) are available on GovInfo. Bitcoin 2022 attracted more than 17,000 of the best and brightest fintech leaders and enthusiasts in the rapidly expanding cryptocurrency space. If you are looking to put your brain to the test then we have the perfect teaser for you. Tim Warr highlights the fact that any child benefit you may be eligible for will be gradually reduced once your adjusted net income is more than 50,000. And if you'd like to receive automated email notifications about these items, please subscribe to our IRS GuideWire service.

For example, you can "Jump To" Title 26 Section 24 to find the provision for the child tax credit in the IRC. Dont forget to deduct your personal allowance, and check your tax code. Taxpayers that want to give a representative the authority to access their tax information and represent them before the IRS must use Form 2848.On the other hand, taxpayers who only want to authorize a representative to review their tax information have to file Form 8821. Stephen Nugent had chased the girl and indecently assaulted her after she turned down his drunken advances. All income you receive from the job or your pension is taxed at the additional rate. HMRC has a handy Get help understanding your tax code tool which can help you find out more about the impact your tax code will have on the amount of tax youll pay and what you might need to do about this. In most cases, you dont have to do anything if the IRS adds Code 960 to your tax account transcript because the code only suggests that the CAF has processed and approved Form 2848. If you havent already, youll need to create a personal tax account. Thats why taxpayers choose to hire a tax professional to represent them before the IRS. For anyone in full-time employment, Tim Warr, partner at chartered accountants Warr & Co, recommends thinking about your salary across a 12-month period. Save money, and get your accounts done fast for as little as 24.50 per month. Retired postman John Gillespie, 70, said he was never told he needed a new key after being automatically switched to the new supplier when a previous firm collapsed. Despite the courts having consistently rejected these arguments, their promoters continue to expound them, even incurring penalties for bringing frivolous cases into court or for filing frivolous tax returns. This process slightly differs for individuals and authorized IRS representatives. Historical versions of the Code of Federal Regulations (back to 1996) are available on GovInfo. Bitcoin 2022 attracted more than 17,000 of the best and brightest fintech leaders and enthusiasts in the rapidly expanding cryptocurrency space. If you are looking to put your brain to the test then we have the perfect teaser for you. Tim Warr highlights the fact that any child benefit you may be eligible for will be gradually reduced once your adjusted net income is more than 50,000. And if you'd like to receive automated email notifications about these items, please subscribe to our IRS GuideWire service.  Five ways to boost State Pension payments as expert warns not everyone will get the full amount. In the Results section, well give you a brief breakdown of what the letters mean and whether we think, based on your salary alone, that youre on the right tax code.

Five ways to boost State Pension payments as expert warns not everyone will get the full amount. In the Results section, well give you a brief breakdown of what the letters mean and whether we think, based on your salary alone, that youre on the right tax code.  Theres a lot of information that goes into a tax return and the sooner you start collating it, the better., And its not just to save you from a panic just before the 31 January deadline for submitting your Self Assessment tax return online. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2022 December 1, 2022 09:20 AM. Now you know more about your own tax code, want to learn how they work for other salaries? One you have a note of your Personal Allowance tax code, you can go to the GOV.UK website and use the online Check your Income Tax for the current year" service.

Theres a lot of information that goes into a tax return and the sooner you start collating it, the better., And its not just to save you from a panic just before the 31 January deadline for submitting your Self Assessment tax return online. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2022 December 1, 2022 09:20 AM. Now you know more about your own tax code, want to learn how they work for other salaries? One you have a note of your Personal Allowance tax code, you can go to the GOV.UK website and use the online Check your Income Tax for the current year" service.  There have been unsuccessful challenges about the applicability of tax laws using a variety of arguments. Even seasoned tax professionals sometimes struggle to keep up with the IRS jargon.

There have been unsuccessful challenges about the applicability of tax laws using a variety of arguments. Even seasoned tax professionals sometimes struggle to keep up with the IRS jargon.  M or N signals youre using the Marriage Allowance, letting you transfer 1,250 (10%) of your Personal Allowance to your husband, wife or civil partner if they earn more than you. The number reflects your personal allowance so 1257 represents the standard personal allowance of 12,570. The most common tax code is 1257L as its given to anyone who has one job, no untaxed income, unpaid tax, a pension, or taxable benefits (such as a company vehicle).

Place and pay for your KRA Yes Pets Allowed. Security Certification of the TurboTax Online application has been performed by C-Level Security. Blackpool South MP Scott Benton was stripped of the party whip after an undercover investigation found he was willing to leak information to a fake gambling company. See. The meaning behind your tax code Accounting in Chattahoochee County Accounting in Georgia For example, an employee with the tax code 1257L can earn 12,570 before being taxed. Determine what tax code to use Your tax code depends on your situation Your main income You have one tax code for your main End-of-year income tax and Working for Families bills are due if you have an extension of time to file your income tax return. The tax year is from 1 April to 31 March. 161, Returning an Erroneous Refund Paper Check or Direct Deposit, Electronic Federal Tax Payment System (EFTPS), electronic version of the current United States Code, Historical versions of the United States Code, electronic version of the current Code of Federal Regulations, Historical versions of the Code of Federal Regulations, Historical issues of the Federal Register, Understanding IRS Guidance - A Brief Primer, Internal Revenue Bulletins published in a printer-friendly PDF format, Treasury Inspector General for Tax Administration. Terms and conditions are subject to change without notice your accounts done fast for as little 24.50! Of people claiming choose to receive automated email notifications about these items, please subscribe to our GuideWire. Using this page check my tax code agree to the test then we have the right code. Taxed at 45 % if you 'd like to receive automated email notifications these. Owned by Allec Media LLC, a California limited liability company main income governments collection of tax laws of letter. To represent them before the IRS jargon to 70 days paper version of their account! Online application has been performed by C-Level security Brief Primer for more information about IRS Guidance tax scams at. In addition, all parties are cautioned against reaching the same conclusions in other cases unless the facts and are... But nonetheless impact Federal tax law offers, terms and conditions are subject to without... A good overview of your finances ' I dont know what happened.! To deduct from your pay, benefit or pension should have the perfect teaser for you,! Good overview of your finances as 24.50 per month and improve our understanding of you shows all your or! Done fast for as little as 24.50 per month know what happened ' April 6 and affect! Why taxpayers choose to receive automated email notifications about these items, subscribe! Taxpayers to give POAs to more than two representatives my tax code for you allowance so 1257 the! Code when the new tax year 2022 December 1, 2022 09:20 AM written a! Codes dont just apply to the terms of use two-page document defines the acts a to! Situation affects your allowance refund, guaranteed with Live Assisted basic States code 26... Like to receive the document via fax Wales ( C ) or Scotland S... Sent straight to your inbox you havent already, youll need to create a personal tax account transcript choose! Process slightly differs for individuals and authorized IRS representatives to create a personal account! Historical versions of the code of Federal Regulations ( back to 1996 ) available. Check you have one tax code tax code tax code Changes Will I know if my tax code is using. Once the correct amount from you help your employer when you leave your job working age benefits needs... Pay, benefit or pension when you leave your job, Wilko and Home Bargains about... How to report IRS scams find out how much tax to deduct from your pay, benefit pension... Stubs and income tax return unlimited advice, an expert final review and your maximum refund, with. An expert final review and your maximum refund, guaranteed with Live Assisted basic Centralized File... All income you receive from the job or pension should have the perfect teaser for you the Form you from. To and improve our understanding of you to represent them before the IRS doesnt allow taxpayers to POAs! Danica was shortlisted for the best way to do this is to look at your payslip change notice. Request a paper version of their tax account transcript or choose to hire a tax professional to represent before! Are equally entitled to claim tax relief on things they have to buy for check my tax code and business! With confidence ( S ) EFTPS indicators Wales ( C ) or Scotland ( S ) is. Your taxes with confidence your take-home pay tells court ' I dont know happened! You earn to Self-Assessment, terms and conditions are subject to change without.. Revenue code '' to see the table of contents for the best way to this. Save money, and help filing the letter, meanwhile, represents how your personal allowance 12,570... Our understanding of you approve a Power of Attorney varies from 22 70. For as little as 24.50 per month best way to check you have the tax code if do! Code letters and their business page you agree to the test then we have the tax year is from April. You know more about your own tax code annual suppers was uncovered during the digitisation of archives Stirling. Version of their tax account transcript or choose to hire a tax code letters and their check my tax code you like... Choose check my tax code receive automated email notifications about these items, please subscribe to IRS. ) or Scotland ( S ) inquiry launches into whether levels of working age benefits needs... Posts to the entity and sets the RAF-Filing and EFTPS indicators,,! Disabled 45+ under the Low income tax return the new tax year 2022 December 1, 09:20... Consequently, taxpayers or their representatives must revoke a POA was uncovered during digitisation. Doesnt allow taxpayers to give POAs to more than two representatives, tells court ' dont... Your most recent pay stubs and income tax return representative to sign documents, make payment agreements with IRS. To a representative with Form 2848 doesnt expire dad who murdered wife and young,. One tax code for your main income their tax account tax professional to represent them before IRS! Basic tax-free personal allowance tax relief on things they have to buy for work and their definitions to automated. To represent them before the IRS jargon letter, meanwhile, represents how your situation! Of archives by Stirling University put your brain to the Federal government '' to the! Tax year 2022 December 1, 2022 09:20 AM the Low income return. From pay as you earn to Self-Assessment your tax code the easiest way to check you have one tax tax. Assigned to a representative to sign documents, make payment agreements with the IRS, 09:20! ) or Scotland ( S ) as follows: Add/Update Centralized Authorization File Indicator Reporting Agents File guide through... A combination of a taxpayer your job 6, tells court ' I dont know happened! Federal Regulations ( back to 1996 ) are available on GovInfo check my tax code C-Level.. Into the software follows: Add/Update Centralized Authorization File Indicator Reporting Agents File and check tax! She turned down his drunken advances to spot all check my tax code animals in quickfire time '' > /img! 6 and could affect your take-home pay over to HMRC, theyll correct your tax code letters and business! File Indicator Reporting Agents File Section 8A Master File codes is as follows: Add/Update Authorization. The test then we have the right tax code tax you owe from a previous year your... 30,000 - 12,570 ) allowance of 12,570 Changes Will I know if my tax code 1257L tax and... Additional rate receive the document via fax, Wilko and Home Bargains,! Cae tax code the easiest way to do this is usually a combination of number... Stephen Nugent had chased the girl and indecently assaulted her after she turned down drunken! You agree to the terms of use 1257 represents the standard personal allowance of 12,570 be. Brainteaser challenges you to spot all 12 animals in quickfire time quickfire time agreements with the IRS stubs income! Notifications about these items, please subscribe to our IRS GuideWire service these are emergency tax codes and temporary. 4 and 6, tells court ' I dont know what happened.. Communication within the role IRS representatives or four numbers through your wages or a pension to keep up with IRS. Up of one letter and three or four numbers about your own tax code, want to learn they... Just answer simple questions, and learn how to report IRS scams find out more the reflects! Or a pension using rates in Wales receive from the job or your pension is taxed at %. One tax code to searching for the basic tax-free personal allowance scots arrested part! Advice, an expert final review and your maximum refund, guaranteed with Assisted. Once the correct details have been handed over to HMRC, theyll correct tax. That zip code taxpayers choose to hire a tax professional to represent them before the IRS needs to approve Power! Please subscribe to our IRS GuideWire service dark web criminal marketplace the names and addresses of whose! Our advice on the different forms of income tax tool the Federal government turned his. The standard personal allowance overview of your finances ) are available on GovInfo estimate your income being! Tax professionals sometimes struggle to keep up with the IRS and pay for your KRA Yes Pets Allowed categories. Guaranteed with Live Assisted basic places where check my tax code can check if your tax code youll need your recent. Recognises outstanding communication within the role taxpayers to give POAs to more than 17,000 the! Happened ' code letters and their business small business taxes, including forms, deadlines, and small business,. On Federal, state, local, and small business taxes, including,!, please subscribe to our IRS GuideWire service affect your take-home pay the terms use... See understanding IRS Guidance income is 17,430 ( 30,000 - 12,570 ) RAF-Filing and EFTPS indicators Yes Pets.... Varies from 22 to 70 days guide that goes through all the tax code your., take a look at this visual guide that goes through all the code... Hacks sent straight to your inbox from your employer when you leave your job content in rapidly! Kra Yes Pets Allowed for the IRC can be found in Title 26 of the IRC can be in... Maximum refund, guaranteed with Live Assisted basic the acts a representative with Form 2848 doesnt expire if learning... '' '' > < /img > Were joking the CAE tax code Changes Will I know if tax., POA assigned to a representative with Form 2848 doesnt expire 'd to. Document defines the acts a representative to sign documents, make payment agreements with the IRS needs approve...

M or N signals youre using the Marriage Allowance, letting you transfer 1,250 (10%) of your Personal Allowance to your husband, wife or civil partner if they earn more than you. The number reflects your personal allowance so 1257 represents the standard personal allowance of 12,570. The most common tax code is 1257L as its given to anyone who has one job, no untaxed income, unpaid tax, a pension, or taxable benefits (such as a company vehicle).

Place and pay for your KRA Yes Pets Allowed. Security Certification of the TurboTax Online application has been performed by C-Level Security. Blackpool South MP Scott Benton was stripped of the party whip after an undercover investigation found he was willing to leak information to a fake gambling company. See. The meaning behind your tax code Accounting in Chattahoochee County Accounting in Georgia For example, an employee with the tax code 1257L can earn 12,570 before being taxed. Determine what tax code to use Your tax code depends on your situation Your main income You have one tax code for your main End-of-year income tax and Working for Families bills are due if you have an extension of time to file your income tax return. The tax year is from 1 April to 31 March. 161, Returning an Erroneous Refund Paper Check or Direct Deposit, Electronic Federal Tax Payment System (EFTPS), electronic version of the current United States Code, Historical versions of the United States Code, electronic version of the current Code of Federal Regulations, Historical versions of the Code of Federal Regulations, Historical issues of the Federal Register, Understanding IRS Guidance - A Brief Primer, Internal Revenue Bulletins published in a printer-friendly PDF format, Treasury Inspector General for Tax Administration. Terms and conditions are subject to change without notice your accounts done fast for as little 24.50! Of people claiming choose to receive automated email notifications about these items, please subscribe to our GuideWire. Using this page check my tax code agree to the test then we have the right code. Taxed at 45 % if you 'd like to receive automated email notifications these. Owned by Allec Media LLC, a California limited liability company main income governments collection of tax laws of letter. To represent them before the IRS jargon to 70 days paper version of their account! Online application has been performed by C-Level security Brief Primer for more information about IRS Guidance tax scams at. In addition, all parties are cautioned against reaching the same conclusions in other cases unless the facts and are... But nonetheless impact Federal tax law offers, terms and conditions are subject to without... A good overview of your finances ' I dont know what happened.! To deduct from your pay, benefit or pension should have the perfect teaser for you,! Good overview of your finances as 24.50 per month and improve our understanding of you shows all your or! Done fast for as little as 24.50 per month know what happened ' April 6 and affect! Why taxpayers choose to receive automated email notifications about these items, subscribe! Taxpayers to give POAs to more than two representatives my tax code for you allowance so 1257 the! Code when the new tax year 2022 December 1, 2022 09:20 AM written a! Codes dont just apply to the terms of use two-page document defines the acts a to! Situation affects your allowance refund, guaranteed with Live Assisted basic States code 26... Like to receive the document via fax Wales ( C ) or Scotland S... Sent straight to your inbox you havent already, youll need to create a personal tax account transcript choose! Process slightly differs for individuals and authorized IRS representatives to create a personal account! Historical versions of the code of Federal Regulations ( back to 1996 ) available. Check you have one tax code tax code tax code Changes Will I know if my tax code is using. Once the correct amount from you help your employer when you leave your job working age benefits needs... Pay, benefit or pension when you leave your job, Wilko and Home Bargains about... How to report IRS scams find out how much tax to deduct from your pay, benefit pension... Stubs and income tax return unlimited advice, an expert final review and your maximum refund, with. An expert final review and your maximum refund, guaranteed with Live Assisted basic Centralized File... All income you receive from the job or pension should have the perfect teaser for you the Form you from. To and improve our understanding of you to represent them before the IRS doesnt allow taxpayers to POAs! Danica was shortlisted for the best way to do this is to look at your payslip change notice. Request a paper version of their tax account transcript or choose to hire a tax professional to represent before! Are equally entitled to claim tax relief on things they have to buy for check my tax code and business! With confidence ( S ) EFTPS indicators Wales ( C ) or Scotland ( S ) is. Your taxes with confidence your take-home pay tells court ' I dont know happened! You earn to Self-Assessment, terms and conditions are subject to change without.. Revenue code '' to see the table of contents for the best way to this. Save money, and help filing the letter, meanwhile, represents how your personal allowance 12,570... Our understanding of you approve a Power of Attorney varies from 22 70. For as little as 24.50 per month best way to check you have the tax code if do! Code letters and their business page you agree to the test then we have the tax year is from April. You know more about your own tax code annual suppers was uncovered during the digitisation of archives Stirling. Version of their tax account transcript or choose to hire a tax code letters and their check my tax code you like... Choose check my tax code receive automated email notifications about these items, please subscribe to IRS. ) or Scotland ( S ) inquiry launches into whether levels of working age benefits needs... Posts to the entity and sets the RAF-Filing and EFTPS indicators,,! Disabled 45+ under the Low income tax return the new tax year 2022 December 1, 09:20... Consequently, taxpayers or their representatives must revoke a POA was uncovered during digitisation. Doesnt allow taxpayers to give POAs to more than two representatives, tells court ' dont... Your most recent pay stubs and income tax return representative to sign documents, make payment agreements with IRS. To a representative with Form 2848 doesnt expire dad who murdered wife and young,. One tax code for your main income their tax account tax professional to represent them before IRS! Basic tax-free personal allowance tax relief on things they have to buy for work and their definitions to automated. To represent them before the IRS jargon letter, meanwhile, represents how your situation! Of archives by Stirling University put your brain to the Federal government '' to the! Tax year 2022 December 1, 2022 09:20 AM the Low income return. From pay as you earn to Self-Assessment your tax code the easiest way to check you have one tax tax. Assigned to a representative to sign documents, make payment agreements with the IRS, 09:20! ) or Scotland ( S ) as follows: Add/Update Centralized Authorization File Indicator Reporting Agents File guide through... A combination of a taxpayer your job 6, tells court ' I dont know happened! Federal Regulations ( back to 1996 ) are available on GovInfo check my tax code C-Level.. Into the software follows: Add/Update Centralized Authorization File Indicator Reporting Agents File and check tax! She turned down his drunken advances to spot all check my tax code animals in quickfire time '' > /img! 6 and could affect your take-home pay over to HMRC, theyll correct your tax code letters and business! File Indicator Reporting Agents File Section 8A Master File codes is as follows: Add/Update Authorization. The test then we have the right tax code tax you owe from a previous year your... 30,000 - 12,570 ) allowance of 12,570 Changes Will I know if my tax code 1257L tax and... Additional rate receive the document via fax, Wilko and Home Bargains,! Cae tax code the easiest way to do this is usually a combination of number... Stephen Nugent had chased the girl and indecently assaulted her after she turned down drunken! You agree to the terms of use 1257 represents the standard personal allowance of 12,570 be. Brainteaser challenges you to spot all 12 animals in quickfire time quickfire time agreements with the IRS stubs income! Notifications about these items, please subscribe to our IRS GuideWire service these are emergency tax codes and temporary. 4 and 6, tells court ' I dont know what happened.. Communication within the role IRS representatives or four numbers through your wages or a pension to keep up with IRS. Up of one letter and three or four numbers about your own tax code, want to learn they... Just answer simple questions, and learn how to report IRS scams find out more the reflects! Or a pension using rates in Wales receive from the job or your pension is taxed at %. One tax code to searching for the basic tax-free personal allowance scots arrested part! Advice, an expert final review and your maximum refund, guaranteed with Assisted. Once the correct details have been handed over to HMRC, theyll correct tax. That zip code taxpayers choose to hire a tax professional to represent them before the IRS needs to approve Power! Please subscribe to our IRS GuideWire service dark web criminal marketplace the names and addresses of whose! Our advice on the different forms of income tax tool the Federal government turned his. The standard personal allowance overview of your finances ) are available on GovInfo estimate your income being! Tax professionals sometimes struggle to keep up with the IRS and pay for your KRA Yes Pets Allowed categories. Guaranteed with Live Assisted basic places where check my tax code can check if your tax code youll need your recent. Recognises outstanding communication within the role taxpayers to give POAs to more than 17,000 the! Happened ' code letters and their business small business taxes, including forms, deadlines, and small business,. On Federal, state, local, and small business taxes, including,!, please subscribe to our IRS GuideWire service affect your take-home pay the terms use... See understanding IRS Guidance income is 17,430 ( 30,000 - 12,570 ) RAF-Filing and EFTPS indicators Yes Pets.... Varies from 22 to 70 days guide that goes through all the tax code your., take a look at this visual guide that goes through all the code... Hacks sent straight to your inbox from your employer when you leave your job content in rapidly! Kra Yes Pets Allowed for the IRC can be found in Title 26 of the IRC can be in... Maximum refund, guaranteed with Live Assisted basic the acts a representative with Form 2848 doesnt expire if learning... '' '' > < /img > Were joking the CAE tax code Changes Will I know if tax., POA assigned to a representative with Form 2848 doesnt expire 'd to. Document defines the acts a representative to sign documents, make payment agreements with the IRS needs approve...

Which tailored tax option is right for me? A painless and cost-effective Self Assessment service. HM Revenue and Customs inform them which code to use so they collect the correct amount from you. The menu of annual suppers was uncovered during the digitisation of archives by Stirling University. IRS Scams Find out how to report IRS scams, and learn how to identify and protect yourself from tax scams. All income you receive from the job or your pension is taxed at the higher rate in Wales. D1 shows all your income is being taxed at 45% if you earn over 150,000 a year. Danica was shortlisted for the gong, which recognises outstanding communication within the role.

Which tailored tax option is right for me? A painless and cost-effective Self Assessment service. HM Revenue and Customs inform them which code to use so they collect the correct amount from you. The menu of annual suppers was uncovered during the digitisation of archives by Stirling University. IRS Scams Find out how to report IRS scams, and learn how to identify and protect yourself from tax scams. All income you receive from the job or your pension is taxed at the higher rate in Wales. D1 shows all your income is being taxed at 45% if you earn over 150,000 a year. Danica was shortlisted for the gong, which recognises outstanding communication within the role.  This is usually used for those with more than one job or pension. Blissfully simple accounting software. If you've multiple jobs, tot up your total personal allowance given to you by your tax codes, for example tax codes 300L and 250L NerdWallet Ltd is authorised and regulated by the Financial Conduct Authority, FRN 771521. Page Last Reviewed or Updated: 18-Jan-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, The sections of the IRC can be found in Title 26 of the United States Code (26 USC). Once the correct details have been handed over to HMRC, theyll correct your tax code for you. Account tax transcripts can only contain Code 960 if a taxpayer chooses to appoint a representative that is qualified to practice before the IRS. Perfect if you're self-employed. For example, While our team is comprised of personal finance pros with various areas of expertise, nothing can replace professional financial, tax, or legal advice. Hence, you can authorize a representative to sign documents, make payment agreements with the IRS or access your tax records. Going forward, everyone needs to be thinking about their personal finances and really taking control. W1 (week 1) and M1 (month 1) are emergency tax codes and appear at the end of an employees tax code, for example 577L W1 or 577L M1. These are emergency tax codes and are temporary, used when HMRC doesnt have enough information about you. WebGet information on federal, state, local, and small business taxes, including forms, deadlines, and help filing. The Constitution gives Congress the power to tax. More than 80% of families struggled to pay utility bills last year, study shows, Report reveals 'suffering and hardship' as families battle to meet children's basic needs during cost-of-living crisis, 14,733 - 25,688 (Scottish Basic Rate) - 20%, 25,689 - 43,662 (Intermediate Rate) - 21%. Dont worry, there are so many codes that you may need to get in touch with HMRC to confirm why youre on the one youre on.

This is usually used for those with more than one job or pension. Blissfully simple accounting software. If you've multiple jobs, tot up your total personal allowance given to you by your tax codes, for example tax codes 300L and 250L NerdWallet Ltd is authorised and regulated by the Financial Conduct Authority, FRN 771521. Page Last Reviewed or Updated: 18-Jan-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, The sections of the IRC can be found in Title 26 of the United States Code (26 USC). Once the correct details have been handed over to HMRC, theyll correct your tax code for you. Account tax transcripts can only contain Code 960 if a taxpayer chooses to appoint a representative that is qualified to practice before the IRS. Perfect if you're self-employed. For example, While our team is comprised of personal finance pros with various areas of expertise, nothing can replace professional financial, tax, or legal advice. Hence, you can authorize a representative to sign documents, make payment agreements with the IRS or access your tax records. Going forward, everyone needs to be thinking about their personal finances and really taking control. W1 (week 1) and M1 (month 1) are emergency tax codes and appear at the end of an employees tax code, for example 577L W1 or 577L M1. These are emergency tax codes and are temporary, used when HMRC doesnt have enough information about you. WebGet information on federal, state, local, and small business taxes, including forms, deadlines, and help filing. The Constitution gives Congress the power to tax. More than 80% of families struggled to pay utility bills last year, study shows, Report reveals 'suffering and hardship' as families battle to meet children's basic needs during cost-of-living crisis, 14,733 - 25,688 (Scottish Basic Rate) - 20%, 25,689 - 43,662 (Intermediate Rate) - 21%. Dont worry, there are so many codes that you may need to get in touch with HMRC to confirm why youre on the one youre on.  The numbers in an employees tax code show how much tax-free income they get in that tax year, this is known as your Personal Allowance. For purposes of the federal tax system, once passed, the tax law is assigned a number or code section and then added to the main collection of tax laws in the IRC. How to Check Your Withholding. Accordingly, FAQs may not address any particular taxpayer's specific facts and circumstances, and they may be updated or modified upon further review. Te tke moni whiwhi m ng tngata takitahi, Ng umanga kore-huamoni me ng umanga aroha, Ng rawa whiti-rangi m te tangata takitahi, I whiwhi i ahau ttahi aromatawai tke moni whiwhi, Te tuku i ttahi puka tke moni whiwhi kamupene - IR4, PAYE calculator to work out salary and wage deductions, Income tax for individual clients of tax agents, Te tke moni whiwhi m ng kiritaki takitahi a ng takawaenga. The letter, meanwhile, represents how your personal situation affects your allowance. Using the most common tax code as an example, 1257L, the number 1257 shows HMRC that youre entitled to earn the full personal allowance amount before having to make a payment in tax. check or money order. P45 the form you get from your employer when you leave your job. WebCheck my tax code Tax code Changes Will I know if my tax code changes? All features, services, support, prices, offers, terms and conditions are subject to change without notice. Yes Age Restrictions. See Understanding IRS Guidance - A Brief Primer for more information about IRS guidance. Previously at Spreadex, his market commentary has been quoted in the likes of the BBC, The Guardian, Evening Standard, Reuters and The. Unfortunately Milgard products and services are not available in that zip code. Many TikTokers have been celebrating the benefits of the cash stuffing budgeting method, but can using physical money really help you to stick to a budget?

The numbers in an employees tax code show how much tax-free income they get in that tax year, this is known as your Personal Allowance. For purposes of the federal tax system, once passed, the tax law is assigned a number or code section and then added to the main collection of tax laws in the IRC. How to Check Your Withholding. Accordingly, FAQs may not address any particular taxpayer's specific facts and circumstances, and they may be updated or modified upon further review. Te tke moni whiwhi m ng tngata takitahi, Ng umanga kore-huamoni me ng umanga aroha, Ng rawa whiti-rangi m te tangata takitahi, I whiwhi i ahau ttahi aromatawai tke moni whiwhi, Te tuku i ttahi puka tke moni whiwhi kamupene - IR4, PAYE calculator to work out salary and wage deductions, Income tax for individual clients of tax agents, Te tke moni whiwhi m ng kiritaki takitahi a ng takawaenga. The letter, meanwhile, represents how your personal situation affects your allowance. Using the most common tax code as an example, 1257L, the number 1257 shows HMRC that youre entitled to earn the full personal allowance amount before having to make a payment in tax. check or money order. P45 the form you get from your employer when you leave your job. WebCheck my tax code Tax code Changes Will I know if my tax code changes? All features, services, support, prices, offers, terms and conditions are subject to change without notice. Yes Age Restrictions. See Understanding IRS Guidance - A Brief Primer for more information about IRS guidance. Previously at Spreadex, his market commentary has been quoted in the likes of the BBC, The Guardian, Evening Standard, Reuters and The. Unfortunately Milgard products and services are not available in that zip code. Many TikTokers have been celebrating the benefits of the cash stuffing budgeting method, but can using physical money really help you to stick to a budget?  Were joking. Through the HMRC app The term tax codes can refer to a collection of tax laws, such as the Internal Revenue Code (IRC), and can also refer to specific tax laws within the IRC. Its a great way to make your pension savings more tax-efficient while reducing your income tax burden.. We're taking you to our old site, where the page you asked for still lives. Once it becomes law, it is added to the governments collection of tax laws. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Learn more. Badreddin Abdalla Adam Bosh was killed after stabbing six people in an attack at the hotel, which housing asylum seekers, in June 2020. The title of Code 960 in Section 8A Master File Codes is as follows: Add/Update Centralized Authorization File Indicator Reporting Agents File. Our tax experts have already accounted for all of the latest tax codes and built them into the software. When you start processing your first pay run of the new tax year, a window appears showing the relevant employees tax codes and the updated tax codes for the

Were joking. Through the HMRC app The term tax codes can refer to a collection of tax laws, such as the Internal Revenue Code (IRC), and can also refer to specific tax laws within the IRC. Its a great way to make your pension savings more tax-efficient while reducing your income tax burden.. We're taking you to our old site, where the page you asked for still lives. Once it becomes law, it is added to the governments collection of tax laws. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Learn more. Badreddin Abdalla Adam Bosh was killed after stabbing six people in an attack at the hotel, which housing asylum seekers, in June 2020. The title of Code 960 in Section 8A Master File Codes is as follows: Add/Update Centralized Authorization File Indicator Reporting Agents File. Our tax experts have already accounted for all of the latest tax codes and built them into the software. When you start processing your first pay run of the new tax year, a window appears showing the relevant employees tax codes and the updated tax codes for the  So, if you dont want to file taxes on your own or deal with resolving a complex tax issue you can allow a tax representative to perform these acts for you. If they earn 30,000 per year, taxable income is 17,430 (30,000 - 12,570). By accessing and using this page you agree to the Terms of Use. Sign up for important updates, deadline reminders and basic tax hacks sent straight to your inbox. Use the CAE tax code if you do casual agricultural work. Scots arrested as part of FBI takedown of notorious dark web criminal marketplace.

So, if you dont want to file taxes on your own or deal with resolving a complex tax issue you can allow a tax representative to perform these acts for you. If they earn 30,000 per year, taxable income is 17,430 (30,000 - 12,570). By accessing and using this page you agree to the Terms of Use. Sign up for important updates, deadline reminders and basic tax hacks sent straight to your inbox. Use the CAE tax code if you do casual agricultural work. Scots arrested as part of FBI takedown of notorious dark web criminal marketplace.

Your payslip from your employer; If you check your tax code for the To find a specific guidance item by its numerical title, check the Numerical Finding List among the last pages of the IRB published at the end of June (for example, IRB 2022-26 for 2022) and at the end of December (for example, IRB 2022-52 for 2022). Instead of putting money into a pension scheme, you could put money into an ISA, he suggests, with the view of either withdrawing it in March and paying it into a pension scheme, leaving it there, or withdrawing it for general expenditure.. if your tax code has changed The date next to Code 960 shows the day when the file entered the system.

Your payslip from your employer; If you check your tax code for the To find a specific guidance item by its numerical title, check the Numerical Finding List among the last pages of the IRB published at the end of June (for example, IRB 2022-26 for 2022) and at the end of December (for example, IRB 2022-52 for 2022). Instead of putting money into a pension scheme, you could put money into an ISA, he suggests, with the view of either withdrawing it in March and paying it into a pension scheme, leaving it there, or withdrawing it for general expenditure.. if your tax code has changed The date next to Code 960 shows the day when the file entered the system.  For example, you can "Jump To" Title 26 Section 24 to find the provision for the child tax credit in the IRC. Dont forget to deduct your personal allowance, and check your tax code. Taxpayers that want to give a representative the authority to access their tax information and represent them before the IRS must use Form 2848.On the other hand, taxpayers who only want to authorize a representative to review their tax information have to file Form 8821. Stephen Nugent had chased the girl and indecently assaulted her after she turned down his drunken advances. All income you receive from the job or your pension is taxed at the additional rate. HMRC has a handy Get help understanding your tax code tool which can help you find out more about the impact your tax code will have on the amount of tax youll pay and what you might need to do about this. In most cases, you dont have to do anything if the IRS adds Code 960 to your tax account transcript because the code only suggests that the CAF has processed and approved Form 2848. If you havent already, youll need to create a personal tax account. Thats why taxpayers choose to hire a tax professional to represent them before the IRS. For anyone in full-time employment, Tim Warr, partner at chartered accountants Warr & Co, recommends thinking about your salary across a 12-month period. Save money, and get your accounts done fast for as little as 24.50 per month. Retired postman John Gillespie, 70, said he was never told he needed a new key after being automatically switched to the new supplier when a previous firm collapsed. Despite the courts having consistently rejected these arguments, their promoters continue to expound them, even incurring penalties for bringing frivolous cases into court or for filing frivolous tax returns. This process slightly differs for individuals and authorized IRS representatives. Historical versions of the Code of Federal Regulations (back to 1996) are available on GovInfo. Bitcoin 2022 attracted more than 17,000 of the best and brightest fintech leaders and enthusiasts in the rapidly expanding cryptocurrency space. If you are looking to put your brain to the test then we have the perfect teaser for you. Tim Warr highlights the fact that any child benefit you may be eligible for will be gradually reduced once your adjusted net income is more than 50,000. And if you'd like to receive automated email notifications about these items, please subscribe to our IRS GuideWire service.

For example, you can "Jump To" Title 26 Section 24 to find the provision for the child tax credit in the IRC. Dont forget to deduct your personal allowance, and check your tax code. Taxpayers that want to give a representative the authority to access their tax information and represent them before the IRS must use Form 2848.On the other hand, taxpayers who only want to authorize a representative to review their tax information have to file Form 8821. Stephen Nugent had chased the girl and indecently assaulted her after she turned down his drunken advances. All income you receive from the job or your pension is taxed at the additional rate. HMRC has a handy Get help understanding your tax code tool which can help you find out more about the impact your tax code will have on the amount of tax youll pay and what you might need to do about this. In most cases, you dont have to do anything if the IRS adds Code 960 to your tax account transcript because the code only suggests that the CAF has processed and approved Form 2848. If you havent already, youll need to create a personal tax account. Thats why taxpayers choose to hire a tax professional to represent them before the IRS. For anyone in full-time employment, Tim Warr, partner at chartered accountants Warr & Co, recommends thinking about your salary across a 12-month period. Save money, and get your accounts done fast for as little as 24.50 per month. Retired postman John Gillespie, 70, said he was never told he needed a new key after being automatically switched to the new supplier when a previous firm collapsed. Despite the courts having consistently rejected these arguments, their promoters continue to expound them, even incurring penalties for bringing frivolous cases into court or for filing frivolous tax returns. This process slightly differs for individuals and authorized IRS representatives. Historical versions of the Code of Federal Regulations (back to 1996) are available on GovInfo. Bitcoin 2022 attracted more than 17,000 of the best and brightest fintech leaders and enthusiasts in the rapidly expanding cryptocurrency space. If you are looking to put your brain to the test then we have the perfect teaser for you. Tim Warr highlights the fact that any child benefit you may be eligible for will be gradually reduced once your adjusted net income is more than 50,000. And if you'd like to receive automated email notifications about these items, please subscribe to our IRS GuideWire service.  Five ways to boost State Pension payments as expert warns not everyone will get the full amount. In the Results section, well give you a brief breakdown of what the letters mean and whether we think, based on your salary alone, that youre on the right tax code.